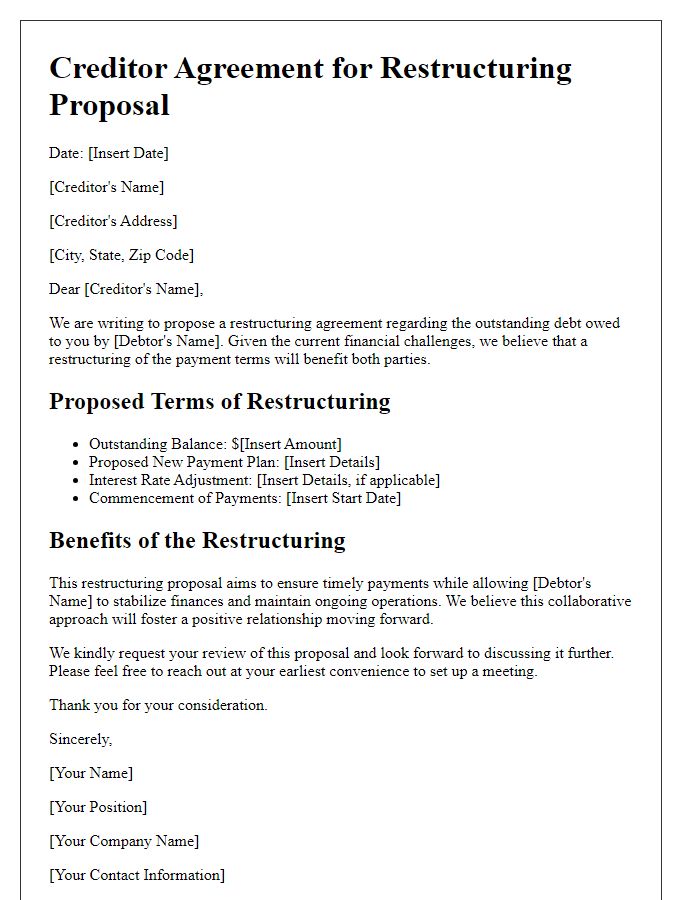

Are you in the process of drafting a creditor agreement and unsure where to start? Crafting a clear and concise letter is essential to ensuring all parties are on the same page regarding the terms of the agreement. In this article, we'll guide you through the key elements to include in your creditor agreement documentation, making the process as smooth as possible. Let's dive deeper into the intricate details that will help you create a comprehensive letter to solidify your creditor arrangements!

