Losing a loved one is never easy, and the practicalities surrounding such a loss can feel overwhelming. One of those tasks often includes notifying institutions about the death of a cardholder, which is essential for managing accounts and preventing potential fraud. In this article, we'll guide you through the process of writing a thoughtful letter to inform relevant parties while showing respect for the deceased's memory. Read on to discover the key elements you should include in your letter to ensure clarity and compassion during this difficult time.

Recipient's Contact Information

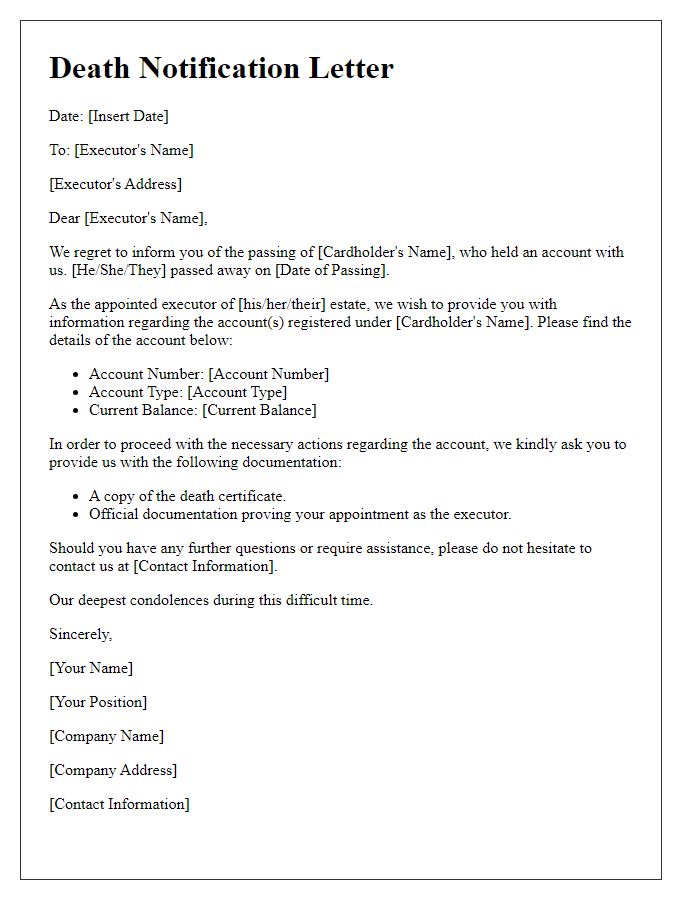

The passing of a cardholder can lead to significant implications regarding their accounts and assets. The notification process should accurately reference the deceased individual's full name, account number, and date of passing to ensure clarity for all parties involved. Informing financial institutions, such as banks or credit card companies, about the death is important for proper account management. Relevant documents, including a death certificate or legal proof of a beneficiary, may be required to update records. Additionally, contacting membership organizations and service providers associated with the deceased can prevent unauthorized transactions. Proper communication channels, such as certified letters or official forms, should be utilized to maintain a professional standard during this sensitive time.

