If you're looking to secure credit, one essential document you may need is a proof of residency letter. This simple yet powerful letter provides a clear statement of where you live, showcasing your stability and reliability to lenders. Whether you're moving into a new apartment or have recently started renting a house, having this proof can significantly enhance your credit application. Curious about how to craft the perfect proof of residency letter? Keep reading to learn more!

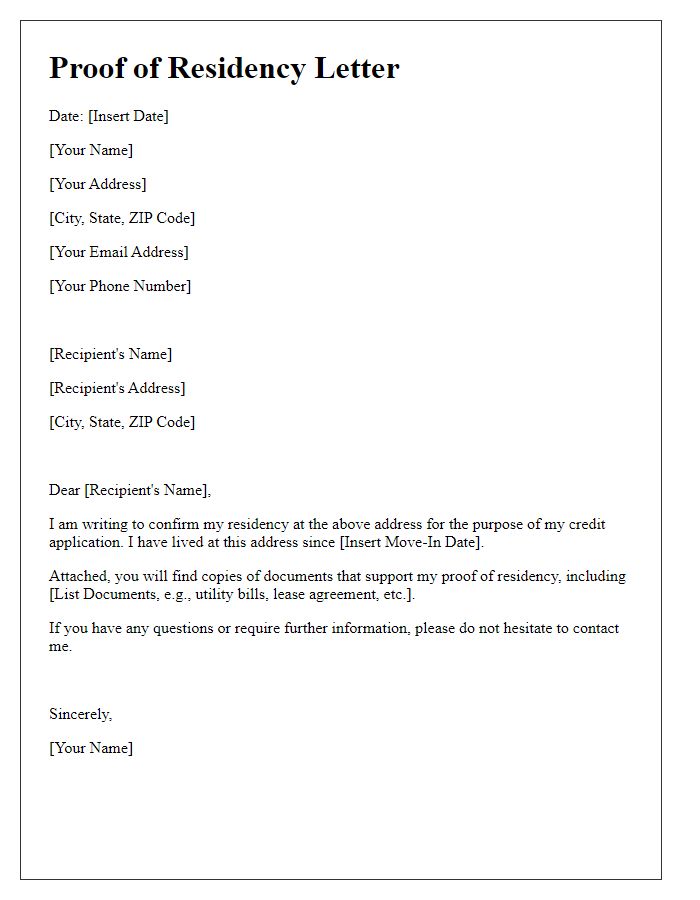

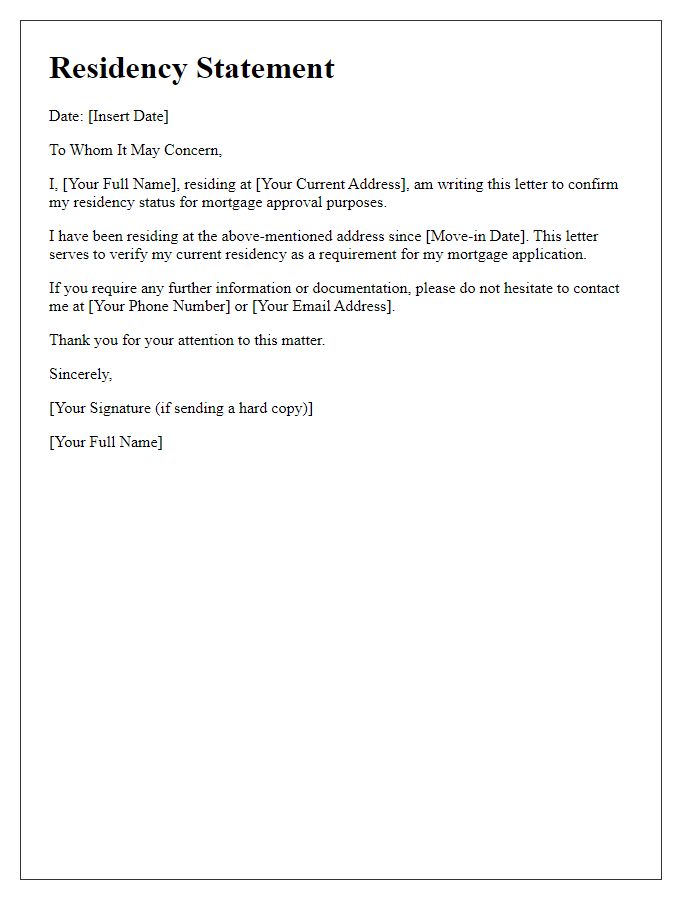

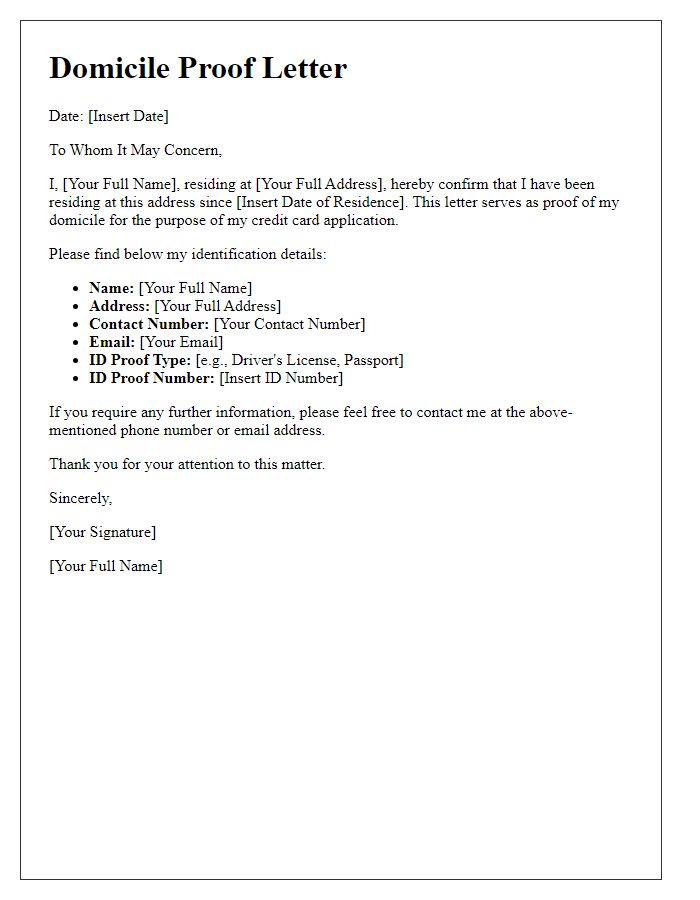

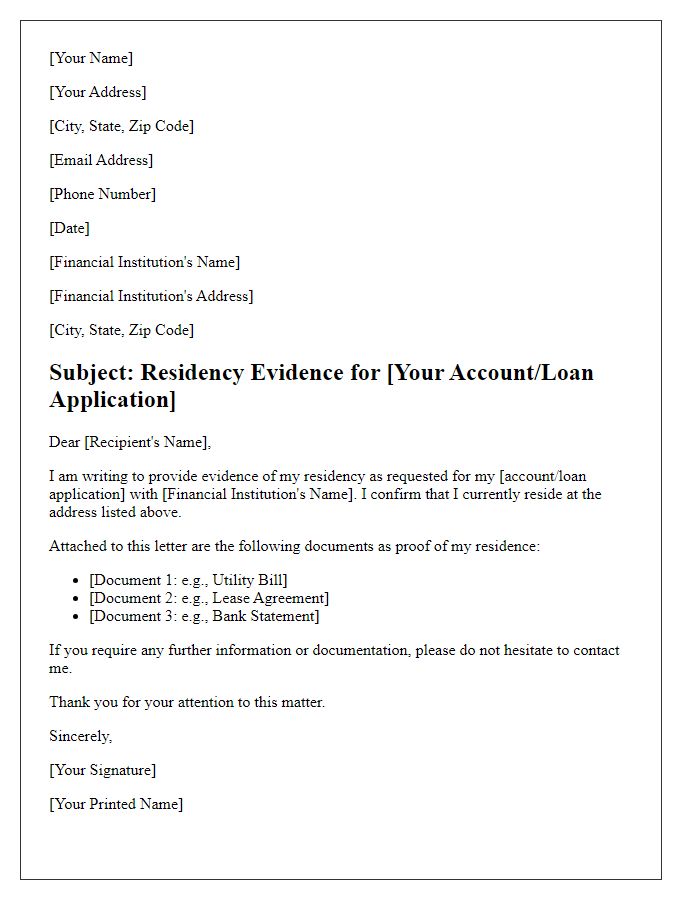

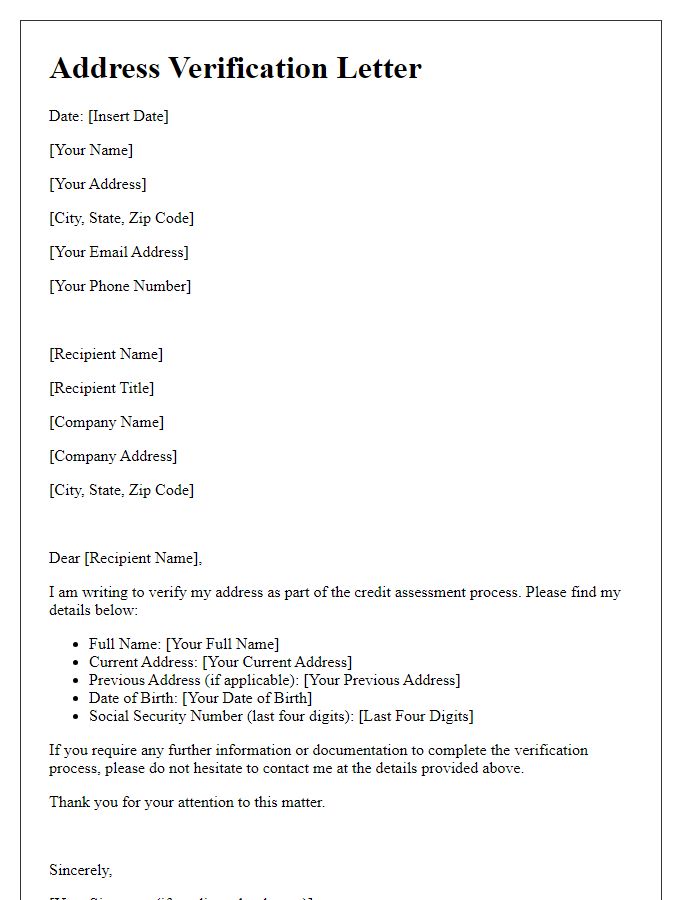

Full Name and Contact Information

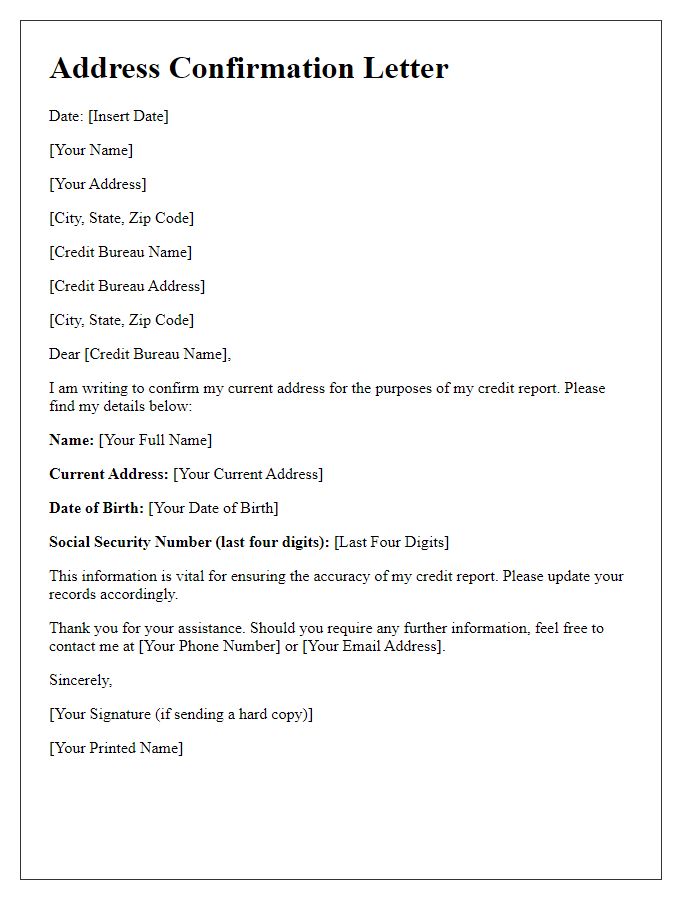

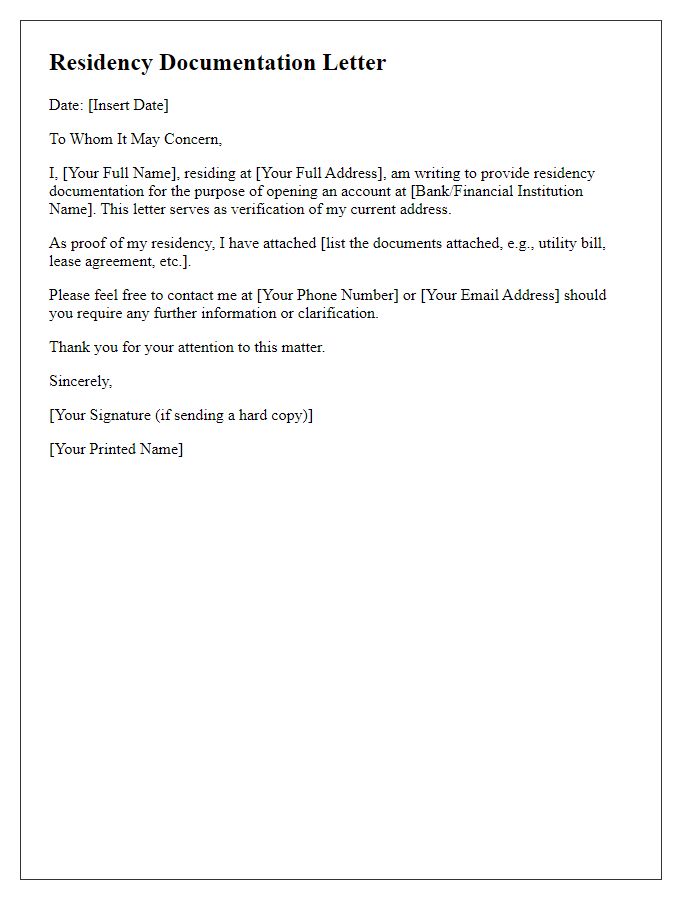

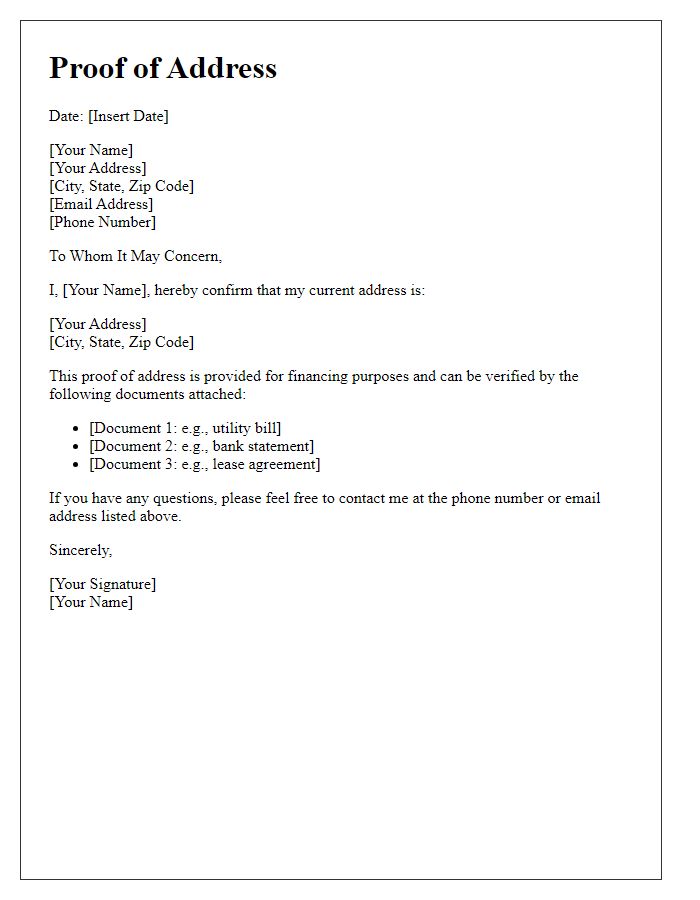

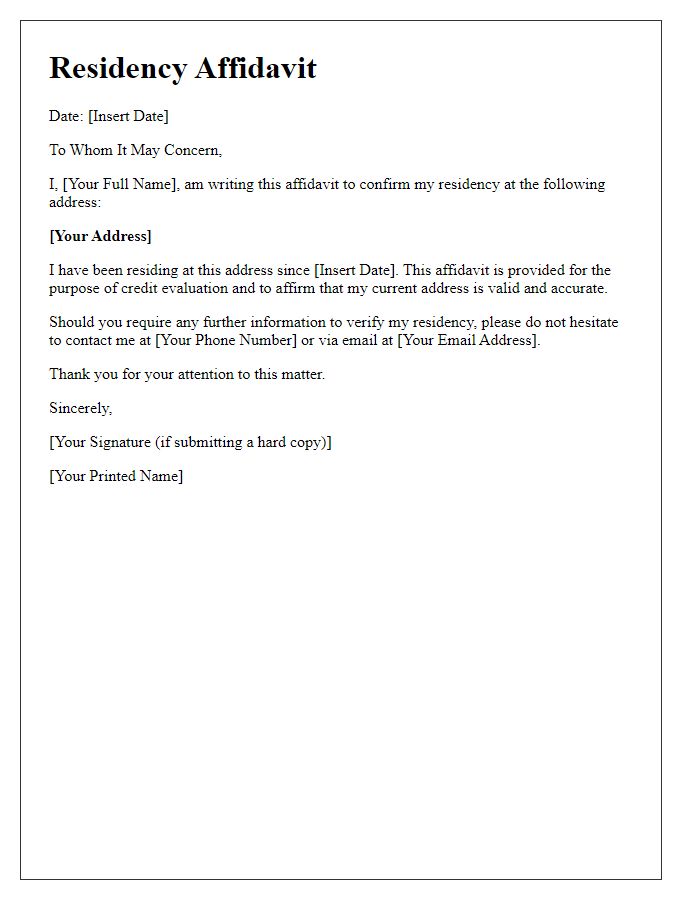

Proof of residency documents often include essential details such as full name, current address, and date of issuance. Utility bills (electricity, water, or gas) from established service providers typically serve as credible evidence. Official correspondence from banks (trustworthy financial institutions like Chase or Bank of America) featuring the applicant's name and address also affirms residency. Government-issued identification, such as a driver's license, should match the stated address. Mortgage statements or lease agreements from recognizable property management brands can further strengthen the claim. Collecting these elements ensures robust verification for credit applications.

Current Address and Residency Duration

Proof of residency is essential for establishing a current address, particularly for credit applications. Residents must provide documentation such as utility bills, lease agreements, or bank statements. Utility bills from companies like Pacific Gas and Electric or Con Edison must display the name of the resident alongside the address, confirming residency duration. Lease agreements typically require signatures and the duration of the lease, ensuring validity for at least one year. Furthermore, bank statements must reflect transactions occurring at the current address within the last three months to serve as valid proof. This documentation helps financial institutions confirm identity and mitigate risks associated with lending.

