Are you tired of seeing that old debt haunting your credit report? It can feel overwhelming to navigate the complexities of financial records, especially when you're trying to move forward. Fortunately, the process of getting a paid debt removed can be simpler than you think, and it's essential for improving your credit score. Ready to learn the steps that can help you clear your slate? Let's dive into the details!

Creditor's contact information

A paid debt removal request can significantly improve credit scores and enhance financial opportunities. Collect all pertinent information from the creditor, including their name, address, phone number, and email to ensure direct communication. Documentation of the debt payment, such as receipts or bank statements, is essential in supporting the request. Clearly outline the debt details: account number, amount paid, and payment date, while specifying a request for removal from credit reports maintained by major credit bureaus, such as Experian, TransUnion, and Equifax. Timely communication increases the chance of successful debt removal, impacting future financing options positively.

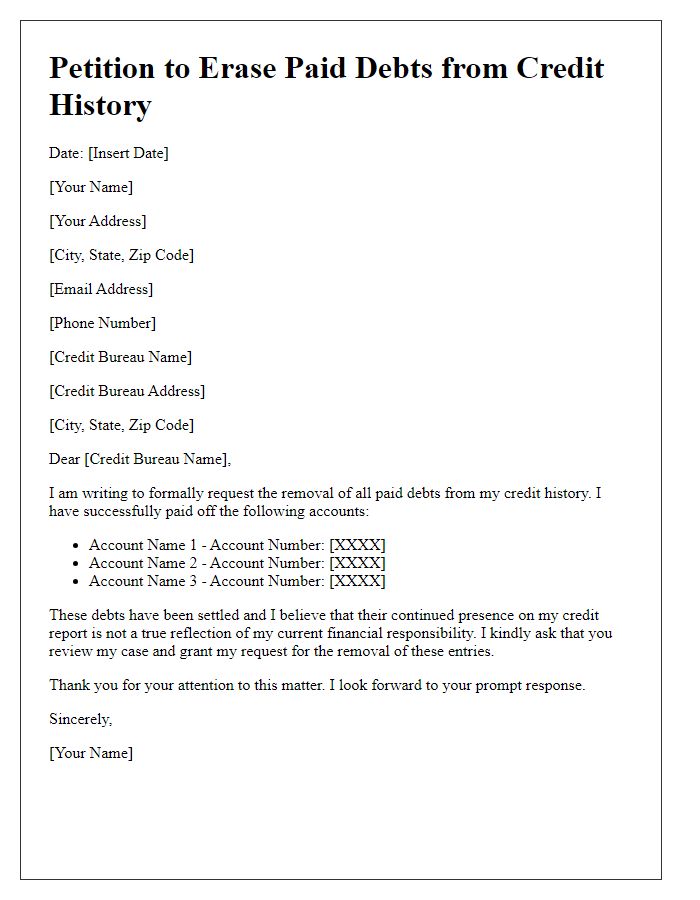

Debtor's account details

A formal request for the removal of a paid debt from a credit report is essential for maintaining one's financial integrity. This request typically includes specific debtor's account details, such as the account number (a unique identifier assigned to the debtor's account), the original creditor's name (the lending institution that provided the credit), the date of the last payment (which reflects when the debt was settled), and the total amount paid. Providing evidence of payment, like a transaction receipt, can support the request. Additionally, mentioning the credit reporting agency (such as Experian, TransUnion, or Equifax) and their respective reporting guidelines ensures compliance with relevant regulations, enhancing the likelihood of success in having the paid debt accurately removed from the report.

