Are you struggling with unresolved issues concerning your creditors? Navigating the world of financial disputes can be daunting, but understanding how to articulate your concerns can make all the difference. In this article, we'll guide you through crafting a formal creditor complaint letter that effectively communicates your issues while maintaining a professional tone. Join us as we explore essential tips and templates to empower you in addressing your creditor complaints with confidence!

Creditor's Contact Information

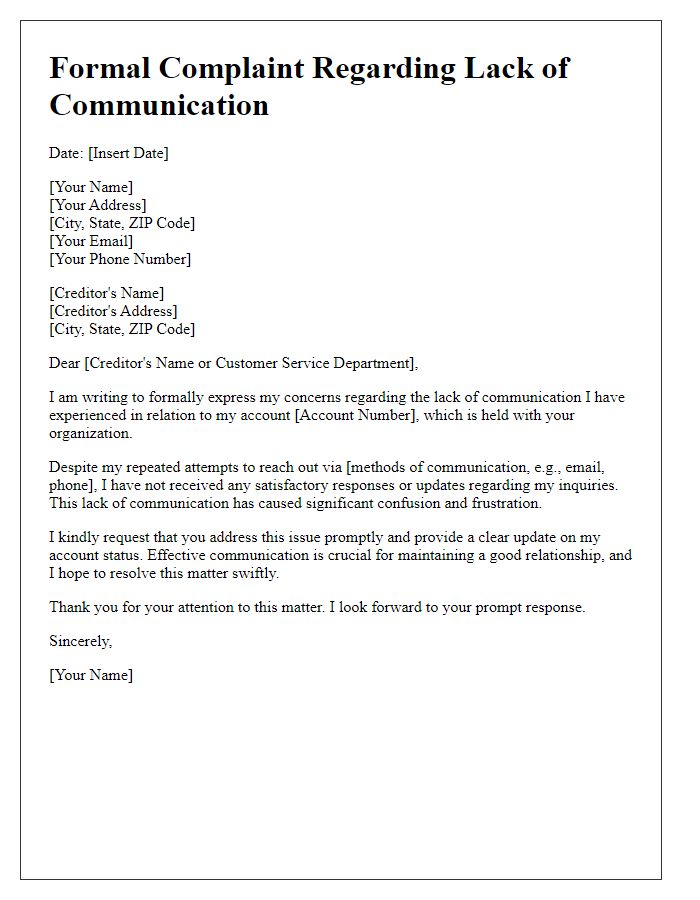

Formal creditor complaints often involve a variety of details that can significantly affect the resolution process. Including the creditor's contact information is crucial for clear communication. The creditor's contact information typically consists of the full name of the creditor organization, mailing address, and a direct phone number or email address for inquiries. This information is essential for facilitating discussions regarding account discrepancies, payment issues, or potential resolutions. Additionally, including the account number associated with the creditor can streamline the identification process, allowing for expedited responses and effective problem-solving. Properly formatting and verifying this information enhances the professionalism and clarity of the complaint.

Account Details and Reference Numbers

In formal creditor complaints, account details and reference numbers play a crucial role in identifying specific cases. Account numbers, often 12 to 16 digits long, serve as unique identifiers for individual customers within the financial system. Reference numbers, which may range from 8 to 10 characters, are typically assigned to specific transactions or issues, facilitating tracking and resolution by creditors. Clear communication of these identifiers, along with specific transaction dates and associated amounts, is essential for an effective resolution process. Banks, such as Wells Fargo or JPMorgan Chase, may require detailed account statements or transaction histories for thorough investigation of complaints related to billing discrepancies or unauthorized charges. Prompt and accurate inclusion of this information expedites the review and response from the creditor.

