If you've ever glanced at your credit report and noticed discrepancies, you're not alone. It's surprisingly common for errors to creep into these reports, which can affect your financial health and creditworthiness. The good news is that disputing these inaccuracies is a straightforward process, and having an effective letter template can make all the difference. Join us to learn how to craft the perfect dispute letter and ensure your credit report reflects your true financial picture!

Accurate Identification Details

Accurate identification details are critical when disputing errors on a credit report. Full name, including middle initials, must match exactly as listed on the document to prevent delays. The Social Security Number (SSN), typically formatted as three digits, two digits, and four digits (XXX-XX-XXXX), uniquely identifies individuals and should be included to facilitate the investigation of the dispute. Current address, along with previous addresses within the last two years, should be provided to establish residency history. Date of birth, often required in a MM/DD/YYYY format, assists in verifying identity. Additionally, including account numbers related to the disputed items, which can vary in length by creditor, will guide the credit bureau to the correct accounts under scrutiny.

Clear Description of Errors

Disputing credit report errors requires precise identification of inaccuracies affecting creditworthiness. Common errors include incorrect account balances, late payments inaccurately reported for accounts such as credit cards or mortgages, and accounts listed that do not belong to the individual. Inaccuracies can stem from identity theft, where fraudulent accounts appear on credit reports. According to the Consumer Financial Protection Bureau (CFPB), over 25% of consumers find mistakes in their credit reports. Each credit reporting agency, such as Experian, Equifax, and TransUnion, must comply with the Fair Credit Reporting Act (FCRA) to ensure the accuracy and integrity of the information they provide. Documentation supporting the dispute, such as bank statements, payment confirmations, or identity theft reports, should be included to strengthen the case for correction.

Supporting Documentation

Disputing credit report errors is crucial for maintaining a healthy financial profile. Incorrect information on credit reports can arise from various sources, including data entry mistakes or fraudulent accounts. Gather supporting documentation, such as recent credit statements, identification documents, and any correspondence related to the disputed entries. For example, if a fraudulent account from a specific lender appears on your report, provide evidence of your identity and letters disputing that account. Ensuring that all documents are carefully organized and clearly labeled can streamline the investigation process, resulting in a faster resolution and correction of your credit report.

Request for Correction

Disputing credit report errors is essential for maintaining a healthy credit score and ensuring accurate financial records. Errors can include inaccurate personal information, incorrect account statuses, or outdated account details. The Fair Credit Reporting Act (FCRA) mandates that credit reporting agencies must investigate disputes and rectify any inaccuracies. When preparing to dispute, gather supporting documents such as credit card statements, loan agreements, and identity verification forms. Address the dispute to major credit bureaus like Equifax, Experian, or TransUnion, and provide specific details outlining the inaccuracies. Include a timeline for resolution, typically 30 days, to enhance urgency and accountability. Engaging in this process can safeguard financial health and improve creditworthiness.

Contact Information and Follow-Up Plan

Disputing errors on a credit report requires accurate contact details and a clear follow-up strategy. Start by including your full name, current address, date of birth, and Social Security number to establish your identity with credit reporting agencies like Equifax, Experian, and TransUnion. Clearly list errors found on the credit report, with specific details such as account numbers, creditor names, and dates of the erroneous entries. Attach supporting documents like payment receipts or identification proving the errors. After sending the dispute letter, note a follow-up plan; mark your calendar for 30 days post-submission, as regulations require agencies to investigate within that timeframe. Prepare for possible further communication via phone or email to document the resolution process and ensure correction.

