Have you ever found an unexpected charge on your statement that left you scratching your head? It can be both frustrating and stressful to deal with unauthorized debt charges, especially when you know that your hard-earned money shouldn't be taken without your consent. Thankfully, there are ways to dispute these charges effectively, and we're here to guide you through the process. So, grab a cup of coffee and dive into our article to discover how you can clear unauthorized debt charges and reclaim your peace of mind!

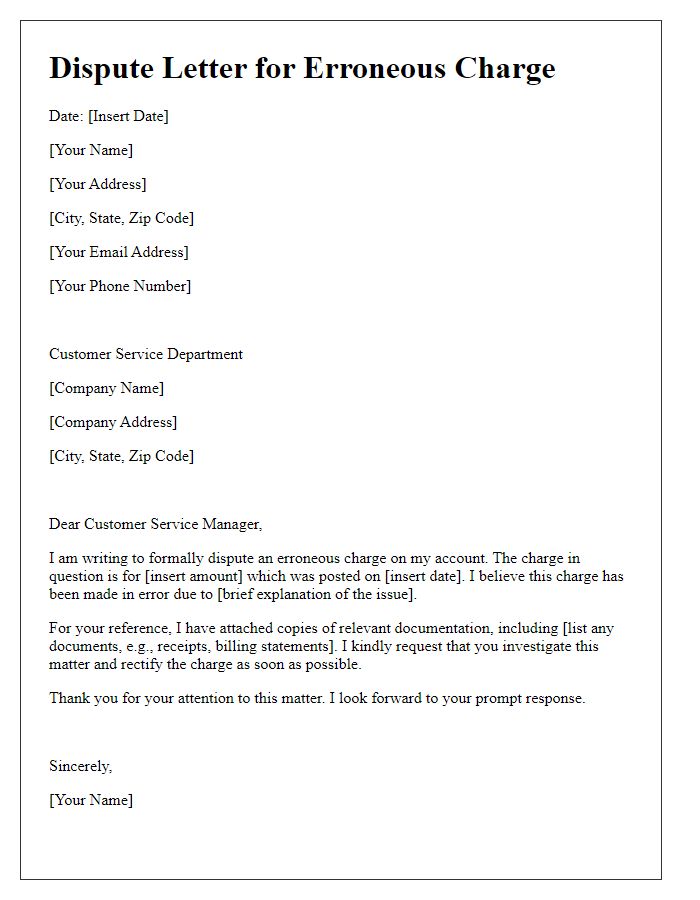

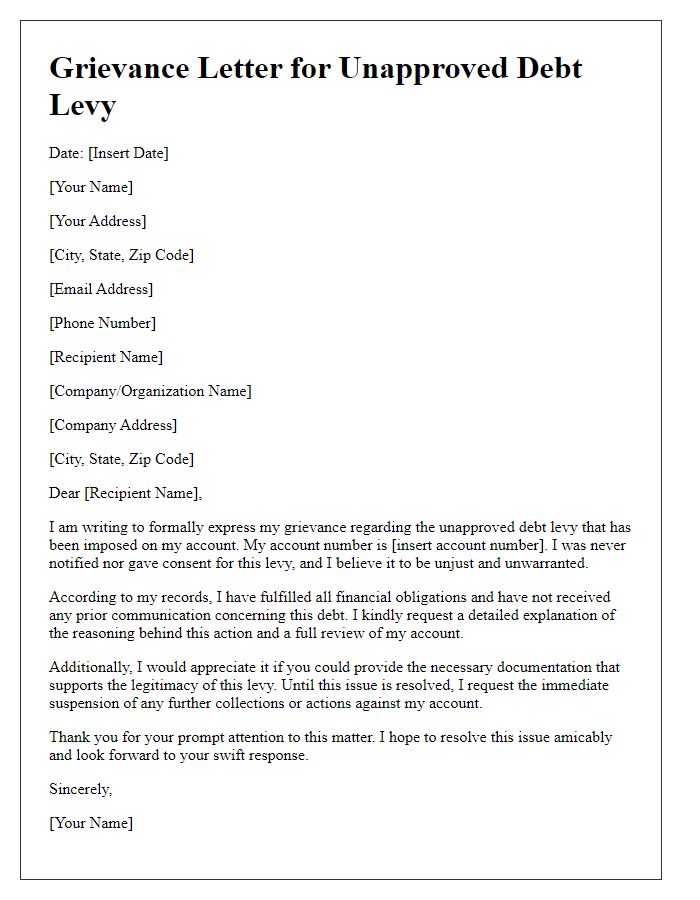

Personal Information (name, address, contact details)

