Are you looking to navigate the often tricky waters of goodwill credit adjustments? Understanding the nuances behind these requests can be crucial for maintaining positive relationships with clients and customers. In this article, we'll break down the essential elements to include in your letter template, ensuring you convey your message clearly and professionally. Dive in to discover practical tips that will help you craft the perfect goodwill credit adjustment letter!

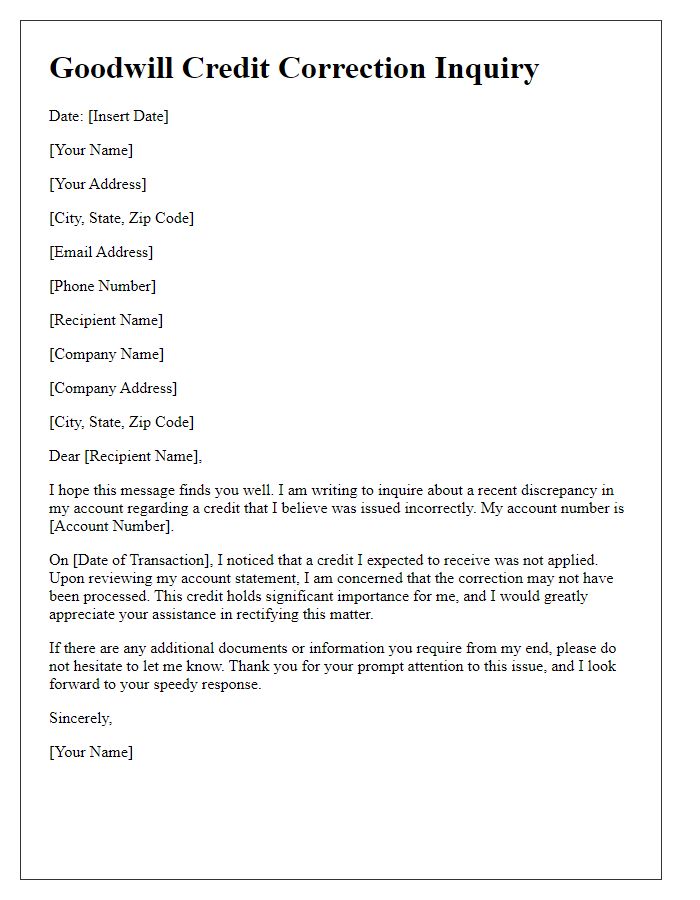

Clear and concise subject line

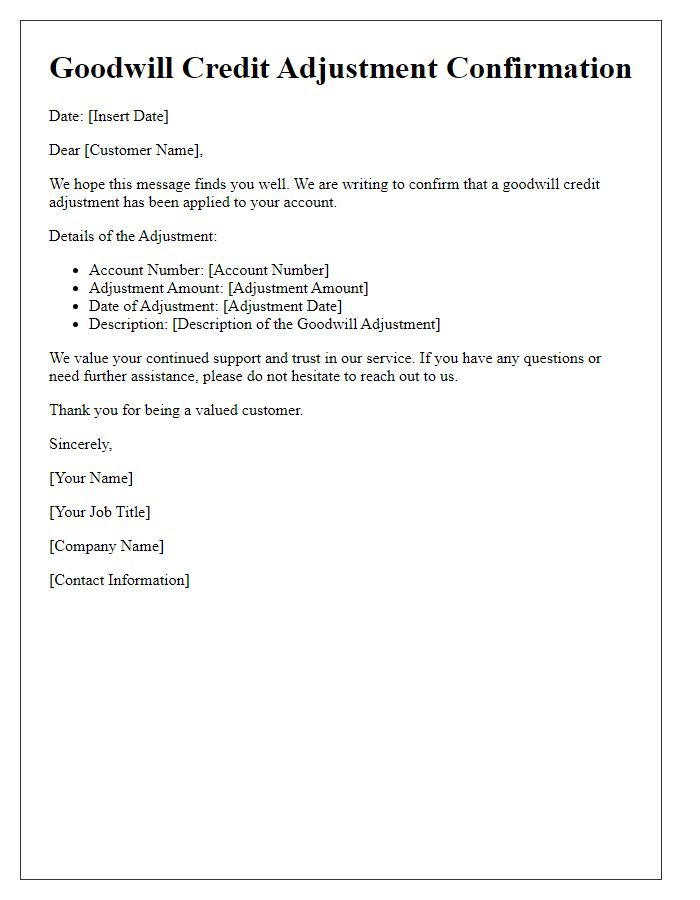

Goodwill credit adjustments often aim to provide customer satisfaction after service inconsistencies. For example, a company might offer a goodwill credit adjustment of $50 to customers who experienced delays in product delivery. This adjustment can be communicated effectively through a clear and concise subject line, such as "Adjustment Confirmation: Your Goodwill Credit for Order #12345." This ensures immediate recognition of the purpose and relevance of the message, highlight the order number for reference, and streamline the customer experience regarding adjustments related to service discrepancies.

