Are you in need of your verified credit history but unsure how to request it? Writing a letter to request this important document is simpler than you might think! In this article, we'll guide you through creating a professional yet approachable letter, helping you take this essential step towards managing your financial future. So, let's dive in and get you the credit information you need!

Subject line clarity

Requesting a verified credit history report is essential for financial transparency. A thorough report, showing the history of borrowings, payments, and credit utilization, must be obtained from credit reporting agencies like Experian, TransUnion, or Equifax. Such reports typically contain vital information, including credit account details, payment history, and any outstanding debts. Providing accurate identification, such as a Social Security Number (SSN) and address verification, is necessary for validation purposes. Additionally, mentioning the specific uses, such as applying for loans or renting properties, helps contextualize the request. The process may take several weeks depending on the agency, emphasizing the importance of submitting the request well in advance.

Personal identification details

Individuals seeking to obtain their verified credit history must provide personal identification details, including full name, date of birth, social security number (last four digits), and current address. Organizations like Experian, Equifax, and TransUnion require this information to comply with the Fair Credit Reporting Act (FCRA) guidelines. Verification of identity is crucial to prevent identity theft and ensure the accuracy of the report. The request can generally be submitted online or via mail, requiring ample documentation such as government-issued identification (driver's license or passport) and proof of residency (utility bill or bank statement) dated within the last 60 days. Timely processing typically ranges from a few minutes to up to 30 days depending on the method of request. Accessing this information allows individuals to stay informed about their credit status, essential for major financial decisions, including house purchases or loan applications.

Specific request statement

Requesting verified credit history is essential for managing personal finances. A credit report, detailing payment history, outstanding debts, and credit inquiries, is crucial for loan applications and housing leases. Individuals typically seek this information from credit bureaus such as Equifax, Experian, or TransUnion. Having access to accurate credit data helps ensure eligibility for favorable interest rates, affecting monthly mortgage payments significantly. Errors in credit reports can lead to adverse effects, such as higher insurance premiums or loan denials, making it vital to verify information regularly. Additionally, federal laws allow consumers to request one free credit report annually from each bureau to promote financial transparency and informed decision-making.

Contact information

Requesting a verified credit history is essential for various financial applications and background checks. A complete report includes detailed information such as the credit score, outstanding debts, payment history, and any credit inquiries, typically sourced from major credit bureaus like Equifax, Experian, and TransUnion, which follow the Fair Credit Reporting Act (FCRA) guidelines. Individuals may need this data for mortgage applications, loan approvals, or personal assessments of financial health. Providing accurate contact information, including full name, current address, and Social Security number, helps expedite the request process and ensures secure retrieval of sensitive information, vital for maintaining privacy and compliance with legal standards.

Formal closing and signature

The request for a verified credit history, often necessary for loan applications, apartment leases, or employment verification, must be clearly articulated. It's essential to specify the need for accuracy and authorization for sensitive information. Include personal identification details--full name, Social Security number, and current address--to help the credit bureau process the request efficiently. Furthermore, request a confirmation of receipt and an expected timeline for when the credit history will be delivered. Provide clear instructions if there are any specific formats preferred for the report. Note: Ensure to adhere to privacy regulations when handling sensitive personal data.