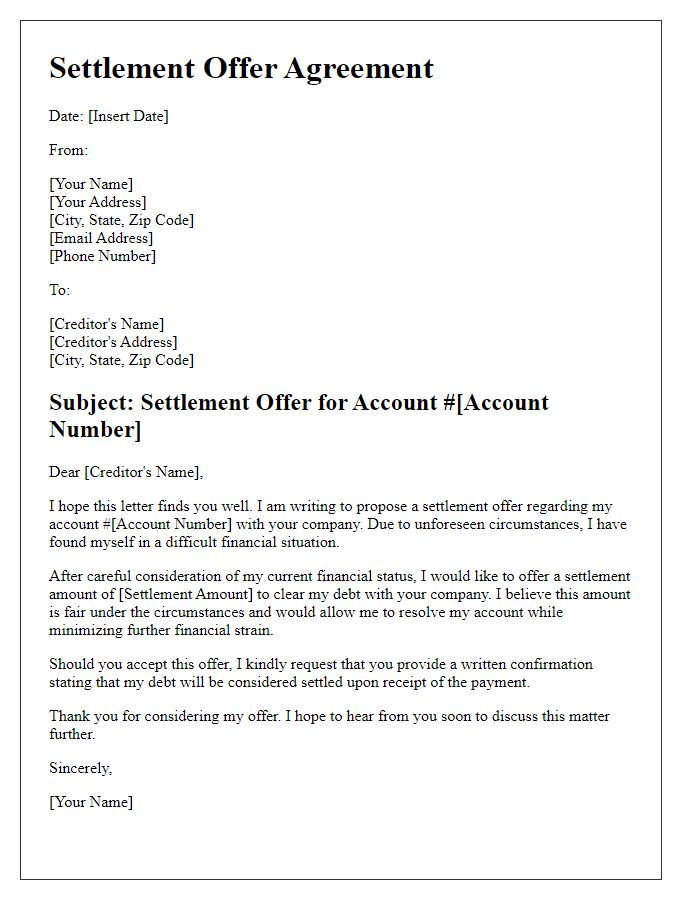

Professional Tone

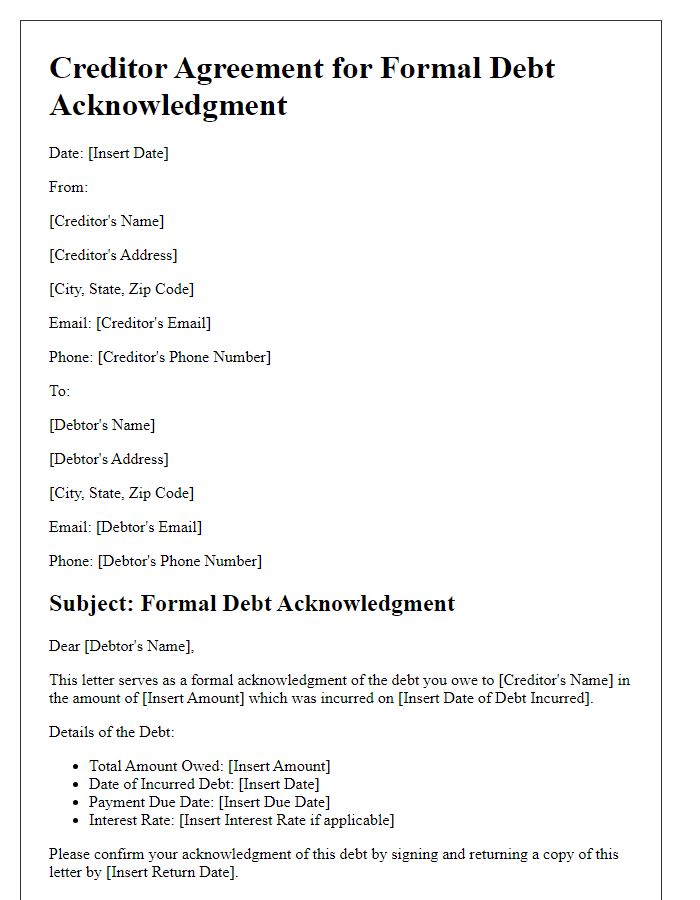

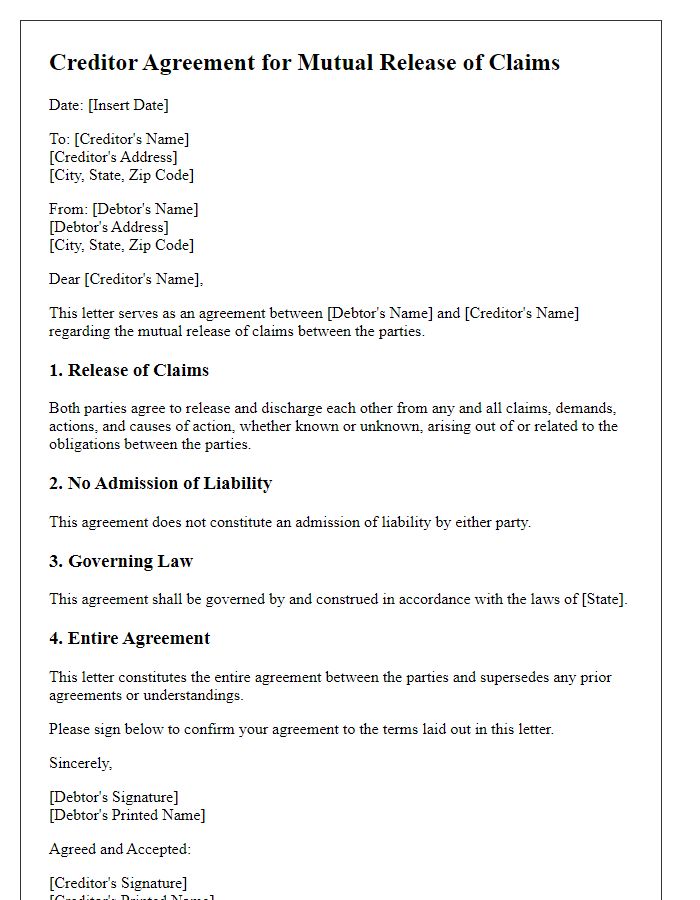

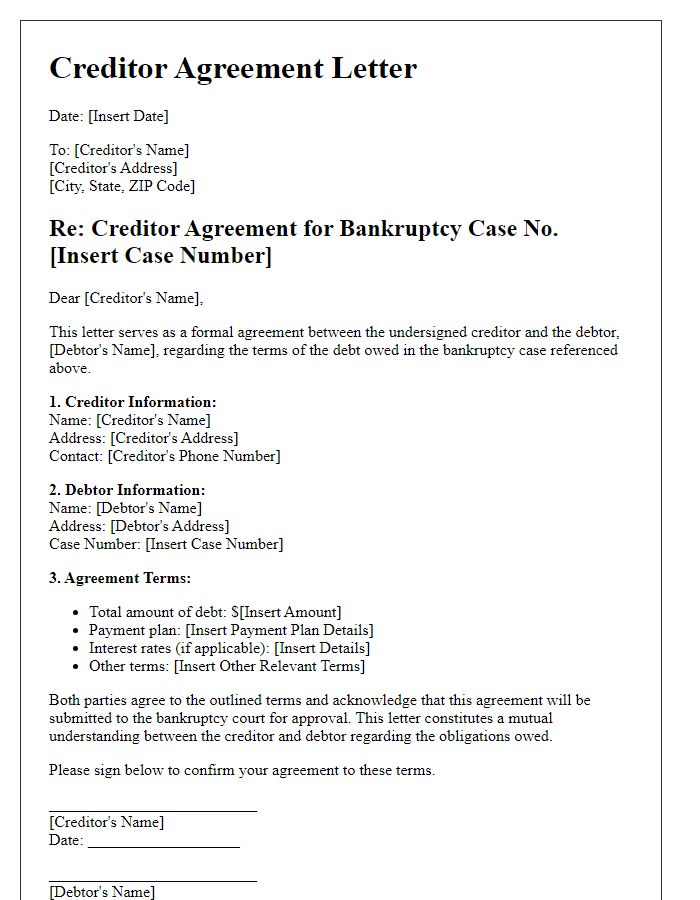

A creditor agreement document outlines terms between a creditor and a borrower, detailing obligations, repayment schedules, and potential penalties for defaults. It serves as a binding legal instrument that safeguards the interests of both parties in financial transactions. Important elements include borrower identification details such as name, address, and financial institution involvement. Clearly stated interest rates, which may vary, typically annual percentage rates (APR), are essential. Notable dates such as the loan start date and repayment timeline significantly impact the borrower's financial planning. Specific clauses addressing late fees or default consequences, including potential legal action, enhance the document's robustness. An effective creditor agreement also stipulates conditions for amendments, ensuring both parties mutually understand and agree to any modifications throughout the loan term.

