Are you feeling overwhelmed by unpaid credit accounts that keep dragging you down? Settling outstanding balances can be a daunting task, but it's an essential step towards financial freedom. In this article, we'll guide you through the process of crafting an effective letter to negotiate and settle your debts, ensuring that you take control of your financial future. Let's dive in and explore the key steps you can take to put those outstanding accounts behind you!

Account information and outstanding amount

Outstanding credit accounts, such as those managed by credit bureaus, can significantly impact an individual's financial stability. Account information typically includes identifiers like account number (often 10-16 digits), credit limit, and outstanding balance. The outstanding amount represents the total balances that are overdue, which can affect credit scores by influencing payment history metrics. Settling these accounts promptly is crucial to preventing additional fees, interest accumulation, and potential legal actions by creditors. An efficient resolution process may involve negotiating payment plans or settlements for less than the full balance, which now equals $2,500 in some cases. Taking action proactively can restore creditworthiness and improve future borrowing opportunities.

Clear payment terms and deadline

Outstanding credit accounts require prompt resolution to maintain financial stability and trust. A defined payment structure facilitates this process, enabling both parties to understand obligations clearly. Standard payment terms, often ranging from 30 to 60 days following the invoice date, must be explicitly stated. For example, a due date of December 1, 2023, could be established for payments exceeding $1,000. Clients should receive a detailed statement outlining the outstanding balance, including any applicable late fees, which often incur after a 15-day grace period. Clear communication of consequences for non-payment, such as potential reporting to credit bureaus, reinforces the importance of adhering to these terms and ensures accountability in financial dealings.

Contact information for queries

Outstanding credit accounts may significantly impact financial stability. Ensuring timely communication is crucial for resolution processes. For any queries regarding outstanding balances, individuals can reach out to the customer service department of the respective creditor. This department typically operates during business hours, 9 AM to 5 PM, Monday through Friday. Essential details to have on hand include account number, full name, and contact information. Additionally, some creditors provide online platforms for queries, allowing for streamlined communication and quicker resolution. It is advisable to maintain documentation of all interactions, including dates and representative names, for future reference.

Assurance of account closure upon payment

Outstanding credit accounts can lead to financial strain and potential damage to credit scores. Timely payments help resolve these accounts, promoting financial health. Many credit agencies, including Experian and TransUnion, offer tools for tracking account status. Upon settling an outstanding balance, account holders may receive confirmation letters, ensuring closure of the account within 30 days. Documenting payment history is crucial, as it reinforces the commitment to responsible credit management. Keeping records of communications can also provide protection against identity theft or clerical errors during the resolution process.

Formal tone and polite language

Outstanding credit account settlements can significantly impact financial health and credit scores. Accurate and timely payments on accounts like revolving credit, personal loans, or business lines of credit are essential to maintain a good credit rating and avoid penalties or late fees. A credit account review often reveals specific outstanding balances, interest rates, and payment due dates that need to be addressed. Ensuring communication with financial institutions, such as banks or credit unions, can facilitate negotiation for possible settlements or repayment plans. In addition, understanding the credit reporting cycle and how settlement can affect future loan approvals is crucial.