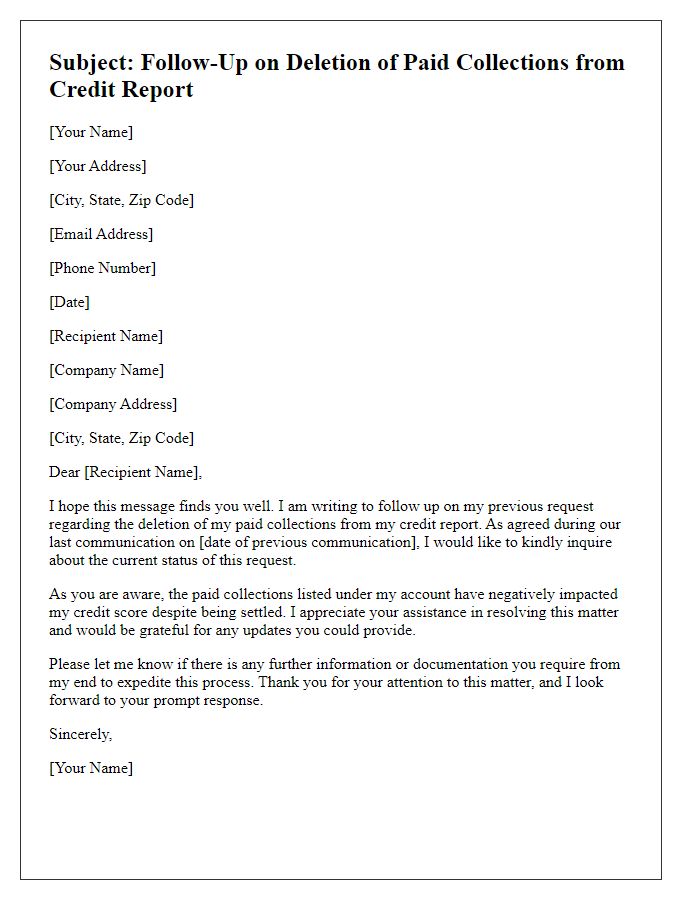

Payment confirmation and details

Payment confirmation serves as a crucial document in the financial reconciliation process, particularly concerning debt settlement statuses reported to major credit bureaus, including Experian, TransUnion, and Equifax. Upon clearing outstanding debts, a confirmation typically includes key details such as the payment date, total amount settled, and the account number associated with the debt, ensuring accurate representation on the credit report. Timely submission of this confirmation, ideally within 30 days post-payment, can facilitate the removal of derogatory marks from the credit report, improving the credit score significantly over time. Furthermore, maintaining copies of such confirmations can prove essential in disputing inaccuracies present on credit reports, a process governed by the Fair Credit Reporting Act (FCRA).

