When you need to confirm the opening date of your account, a well-crafted letter can make all the difference. Whether it's for personal records, application purposes, or even resolving discrepancies, knowing how to articulate your request clearly is essential. In this article, we'll walk you through a straightforward template to help you draft a concise letter that gets to the point without the fluff. So, if you're ready to streamline your communication and ensure your request is met efficiently, keep reading!

Subject Line

Account opening dates are critical for numerous financial transactions, especially in institutions such as banks or investment firms. An account established on September 15, 2020, for instance, may be required for validating eligibility for various services, including loans or credit assessments. Such dates are often recorded in official documents like account statements or welcome letters, ensuring accuracy and compliance with regulatory standards. Financial entities typically maintain nuances in their databases to facilitate swift verification, which is paramount for customer service efficiency and security measures in identity verification processes.

Recipient Information

Account opening dates serve as critical milestones in financial communications. The specified date, usually found on official documents like account statements or bank correspondence, establishes a timeline for account activity and eligibility for services. Banks and credit unions, such as JPMorgan Chase or Bank of America, typically provide verification letters upon request, detailing account opening dates alongside other account specifics. Accurate documentation ensures transparency and aids in resolving potential disputes, especially concerning service fees or interest rates. Collections, legal matters, and credit inquiries often rely on this date, emphasizing its importance in personal finance management.

Account Holder's Details

The account holder's details, including the full name, account number, and type of account (e.g., savings, checking) are crucial for verification purposes. The account opening date reflects significant milestones in the holder's financial history. This information is often found on bank statements or in official contract documents issued by financial institutions. For personal accounts, the typical verification process may require confirmation from senior bank officials or customer service representatives. In professional settings, corporate accounts may need additional verification involving business registration documents or resolutions from company boards, ensuring the legitimacy of account activity from the established opening date.

Date of Account Opening

To verify the date of account opening for a financial institution, it is essential to reference transactional records accurately. The official date of account opening represents a significant milestone for customers, documenting when they became clients of the bank or credit union. Typically, institutions store this information in their core banking systems, which may include unique identifiers like account numbers and customer names. Historical records, such as welcome letters and statements from the institution, will often indicate the opening date. Many banks also provide account opening details in digital formats through online banking platforms or official account documentation, ensuring that clients can access this vital information efficiently.