Letter Template For Requesting Verified Credit History Samples

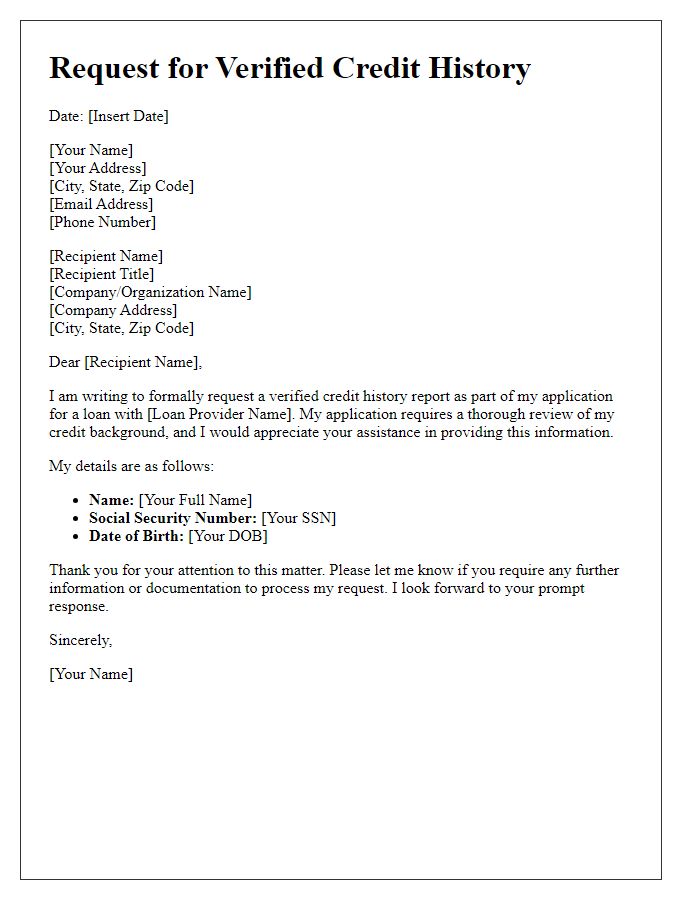

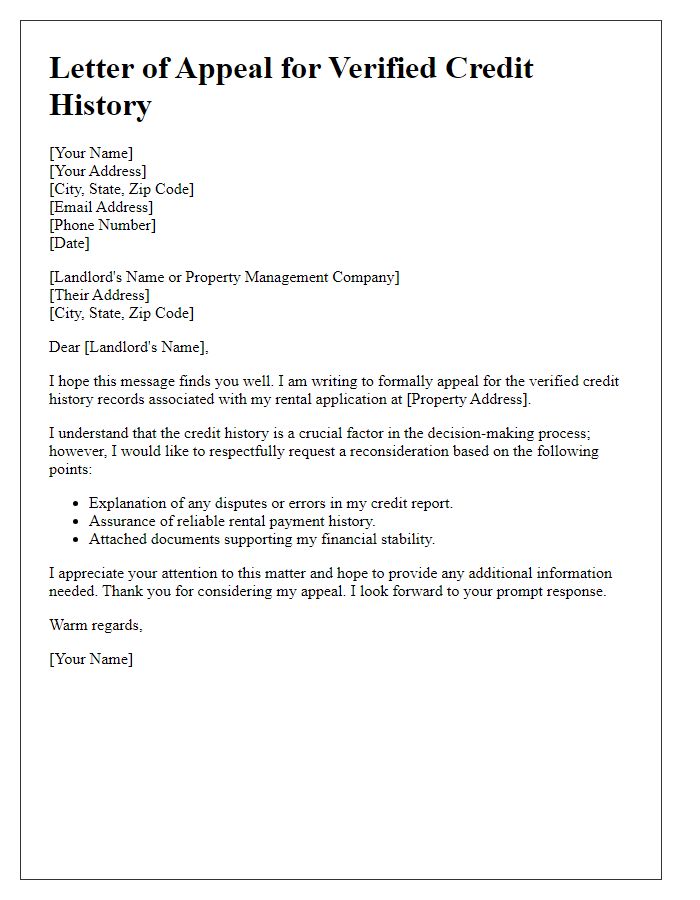

Letter template of request for verified credit history for loan application

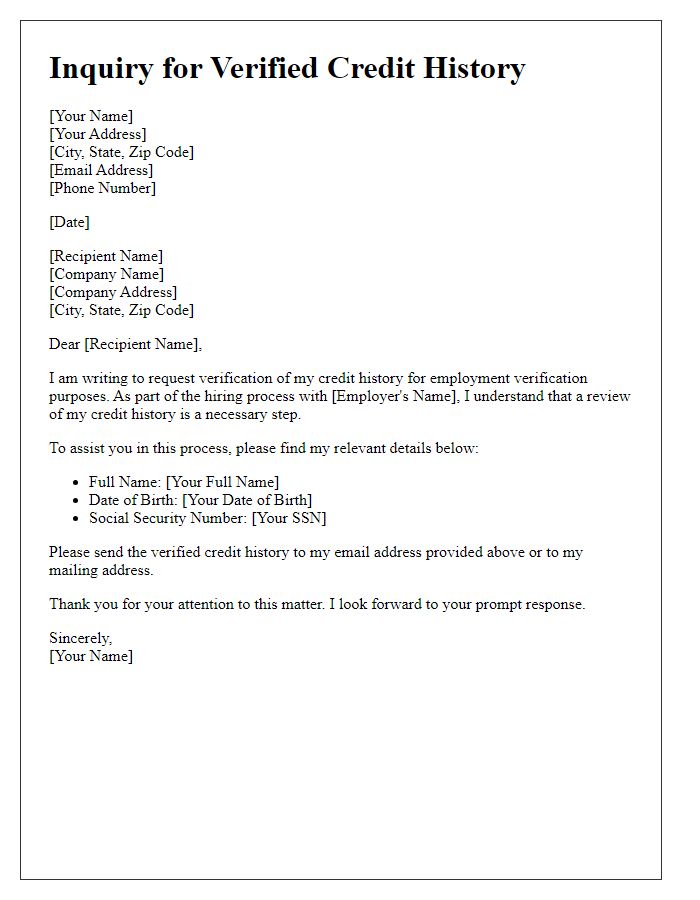

Letter template of inquiry for verified credit history for employment verification

