Are you concerned about your credit score and its potential impact on your financial future? Understanding your Equifax credit score is crucial, as it's often used by lenders to evaluate your creditworthiness. In this article, we'll walk you through how to review your Equifax credit report effectively, highlighting key components and what to look for. So, let's dive in and empower yourself with the knowledge to take control of your credit journey!

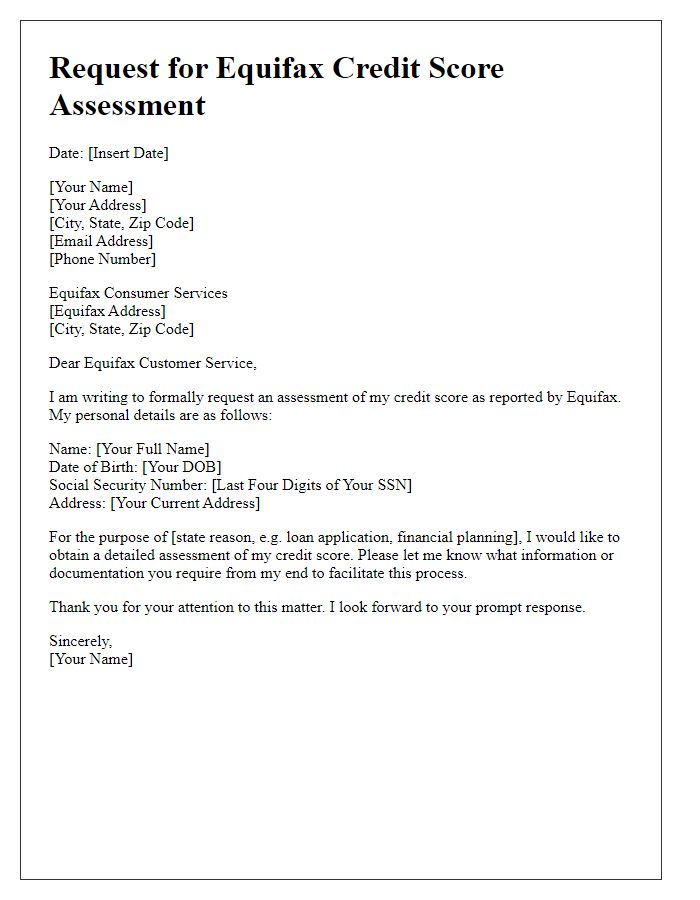

Accurate personal information

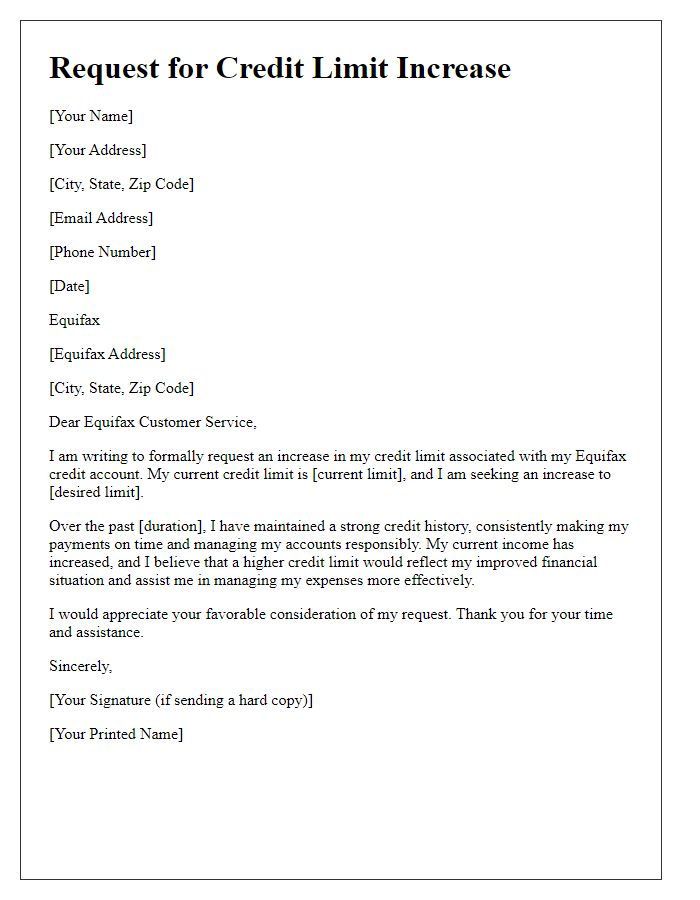

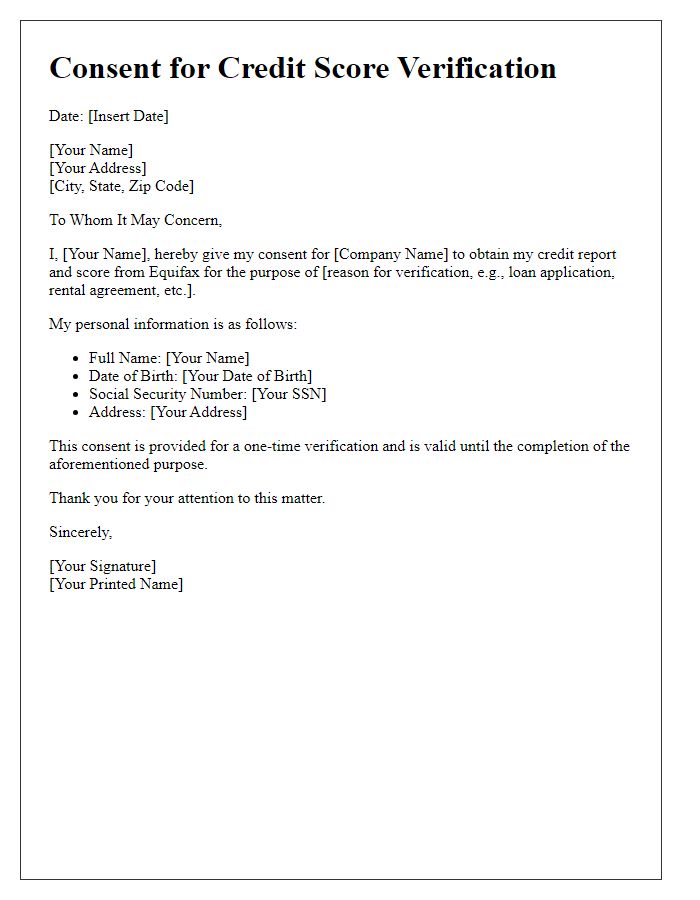

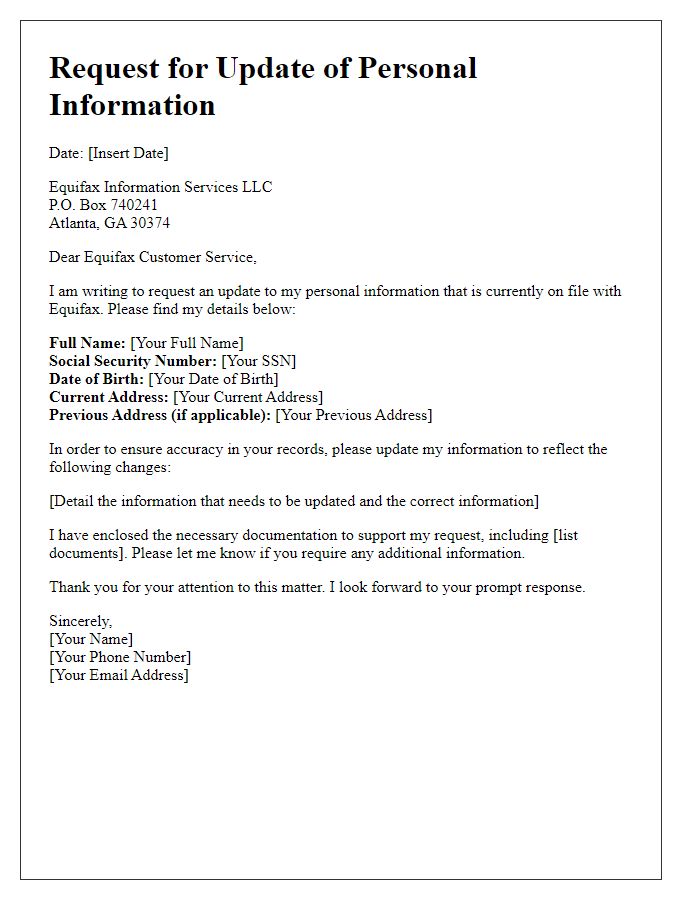

Accurate personal information is crucial for maintaining a reliable credit report with Equifax, one of the three major credit bureaus in the United States. Ensuring that details such as your full name, Social Security number, date of birth, and current address are correct can significantly impact your credit score calculation. Any discrepancies in these key identifiers can lead to confusion or misreporting of your credit history, making it essential to regularly review and update your information. For example, missed payments or incorrect balances on accounts could arise from mismatched personal data, ultimately affecting loan approval rates and interest charges. Regular monitoring of your credit report can help identify and rectify issues promptly, safeguarding your financial health.

