Have you recently received a notice that your credit application has been declined? It can be a frustrating experience, but it's important to remember that this isn't the end of your journey toward securing the credit you need. By taking the time to reconsider the decision and address any potential concerns, you may find a path forward. Dive into our article to discover how you can craft a compelling letter to request a reconsideration of your application.

Applicant's personal details

The reconsideration of a declined credit application requires a comprehensive understanding of the applicant's personal details, including full name, date of birth, and social security number for identity verification. The applicant's current address, previous addresses, and contact information, such as phone numbers and email addresses, provide necessary context for background checks. Employment status, including job title, employer name, and duration of employment, plays a crucial role in assessing financial stability. Furthermore, annual income figures contribute to understanding the applicant's ability to repay the credit. Additional information, such as existing debts, credit scores, and reasons for previous declines, helps build a comprehensive picture to support the reconsideration request.

Reason for initial decline

A declined credit application can significantly impact personal finances, often due to various factors. Common reasons include a low credit score, typically below 580, high debt-to-income ratio exceeding 43%, and a limited credit history, particularly for first-time credit seekers. Lenders, such as banks and credit unions, assess these criteria to gauge creditworthiness. For instance, an applicant with outstanding debts of $5,000 may struggle if their monthly income is only $3,000. Additionally, errors in the credit report can lead to unjust declines, with inaccuracies affecting scores by up to 100 points. Seeking reconsideration involves addressing these issues, providing updated financial information, and demonstrating improvements in credit behavior.

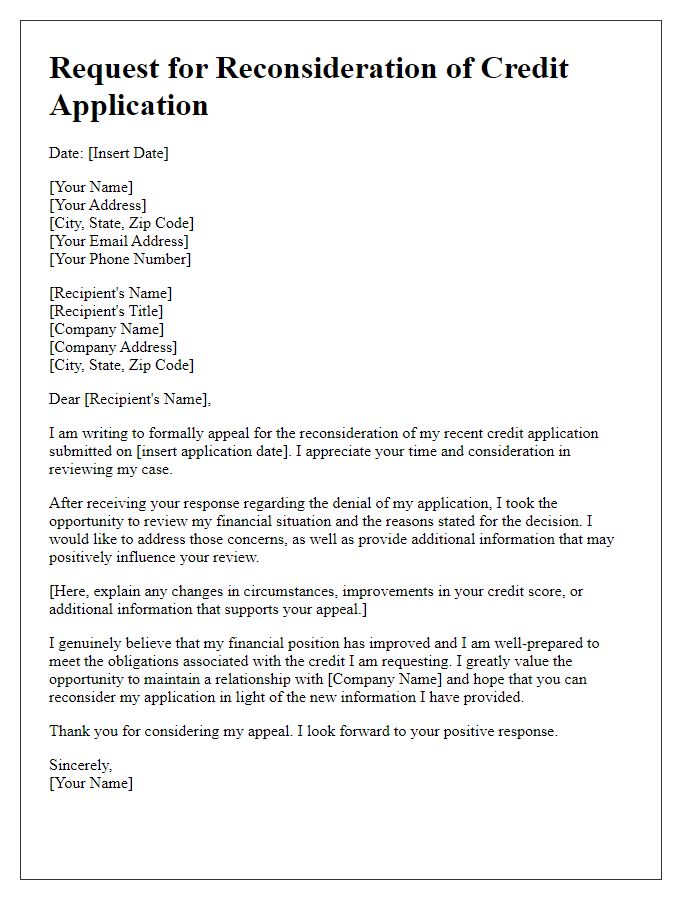

Request for reconsideration

A reconsideration request for a declined credit application highlights the applicant's financial circumstances and intent to improve creditworthiness. Specific details about the loan amount (e.g., $10,000) and purpose (e.g., debt consolidation, home improvement) emphasize the importance of this credit decision. Key factors such as recently improved credit scores (e.g., a rise from 620 to 680 after settling debts) and steady employment (e.g., two years at Company XYZ) can strengthen the appeal. Additionally, personal circumstances like medical expenses or job loss that previously affected credit history should be mentioned for context, providing a full understanding of the applicant's current financial stability. Demonstrating a commitment to better financial management through budgeting or financial counseling can further persuade the lender to reconsider the application.