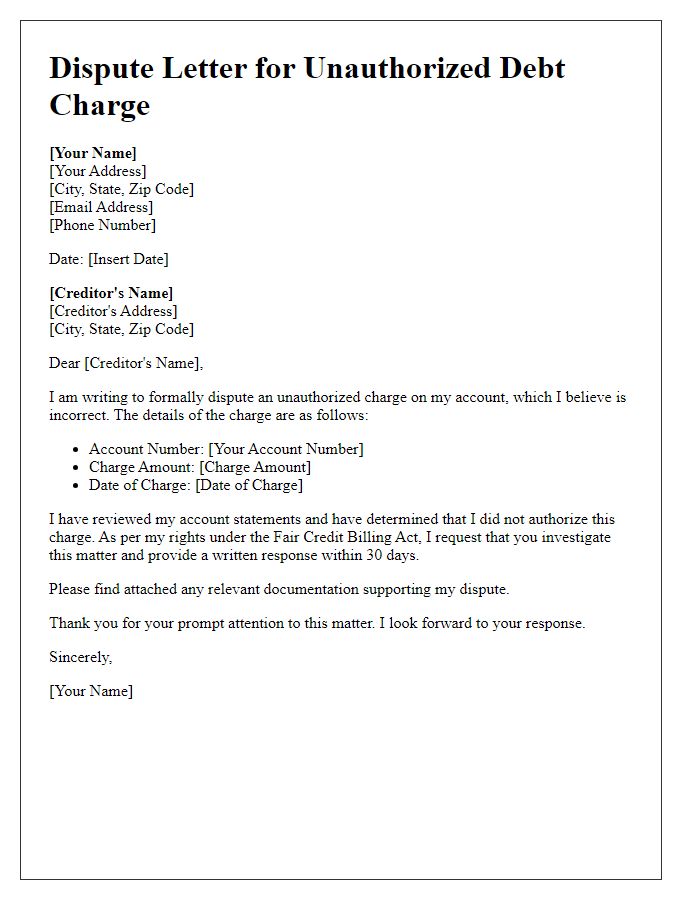

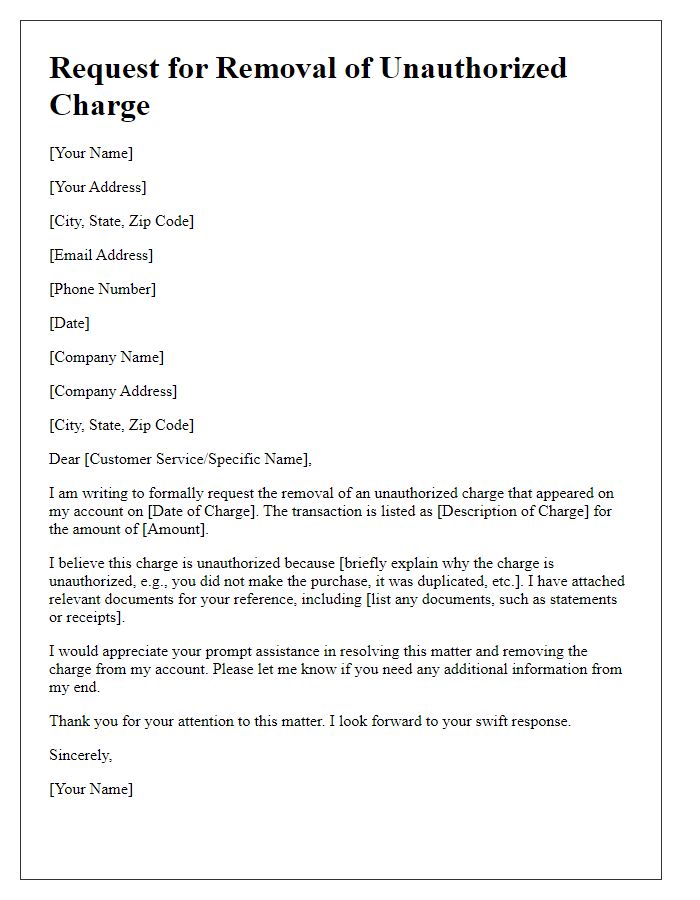

Unauthorized debt charges can significantly impact personal finances and credit scores. Addressing such discrepancies promptly is crucial for maintaining financial health. Individuals should gather personal information, including full name, residential address, and contact details, to ensure clear communication with financial institutions. Additionally, record account numbers or transaction details that pertain to the unauthorized charge. Banks or credit card companies often require this information to investigate discrepancies effectively. A detailed account of the unauthorized charge, including dates and amounts, can further support the claim.

