Are you feeling overwhelmed by outdated account balances that no longer reflect your current financial situation? It can be a hassle to keep track of all those lingering figures that just don't make sense anymore. Cleaning up your accounts opens up opportunities for better financial management and clarity. Join us as we explore the steps to effectively remove outdated account balances and streamline your finances!

Account Holder Information

Outdated account balances can significantly impact personal financial management and account holder decision-making. Account holders often encounter discrepancies where either the balance displayed does not reflect recent transactions or remains unchanged for extended periods. In banks like Wells Fargo or Chase, regularly updating account balances is essential to maintain financial accuracy and ensure users do not overspend based on outdated information. Furthermore, proper maintenance of account information, including the removal of obsolete balances, helps in providing clarity and reducing confusion for account holders, allowing for better budget planning and resource allocation. Regular audits of account data can help mitigate these issues and enhance overall customer experience.

Account Details

An outdated account balance can significantly impact personal finance management. In financial institutions, discrepancies in account statements often arise from delayed transactions or administrative errors. Maintaining accurate account information is crucial for budgeting, as it affects cash flow and spending behavior. Clients should regularly monitor their statements for updates to avoid issues. Institutions must ensure that their account management systems are updated promptly, ideally through automated processes, to reflect real-time balances. Regular audits of account balances can help identify these discrepancies and enhance customer trust in the financial institution's reliability.

