Are you looking to close a joint bank account but aren't sure how to ask your bank? It's a common situation that can feel a bit overwhelming, but with the right approach, it can be straightforward. In this article, we'll provide you with a clear and effective letter template to request the deletion of your joint account, ensuring you cover all crucial details. So, let's dive in and explore how to simplify this process for a smooth account closure!

Account Holder Information

In financial institutions, a joint account (also known as a joint bank account) involves multiple account holders sharing access and responsibilities. Account Holder Information includes personal details such as full names, addresses, and Social Security Numbers (SSNs) of individuals involved. Deleting a joint account requires consensus from all parties, typically documented through a formal request. Various banks, such as Wells Fargo and Chase, may have specific forms or procedures that ensure each account holder agrees to the closure, preventing disputes. Important considerations include outstanding balances, pending transactions, and potential fees related to early account closure, which can vary significantly by institution.

Recipient Bank Details

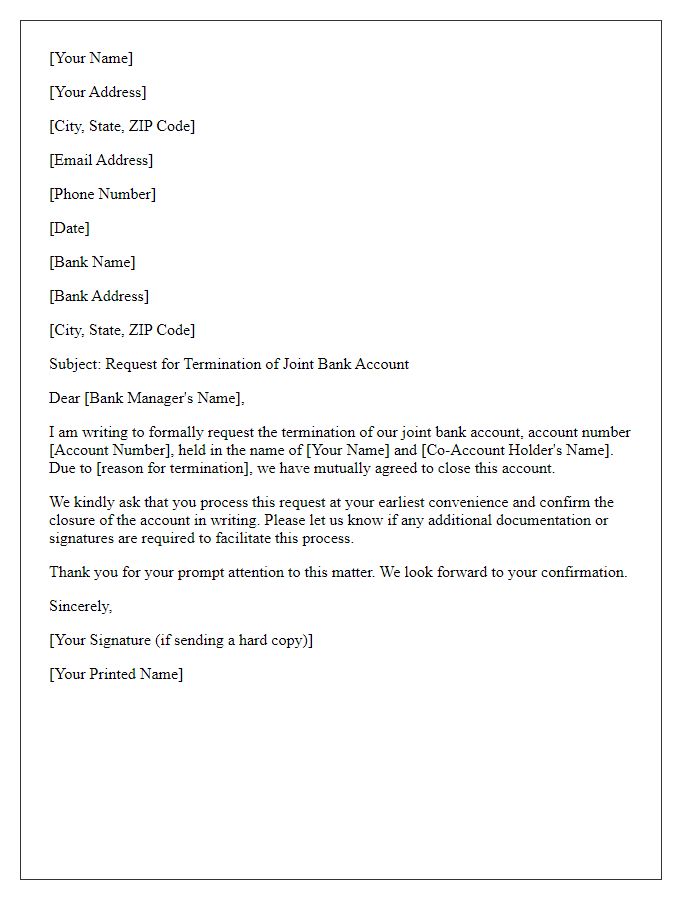

A joint account deletion request requires specific details for processing. Include the bank name (e.g., First National Bank), account type (e.g., joint checking account), and account number (e.g., 123456789). Specify both account holders' full names (e.g., John Doe and Jane Smith) to verify identities. Mention the reason for deletion (e.g., separation of finances due to divorce) for clarity. Ensure to provide contact information, such as phone number (e.g., (555) 123-4567) and email address (e.g., johndoe@email.com), for any required follow-up. End with a request for confirmation of closure to ensure the process is completed.

