Have you ever felt a sinking feeling in your stomach when you realize your personal information may be compromised? Credit report breaches are more common than you might think, and knowing how to address this issue is crucial for protecting your financial health. In this article, we'll guide you through the process of reporting a credit report breach effectively, ensuring that your concerns are heard and acted upon. So, let's dive in and explore the steps you can take to safeguard your identity and credit!

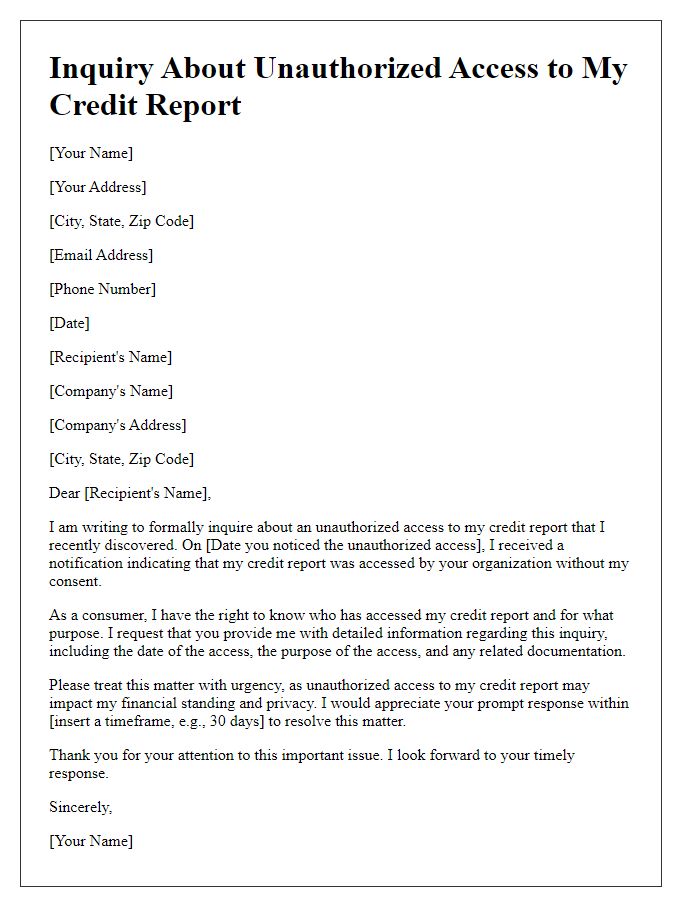

Recipient's contact information

A credit report breach may involve unauthorized access to personal financial information by individuals or entities, resulting in potential identity theft or fraud. Such breaches can affect credit scores and financial security. Relevant agencies like Experian, TransUnion, and Equifax track credit histories and manage dispute processes. Consumers should report breaches to the Federal Trade Commission (FTC) and place fraud alerts with credit bureaus. Additionally, reviewing credit reports annually for discrepancies is crucial, with the possibility of obtaining free reports from AnnualCreditReport.com.

