Are you feeling anxious about a missed credit payment? You're not aloneâmany people face similar challenges in managing their finances. In this article, we'll break down how to address the situation with a clear and respectful letter that communicates your circumstances effectively. So, let's dive in and help you navigate this financial hurdle together!

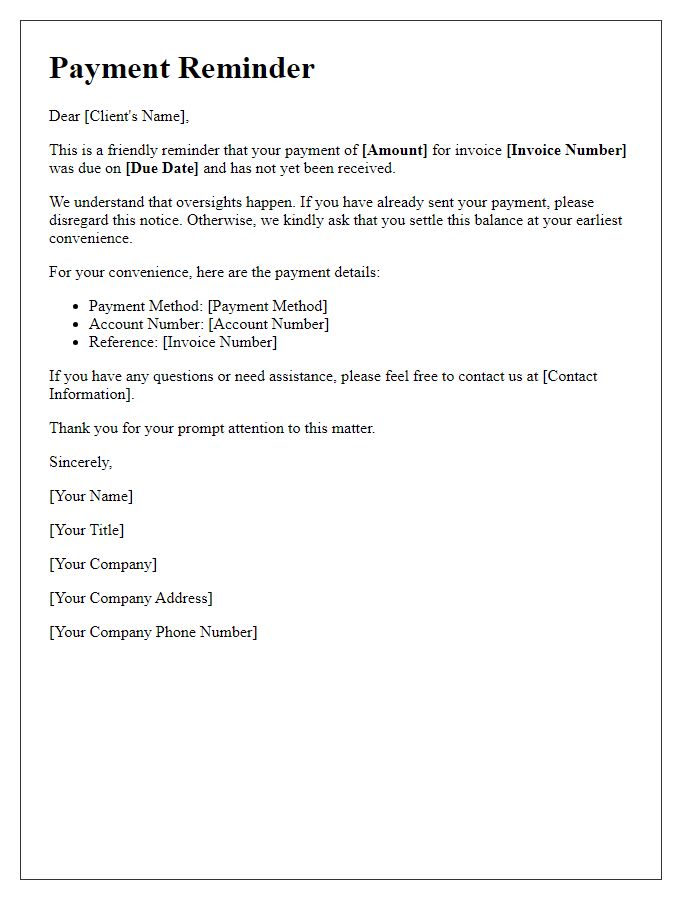

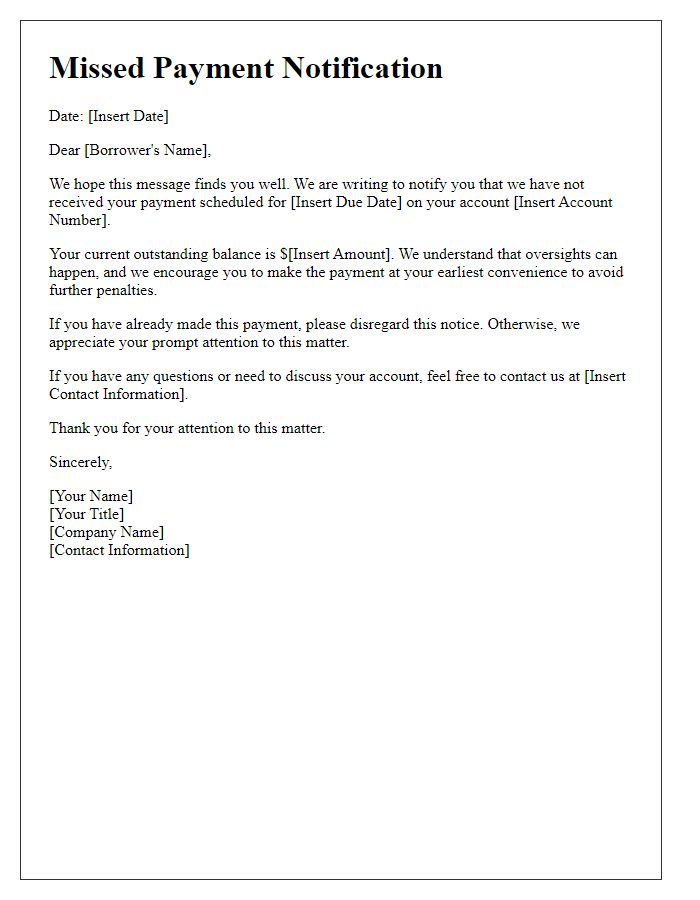

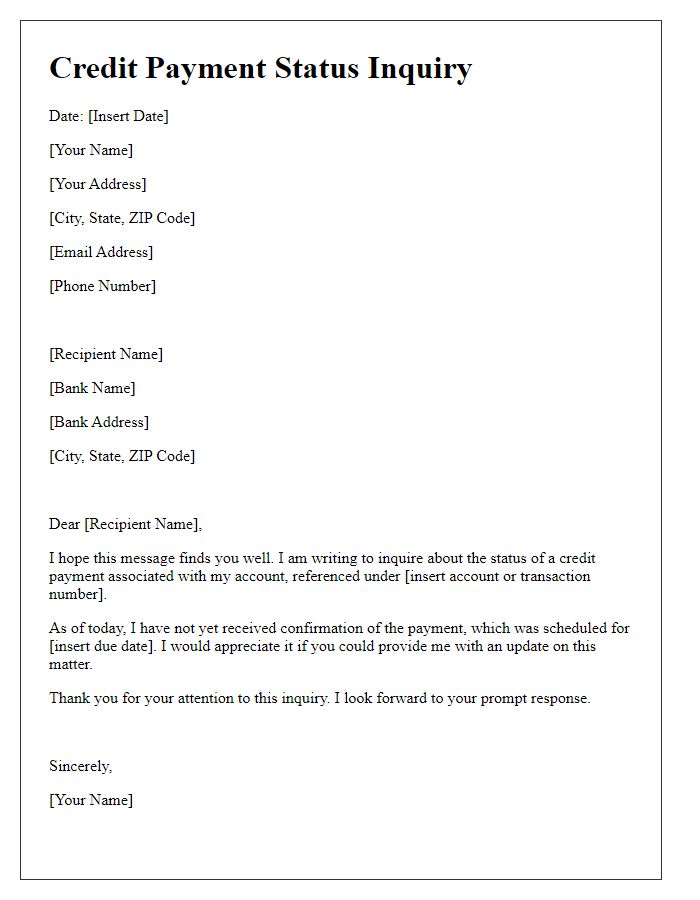

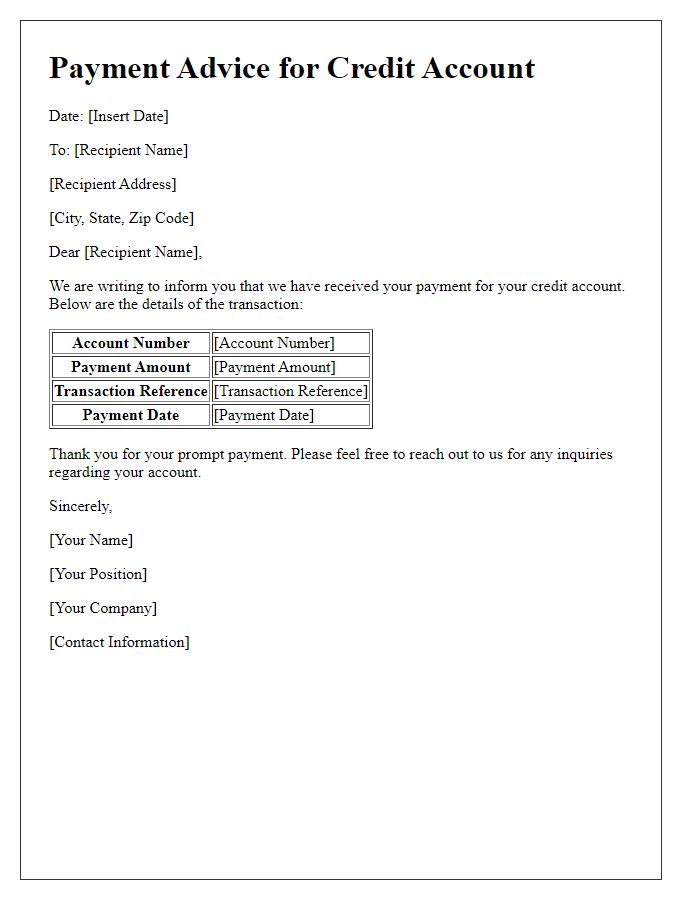

Polite opening and customer identification

