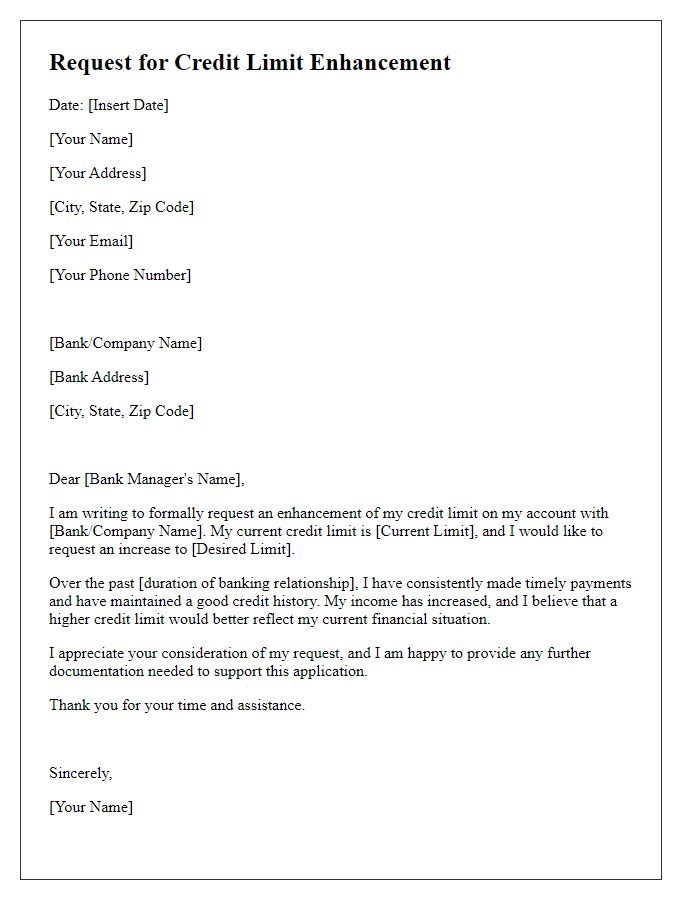

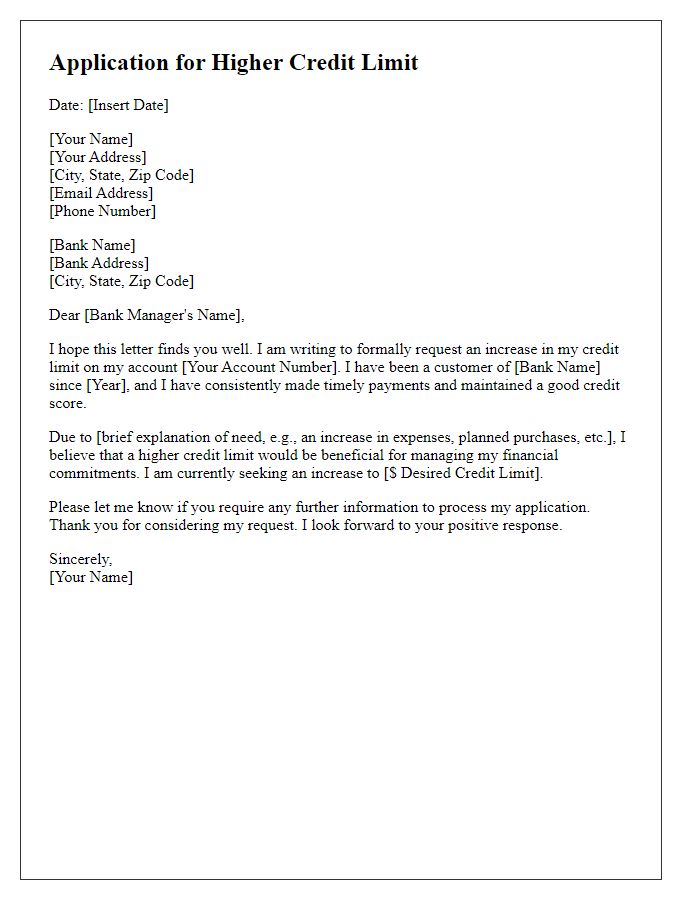

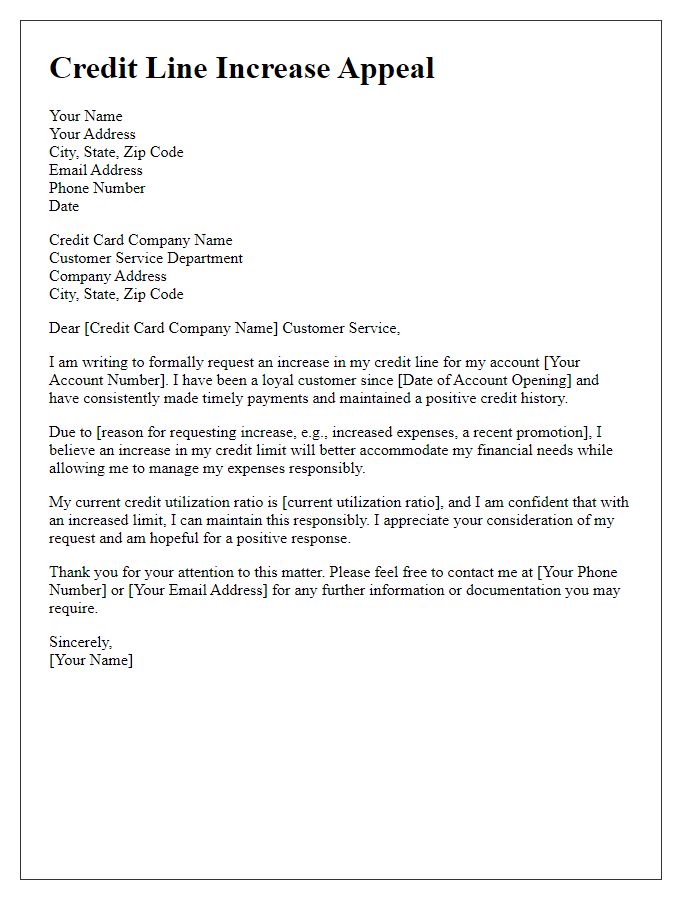

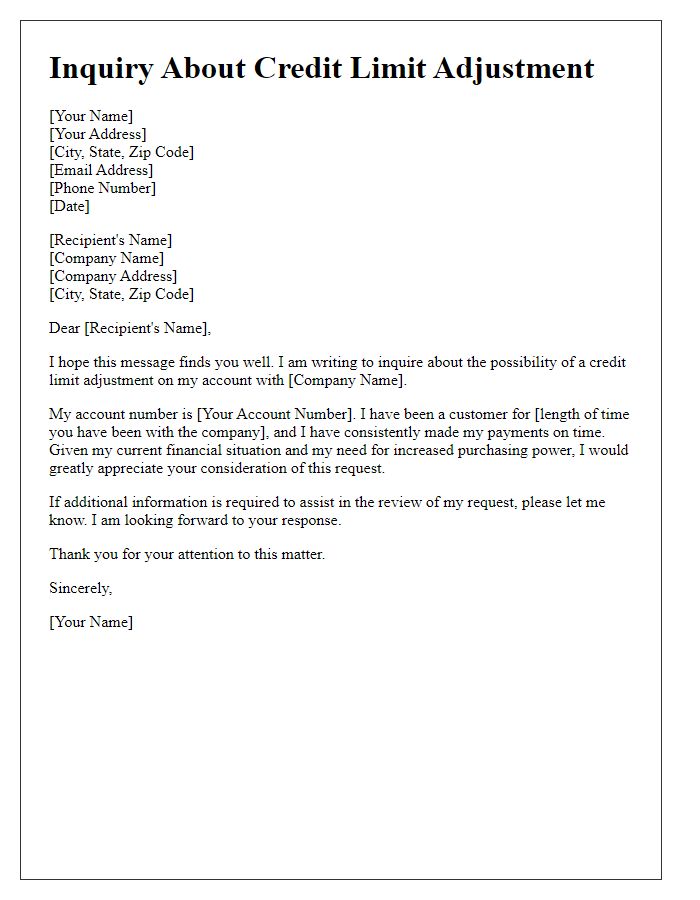

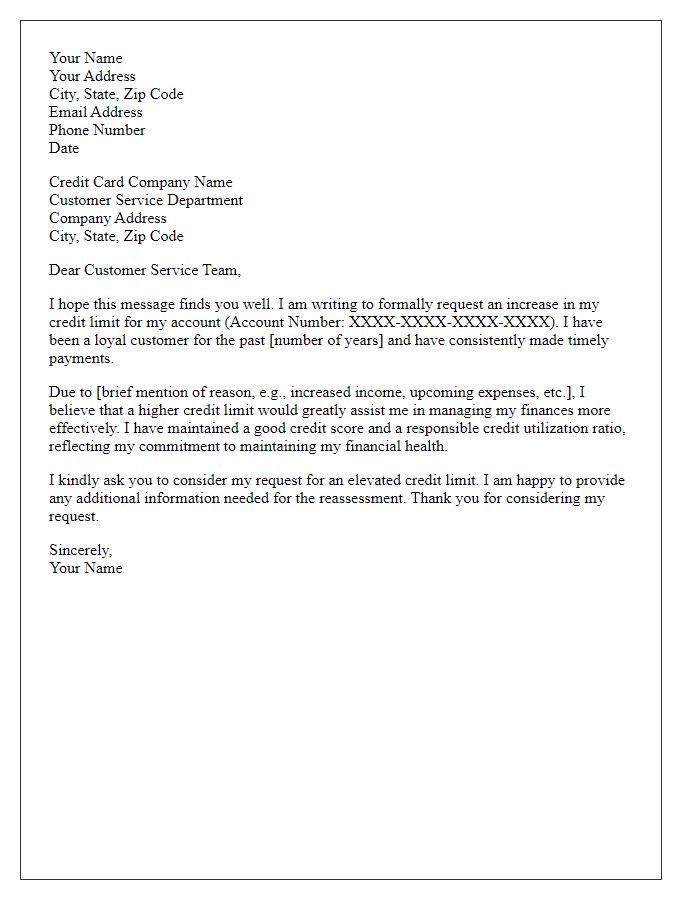

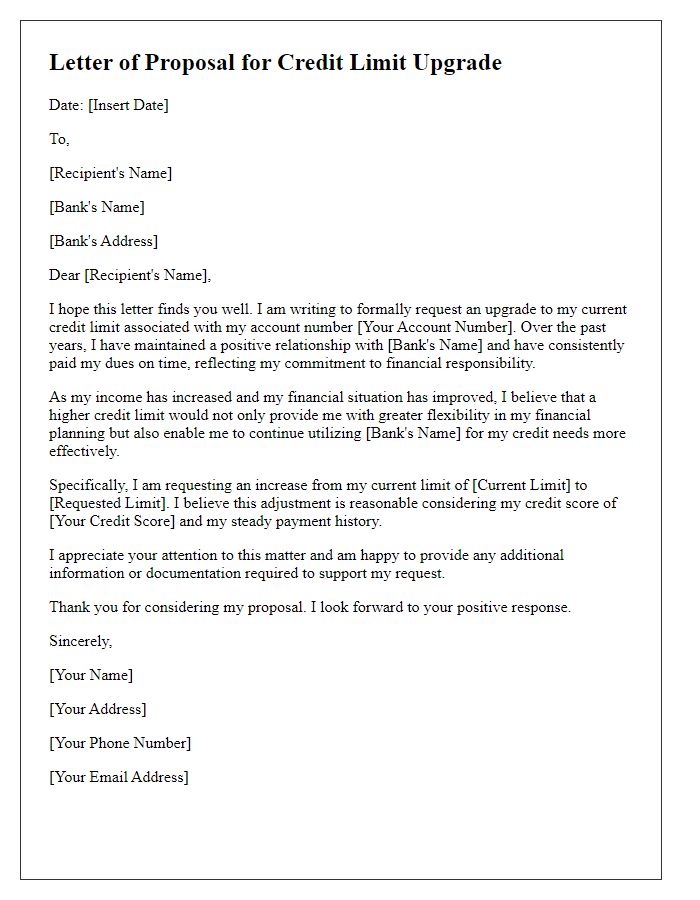

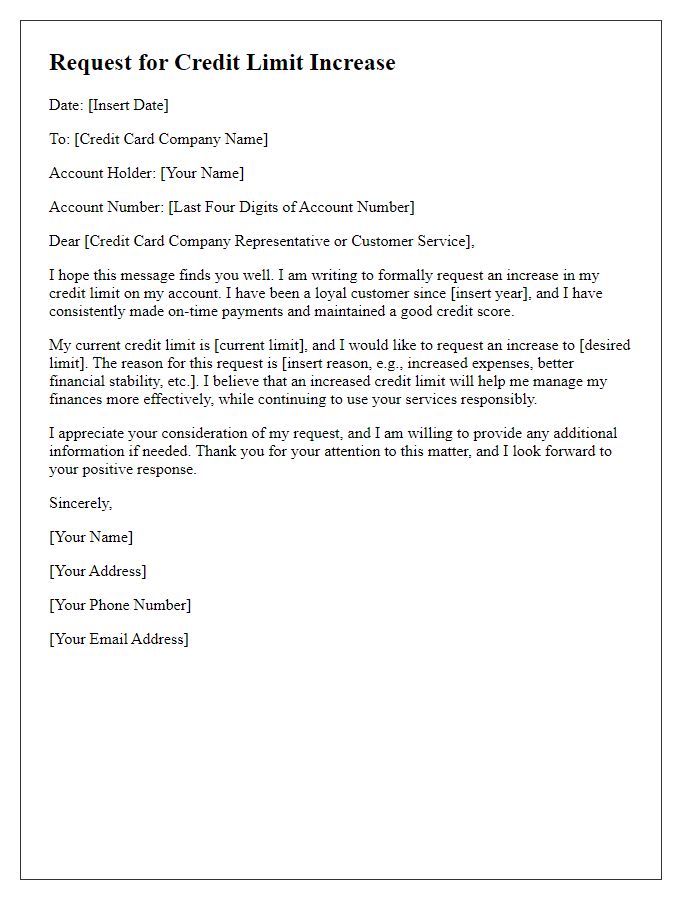

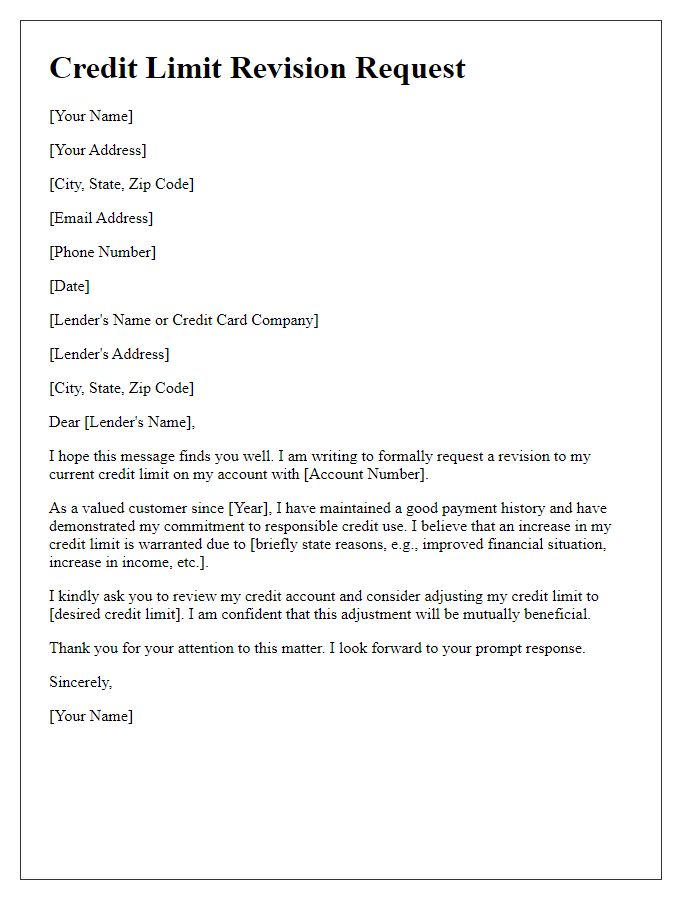

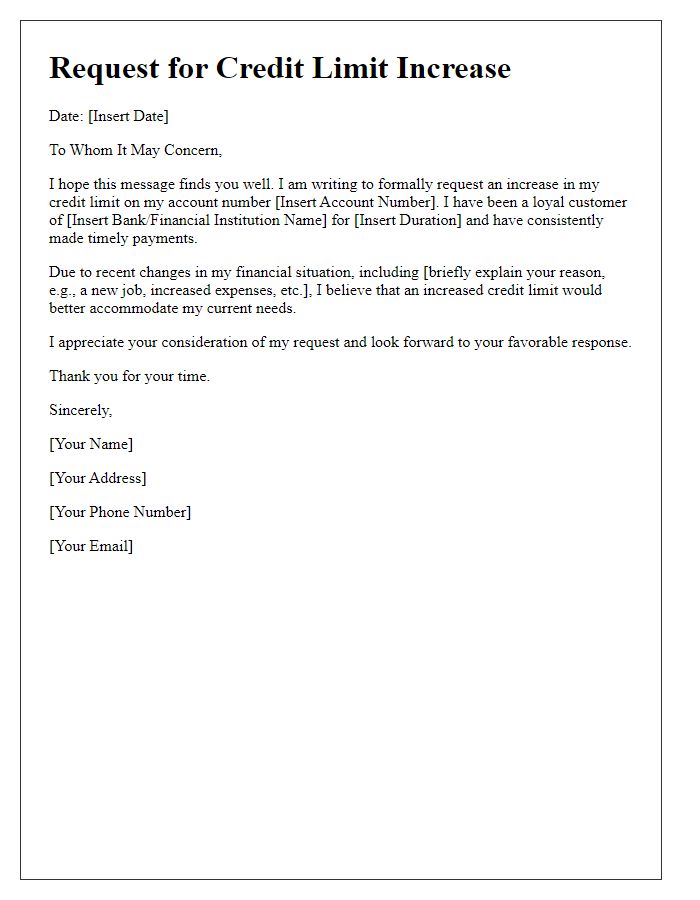

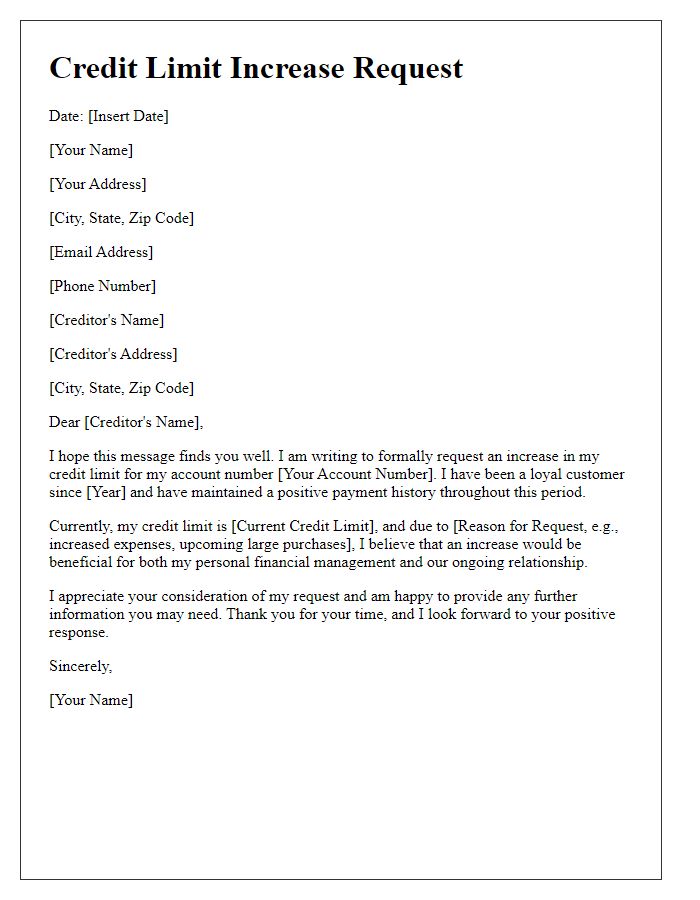

Are you considering asking your credit card issuer for a credit limit increase? It's a common request that can offer you greater purchasing power and improved credit utilization. Writing a well-structured letter can help you effectively communicate your needs and showcase your creditworthiness. Let's dive into the essential components of crafting the perfect request so you can feel confident in your appeal!