Subject line specifying breach details

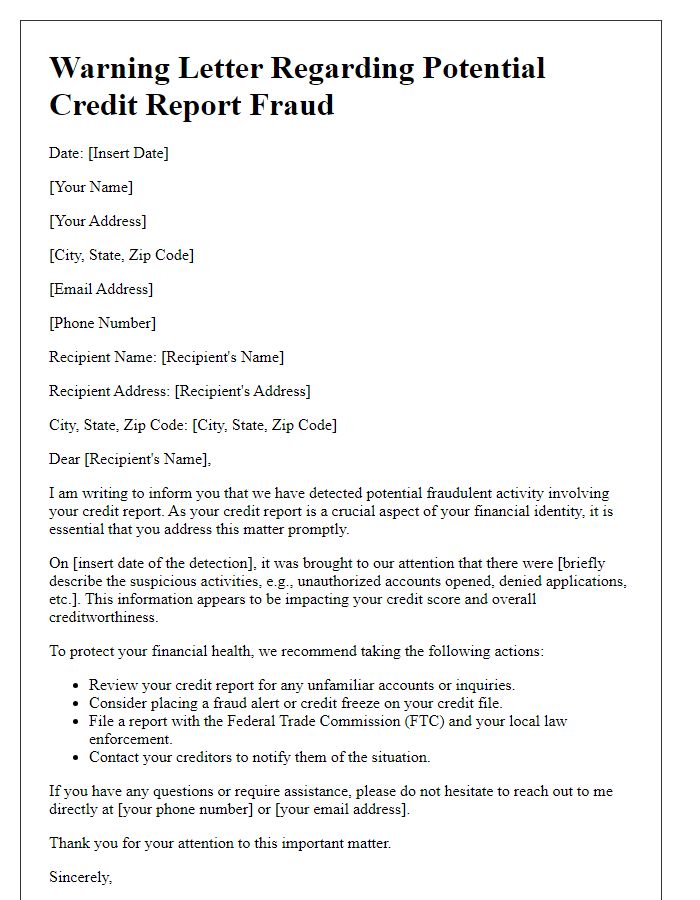

A credit report breach can lead to significant risks for individuals, particularly related to identity theft and financial fraud. Identity theft occurs when personal information, such as Social Security numbers, is accessed unlawfully. According to the Federal Trade Commission, over 9 million Americans are victims of identity theft annually. Affected individuals may find unauthorized accounts opened in their names, impacting credit scores drastically. Timely reporting to credit bureaus, such as Experian, Equifax, and TransUnion, is essential for mitigating damage. Additionally, notifying local law enforcement can provide further protection and documentation for future disputes. Individuals are also encouraged to place fraud alerts on their credit reports to alert potential creditors of possible identity theft.

