Navigating the complexities of divorce can be overwhelming, especially when it comes to finances and credit accounts. Many individuals may not realize how their marital status can directly affect their credit score and financial stability. It's crucial to understand the potential implications for shared accounts and how to protect your credit during this challenging time. If you're looking for practical tips and insights on managing your credit amidst divorce, keep reading for essential advice!

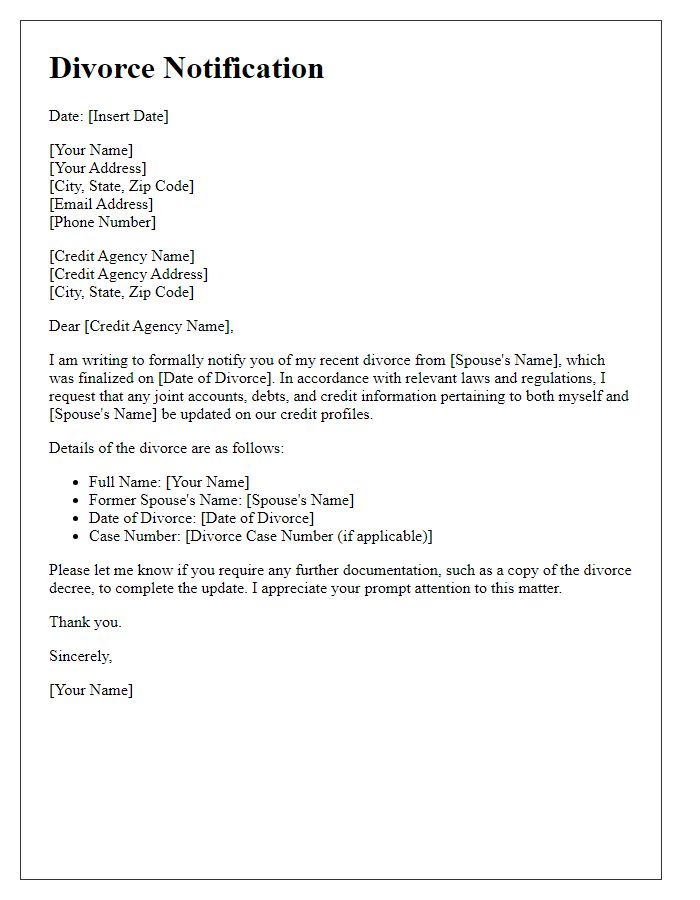

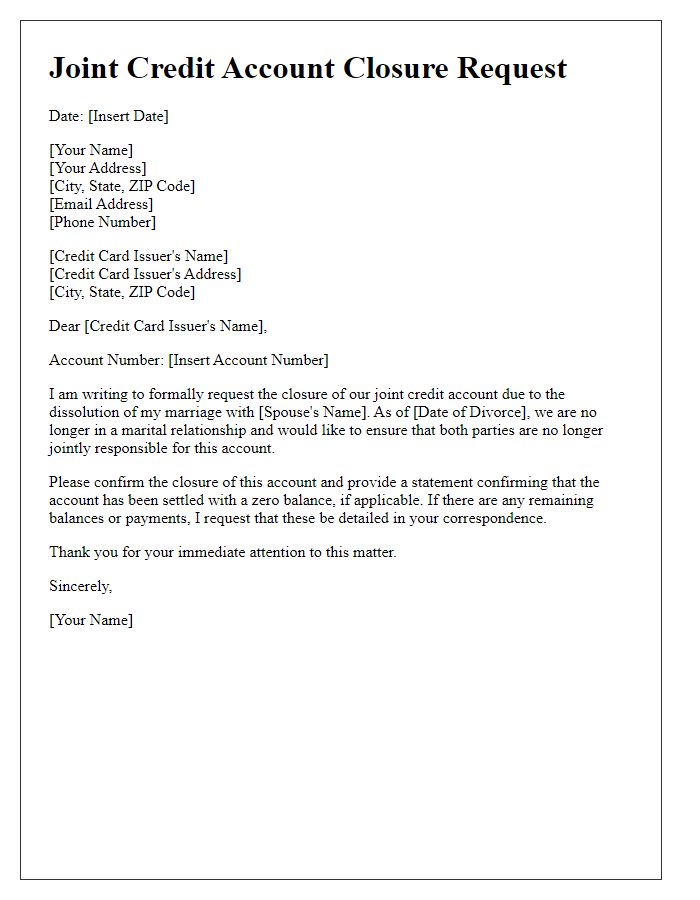

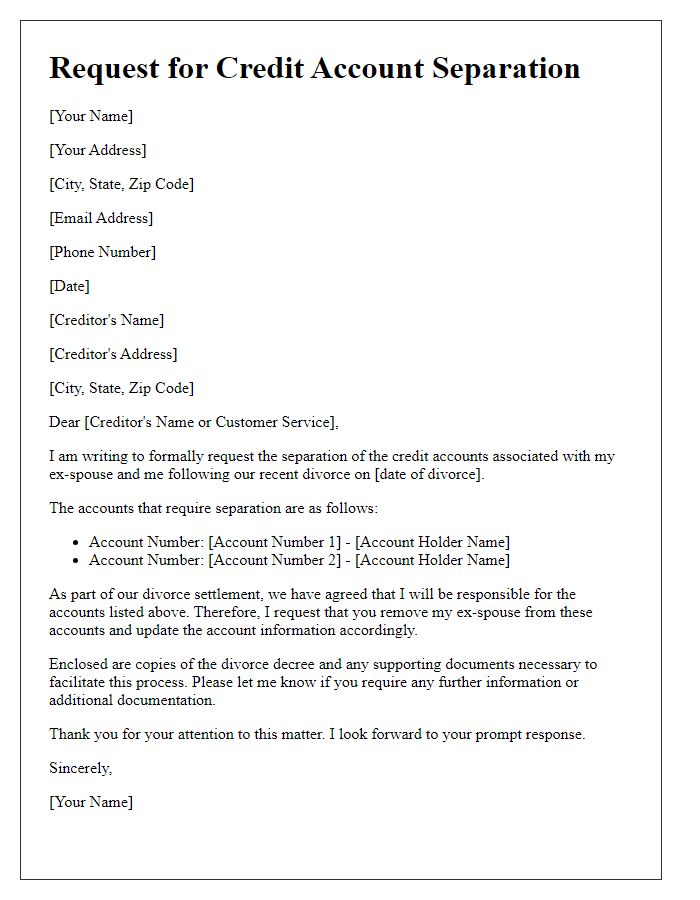

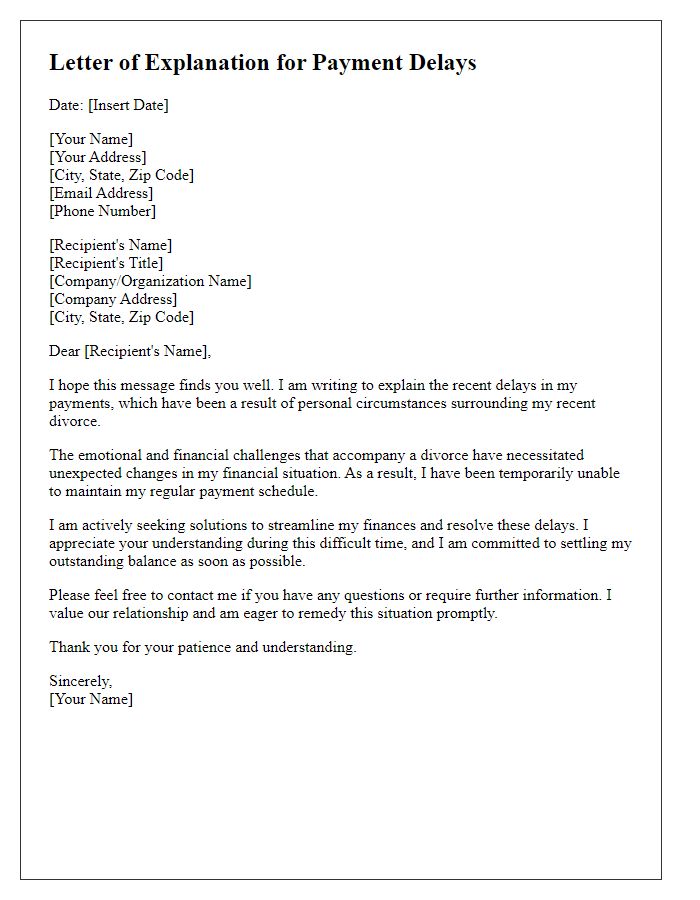

Account information and closure request