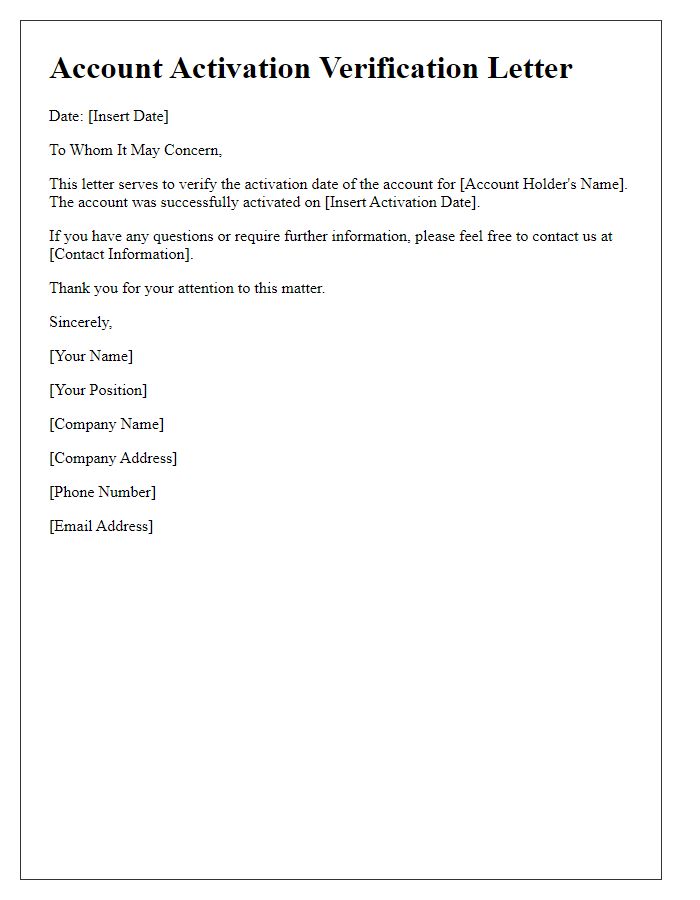

Verification Statement

An account opening date verification statement serves to confirm the specific initiation date of a financial relationship with a banking institution, such as XYZ Bank established in 2002, for personal or business accounts. This date, typically recorded in official documents like account opening forms, helps establish the duration of account activity and is significant for various purposes including compliance with regulatory standards, eligibility for services, and interest accrual calculations. Accurate verification of this date can be critical for mortgage applications, loan eligibility assessment, and identity verification processes. Record keepers and banking officials should ensure that all dates are backed by documentation to maintain integrity and legal compliance.