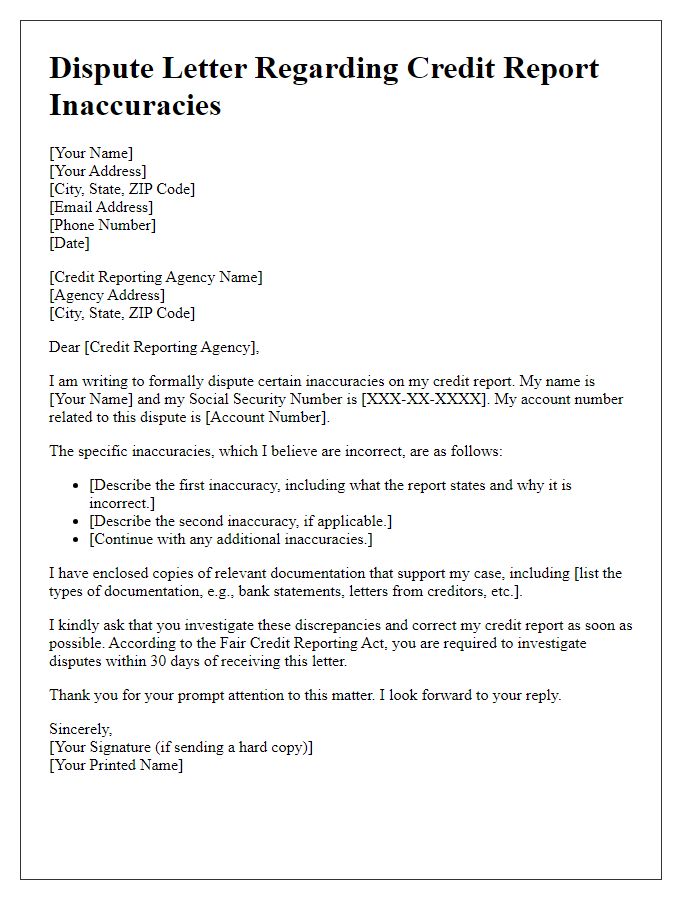

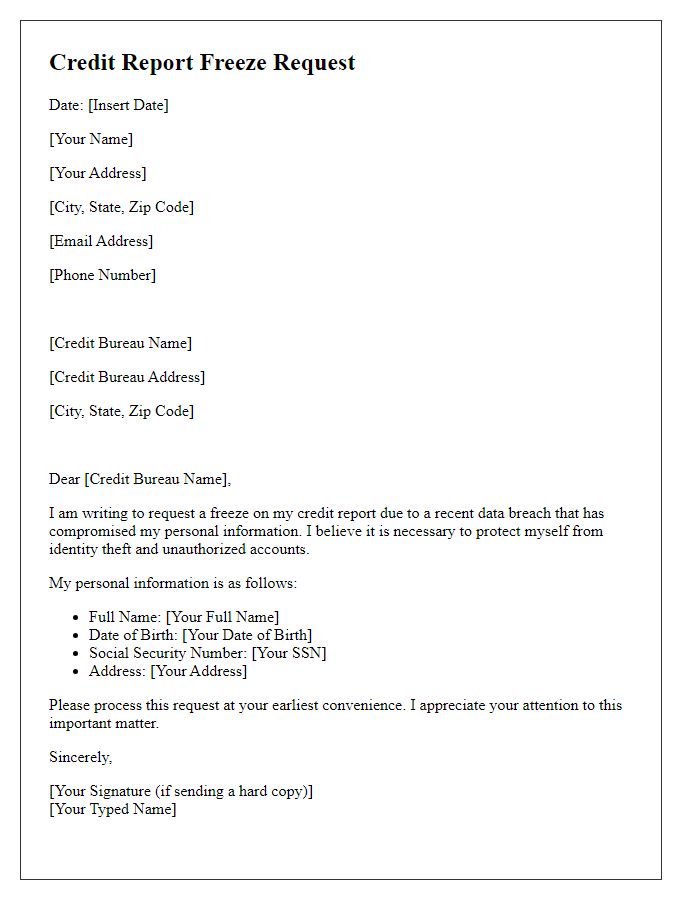

Personal identification information

A credit report breach can severely compromise personal identification information, including Social Security numbers, addresses, and account details. Identity theft incidents in the United States reached approximately 1.4 million reports in 2020 alone, highlighting the urgency of addressing such breaches. Companies like Experian and Equifax utilize data encryption methods to protect sensitive information, but vulnerabilities still exist. Affected individuals should immediately notify credit reporting agencies, implement credit freezes, and monitor their financial statements for any unauthorized activity. Legal protections under the Fair Credit Reporting Act may provide further recourse for victims.