Divorce proceedings can significantly impact credit accounts, often affecting combined financial responsibilities. Separate accounts like credit cards and mortgages may need reevaluation, with financial liability shifting post-divorce decree. For instance, credit scores (ranging from 300 to 850) can fluctuate based on missed payments during this transition, influencing future borrowing ability. Closure requests for joint accounts, such as Visa or MasterCard, may arise amidst the divorce, necessitating documentation to protect individual credit histories. Additionally, state laws, such as community property regulations in states like California, can further complicate the division of debts. Timely communication with creditors is essential to mitigate potential negative impacts on credit reports during this sensitive period.

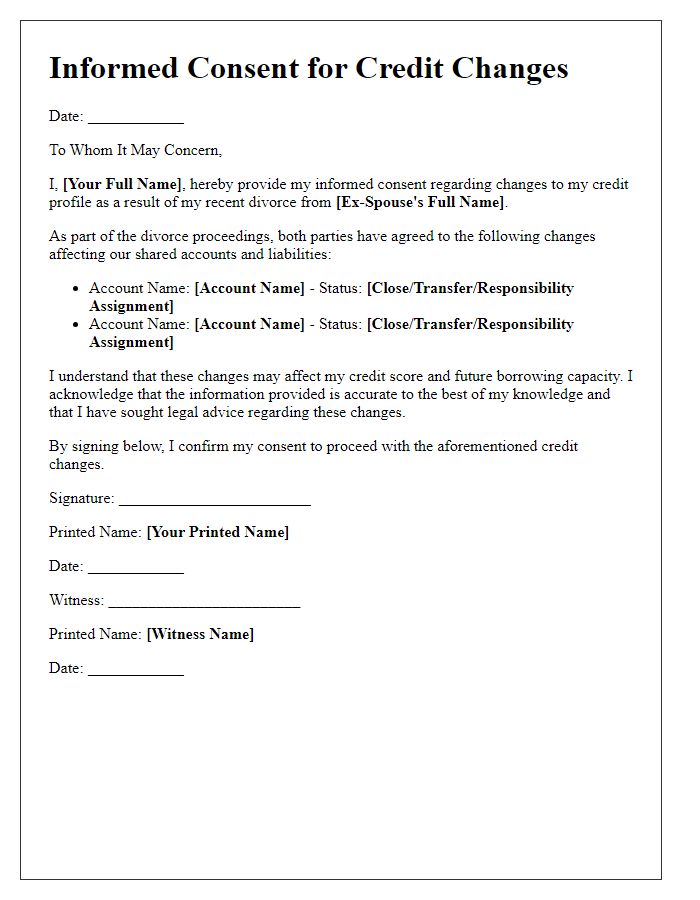

Impact on credit score

Divorce proceedings can significantly influence individual credit scores, particularly when joint credit accounts are involved. Shared accounts, such as credit cards and mortgages, can lead to complications if payments are not maintained. In the United States, late payments on these shared accounts can decrease a credit score by up to 100 points, with a FICO score range generally fluctuating between 300 and 850. Moreover, one spouse may become solely responsible for the debt after the divorce, causing potential financial strain if the obligations remain unpaid. This situation not only affects personal credit histories but can also hinder future loan applications, impacting borrowing capacity for essential needs like housing or vehicles.