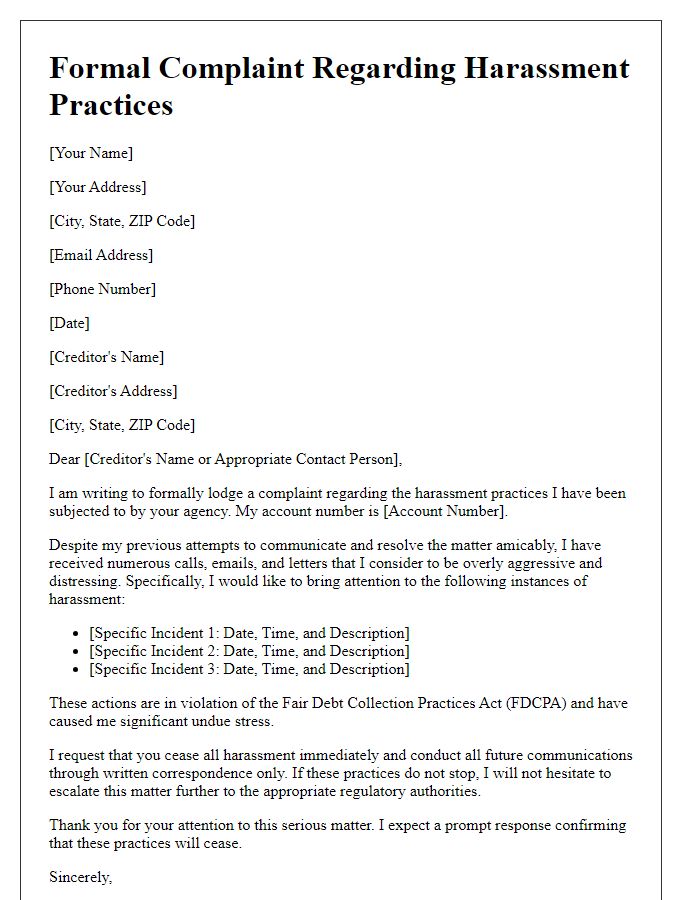

Detailed Description of the Complaint

Creditors sometimes engage in unfair practices, leading to disputes and complaints. For example, a creditor's collection agency may falsely report a delinquent payment date, misleading consumers like John Doe of Springfield, Illinois. In March 2023, John received a notice claiming a $2,000 balance due from a medical debt incurred in 2021. However, John had settled the debt in full, providing receipts from his healthcare provider. Additionally, the agency attempted to contact him multiple times outside legal hours, violating the Fair Debt Collection Practices Act which restricts communication times. Such actions can cause significant emotional distress, harm credit scores, and violate consumer rights. The impact of these practices can be profound, emphasizing the need for formal acknowledgment and remediation from regulatory bodies.

Desired Resolution or Action

Formal complaints regarding creditor issues often center on disputes about debt amounts, interest rates, or reporting inaccuracies. Clear communication is vital. Specific actions requested may include a correction of erroneous information on credit reports, a reduction in interest rates, or clarification of charges. Timelines for response should be standardized; typically a 30-day period is customary. Documentation must be complete, including account numbers, dates of agreements, and relevant correspondence. Providing supporting evidence enhances credibility, ensuring the complaint is taken seriously.

Relevant Supporting Documents or Evidence

In the context of addressing a formal creditor complaint regarding unresolved financial obligations, it is essential to gather and present relevant supporting documents or evidence to bolster your case. Important documents include copies of account statements, loan agreements, and correspondence with the creditor, showcasing any transactions related to the disputed debt. Additionally, records of payment confirmations, such as bank statements or receipts, serve as critical evidence of compliance with payment terms. Integration of documentation such as credit reports can also provide insight into the account's standing and validate claims. Statistical data on consumer rights and repayment agreements, perhaps from the Fair Debt Collection Practices Act (FDCPA), could enhance the credibility of the complaint. Ensuring all documents are dated and categorized clearly is vital for facilitating a thorough review by the creditor.