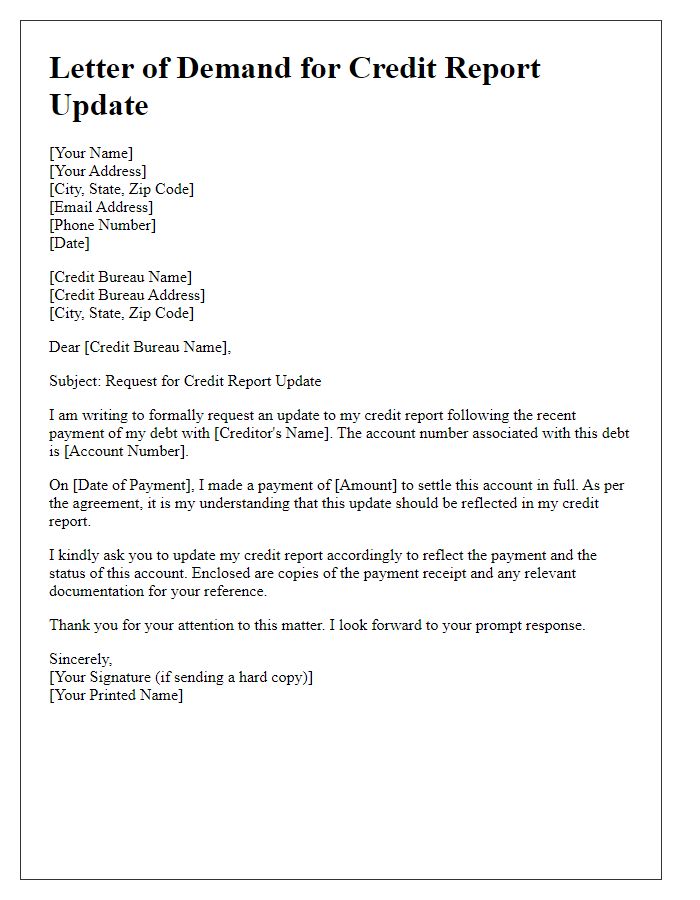

Request for account update and removal

A request for account update regarding the removal of paid debts from credit reports is crucial for enhancing one's credit score and improving financial health. Many consumers, particularly in the United States, may accumulate debts, such as credit card balances or medical bills, leading to negative marks on their credit reports issued by agencies like Equifax or Experian. Once these debts are settled, requesting an account update is essential. Individuals can send communication to creditors or collection agencies, specifically referencing account numbers, payment amounts, and dates of settlement. Clearing these marks can potentially increase credit ratings by 50 points or more, allowing individuals to qualify for lower interest rates on loans or mortgages in the future.

Polite closing and signature

Polite closing and signature should reflect professionalism and gratitude. A suitable closing could be "Sincerely" or "Thank you for your attention to this matter." Follow the closing with your name, typically formatted as First Name Last Name, along with additional contact details if necessary, like your phone number or email.

