Are you thinking about canceling your credit alert subscription but unsure how to go about it? You're not alone; many people find themselves in a similar situation when they reassess their financial monitoring needs. In this article, we'll guide you through the process of writing a cancellation letter that's clear and concise, ensuring you communicate your request effectively. Stick around to discover helpful tips and a template that can make your cancellation hassle-free!

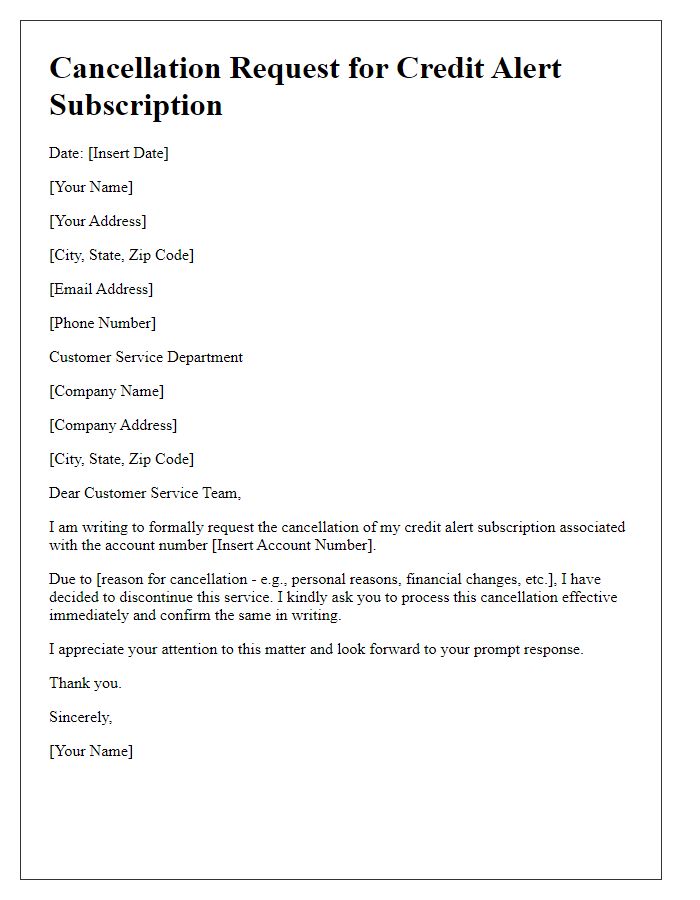

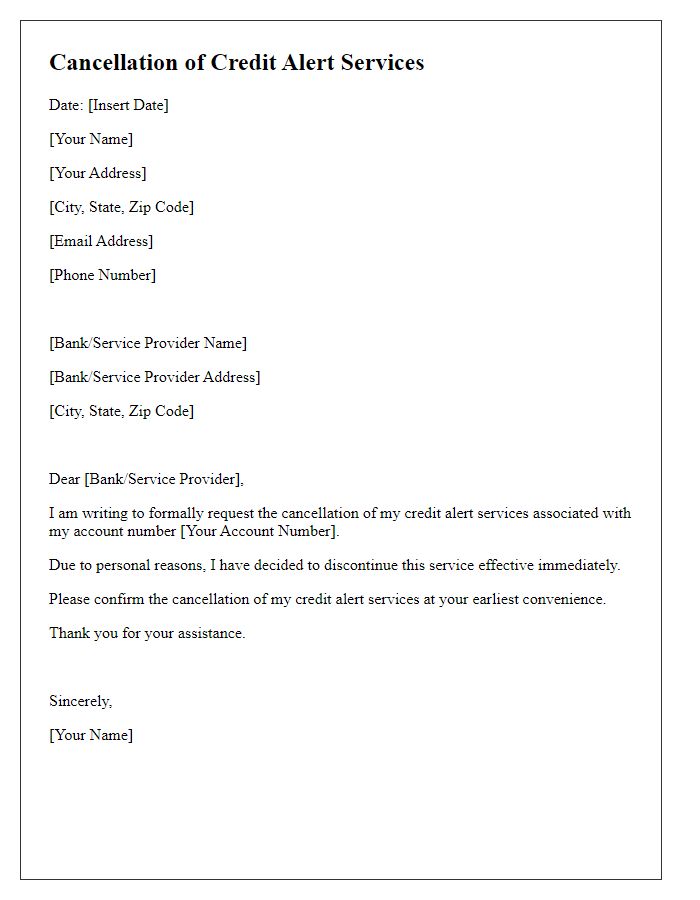

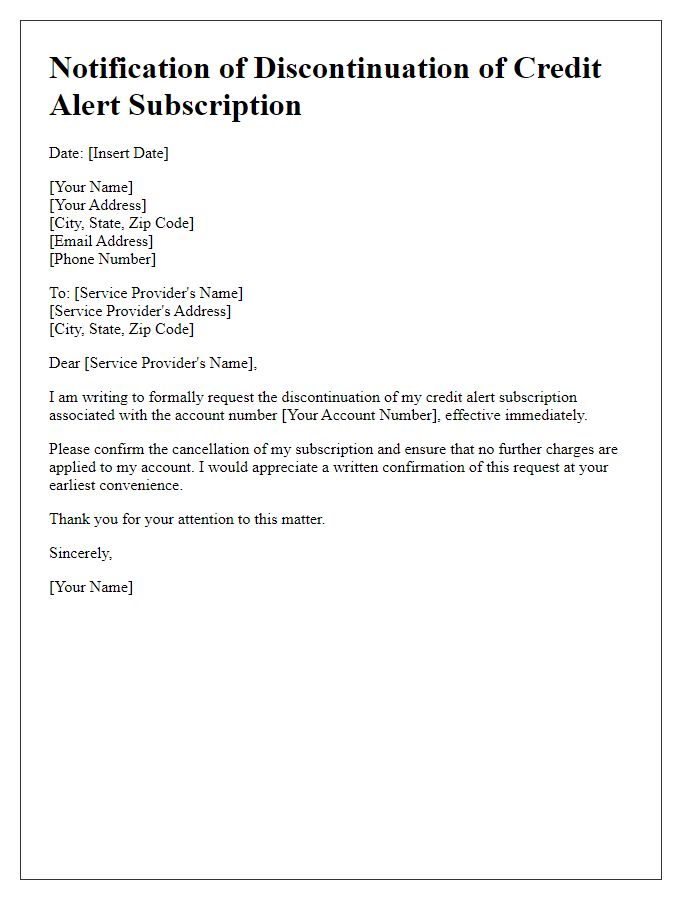

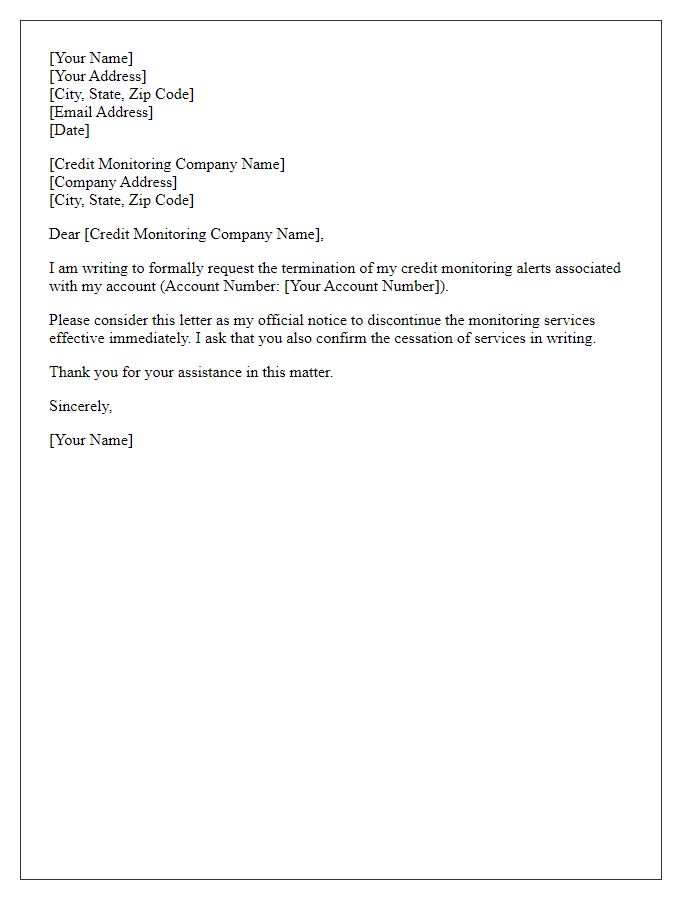

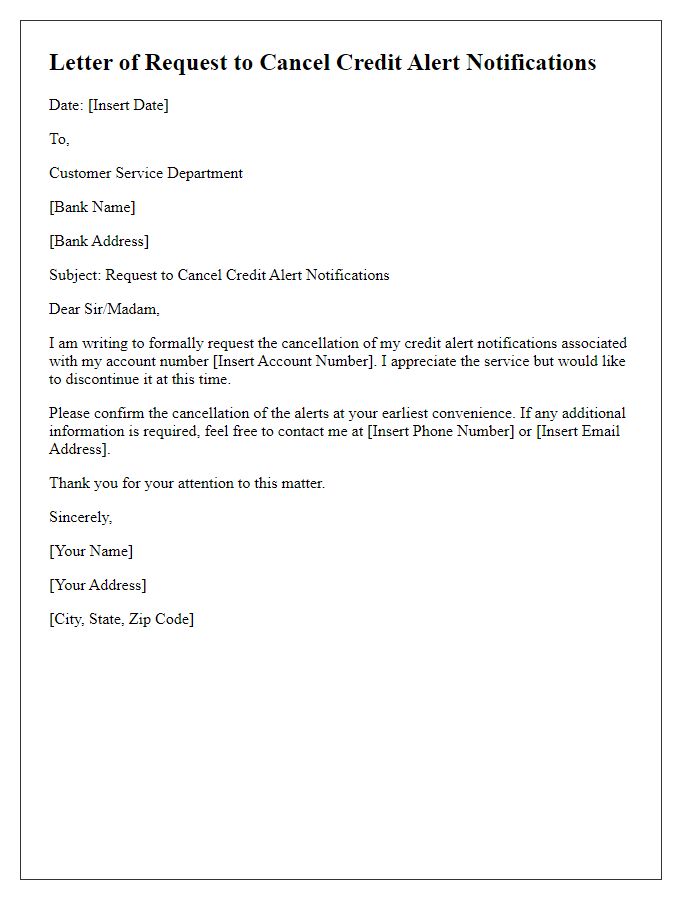

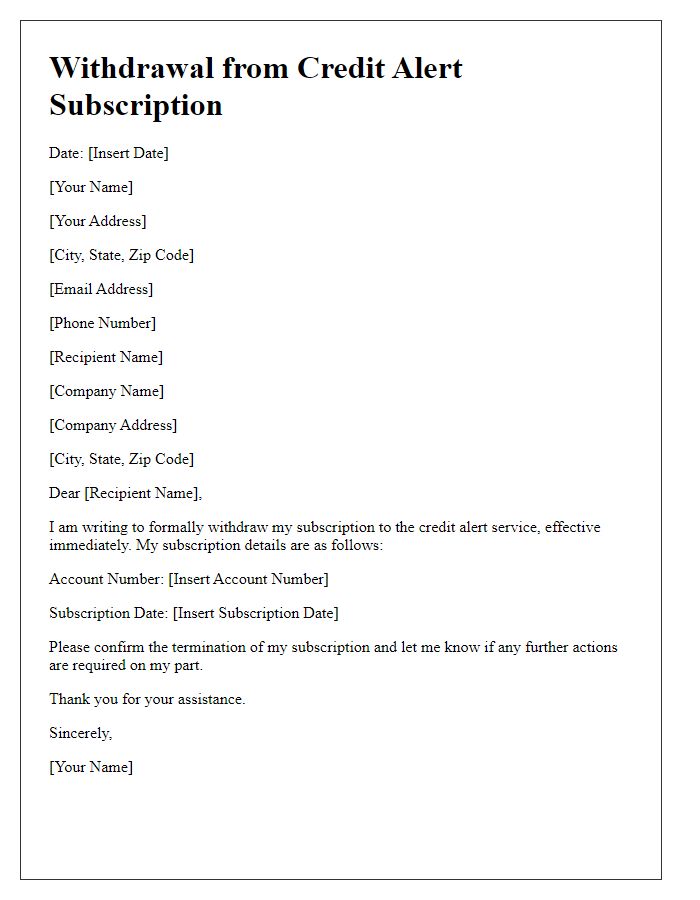