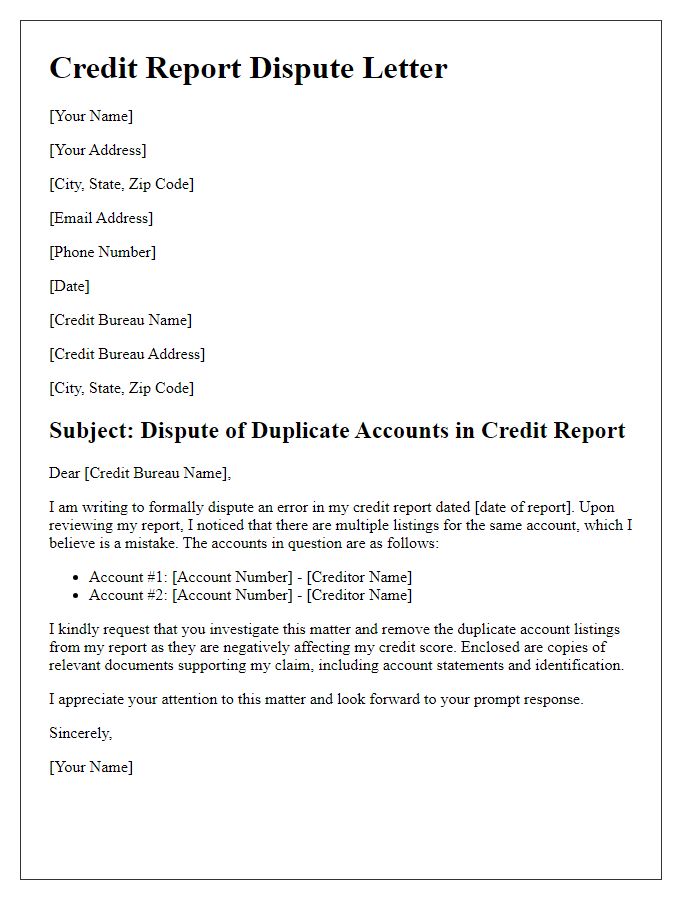

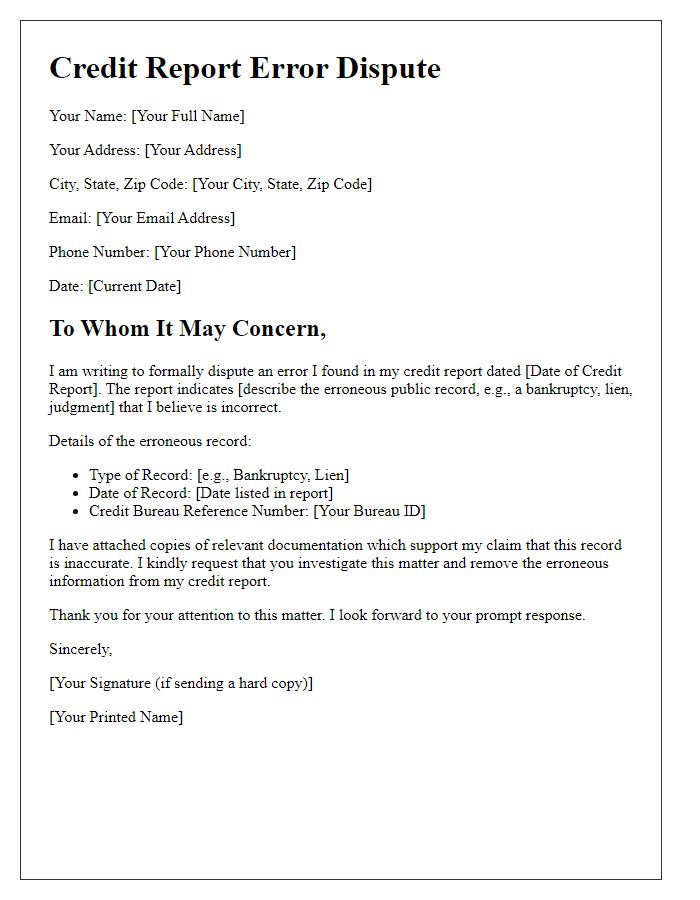

Letter Template For Dispute Credit Report Errors Samples

