If you've recently frozen your credit and are looking to have that freeze lifted, a well-crafted letter can make all the difference. This straightforward request not only ensures the security of your finances but also invites a smoother borrowing process when needed. In our article, we'll walk you through creating an effective letter that captures your needs and adheres to all necessary guidelines. So, let's dive in and explore how to seamlessly request your credit freeze removal!

Personal Identification Information

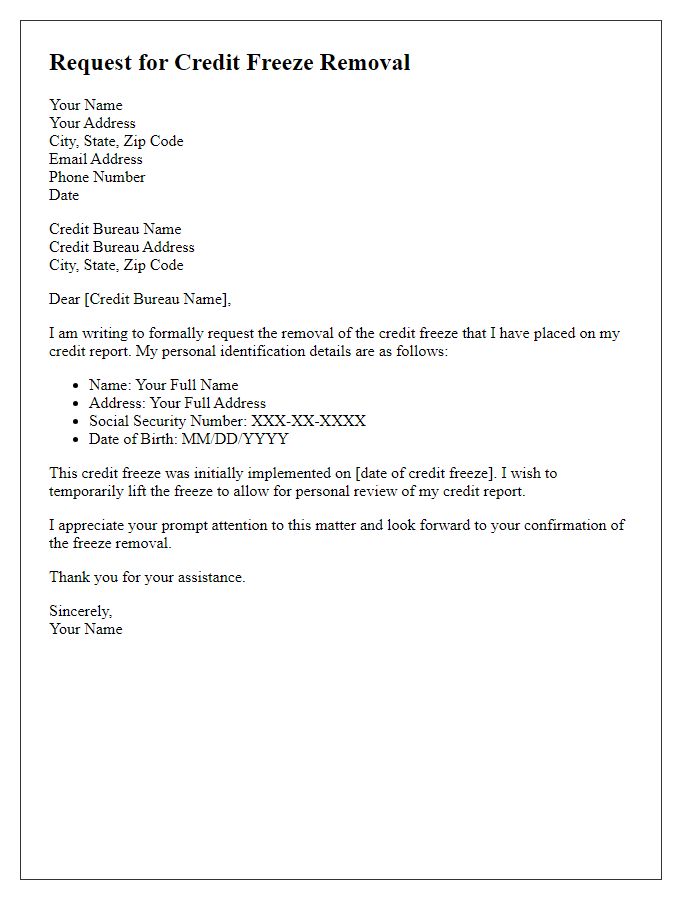

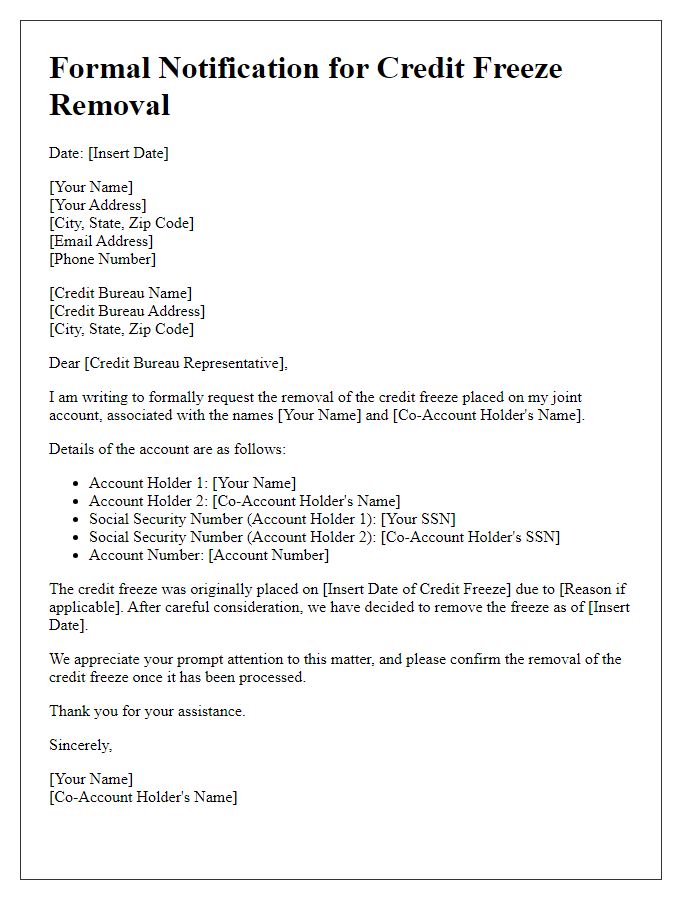

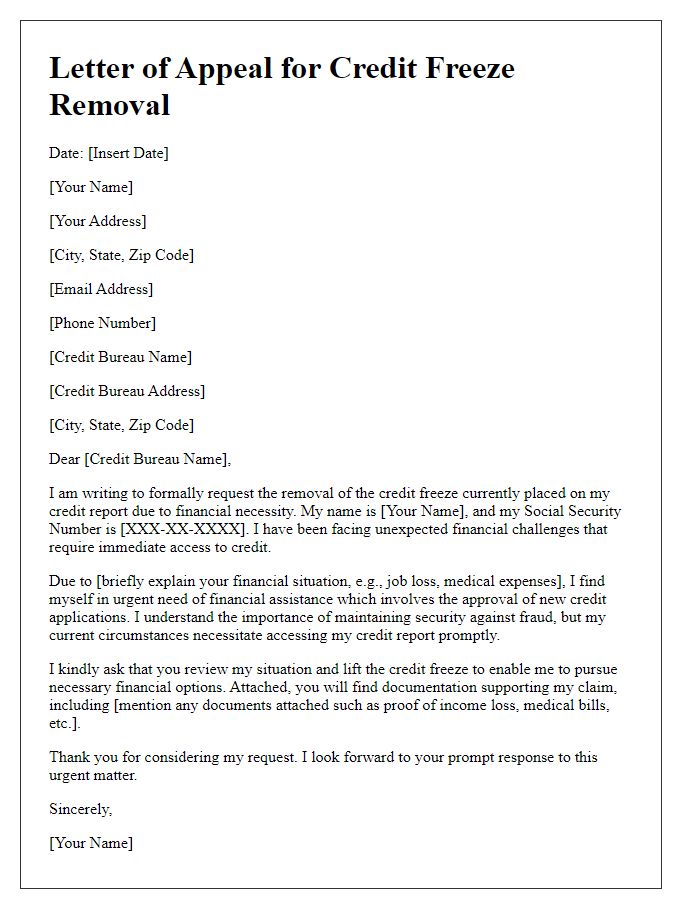

To request the removal of a credit freeze, individuals must provide key personal identification information such as full name, date of birth, social security number, and current address. This identification is crucial for credit bureaus, like Experian, TransUnion, and Equifax, to verify identity and ensure the request is legitimate. Additionally, individuals may need to provide their unique PIN or password associated with the credit freeze, as well as any recent account numbers or reference codes linked to their credit report. This detailed information helps facilitate a secure process in lifting the freeze, allowing access to credit accounts, loans, and services in financial contexts.

Credit Bureau Details

A credit freeze is a security measure utilized by consumers to protect their credit reports from unauthorized access, particularly during identity theft. Major credit bureaus including Experian, TransUnion, and Equifax retain personal information such as Social Security numbers, credit scores, and account details. The process to remove a credit freeze involves submitting a request to the relevant bureau, often requiring personal information and a unique PIN or password that was provided during the freeze initiation. This removal can typically be completed online or over the phone, allowing access to credit reports for various activities, such as applying for loans, mortgages, or new credit cards. Timely removal of the freeze ensures that consumers can navigate these financial processes without undue delays.