Deceased's Account Details

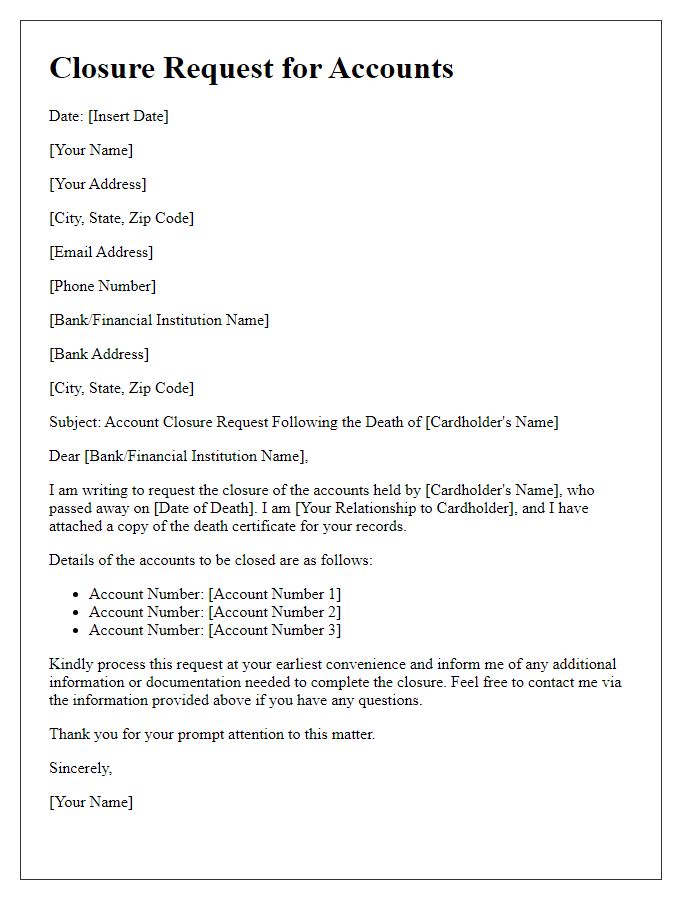

Notification of a cardholder's death may involve sensitive information related to accounts like credit or debit cards. The deceased individual's account details typically include full name, account number, issuing bank name, and date of birth. In cases where there are outstanding balances, elements such as balance amount, transaction history, and joint account holder information may also be necessary. Proper documentation, such as a death certificate, might be required to officially close the account. Financial institutions might then initiate processes to settle any dues or claims related to the estate of the deceased, adhering to applicable legal regulations and privacy standards.

Death Notification Statement

The sudden passing of a cardholder can lead to emotional distress among family members and significant changes in account management. Legal representatives typically require a Death Notification Statement, which serves as a formal document confirming the individual's demise. This statement often includes key details such as the full name, date of birth, and account number of the deceased, alongside the date of death, usually provided through a certified copy of the death certificate issued by local authorities. Financial institutions emphasize the importance of notifying them promptly about the cardholder's death to prevent unauthorized transactions and to facilitate the transition of account management to the legal heirs. Efficient processing ensures that personal assets are managed according to the deceased's wishes while adhering to relevant federal and state regulations governing estate management.

Required Documentation

When a cardholder passes away, it is essential to follow specific procedures to update account status and ensure proper handling of any remaining obligations. Required documentation typically includes a certified copy of the death certificate, which provides official proof of the cardholder's passing. Additional documents may include a copy of the cardholder's will or estate documents, outlining the distribution of assets. Identification, such as a government-issued photo ID of the executor or responsible party, may also be necessary for verification purposes. Information regarding outstanding balances or transactions associated with the account should be gathered, as this will aid in proper estate management.

Contact Information for Further Assistance

A death of a cardholder, particularly in financial institutions, requires careful communication regarding the next steps. Important details include the deceased's account number and the date of passing. Contact information for customer service should be clearly listed, including phone numbers (such as a dedicated helpline) available during specific hours, and email options for discreet inquiries. A physical address for submitting necessary documents, like death certificates, should also be included. Providing resources for beneficiaries regarding estate processing and how to close accounts or transfer assets is vital. Including FAQs or links to online support can assist families navigating this challenging time.