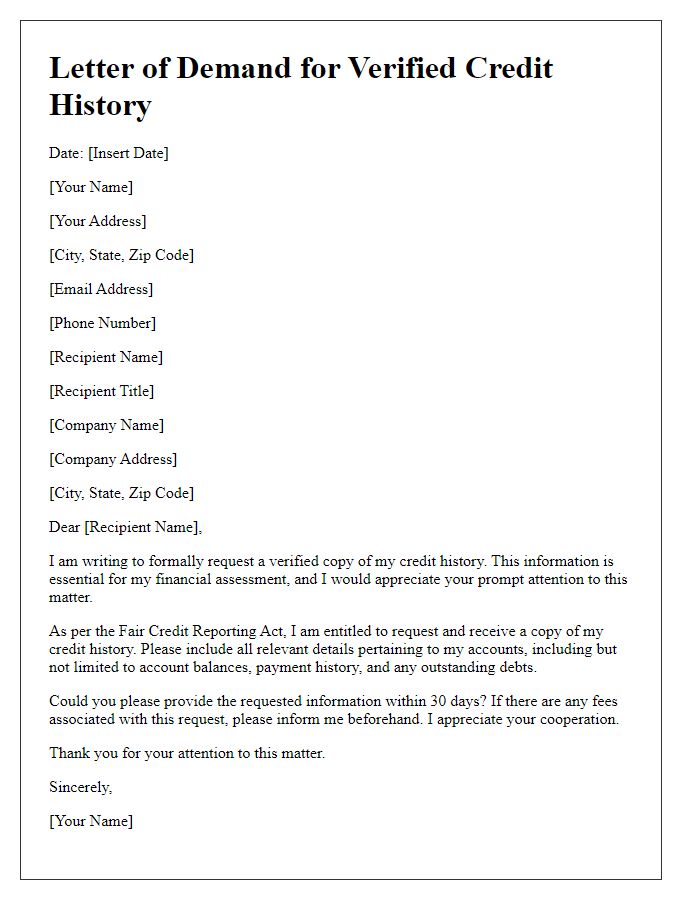

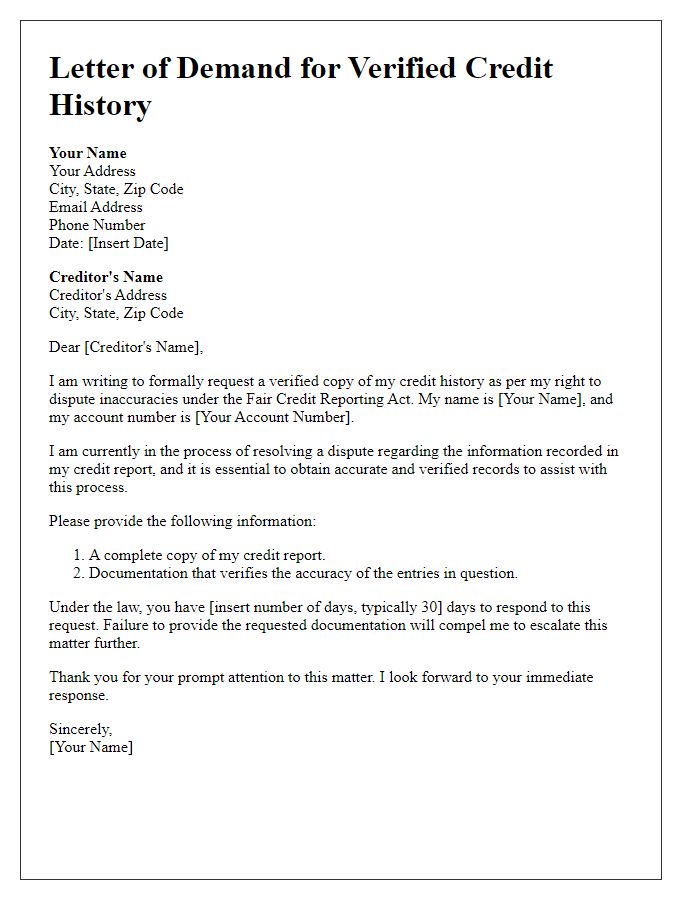

Letter template of demand for verified credit history for financial assessment