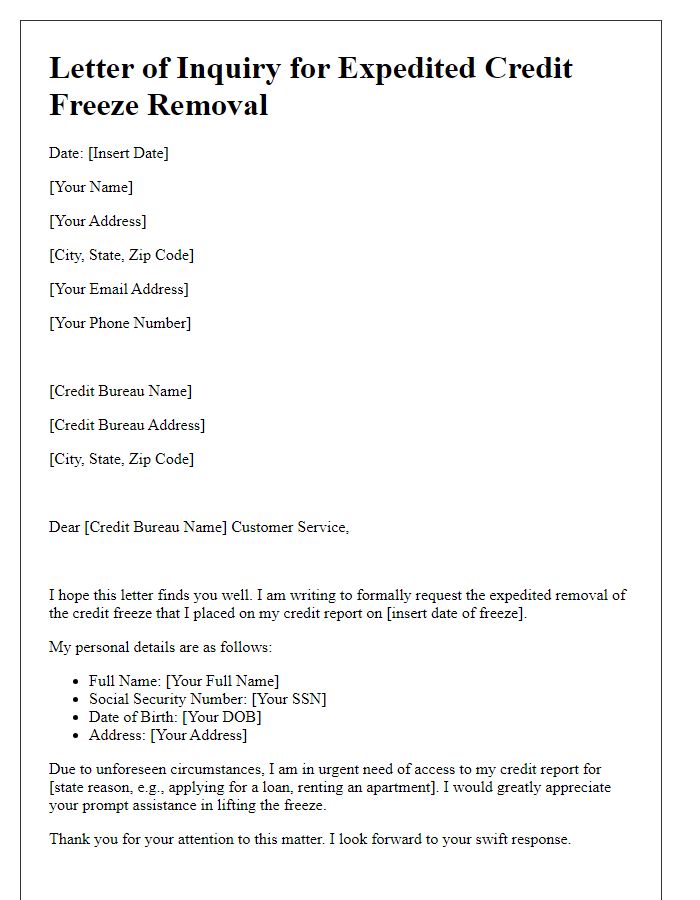

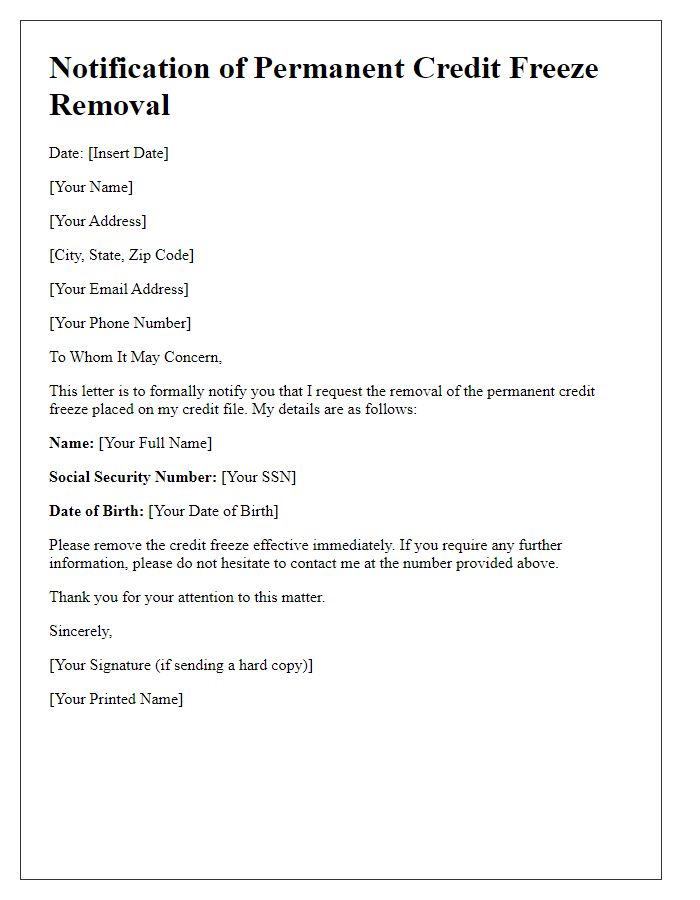

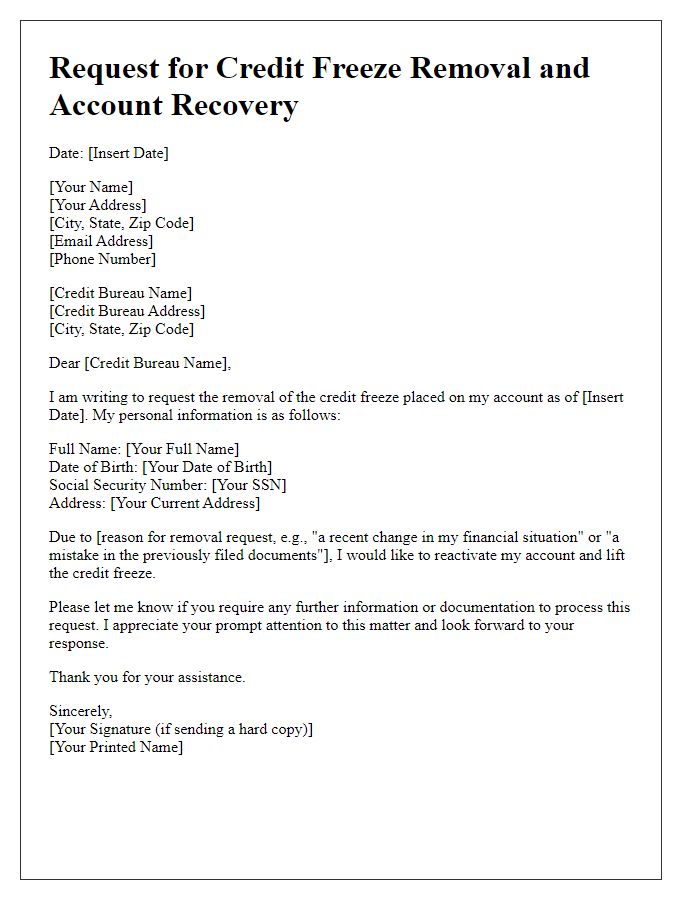

Specific Credit Freeze Removal Request

A credit freeze removal request should include essential details to expedite the process. The requestor must provide their full name, current address (street, city, state, zip code), and social security number (last four digits) for identification. A clear statement expressing the desire to temporarily lift the credit freeze is necessary, along with a specific timeframe for the removal. The request should be directed to the major credit bureaus such as Equifax, Experian, or TransUnion, identified by the respective bureau's customer service address. Including any confirmation number or PIN received during the initial credit freeze request adds credibility. The date of the original freeze request is relevant, along with signature confirmation to authenticate the identity of the requestor.

Proof of Identity Documentation

Requesting a credit freeze removal requires specific proof of identity documentation, such as a government-issued photo ID (like a driver's license or passport) and social security number verification. Identity theft incidents soared to over 1.4 million cases in 2020, prompting many consumers to freeze their credit reports with major credit bureaus like Equifax, Experian, and TransUnion. Each bureau has distinct procedures for security measure removal that typically require precise identity validation to ensure safety. Timeliness is crucial; lifting a freeze can take several hours to days, potentially impacting future credit applications or loans.

Contact Information for Follow-up

A credit freeze removal request often necessitates clear contact information for effective follow-up. Include personal details such as name (preferably as it appears on the credit report), address (including city, state, and zip code), and Social Security number (last four digits). Additionally, provide a phone number for immediate communication and an email address for written correspondence. Ensure to specify the date of the credit freeze request and the applicable freeze PIN or password, if used. This comprehensive information will facilitate quick verification and prompt response from the credit reporting agency or financial institution.

Letter Template For Requesting Credit Freeze Removal Samples

Letter template of request for credit freeze removal for personal review.

Letter template of formal notification for credit freeze removal on joint accounts.

Letter template of appeal for credit freeze removal due to financial necessity.

