Are you looking to close a secured credit card account but unsure how to go about it? You're not alone, as many people find themselves in this situation and need a straightforward approach. Writing a clear and concise letter can make the process much easier, ensuring your request is processed promptly. Curious about the steps to take and what to include in your letter? Read on for more helpful tips!

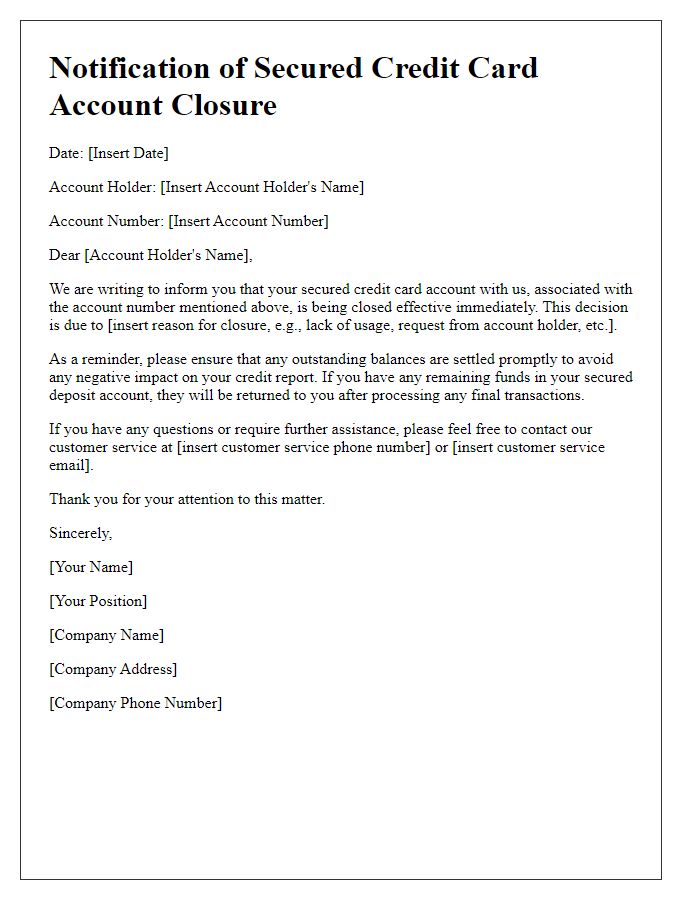

Account information and cardholder details

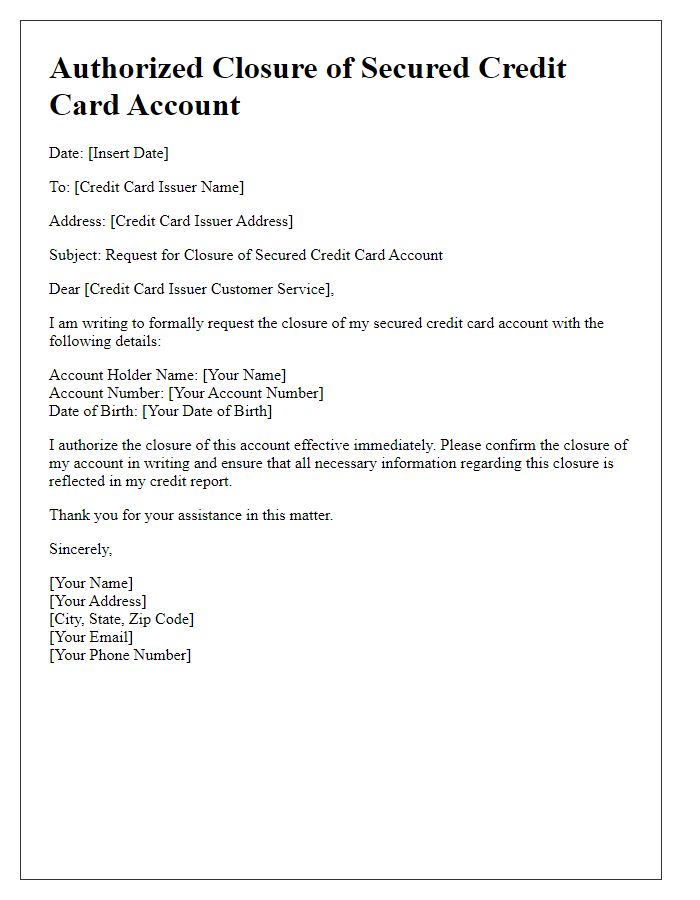

When closing a secured credit card account, it is essential to provide specific account information to ensure a seamless process. The account number, typically a 16-digit sequence, must be clearly stated along with the cardholder's full name as it appears on the card. The billing address linked to the account, including city, state, and ZIP code, is necessary for verification purposes. Additionally, the card's expiration date and any associated security PIN should be mentioned to prevent future transactions. Notifying the card issuer about the closure helps maintain an accurate credit report, as secured credit cards may impact credit scores based on payment history. Always request written confirmation of the account closure to keep for personal records and obtain insight into any remaining balance or fees.