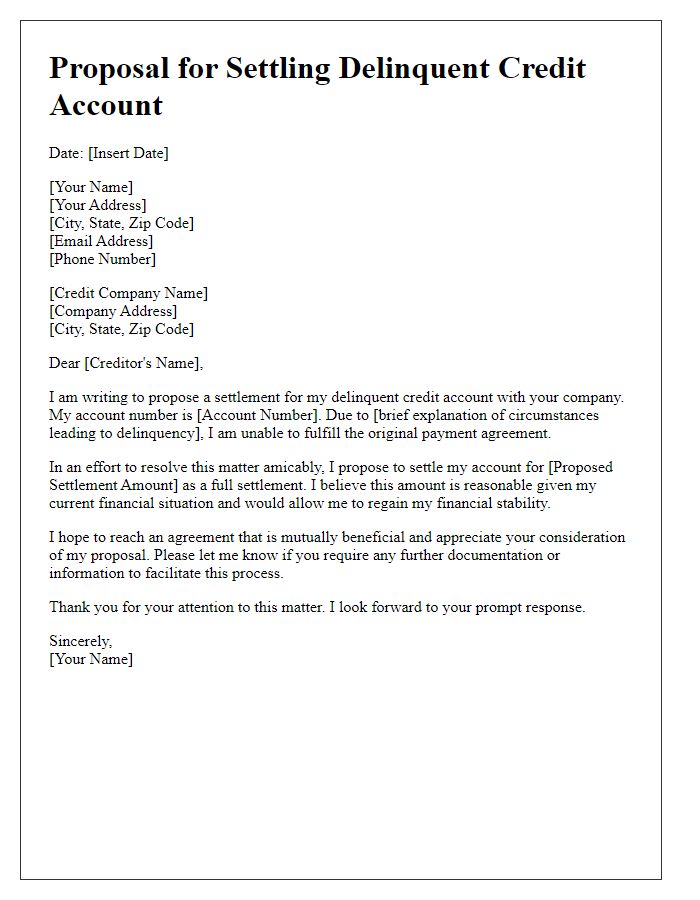

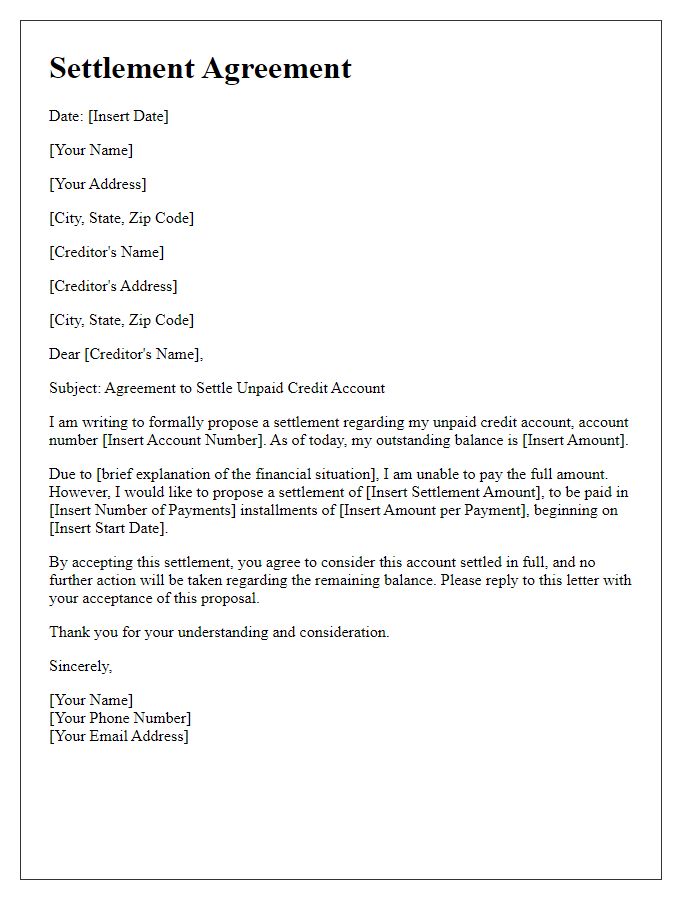

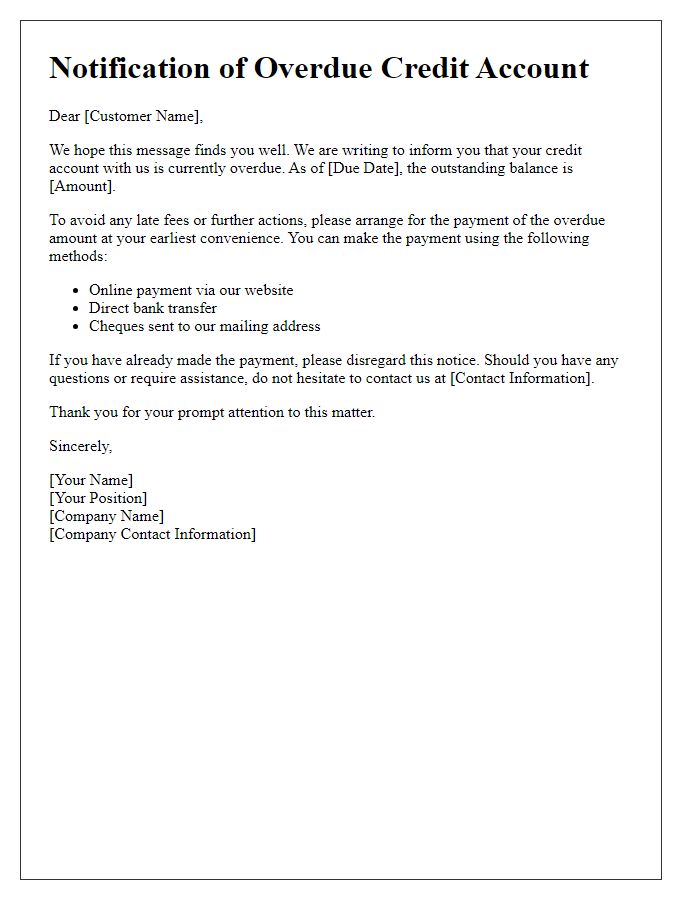