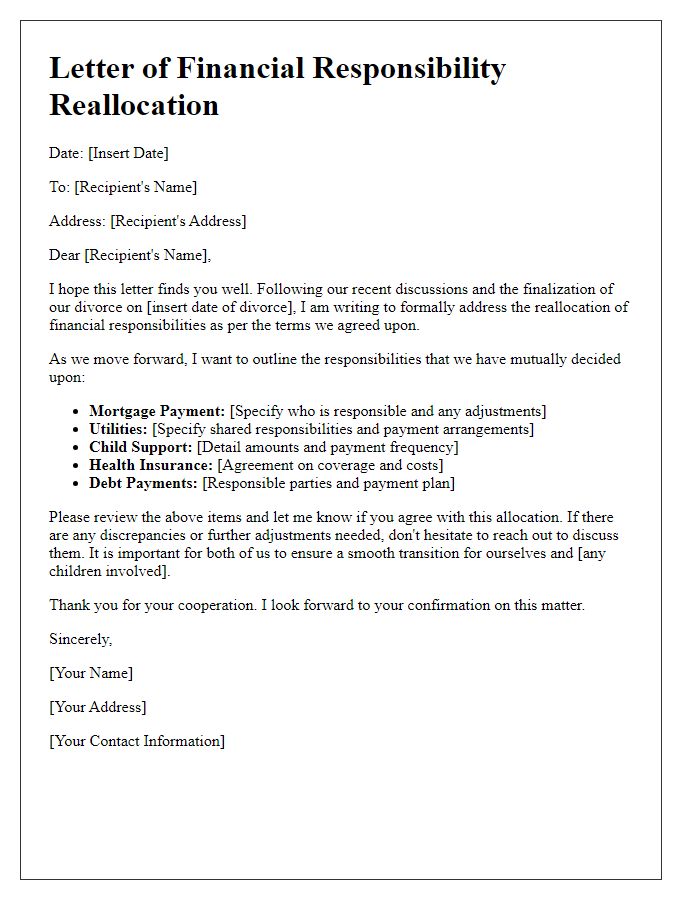

Joint accounts and debt responsibility

Divorce proceedings can significantly impact credit accounts, particularly when it involves joint accounts and shared debt responsibility. Joint credit accounts, such as credit cards or personal loans, may remain active even after divorce finalization, potentially leading to missed payments. Both parties typically retain responsibility for any existing debt, including any incurred interest. For instance, a joint credit card with a balance of $5,000 and a shared mortgage of $200,000 can complicate financial independence post-divorce. Failure to manage these accounts properly can negatively affect personal credit scores for both spouses. Additionally, creditors may not recognize the divorce decree when determining liability, posing further risk to financial health. Careful planning and communication regarding these accounts are essential for both parties to mitigate potential credit damage during and after the divorce process.

