Are you concerned about a recent financial fraud incident that has left you feeling vulnerable? You're not alone, as many people face similar challenges in today's fast-paced digital world. Understanding the steps to address and resolve these issues can empower you to protect yourself and rebuild your financial security. Join us as we explore effective strategies and practical advice to navigate this unsettling situation and regain your peace of mind.

Subject Line Precision

Addressing financial fraud incidents requires precision in communication. Utilize concise subject lines that immediately capture the nature of the issue. For example, "Urgent: Report of Unauthorized Transactions on Account #123456" highlights the urgency and specificity of the incident. Clear identification of the financial institution, such as "ABC Bank," enhances context, ensuring the recipient understands the gravity of the situation. Including dates, e.g., "Fraudulent Activity Detected on September 15, 2023," establishes a timeline critical for investigation. Furthermore, indicating the affected account type, like "Savings Account," provides clarity, facilitating a focused response from financial professionals.

Clear Incident Description

The Rise of Financial Fraud has become a significant concern for both individuals and organizations globally. In 2022 alone, losses from wire fraud schemes--often involving unsuspecting victims transferring money under false pretenses--reached an estimated $1.4 billion according to the Federal Bureau of Investigation (FBI). One incident occurred in March 2023, where a small business in San Francisco fell victim to a phishing attack, resulting in a fraudulent wire transfer of $150,000. Cybercriminals, posing as legitimate suppliers, manipulated the company's accounting department through deceptive emails, ultimately leading to financial ruin for the business. The swift escalation of digital transactions has made protecting sensitive financial information imperative to prevent such malicious activities.

Immediate Actions Taken

In response to the recent financial fraud incident, immediate actions were implemented to address the situation effectively. A thorough investigation commenced on October 1, 2023, led by a specialized task force from the Compliance Department and external forensic consultants. All compromised accounts, identified by unusual transaction patterns involving a significant amount of $150,000, were promptly frozen to prevent further unauthorized access. Notifications were sent to affected customers through email and SMS to ensure they were aware of the situation and the steps being taken to secure their accounts. Additionally, all security protocols, including two-factor authentication and real-time transaction alerts, were reviewed and reinforced. The team continuously monitors any suspicious activities while collaborating with local law enforcement for further investigations.

Legal and Compliance Measures

In recent financial fraud incidents, organizations such as banks (like JPMorgan Chase) and payment processors (such as PayPal) have faced significant repercussions, including loss of consumer trust and stringent regulatory scrutiny. Implementing strong internal controls (like dual authorization for transactions), conducting regular audits (quarterly or annually), and ensuring compliance with legislation (such as the Sarbanes-Oxley Act) are essential measures. Employee training (focusing on fraud detection and prevention) can enhance awareness. Additionally, establishing a whistleblower policy (facilitating anonymous reporting) promotes transparency. Organizations must also collaborate with law enforcement (such as the FBI's Cyber Crime Division) and regulatory agencies (like the Consumer Financial Protection Bureau) to address incidents effectively and mitigate future risks.

Remedial Steps and Assurance

Financial fraud incidents can create significant distress for individuals and organizations alike. In response to fraudulent activities such as credit card fraud, data breaches, or unauthorized transactions, various remedial steps can be employed. Immediate actions often include freezing affected accounts, which prevents further unauthorized access. In addition, reporting the incident to financial institutions plays a critical role; institutions such as major banks or credit card companies investigate the incident, providing support. Monitoring financial statements and credit reports, specifically from agencies like Experian or TransUnion, is essential to detect any anomalies. Assurance of increased security measures might be implemented, including enhanced encryption protocols and multi-factor authentication, ensuring sensitive data is better protected.

