Are you tired of feeling burdened by a bankruptcy that's still hanging over your head? We understand how weighty such a situation can be, and that's why finding a way to dismiss it can open doors to fresh opportunities. In this guide, we'll walk you through the essential steps to draft a compelling letter for the removal of your bankruptcy dismissal, ensuring you have the best chance at a positive outcome. So, let's dive in and explore how you can regain control of your financial future!

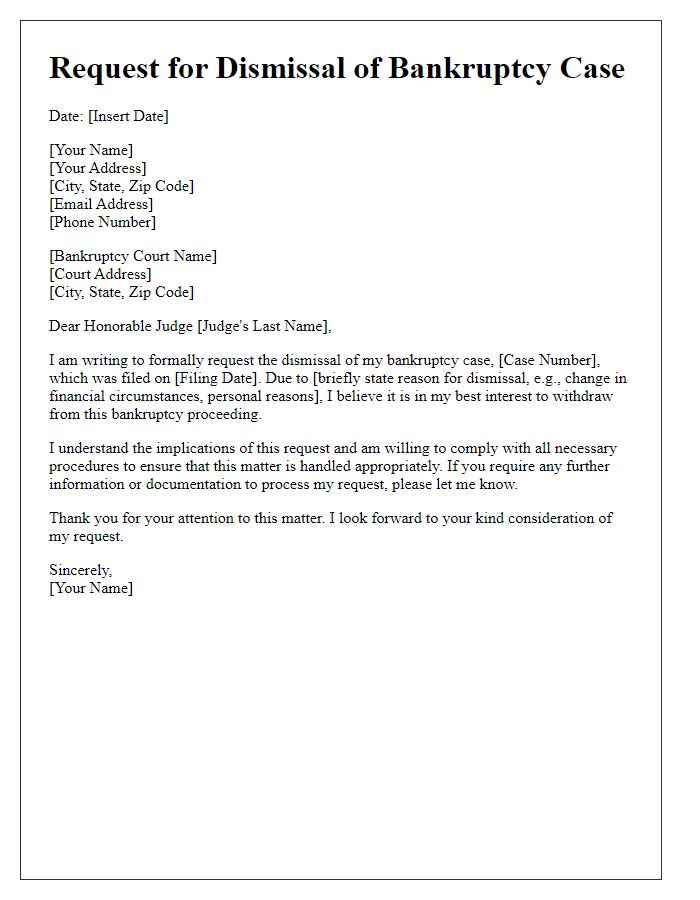

Clear Identification of Parties

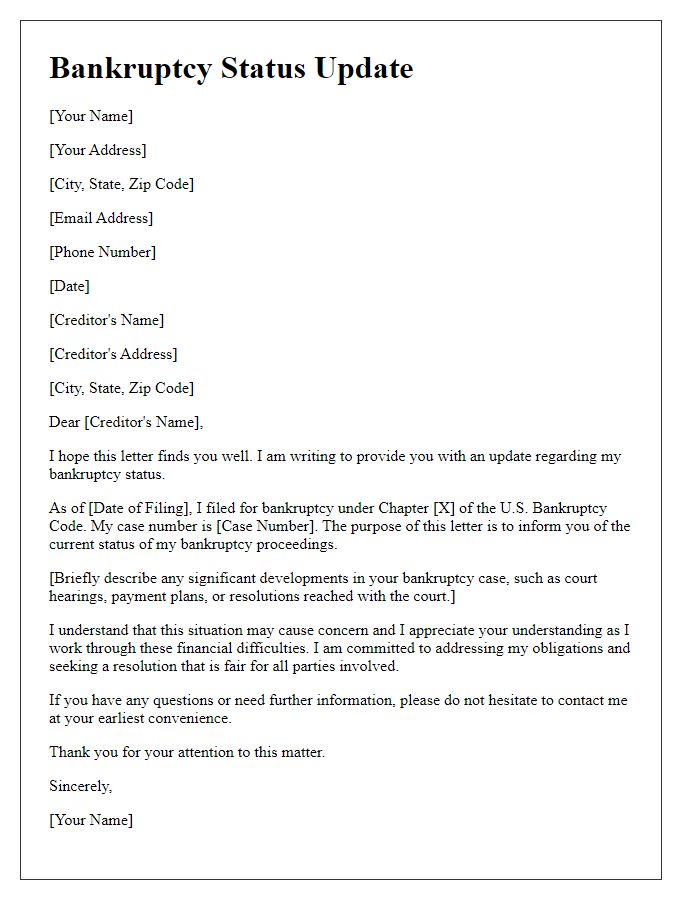

Identification of parties is a crucial aspect of the bankruptcy removal process. In this context, it is essential to clearly outline the names of the parties involved, including the debtor, creditor, and legal representatives. For example, the debtor, John Smith, residing at 123 Elm Street, Springfield, must be properly identified alongside the creditor, ABC Finance Corporation, with its registered office at 456 Maple Avenue, Springfield. Additionally, any legal representatives, such as Attorney Jane Doe, must be included with their contact information. This clear delineation aids in establishing formal recognition of all parties in this legal process and ensures proper communication throughout the dismissal procedure.