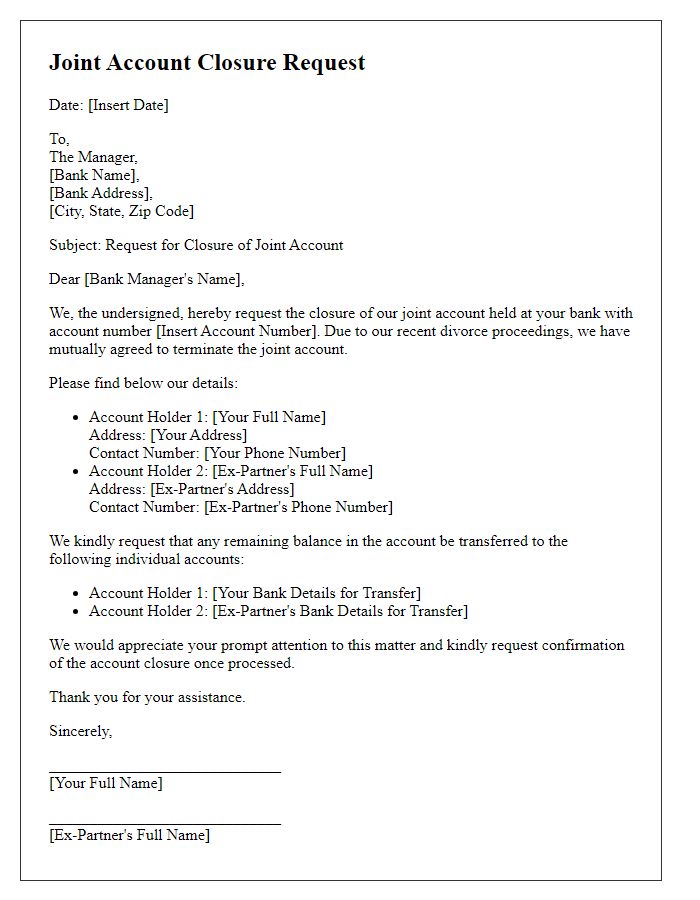

Reason for Deletion

Joint accounts can face deletion due to various reasons, including relationship changes, such as separation or divorce, or financial management decisions. Partner A and Partner B may mutually agree to remove their names from a joint bank account held at XYZ Bank, influencing the financial relationships tied to the account. The process typically involves submitting a formal request to the bank, including essential details such as account number, names of account holders, and the reason for deletion. Furthermore, clearing outstanding balances or transferring funds might be necessary before the deletion can occur, ensuring compliance with the bank's policies and avoiding potential fees or penalties. Documentation verifying identity, such as government-issued ID, and proof of joint ownership may also be required to expedite the account closure process.

Consent from Both Parties

In a joint account scenario, maintaining mutual consent is crucial for account deletion. The request involves both account holders, ensuring compliance with financial institution policies. The primary goal includes confirming identities, typically through government-issued identification, like a driver's license or passport. The request should specify the account number associated with the joint account, highlighting both parties' shared commitment to the closure. Additionally, any remaining balances or outstanding transactions must be addressed, ensuring a seamless transition, free from liabilities or financial discrepancies. Customer service protocols may necessitate written confirmation from both parties, emphasizing the need for clear communication during the account deletion process.

Contact Information for Follow-Up

When requesting the deletion of a joint account, it's important to include detailed contact information for any necessary follow-up communications. Individuals should provide their full names as they appear on the joint account, account numbers associated with the account, and a valid email address for timely correspondence. Additionally, listing a primary phone number ensures the financial institution can reach both parties efficiently. It is advisable to indicate preferred methods of communication, such as phone calls during business hours or emails for documentation purposes. Including a postal address for official correspondence may also be beneficial, especially if documentation must be sent. By ensuring that all contact details are clear and accessible, the process of account deletion can proceed smoothly, minimizing potential delays.