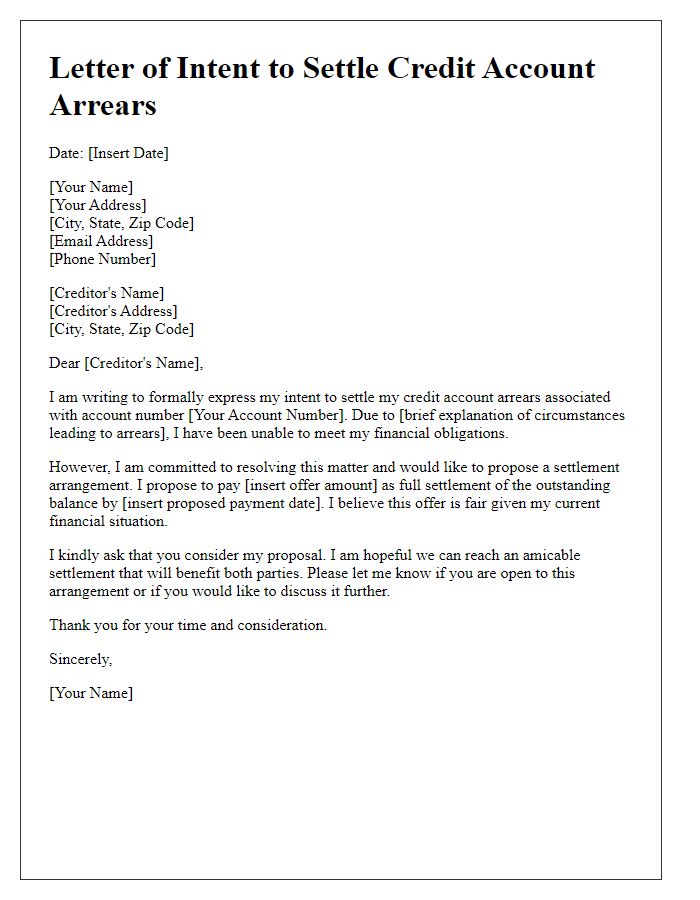

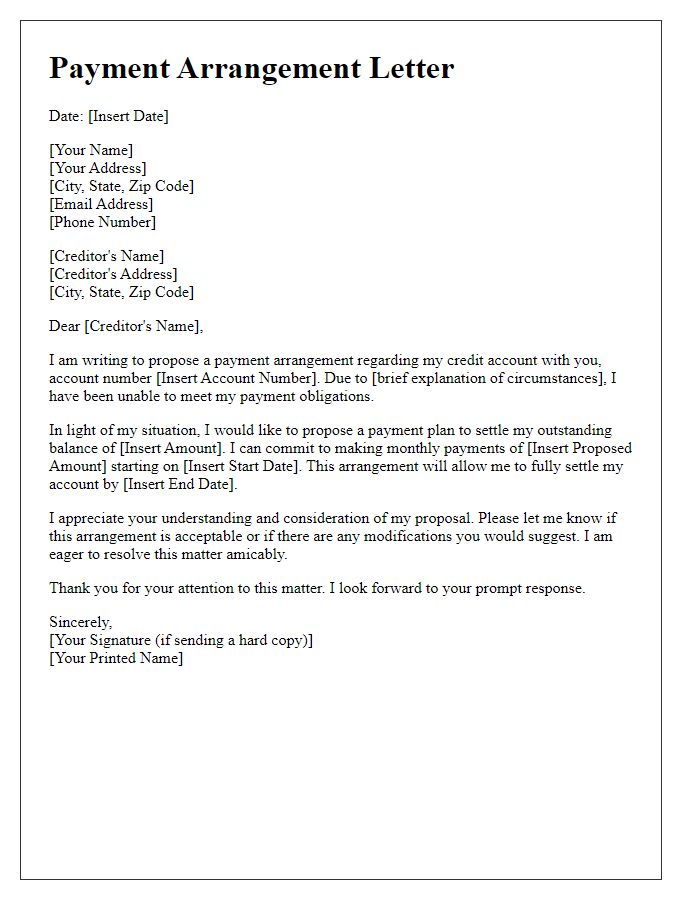

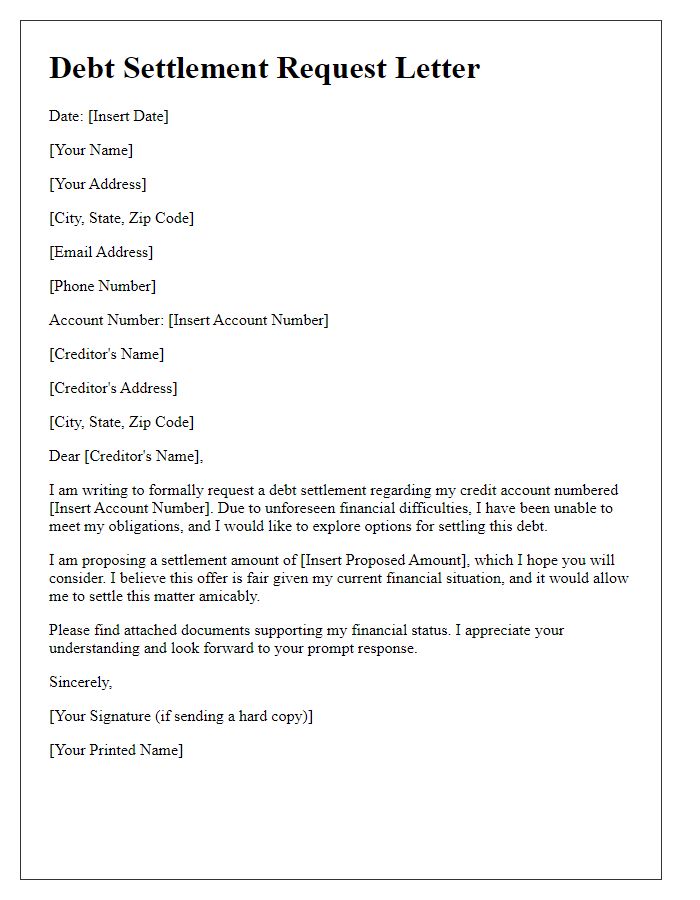

