Are you looking to draft a letter requesting explanatory credit factors but don't know where to start? You've come to the right place! Understanding how credit factors work can significantly impact your financial health and future opportunities. Join me as we explore the essential elements to include in your letter, and discover tips that will enhance your chances of receiving a detailed response.

Clarity and Structure

Clarity and structure in communication significantly enhance the understanding of complex messages. Clear language defines key terms and avoids ambiguity, ensuring that the desired information is conveyed effectively. The structure involves organizing content in a logical flow, typically through headings, bullet points, or numbered lists, which guide the reader through the text. For example, in a business report, the use of sections like Introduction, Analysis, and Conclusion provides a roadmap for readers. Visual aids such as charts or infographics can also clarify data by presenting it in a digestible format, making complex information more accessible and comprehensible.

Conciseness and Precision

Concise and precise communication regarding explanatory credit factors is essential for a clear understanding of credit scoring. Factors influencing credit scores include payment history, which constitutes 35% of the FICO score, outstanding debt amounts contributing 30%, length of credit history accounting for 15%, new credit inquiries impacting 10%, and credit mix diversity representing another 10%. For further clarification, it may be beneficial to examine specific lending policies within major credit bureaus such as Equifax, Experian, and TransUnion, as they utilize varying methodologies for calculating credit scores and determining risk. Accurate understanding of these factors can significantly enhance one's financial literacy and credit management strategies.

Formal Tone and Language

A request for explanatory credit factors is essential for understanding the nuances of financial assessments. Specific factors influencing credit evaluations may include payment history (the most significant contributing factor, accounting for 35% of the credit score), credit utilization ratio (the balance-to-limit ratio, ideally below 30%), length of credit history (average age of accounts impacting 15% of the score), types of credit accounts (diversity between installment loans and revolving credit making up 10%), and recent inquiries (hard pulls affecting credit scores for a limited duration). These components collectively influence overall creditworthiness and are crucial for informed decision-making regarding loans, mortgages, and credit cards.

Specific Credit Details Requested

Credit reports often contain various factors that impact credit scores, such as payment history, credit utilization, and account types. Specific elements like late payment incidents (noted within 30, 60, or 90 days past due) can significantly lower scores. Individuals might request details regarding recent inquiries (typically conducted when applying for new credit) to understand how multiple requests might affect overall creditworthiness. Additionally, understanding credit utilization ratios (the percentage of available credit being used, ideally below 30%) is important for managing financial health. Clarification on any derogatory marks (recorded within the last seven years) will provide insight into long-term credit implications. Such detailed inquiries aid in formulating strategies for improving and maintaining higher credit scores.

Contact Information and Follow-up Plan

Contacting the financial institution for requesting explanatory credit factors can be crucial for understanding one's credit report. When reaching out, include essential contact details such as full name, address, phone number, and email address for proper identification and response. A follow-up plan is beneficial; suggesting a specific timeframe, such as one to two weeks post-request, ensures proactive communication. Additionally, it is helpful to note preferred contact methods; opting for email can provide documented correspondence. As credit factors impact financing options, clarity in understanding them aids in improving credit scores and achieving financial goals.