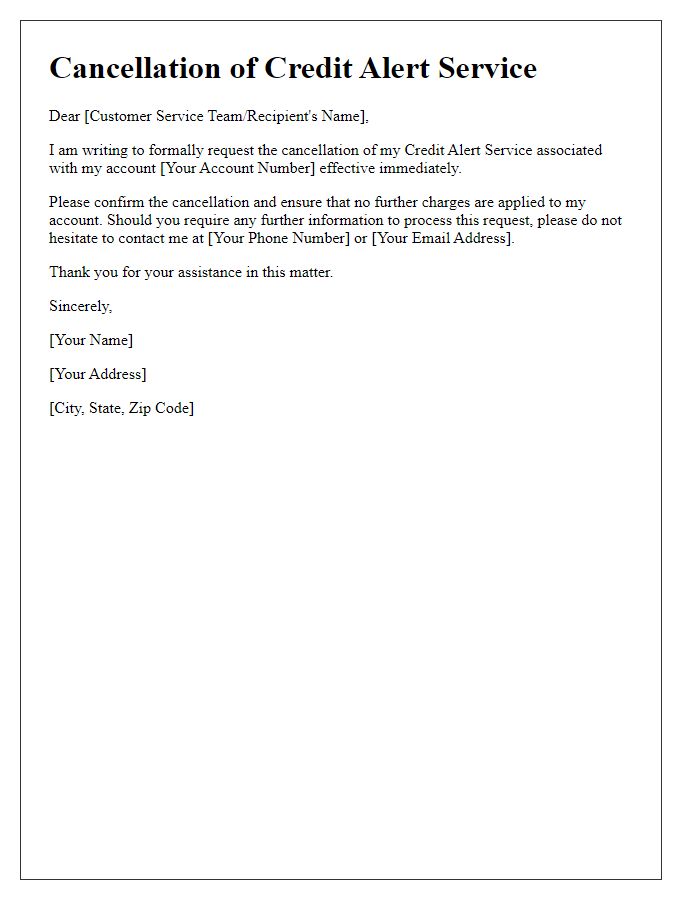

Subscriber's full name and contact information

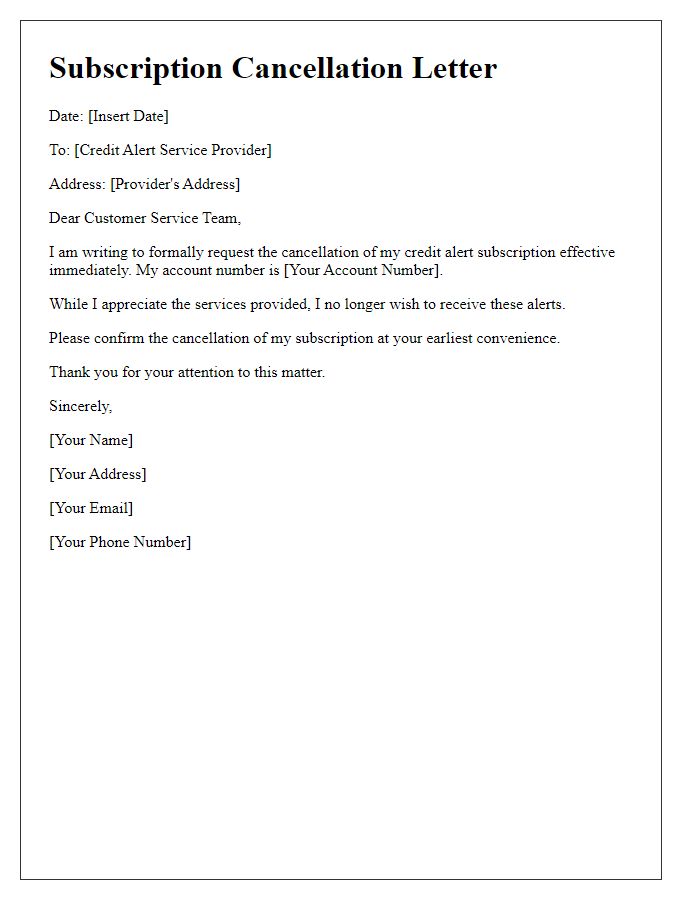

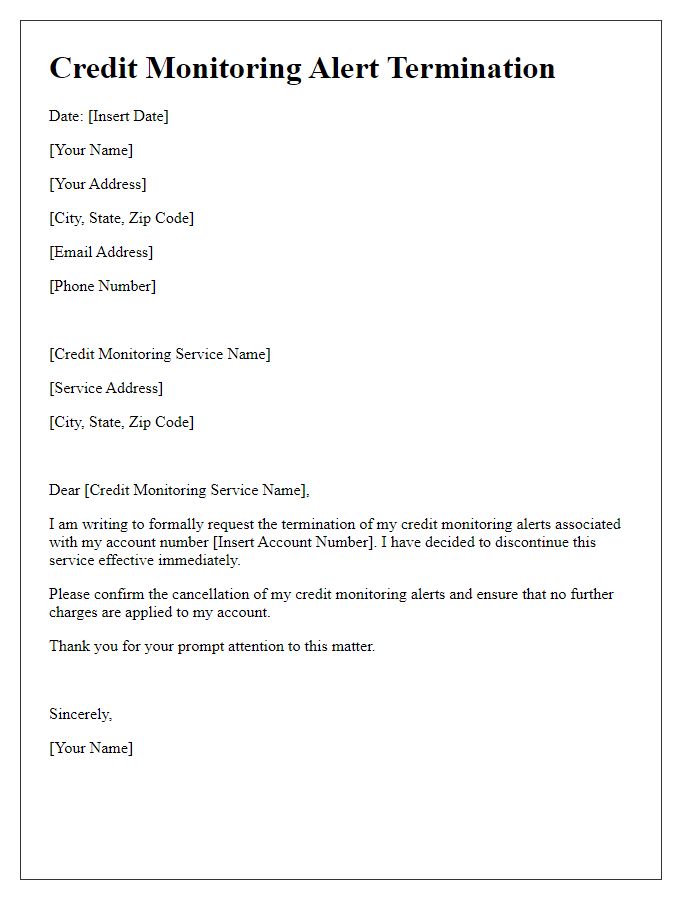

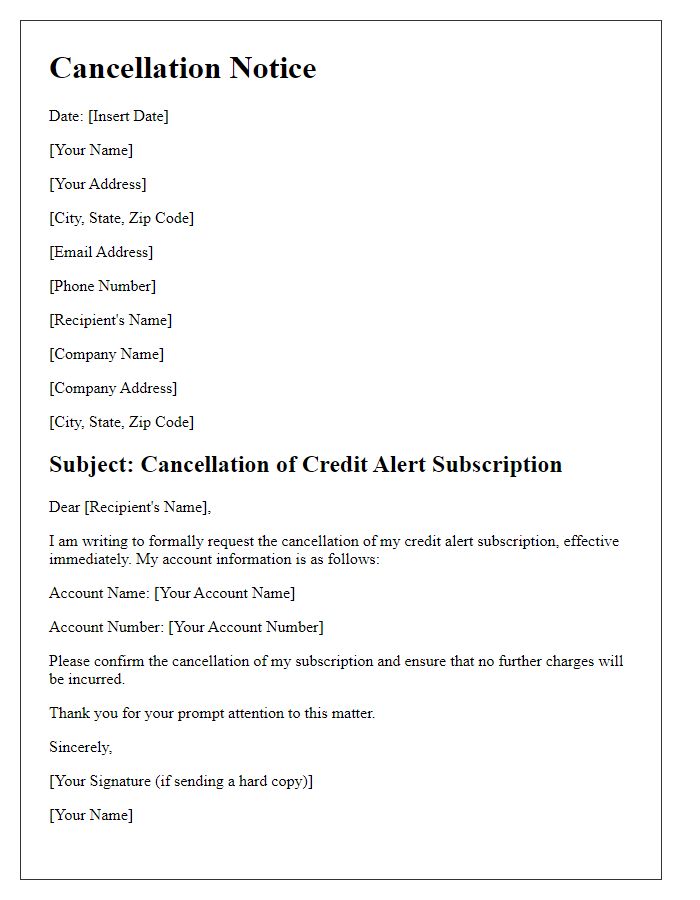

The process of canceling a credit alert subscription requires the subscriber's full name, including middle initial if applicable, as well as accurate contact information such as a phone number and email address. Providing specific details like the subscription activation date and the service provider's name can expedite the cancellation procedure. Subscribers may also reference their account number to ensure accurate processing. Some companies may require a confirmation of cancellation through a follow-up email or phone call to complete the process, enhancing transparency and security for both parties involved.

