Are you struggling with your credit history and facing hurdles in securing a loan or credit card? It's a common challenge many face, especially when your credit is thin or insufficient. Crafting a well-thought-out appeal letter can make a significant difference in how lenders view your application. Join us as we explore effective strategies and templates to help you articulate your case and improve your chances of approval!

Personal Information.

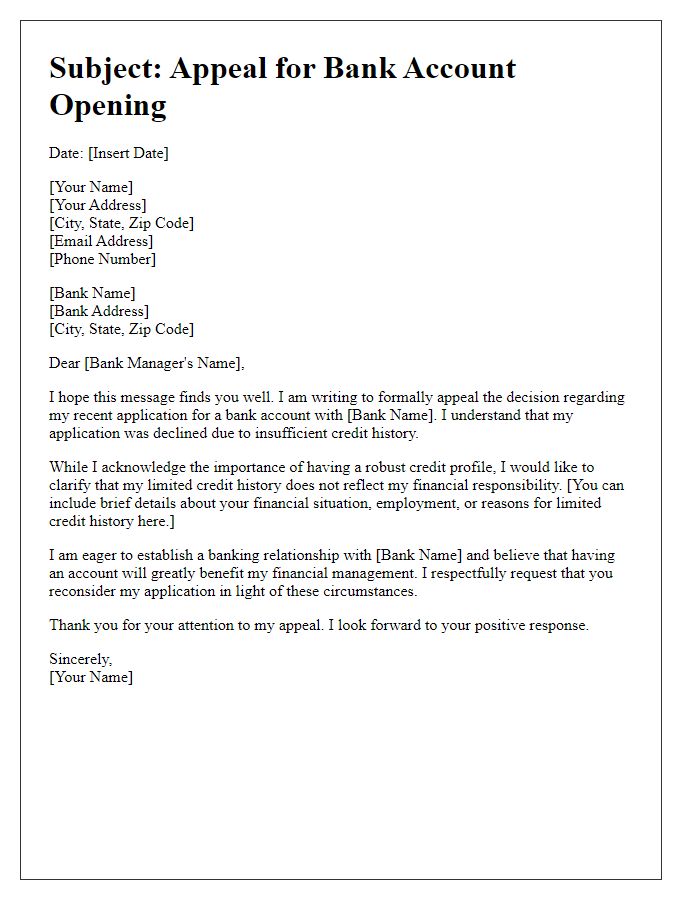

Individuals applying for credit often face challenges due to insufficient credit history, which is the record of an individual's borrowing and repayment activity. This history is crucial for lenders, such as banks and credit unions, when assessing creditworthiness. Factors influencing credit history include the length of account existence, payment consistency, and number of credit inquiries. Lenders may request personal information such as Social Security numbers, names, and addresses to verify identity and assess credit eligibility. This data is essential for determining risk and making informed decisions on credit applications. A lack of information may lead to automatic denials, making it necessary for applicants to appeal by providing additional context about their financial situation or alternative evidence of responsible financial behavior.

Account and Loan Details.