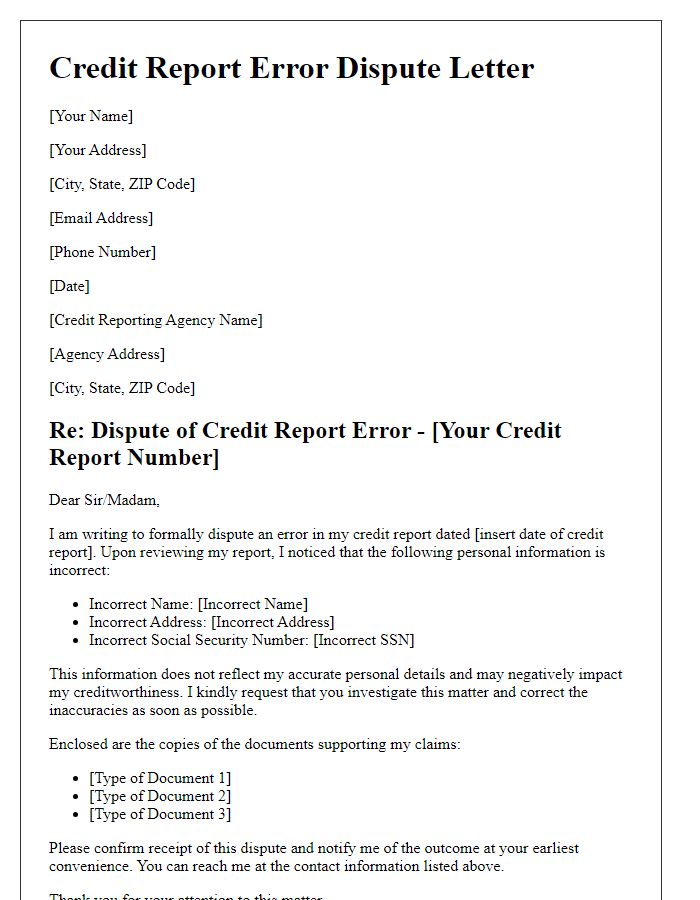

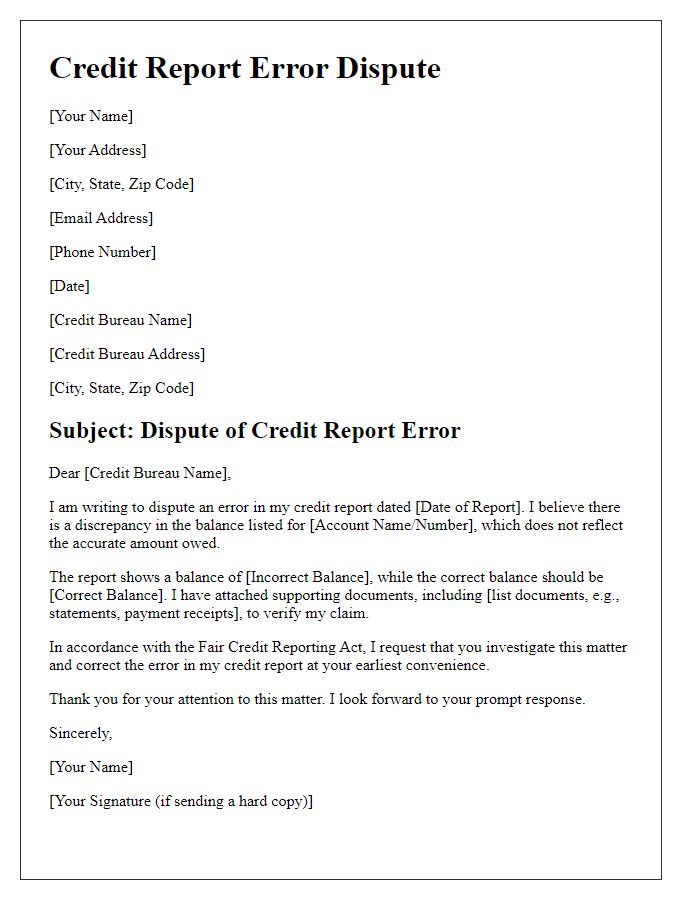

Letter template of credit report error dispute for incorrect personal information.

