Hey there! If you've recently experienced a loss of income and are worried about how it might impact your credit, you're not alone. Many people face similar challenges, and it's important to understand how financial changes can affect your credit score. In this article, we'll explore the nuances of income loss, credit ratings, and what steps you can take to mitigate any negative effects on your financial health. So, let's dive in and discover how to navigate this tough situation together!

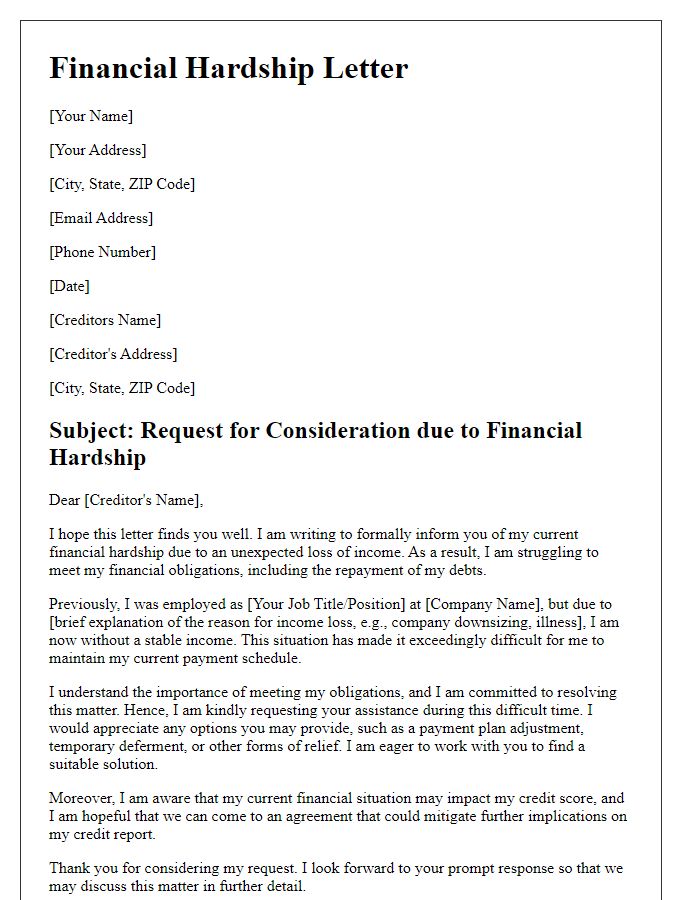

Accurate personal information

Income loss impacts credit scores significantly, especially when financial obligations remain unmet. When individuals experience disruptions in steady income, typically due to events like job layoffs or medical emergencies, it can lead to missed payments on loans and credit cards, critical factors that credit scoring models, such as FICO, evaluate. A missed payment can drop a credit score by as much as 100 points, depending on the individual's prior credit history. Additionally, high credit utilization ratios, resulting from unpaid balances, can further compound the negative impacts on credit history. Financial institutions, such as banks and credit unions, monitor these credit scores regularly, influencing future lending decisions and interest rates. Timely updates and accurate personal information on loans and accounts become vital in mitigating the adverse effects of income loss on credit standing.

Clear explanation of income loss

Income loss from employment disruption can significantly influence credit scores and overall financial stability. A sudden reduction in earnings, such as a job loss or decreased hours due to economic downturns, affects the ability to meet financial obligations like mortgage payments, credit card bills, or personal loans. According to recent studies, nearly 40% of individuals experiencing income loss report difficulties paying their monthly expenses. Additionally, factors such as rising unemployment rates (peaking at 14.8% in April 2020 in the United States) amplify the likelihood of missed payments, severely impacting credit histories maintained by agencies like Experian or Equifax. This situation creates a cycle where diminished income leads to increased debt and poor credit ratings, ultimately affecting future borrowing opportunities and interest rates.