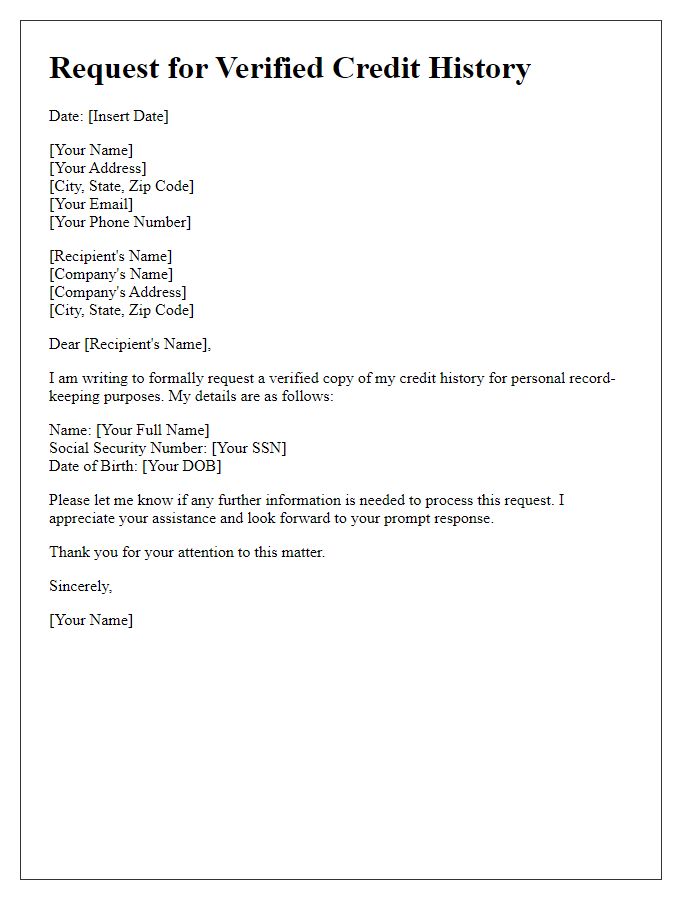

Letter template of solicitation for verified credit history for personal records

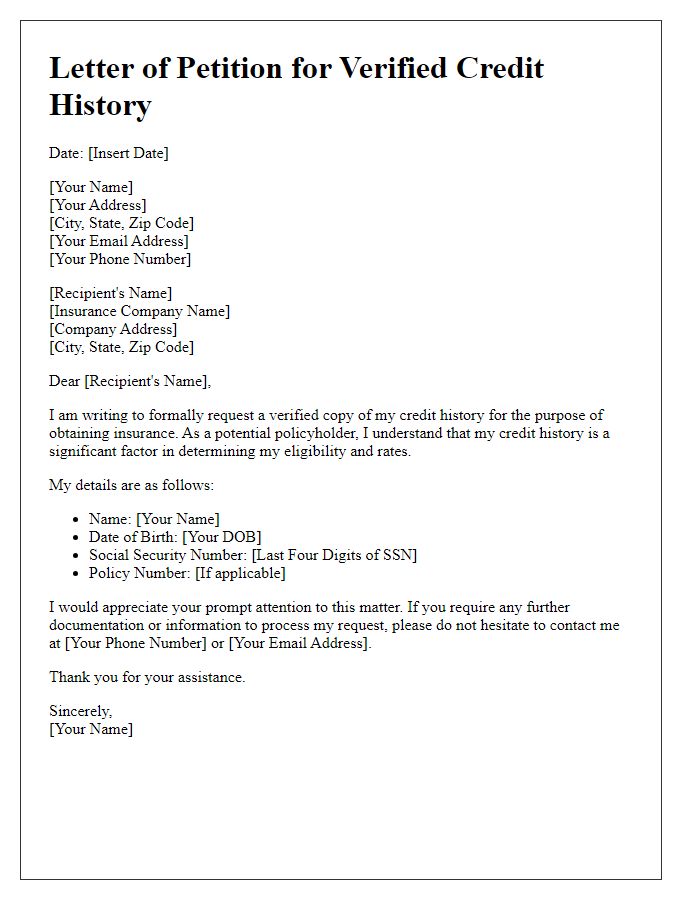

Letter template of petition