Have you ever been the victim of fraud and had to deal with the daunting task of closing a fraudulent account? It can be a frustrating experience, filled with confusion and uncertainty about the next steps. In this article, we'll explore an effective letter template that will help you communicate clearly with your bank or financial institution to facilitate a smooth account closure. Ready to take control and protect your finances? Let's dive in!

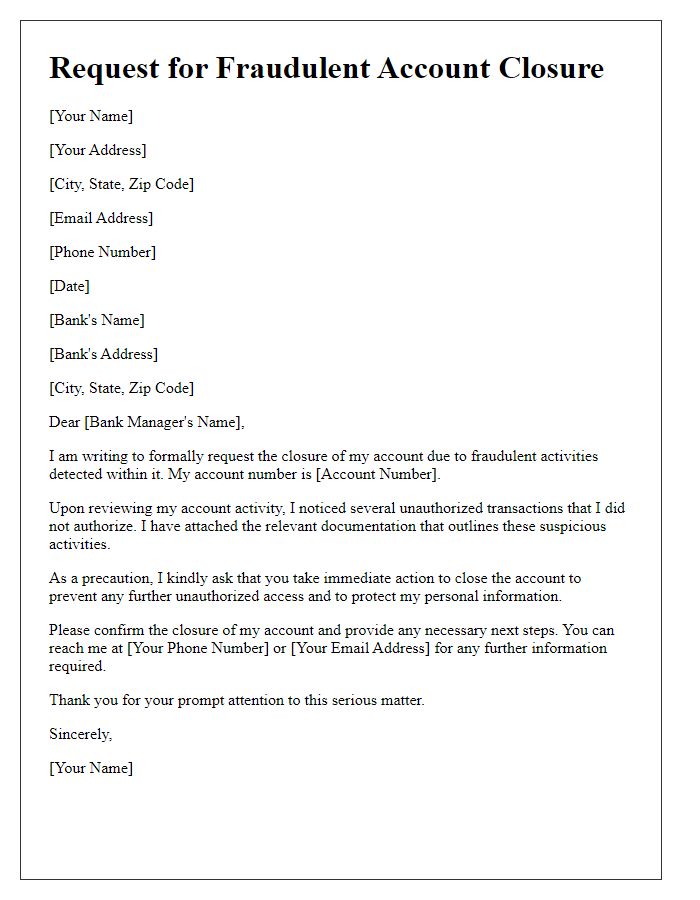

Account Information

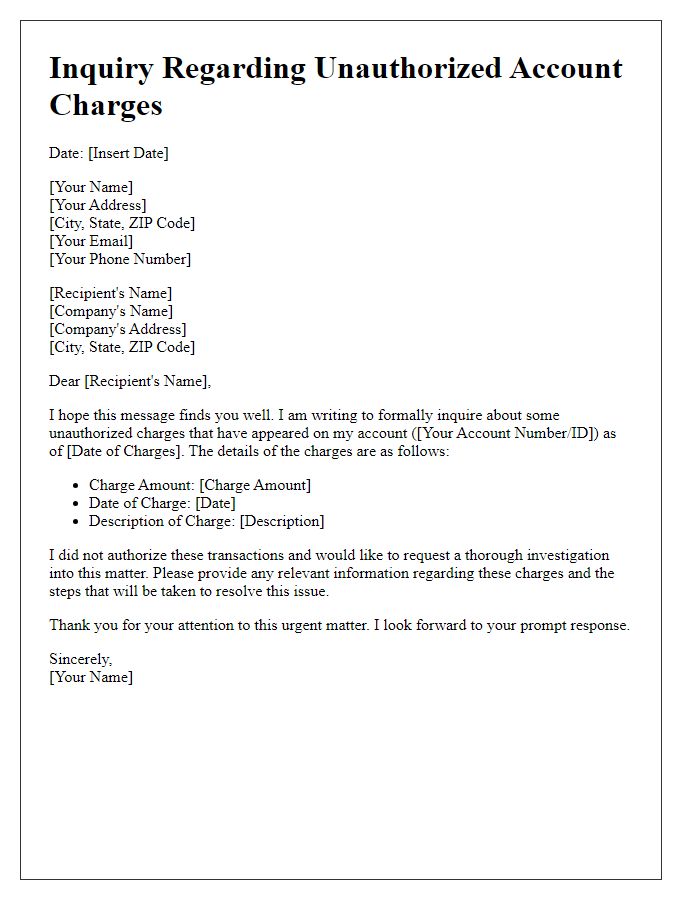

Fraudulent account closure alerts can significantly impact individuals' financial stability and identity security. When users discover unauthorized account activities, immediate actions are required to mitigate potential damage, such as contacting financial institutions for unauthorized account activity reported within 24 hours. Comprehensive documentation, including full account numbers, transaction dates, and details of the fraudulent activities is essential for investigation processes. This is often crucial in institutions like banks and credit unions, where fraud protection measures may involve securing funds or restoring account access throughout federally mandated timelines. Additionally, identity theft-related protocols from organizations such as the Federal Trade Commission (FTC) and local law enforcement agencies are vital resources for victims seeking to safeguard personal information.