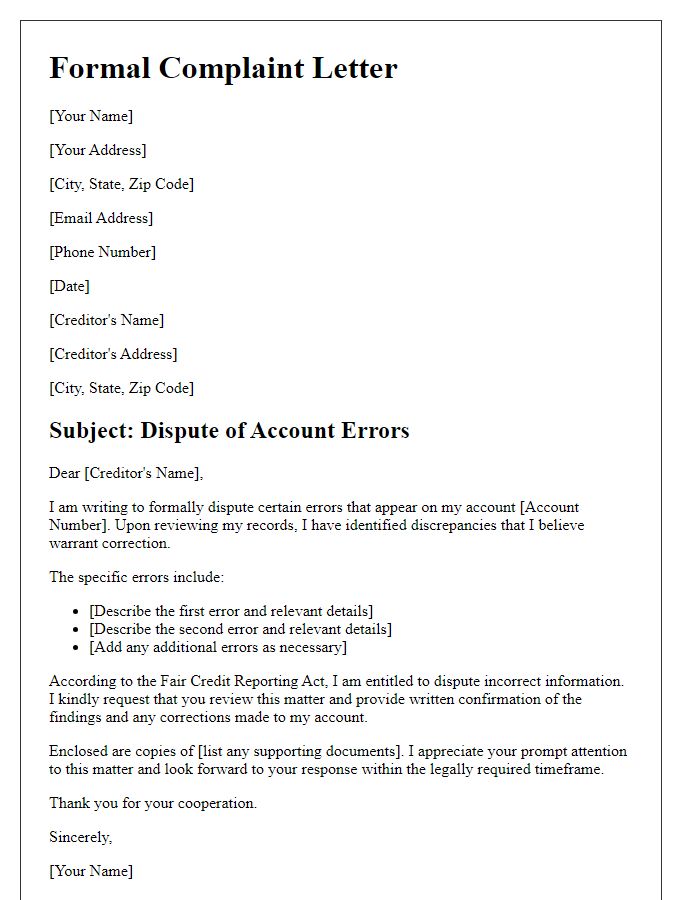

Letter Template For Formal Creditor Complaint Samples

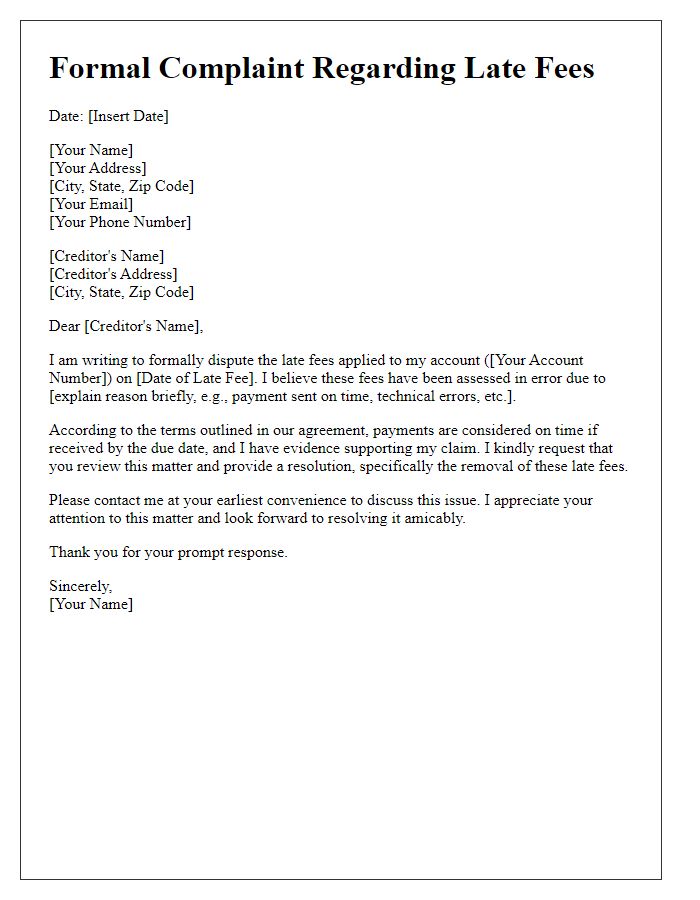

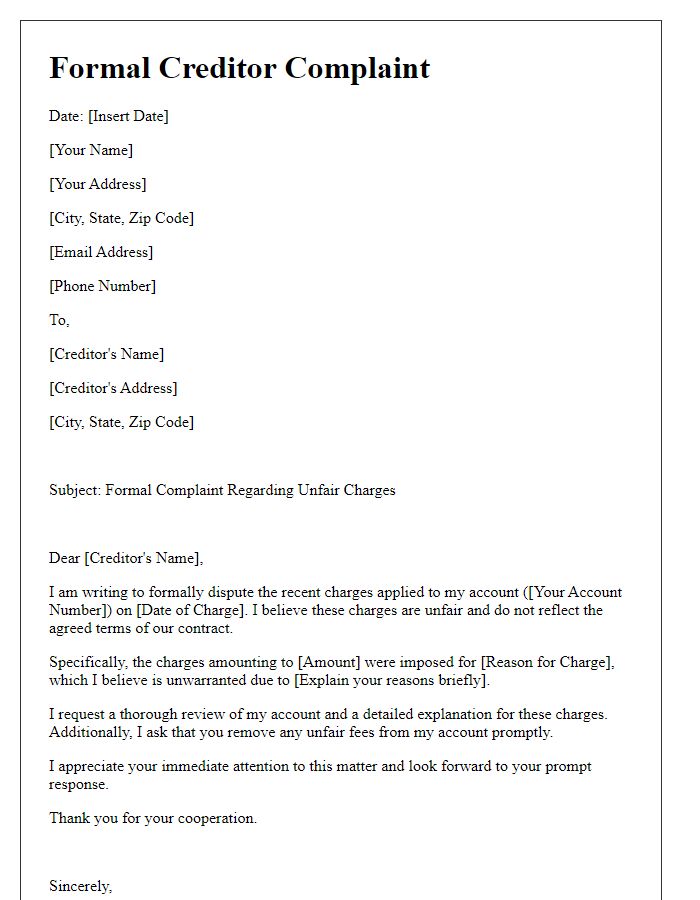