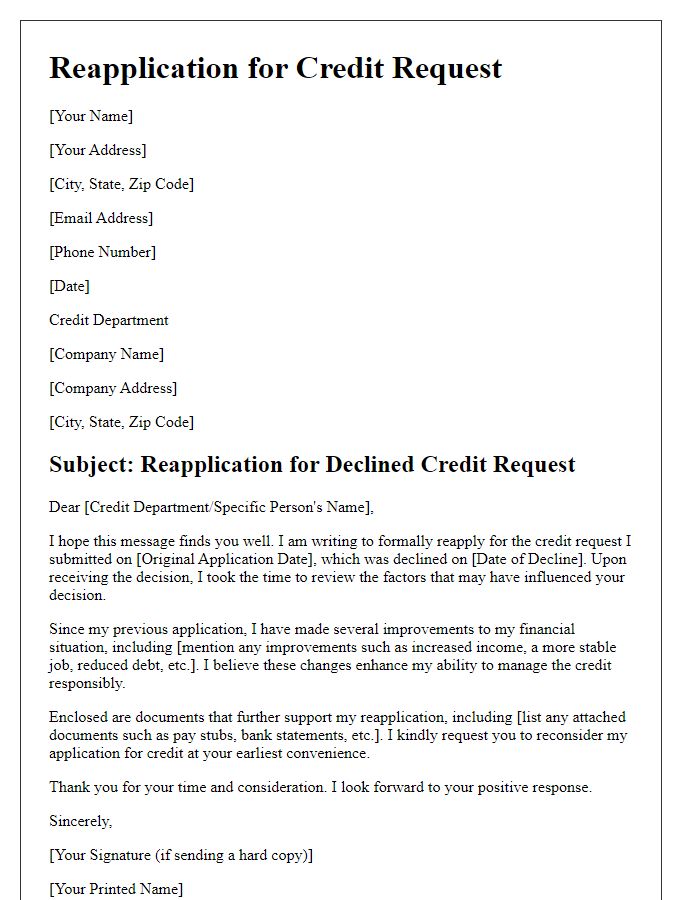

Additional supporting information

A reconsideration for a declined credit application can significantly impact an applicant's financial opportunities. A comprehensive submission may include updated financial data, employment verification, and a history of timely payments on existing debts. This information can bolster an application previously denied due to insufficient credit history or high debt-to-income ratios. Submitting recent pay stubs reflecting a consistent income, documentation of promotions or raises, and a clear budget plan can illustrate improved financial reliability and responsible credit use. Additionally, including letters from creditors confirming satisfaction of outstanding debts can provide further evidence of the applicant's commitment to meeting their financial obligations. This thorough approach often increases the likelihood of reevaluating the initial credit decision favorably.