Account or subscription reference number

A credit alert subscription cancellation requires attention to specific details to ensure accuracy and efficiency. Customers should include their account or subscription reference number, usually a unique identifier consisting of alphanumeric characters that links to their credit alert services. When communicating with the service provider, it is essential to specify the reason for cancellation, whether due to changes in financial situations or preferences. Additionally, noting any relevant dates, such as the initial subscription date or the desired cancellation date, can help streamline the process. Keeping a record of any confirmation numbers or responses from the provider serves as proof of the cancellation request.

Clear statement of cancellation intent

To cancel a credit alert subscription, users should send a direct request to the service provider. A clear statement indicating intent to cancel, along with relevant account details such as user ID or subscription number, is essential for processing the request efficiently. Including the date of cancellation request and a request for confirmation can help ensure the subscription is officially terminated. Additionally, mentioning any specific reasons, like dissatisfaction with the service or financial considerations, can provide valuable feedback for the provider.

Effective date for cancellation request

Credit alert subscription cancellation requires timely processing to ensure no further charges occur. Effective date for cancellation request should be no later than the next billing cycle, typically 30 days from submission. Ensure that the subscription details, such as account number and service provider name (for example, Experian or TransUnion), are included in the cancellation notice. Providing a clear request for confirmation of cancellation will help maintain a record of the transaction and prevent possible billing errors. Following internal procedures for cancellation within the specified time frame is essential to avoid unauthorized charges.

Request for confirmation of cancellation completion

A confirmation request regarding the cancellation of a credit alert subscription is essential for maintaining accurate financial monitoring. The subscription offers real-time notifications about credit scores, identity theft alerts, and credit report changes. Receiving a confirmation ensures the cancellation process has been completed, preventing unwanted charges from the credit monitoring service provider. Individuals may request this confirmation through various communication channels such as email or customer service phone lines. The cancellation confirmation should ideally include the date of cancellation, the relevant account details, and assurance that no further payments will occur.

Comments