Letter template of formal creditor complaint seeking resolution on late fees.

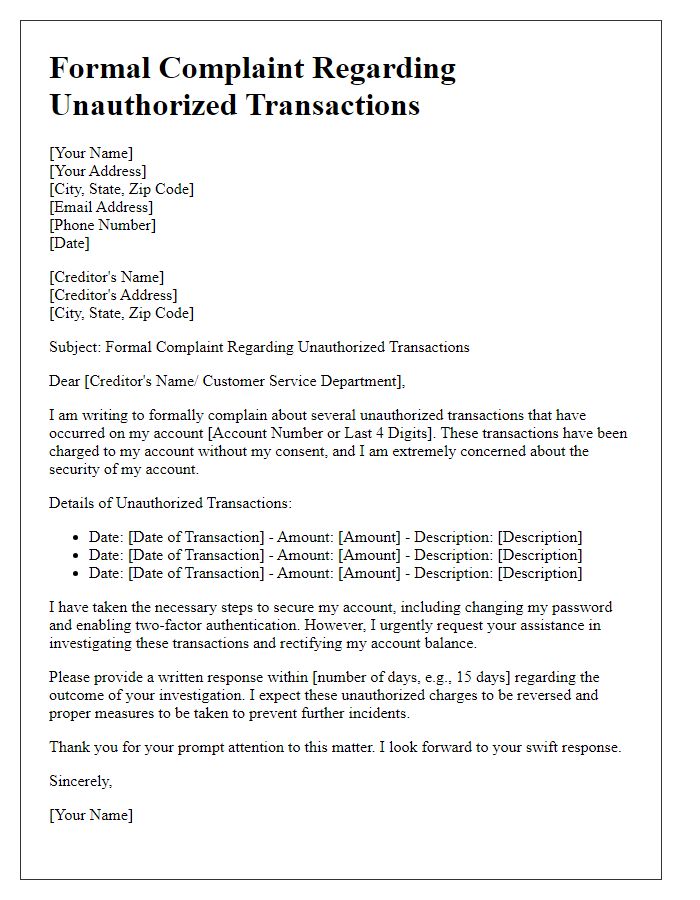

Letter template of formal creditor complaint about unauthorized transactions.