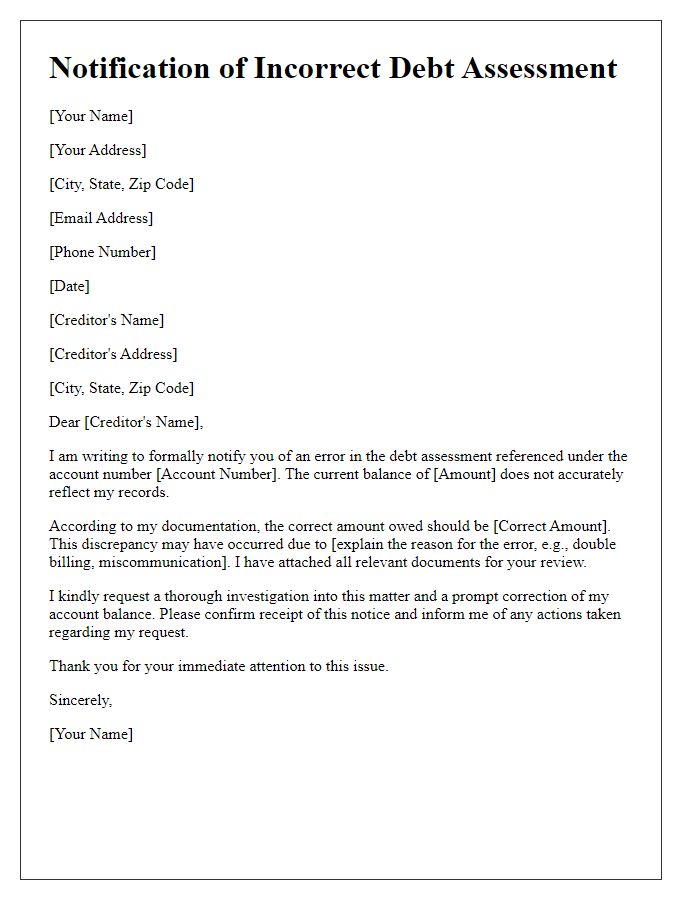

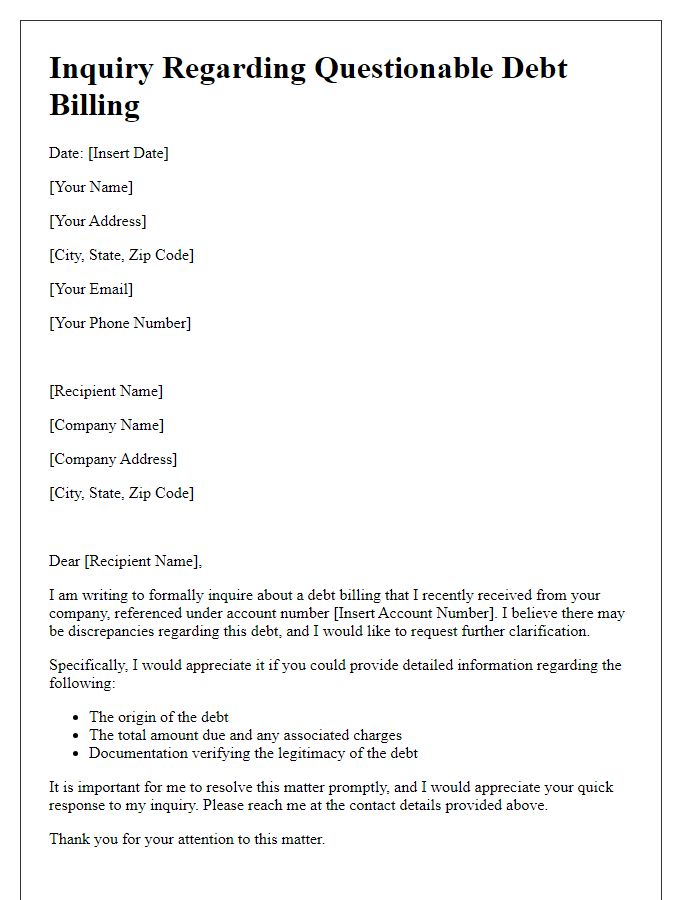

Account Details (account number, financial institution)

Unauthorized debt charges can lead to significant financial discrepancies, especially in consumer accounts held at financial institutions. When disputing an unauthorized debt charge, it's essential to provide specific account details such as the account number, which uniquely identifies the consumer's account. Additionally, including the name of the financial institution, like Bank of America or Wells Fargo, helps streamline the communication process. Specific charges of concern should be listed with date and amount. Documentation, such as recent statements or transaction histories, serves as evidence to support the claim against the unexpected charge. Prompt action is crucial, as regulations like the Fair Credit Billing Act provide time frames for disputing fraudulent charges, ensuring consumer rights are upheld.