Letter Template For Requesting Joint Account Deletion Samples

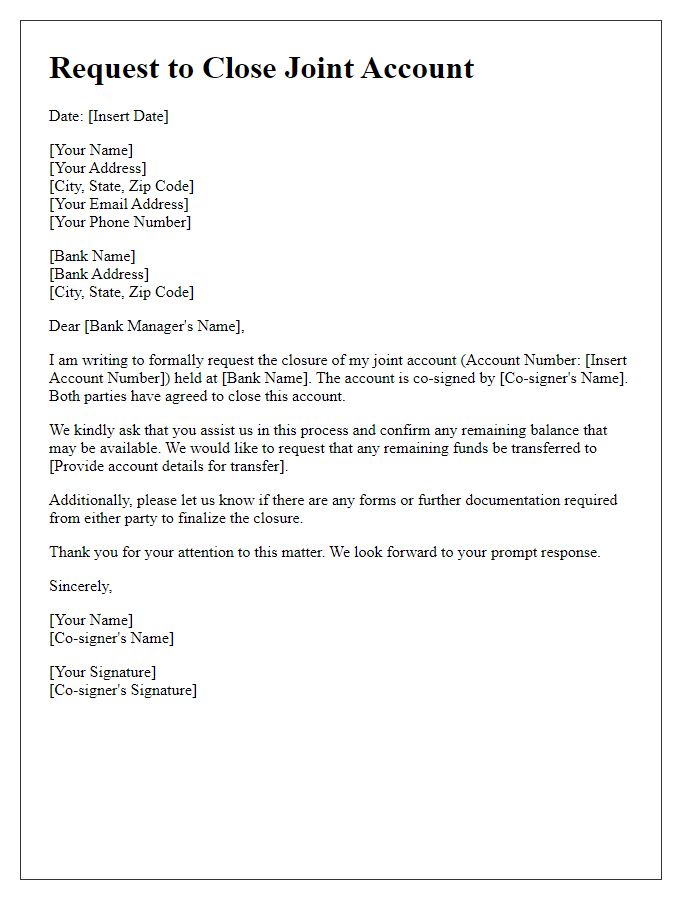

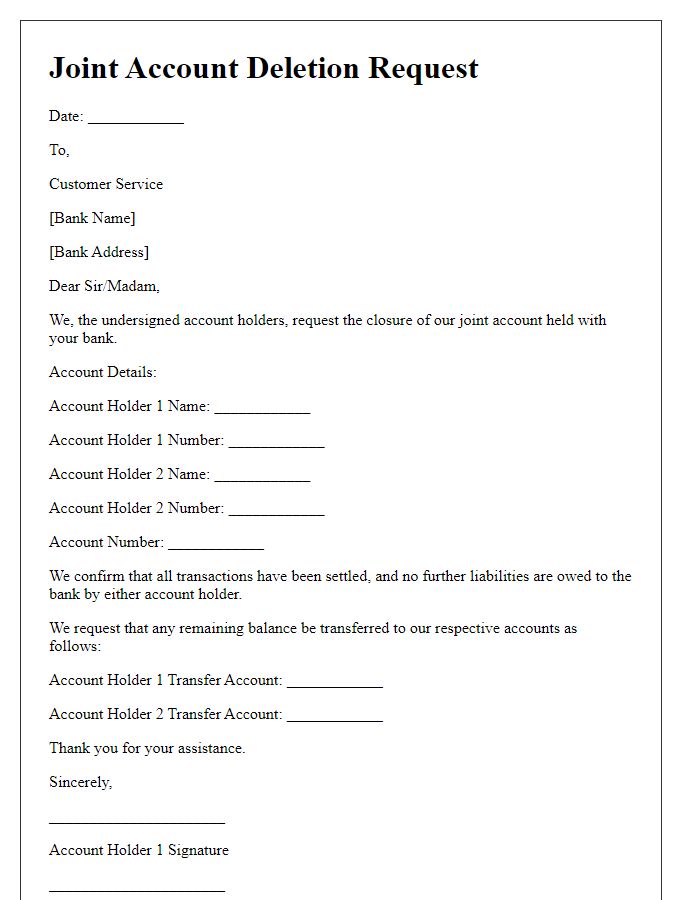

