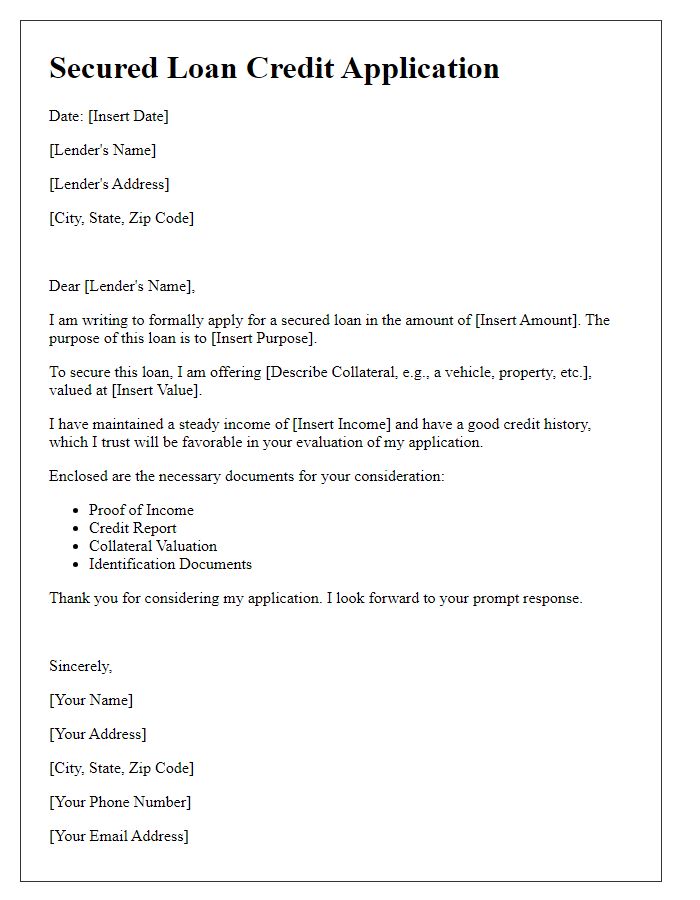

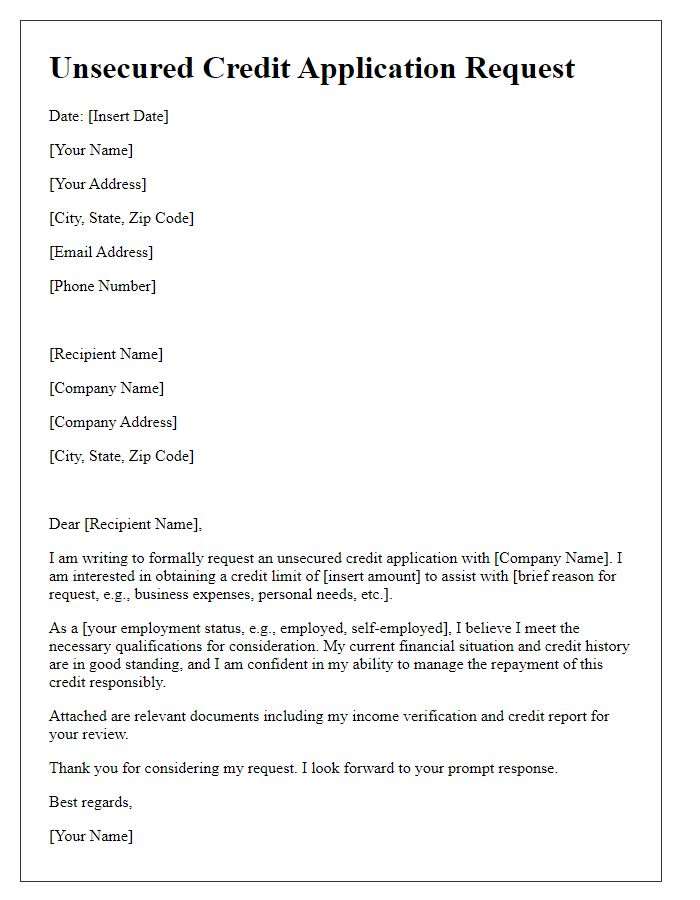

Are you considering applying for credit but unsure where to start? Crafting the perfect letter for your credit application can set you apart and give you the best chance for approval. In this article, we'll walk you through a simple yet effective template that highlights your qualifications and intentions. Join us as we explore the essential elements of a successful credit application letter!

