When it comes to ensuring your credit report is accurate, it's crucial to take proactive steps to protect your financial reputation. Many individuals don't realize the significant impact that a single error can have on their credit score and overall financial health. Taking the time to verify your credit report and dispute any inaccuracies can make all the difference in securing loans, mortgages, and better interest rates. Join us as we explore the essential components of writing a letter to ensure your credit is reported accuratelyâyour financial future depends on it!

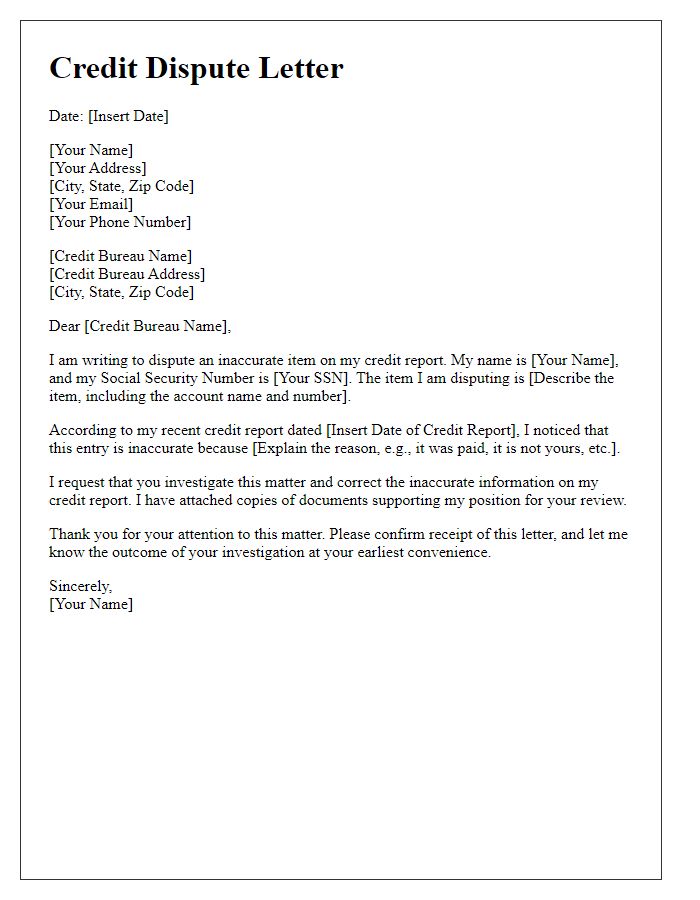

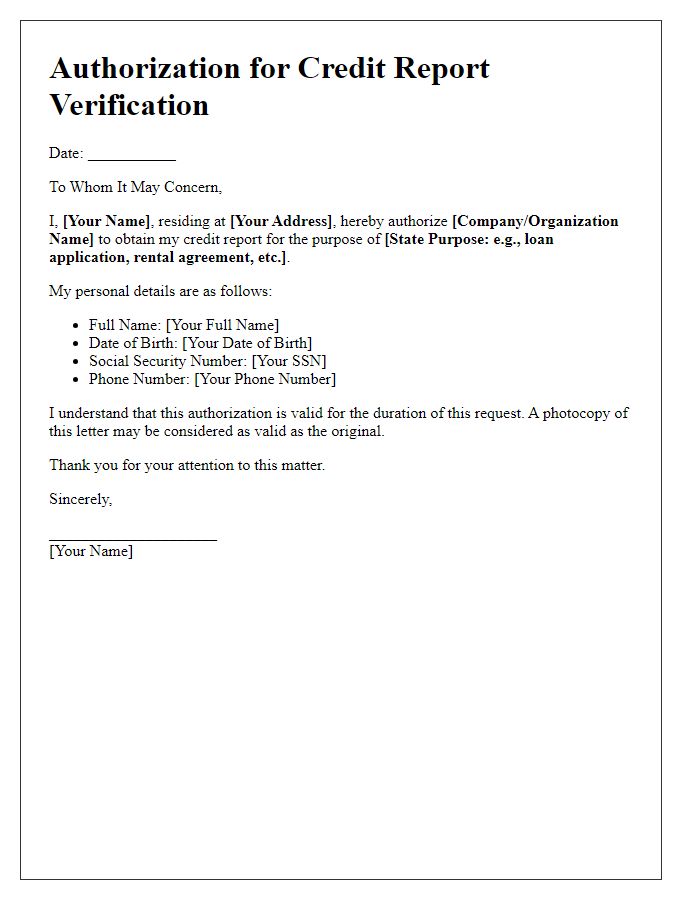

Personal identification information

Accurate credit reporting is vital for maintaining financial health, with personal identification information playing a crucial role. Full name, including middle names, plays a significant part in credit files, while Social Security Number (SSN) provides a unique identification linkage to financial history. Date of birth aids in verifying identity across credit bureaus. Address history, including current residence and previous addresses over the past five years, ensures the credit report reflects accurate residency information. Employment