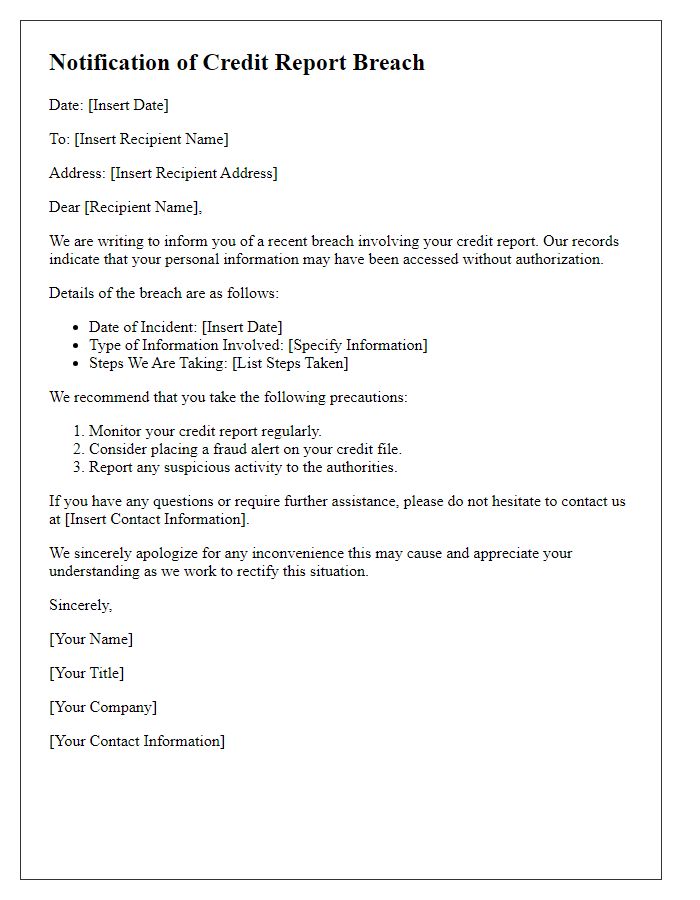

Description of the breach incident

A recent data breach incident affected multiple individuals, including myself, where sensitive financial information was unlawfully accessed. On October 12, 2023, an unauthorized entity exploited vulnerabilities in the server of a major credit reporting agency, Experian, compromising personal data such as Social Security numbers and credit card details. This breach involved a staggering quantity of over 3 million records, exposing individuals to potential identity theft and fraud. Reports indicate that this incident has also led to increased instances of fraudulent credit applications, significantly impacting the credit scores of victims. Immediate action is required to mitigate the risks associated with this breach and to secure our financial identities.

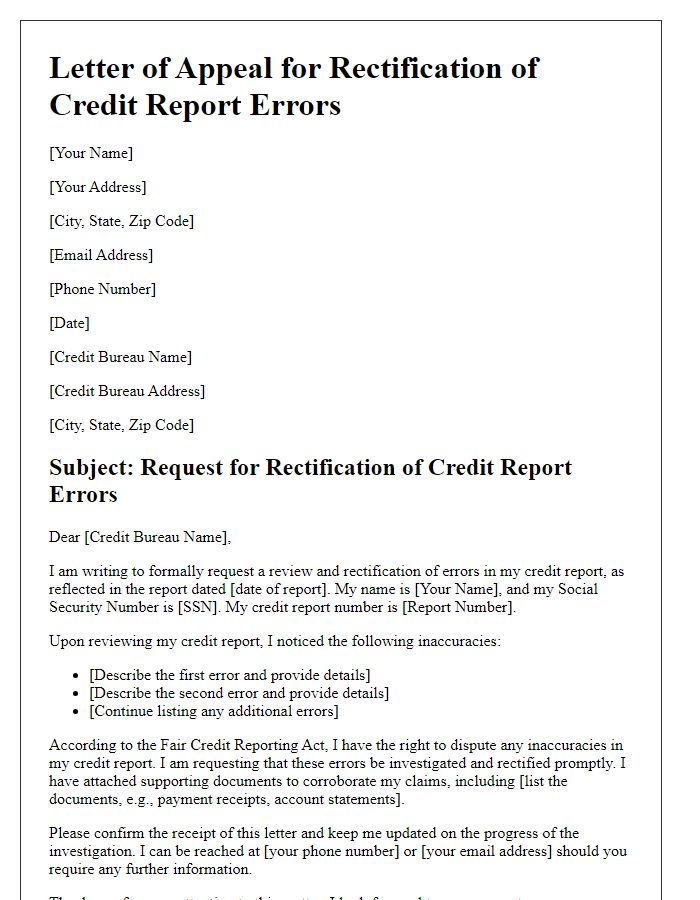

Requested actions or resolutions

A breach of personal credit report data can lead to significant risks, including identity theft and financial fraud. Immediate investigation is crucial, alongside actions like freezing the credit report with major bureaus such as Equifax, Experian, and TransUnion to prevent unauthorized access. Additionally, issuing a fraud alert can warn potential creditors to verify identities before approving new accounts. It is also important to request a copy of the credit report for detailed examination of any unusual activities, ensuring all inaccuracies are disputed immediately, referring to the Fair Credit Reporting Act as necessary. Regular monitoring of the credit report and enrolling in identity theft protection services can provide ongoing security.