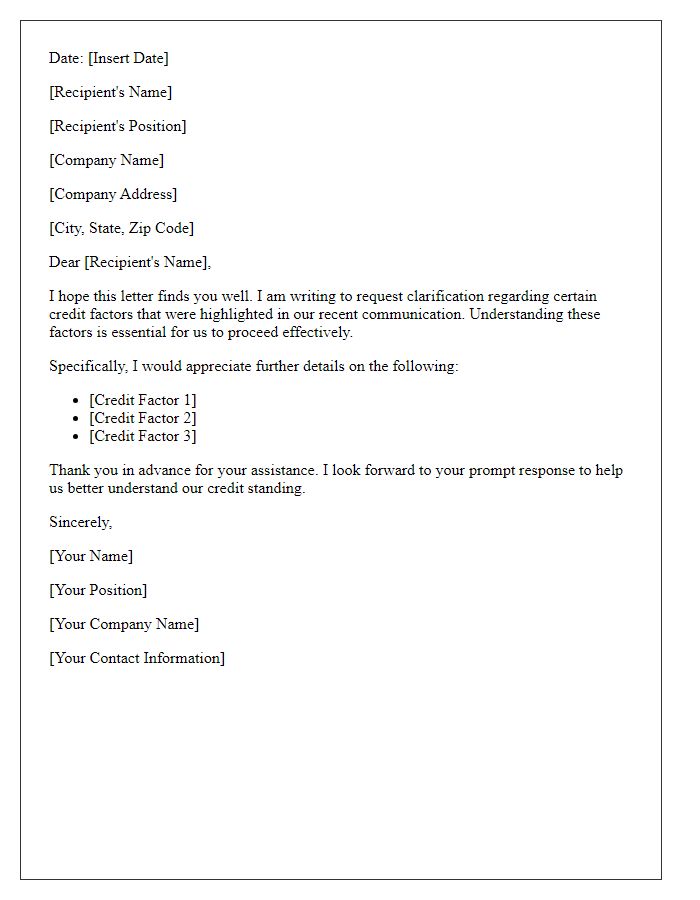

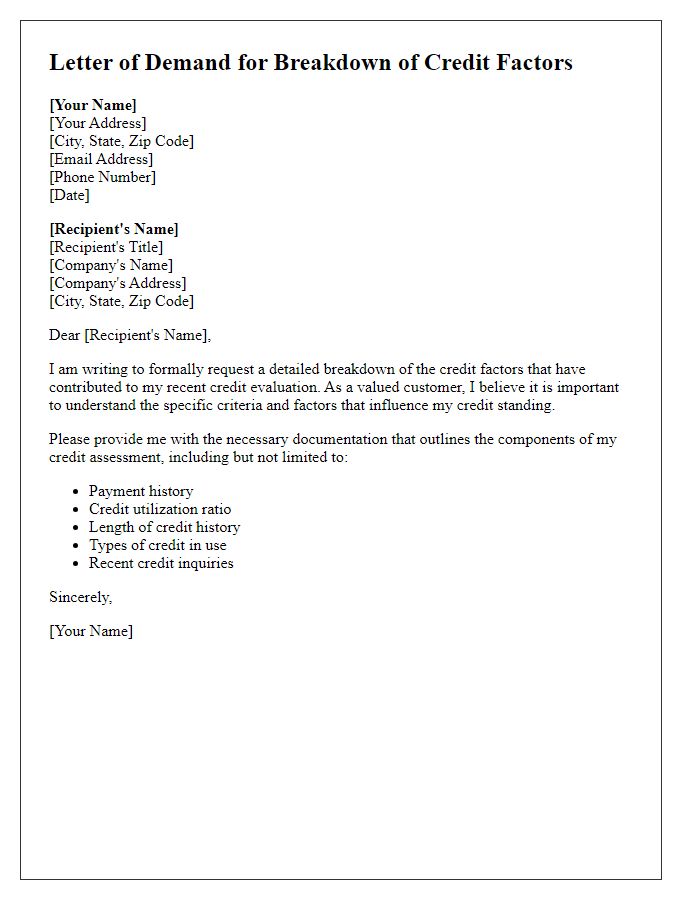

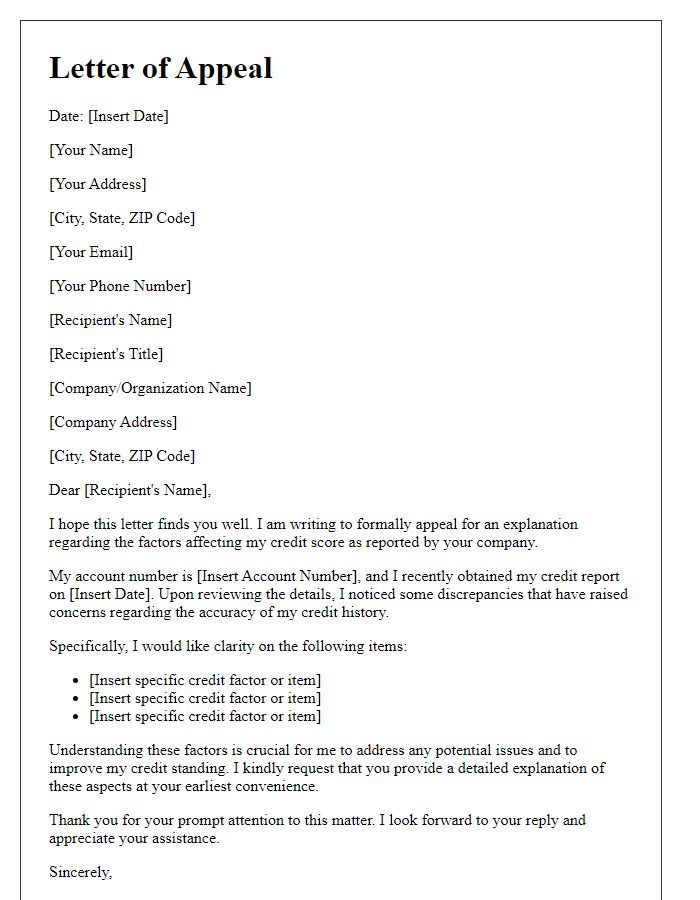

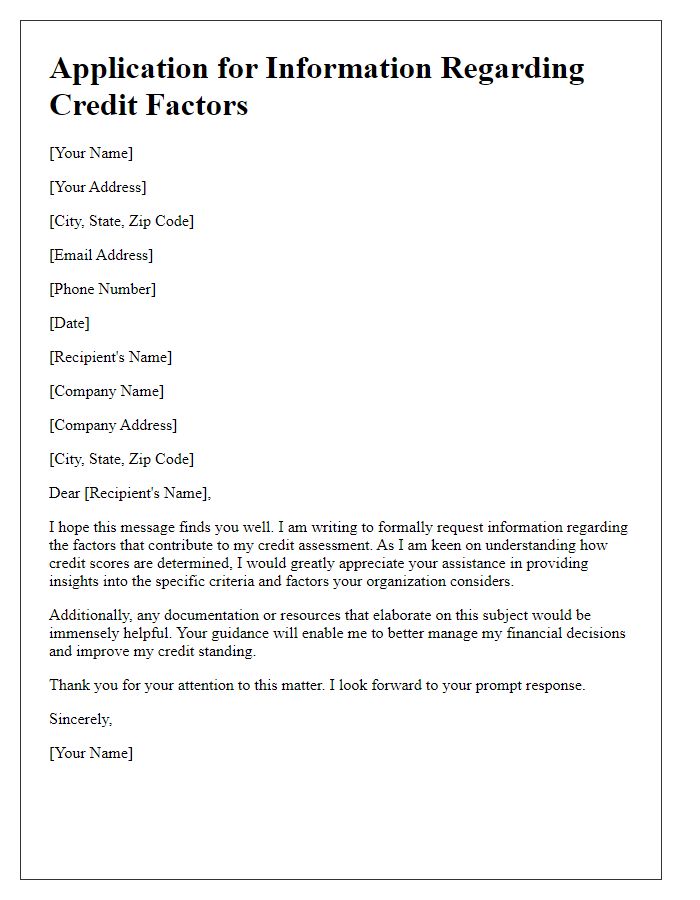

Letter Template For Requesting Explanatory Credit Factors Samples