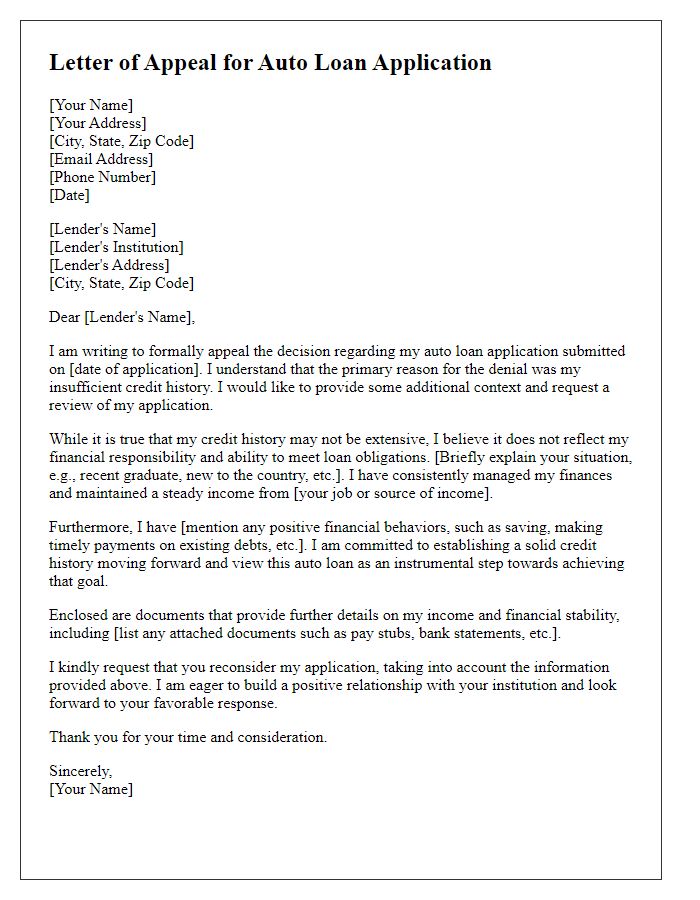

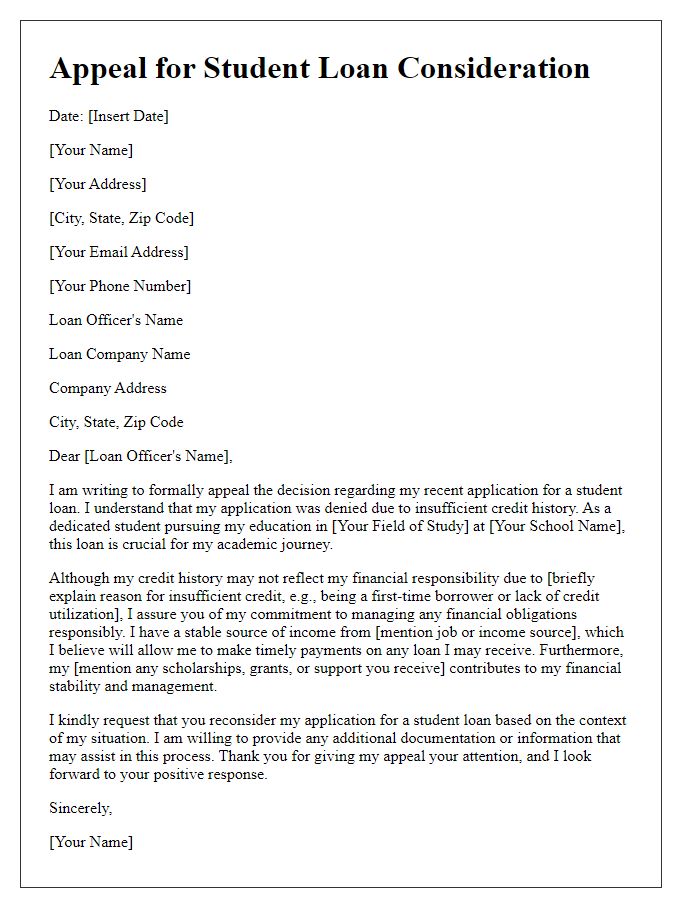

Insufficient credit history can significantly impact loan applications, especially for individuals seeking mortgages or personal loans from financial institutions. Many lenders, such as major banks (e.g., Wells Fargo, Bank of America) and credit unions, rely heavily on credit scores derived from FICO or VantageScore models to assess risk. Applications frequently include details like loan amounts (for example, $200,000 for a home loan) and account types (like secured or unsecured loans). Customers with limited credit history may indicate fewer than three tradelines (accounts that report to credit bureaus) on their reports, which can raise red flags. In response, applicants should accurately detail current accounts--such as checking or savings accounts--and may also highlight alternative data, such as consistent rental payments or utility bills, to strengthen their appeals and demonstrate reliability as borrowers.

Explanation of Insufficient Credit History.

Insufficient credit history significantly impacts loan applications, particularly for individuals seeking mortgages or personal loans. Many lenders, including major banks like Bank of America or Wells Fargo, often require a minimum credit history of at least three years to assess a borrower's financial behavior. Limited credit history, often experienced by young adults or recent immigrants, can lead to lower credit scores, affecting interest rates and loan approval chances. Moreover, the absence of diverse credit types, such as credit cards, installment loans, or lines of credit, can further exacerbate the situation by leaving lenders with insufficient data to gauge an applicant's creditworthiness. This phenomenon can hinder entrance into major financial opportunities, particularly home ownership, which is critical for long-term wealth building.

