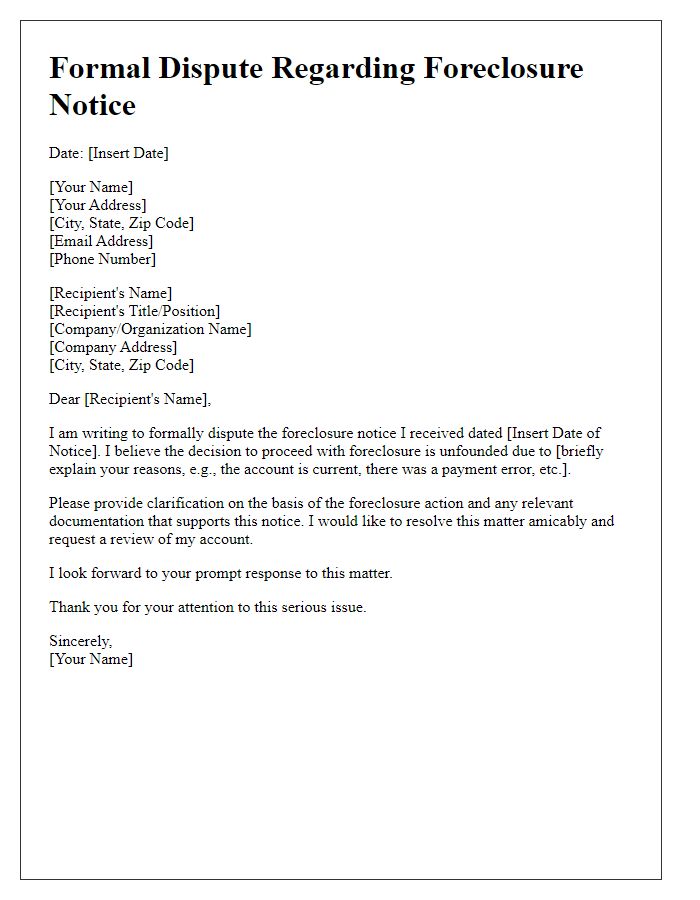

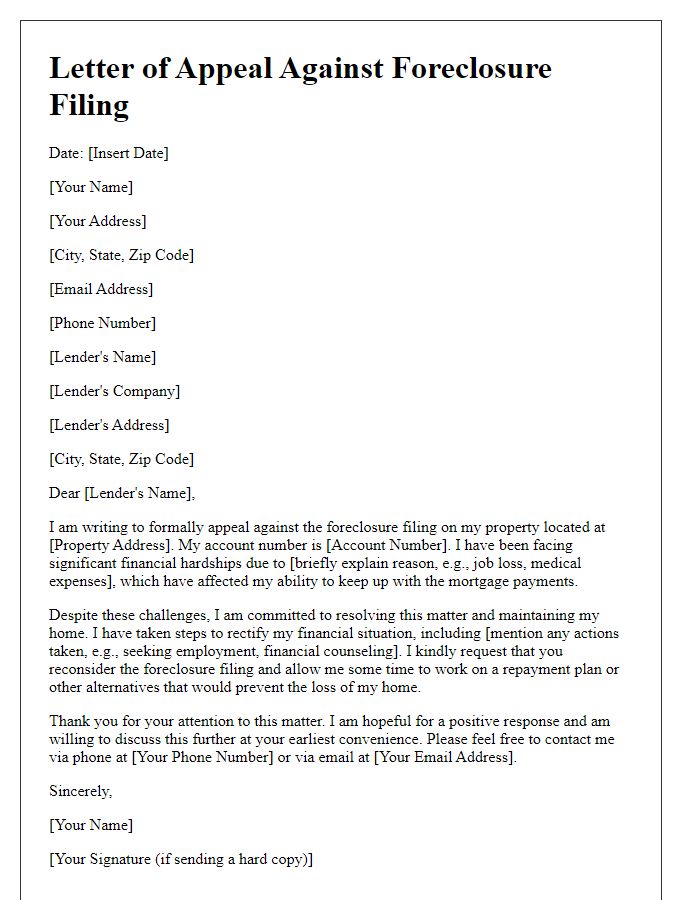

Are you feeling overwhelmed by the thought of disputing a foreclosure record? Many homeowners often find themselves in challenging situations, navigating complex legal jargon and daunting paperwork. It's essential to understand that you have rights and options available to protect your home ownership. Dive into our article to discover a step-by-step letter template that can effectively articulate your dispute and advocate for your rights.