Letter Template For Paid Debt Removal From Report Samples

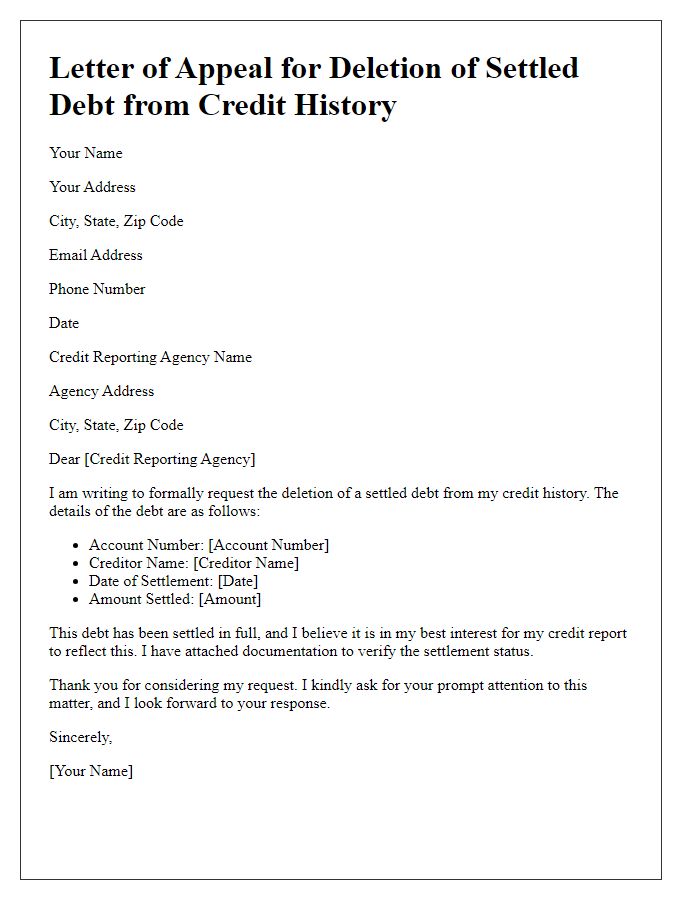

Letter template of appeal for deletion of settled debt from credit history

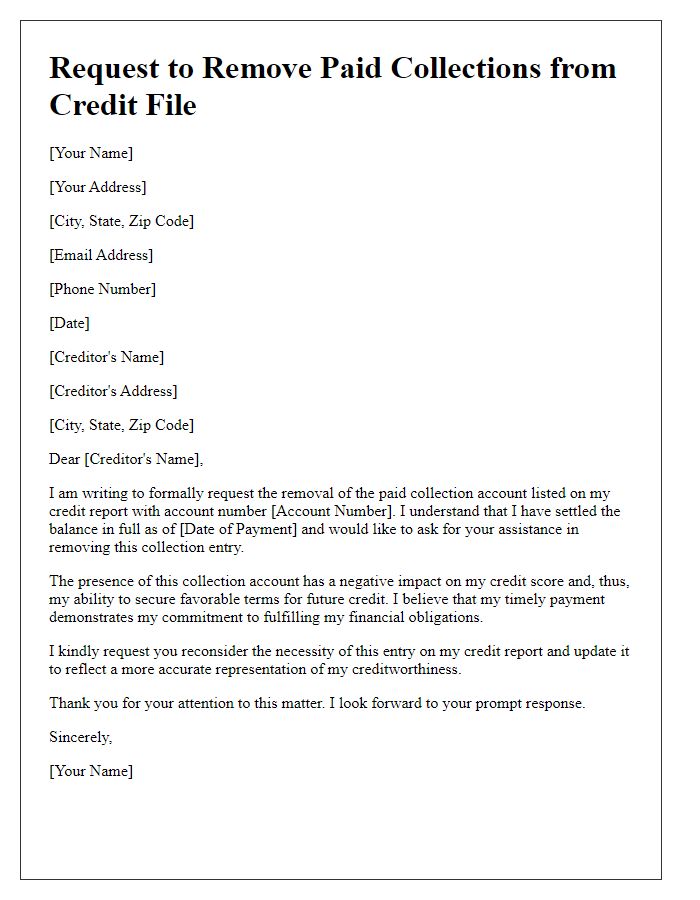

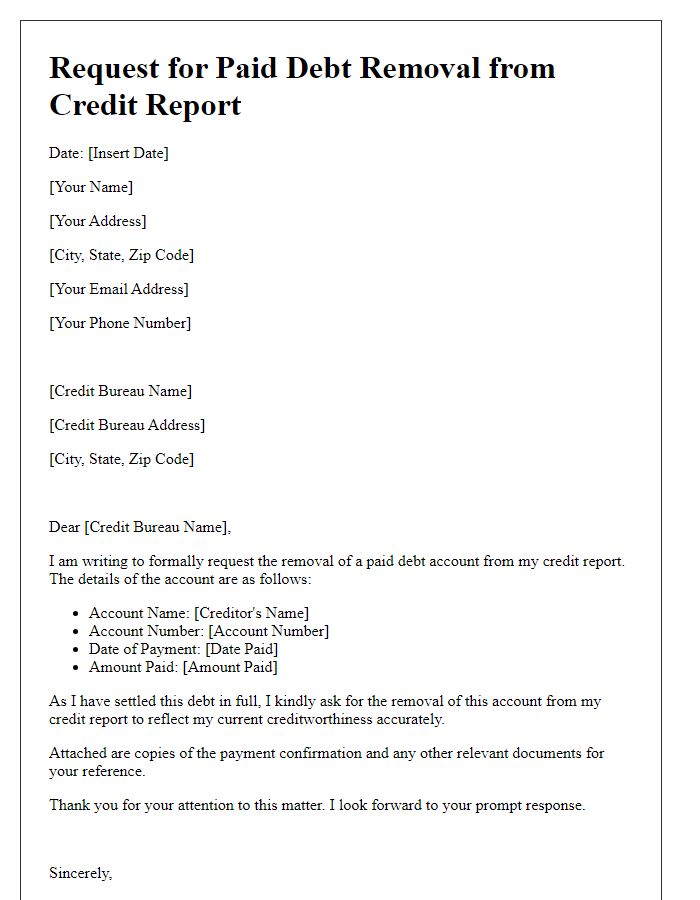