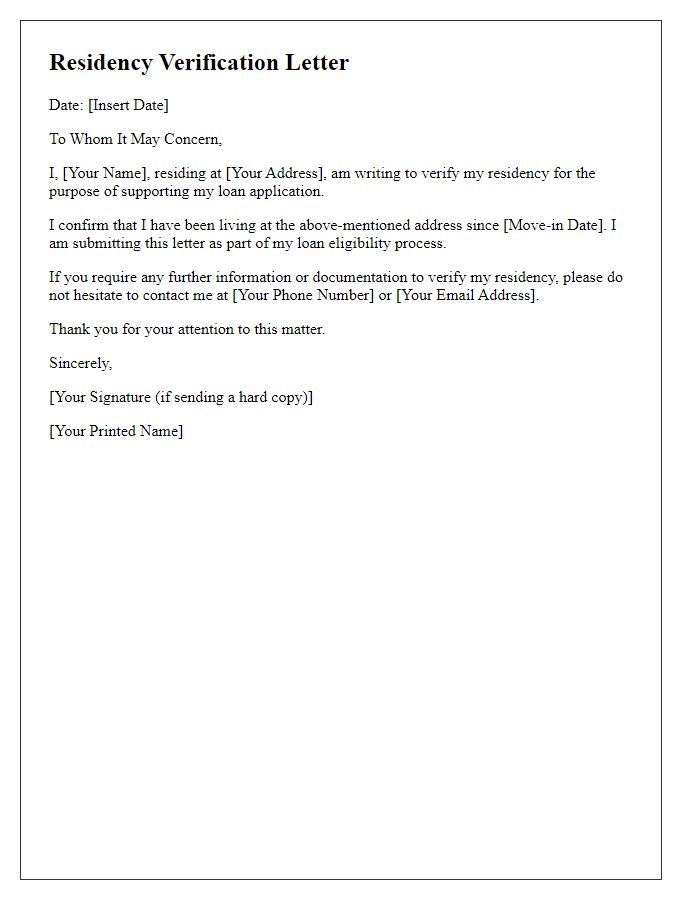

Purpose Statement and Intended Use

Proof of residency documents are essential for establishing an individual's permanent address, particularly in the financial sector, such as for credit applications. Banks and lending institutions often require a current utility bill or government-issued ID that clearly displays the name and address of the applicant to verify residency. In certain cases, lease agreements or official correspondence from government agencies can also serve as acceptable proof. This documentation ensures that lenders can confirm the applicant's identity and address, ultimately reducing the risk of fraud and facilitating legitimate access to credit products. Additional criteria may include a recent date, typically within the last 30 days, to ensure accuracy in residency verification.

Verification Authority and Relationship

A proof of residency document serves as an essential verification tool for financial institutions to confirm a person's address, typically used when applying for credit. Key elements often included in such documentation are the individual's full name, current residential address, and date of issuance. Entities that may issue valid proof of residency include government agencies (for instance, the Department of Motor Vehicles in the United States), utility companies that provide electricity or water services, and banking institutions that maintain a record of account holder addresses. Details accompanying the document, such as account numbers or service addresses, should be clearly visible to establish credibility. Additionally, recent dates (not older than three months) are crucial in ensuring that the residency status is still accurate and applicable for the intended credit application.

Date and Signature

A proof of residency document often includes essential details confirming a person's address to satisfy legal or financial verification requirements. A utility bill (such as water, gas, or electricity), dated within the last two months, often serves this purpose, displaying the person's name and the residential address. Alternatively, official documents from local government (such as tax records or voter registration cards) may also be common forms of proof. It is crucial that the date on the document indicates recent activity, while a legible signature may be required in some cases to validate authenticity, depending on institutional requirements.

Comments