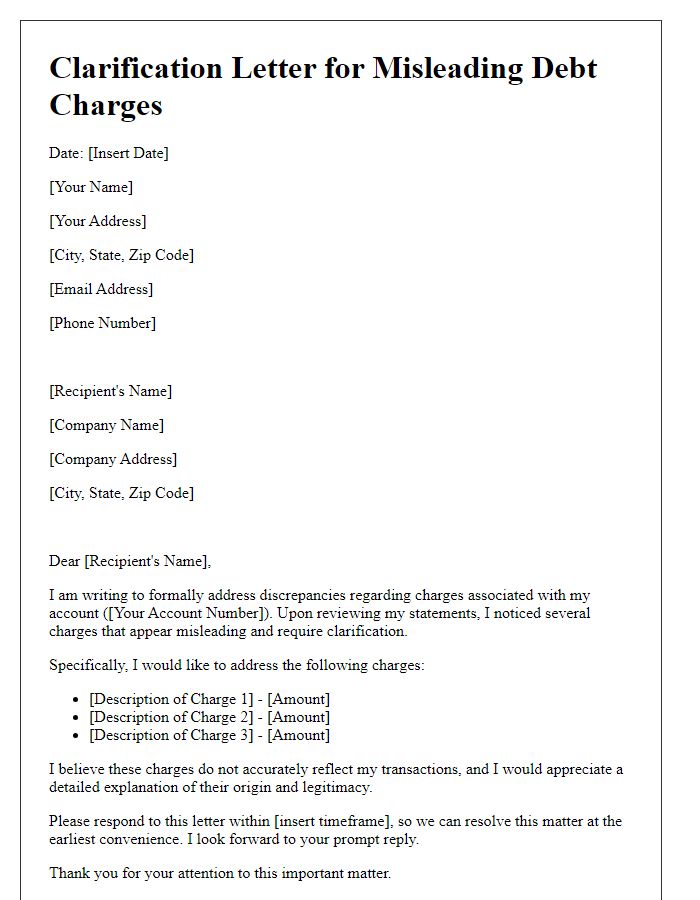

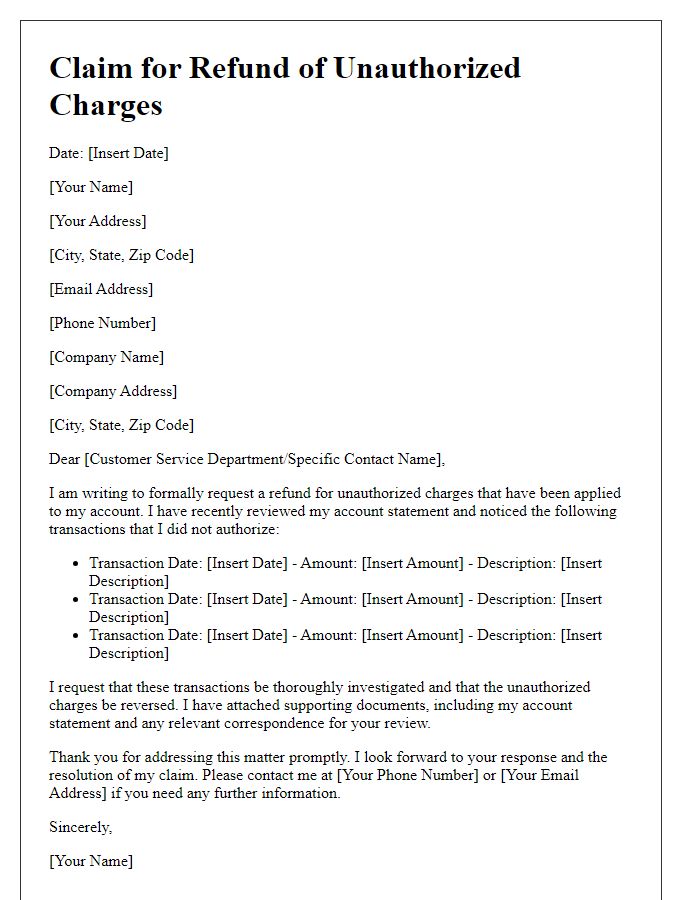

Unauthorized Charge Details (amount, date, description)

Unauthorized charges on credit accounts can lead to significant financial strain for consumers. For instance, a transaction of $150.00 on February 10, 2023, categorized under subscription services, might reflect a fraudulent activity if the individual never signed up for such a service. In many cases, disputing these unauthorized charges involves contacting financial institutions like