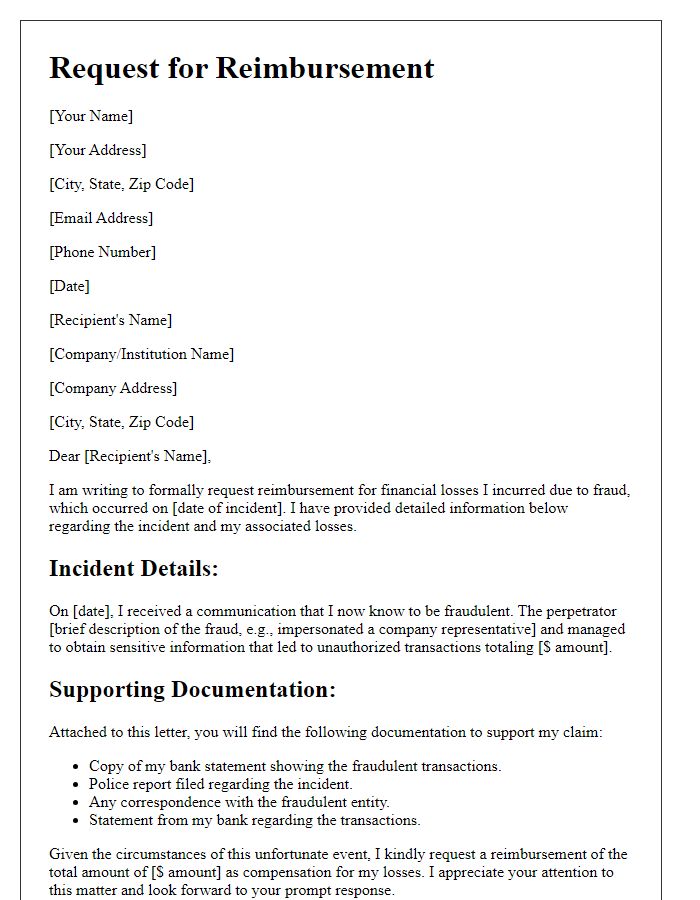

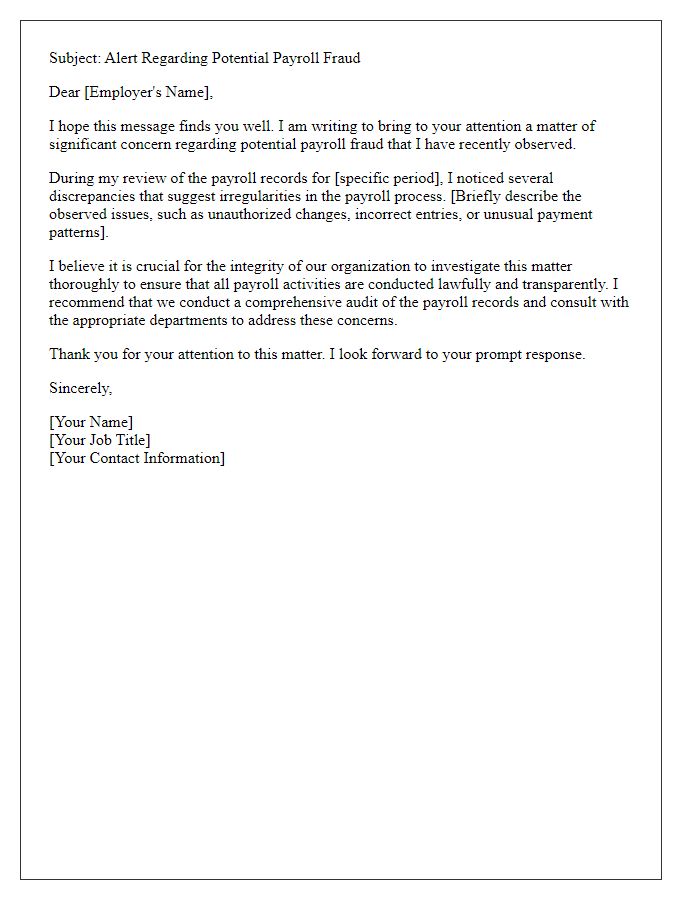

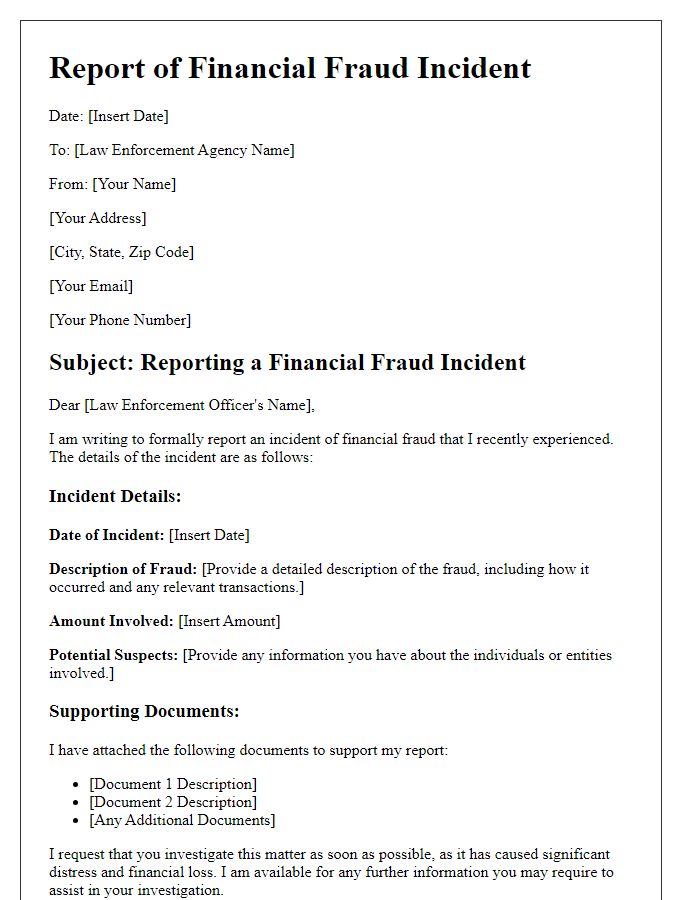

Letter Template For Addressing