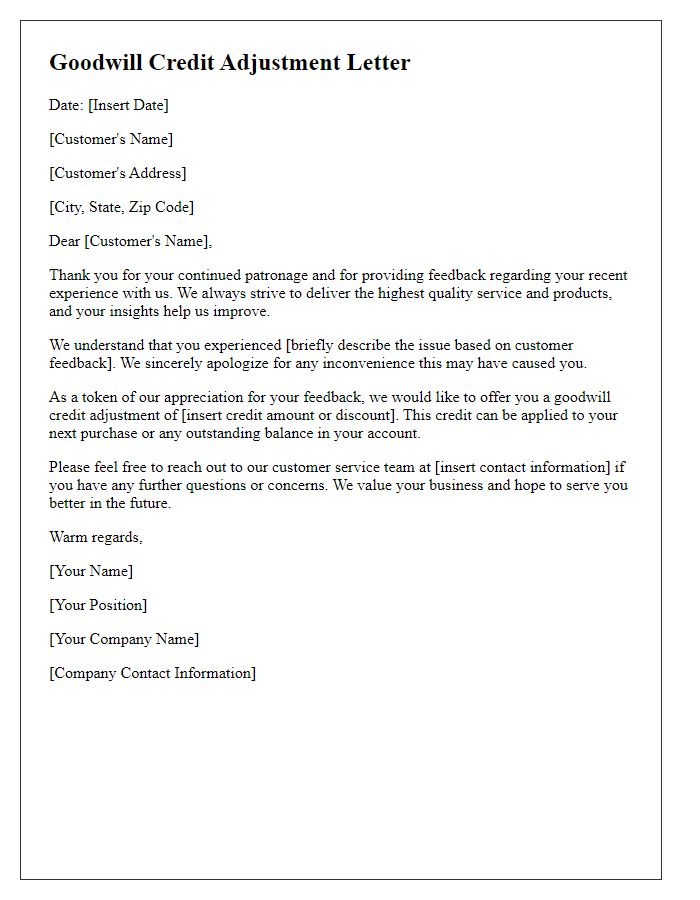

Polite and professional tone

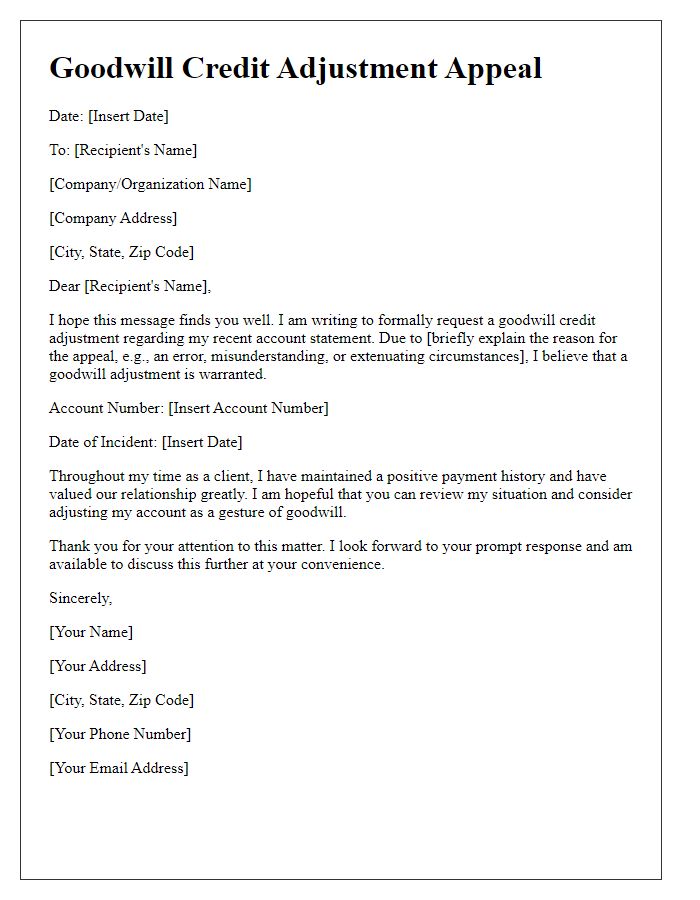

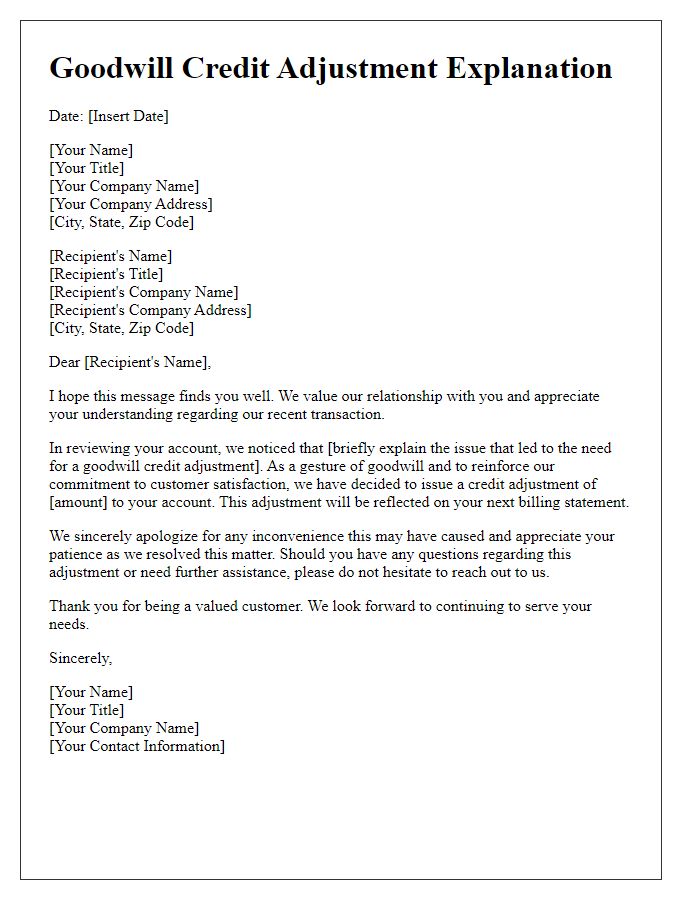

A goodwill credit adjustment is a gesture of goodwill from a company to a customer, often used to rectify a situation or enhance customer satisfaction. This adjustment may occur due to service disruptions or product issues. A traditional approach involves a clear and concise communication from the customer service department, detailing the nature of the adjustment. Specific terms such as credit amounts, account details, and expiration dates (if applicable) should be included for transparency. Addressing the customer by name personalizes the communication while expressing appreciation for their loyalty. The tone remains polite and professional, reinforcing the company's commitment to customer care and satisfaction.