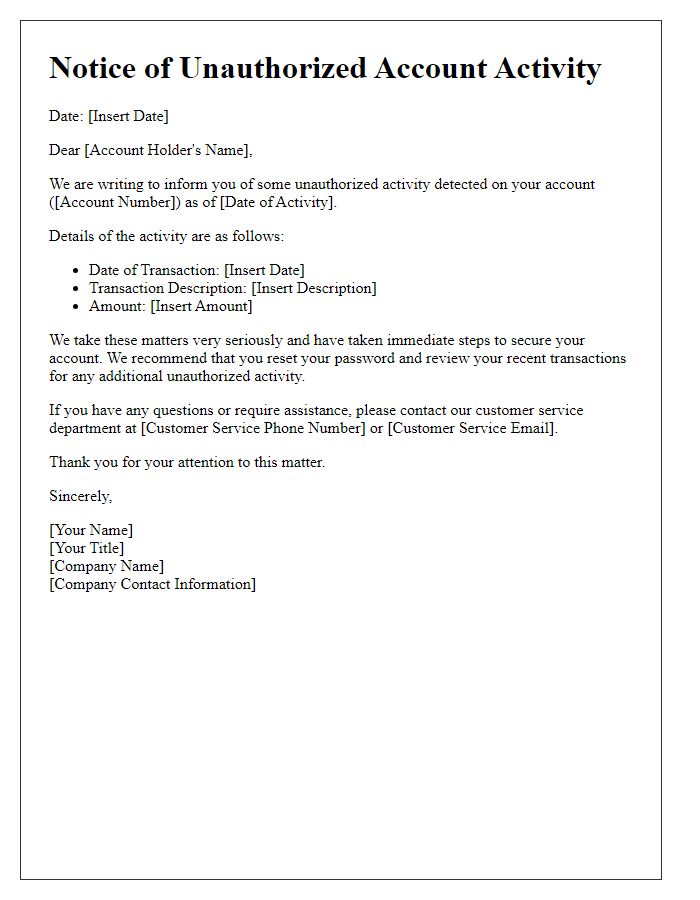

Evidence of Fraud

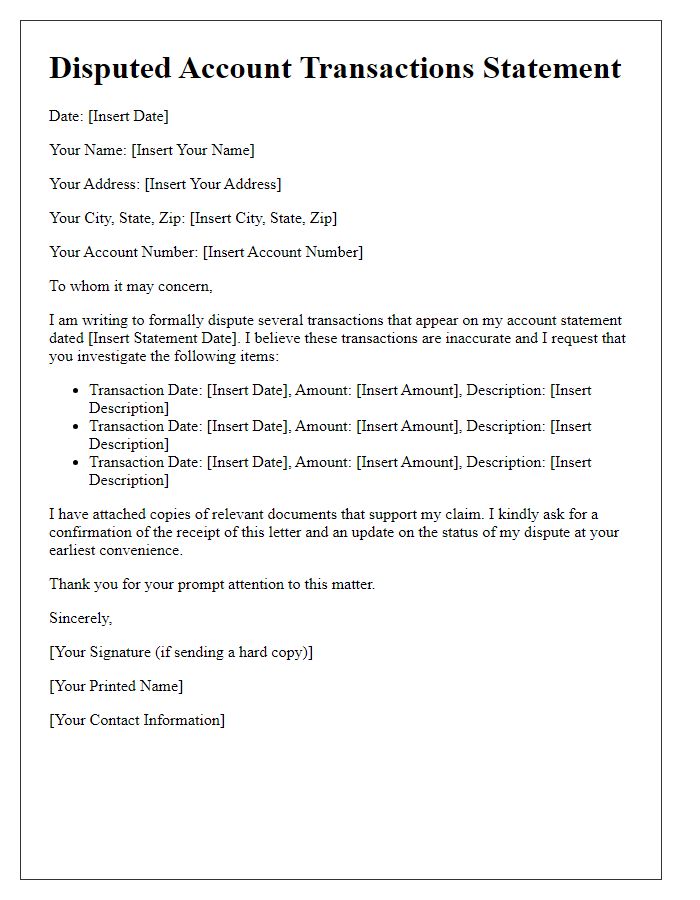

Fraudulent accounts contribute significantly to financial losses for individuals and institutions, necessitating immediate action. A fraudulent account, defined as one established using false information or unauthorized use of someone's identity, can lead to severe consequences for victims. Documented evidence such as bank statements, transaction records, and correspondence with the financial institution serves as crucial proof of these fraudulent activities. Institutions often employ robust systems, such as identity verification protocols, to mitigate risks. Contacting regulatory entities, like the Federal Trade Commission (FTC) in the United States, can further assist victims in addressing identity theft and restoring their rightful financial standing.