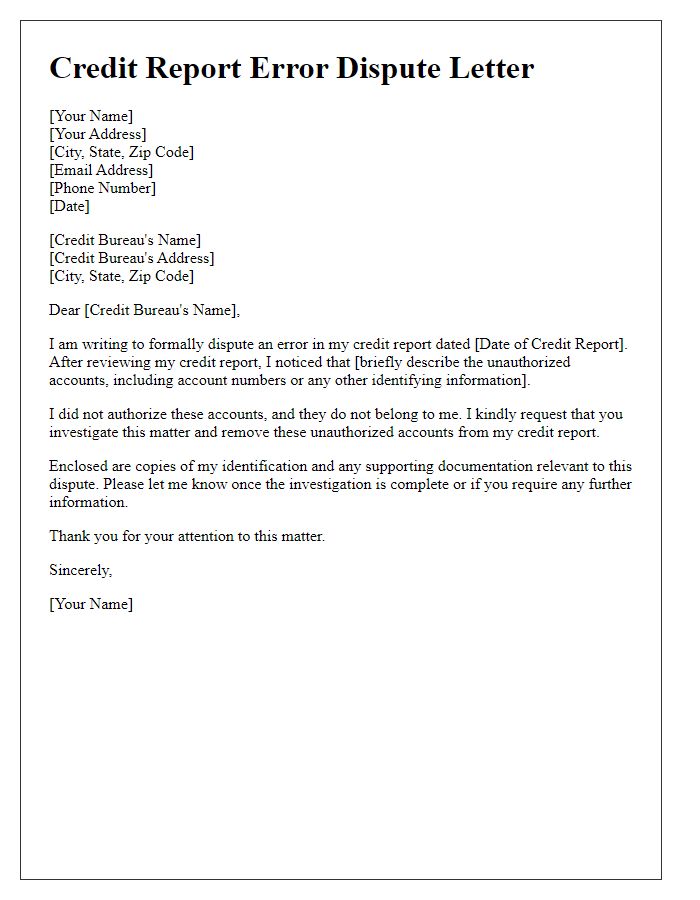

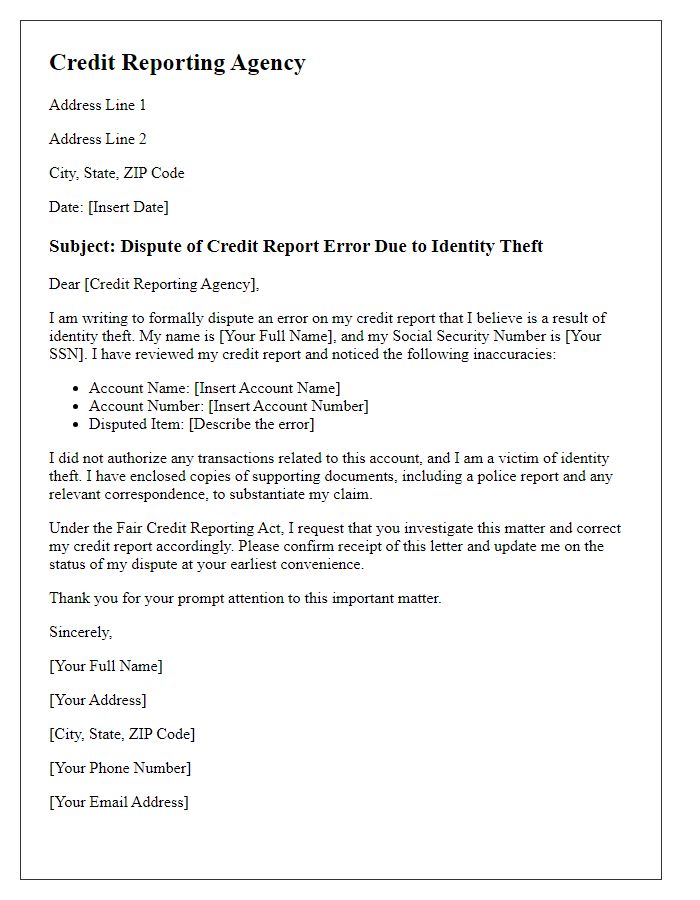

Letter template of credit report error dispute for unauthorized accounts.