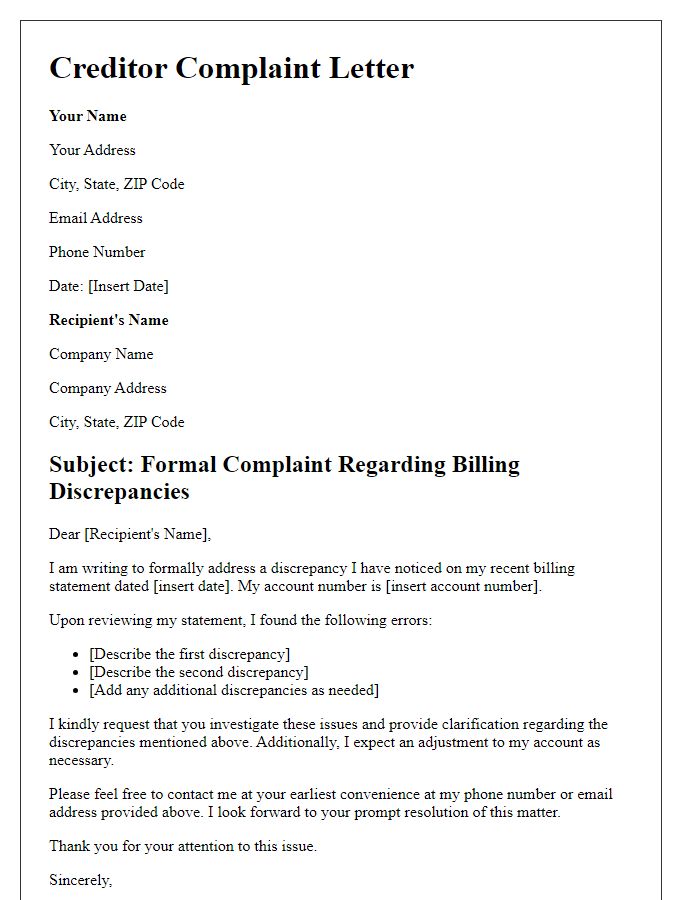

Letter template of formal creditor complaint addressing billing discrepancies.

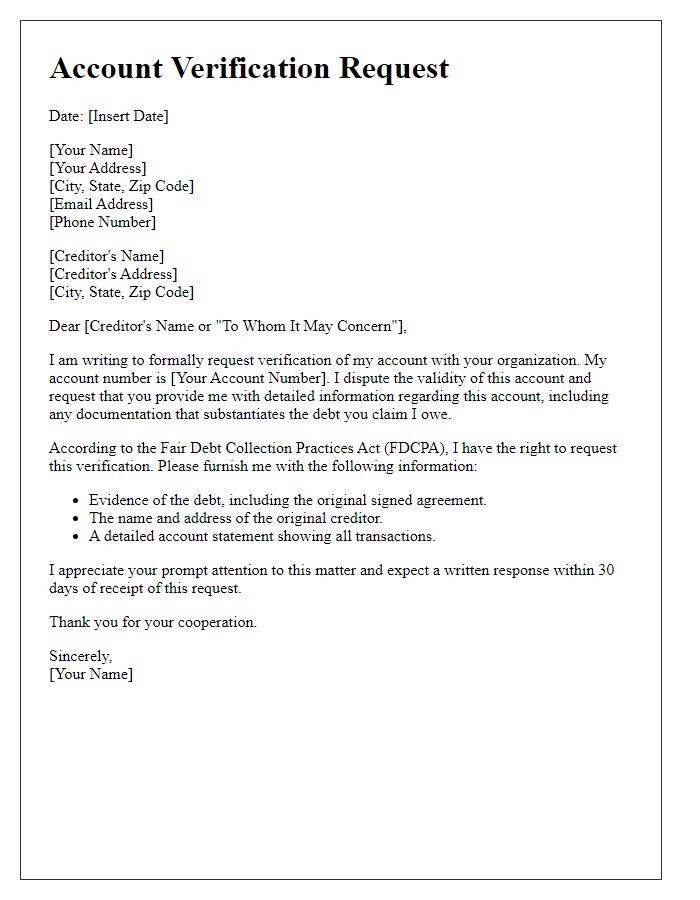

Letter template of formal creditor complaint requesting account verification.

