Have you ever felt the frustration of a missed credit repayment report? It can often lead to unnecessary stress, especially when you're working hard to maintain a good credit score. Understanding the steps to address overlooked repayments is crucial for anyone looking to improve their financial standing. Curious about how to navigate this process effectively? Read on to discover more!

Accurate Personal Information

Accurate personal information on credit repayment reporting is crucial for maintaining a positive credit score. Personal details such as name, social security number (SSN), and address must match across all financial institutions. Inaccuracies can lead to a misrepresentation of creditworthiness and potential denial of loans. For instance, a discrepancy in the name, such as a missing hyphen or incorrect spelling, can result in misreported payment history, hindering your ability to secure favorable interest rates. Regularly reviewing credit reports from agencies like Experian, Equifax, and TransUnion ensures that all information is correctly recorded. Timely updates to personal information, especially after significant life events like marriage or relocation, can prevent future financial complications.

Clear Debt Details

Clear documentation of credit repayment obligations is essential for maintaining a healthy financial profile. When a borrower misses a payment deadline, the account details, such as the account number, outstanding balance (potentially rising over 30 days past due), and creditor information, become critical. Lenders like banks or credit unions may report this missed payment to credit bureaus, impacting credit scores significantly, often by 100 points. Accurate recording of payment history is mandated by the Fair Credit Reporting Act (FCRA), which stipulates that all credit reporting must be fair and accurate. It is important for borrowers to monitor their credit reports regularly, utilizing resources such as AnnualCreditReport.com, to dispute any inaccuracies that may arise from overlooked repayment situations. Prompt resolution can prevent long-term harm to creditworthiness.

Missed Repayment Explanation

Missed repayment events can negatively impact an individual's credit report, resulting in lower credit scores. These missed payments may occur due to various factors such as unexpected medical emergencies (e.g., hospital visits exceeding $10,000) or job loss (e.g., 3 million people in the U.S. filing for unemployment in 2020). Specific creditors like credit card companies (average APR around 16%) closely monitor payment histories and may report delinquencies after 30 days of non-payment, potentially leading to long-term financial consequences. Addressing this overlooked credit repayment swiftly can assist in mitigating adverse effects, allowing individuals to rectify financial records and restore creditworthiness.

Resolution Proposal

Overlooked credit repayment reporting can significantly impact credit scores, with delinquencies recorded for up to seven years in the United States. Such reporting might stem from missed payments, incorrect billing information, or communication errors with financial institutions. Credit scoring models, like FICO, can penalize consumers by reducing their scores by 100 points or more due to a single 30-day late payment. Proposed resolutions include requesting the creditor to update payment history, initiating goodwill adjustments, and exploring credit counseling services. These actions can help mitigate the effects of negative reporting, improve credit health, and facilitate more favorable borrowing terms in the future.

Polite and Professional Tone

Overlooking credit repayment reporting can significantly impact an individual's credit score, which lenders use to assess financial trustworthiness. For instance, missed payments reported to credit bureaus such as Experian or Equifax can remain on a credit report for up to seven years. This process often involves data from various creditors, banks, and financial institutions that must be accurately reported on time. Credit scoring models, including FICO and VantageScore, heavily weigh payment history, which makes timely repayments essential for maintaining a good score. Consumers experiencing potential errors should contact their lenders and request correction to ensure proper reporting and minimize adverse effects on their credit history.