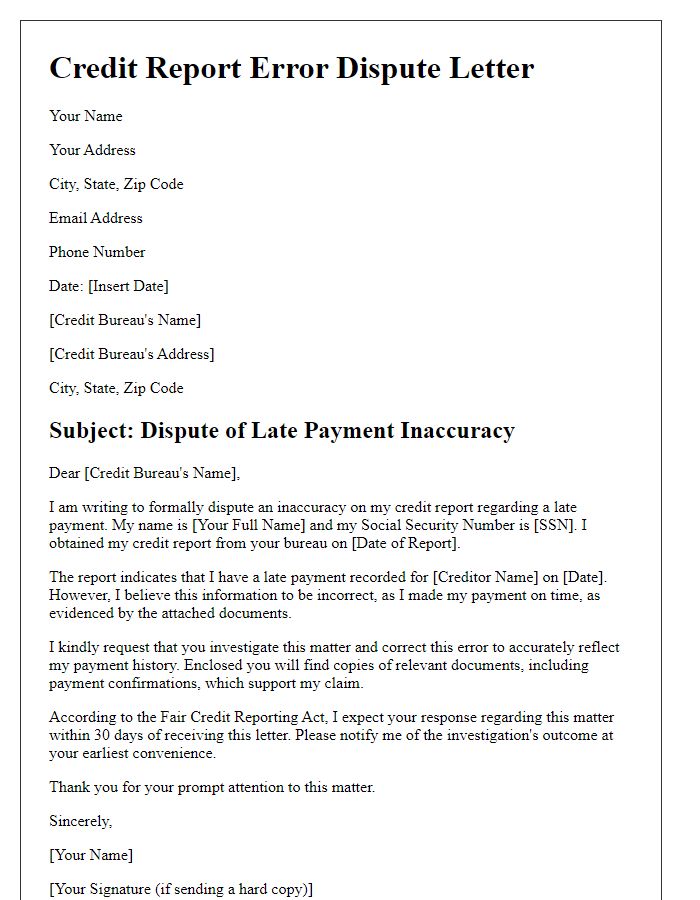

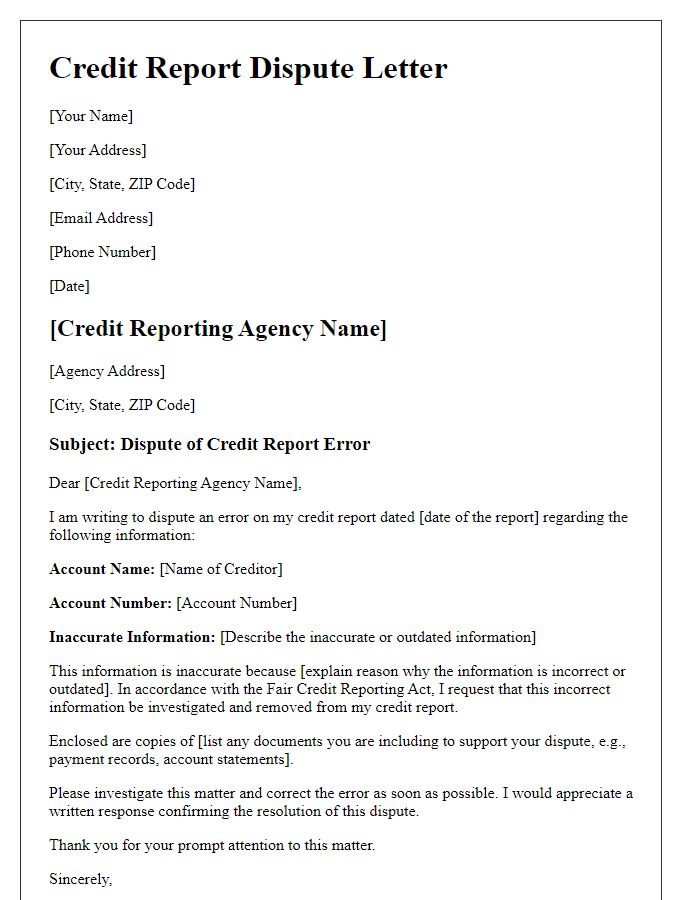

Letter template of credit report error dispute for late payment inaccuracies.

Letter template of credit report error dispute for balance discrepancies.

Letter template of credit report error dispute for identity theft claims.