Letter template of solicitation for comprehensive credit factors details

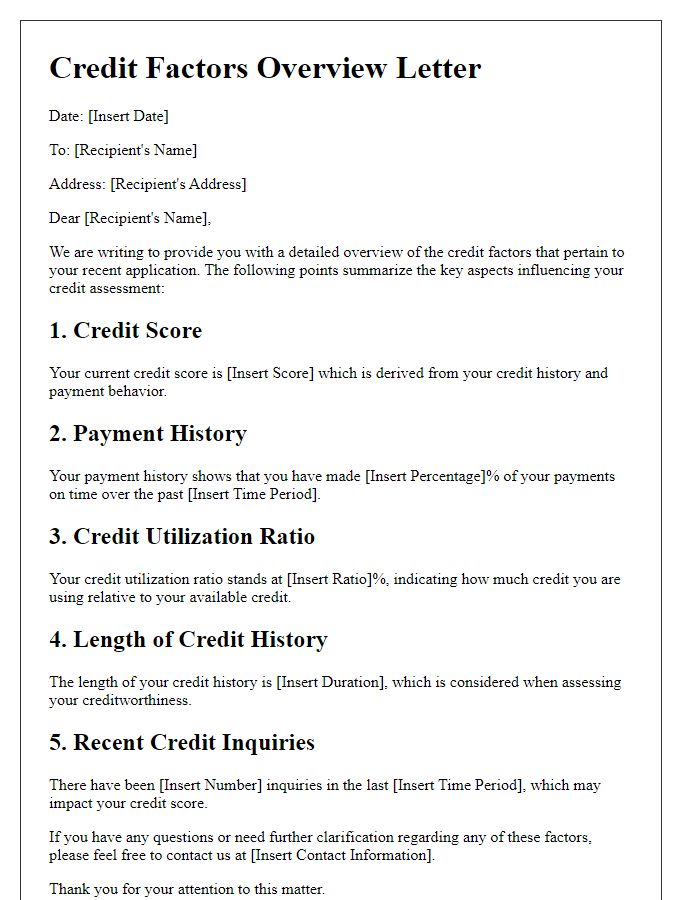

Letter template of correspondence for detailed overview of credit factors

Comments