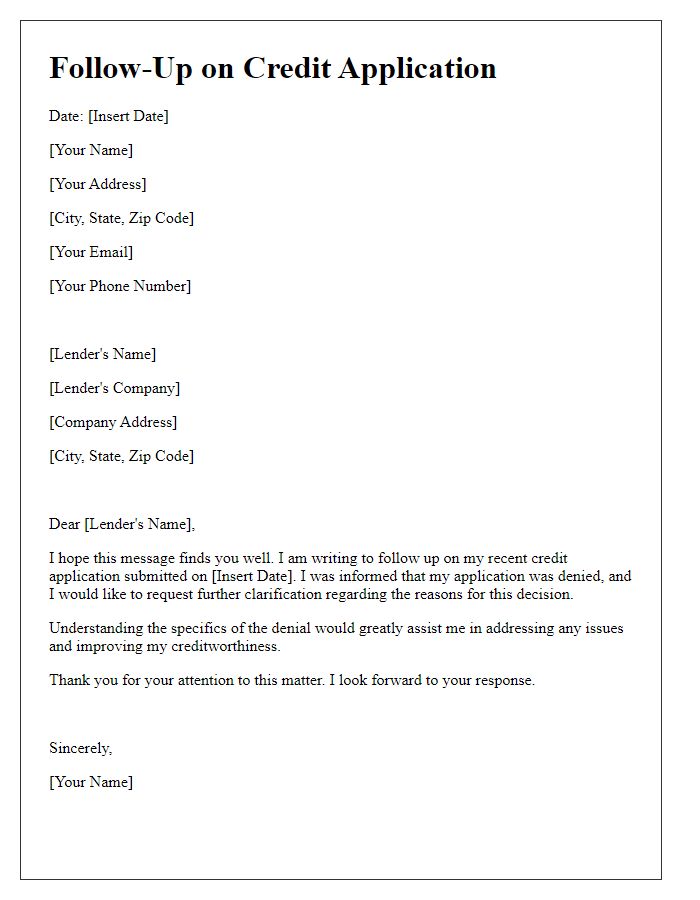

Contact information for follow-up

A reconsideration request for a declined credit application can often be enhanced by providing specific details regarding the application and the reasons for the initial denial. The applicant can address factors such as a recent employment increase, improved credit score from 650 to 720 within six months, or the resolution of past delinquencies. Providing information about stable income, which now totals $75,000 annually, and a reduction in debt-to-income ratio to 30% can support the case for reconsideration. The applicant should also include contact information, such as a phone number (e.g., (123) 456-7890) and email address (e.g., applicant@email.com), to facilitate an easy follow-up. This proactive approach can significantly influence the decision regarding creditworthiness and eligibility for the requested credit line.