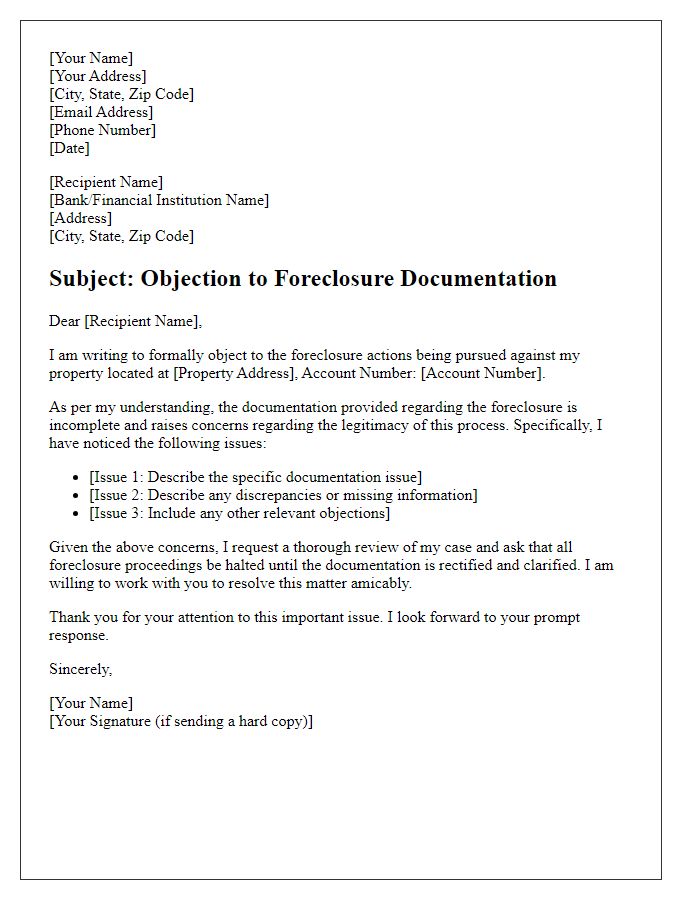

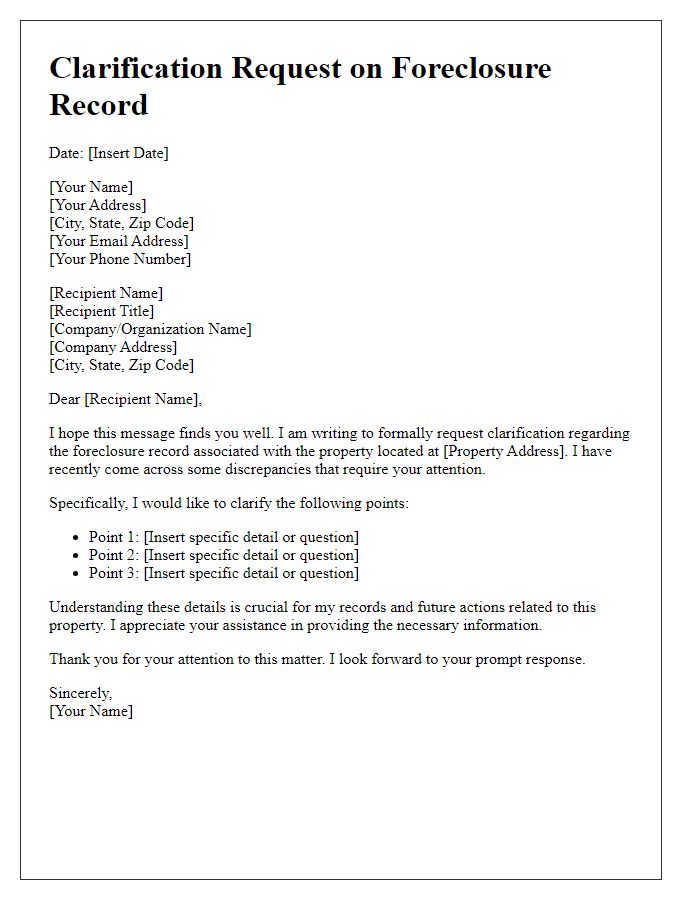

Clear identification of parties and property

Foreclosure disputes often arise from inaccuracies in records. In these cases, clear party identification is essential. The property in question may be located at a specific address, such as 123 Maple Street, Anytown. The claimant typically includes the mortgage lender, such as Big Bank Corp, alongside the borrower, identified by name, like John Doe, whose loan number (e.g., 987654321) links them to the property. Dates relevant to the foreclosure process, like the notice of default issued on January 15, 2023, are crucial for context. Accurate identification helps clarify responsibilities and strengthens the argument against erroneous records that could affect ownership status or credit ratings.