Letter Template For Informing Death Of Cardholder Samples

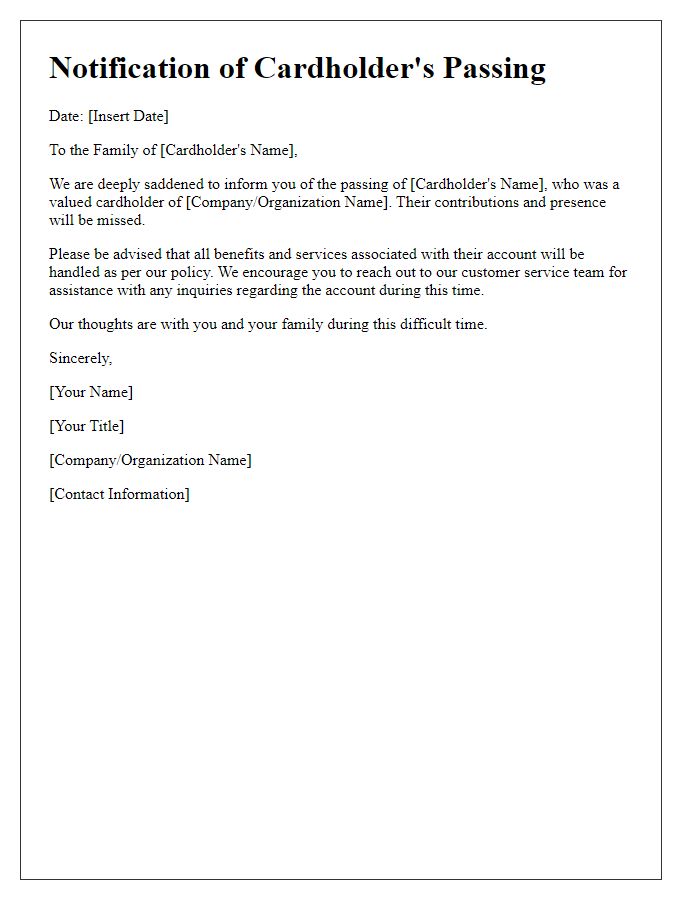

Letter template of notification for passing of cardholder to family members

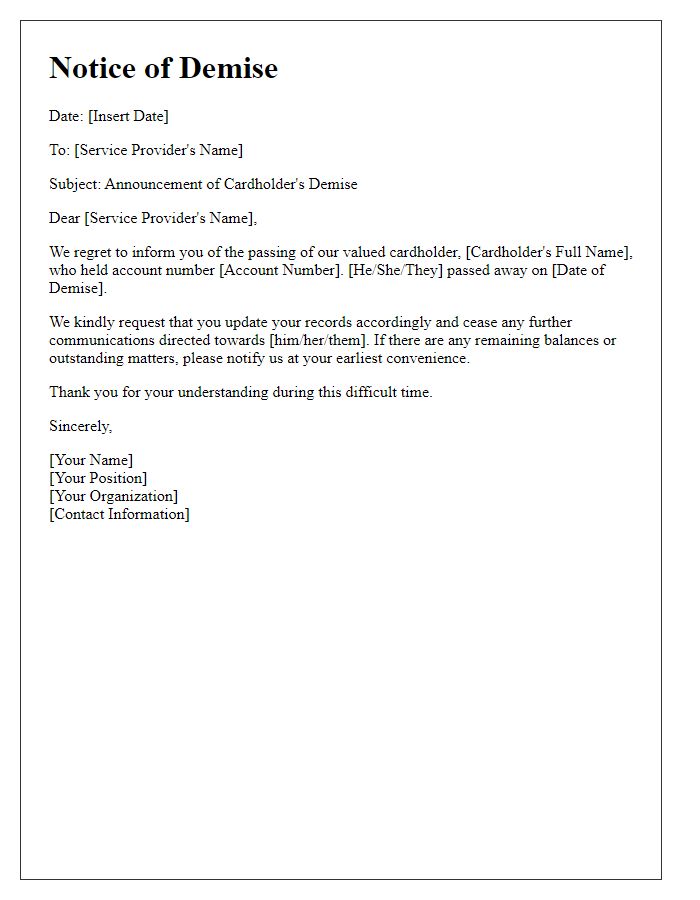

Letter template of announcement regarding cardholder's demise to service providers