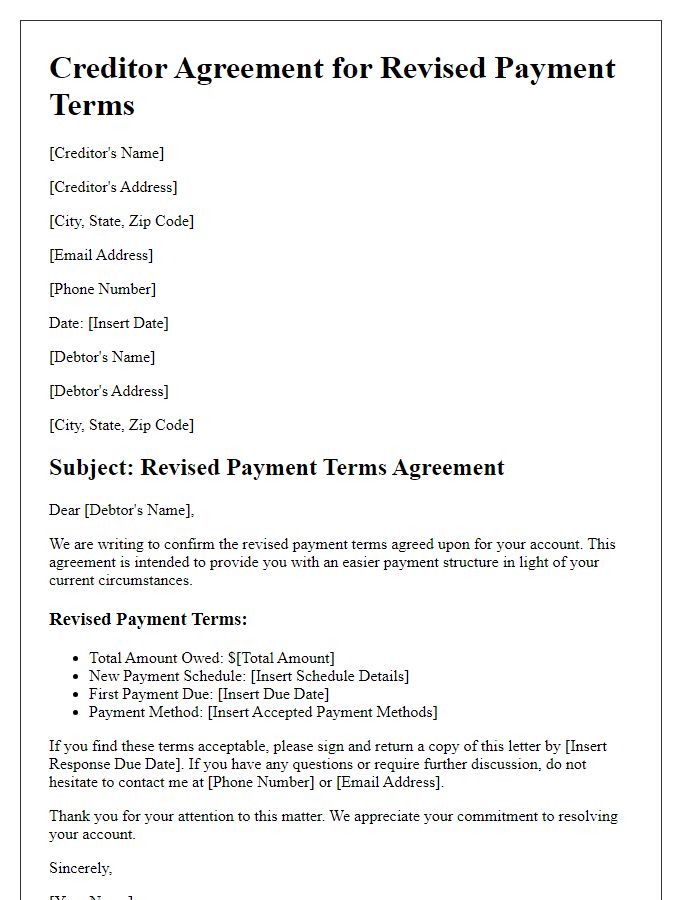

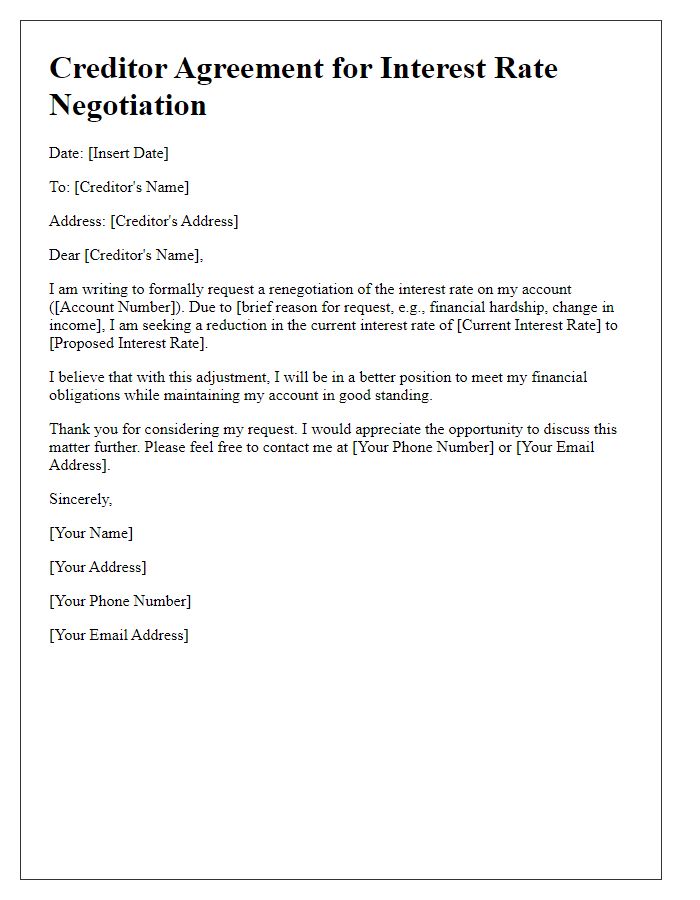

Clear Terms and Conditions

A creditor agreement typically outlines the specific obligations and rights between lenders and borrowers, emphasizing clear terms and conditions. For instance, the principal amount, which is the original sum of money borrowed (often ranging from hundreds to millions of dollars), must be stated alongside the interest rate, commonly expressed as an annual percentage rate (APR) that can significantly impact repayment amounts over time. Additionally, the repayment schedule, detailing the frequency of payments--be it monthly, quarterly, or annually--should specify dates. Late fees, which may incur after a grace period (typically 15-30 days), warrant attention to prevent misunderstandings. Furthermore, securing clauses, like collateral requirements, can protect the creditor's interests, while consequences for defaulting, potentially resulting in legal actions or debt collection, must be clearly articulated. Lastly, both parties' signatures and dates mark acceptance, ensuring legal enforceability under jurisdiction laws governing the agreement, such as the Uniform Commercial Code (UCC) in the United States.

