Are you feeling overwhelmed by a tax lien notice and wondering how to dispute it? You're not alone; many individuals face challenges when it comes to navigating the complexities of tax liens. In this article, we'll break down the essential steps needed to draft a clear and effective letter template for disputing a tax lien report. Join us as we guide you through the process and empower you to take control of your financial situation!

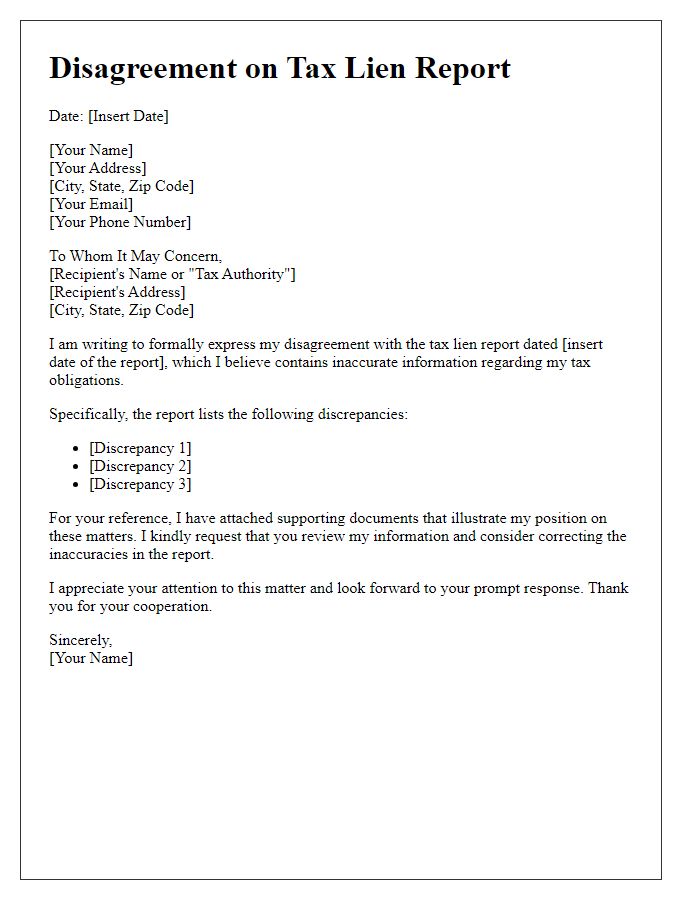

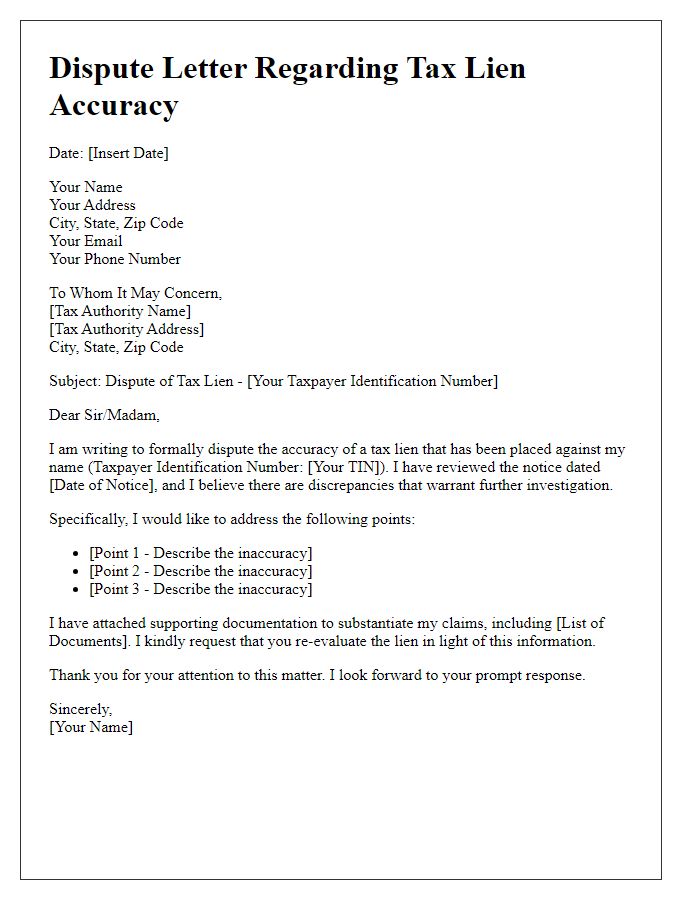

Accurate Personal Information

Accurate personal information is crucial when disputing a tax lien report, ensuring that all data matches legal documents such as Social Security numbers, addresses, and names. Any discrepancies in personal details can lead to complications, prolonging the dispute process. Organizations like the Internal Revenue Service (IRS) and local tax authorities meticulously review personal data to validate claims. Accurate identification aids in establishing credibility and ensures your dispute is processed efficiently. Records such as property tax assessments and previous tax filings from the tax assessor's office can be referenced to support claims of incorrect information. Robust documentation bolsters the integrity of your dispute, potentially leading to resolution and the removal of erroneous tax liens.