Specific credit report in question

Requesting a credit report review from Equifax (one of the major credit bureaus) is essential for maintaining an accurate financial profile. An examination of a specific credit report, particularly from March 2023, reveals inaccuracies in personal information including name discrepancies and incorrect account statuses. This report influences credit score calculations, affecting loan eligibility and interest rates significantly. Ensuring authentic data reflects on this credit report is crucial for financial credibility. A thorough review of associated accounts, payment history, and inquiries will provide clarity on any potential errors impacting overall creditworthiness, which includes evaluating derogatory marks and their resolution timelines.

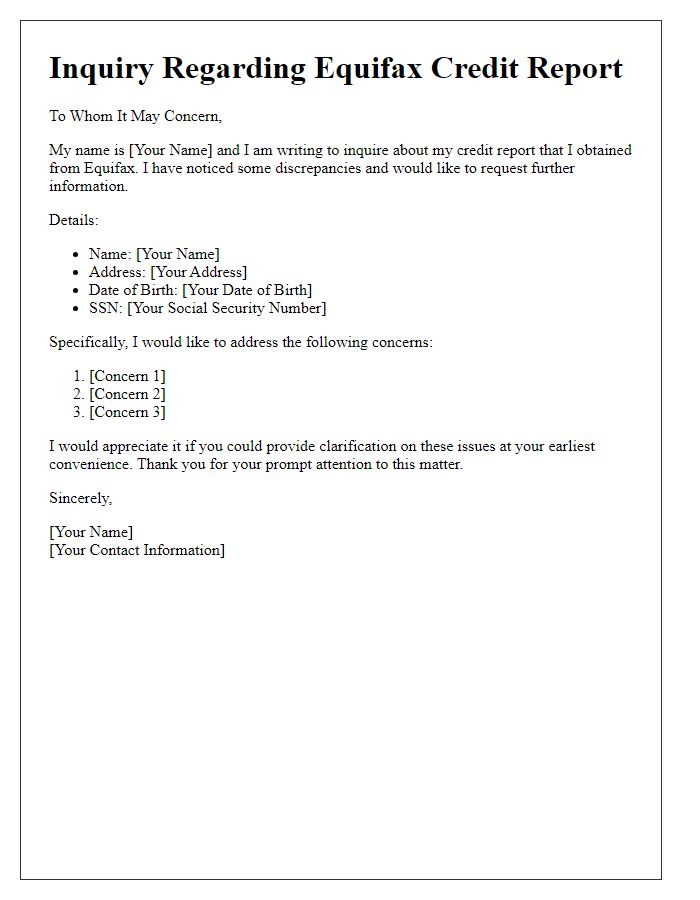

Detailed description of inaccuracies

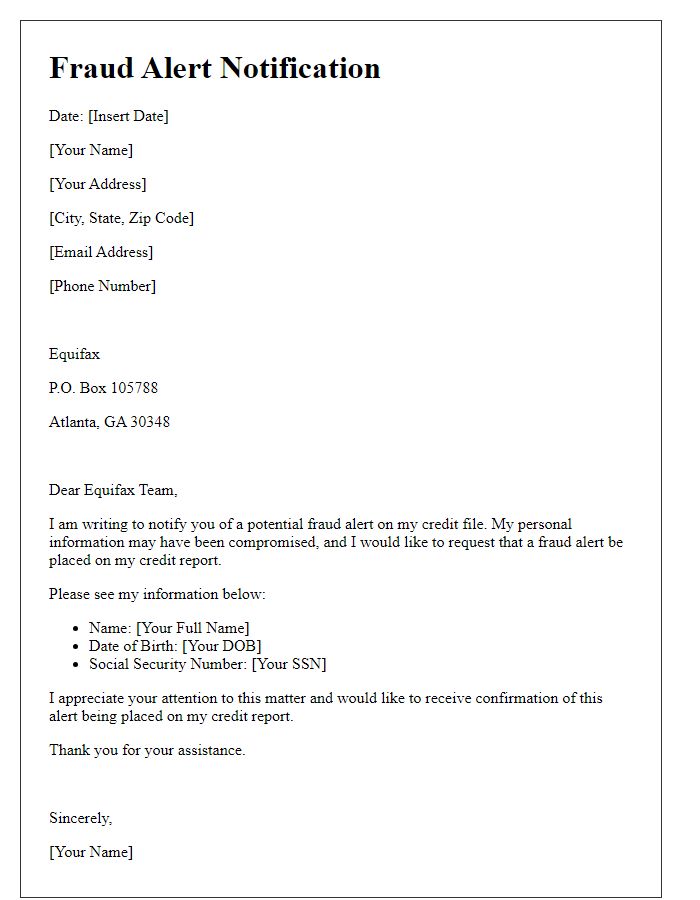

Inaccuracies in credit reports can significantly impact financial opportunities, including loan approvals and interest rates. For instance, an individual may discover erroneous late payment entries for a credit card, reflecting events from 2022 that never occurred. Disputed accounts, like a reported collection from an agency such as ABC Collections, may show a balance that was paid in full three months prior. Additionally, incorrect personal information, including the wrong address or Social Security Number, can lead to confusion and further complications. Errors like these require prompt attention to ensure accurate representations of creditworthiness, especially when applying for significant financial commitments, such as home mortgages or auto loans.