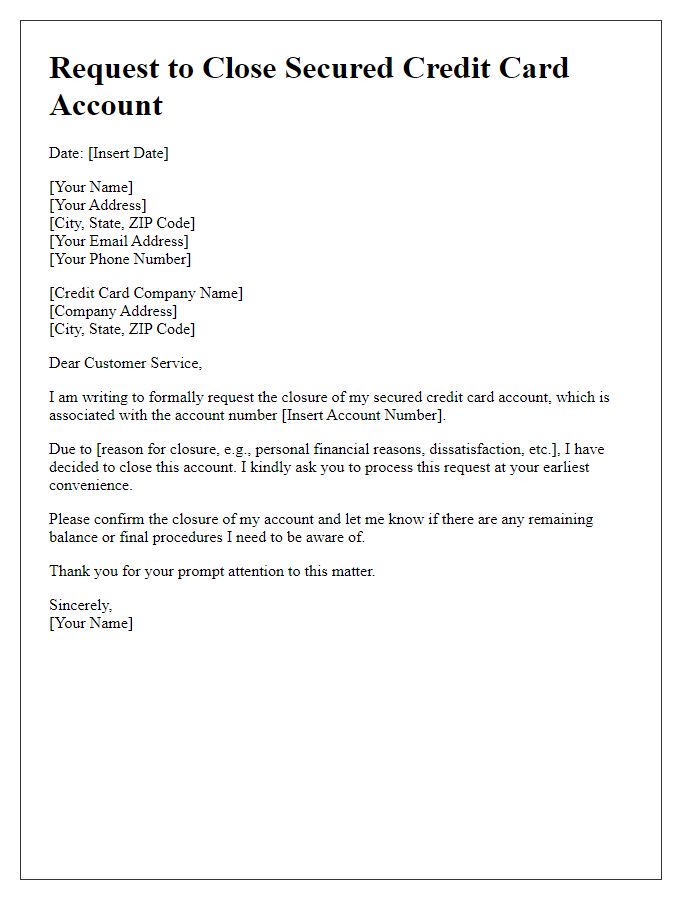

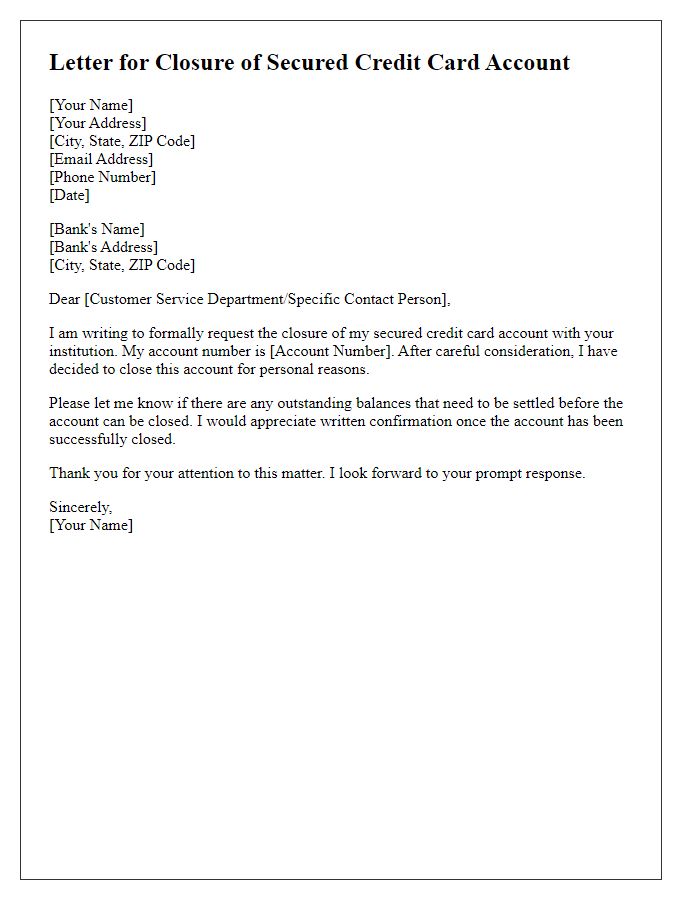

Reason for account closure

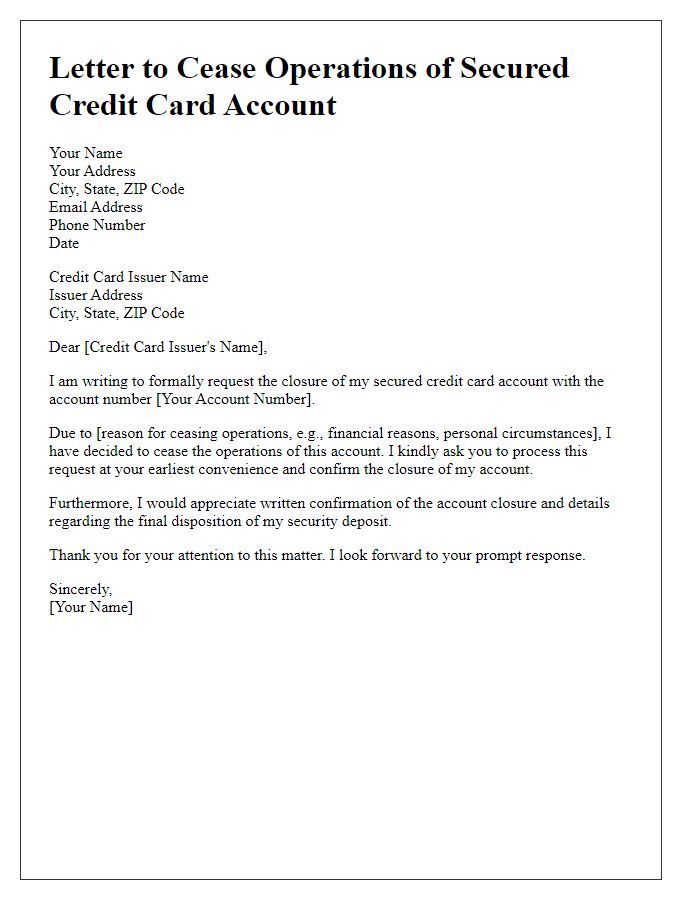

Closing a secured credit card account can significantly impact your credit score and financial planning. Several reasons may prompt this decision, including high annual fees associated with cards like the Capital One Secured Mastercard or lack of benefits compared to unsecured alternatives. Account holders often cite the desire to simplify finances, as maintaining multiple accounts can be cumbersome. In some cases, individuals seek to transition to better rewards programs, such as those offered by Chase or Discover, which provide enhanced cashback or travel perks. Additionally, accumulated savings might motivate a shift away from secured credit accounts, as users aim for increased purchasing power without collateral requirements.

