Are you feeling overwhelmed by your financial situation and looking for a way to regain control? Seeking a credit management consultation could be the first step towards a healthier financial future. With expert guidance, you can learn effective strategies to improve your credit score and manage your debts more efficiently. Ready to take charge of your finances? Read on to discover how a consultation can transform your financial landscape!

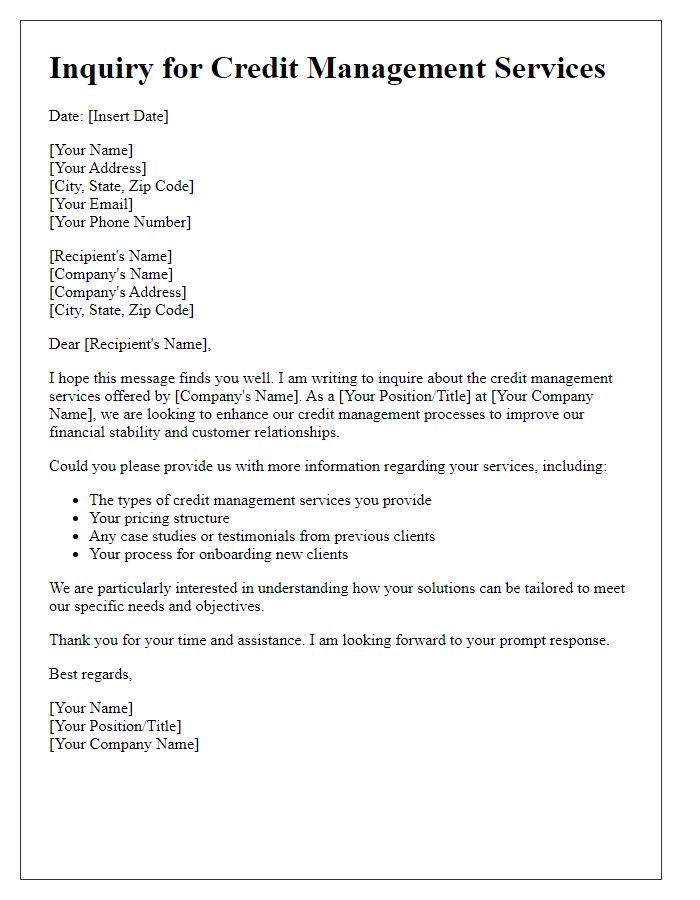

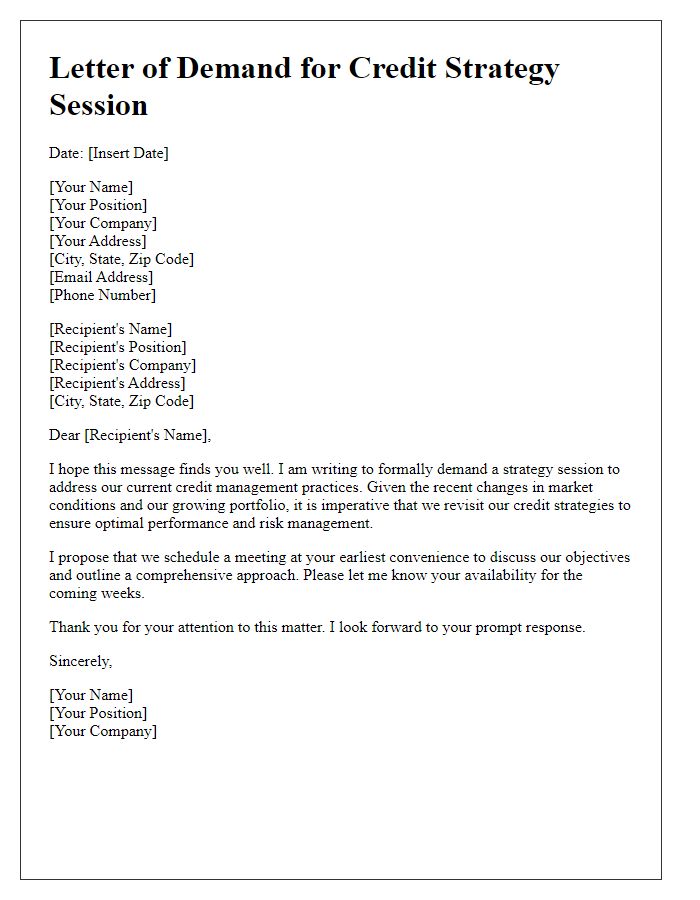

Personal and Contact Information

Credit management consultation involves assessing personal credit situations to provide tailored financial advice. Individuals seeking assistance should include essential details such as full name, contact number, email address, and mailing address. For example, a person named John Doe might provide his phone number, 555-123-4567, and email, johndoe@example.com, along with his residential address at 123 Elm Street, Springfield. This information allows credit counselors