Letter Template For Reconsidering Declined Credit Application Samples

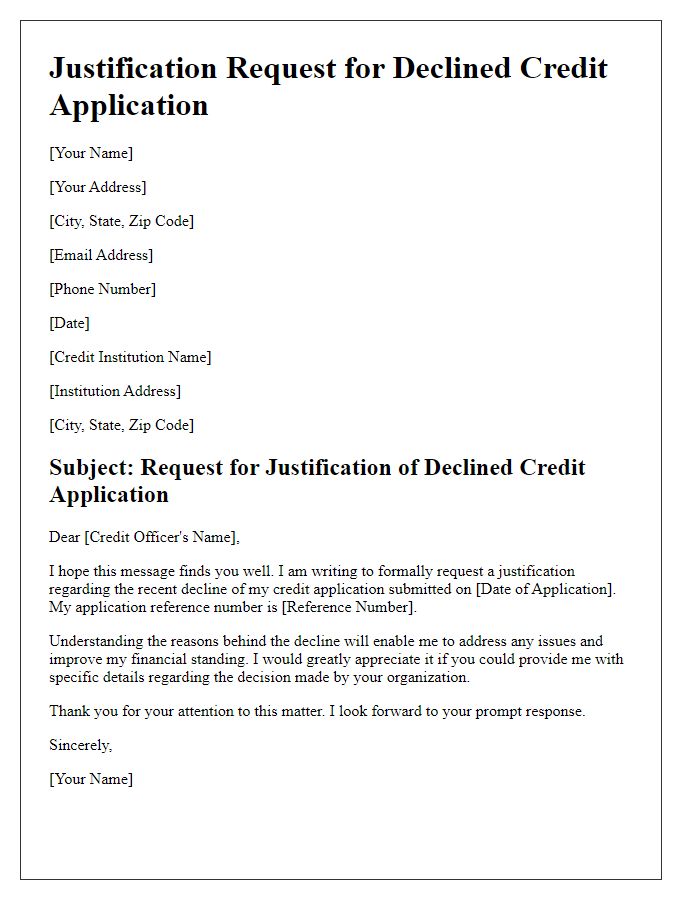

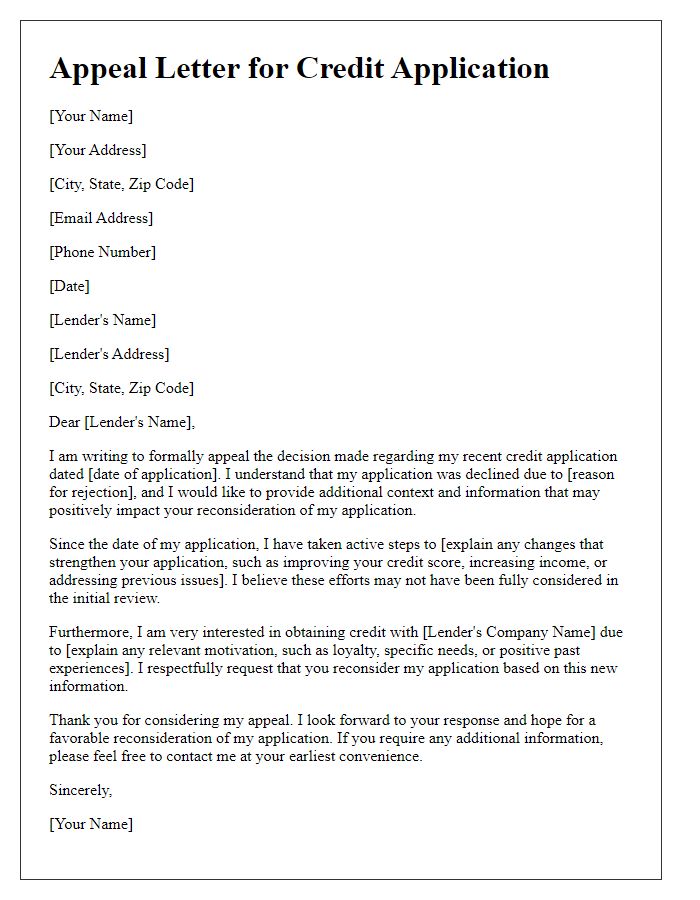

Letter template of justification request for declined credit application