Financial Fraud Incident Samples

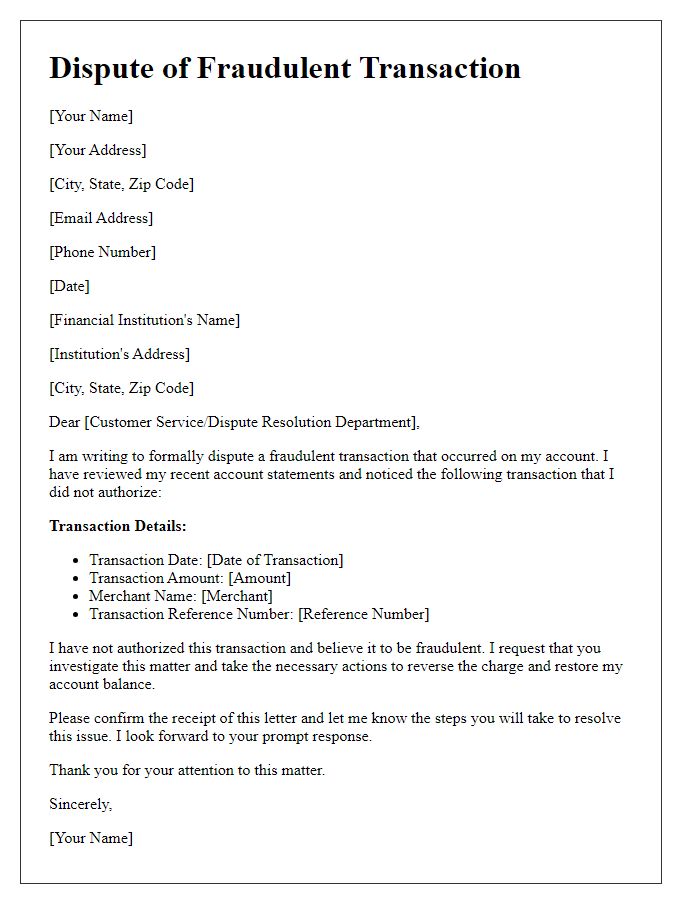

Letter template of disputing fraudulent transactions with a financial institution