Visa or MasterCard, providing specific documentation, and typically following a formal complaint protocol. It's crucial to collect evidence such as transaction records, usage history, and communication logs with vendors. Consumers should be aware that federal regulations, such as the Fair Credit Billing Act, protect them against unauthorized charges, offering a resolution time frame of up to 60 days for investigation.

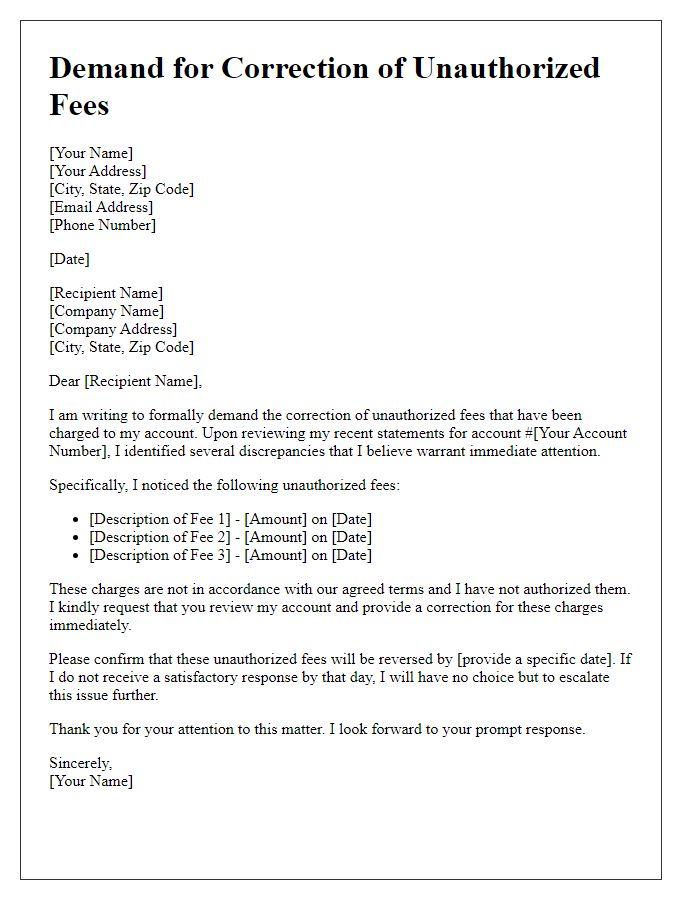

Request for Investigation and Resolution (refund, correction)