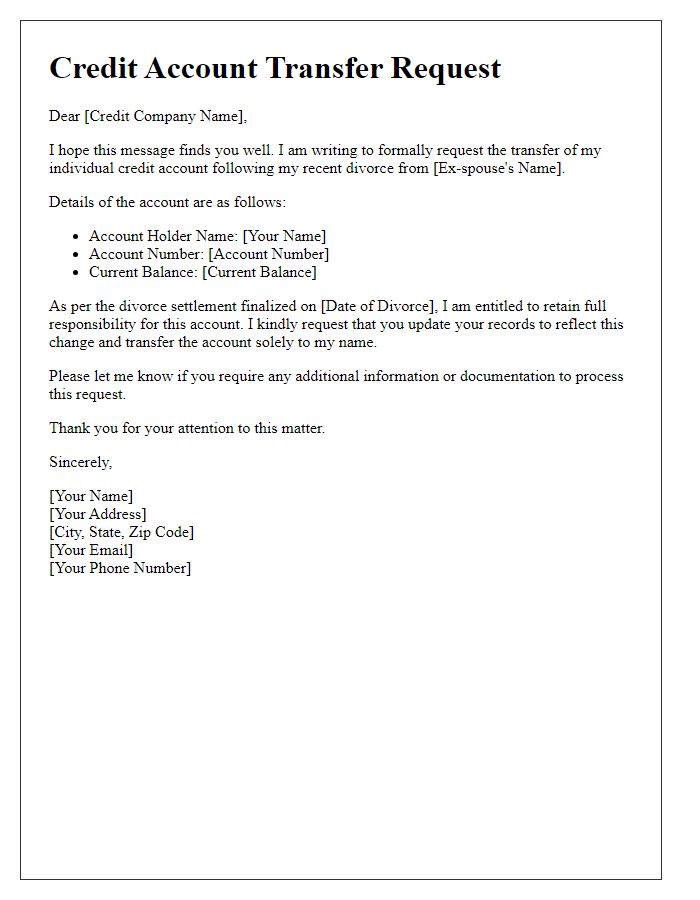

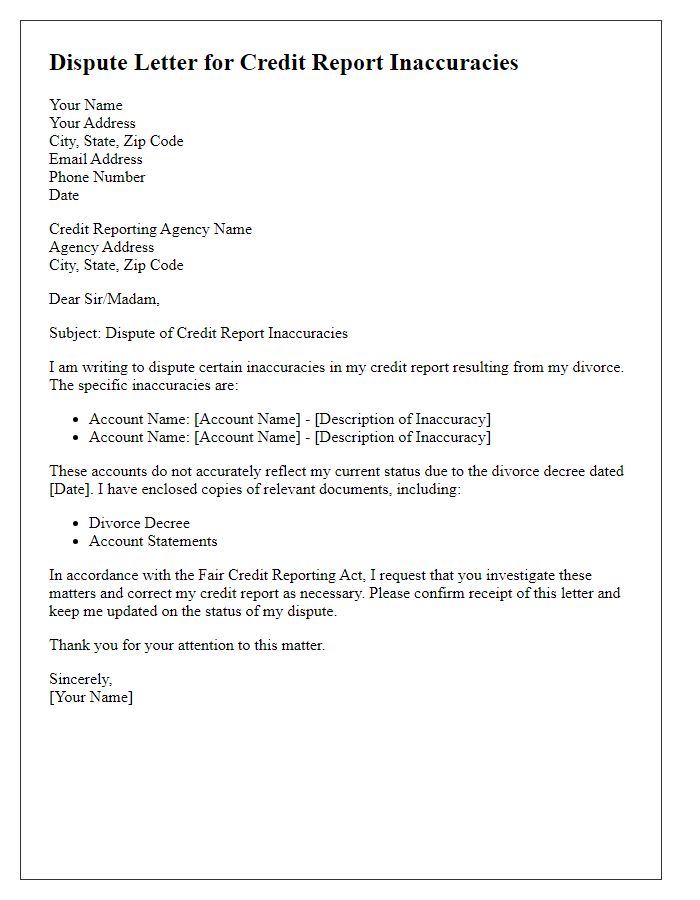

Legal documentation and divorce decree

Divorce proceedings can significantly impact credit accounts, especially when joint accounts are involved. Legal documentation, such as the divorce decree, often outlines the division of assets and liabilities between parties, affecting credit scores. This decree may specify which spouse is responsible for particular debts, such as credit cards and loans, often creating complications if joint accounts remain open. Failure to manage these accounts post-divorce could lead to missed payments or defaults, negatively influencing credit ratings. It's essential for both parties to review their credit reports and ensure that all financial agreements from the decree are adhered to effectively, maintaining financial stability after the dissolution of marriage.