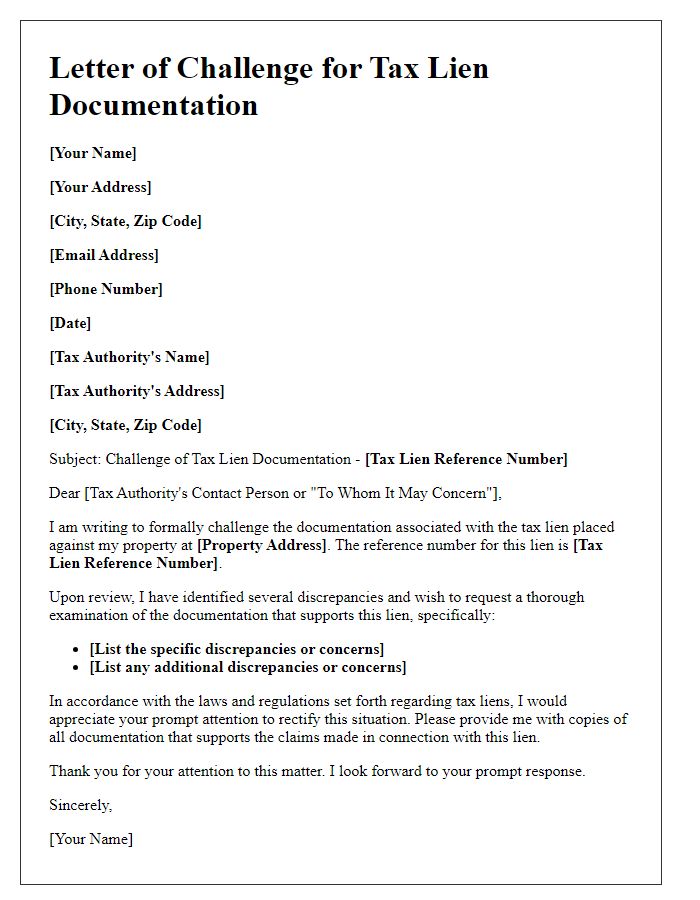

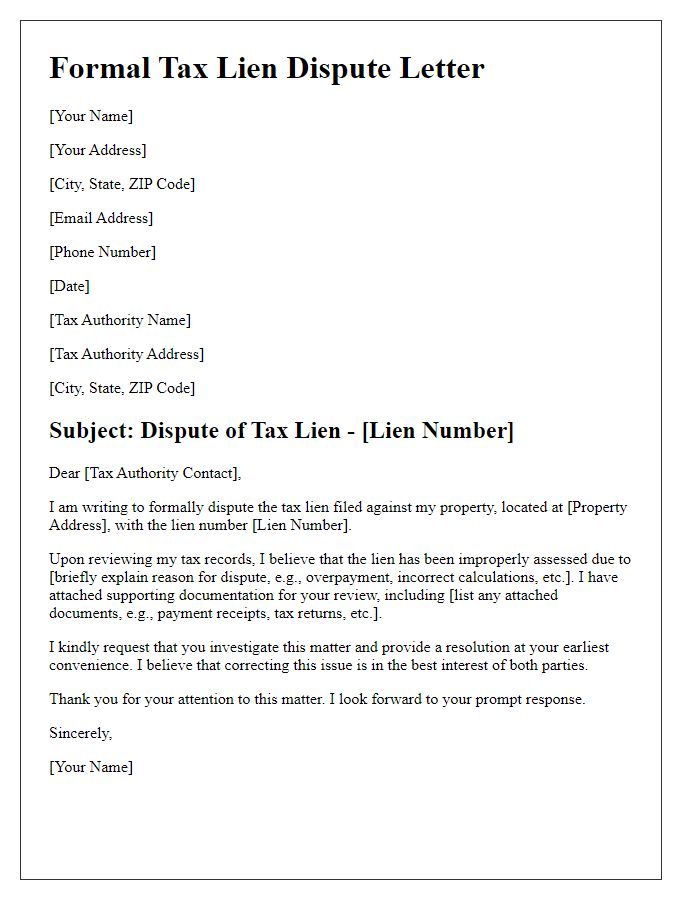

Clear Dispute Identification

Tax lien reports contain detailed records of unpaid tax obligations that can significantly impact credit scores and property ownership. Clear identification of disputes within these reports is crucial for addressing inaccuracies. Tax authorities, such as the Internal Revenue Service (IRS) in the United States, assign these liens, which can remain on public records for up to seven years, potentially hindering financial transactions. Disputes should pinpoint specific lien amounts, timelines, and associated properties, ensuring clarity for resolution processes. Proper documentation, including account statements and correspondence with tax agencies, supports the dispute's legitimacy, enabling timely corrections and restoration of creditworthiness.

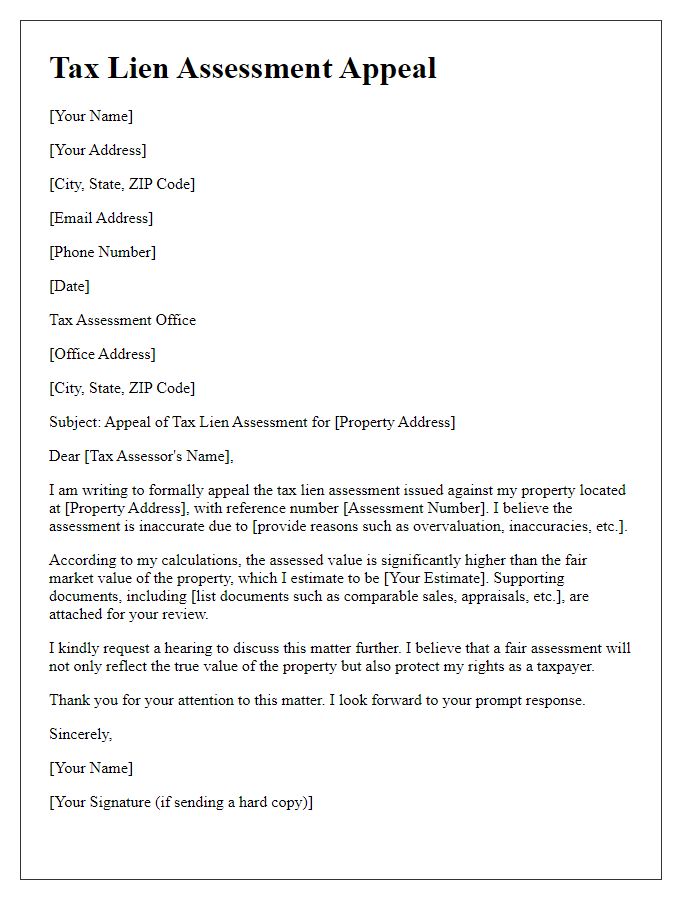

Detailed Explanation and Evidence

A tax lien dispute requires a thorough examination of financial records and relevant documentation. Discrepancies in tax assessments, such as those from the Internal Revenue Service (IRS) or state tax authorities, can lead to unjustified liens on properties. For instance, a tax lien issued in 2022 for unpaid taxes of $5,000 may stem from accounting errors or misreported income. Evidence such as bank statements, W-2 forms, and previous tax returns from 2019 to 2021 should be collected to substantiate claims. Details about the property, including its assessed value and any sales history, are crucial. The dispute process typically involves filing a formal challenge with supporting documents to the local tax office, highlighting inconsistencies and requesting a review or adjustment of the lien. Timeliness in submitting this evidence can greatly influence the outcome of the dispute.