for verified credit history for insurance purposes

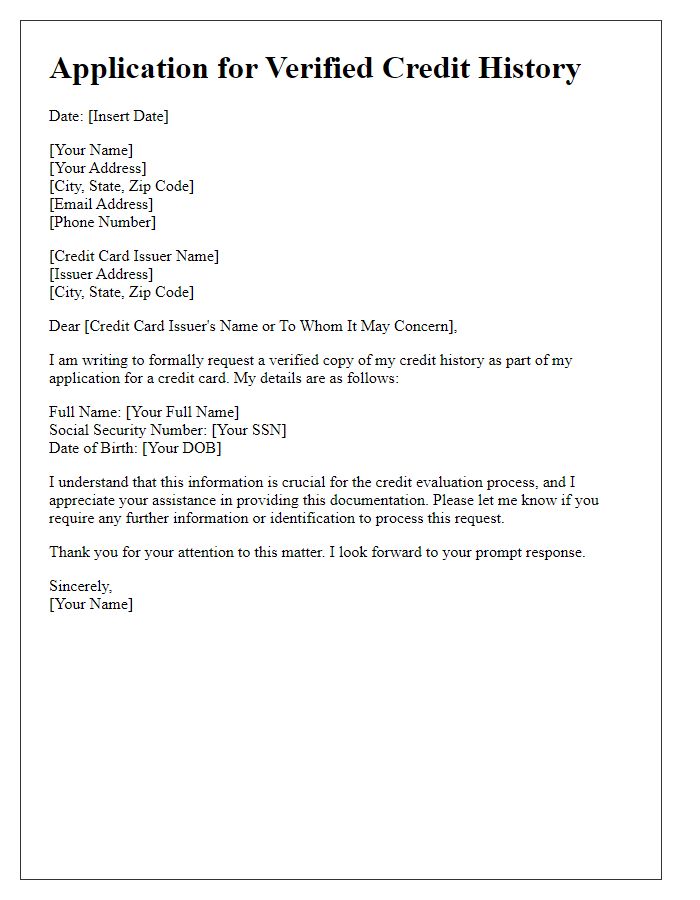

Letter template of application for verified credit history for credit card approval