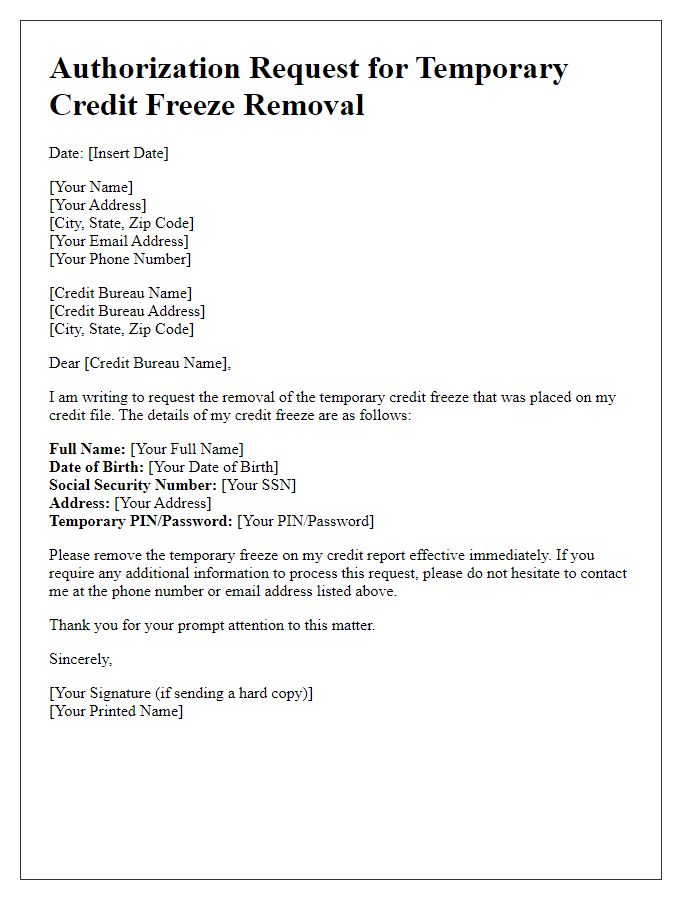

Letter template of authorization request for temporary credit freeze removal.

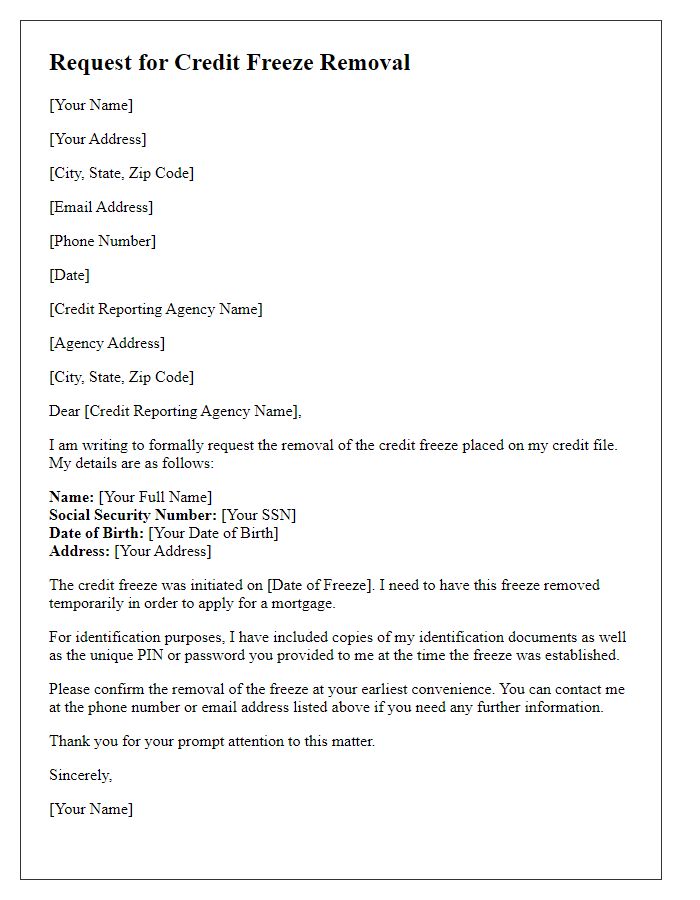

Letter template of request for credit freeze removal to apply for mortgage.