Request for written confirmation of account closure

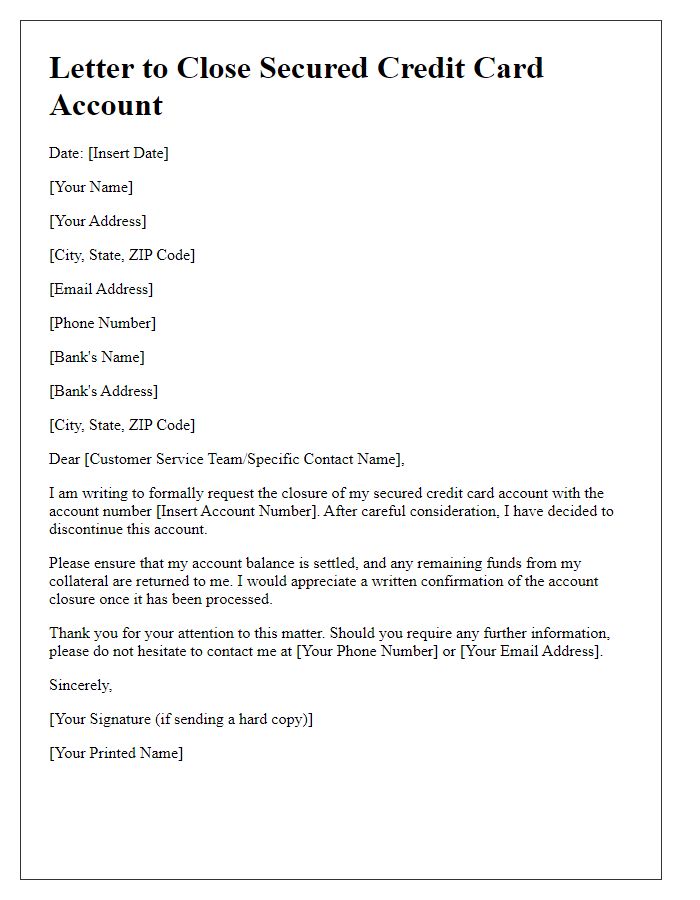

Closing a secured credit card account can involve several important steps. After ensuring the account balance is paid in full (typically requiring a payment of the total credit limit, such as $300 for a standard secured card), account holders must send a formal request. This request should specify the desire to close the account with the credit card issuer, which may include companies like Capital One or Discover. Following the request, seeking written confirmation of account closure is crucial for personal records and future financial safety. An account closure confirmation letter from the issuer serves as proof that the account, once tied to a credit limit, is officially closed, ensuring no potential disputes or misunderstandings exist in the future. Additionally, it aids in maintaining accurate credit reports with agencies such as Experian, Equifax, and TransUnion.

Instructions for handling remaining balances or deposits

Closing a secured credit card account requires careful handling of remaining balances and deposits. First, ensure that all outstanding balances, including any fees, are paid in full to avoid negative impacts on your credit score. Contact the issuing bank, such as Capital One or Discover, to confirm the total amount due. Next, inquire about the appropriate procedures to close the account, which may involve submitting a written request or completing a form online. Once the account is closed, the security deposit, held as collateral during the account's active status, will typically be refunded after verifying that there are no outstanding debts. This refund process can take several weeks, depending on policies specific to lenders like Wells Fargo. Keep a record of all communications and confirmations for future reference. Aim to obtain a written statement confirming the account closure, which can ensure clarity in case of any discrepancies.

Contact information for follow-up communication

Clients often require closure of secured credit card accounts for various reasons, such as improved credit scores or financial changes. To effectively close a secured credit card account, provide essential contact details, which could include the bank's customer service phone number, email address, or mailing address, usually found on the credit card issuer's official website or statement. Include specific account details such as account number (last four digits for security), cardholder name, and Social Security number (for verification purposes). Following up ensures confirmation of account closure and discussions related to any remaining funds or collateral associated with the secured credit card. Banks may provide a written notice confirming the closure, which serves as vital documentation for personal records.