Case Details and Reference Numbers

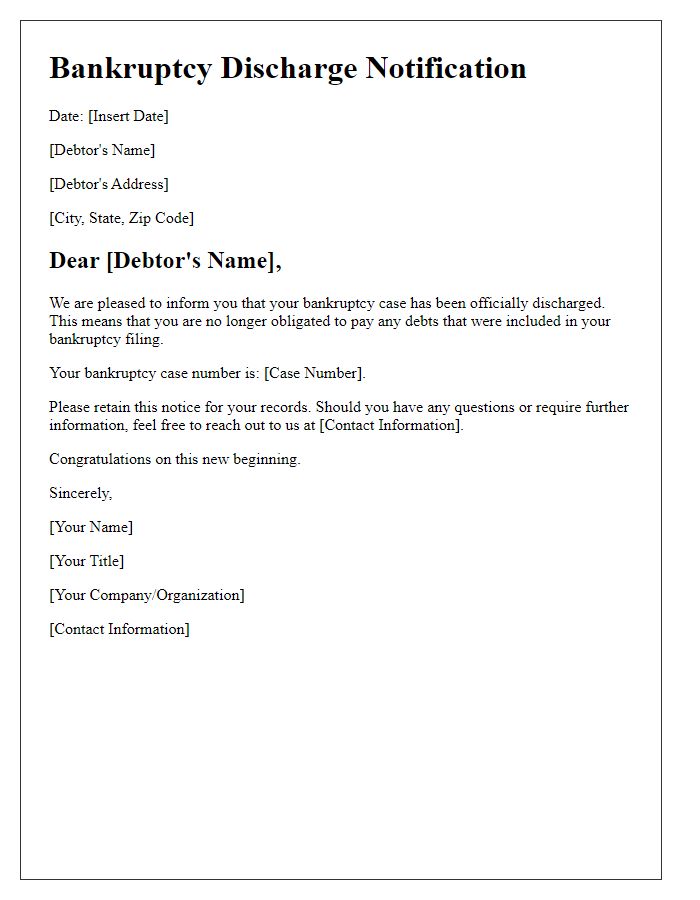

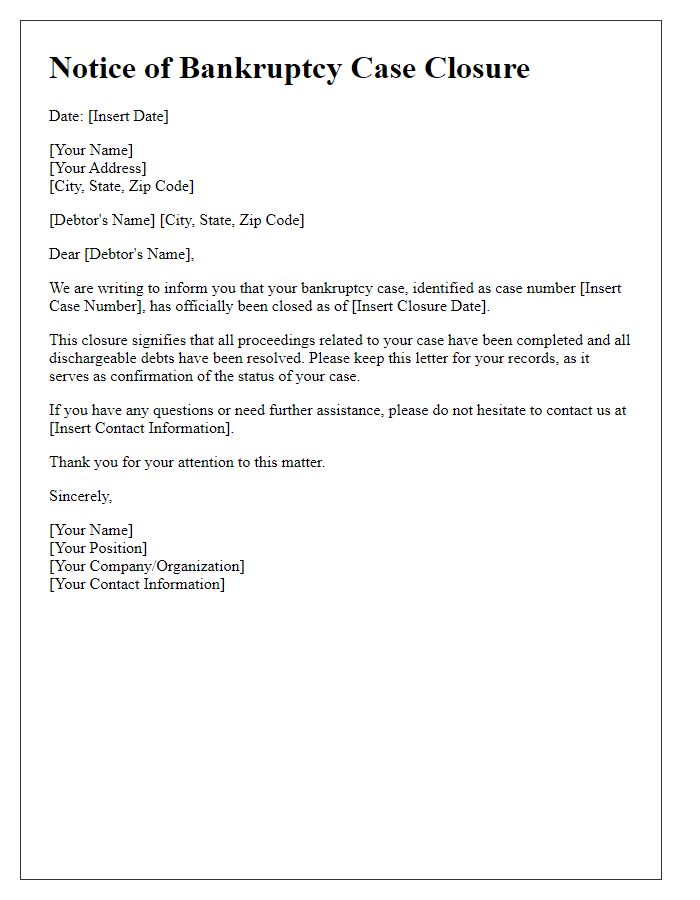

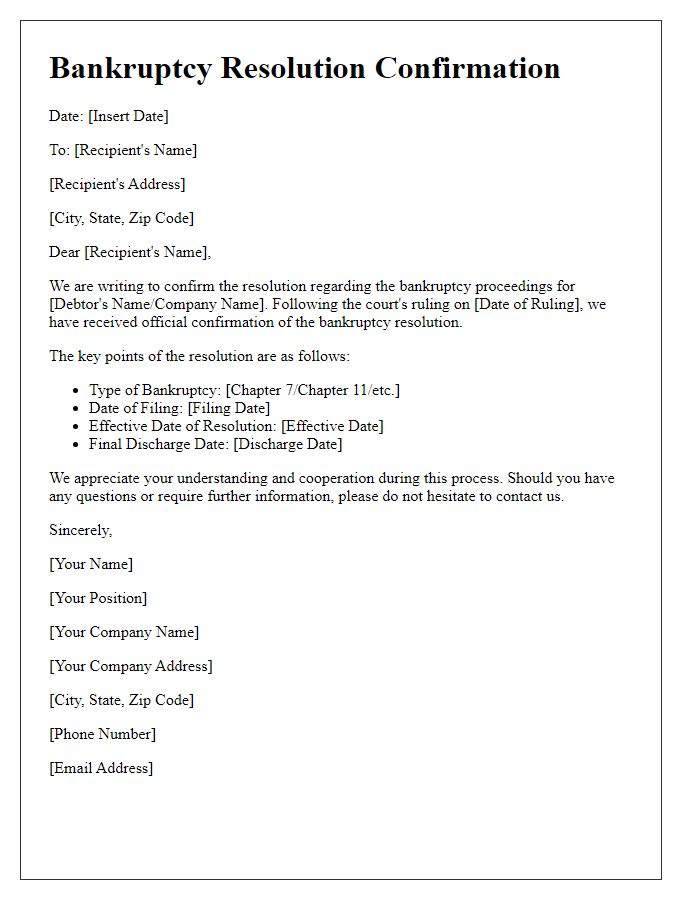

A dismissed bankruptcy can significantly impact an individual's credit history and financial future. The bankruptcy dismissal status is often noted in official documents such as the case number (e.g., 12-34567-TBA) and the court's reference number, which can be found in records maintained by the U.S. Bankruptcy Court, typically located in jurisdictions like California or New York. Alongside the dismissal, associated documents, including the discharge certificate, notification orders, and creditor responses, will be crucial for future credit applications as they provide evidence of financial recovery. This record can deeply influence lending decisions made by financial institutions like banks or credit unions, which often require a clean slate to approve loans or mortgages for individuals seeking to rebuild their financial health after bankruptcy proceedings.