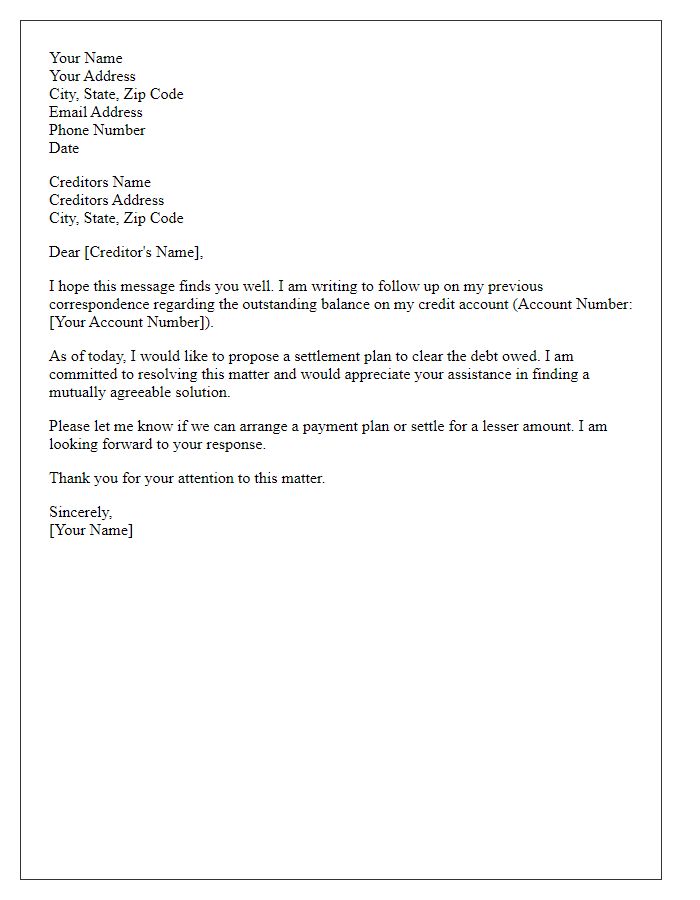

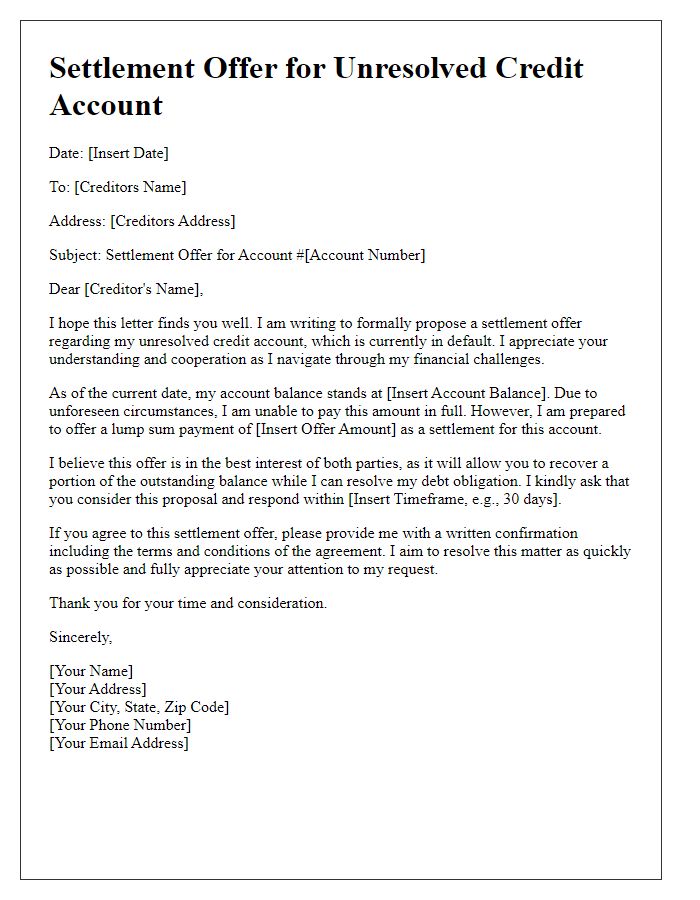

Letter Template For Settling Outstanding Credit Account Samples