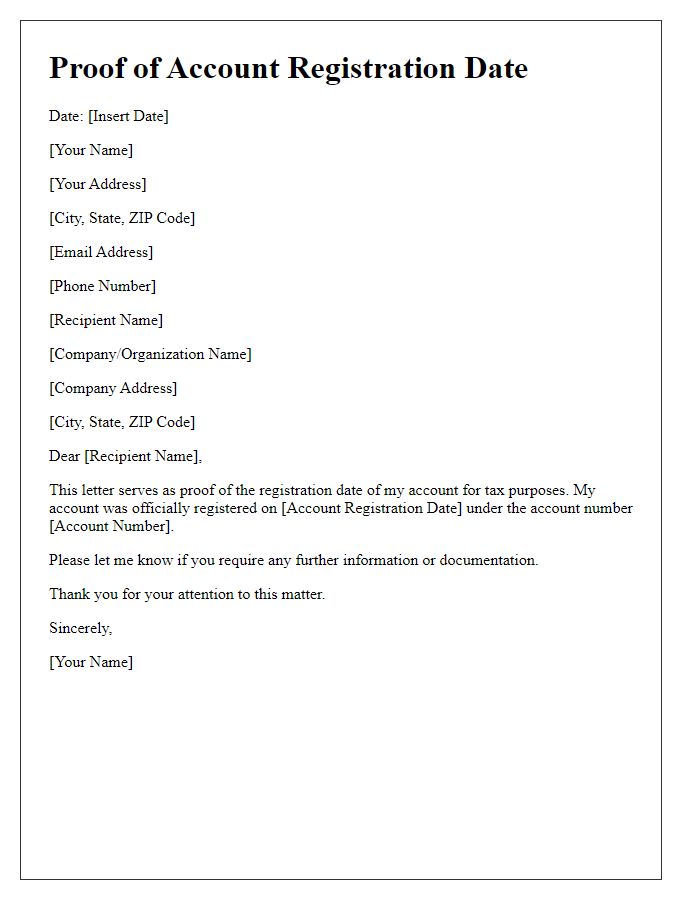

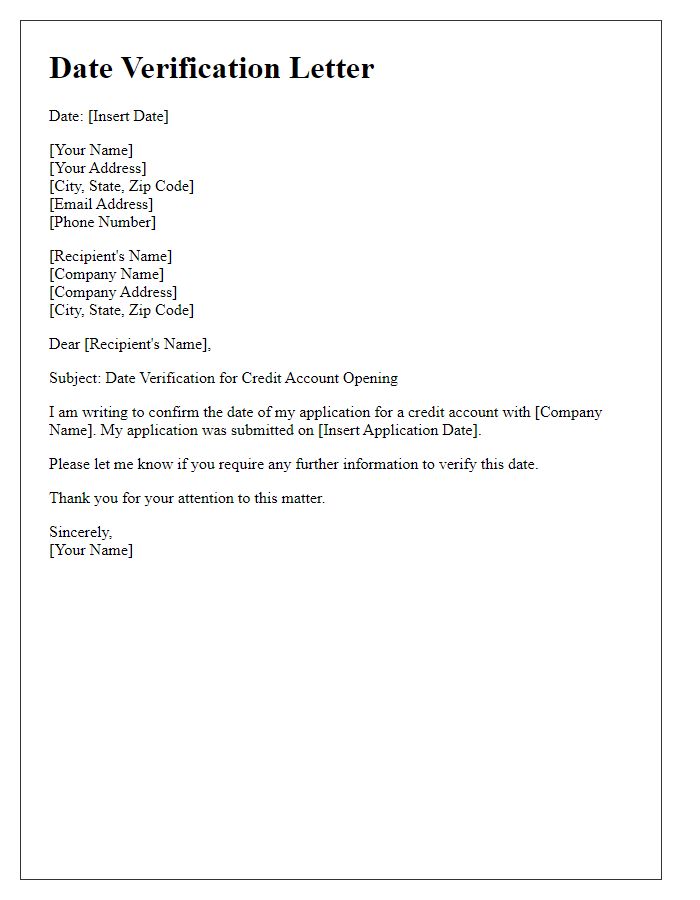

Letter Template For Verifying Account Opening Date Samples

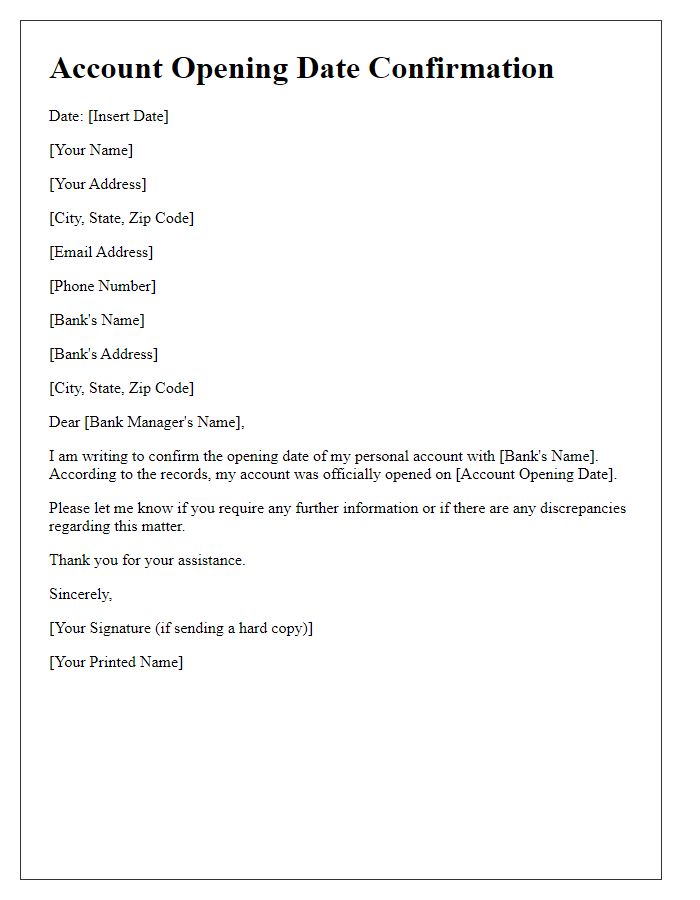