Closure Request

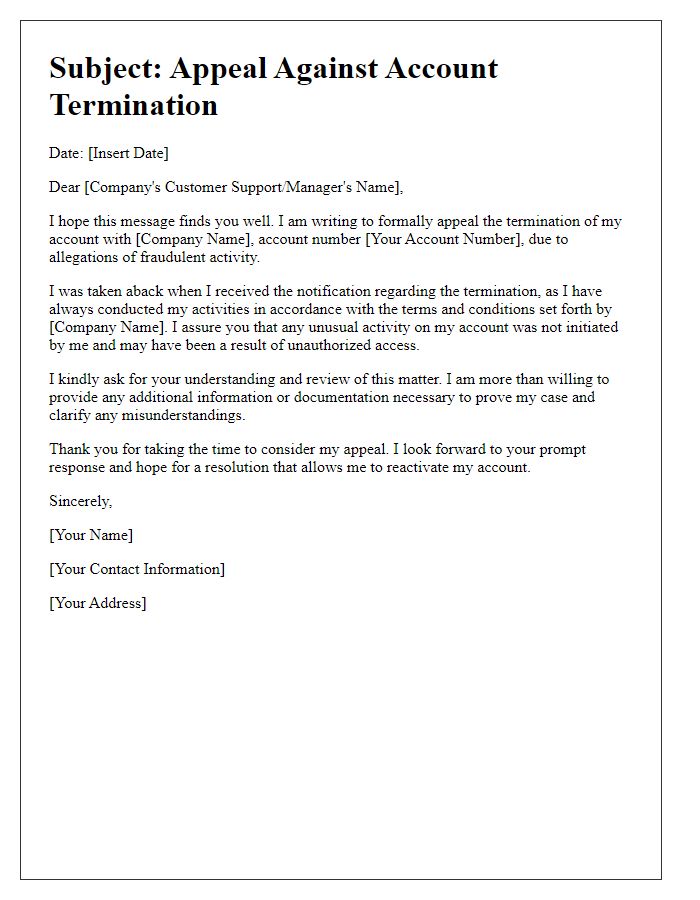

Inappropriate account closures due to fraudulent activities have become a major concern for financial institutions, particularly regarding online banking platforms. Complications often arise when account holders notice unauthorized transactions or suspicious login attempts. The process for reporting fraud typically involves contacting customer service, which may lead to account freezes while investigations occur. Timely reporting is crucial, as financial institutions often have specific guidelines and deadlines for fraud claims. Additionally, maintaining detailed documentation of transactions and communications with bank representatives ensures proper tracking of the case, protecting the consumer's financial interests.