A polite update regarding a missing credit payment highlights customer identification, ensuring clarity and understanding in communication. This approach maintains professionalism while addressing potential concerns. The customer, typically identified by account number or name, receives acknowledgment of their account status. Personalized greetings reinforce the relationship and encourage prompt attention to the payment issue. Moreover, offering support or assistance fosters trust and transparency, emphasizing the importance of maintaining a clear communication channel. This method not only addresses the payment concern but also strengthens customer engagement and satisfaction.

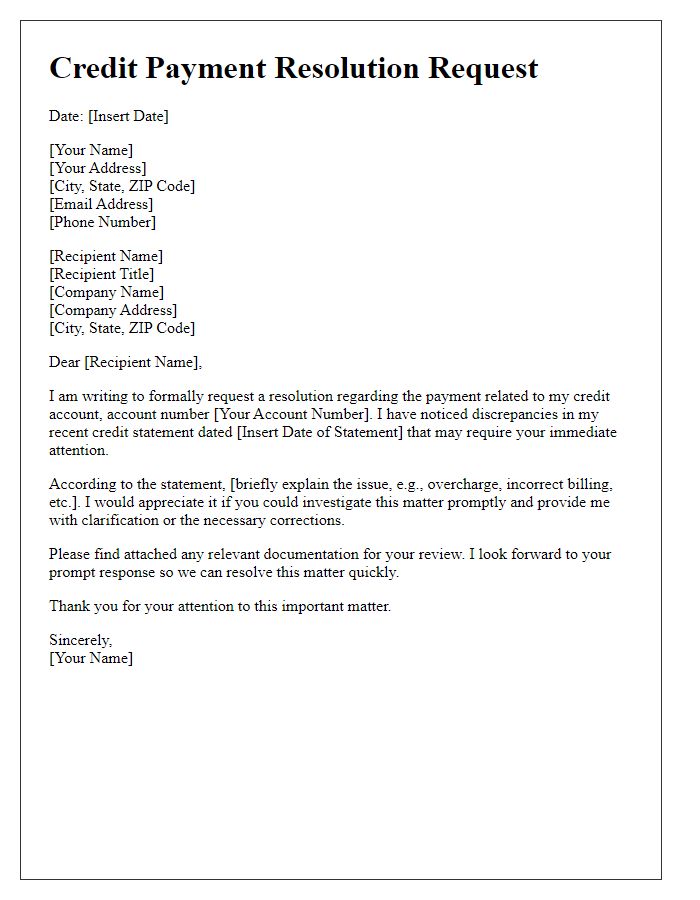

Clear statement of the missed payment

In August 2023, a credit payment of $150 was not received by ABC Financial Services for account number 123456789. This missed payment affects your credit score and incurs a late fee of $25. Failure to address this missed payment by the next billing cycle could result in further penalties or impact your credit history negatively. To avoid complications, payments must be submitted by the due date in the future. Regular monitoring of account statements can help in identifying potential discrepancies promptly.