Supporting Documentation.

Submitting a credit history appeal often requires detailed supporting documentation to strengthen the case. Gather key documents such as proof of identification, including a government-issued ID (passport or driver's license), which validates the identity of the applicant. Compile credit reports from major bureaus like Experian, Equifax, and TransUnion, highlighting any discrepancies or outdated information that may impact the credit score. Include bank statements from the past 3-6 months to demonstrate consistent financial behavior and income stability. Attach employment verification letters or pay stubs to showcase reliable income sources. Lastly, any evidence of responsible financial management, such as loan repayment records or utility payment confirmations, can effectively illustrate creditworthiness despite insufficient credit history.

Request for Reconsideration.

Insufficient credit history can impact loan applications, especially for individuals seeking mortgages or personal loans. Lenders often require a minimum credit score of 620 (on a scale from 300 to 850) to approve loans, and a limited credit record may result in automatic denials. This situation commonly arises for first-time borrowers, such as recent college graduates or newly arrived immigrants, who might lack established credit history from major credit bureaus like Experian, TransUnion, and Equifax. Additionally, the absence of diverse credit types, such as credit cards, installment loans, or retail accounts, can further impede loan eligibility. Consequently, appealing for reconsideration should include supporting documents, such as proof of timely payments on rent or utilities, to demonstrate reliable financial behavior, thereby enhancing the chances of a favorable outcome.