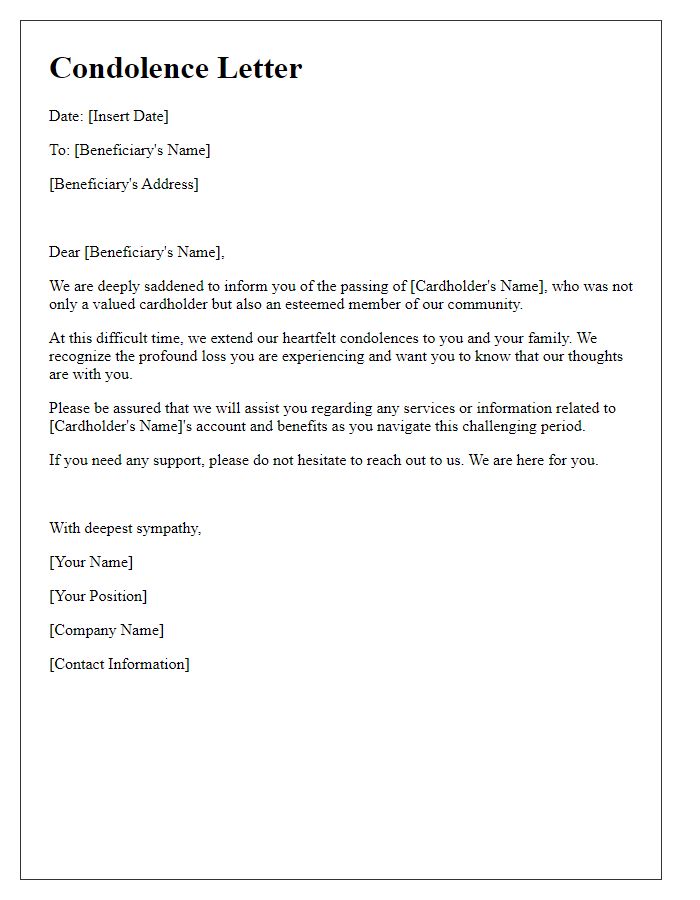

Letter template of condolence message for the death of cardholder to beneficiaries