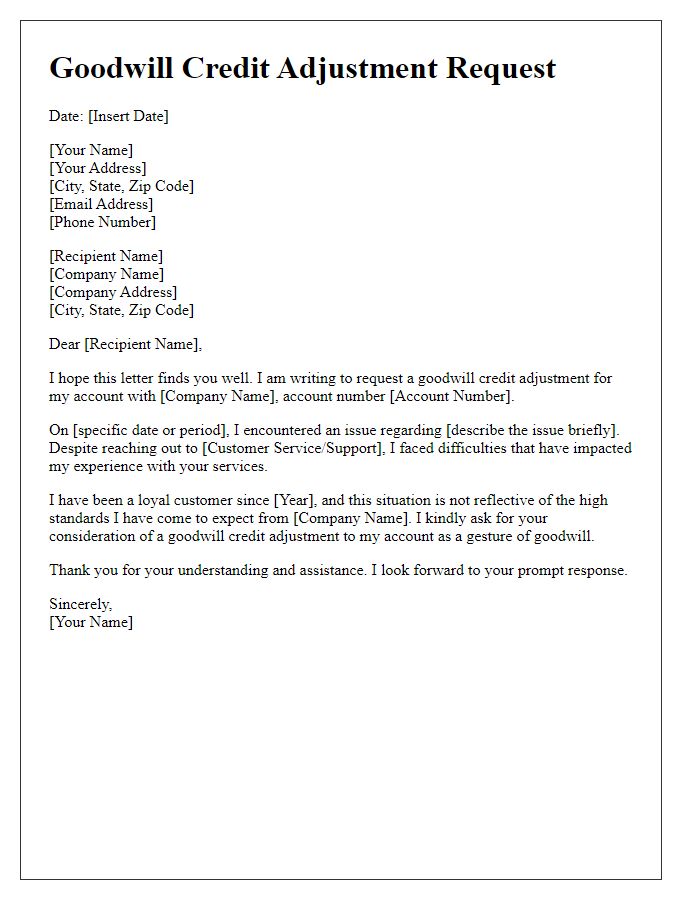

Specific account or transaction details

Goodwill credit adjustments are designed to rectify discrepancies in customer accounts or transactions. For instance, a specific transaction involving a $150 purchase on August 15, 2023, at Retail Store XYZ may show an overcharge due to a pricing error in the system. This adjustment process involves reviewing account details, such as account number 123456789, and ensuring that credits are accurately applied to the customer's balance. Additionally, documenting the reason for the adjustment, along with a reference to any relevant policies or customer service guidelines, helps ensure clarity and maintain customer satisfaction. The final step involves notifying the customer of the adjustment via email, explaining the correction in detail.

Reason for goodwill adjustment request

A goodwill credit adjustment request often arises from customer dissatisfaction due to unexpected service issues, such as product defects, delayed deliveries, or poor customer service experiences. For example, a customer may encounter a malfunctioning electronic device like a smartphone just weeks after purchase, disrupting their daily activities. Additionally, factors such as an unforeseen shipping delay of over a week, resulting in missed deadlines, can amplify frustration. Businesses might grant goodwill credits, hoping to restore customer trust and loyalty, enhancing overall brand reputation. Factors like previous purchase history and customer engagement level can also influence the decision for adjustment.

Contact information for follow-up

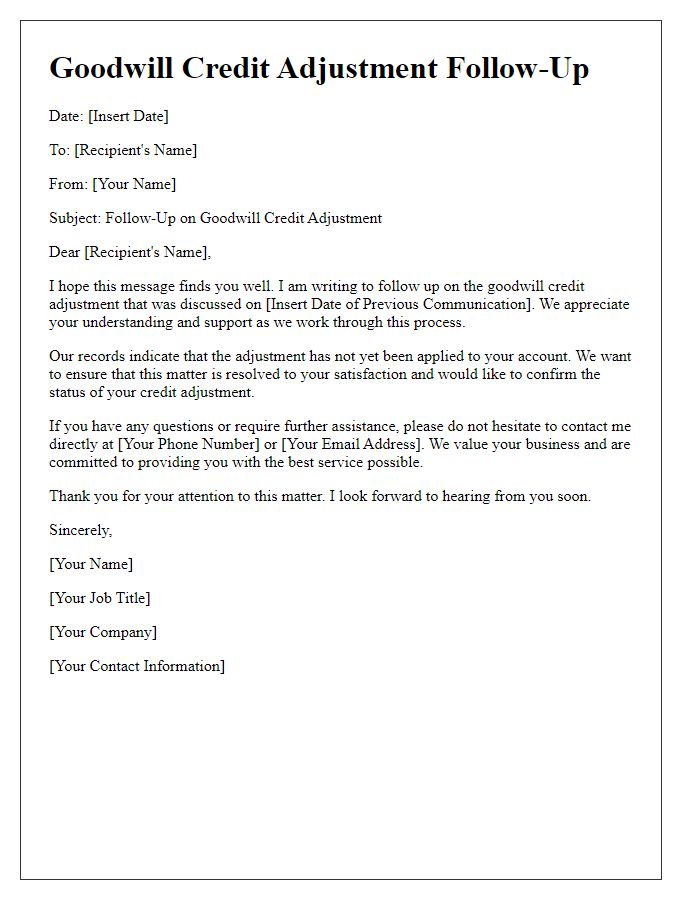

Goodwill credit adjustments often require clear communication for effective resolution. Include both sender and recipient details: Sender's name, job title, company name, phone number, and email address, ensuring they are accurate for follow-up. Additionally, include recipient's name, company name, and contact details for seamless correspondence. Effective tracking of these adjustments can enhance customer satisfaction and foster stronger business relationships within the retail or service industries.

Letter Template For Goodwill Credit Adjustment Samples

Letter template of goodwill credit adjustment based on customer feedback

Comments