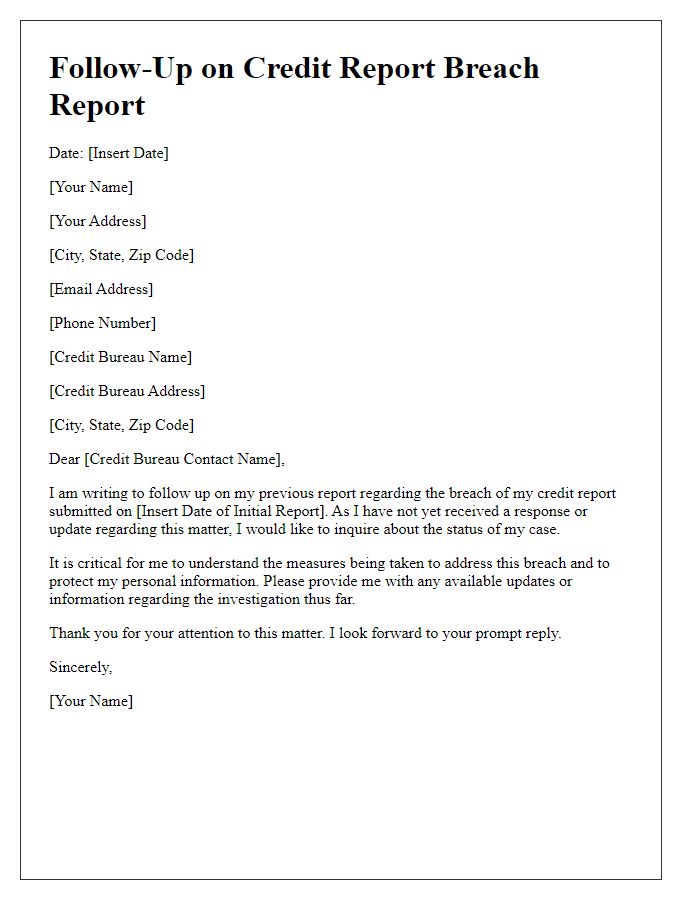

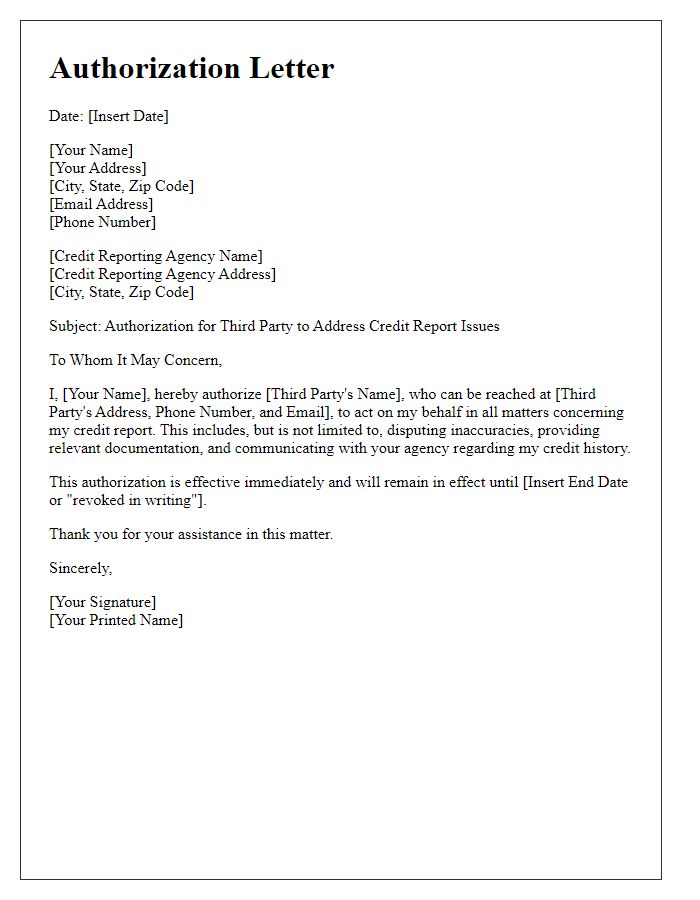

Letter Template For Reporting Credit Report Breach Samples

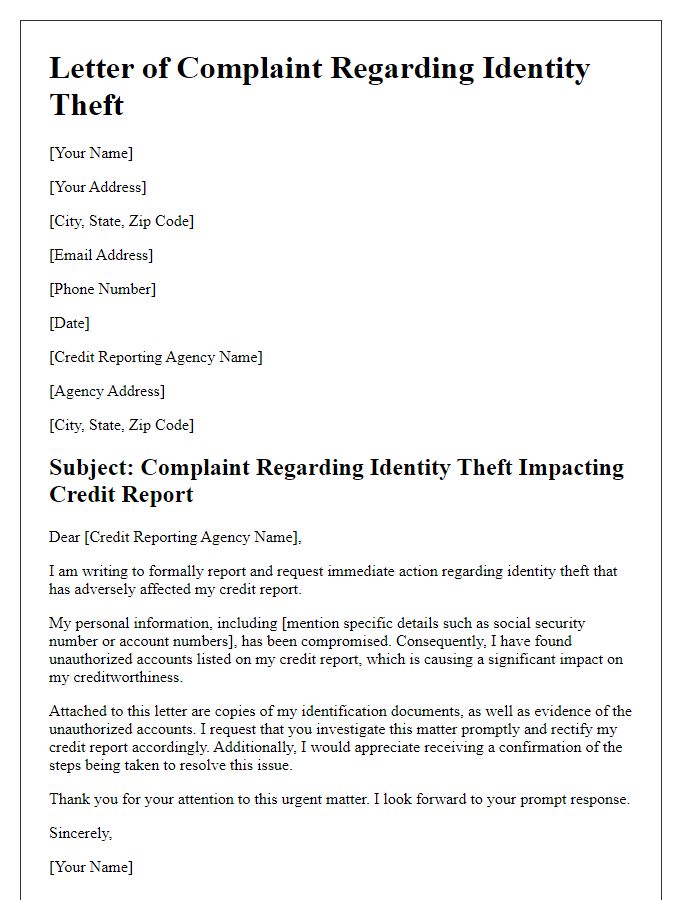