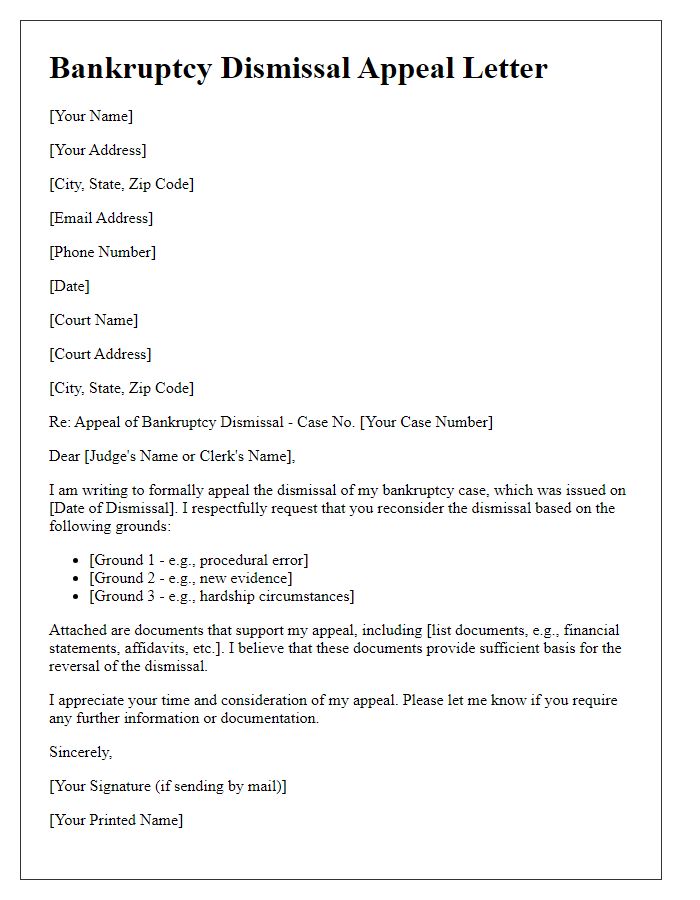

Official Court and Legal Terminology

A dismissed bankruptcy case can have significant legal implications for individuals seeking to restore their financial reputation. Dismissal refers to the termination of bankruptcy proceedings by a court, often citing reasons such as failure to meet filing requirements in compliance with Title 11 of the United States Code. In cases where the court dismisses a Chapter 7 or Chapter 13 filing, individuals may face barriers to re-filings, typically lasting 180 days. Additionally, the removal of a dismissed bankruptcy from a credit report, usually managed by major credit reporting agencies like Experian, Equifax, and TransUnion, may take up to seven years. Individuals often need to submit formal requests with supporting documentation to the court to initiate the removal process.

Specific Dismissal Reason and Court Order

A court order regarding the specific dismissal of a bankruptcy case can significantly impact credit reports and future financial decisions. A dismissal reason such as "failure to comply with court requests," particularly noted in federal bankruptcy cases under Title 11 of the United States Code, can result in the case being closed without discharge. Affected individuals might find this dismissal reflected in their credit reports, which could last from seven to ten years, depending on the original bankruptcy type filed, such as Chapter 7 or Chapter 13. Legal representatives often advise those facing dismissal to review and rectify any noncompliance issues promptly to strengthen future re-filing efforts and improve their financial rehabilitation prospects.

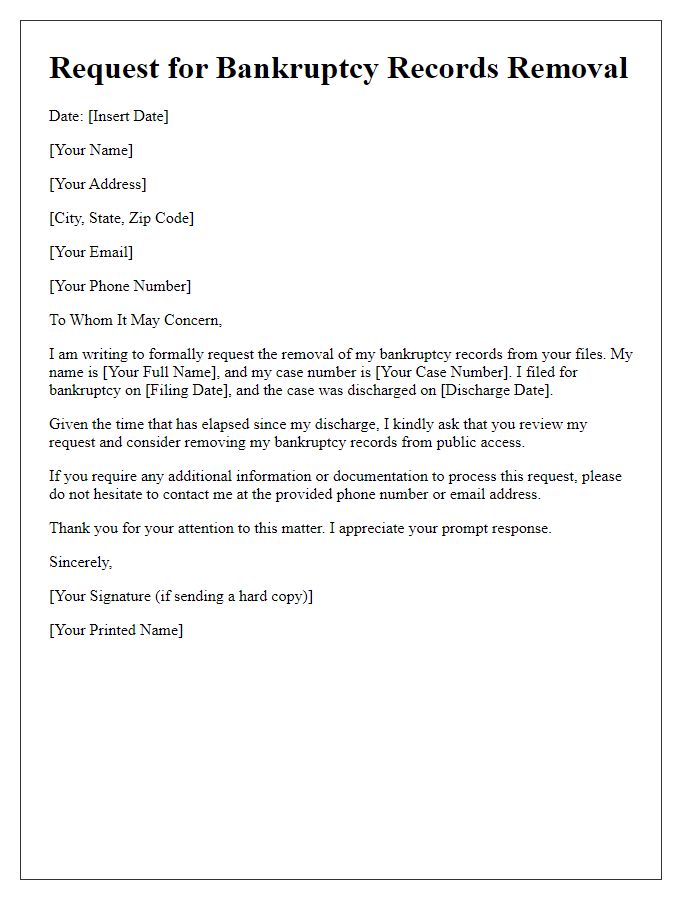

Request for Credit Report Update and Confirmation

Dismissed bankruptcy cases can impact credit scores significantly, often remaining on credit reports for up to ten years. Consumers, after experiencing a bankruptcy dismissal, seek to improve their creditworthiness and financial standing. A credit report update should accurately reflect the status of the bankruptcy, ensuring it is marked as dismissed rather than discharged. This distinction helps lenders assess the individual's current financial behavior and reliability. Prompt action in requesting these updates can aid in securing future loans or credit cards, which are crucial for rebuilding financial health. Consumers must contact major credit bureaus, like Experian, TransUnion, and Equifax, to ensure timely corrections in their credit files.

Comments