Contact Information

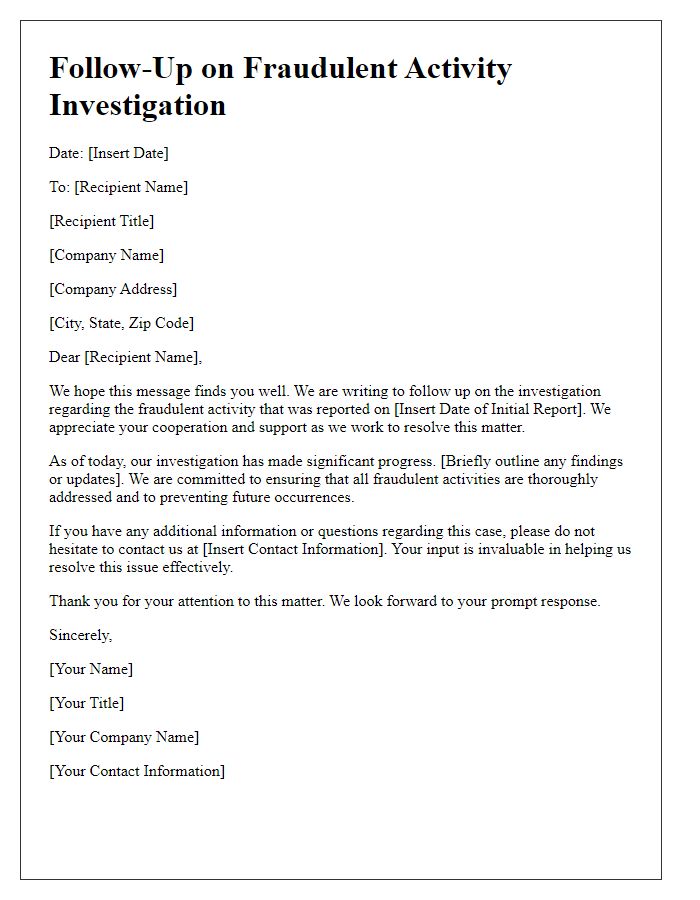

Fraudulent account closure can have significant implications on personal finances and identity security. When individuals suspect unauthorized access or fraudulent activity related to their accounts, immediate action is necessary. Typically, the incident should be reported to the financial institution, such as a bank or credit card company, usually reached through designated customer service numbers that may vary in format by institution. This may include toll-free hotlines or local contact numbers listed online. Additionally, submitting official documentation, such as a written statement describing the fraudulent activity, may help expedite the process. It is crucial to reference the account number and any transaction details, as these identifiers assist the institution in investigating the claim effectively. Keeping records of all communications can provide a valuable reference for ongoing disputes, especially if the issue escalates to regulatory bodies like the Federal Trade Commission (FTC) or consumer protection agencies.

Security Measures Compliance

Fraudulent account closure incidents highlight the importance of stringent security measures in financial institutions. Organizations must implement robust identity verification processes to prevent unauthorized account access, with technology such as biometric authentication and two-factor authentication. Regulatory bodies like the Financial Industry Regulatory Authority (FINRA) emphasize that institutions should conduct thorough investigations (within a 30-day period) of reported fraudulent activities, ensuring prompt resolution and consumer protection. Additionally, educating users about common fraud schemes is essential; statistics reveal that identity theft cases reached over 1.4 million in the United States in 2020 alone. Continuous monitoring of accounts for unusual transactions, coupled with automated alerts for suspicious activities, further strengthens defense against potential fraud.

Comments