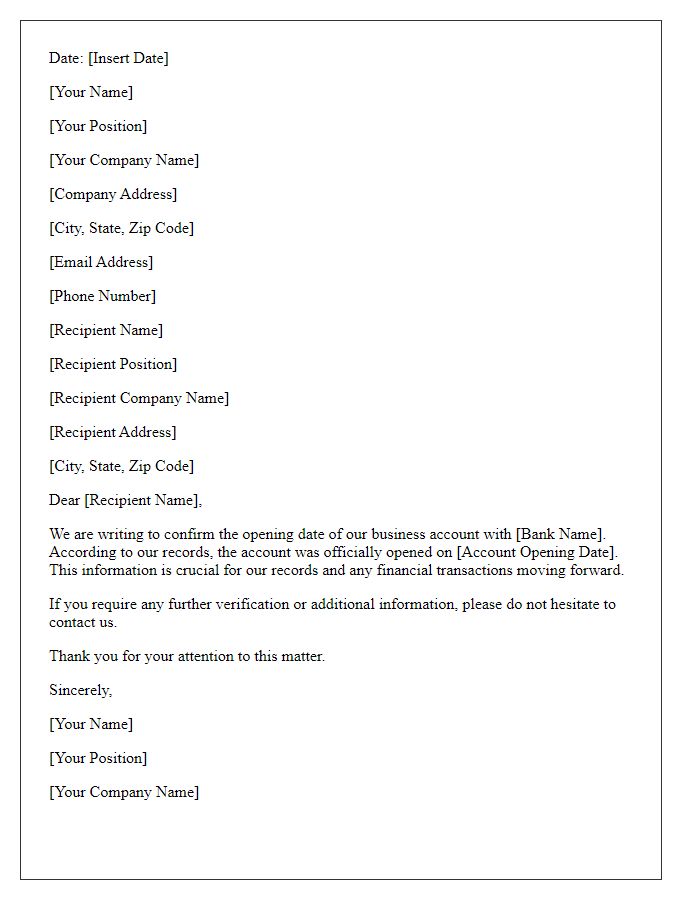

Letter template of account opening date confirmation for personal accounts

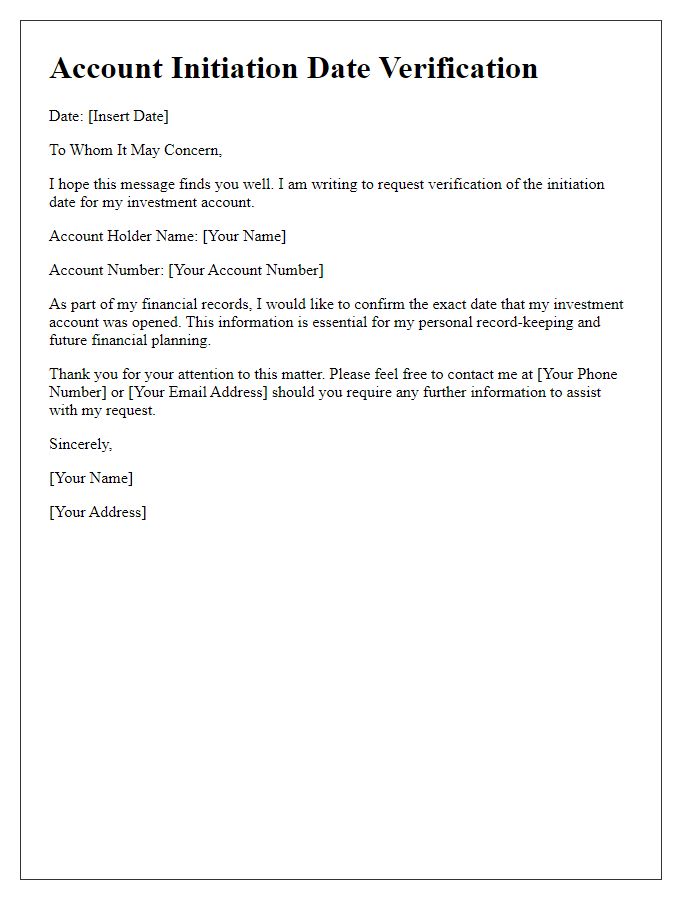

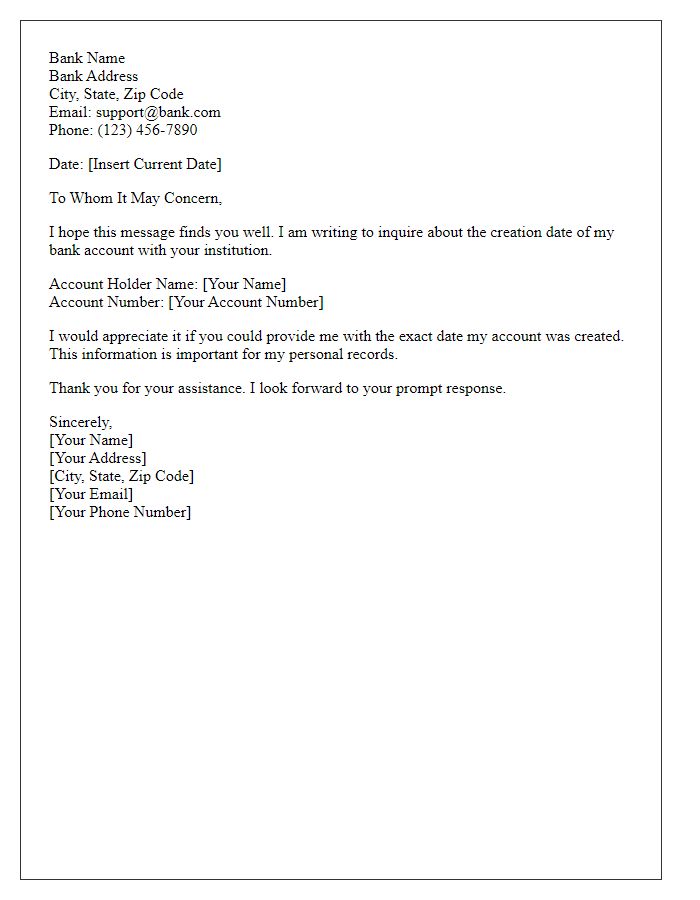