Letter Template For Insufficient Credit History Appeal Samples

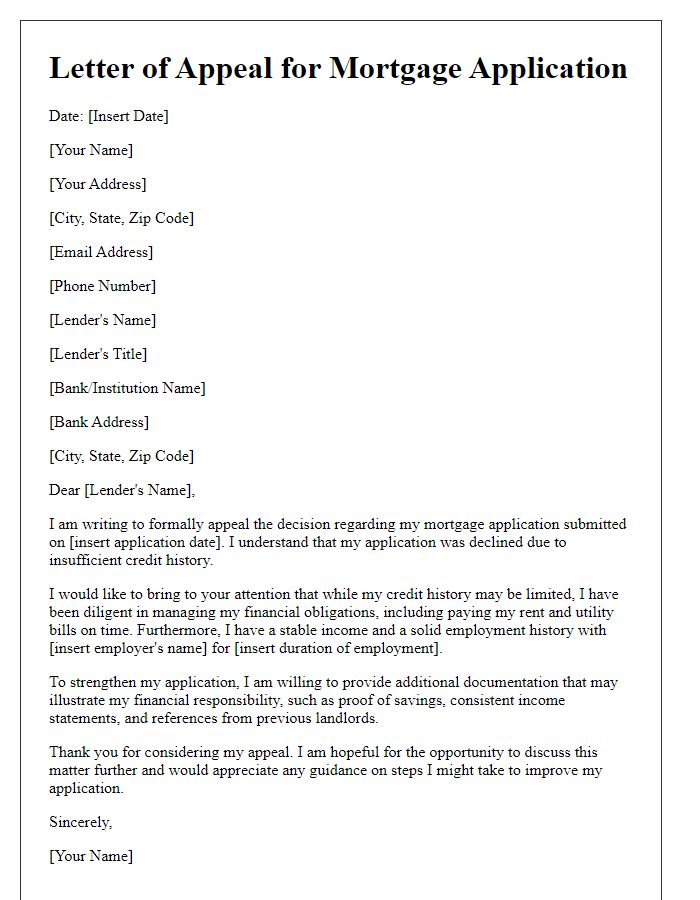

Letter template of insufficient credit history appeal for mortgage application

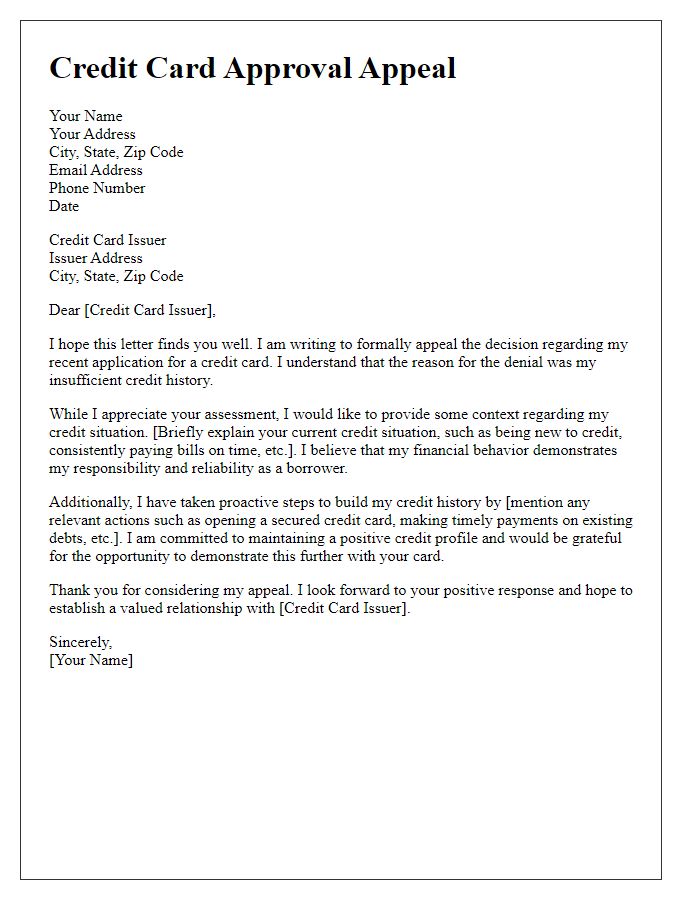

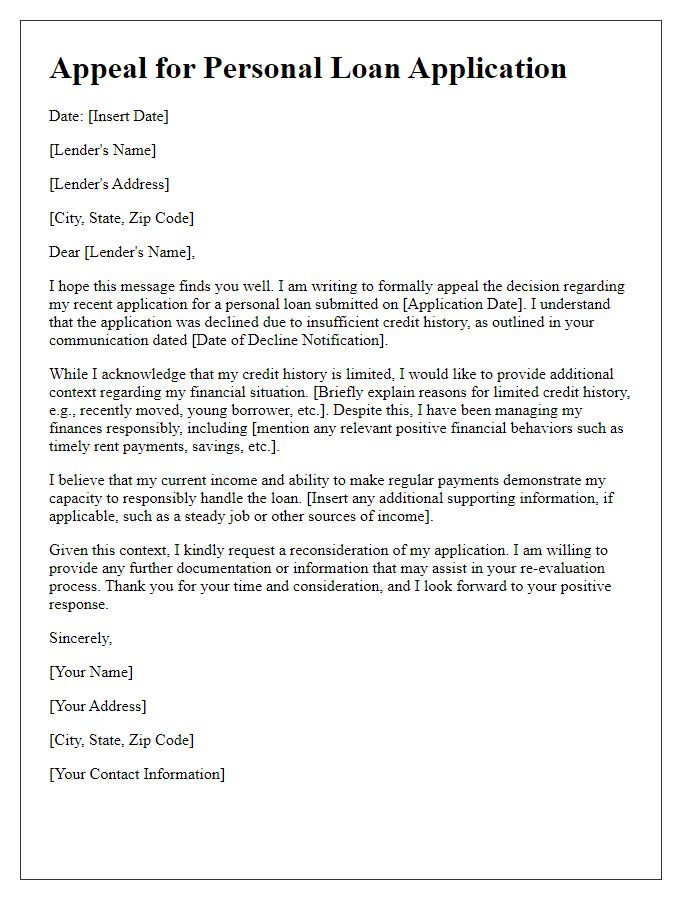

