Are you feeling overwhelmed by debt and unsure how to approach your creditors? Negotiating repayment terms can seem daunting, but it's a crucial step toward regaining control of your finances. In this article, we'll guide you through crafting a persuasive letter that outlines your situation and proposes a mutually beneficial repayment plan. Keep reading to discover tips and templates that will help you take this important step forward!

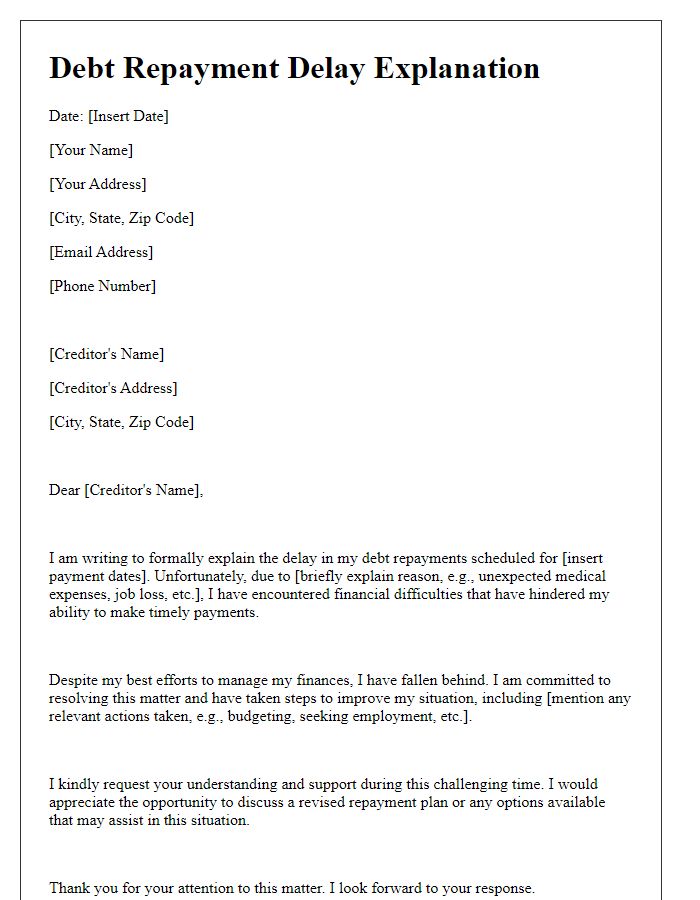

Personal and Contact Information

In negotiating debt repayment terms, it's crucial to include personal contact information that reflects readiness and seriousness in communication. Full name should appear prominently at the beginning, providing a clear identity in the interaction. Inclusion of phone number allows for direct communication, facilitating quicker discussions on payment terms. Email address creates an additional channel for written correspondence or documentation concerning agreements or changes. The date of the letter serves as a timestamp indicating when the negotiation began, reinforcing the timeline of interactions. Address, including city and zip code, ensures that the recipient knows exactly where to reach the sender, fostering transparency and clarity in the negotiation process.

Account and Debt Details

Debts can significantly impact financial stability, especially for individuals and businesses managing various obligations. A specific account, such as a personal loan account with a balance of $5,000 held by XYZ Bank, may be under negotiation for repayment. Key factors influencing the negotiations include the interest rate of 7% per annum and repayment term of 24 months. Additionally, the total debt amount due may encompass late fees or additional charges that fluctuate based on payment history. Creating a detailed repayment plan that includes proposed installment amounts of $300 monthly could provide a clearer path to debt resolution. Understanding the consequences of default, such as negatively affecting credit scores over 100 points, stresses the importance of reaching amicable terms for both parties involved.

Proposed Repayment Plan

A proposed repayment plan can help facilitate a manageable way for individuals to settle outstanding debts, such as credit card balances or personal loans. Establishing a structured timeline, like a six-month period, allows for smaller installment payments, potentially 50% of the current monthly payment, to be made each month. This not only eases financial pressure on the debtor but also demonstrates commitment to repaying the owed amount. Furthermore, including the specifics of the outstanding total, potentially exceeding $5,000, can provide clarity for both parties involved. It is essential to maintain open communication during this process, ensuring that all modifications to the original agreement are documented, fostering a transparent negotiation environment.

Financial Hardship Explanation

Negotiating debt repayment terms involves a clear understanding of one's financial situation and the ability to communicate that effectively to creditors. A detailed explanation of financial hardship should include specific circumstances such as job loss, medical expenses, or increased living costs. For instance, a loss of employment resulting in a 50% decrease in monthly income can significantly impact the ability to meet existing payment obligations. Mentioning events like unexpected medical bills averaging $1,500 per month can illustrate the urgency of the situation. Additionally, costs like housing and utilities that together may exceed $2,000 per month further highlight the strain on finances. Establishing a clear request for modified repayment terms--such as lower monthly payments or a temporary forbearance--can also facilitate a more productive negotiation process.

Goodwill and Commitment Statement

Negotiating debt repayment terms requires clear communication and a genuine demonstration of goodwill. A Goodwill and Commitment Statement should articulate the intent to resolve outstanding debts responsibly. This document must emphasize the borrower's financial situation, recognition of the debt, and a proposed repayment plan detailing amounts and scheduling. Include specific figures such as total debt owed, monthly repayment capabilities, and any external factors affecting financial stability. Highlight previous positive interactions with the creditor to build trust. Additionally, express commitment to honoring the new terms with consistency and transparency, showing a dedicated approach to restoring financial standing while ensuring a realistic and feasible path forward.

Comments