to prepare relevant insights and improve potential strategies for managing debt effectively. Moreover, it facilitates follow-up communication, ensuring a comprehensive approach to personal financial management.

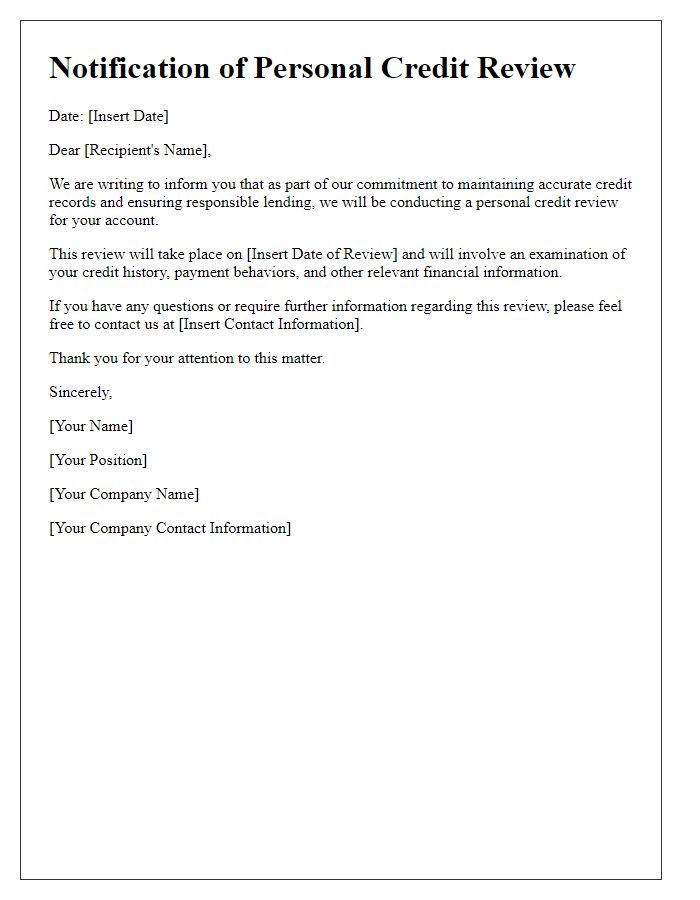

Account Details and History

Effective credit management consultation requires detailed account information and comprehensive history analysis. Relevant account details include account number, outstanding balance, payment history, interest rates, and credit utilization ratios. Understanding payment history entails examining missed payments, late fees, and the duration of delinquency, which can significantly impact credit scores. Additionally, an overview of credit inquiries and any existing debt will aid consultants in tailoring strategies that enhance financial health. Essential documentation such as bank statements, income verification, and current debts will provide a clearer picture of financial standing and guide the development of customized credit management plans.