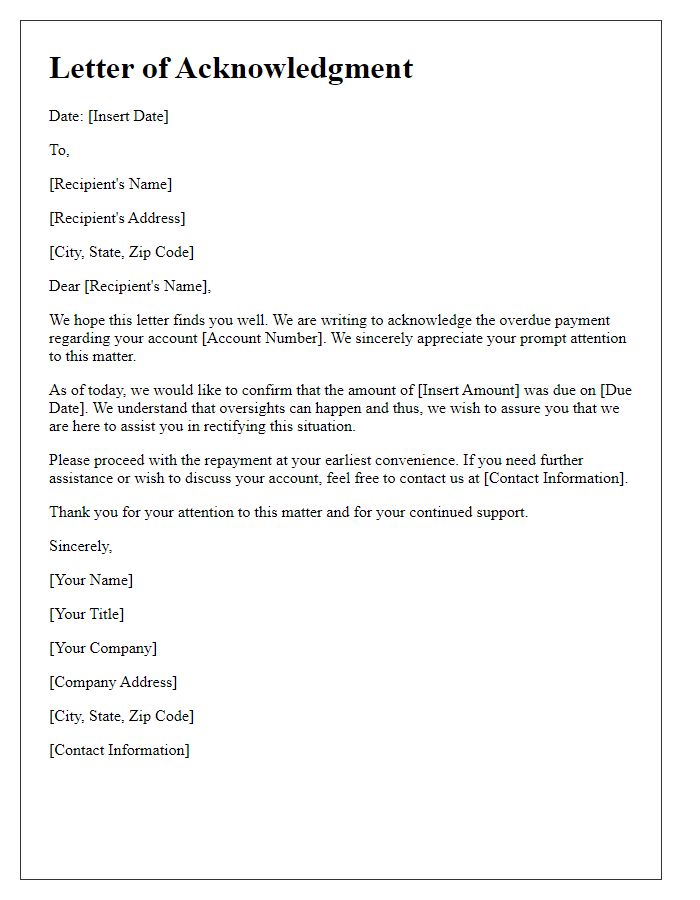

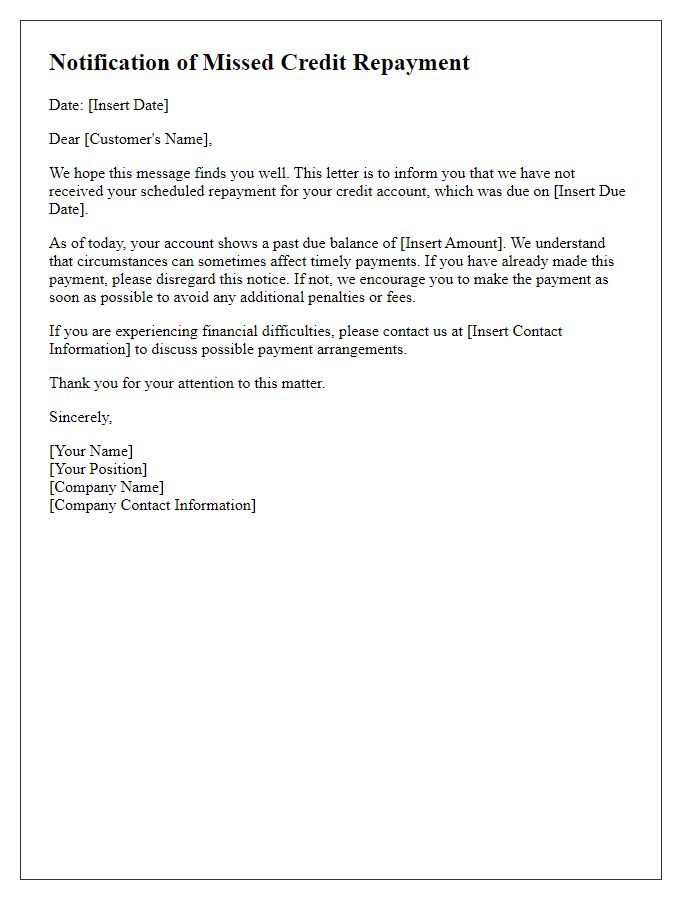

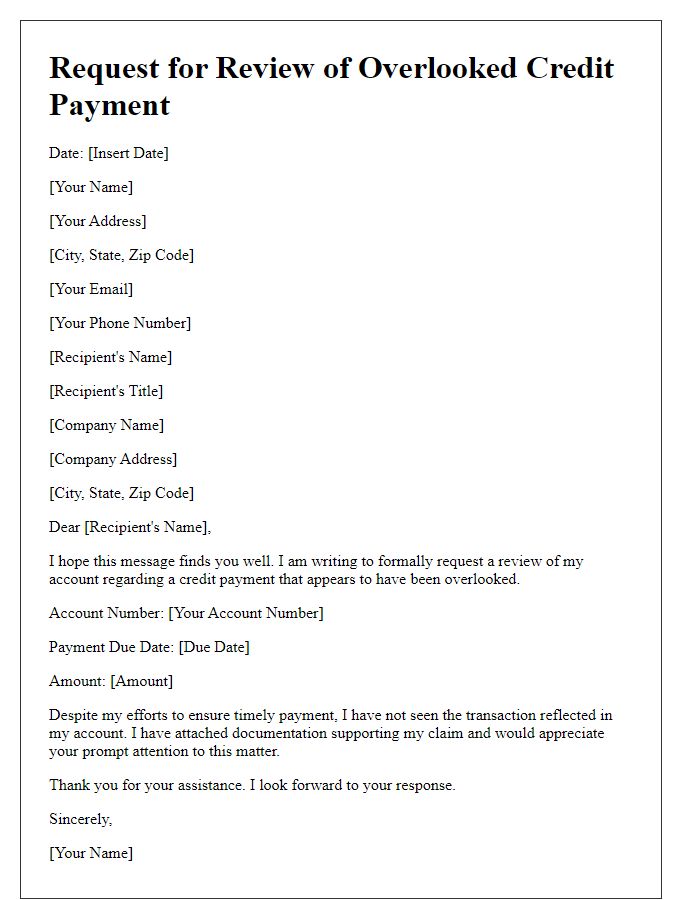