Letter template of insufficient credit history appeal for credit card approval

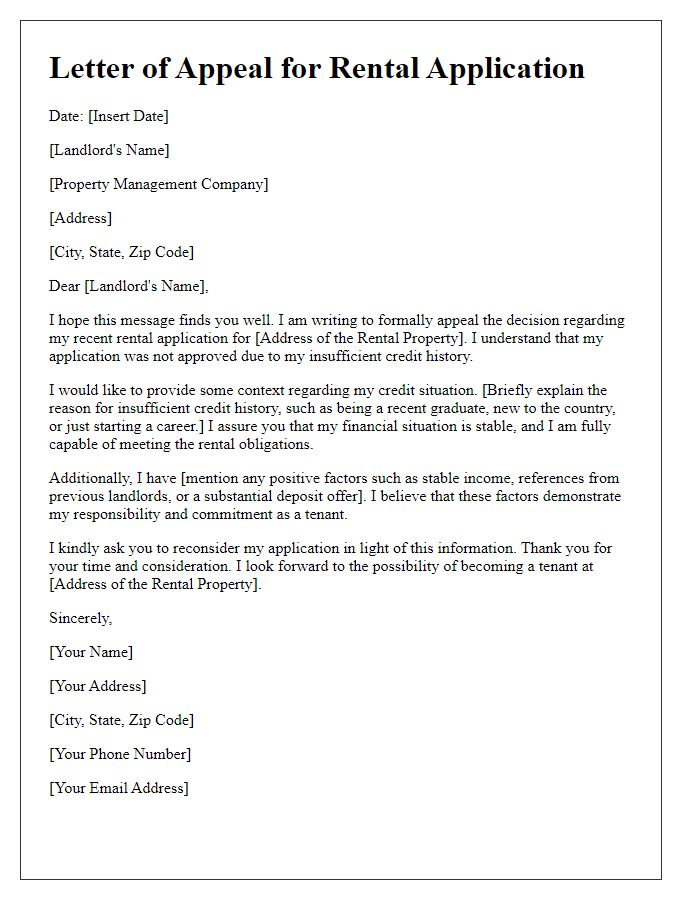

Letter template of insufficient credit history appeal for rental application

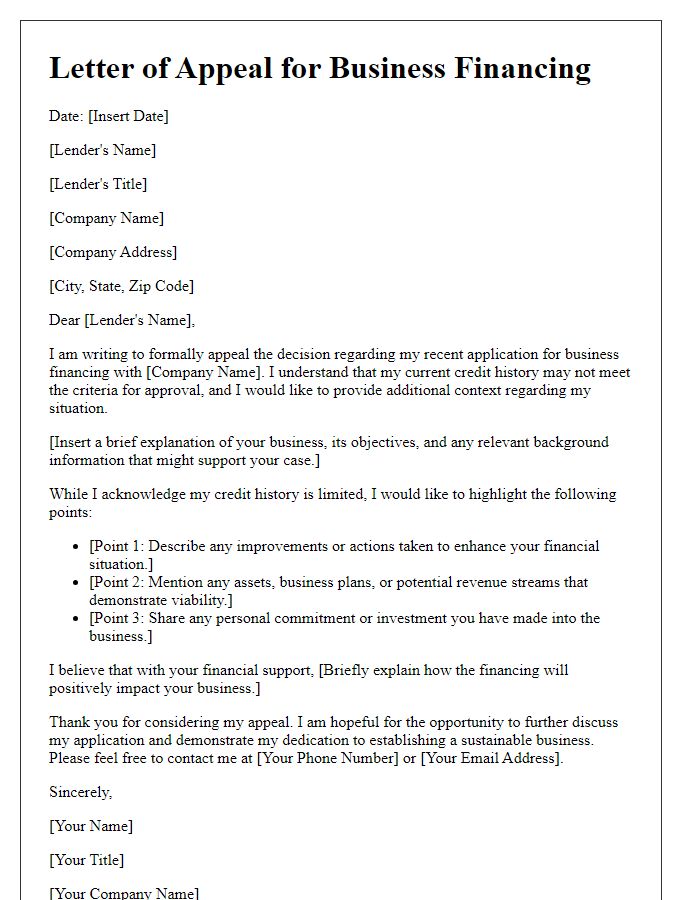

Letter template of insufficient credit history appeal for business financing