Letter template of formal request to remove paid collections from credit file

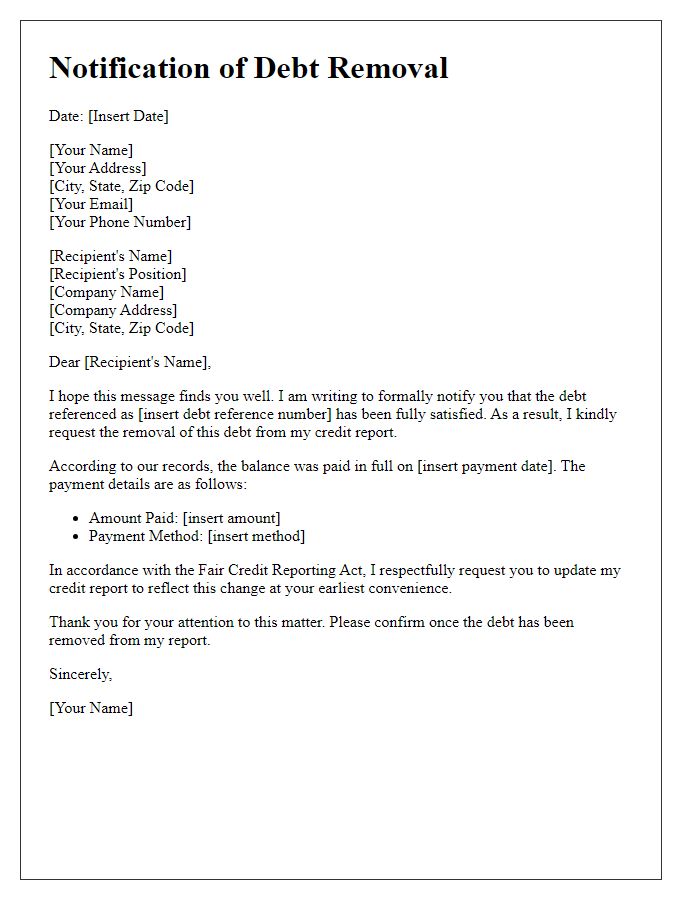

Letter template of notification for removal of satisfied debt from report

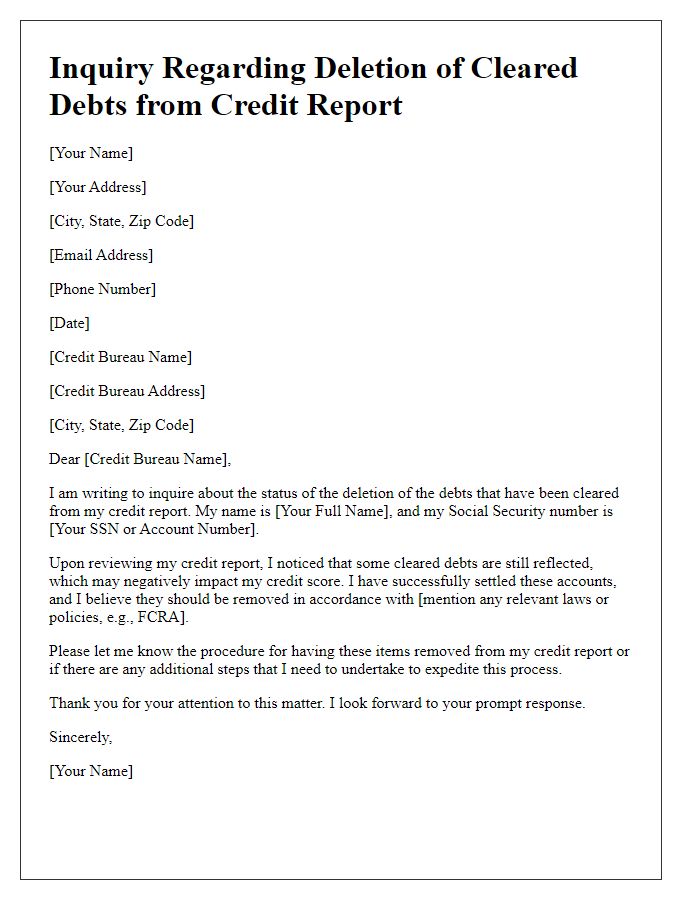

Letter template of inquiry regarding the deletion of cleared debts from report