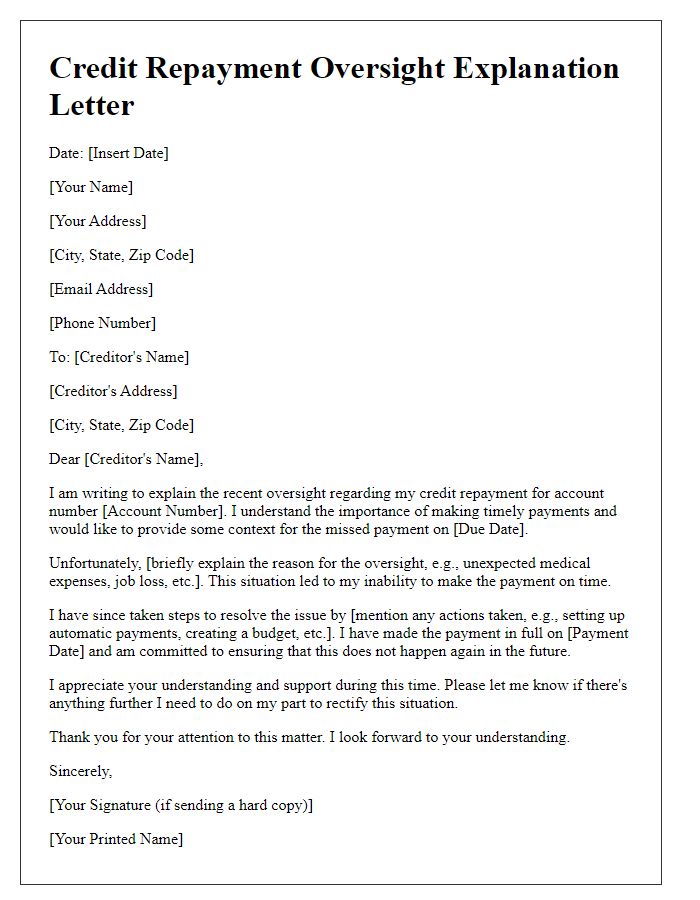

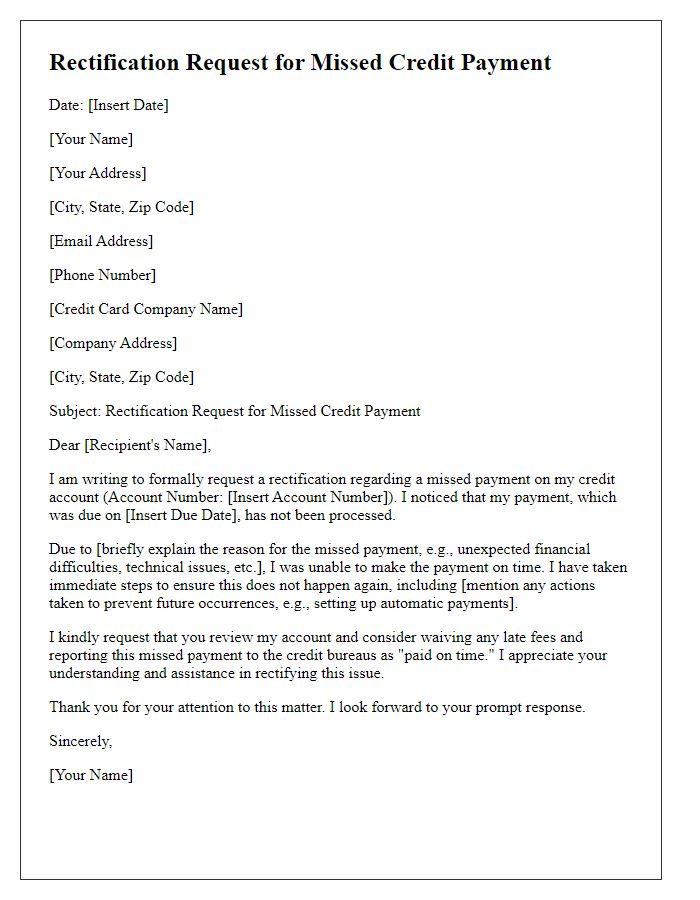