history, detailing current and past employers, allows for verification of income stability and consistency. Accurate personal identification reduces the risk of identity theft, ensuring that only legitimate financial activities affect credit scores, ultimately influencing loan approval, interest rates, and future financial opportunities.

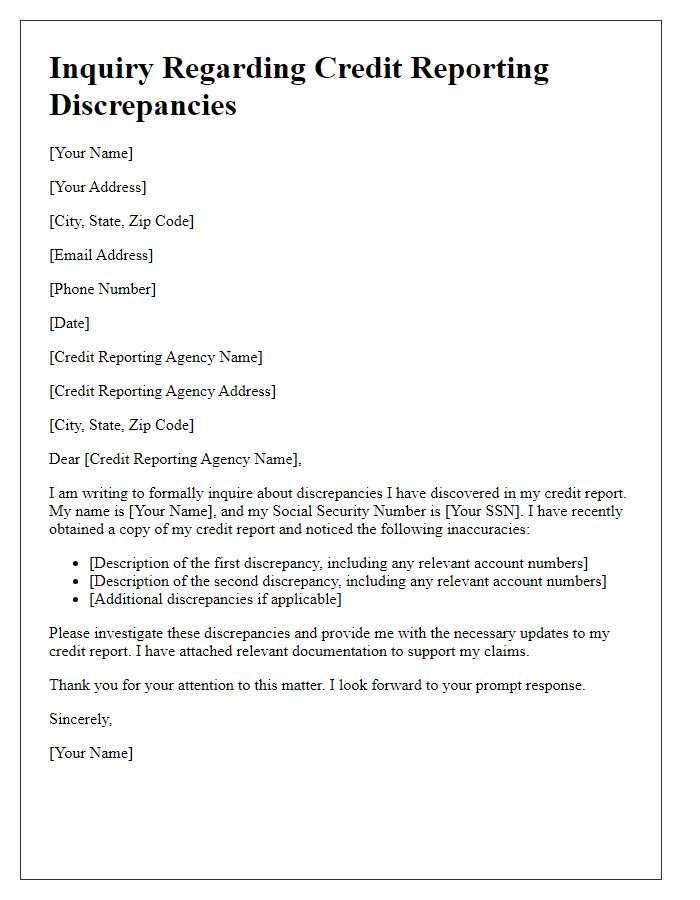

Creditor's contact details

Accurate credit reporting is crucial for financial health and involves communication with creditors like banks, credit unions, and mortgage lenders. These entities, located in various geographical regions, may include large national banks such as JPMorgan Chase and Bank of America, or smaller community banks offering personalized services. It is essential to have correct contact details, including phone numbers, email addresses, and physical addresses, for each creditor to facilitate swift resolution of any discrepancies. Errors in credit reporting can lead to significant financial repercussions, impacting interest rates, loan approvals, and even employment opportunities. Understanding creditor protocols and having access to dedicated customer service teams can expedite the process of maintaining a pristine credit report.