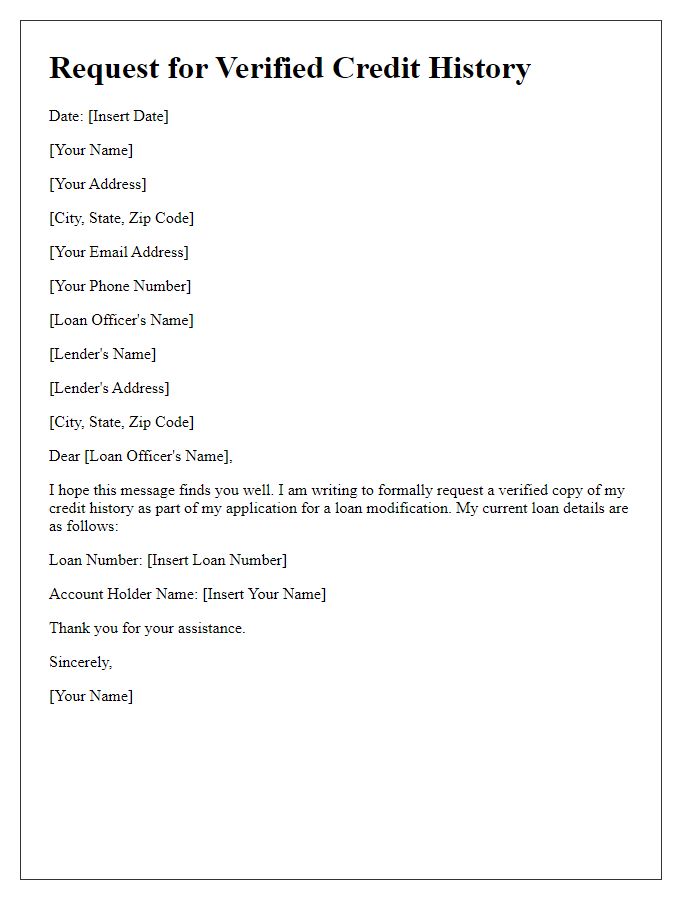

Letter template of request for verified credit history for loan modification

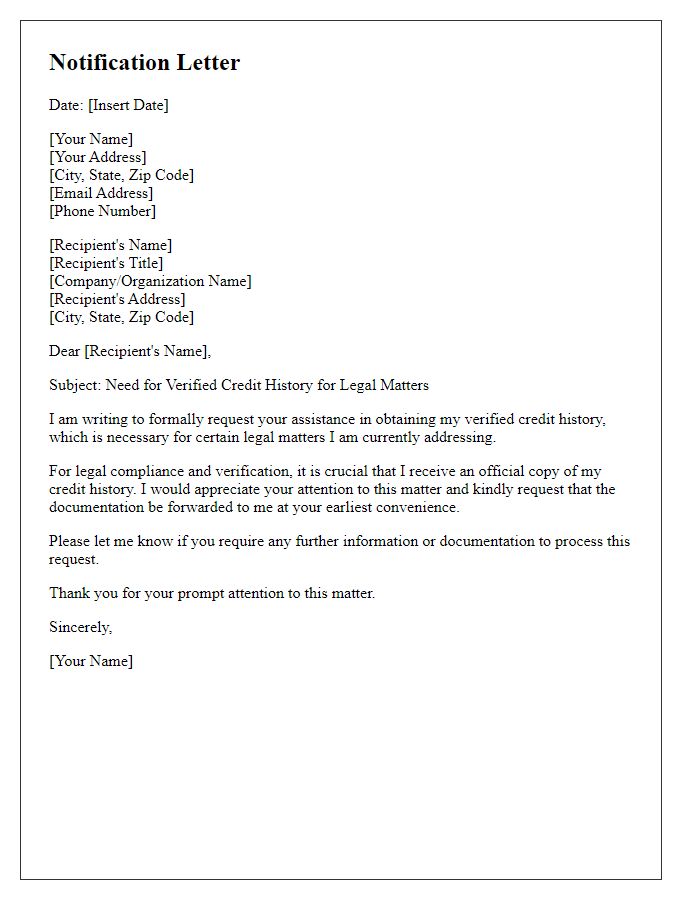

Letter template of notification for need of verified credit history for legal matters

Comments