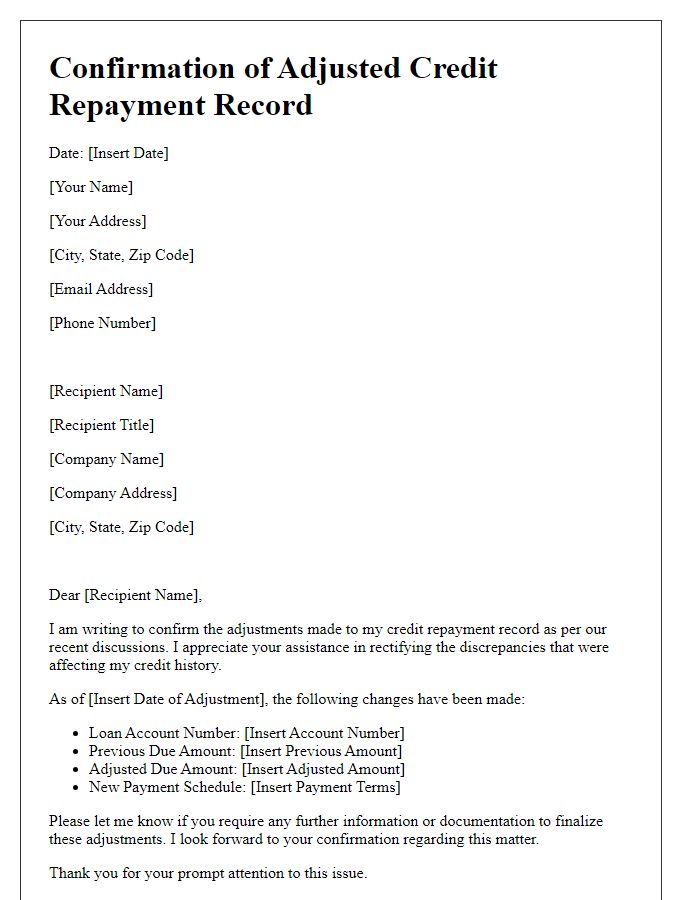

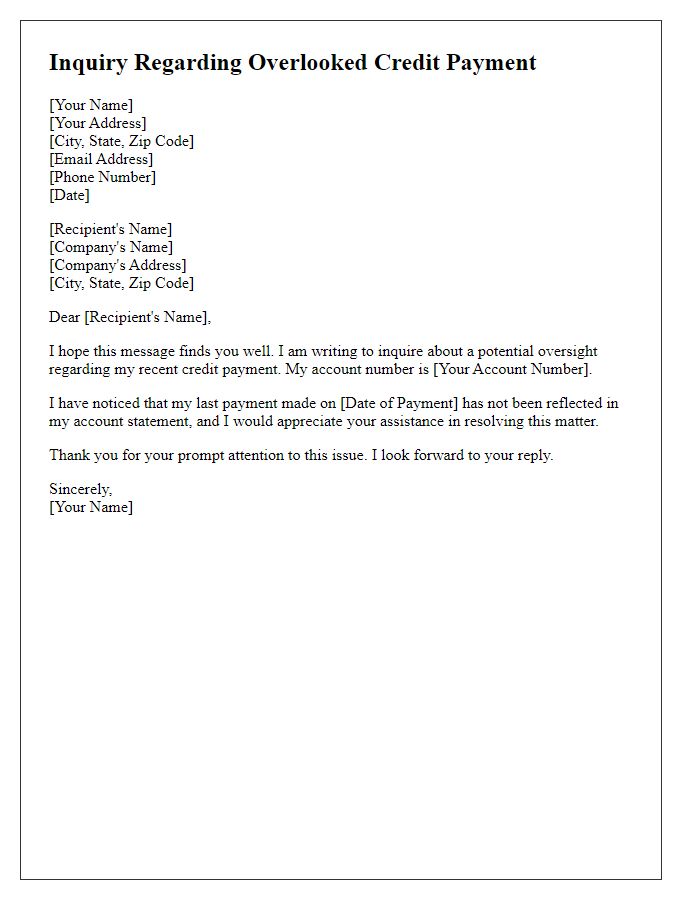

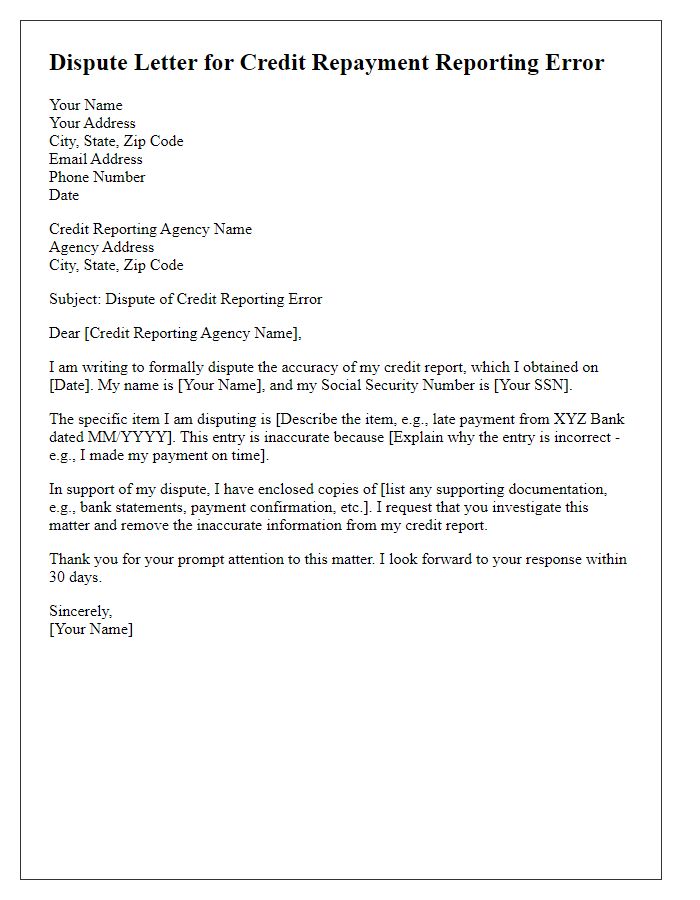