Personal identification information

A credit limit increase request typically involves personal identification information, including the applicant's full name, which is essential for verifying identity; Social Security number, which supports credit history checks; current address, providing a way to locate the applicant; date of birth, which confirms age eligibility; employment information, including job title and employer, to assess financial stability; and monthly income, which demonstrates repayment capability. Additionally, the account number of the existing credit line is necessary to specify which account requires an increase, ensuring the request is processed accurately and efficiently by the credit issuer.

Reason for the credit limit increase request

Many consumers seek an increase in their credit limit to improve financial flexibility and manage expenses more effectively. A higher credit limit, particularly on revolving credit accounts such as credit cards, enables individuals to maintain lower credit utilization ratios (ideally below 30%), which can positively impact credit scores. Increased purchasing power can also facilitate major purchases, such as home renovations, medical expenses, or travel plans, without significantly disrupting monthly financing strategies. Additionally, having a higher limit may provide a safety net in emergencies or unforeseen expenses, enhancing overall financial security and allowing for better planning of future expenditures.

Current financial status and income

Current financial status, characterized by an annual income of $75,000, reflects a steady employment position at a reputable company in the technology sector. Monthly expenses approximate $2,500, including mortgage payments, utilities, and groceries, leading to a favorable debt-to-income ratio of 20%. A robust credit score of 780, accumulated through consistent payments and prudent management of existing credit accounts, enhances overall financial credibility. Recent favorable changes in personal financial circumstances, including a promotion and a 15% salary increase, indicate an improved capacity to manage and repay higher credit limits effectively. A request for an increased credit limit could provide greater flexibility for significant purchases and help maintain a lower credit utilization ratio, further benefiting credit score dynamics.

Credit history and payment track record

A request for a credit limit increase can be influenced by factors such as credit history, payment track record, and overall financial stability. Individuals with a strong credit history, typically characterized by a FICO score above 700, often see higher approval rates for credit limit increases. A consistent payment track record, demonstrating timely payments over a period of at least six months, is also crucial. This includes a history free from late payments, collections, or charge-offs. Additionally, current income levels and existing debt-to-income ratios, ideally below 30%, can impact the decision-making process of credit institutions. Financial institutions, such as major banks or credit unions, review these financial behaviors to assess the risk associated with granting a higher credit limit.

Future financial obligations and commitments

Future financial obligations and commitments often necessitate a careful examination of one's credit limits. A higher credit limit provides flexibility, enabling the management of larger expenses such as home renovations, educational pursuits, or unexpected medical bills. Financial institutions assess these requests based on factors including credit utilization rates, payment history, and income stability. For example, an increase from a $5,000 limit to $10,000 can significantly impact cash flow during high expenditure periods, creating room for essential purchases without impacting credit scores. Ultimately, a reasonable request for a credit limit increase should reflect positive financial trends and future planning.

Comments