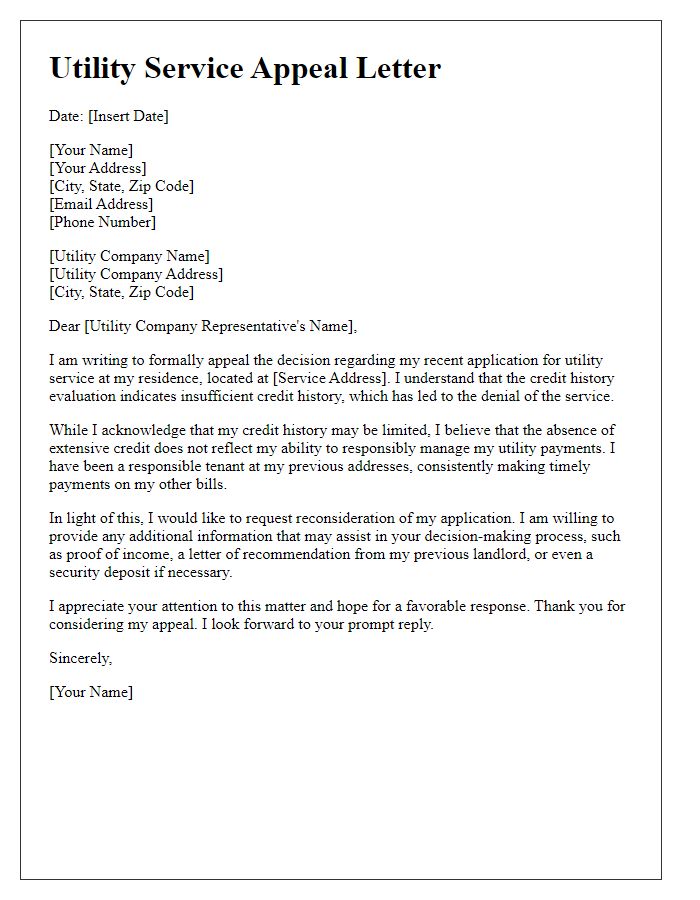

Letter template of insufficient credit history appeal for utility service

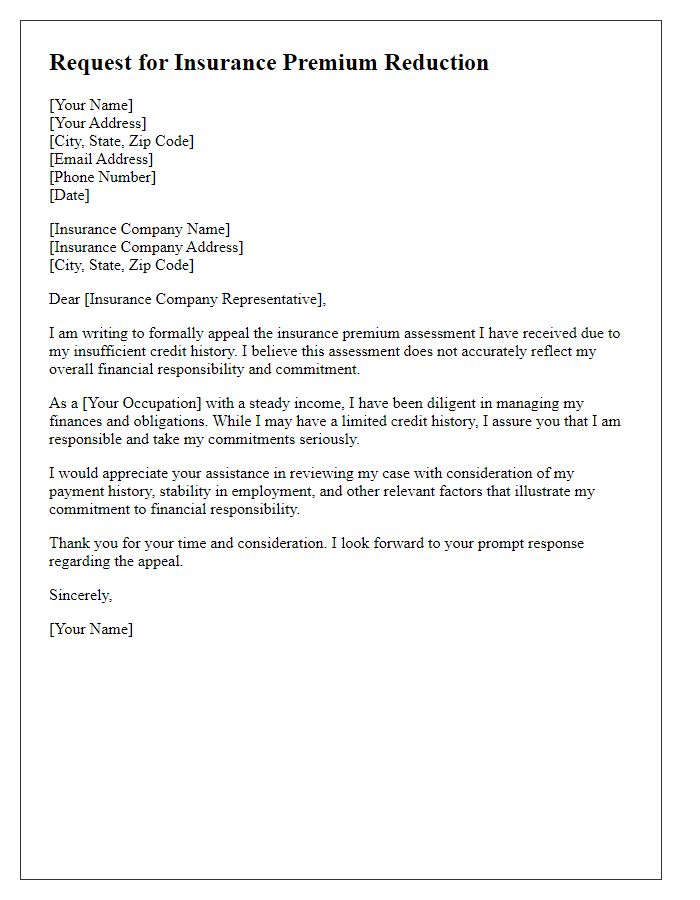

Letter template of insufficient credit history appeal for insurance premium reduction

Comments