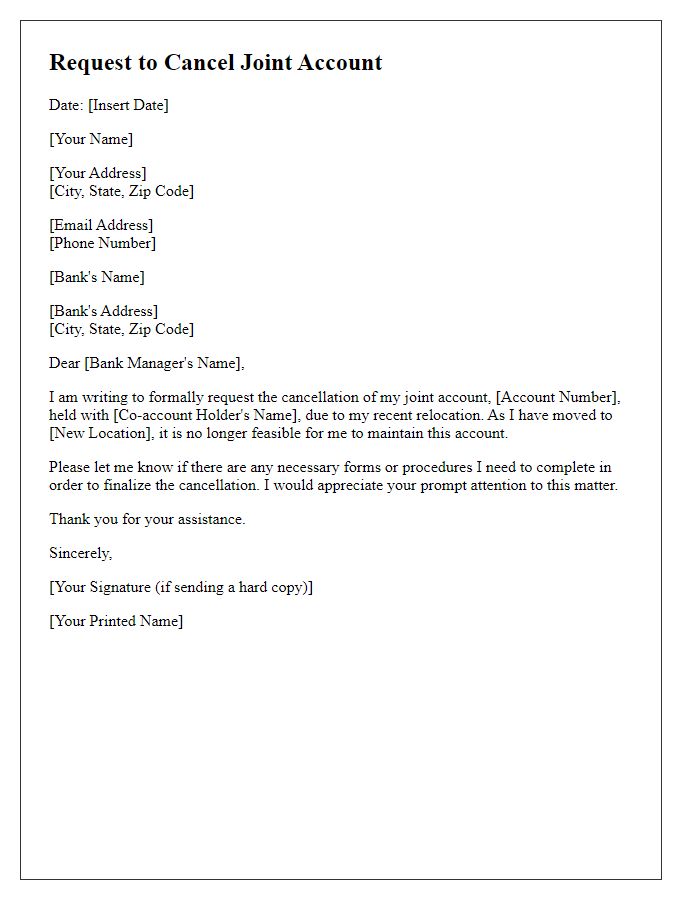

Letter template of request for closing a joint account with co-signer approval.