Letter template of account initiation date verification for investment accounts

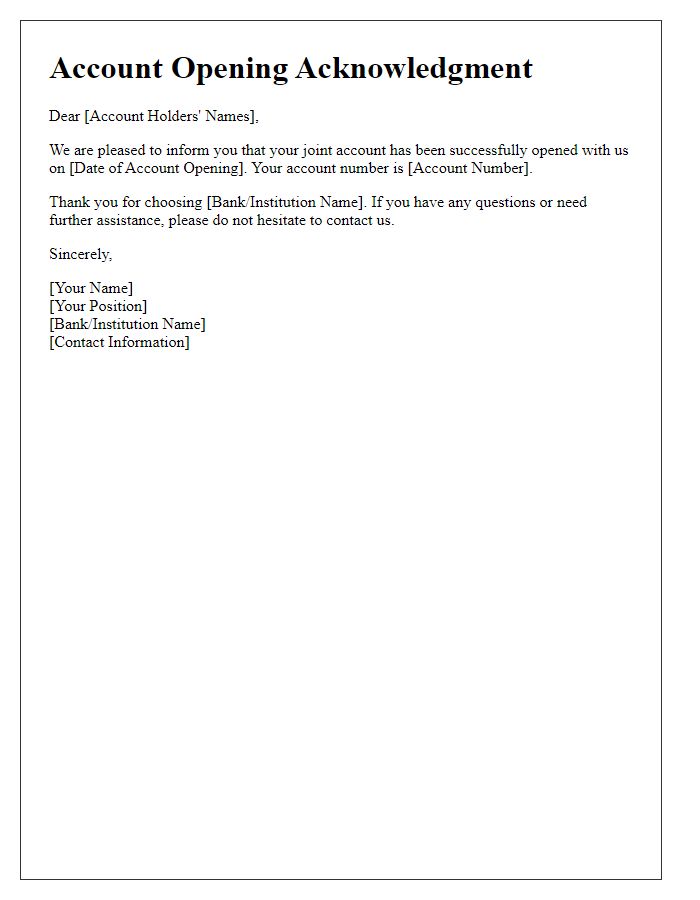

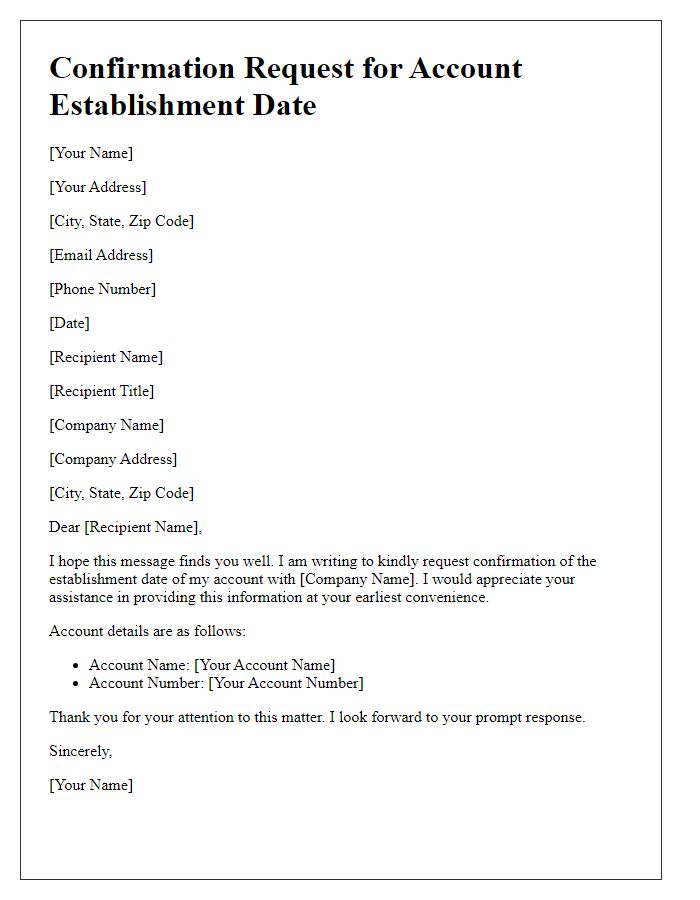