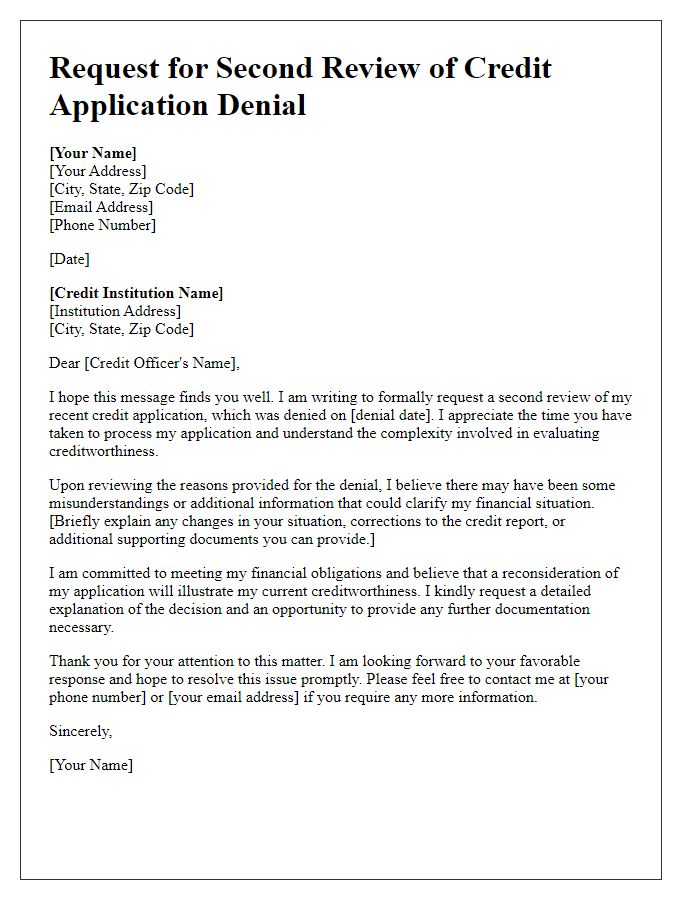

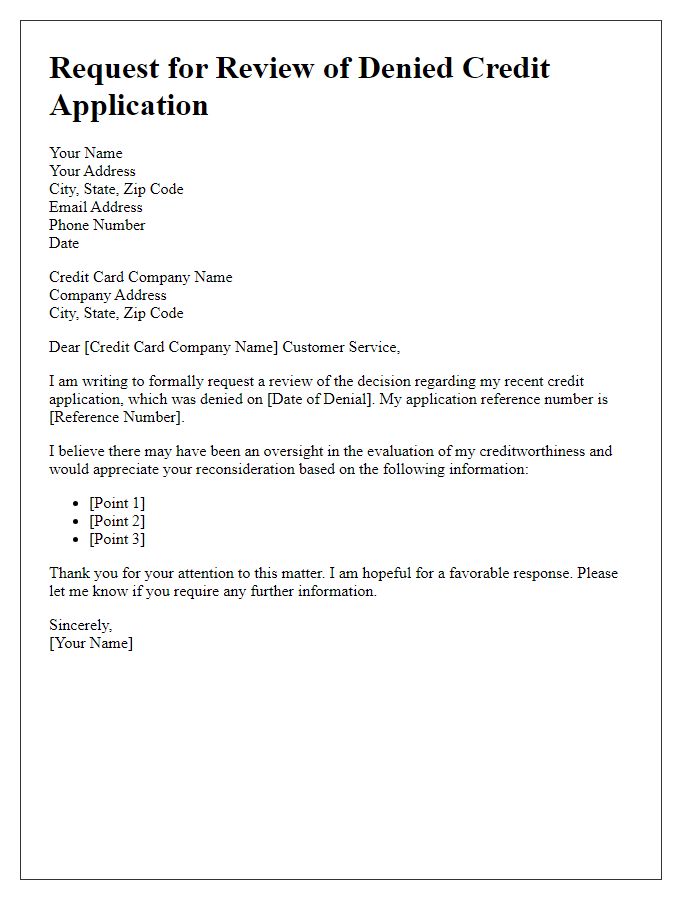

Letter template of request for second review of credit application denial

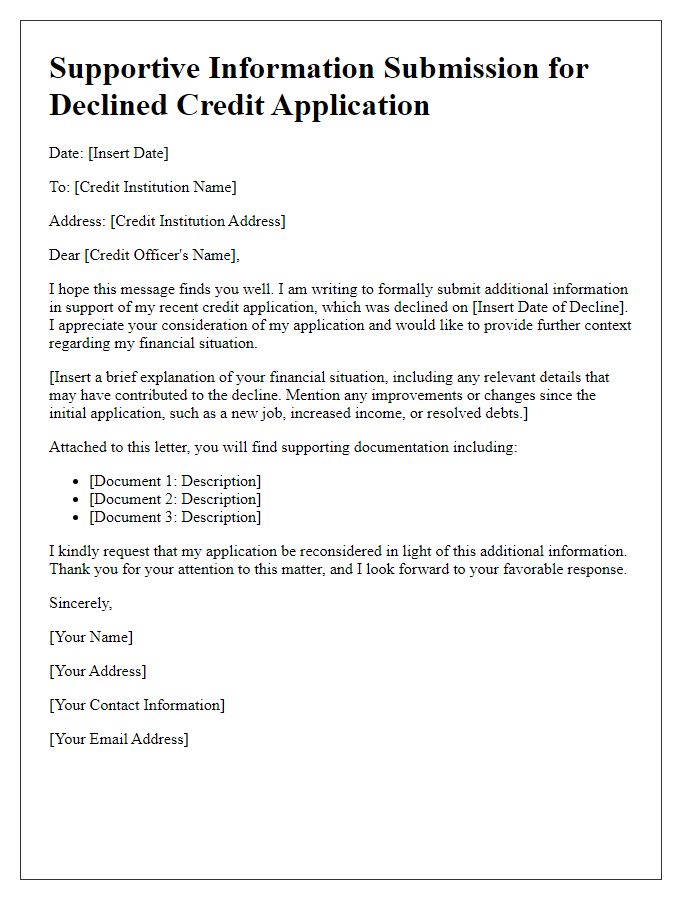

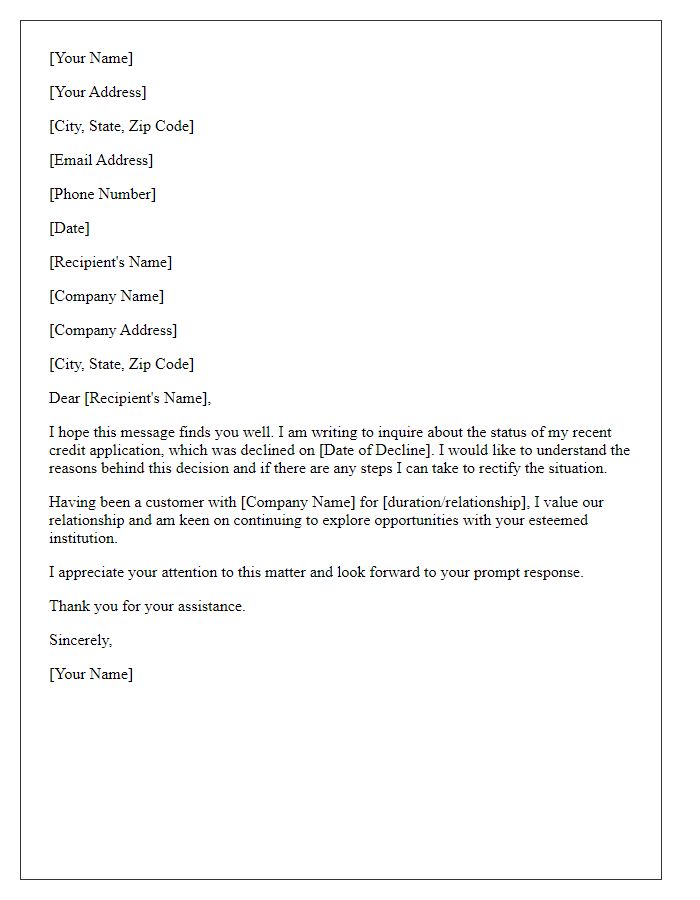