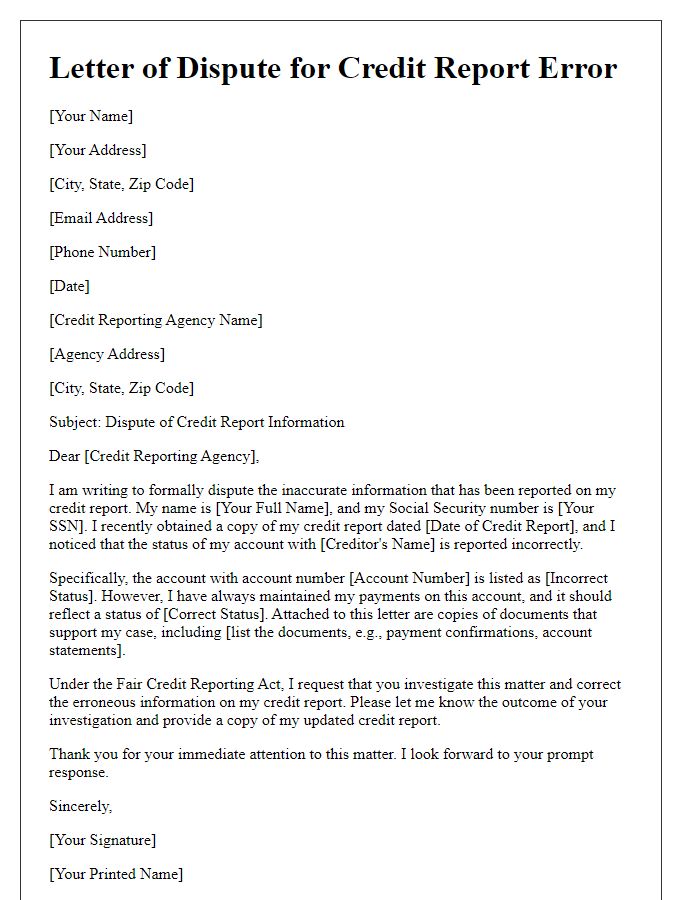

Letter template of credit report error dispute for out-of-date information.

Letter template of credit report error dispute for misreported account status.

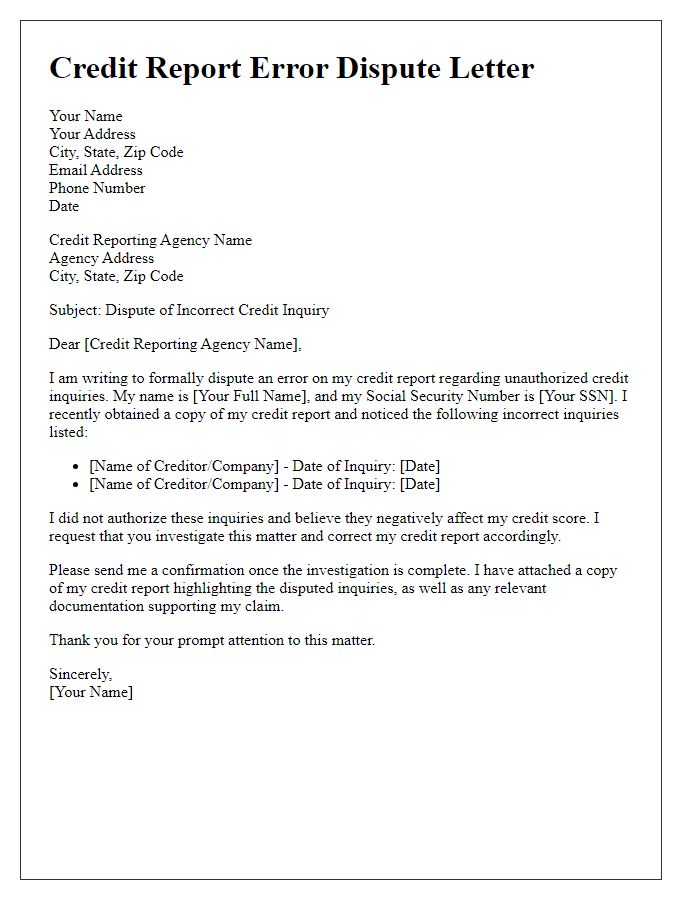

Letter template of credit report error dispute for incorrect credit inquiries.

Comments