Explanation of consequences or policies

Missing a credit payment can lead to serious repercussions for account holders, especially with major financial institutions such as banks or credit card companies. Typically, a late payment can result in a penalty fee, which may range from $25 to $40 depending on the institution's policies. Furthermore, a missed payment can negatively impact credit scores, with potential reductions of up to 30 points on the FICO score, affecting future borrowing capabilities and interest rates. Accounts may incur a higher Annual Percentage Rate (APR) after just one missed payment, making borrowing more expensive over time. Additionally, repeated missed payments can lead to account delinquency, resulting in collections actions or potential legal consequences. Institutions often follow regulations under the Fair Credit Reporting Act, meaning missed payments could be reported to credit bureaus and remain on credit reports for seven years. Timely communication with creditors may provide options for payment plans or hardship assistance, mitigating some adverse effects.

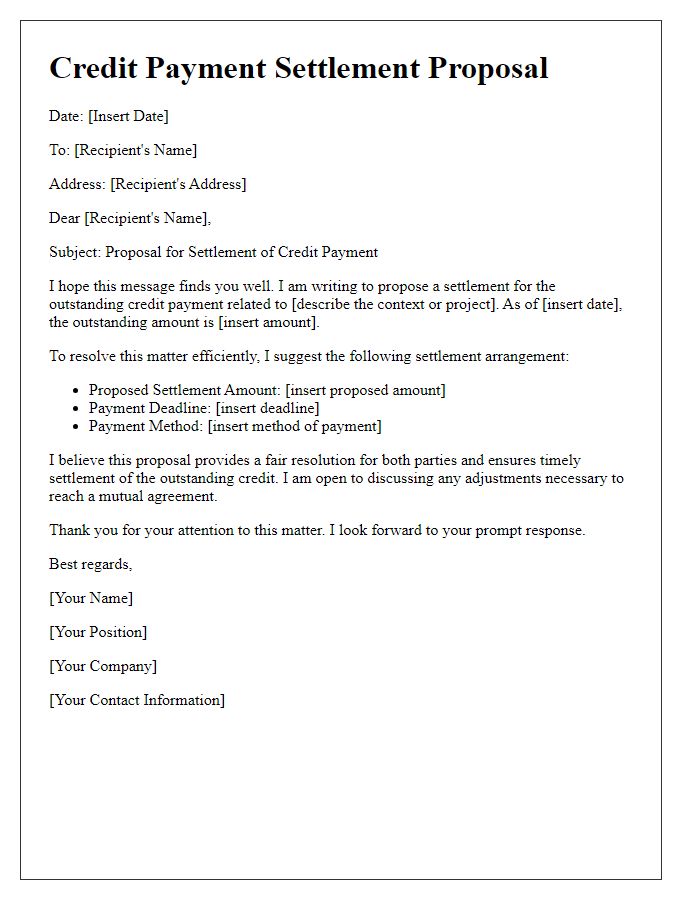

Request for prompt payment and resolution options

Late payments on credit accounts can negatively impact credit scores, often measured through FICO scores ranging from 300 to 850. Outstanding balances can incur late fees, with typical penalties reaching $40 or more. Maintaining timely payments is crucial, as a single missed payment can remain on a credit report for up to seven years. Contacting the creditor directly provides options for resolution, such as setting up a payment plan or discussing hardship programs. Gathering documentation to support a payment request might prove beneficial, especially if unexpected events like job loss or medical emergencies occurred. Understanding consumer rights under the Fair Debt Collection Practices Act can empower individuals to negotiate effectively with creditors.

Contact information for customer support

Customers experiencing issues with missing credit payments should reach out to customer support for assistance. The dedicated support hotline is available at 1-800-555-0199, accessible Monday through Friday from 9 AM to 6 PM EST. Alternatively, customers can email the support team at support@creditcompany.com for detailed inquiries and resolutions. The response time for email inquiries is typically within 24 hours. Additionally, users can visit the official website at www.creditcompany.com/help for a comprehensive FAQ section and live chat options during business hours.

Comments