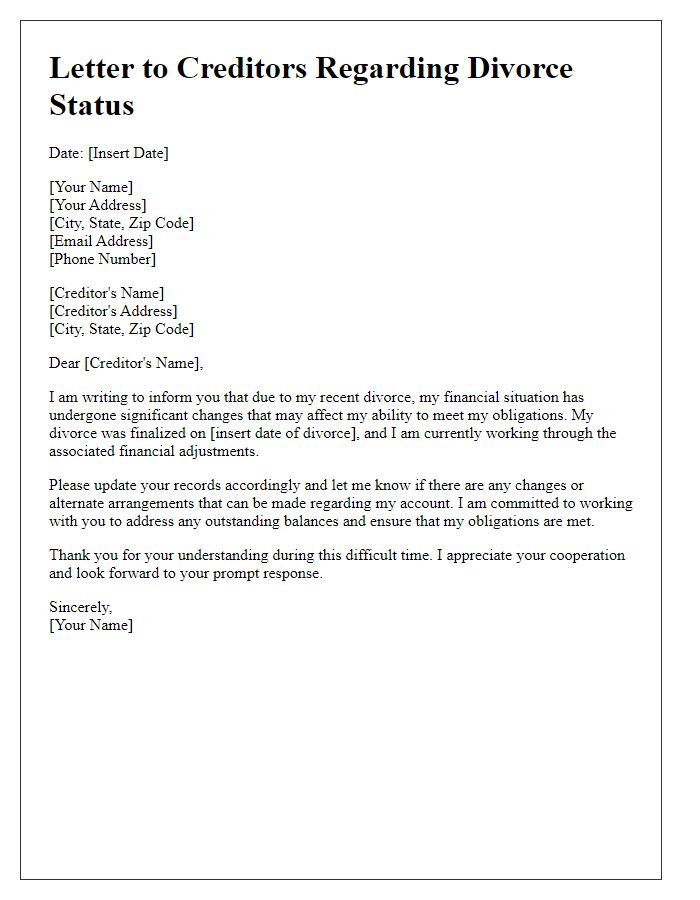

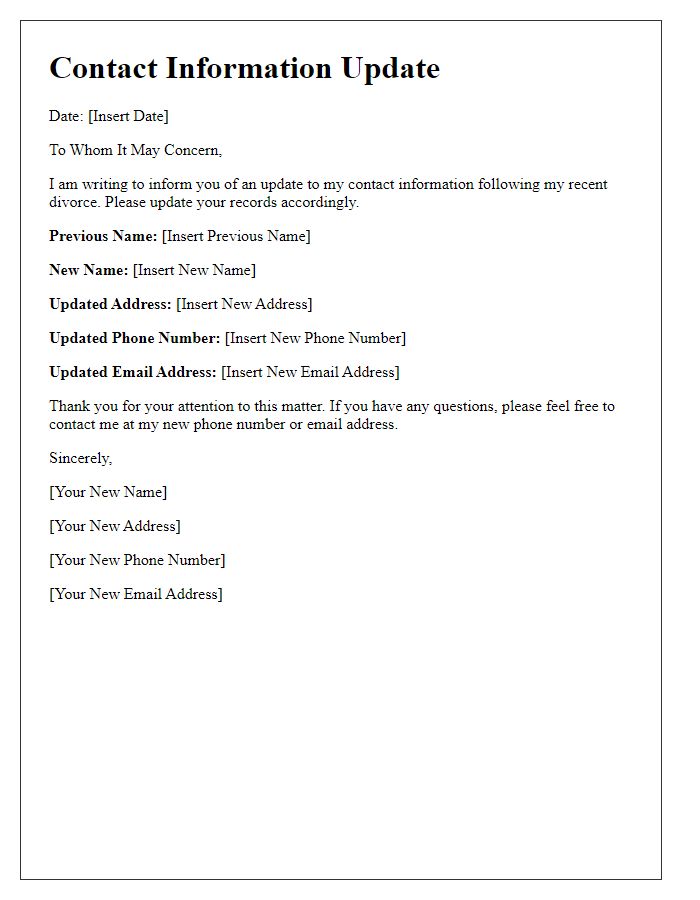

Contact information for follow-up

Divorce proceedings often have significant implications on financial health, including credit accounts. In many cases, shared accounts such as joint credit cards, mortgages, or loans can lead to complications. Divorce, which legally dissolves a marriage and can involve lengthy court proceedings, may result in the need for both parties to reassess their individual credit standings. Depending on state laws, debts and assets might be divided, affecting credit utilization ratios and leading to potential credit score fluctuations. Securing contact information for financial institutions or credit bureaus becomes crucial for follow-up actions, such as updating account responsibilities or monitoring credit reports for discrepancies. Address book entries might include the credit card company's customer service number, mortgage lender's contact, or legal advisor's information for guidance through this process.

Comments