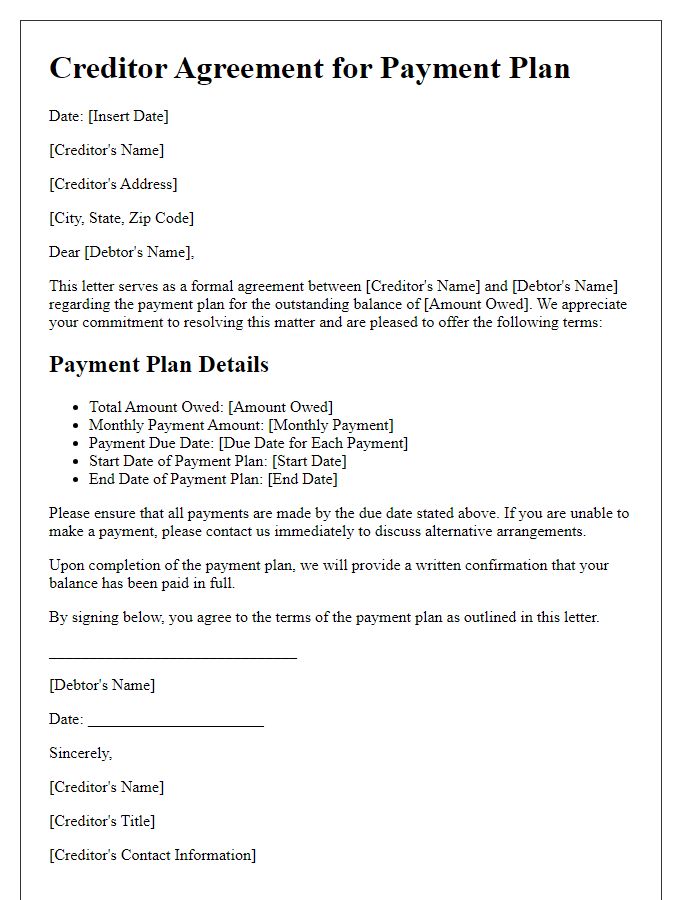

Payment Schedule Details

Crafting a payment schedule for a creditor agreement is essential for outlining financial responsibilities and repayment timelines. Specifically, the schedule may include critical details such as due dates, payment amounts, and applicable interest rates. For instance, a personal loan of $5,000 might require monthly payments of $250 over a 24-month period, with a fixed interest rate of 5% APR. Each entry should clearly specify both principal repayment and interest charges, allowing for transparent financial planning. It is also advisable to note penalties for late payments, typically ranging from $25 to $50, and the potential for increased interest rates on overdue balances, ensuring both parties understand the consequences of missed deadlines. Additionally, include provisions for early repayment options, highlighting any fees or discounts that might apply.