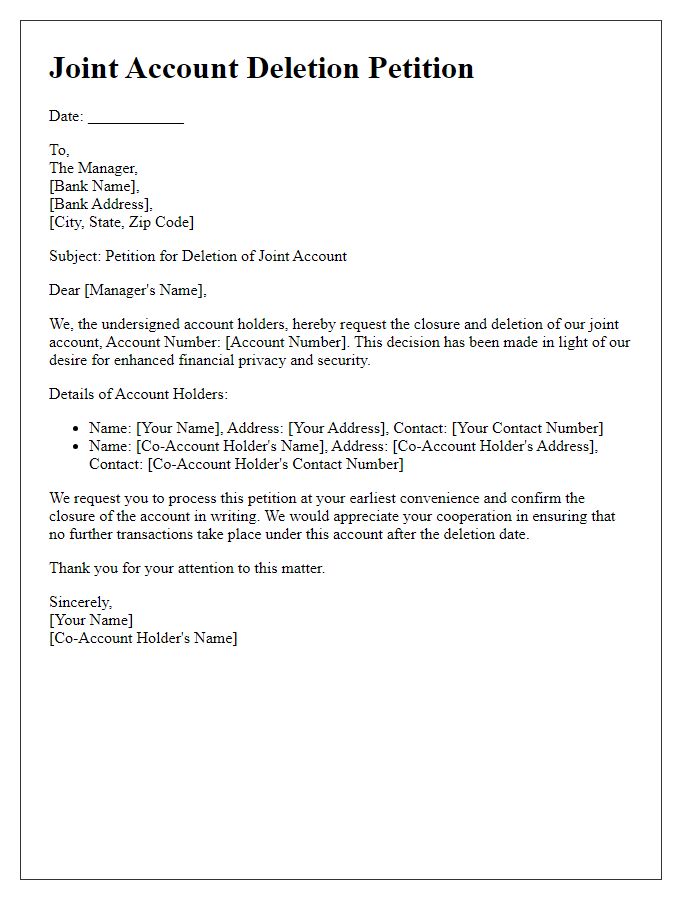

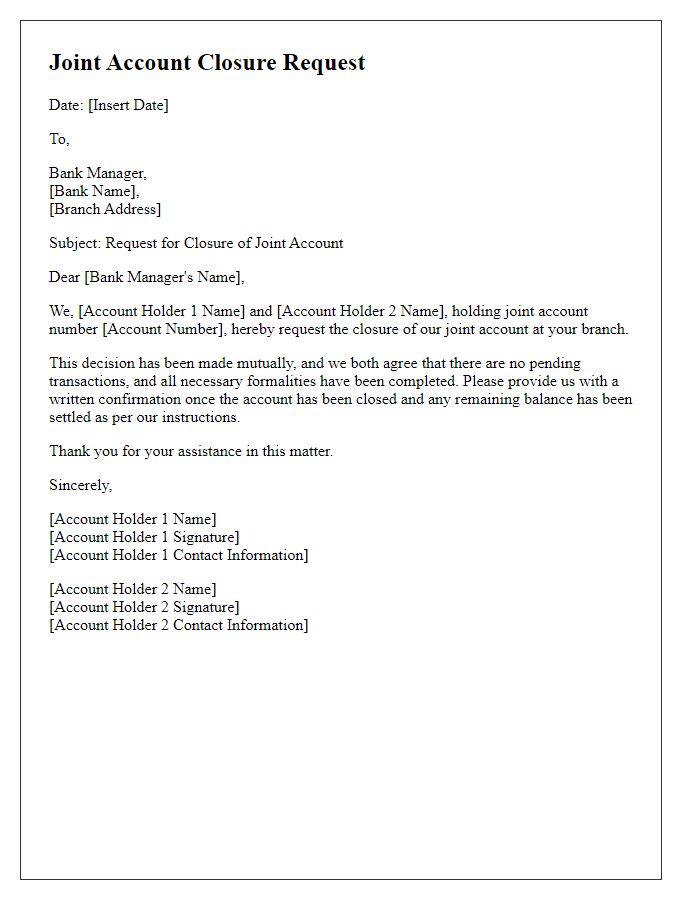

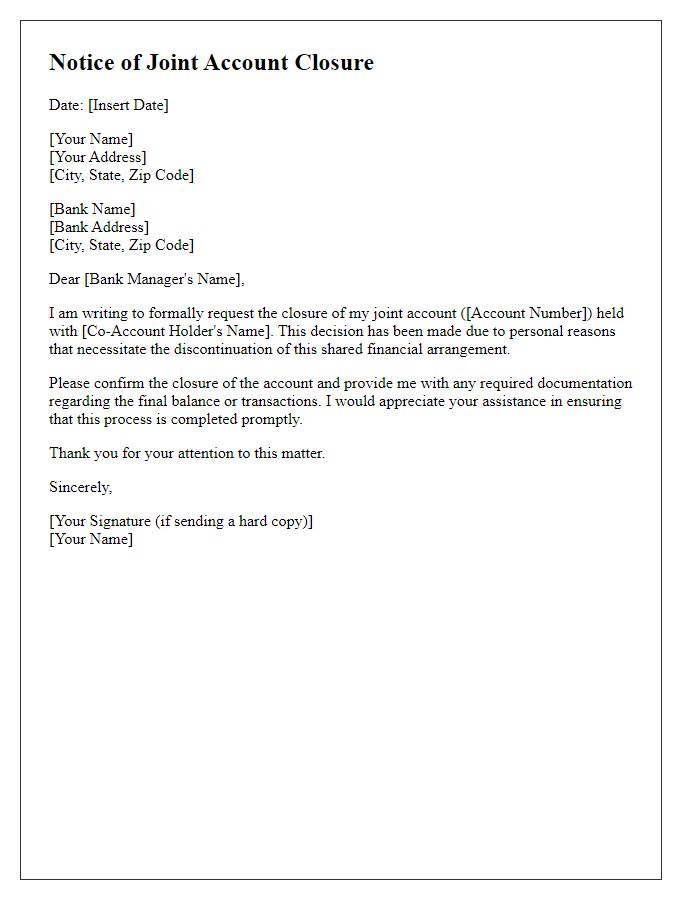

Letter template of joint account deletion petition for financial privacy.