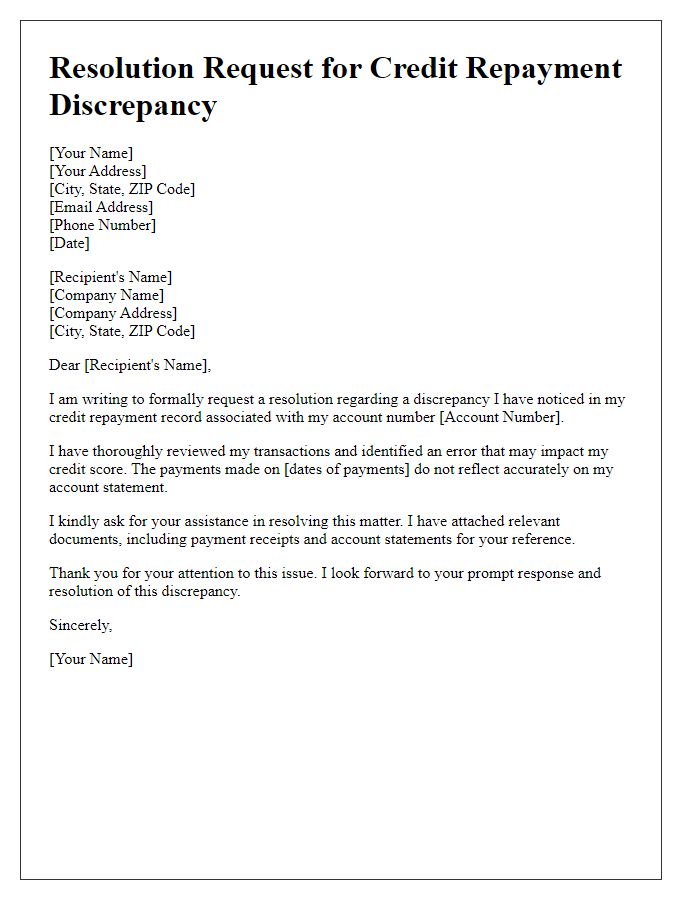

Letter Template For Overlooked Credit Repayment Reporting Samples