Letter template of complaint for identity theft impacting credit report.

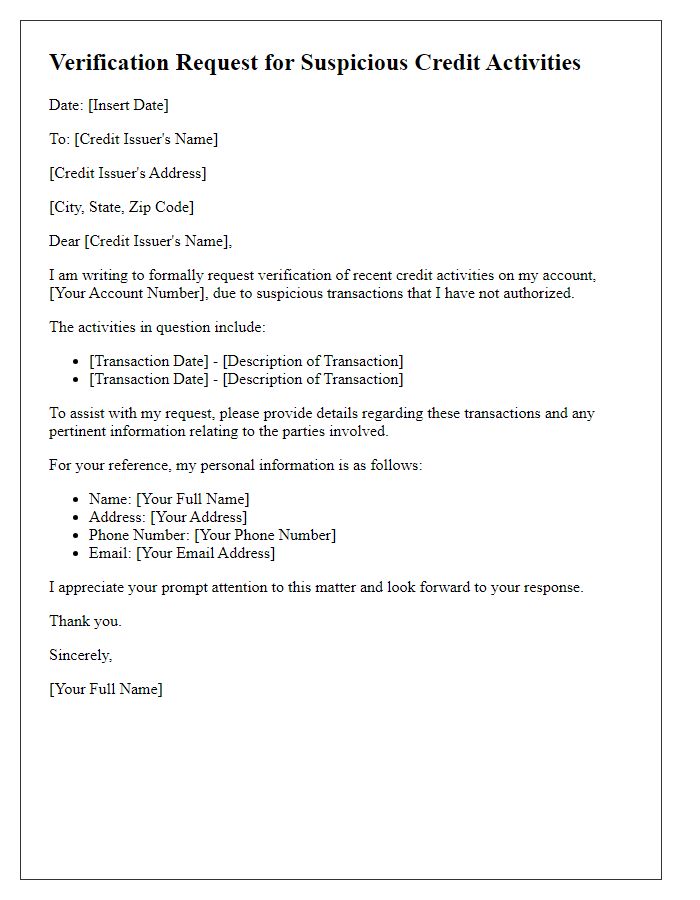

Letter template of verification request for suspicious credit activities.

Comments