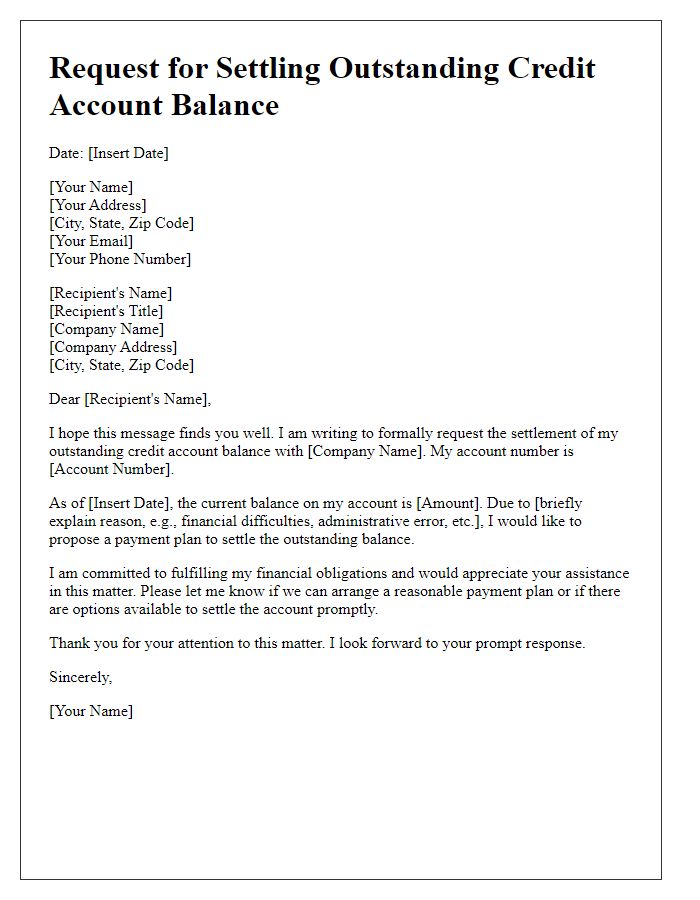

Letter template of request for settling outstanding credit account balance