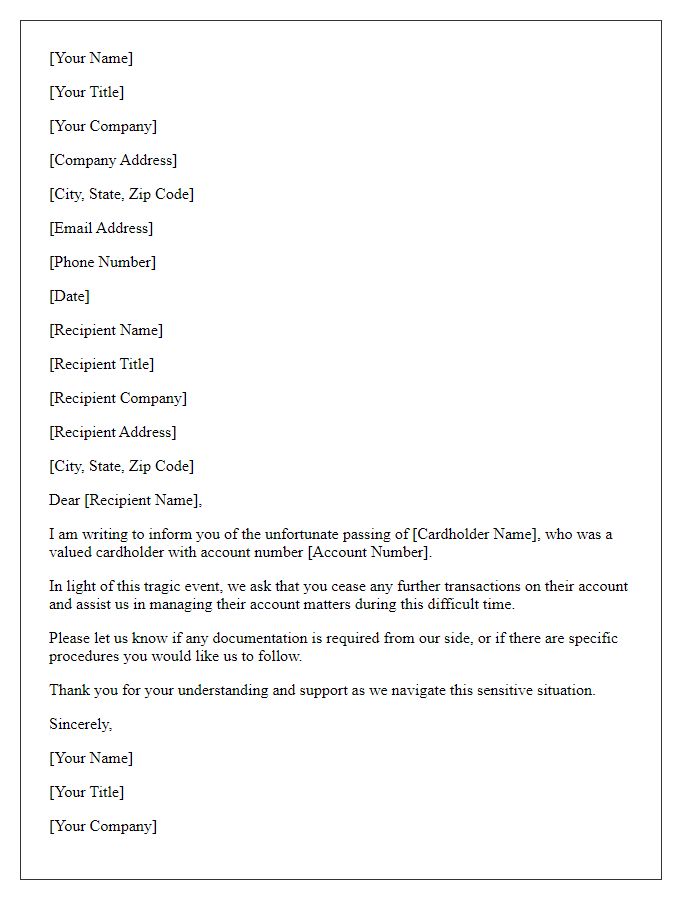

Letter template of communication about cardholder's death for account management

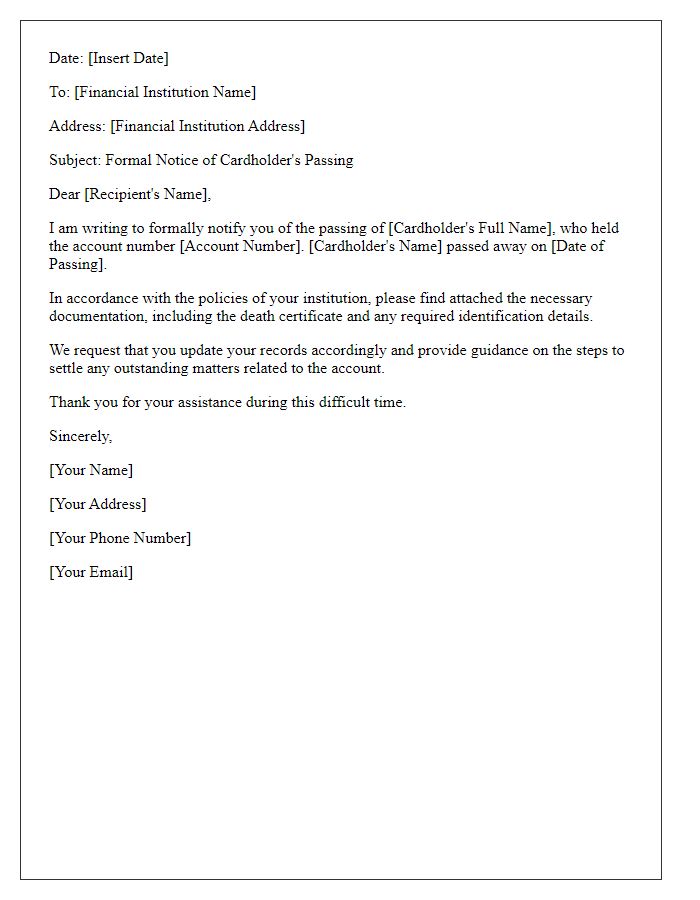

Letter template of formal notice of cardholder's passing for financial institutions