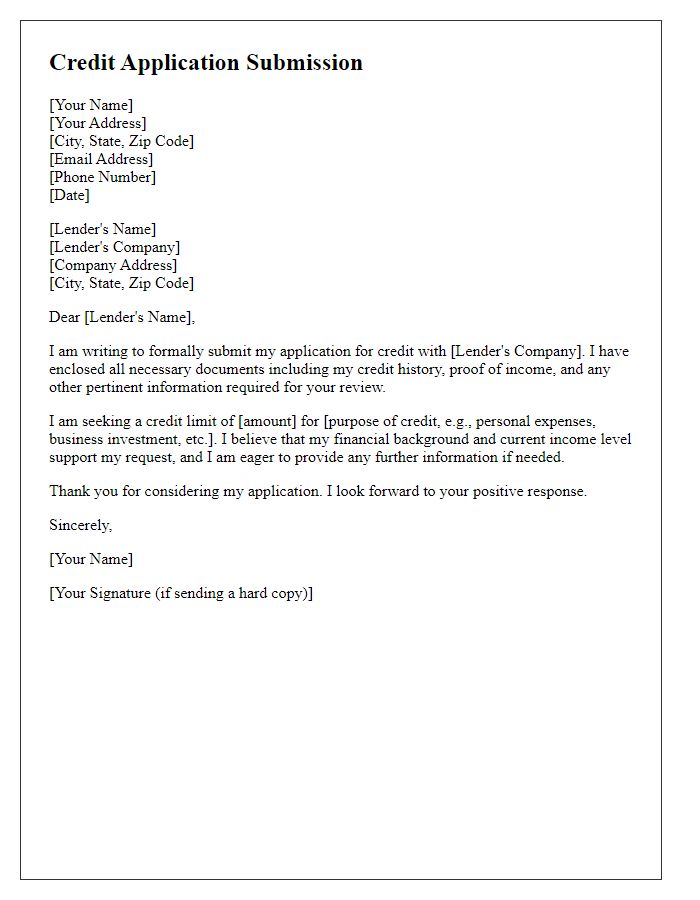

Applicant's full name and contact information

The applicant, Johnathan Smith, residing at 123 Maple Street, Springfield, with a contact number of (555) 123-4567, seeks a credit application. This request involves a comprehensive review of financial history, employment status, and credit score, crucial for determining eligibility for a credit line. The current credit score stands at 720, reflecting responsible management of previous debts, including a car loan from First National Bank and a secured credit card from Apex Financial. This submission is essential for potential financial commitments or acquisitions, intending to enhance purchasing power for home improvements or educational purposes.

Credit amount requested and purpose

A credit application submission often includes critical details such as the requested credit amount (which can vary widely, ranging from a few hundred to several thousand dollars, depending on individual circumstances) and the purpose of the request (like financing a home renovation, consolidating debt, or purchasing a vehicle). Clear articulation of the intended use of the funds helps financial institutions evaluate the risk and ensure alignment with borrower needs. For instance, home renovations could increase property value, while debt consolidation may improve financial stability. This information aids lenders in making informed lending decisions.