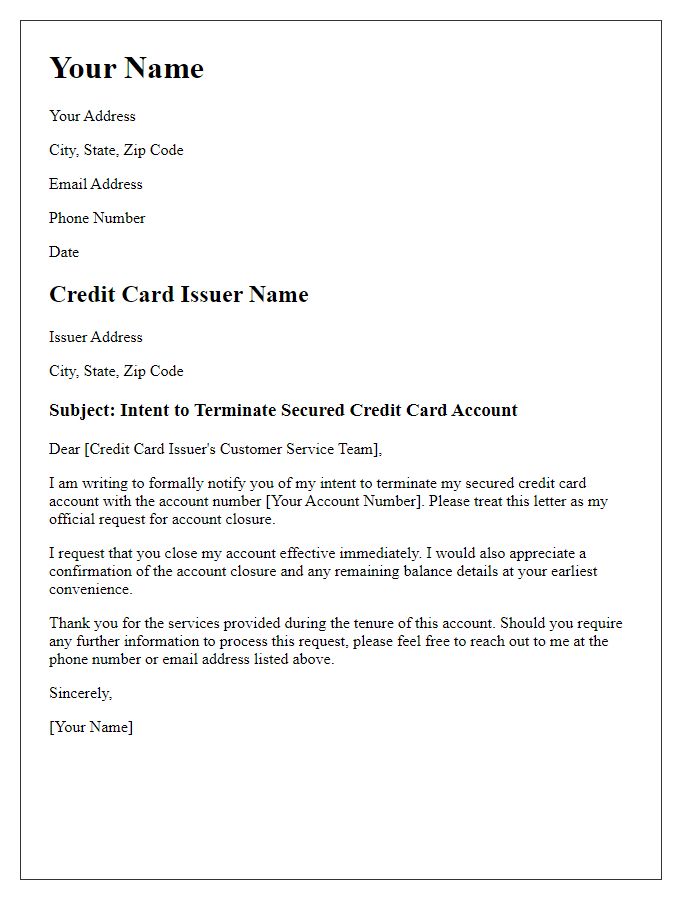

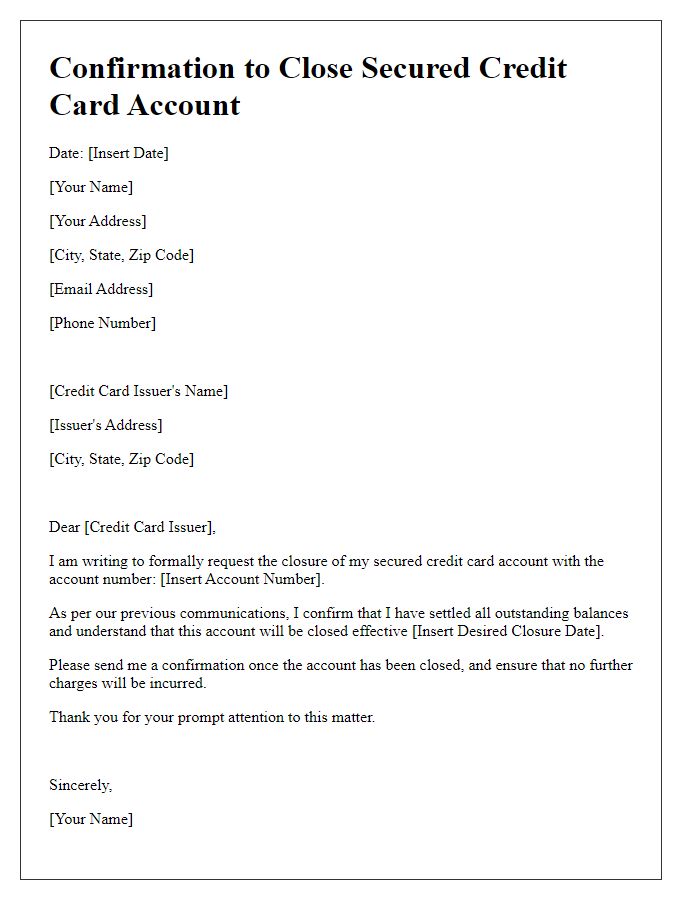

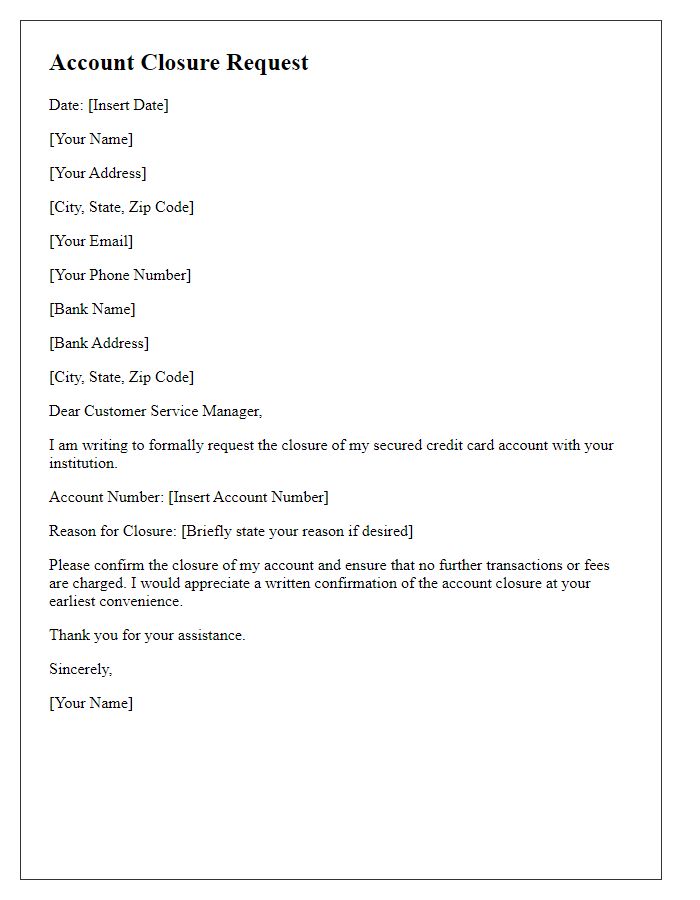

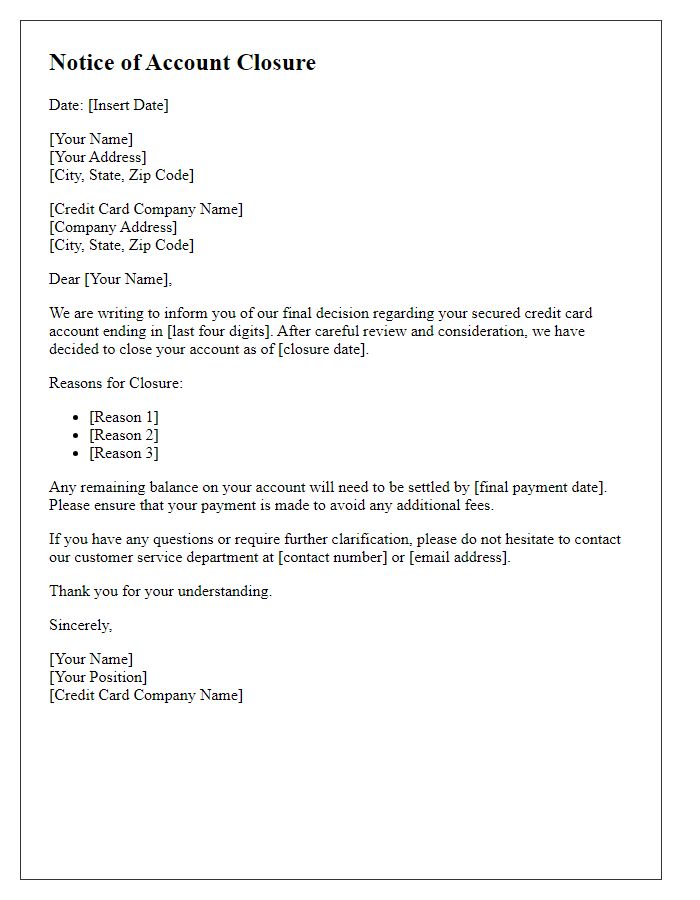

Letter Template For Closing Secured Credit Card Account Samples

Letter template of notification for secured credit card account closure.

Comments