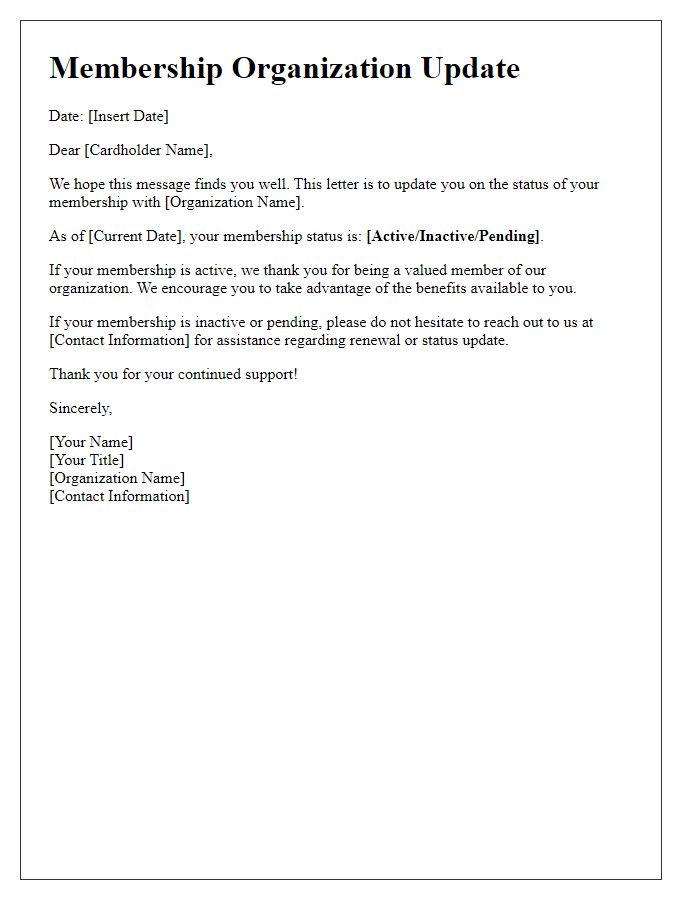

Letter template of update on cardholder status for membership organizations

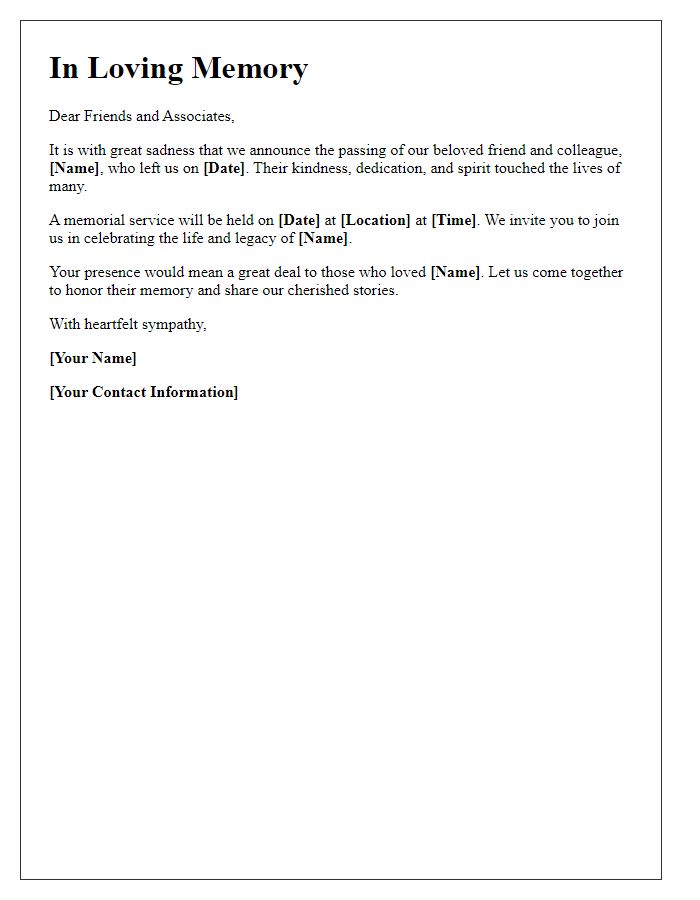

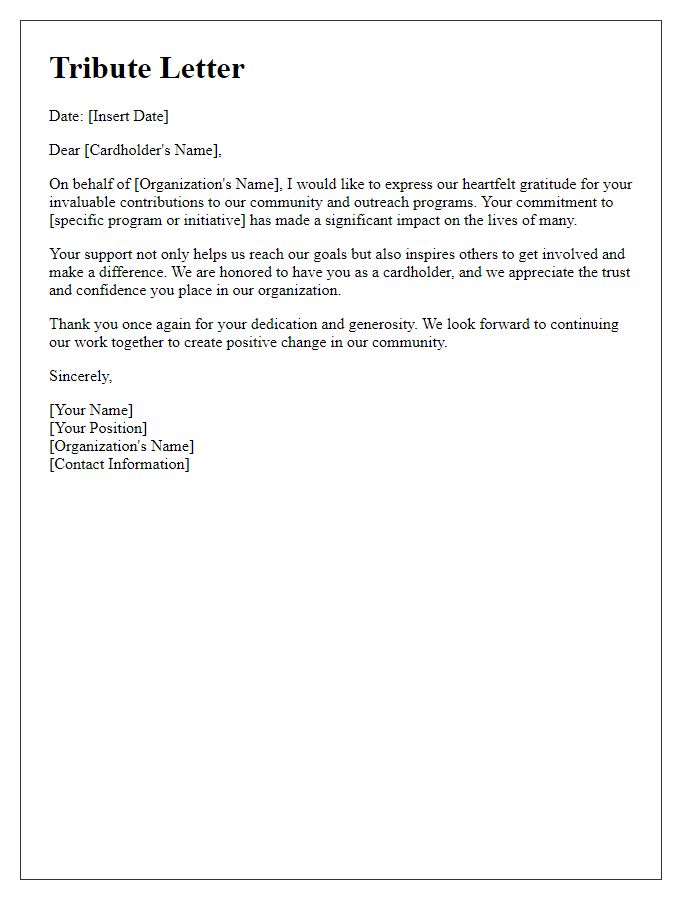

Letter template of memorial announcement for cardholder to friends and associates

Letter template of death notification for cardholder to estate executors

Letter template of closure request for accounts following cardholder's death

Comments