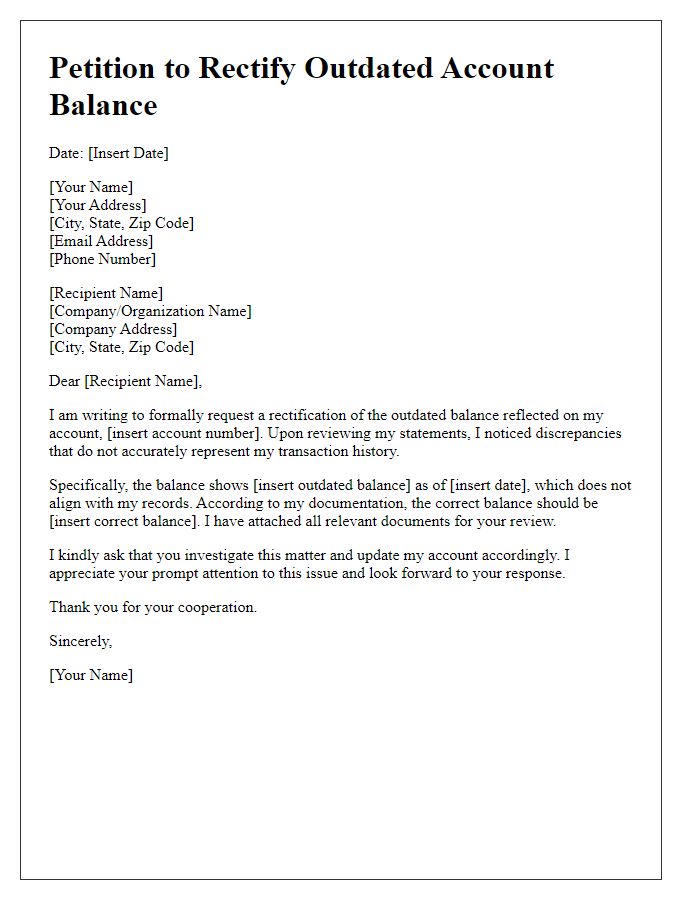

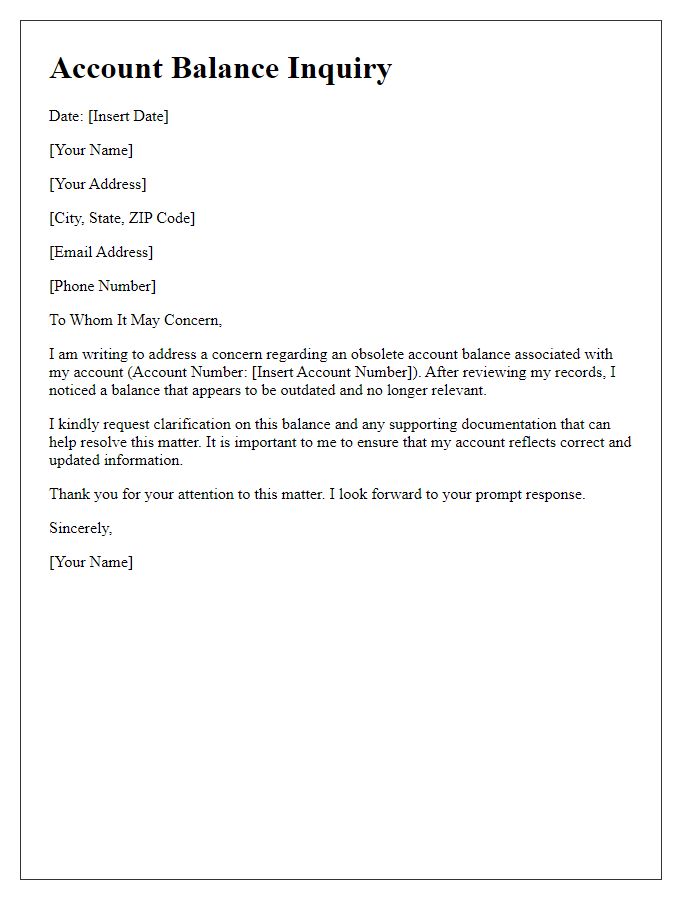

Request for Account Balance Update

A request for account balance update serves to address discrepancies in personal financial records. Users often encounter outdated balances due to delays in transaction processing or banking errors. Accurate data is crucial for informed budgeting decisions. This typically involves contacting the financial institution--often via email or phone--citing specific account details, such as the account number and prior balance figures. It's essential to provide a detailed description of the discrepancies, referencing transaction dates and amounts when applicable. Prompt communication ensures that updated balance information reflects current financial status, enhancing effective personal money management.

Evidence of Transactions

Outdated account balances can lead to inaccurate financial reporting and misunderstanding between clients and financial institutions. Evidence of transactions must include detailed records such as bank statements or transaction receipts, spanning specific periods, from institutions like JPMorgan Chase or Bank of America. Date stamps reflecting transactions, transaction IDs, and amounts must also be included to ensure clarity. For audits, supporting documents related to the transactions, like invoices or purchase orders, should accompany the evidence. This process ensures that discrepancies are cleared and accounts are accurately updated, maintaining the integrity of financial management practices.

Contact Information

In online banking systems, outdated account balances can lead to confusion regarding financial health, transaction capabilities, and user experience. Users may encounter discrepancies if account balance data is not updated in real-time, especially following significant transactions, such as large deposits or withdrawals. For instance, account holders with savings accounts at financial institutions like Wells Fargo or Chase may see their balances lag due to processing lags. Accurate real-time data is crucial for making informed financial decisions and avoiding overdraft fees, which may incur up to $35 per transaction, depending on the bank's policy. Regular updates to account management systems are essential to ensure users maintain a clear and accurate overview of their finances.

Letter Template For Removing Outdated Account Balance Samples

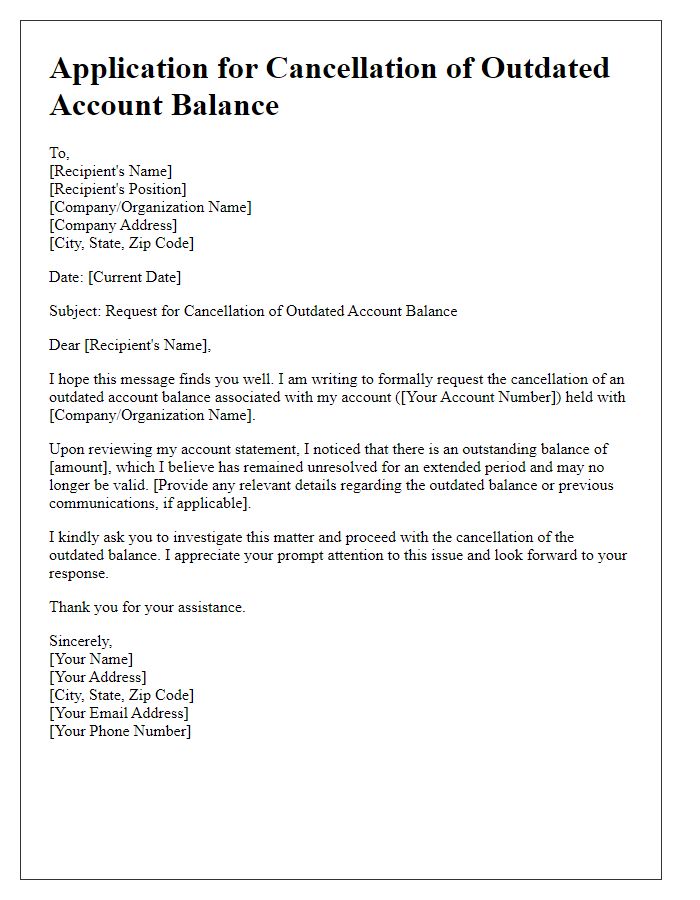

Letter template of application for cancellation of outdated account balance.

Comments