Impact on credit and finances

Income loss significantly impacts credit scores and overall financial stability. Unemployment rates, such as the 6.2% peak during the 2020 economic downturn, illustrate the widespread effects on households. Missed payments on credit accounts can occur when income drops, leading to late fees and derogatory marks. According to FICO, a payment that is 30 days late can decrease a credit score by up to 110 points. Debt-to-income ratios consequently worsen, affecting creditworthiness. Lenders such as banks might hesitate to issue new credit lines or personal loans, further complicating financial recovery. Adverse credit histories may also hinder future opportunities for housing, employment, and insurance, trapping individuals in a cycle of financial distress.

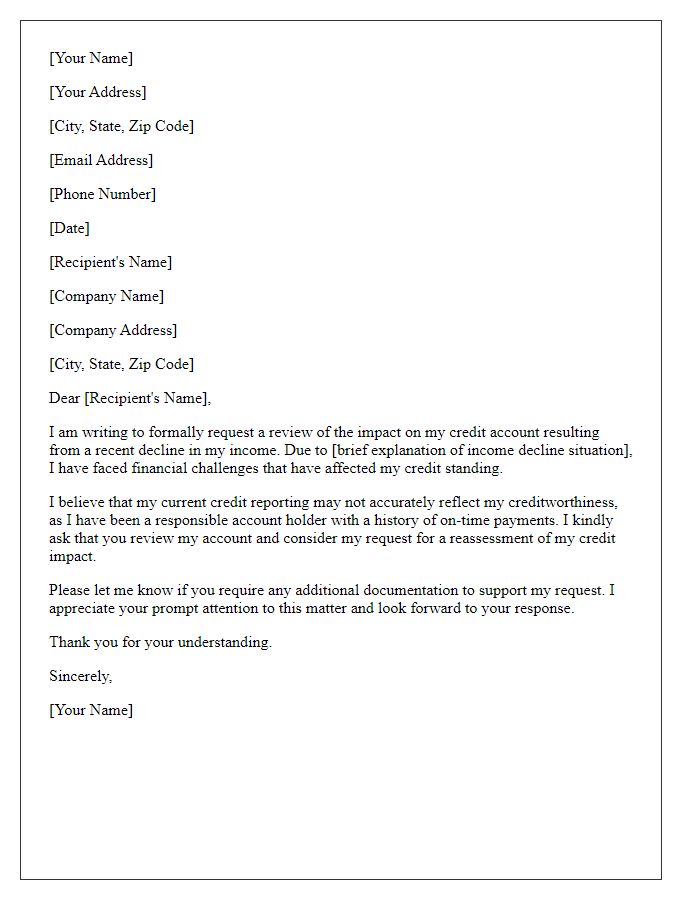

Request for consideration or arrangement

Facing income loss can significantly impact credit scores due to increased utilization of available credit and missed payments. This situation, particularly evident during financial crises such as the global pandemic starting in 2020, can lead to a downward trend in creditworthiness. Unemployment rates soared, affecting millions and causing delays in meeting financial obligations. Individuals struggling to manage monthly bills such as rent, mortgages, or personal loans may also encounter difficulty in maintaining timely payments, thereby negatively influencing their credit history. Consequently, credit reporting agencies, including Experian, TransUnion, and Equifax, may reflect these missed payments, making it challenging for individuals to secure future loans or favorable interest rates. Seeking consideration or alternative arrangements from lenders can create opportunities to mitigate adverse effects, such as deferred payments or restructured loan terms to provide temporary relief during hardship.

Contact details for follow-up

Income loss can significantly impact credit scores, especially when individuals miss payments on loans or credit cards. Financial hardships, such as job loss or reduced work hours, can lead to increased credit utilization rates, raising concerns for lenders. Credit scores, typically calculated using models like FICO, factor in payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%), and types of credit used (10%). International economic conditions, such as recessions or inflation rates, can exacerbate income loss situations. Timely communication with creditors becomes essential; discussing financial challenges may allow for payment adjustments or deferment options, ultimately minimizing long-term damage to credit standing. Following up with creditors promptly is crucial to demonstrate proactive steps toward financial recovery.