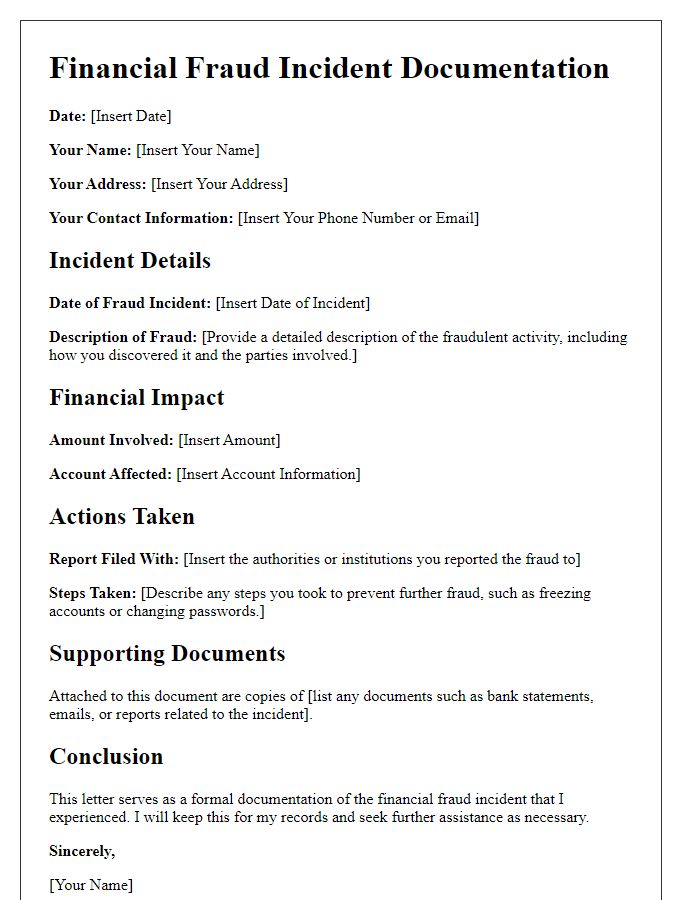

Letter template of documenting a financial fraud incident for personal records

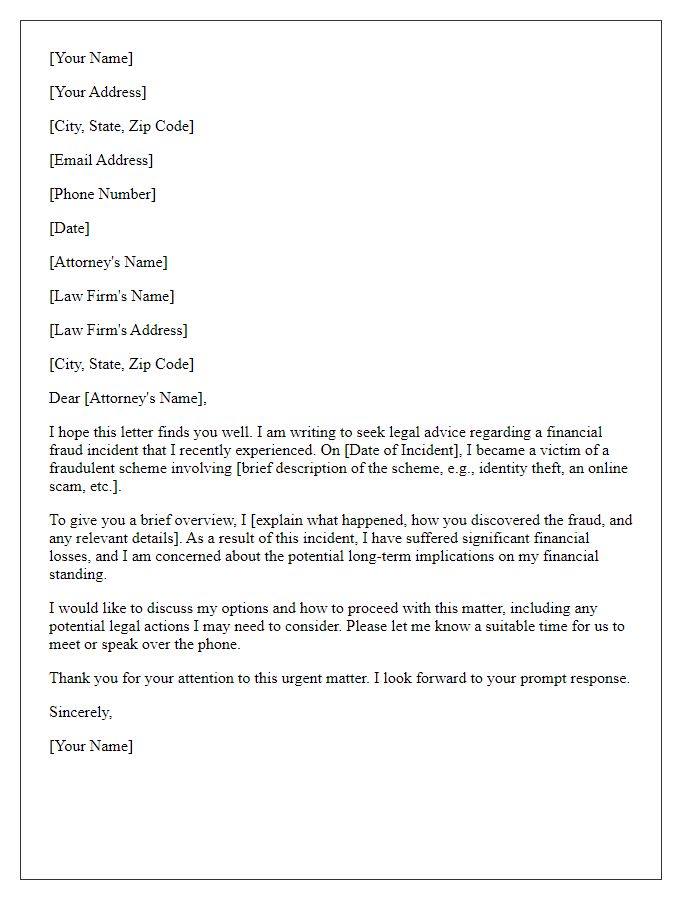

Letter template of seeking legal advice after a financial fraud incident

Letter template of communicating with a victim support service regarding financial fraud

Comments