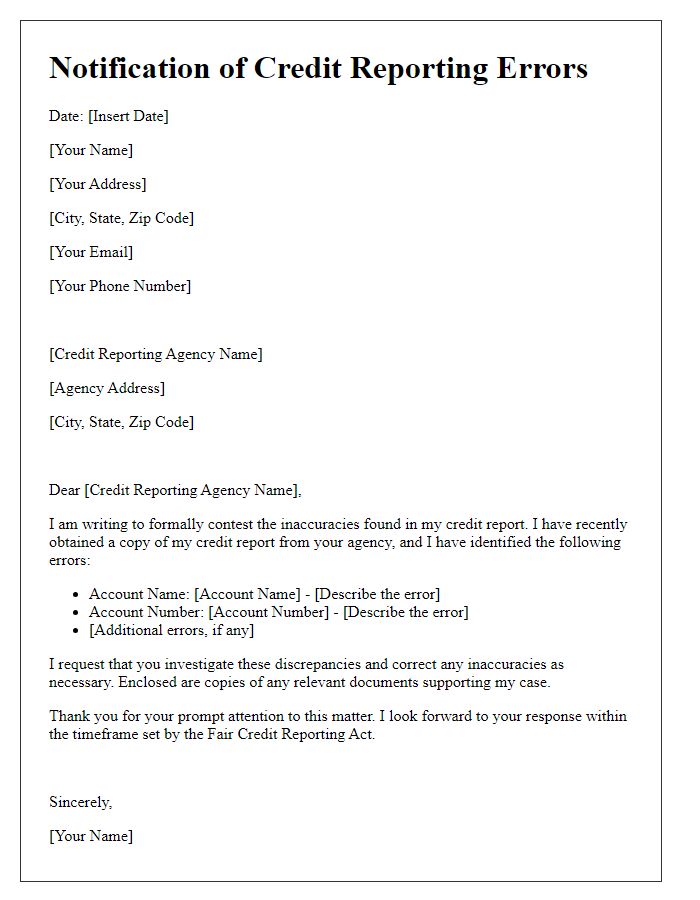

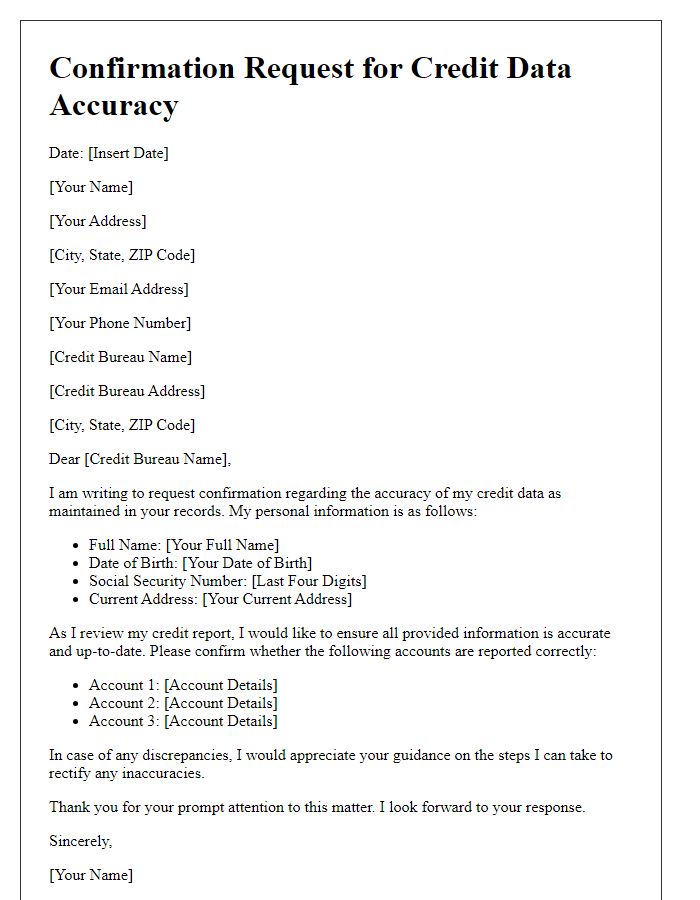

Detailed account information

Accurate credit reporting is crucial for individuals seeking favorable financial opportunities. Credit bureaus, such as Experian, Equifax, and TransUnion, compile and manage credit data across various accounts, including credit cards, loans, and mortgages. Incorrect information may result from clerical errors or fraudulent activities. Regularly reviewing accounts, highlighting account numbers, outstanding balances, payment history, and credit limits, is essential to maintain accuracy. For example, a late payment reported on a credit card account can significantly impact an individual's credit score, calculated using factors such as payment history (35% of the score), credit utilization (30%), length of credit history (15%), and new credit inquiries (10%). Discrepancies should be reported promptly to ensure corrections are made, allowing consumers to sustain a healthy credit profile and enhance their chances of obtaining loans or mortgages with favorable terms.