Letter Template For Income Loss Impact On Credit Samples

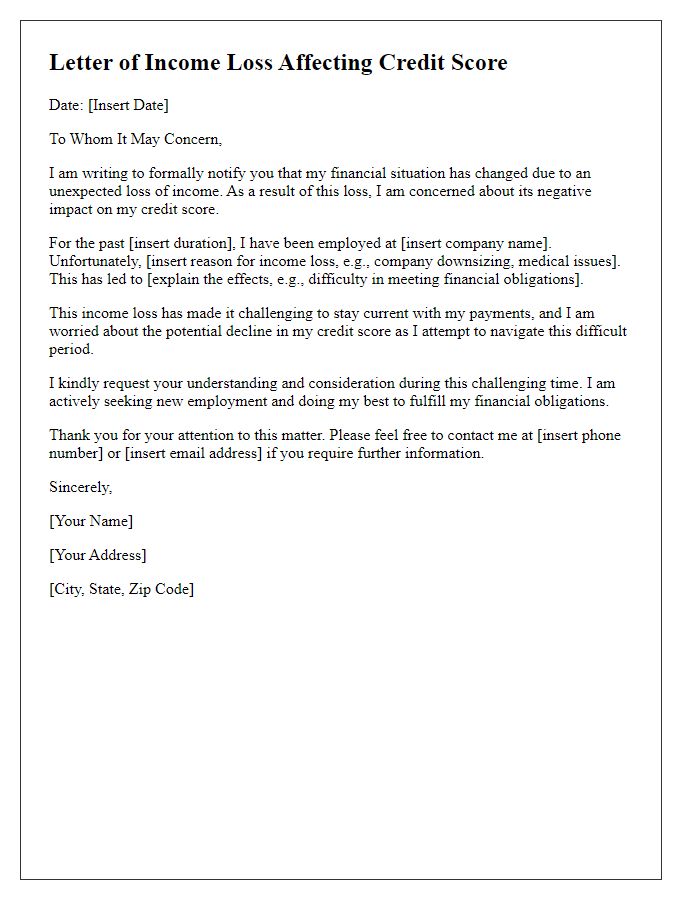

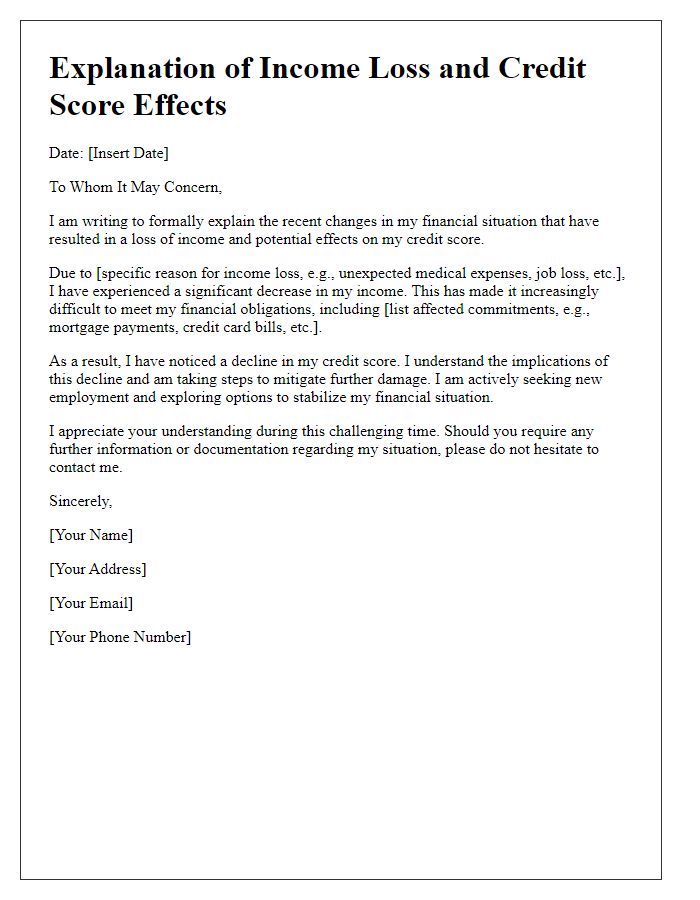

Letter template of financial hardship due to income loss and its credit implications.