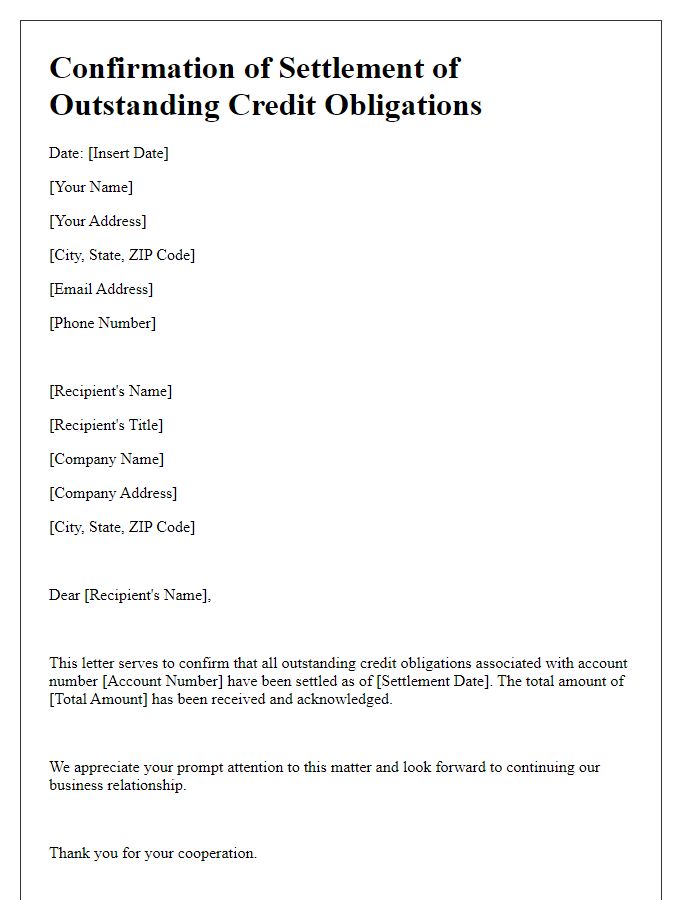

Letter template of confirmation for settling outstanding credit obligations

Comments