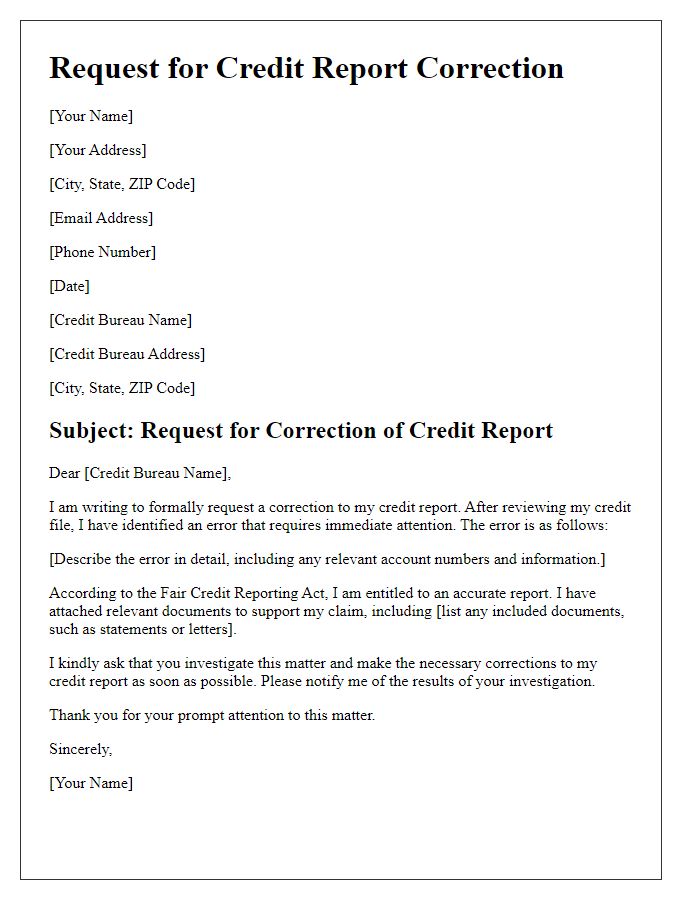

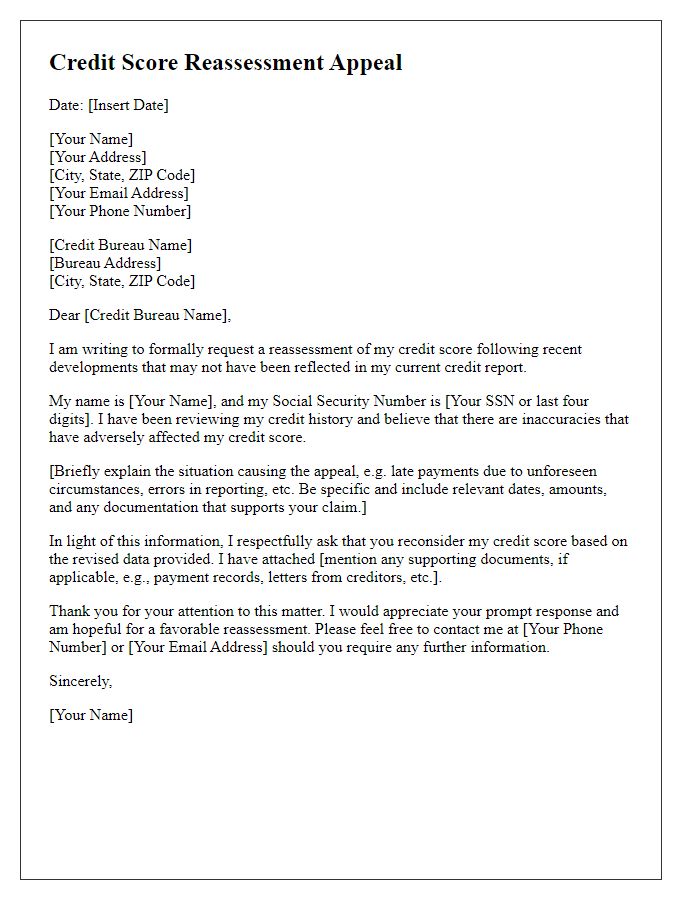

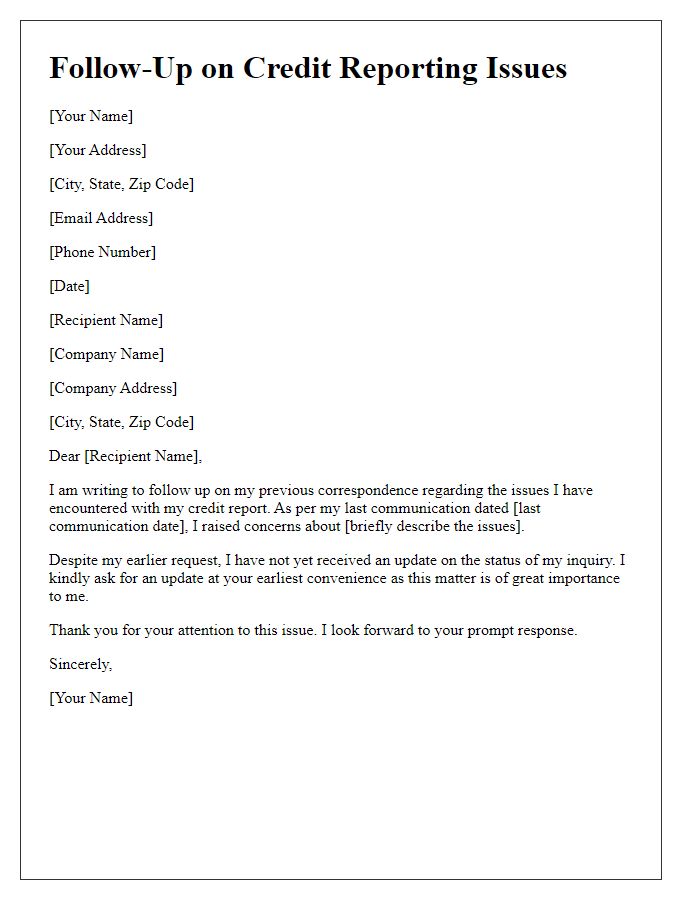

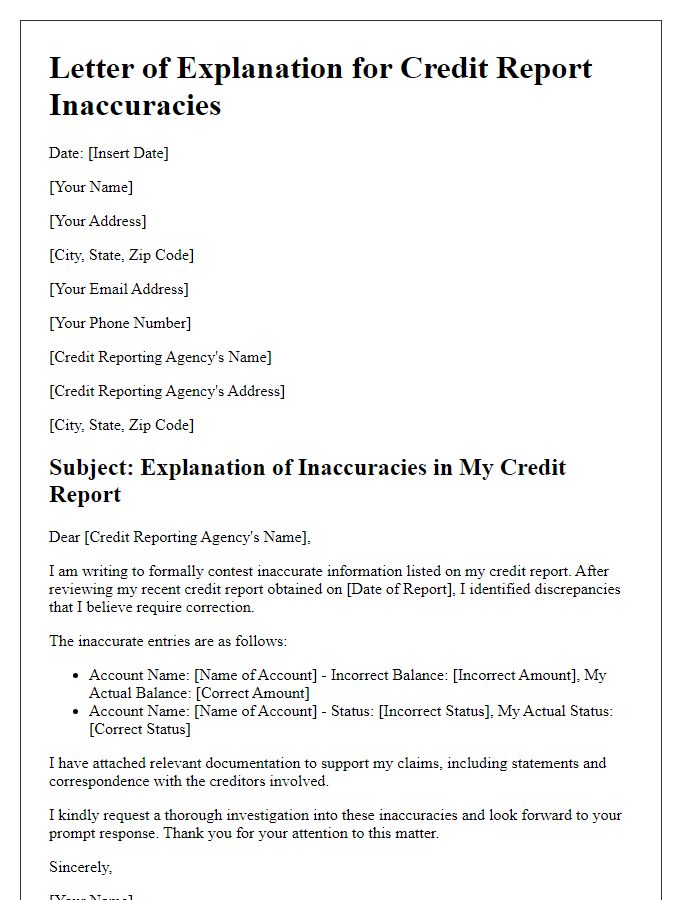

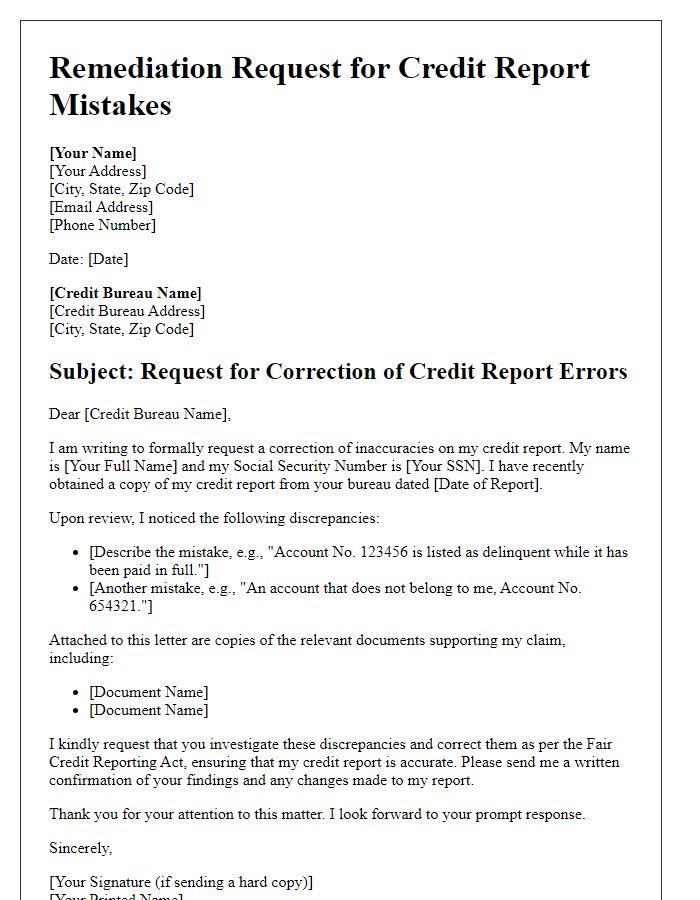

Dispute explanation and correction request

Filing a dispute for inaccurate credit reporting involves highlighting errors in credit reports from agencies such as Experian, Equifax, or TransUnion. Errors can include incorrect account information, payments reported late despite being made on time, or accounts that do not belong to an individual. A detailed explanation about the specific inaccuracies should be documented, including account numbers, dates of transactions, and the nature of the dispute. Consumers must provide supporting documentation, like bank statements or payment confirmations, to bolster their claims. A formal request for correction must be articulated to initiate investigations into the reported errors, allowing for an accurate reflection of the individual's credit profile, crucial for loans or mortgages.

Supporting documentation and evidence

Accurate credit reporting is crucial for maintaining a healthy credit score, which can impact loan approvals, interest rates, and overall financial health. Often, discrepancies arise due to outdated information or clerical errors in credit files maintained by major credit bureaus such as Experian, TransUnion, and Equifax. Supporting documentation includes financial statements, payment records, or identification that can substantiate claims regarding inaccuracies. For instance, a consumer might gather bank statements from the last six months showing consistent on-time payments for loans, which contradicts a missed payment report from a credit bureau. Additionally, attaching official letters or agreements can provide further evidence of the validity of one's claim, ensuring that the credit bureau has all necessary information to rectify any potential errors. Timely resolution of such inaccuracies can prevent long-term negative consequences on an individual's credit profile.

Comments