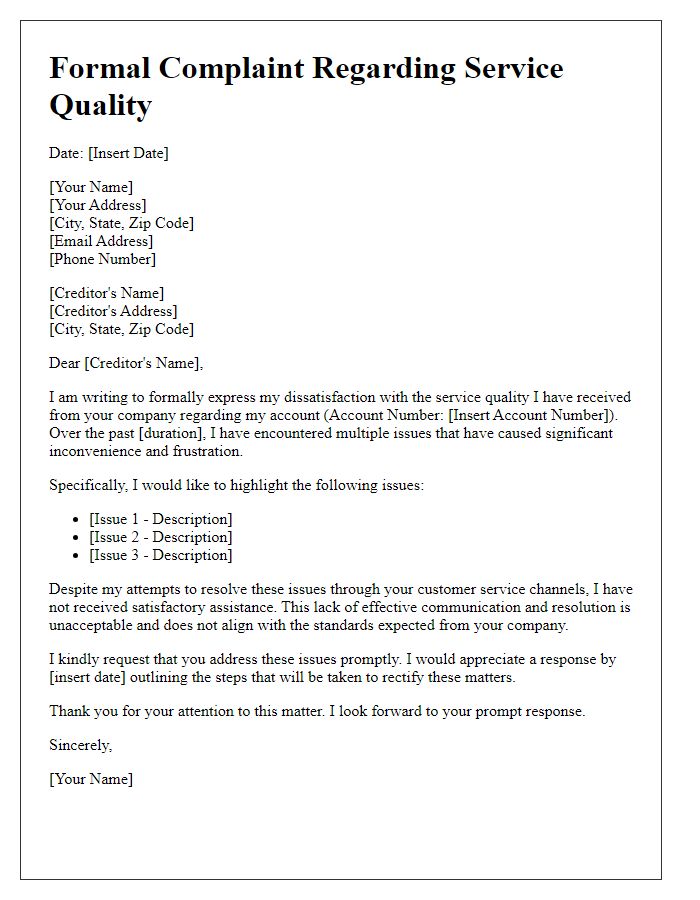

Letter template of formal creditor complaint about service quality issues.

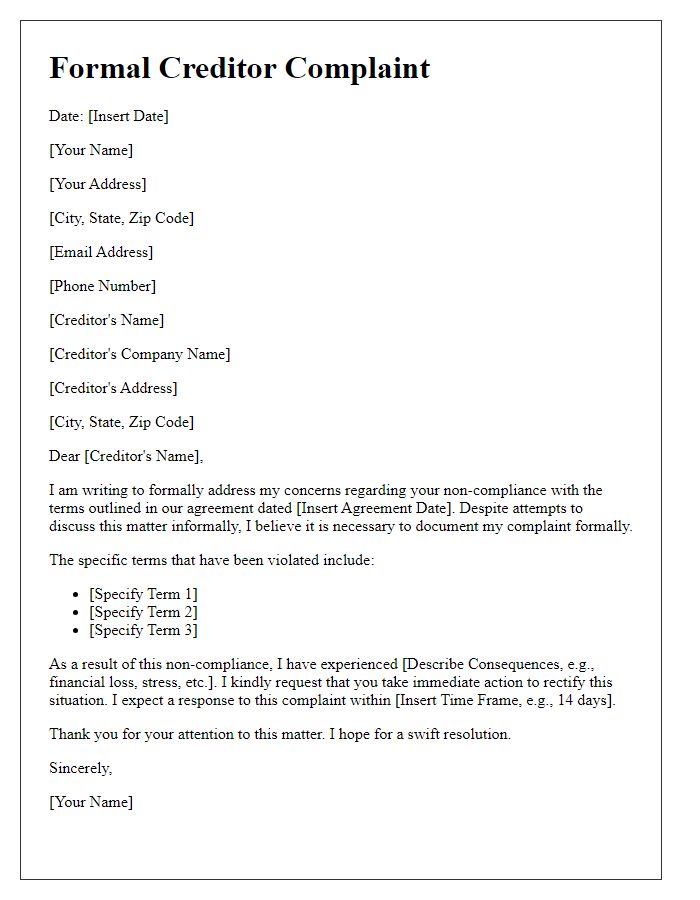

Letter template of formal creditor complaint for non-compliance with terms.

Comments