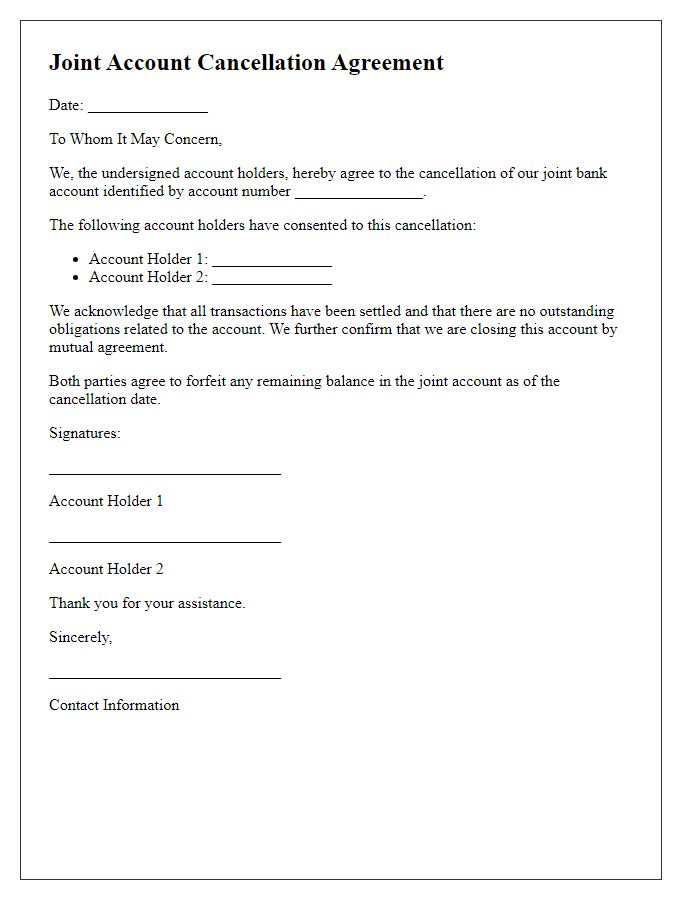

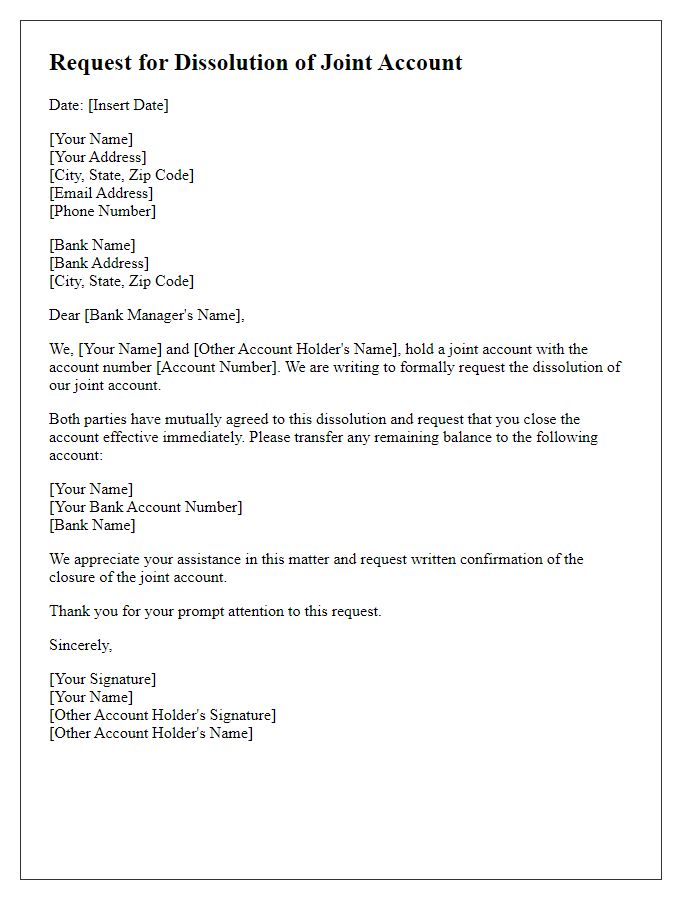

Letter template of joint account cancellation agreement between account holders.

Comments