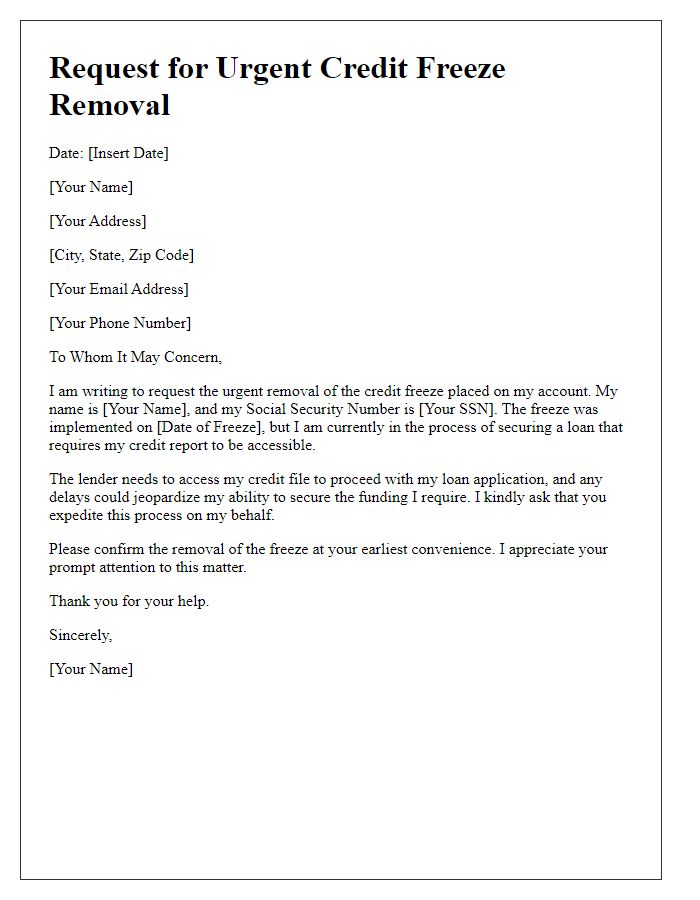

Letter template of request for urgent credit freeze removal for loan processing.

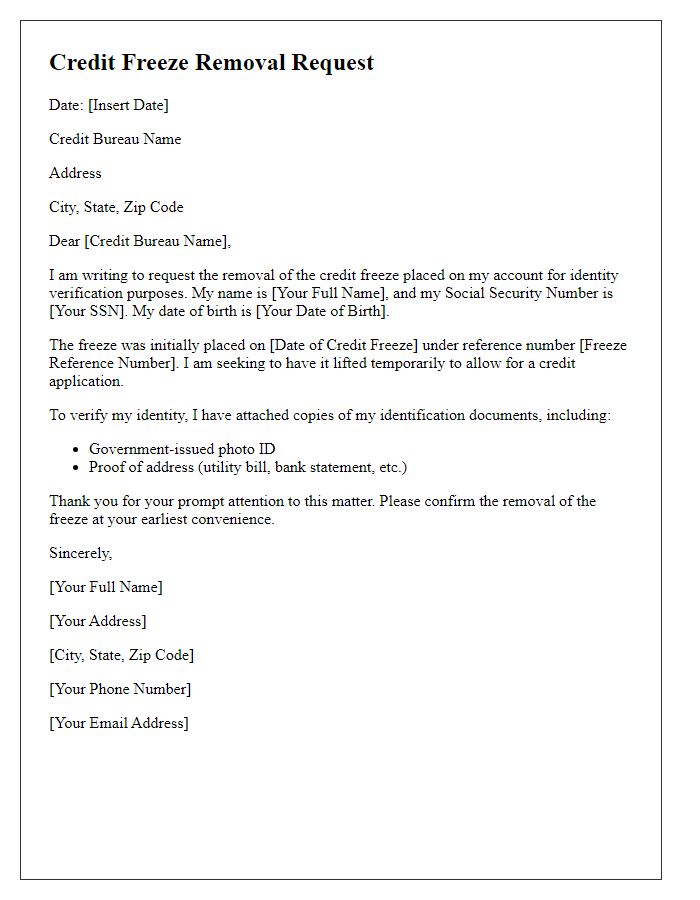

Letter template of credit freeze removal request for identity verification purposes.

Comments