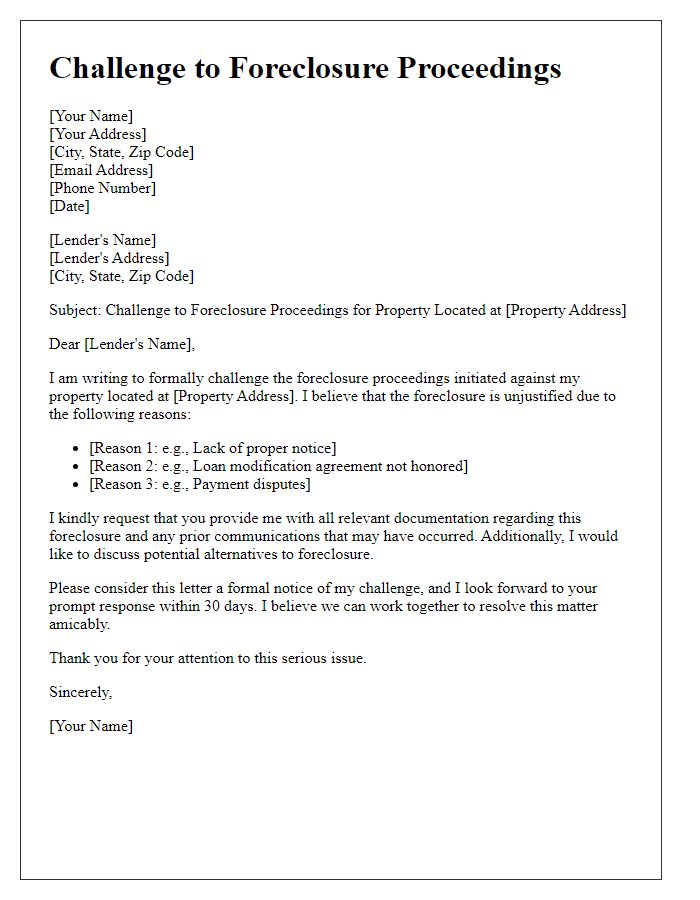

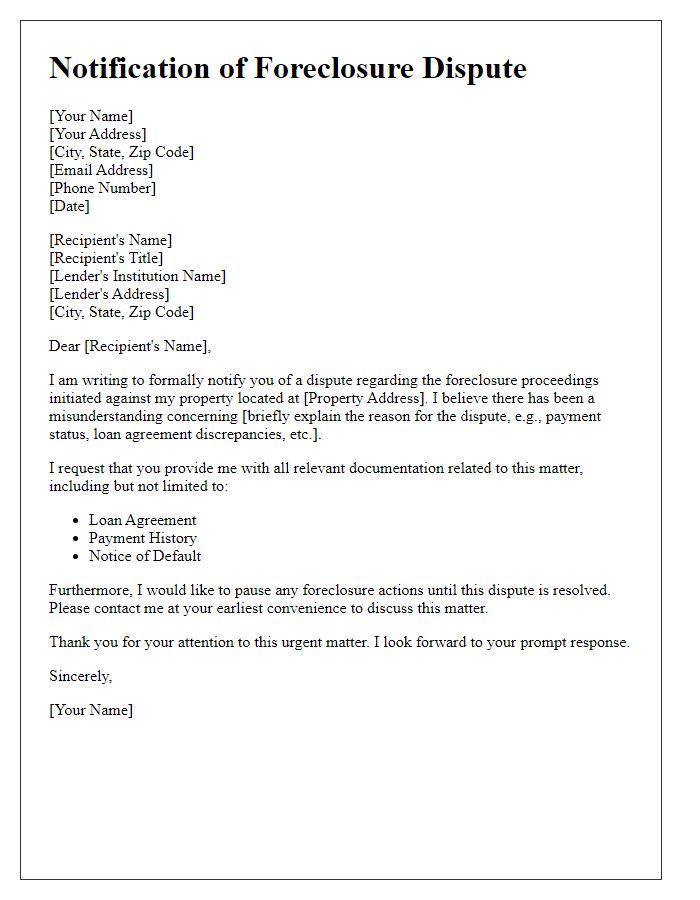

Detailed explanation of the dispute

Disputes regarding foreclosure records can arise due to various reasons, such as procedural errors, inaccurate information, or miscommunication with financial institutions. For instance, a homeowner may challenge a foreclosure due to the lack of proper notice from the lender, as required by law, such as the Real Estate Settlement Procedures Act (RESPA) in the United States. Mistakes in the amount owed can also prompt disputes, particularly if the mortgage servicer fails to account for payments made, totaling hundreds to thousands of dollars. Furthermore, discrepancies in property ownership or the chain of title could invalidate a foreclosure, impacting property rights significantly in states like California, where judicial foreclosure processes are common. Homeowners should meticulously document their communications with lenders and maintain records of payments, as these details can be crucial when addressing contested foreclosure actions. Additionally, obtaining legal advice may help navigate complex legal frameworks.

Supporting documentation and evidence

A formal dispute regarding a foreclosure record requires robust supporting documentation and evidence to substantiate your claims. Essential documents include the original mortgage agreement detailing the loan terms and repayment schedule, proof of payment history showcasing timely payments, and any correspondence with the lender indicating agreements or modifications made. Additional evidence may consist of a recent credit report from agencies such as Experian or Equifax, highlighting inaccuracies associated with the foreclosure entry. It is also crucial to include details from local laws regarding foreclosure procedures in your state, which may reveal violations of mandated protocols. Furthermore, gather affidavits or statements from witnesses who can support your position. All such components create a compelling narrative to challenge the legitimacy of the foreclosure record effectively.

Specific request or desired outcome

Homeowners facing foreclosure often need to dispute related records to protect their financial future. A foreclosure record can negatively impact credit scores, access to new loans, and overall financial stability. Specific outcomes desired may include correction of inaccurate records, removal of erroneous entries from credit reports, or a full review of the foreclosure process to ensure compliance with state laws, such as the Fair Foreclosure Act in New Jersey. Ensuring all documentation, like mortgage statements and payment history, reflects accurate information is essential for achieving a favorable resolution and restoring one's financial reputation.

Formal language and respectful tone

The recent foreclosure record associated with [Property Address] is concerning and requires immediate review. The foreclosure proceedings initiated by [Lender's Name] are based on [specific reason or circumstance, such as missed payments, etc.]. Currently, the record indicates that [specific details about the foreclosure, such as dates or amounts involved]. I believe there may be inaccuracies in the documentation or procedural errors that warrant reconsideration. Furthermore, [mention any mitigating circumstances, payments made, or negotiations attempted]. I kindly request a thorough investigation into this matter to ensure that all pertinent information is taken into account, given the significant impact that a foreclosure record can have on one's credit history and overall financial stability. Thank you for your attention to this urgent matter.

Comments