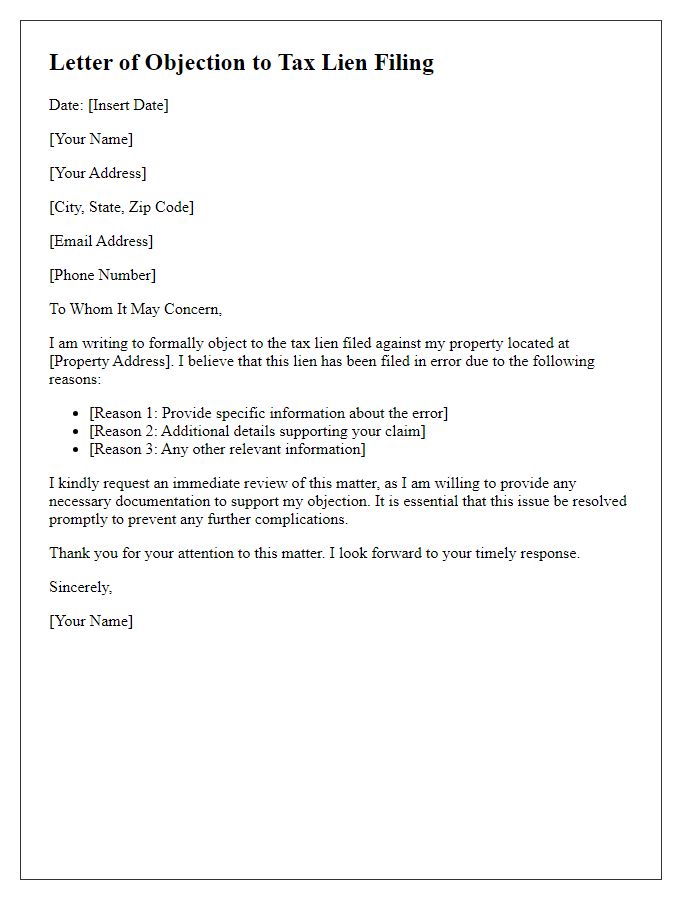

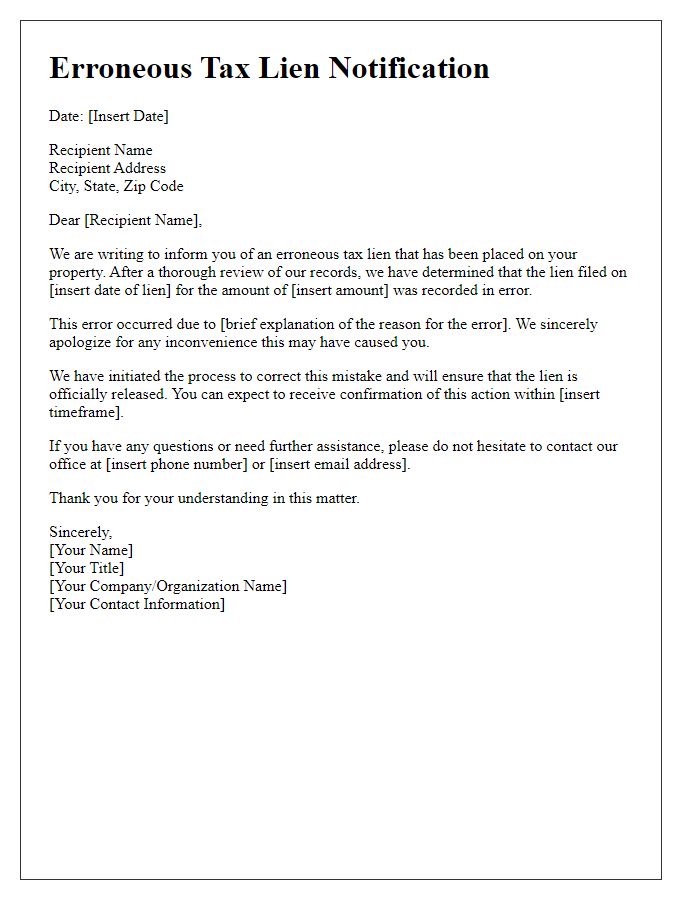

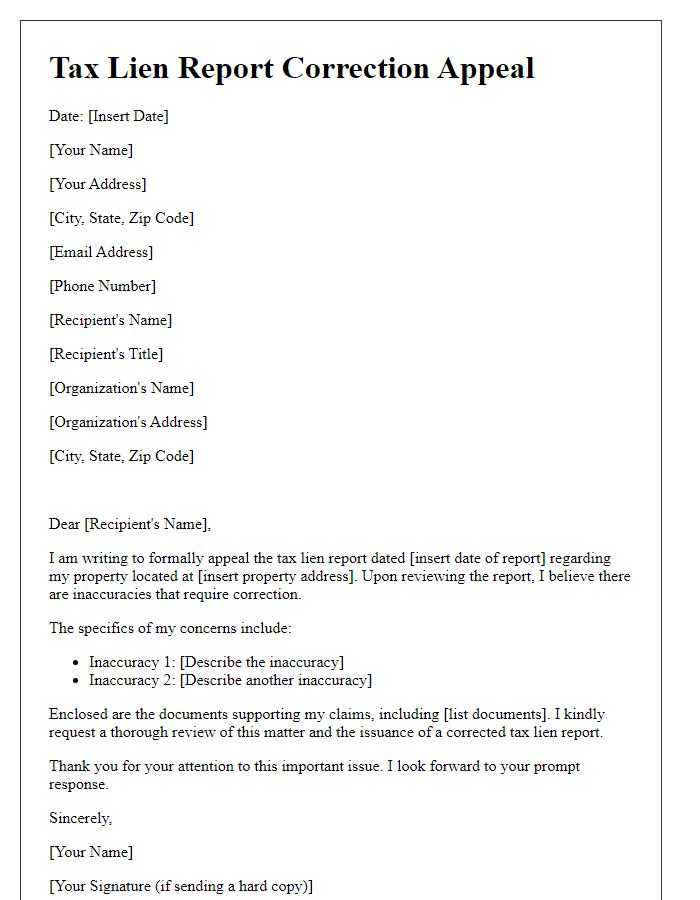

Request for Correction and Resolution

Tax lien reports often contain inaccuracies that can impact credit scores and financial decisions. A disputed tax lien may arise from incorrect information reported by local governments (for instance, a city or county tax office). Errors can occur in key details such as the lien amount, date of lien issuance, or even the property address, potentially due to data entry mistakes or outdated information. For example, a tax lien filed in 2022 for an amount of $5,000 might be mistakenly reported as being filed in 2021 or incorrectly linked to an unrelated property. Prompt resolution can involve contacting the reporting agency or lien holder, filing a formal dispute, and providing evidence of discrepancies, such as tax payment receipts or correspondence with local tax authorities. Addressing these inaccuracies is crucial for maintaining a healthy credit profile and ensuring fair treatment in financial matters.