Letter template of supportive information submission for declined credit application

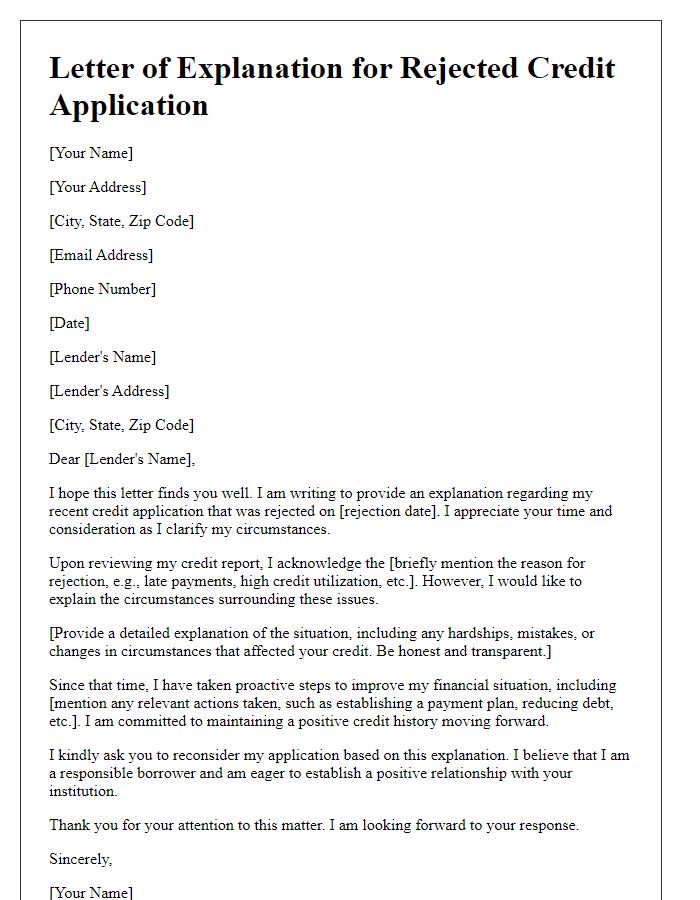

Letter template of explanation of circumstances for rejected credit application

Comments