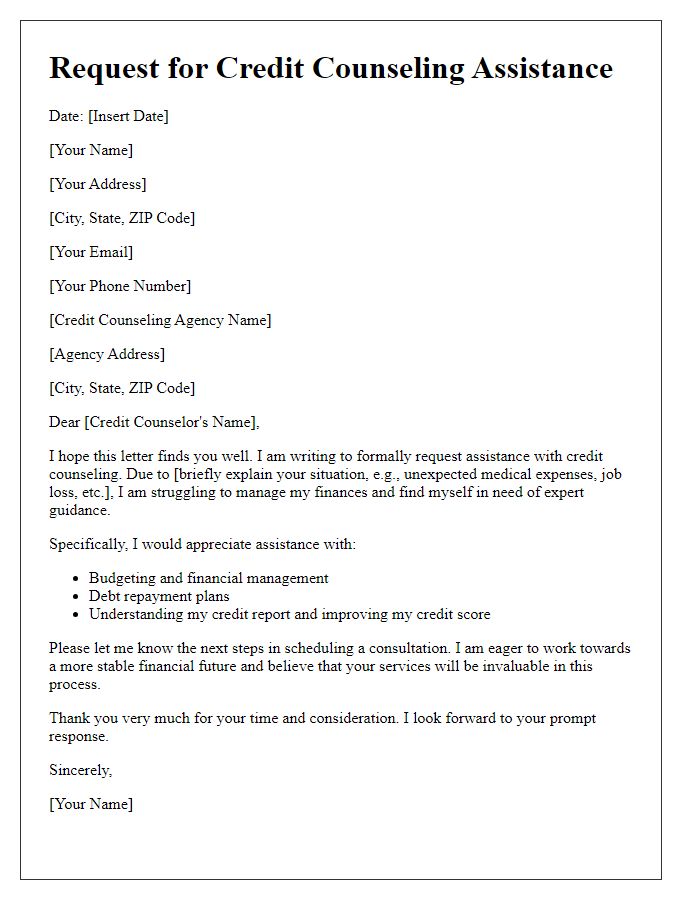

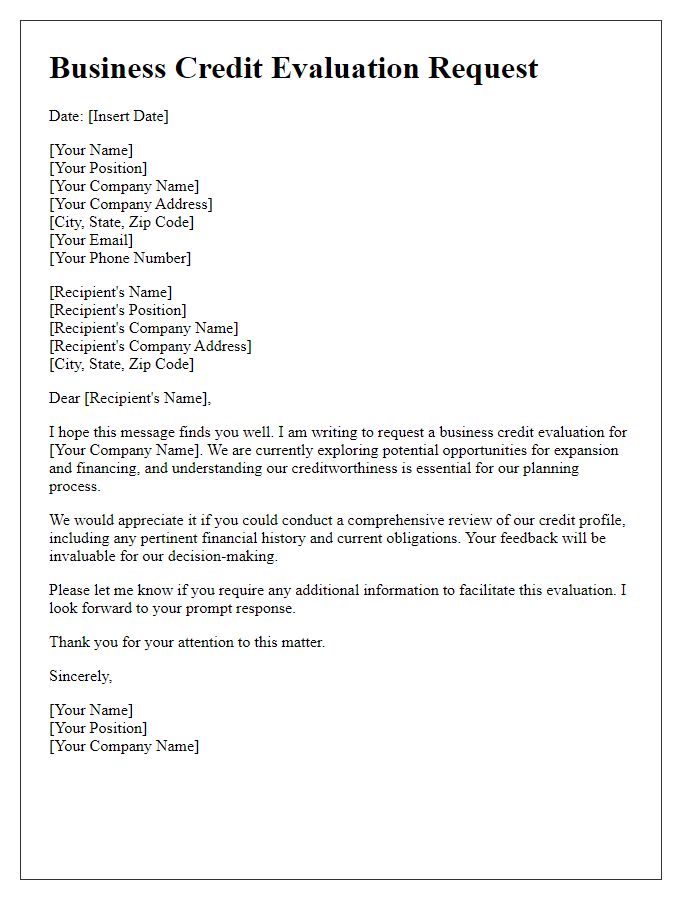

Purpose of Consultation

Credit management consultations are essential for individuals and businesses aiming to improve their financial standing and credit scores. A dedicated consultation service can provide strategies tailored to specific financial situations, including debt reduction plans, budgeting techniques, and understanding credit reports. For example, obtaining a consultation regarding a poor credit score can involve analyzing the factors leading to the score, exploring ways to manage existing debts, such as credit card balances exceeding 30% of total credit limits, and developing plans to increase credit utilization ratio efficiently. Additionally, gaining insights into maintaining timely payments for loans and understanding the impact of inquiries on credit history is crucial for long-term financial health. Factors such as the Fair Isaac Corporation (FICO) score algorithm can also be addressed, providing clients with a solid foundation for building a better credit future.

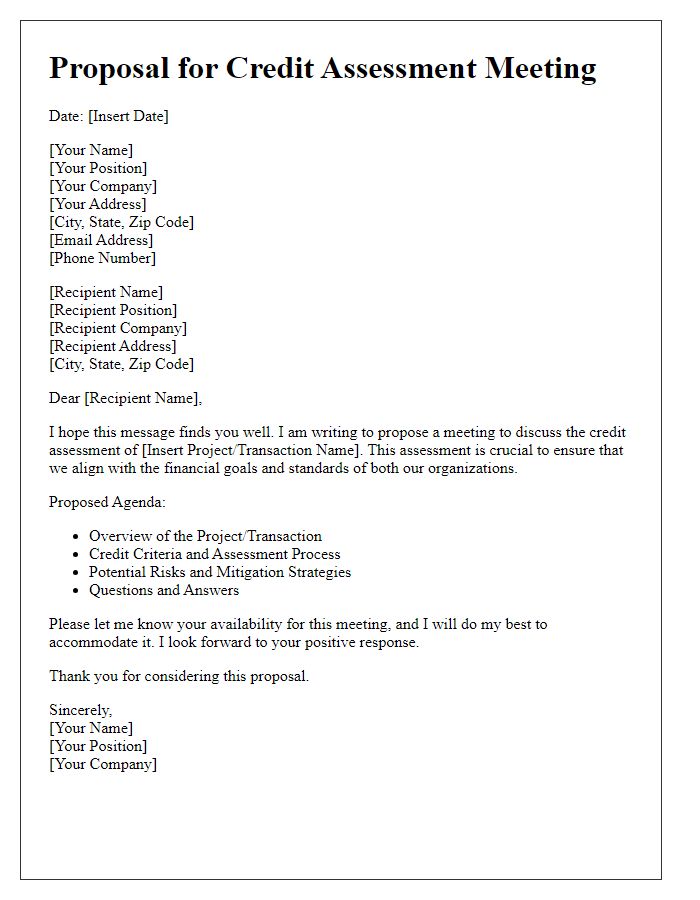

Preferred Consultation Method and Timing

A credit management consultation request ensures effective management of financial resources. Many individuals seek advice to improve their credit scores, which can significantly impact loan approval processes, interest rates, and overall financial health. It is essential to specify the preferred consultation method, such as in-person sessions at local financial institutions or virtual meetings via platforms like Zoom or Microsoft Teams. Timing plays a crucial role in optimizing the consultation experience; for example, evenings or weekends may be more convenient for working professionals seeking guidance. In addition, mentioning specific dates or a general time frame can facilitate scheduling and ensure timely access to essential financial advice.

Consent for Information Sharing

Seeking a credit management consultation often involves sensitive financial information exchange. Consent for information sharing is a crucial step in establishing transparency with financial institutions. Clients must provide explicit permission for their personal data, including credit scores, income levels, and debt obligations, to be accessed by credit advisors. This process ensures compliance with data protection regulations like GDPR or CCPA. Providing a clear understanding of which entities will receive access to this information is vital. Clients may want to know about the duration of consent, rights to revoke access, and the measures taken to safeguard their information. Proper documentation of this consent promotes a foundation of trust necessary for effective financial advice.

Comments