Unauthorized debt charges, often reflected on consumer credit reports, can lead to significant financial distress. These charges may stem from erroneous billing or fraudulent activity, adversely impacting credit scores and financial health. Account numbers associated with these discrepancies should be reviewed thoroughly, particularly in high-interest situations where rectifications can save consumers substantial amounts. Requesting an investigation from financial institutions or credit card companies, such as Bank of America or Chase, is crucial for resolving these disputes. Documentation, including transaction records and communication logs with service providers, plays a vital role in supporting claims for refunds or corrections. Timelines for investigation responses can vary, often lasting up to 45 days, necessitating careful monitoring throughout the process for consumer protection under federal laws like the Fair Credit Billing Act (FCBA).

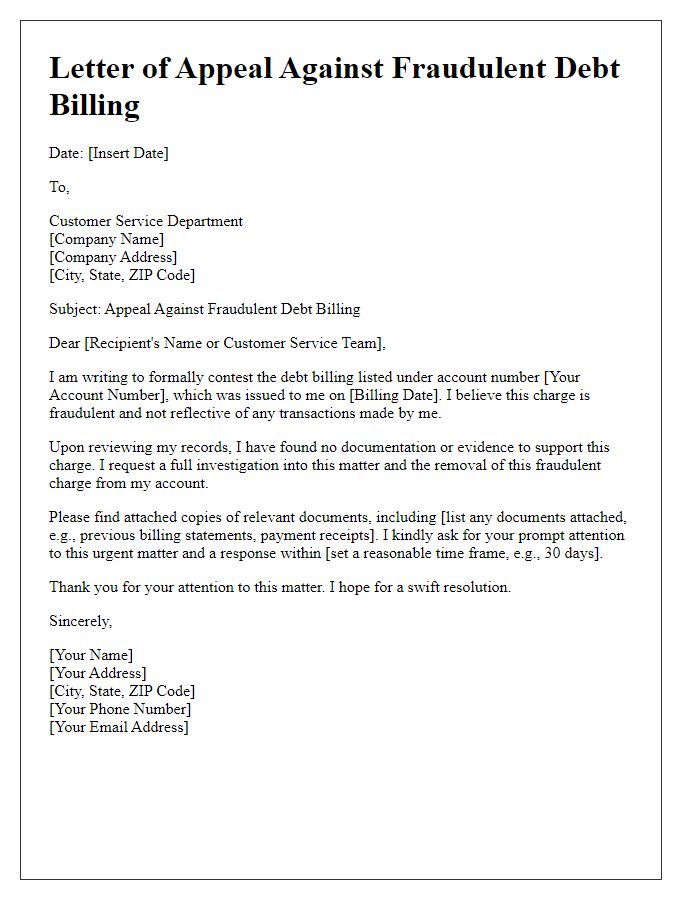

Legal Rights and Next Steps (consumer protection, potential actions)

Unauthorized debt charges can significantly impact a consumer's financial stability and credit score. Consumers should promptly dispute any unfamiliar charges to safeguard their legal rights under the Fair Debt Collection Practices Act (FDCPA) and the Fair Credit Reporting Act (FCRA). Documentation of the charges, including invoices or statements from creditors, is essential for substantiating the dispute. Contacting the creditor or debt collector directly to request validation of the debt is a critical next step. If the dispute remains unresolved, filing a complaint with the Consumer Financial Protection Bureau (CFPB) serves as a further protective measure. Seeking legal counsel may also be advisable to explore potential actions, such as litigation against the creditor for violations of consumer protection laws. Being well-informed about these rights and proactive in addressing unauthorized charges can empower consumers to reclaim control over their financial well-being.

Comments