Letter template of acknowledgment of account opening date for joint accounts

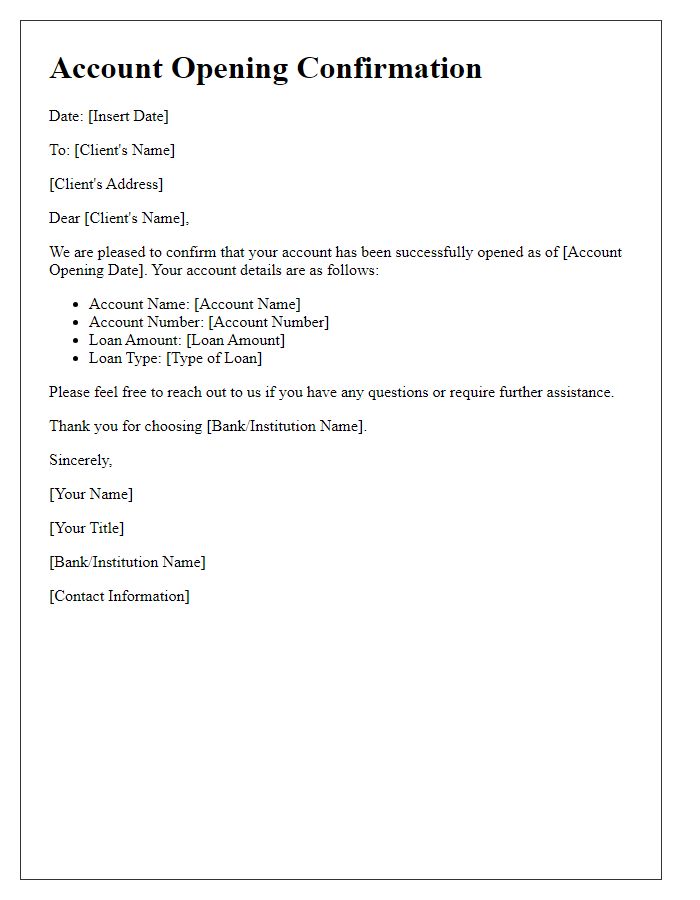

Letter template of confirmation of account opening date for loan applications

Comments