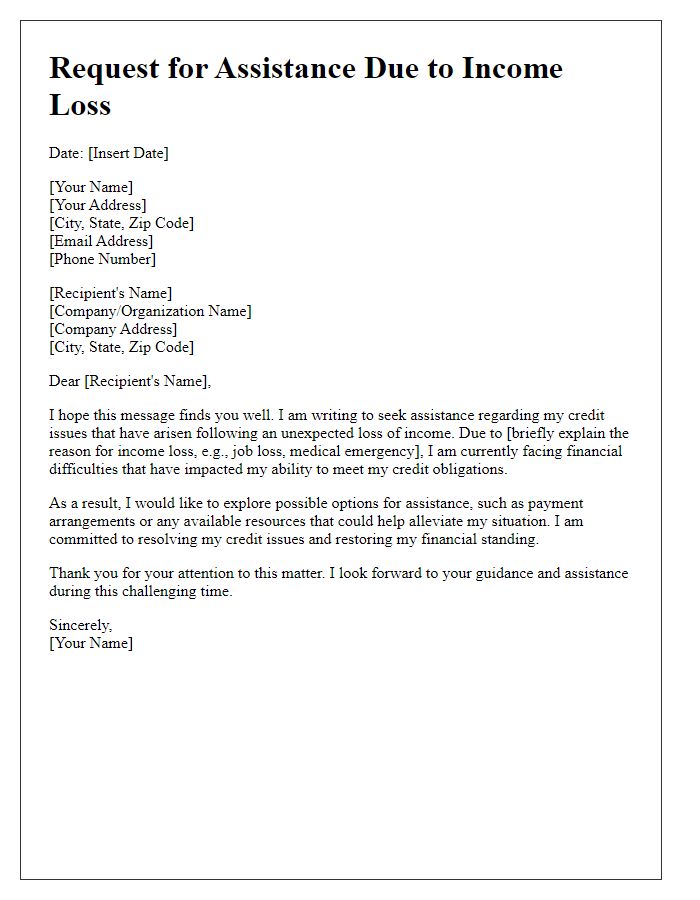

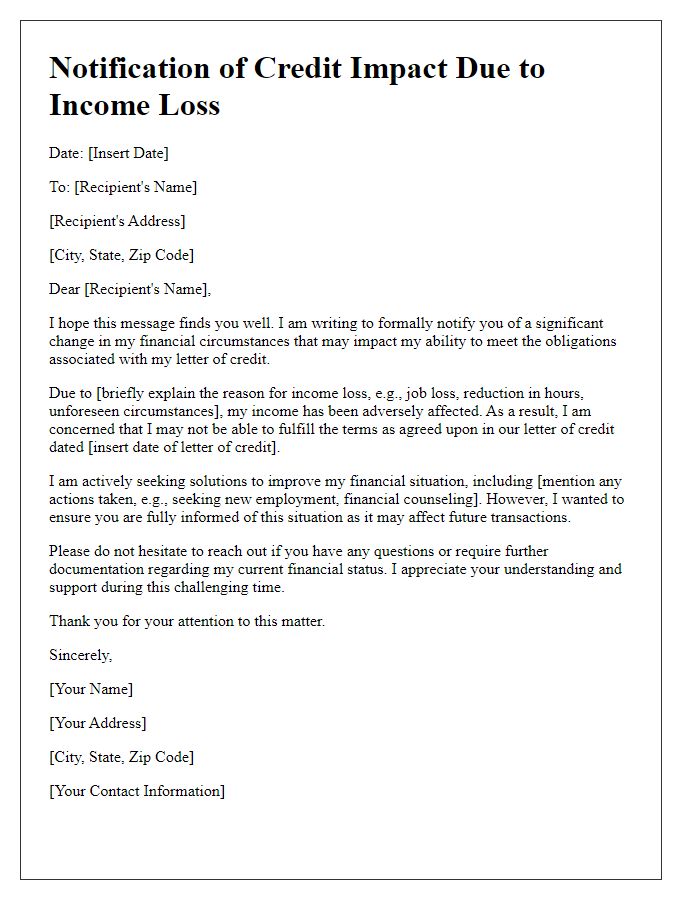

Letter template of seeking assistance for credit issues after income loss.

Comments