Are you curious about how to improve your credit score and achieve your financial goals? Understanding your credit report can be overwhelming, but it's crucial for making informed decisions. In this article, we'll break down how to analyze your Experian credit score step by step, empowering you to take control of your financial future. So, buckle up and get ready to dive into the world of credit analysisâlet's explore together!

Personal Information Verification

Experian credit score analysis involves a detailed review of individual credit history and personal information. Accurate personal information, including full name, date of birth, and social security number, is crucial for credit report accuracy. The analysis examines data from financial institutions, highlighting accounts such as credit cards, mortgages, and loans. Noteworthy factors include payment history, credit utilization (ideally below 30%), and account age. Additionally, it's important to consider identifiers like addresses linked to credit accounts, which impact credit scores based on creditworthiness. Regular reviews of your report can identify discrepancies, allowing for beneficial corrections that enhance credit standing.

Credit Score Summary

Experian provides a comprehensive credit score analysis that includes crucial metrics such as FICO Score, which ranges from 300 to 850, reflecting creditworthiness based on factors like payment history (35%), credit utilization (30%), length of credit history (15%), types of credit (10%), and new credit inquiries (10%). In 2023, the average FICO Score in the United States has steadily improved, reaching approximately 703, indicating a favorable credit environment. Experian's analysis also highlights the significance of maintaining a low credit utilization ratio, ideally below 30%, to enhance one's credit score. Credit reports include detailed information on accounts, outstanding balances, and late payments, which are crucial for recognizing areas needing improvement. Additionally, monitoring tools and alerts can assist individuals in tracking changes in their scores and managing identity theft risks effectively.

Key Factors Impacting Score

Experian's credit score analysis highlights several key factors significantly impacting an individual's credit score. Credit utilization ratio, defined as the percentage of available credit being used, should ideally remain below 30% to prevent score deterioration. Payment history, which encompasses timely payment of bills and debts over the past 24 months, accounts for 35% of the total score, making it crucial for maintaining a positive credit profile. Length of credit history refers to the average age of all credit accounts and can influence scores, with older accounts typically enhancing credibility. Types of credit, including revolving credit (like credit cards) and installment loans (like mortgages), contribute to score diversity, helping showcase responsible borrowing behavior. Lastly, recent inquiries or hard pulls on credit reports within the past 12 months can temporarily lower scores, underscoring the need for minimal applications for new credit during that period.

Credit Report Insights

Experian credit score analysis reveals critical insights into financial health. A credit score, typically ranging from 300 to 850, reflects creditworthiness based on factors like payment history, credit utilization, and length of credit history. Reviewing a credit report allows consumers to identify discrepancies and areas for improvement. For instance, late payments can significantly lower scores by 30 to 40 points, while maxed-out credit cards can inflate credit utilization ratios beyond the recommended 30%. Regular monitoring of credit reports from all three major bureaus--Experian, TransUnion, and Equifax--ensures accuracy and helps mitigate identity theft risks. Using tools like Experian's CreditLock helps safeguard personal information. Taking proactive steps by paying down debt, maintaining low credit card balances, and disputing inaccuracies contributes to score enhancement over time.

Recommendation and Actions

Experian credit score analysis reveals crucial insights regarding financial health and lending eligibility. Understanding the credit score, which typically ranges from 300 to 850, is pivotal for consumers aiming to secure favorable interest rates on loans or credit cards. A score above 700 is often considered good, while scores below 600 may lead to loan denial. For optimal credit management, individuals should regularly review reports for inaccuracies, which can affect scores significantly. Establishing timely payment habits and reducing outstanding debts will positively impact overall credit utilization, ideally maintaining below 30% of available credit limits. Additionally, diversifying credit types, such as revolving accounts (credit cards) and installment loans (auto loans, mortgages), can further enhance creditworthiness. Regular monitoring of the score through platforms like Experian provides immediate feedback on financial actions taken, facilitating informed decisions to improve credit profiles.

Letter Template For Experian Credit Score Analysis Samples

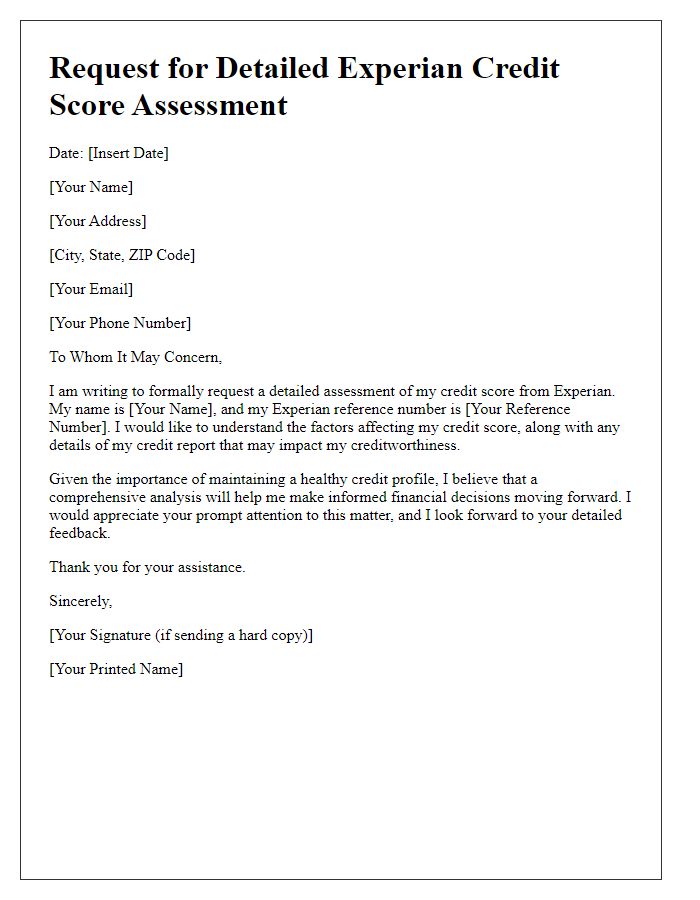

Letter template of request for detailed Experian credit score assessment

Comments