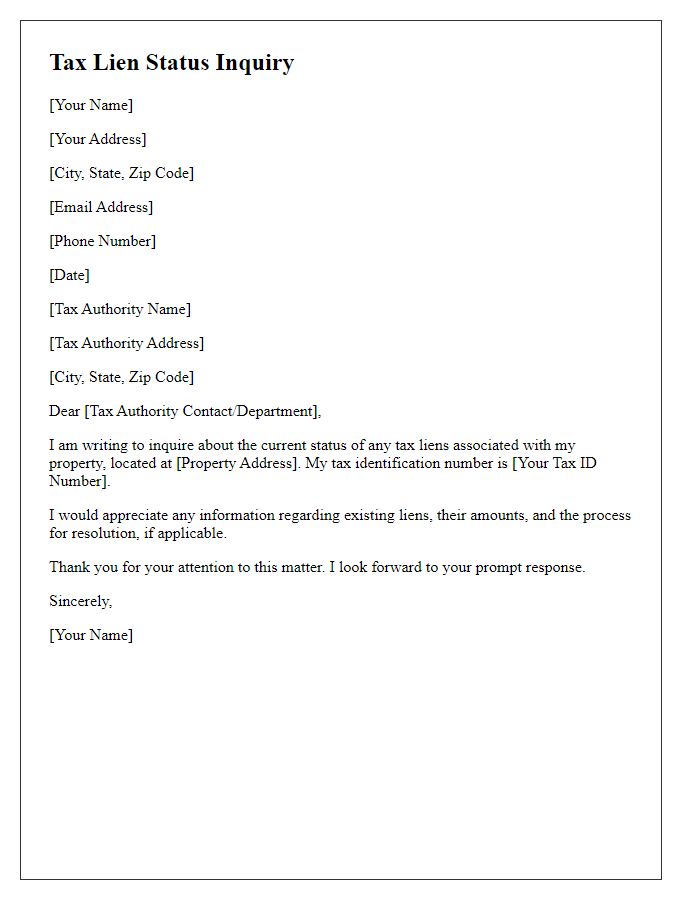

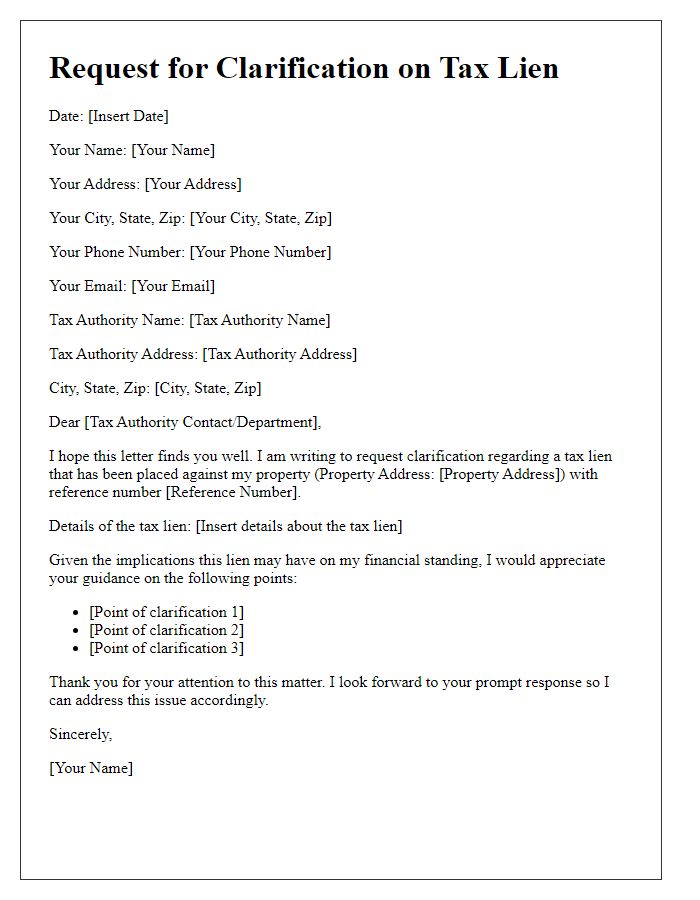

Contact Information for Follow-up

A tax lien report dispute requires precise documentation and clear communication with relevant authorities, such as the local tax assessor's office and credit reporting agencies. Essential details include taxpayer identification numbers (TIN) or social security numbers (SSN) for identification purposes. Dates related to the lien filing are crucial; for example, a lien filed on January 15, 2023, may carry different implications than a lien from 2020. Mentioning the specific amount of the lien, like $5,000, provides context to the dispute. Providing direct contact information, including phone numbers and email addresses, facilitates prompt follow-up communication. This will ensure timely resolution of discrepancies and maintain accurate credit profiles.

Comments