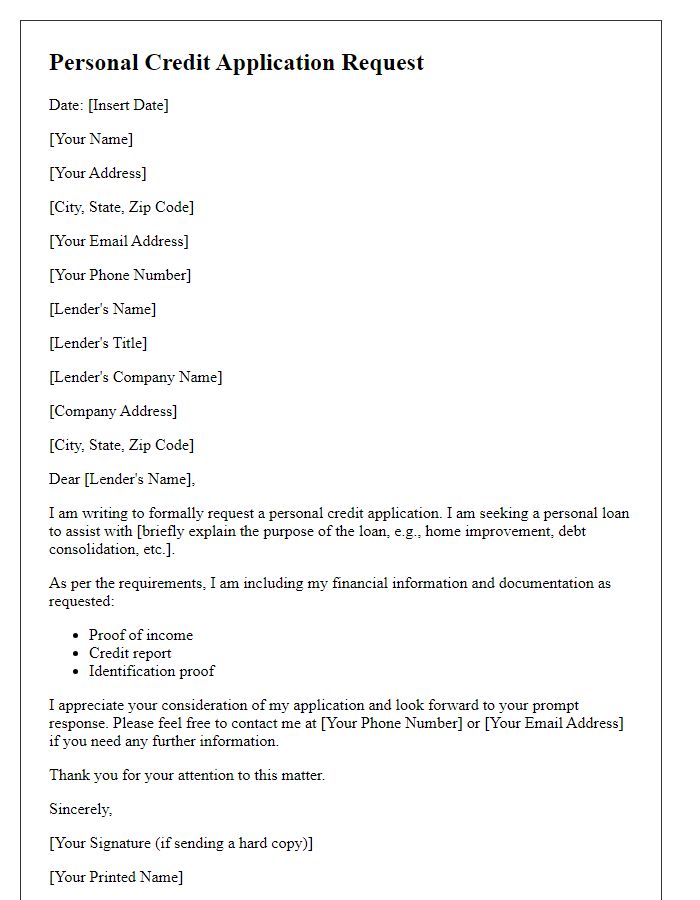

Financial statements and credit history

Financial statements play a crucial role in the credit application process for individuals or businesses seeking financing from lenders. These documents, which typically include the balance sheet (showing assets and liabilities), income statement (reflecting revenues and expenses), and cash flow statement (indicating liquidity), provide a comprehensive view of financial health. Lenders examine these statements to assess the applicant's ability to repay the loan. Additionally, a credit history report, often obtained from agencies like Experian, TransUnion, or Equifax, offers insights into past borrowing behavior, including timely payments and defaults. Good credit scores (ranging from 300 to 850, with higher being better) significantly enhance the likelihood of loan approval and favorable interest rates. Understanding these elements is essential for applicants aiming to secure financing and optimize their financial opportunities.

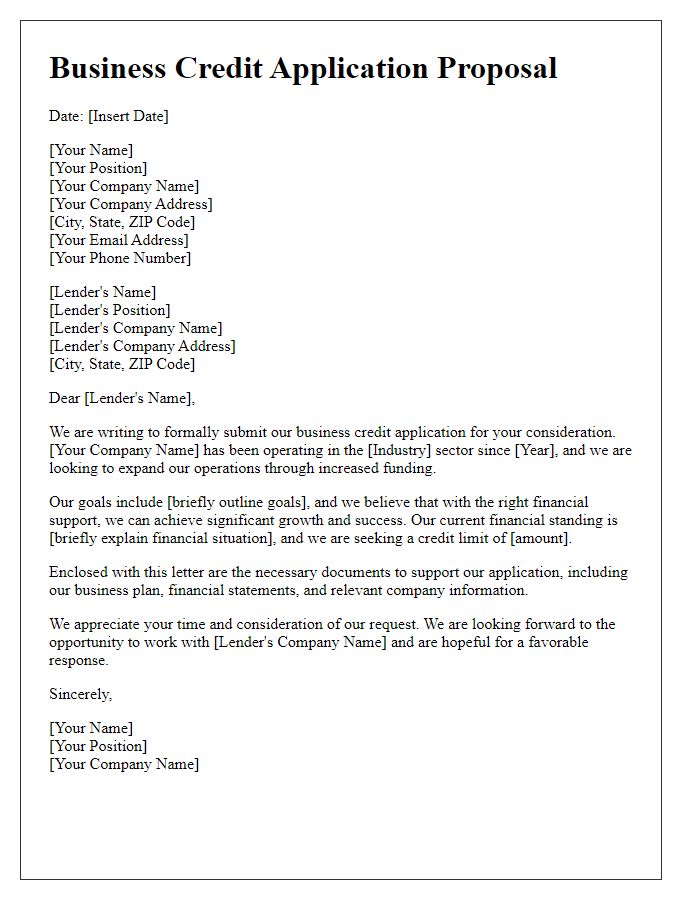

Business or employment details

When applying for credit, it is essential to include comprehensive business or employment details to facilitate an informed decision by the lender. This includes the business name, such as "ABC Innovations LLC," along with its registration number, like "123456789," and the physical address located at "456 Business Ave, Suite 100, New York, NY 10001." Provide the nature of the business, describing it as a technology startup focused on software development. Include the length of time in operation, indicating it has been established for five years. If self-employed, mention the title, such as "Founder and CEO," along with relevant income information, for instance, an annual revenue of "$250,000." Employment details should also include current employer, if applicable, stating the name "XYZ Corp" with a position held, like "Senior Developer," and length of employment, totaling "three years" to give potential lenders a comprehensive understanding of financial stability and the operational background of the applicant.

Authorization for credit check and signature

A comprehensive credit application must include crucial elements like authorization for a credit check and the applicant's signature. The authorization allows financial institutions, such as banks or credit unions, to access an individual's credit report from agencies like Experian, TransUnion, or Equifax. This report contains vital information regarding credit history, including outstanding debts, payment history, and credit limits, which all assist lenders in assessing creditworthiness. Additionally, the applicant's signature validates the application, confirming that all provided details are accurate and that the applicant understands the terms of the application process. Such details ensure compliance with regulations like the Fair Credit Reporting Act (FCRA) and build trust between the applicant and the lender.

Comments