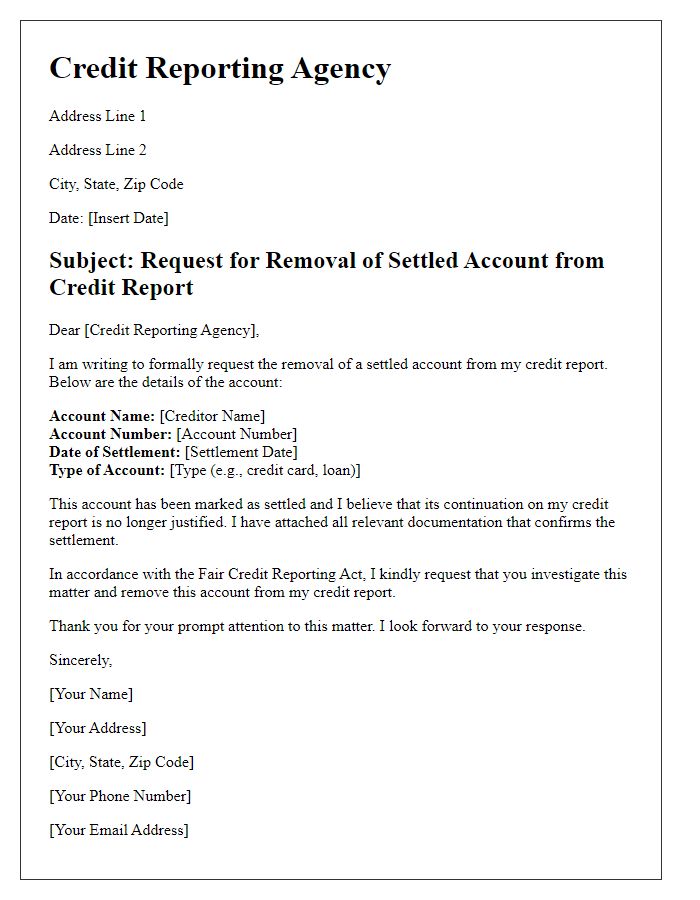

Letter template of correspondence for removing settled accounts from credit report

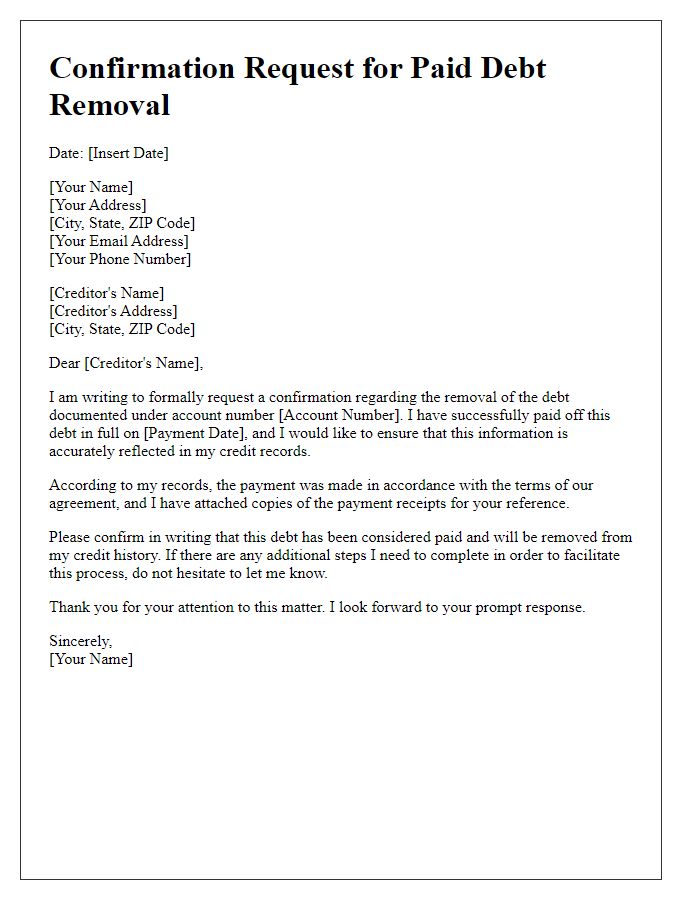

Letter template of confirmation request for paid debt removal from records

Comments