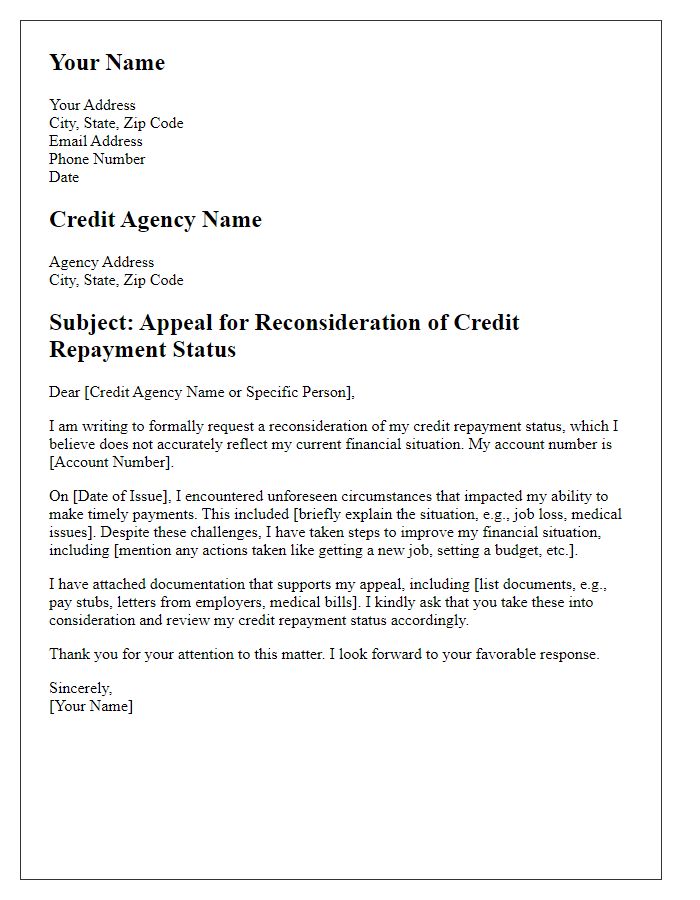

Letter template of appeal for reconsideration of credit repayment status.

Comments