Supporting documentation evidence

A thorough review of an Equifax credit score often requires supporting documentation that substantiates claims regarding discrepancies or inaccuracies. Relevant documents may include a copy of the consumer's credit report (generated directly from Equifax), previous correspondence related to credit accounts, payment records showcasing on-time payments, and identity verification documents such as government-issued ID (driver's license or passport). Additional evidence such as bank statements may illustrate account activity, and proof of residence can establish the consumer's current address. This comprehensive documentation plays a crucial role in ensuring that claims are validated and that the consumer's credit history accurately reflects their financial behavior.

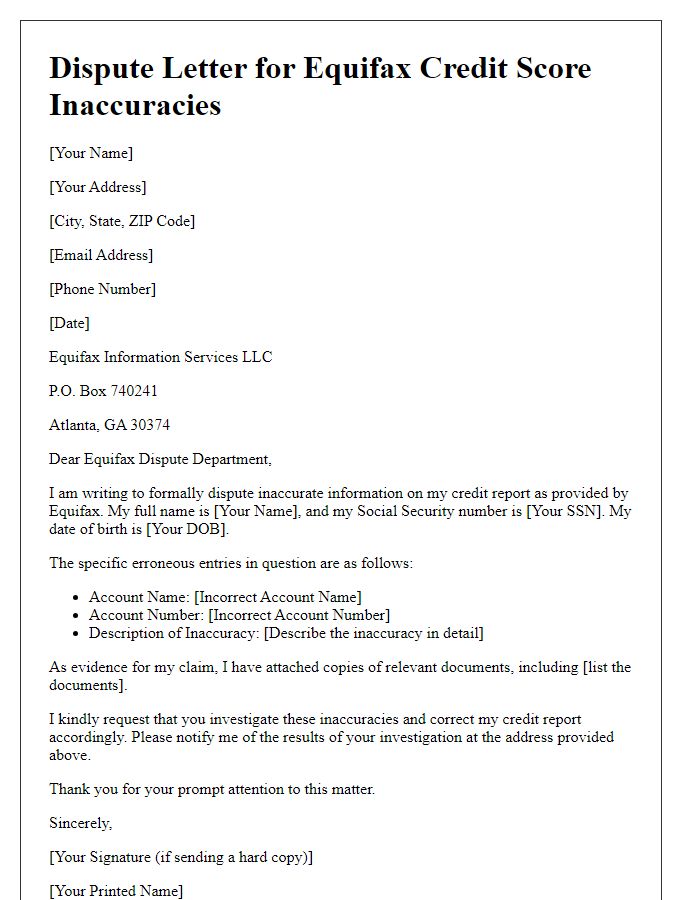

Clear request for correction or explanation

Credit reports contain important information affecting financial decisions, such as loan approvals. Errors in credit reports, like incorrect account balances or missing payment history, can negatively impact credit scores. For example, a missing payment from January 2023 may lower a score by 50 points, leading to higher interest rates on loans. Equifax, one of the major credit reporting agencies, provides consumer access to credit reports and the ability to dispute inaccuracies. Timely requests for corrections are crucial, as inaccuracies can linger for months or longer, delaying financial opportunities, such as mortgage approvals. Understanding the credit repair process is essential for maintaining financial health and securing favorable lending terms.

Comments