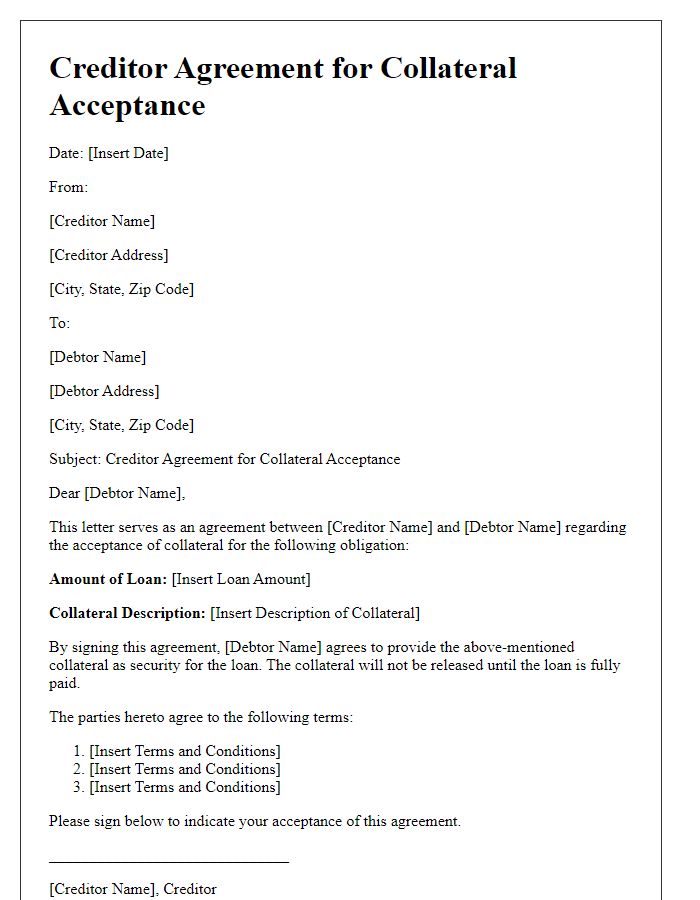

Confidentiality Clause

A confidentiality clause in a creditor agreement serves to protect sensitive information exchanged between parties during the agreement process. This clause typically stipulates that any information pertaining to the creditor's financial practices, business operations, and proprietary data remains confidential. For example, if a creditor, such as XYZ Bank, shares details about loan terms, creditworthiness standards, or specific client data, these particulars should not be disclosed to third parties without explicit consent. Breach of this confidentiality can result in severe penalties, including financial damages and loss of trust. Such stipulations ensure that both parties uphold integrity while promoting transparency and security in financial dealings.

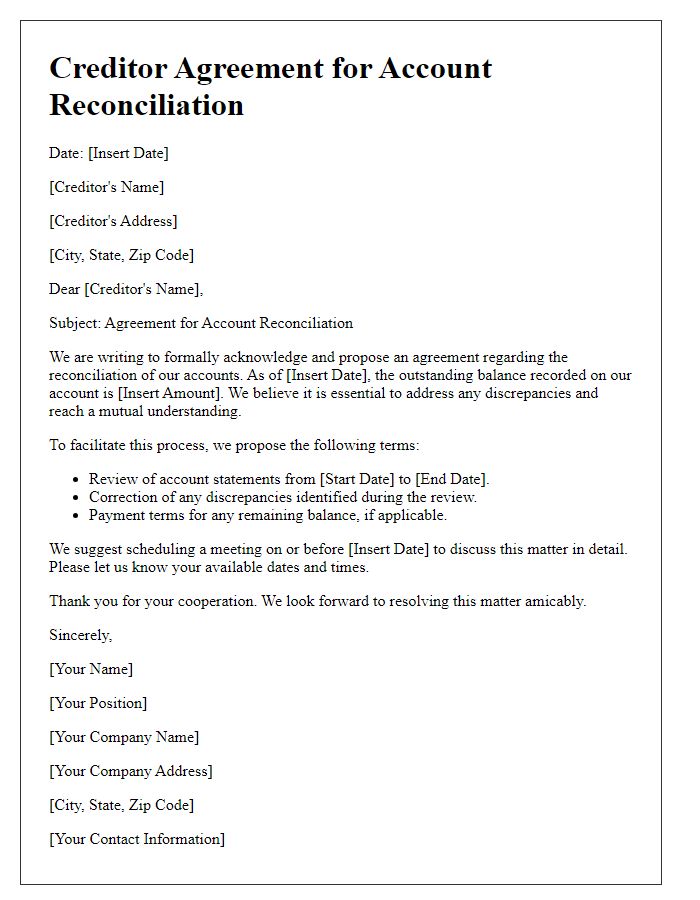

Signatures and Contact Information

A creditor agreement documentation involves essential elements to finalize the terms and responsibilities concerning the loan or credit transaction. Signatures serve as the legal acknowledgment of the agreement from both parties, indicating their consent to the outlined conditions, such as interest rates (typically ranging from 3% to 30% based on creditworthiness) and repayment schedules. Contact information includes the creditors' (financial institutions or private lenders) addresses, phone numbers, and email addresses, ensuring efficient communication throughout the agreement's duration. Accurate details ensure accountability, which is crucial during potential disputes or clarifications about terms. Proper formatting and clarity enhance the document's validity, making it essential for both parties to review thoroughly before signing.

Comments