Navigating the financial repercussions of COVID-19 can be overwhelming, especially when it comes to managing credit issues. Many individuals and businesses are feeling the strain, uncertain about how to address outstanding debts and maintain their financial stability. It's crucial to understand your options and the steps you can take to protect your credit score during these challenging times. Join us as we delve deeper into practical solutions and resources available to help you overcome credit issues related to the pandemic.

Financial Hardship Explanation

Many individuals and families are facing financial hardship due to the COVID-19 pandemic caused by the SARS-CoV-2 virus since early 2020. Unemployment rates soared to unprecedented levels, exceeding 14% in April 2020, leading to reduced incomes and increased stress on household budgets. The government implemented programs, such as the Coronavirus Aid, Relief, and Economic Security (CARES) Act, to alleviate some financial burdens, providing direct payments (up to $1,200 for eligible adults) and enhanced unemployment benefits. Despite these measures, numerous borrowers struggle to keep up with mortgage payments, credit card bills, and other debts due to prolonged business closures and public health-related restrictions. Many businesses in heavily impacted sectors like hospitality, travel, and retail faced severe declines in revenue, leading to layoffs and furloughs. Therefore, providing a detailed account of individual circumstances and any supportive documentation is crucial when explaining financial hardship to creditors or lenders during these challenging times.

Payment Arrangement Request

Due to the financial impacts of the COVID-19 pandemic, many individuals are experiencing difficulty maintaining regular payment schedules for credit obligations. For example, the unemployment rate soared to an unprecedented 14.7% in April 2020, highlighting the economic strain felt nationwide. As a result, numerous people are seeking payment arrangements with financial institutions to alleviate the burden of outstanding debts. Many lenders have instituted temporary relief programs, including deferred payments or reduced interest rates, to accommodate affected borrowers. It is crucial for individuals to communicate their specific circumstances effectively, detailing factors such as job loss, reduced income, or increased expenses. Each lender may require different documentation or proof of hardship, making clear communication essential in securing favorable terms for payment arrangements during these challenging times.

Supporting Documentation

COVID-19 has created significant economic challenges for individuals and businesses, leading to credit issues that require clear documentation. Borrowers affected by the pandemic should gather supporting documentation to explain financial struggles, including recent pay stubs that reflect changes in income, termination letters from employers, or furlough notices. Bank statements from the previous three months reveal cash flow problems, while tax returns from the past two years can provide context for income history. Additionally, any correspondence with creditors addressing payment plans or forbearance agreements demonstrates proactive efforts to mitigate credit impacts. Collecting this information is crucial for presenting a comprehensive view of the financial situation amid the ongoing pandemic crisis.

Contact Information

COVID-19 has significantly impacted financial stability for many individuals and businesses, leading to credit issues as a result. Borrowers facing difficulties might experience late payment reports to credit bureaus, affecting scores that typically range from 300 to 850. Various lenders and institutions have introduced relief programs, including forbearance options and loan modifications, to assist customers during this pandemic. Localities such as New York City and San Francisco have implemented temporary moratoriums on evictions to provide additional support. Consumers are encouraged to reach out directly to creditors and financial advisors for personalized solutions and to understand their rights under the Fair Credit Reporting Act. Regular communication and documentation of circumstances can be essential for negotiating favorable terms during these challenging times.

Tone of Empathy and Collaboration

The economic impact of the COVID-19 pandemic has led to widespread financial challenges, affecting millions of individuals and families. In response, numerous credit institutions, such as major banks and credit unions, have developed strategies to assist customers facing difficulties in making payments. Programs like deferments and payment plans have been introduced to address growing concerns related to unemployment rates, which reached around 14.7% in April 2020. These initiatives aim to provide relief during challenging times, fostering an environment of understanding and support. As organizations navigate this unprecedented crisis, communication is crucial, highlighting the importance of collaboration between creditors and customers to find workable solutions. Resources such as the Consumer Financial Protection Bureau offer guidance and assistance to those needing help with managing their credit during this extraordinary period.

Letter Template For Covid-19 Related Credit Issues Samples

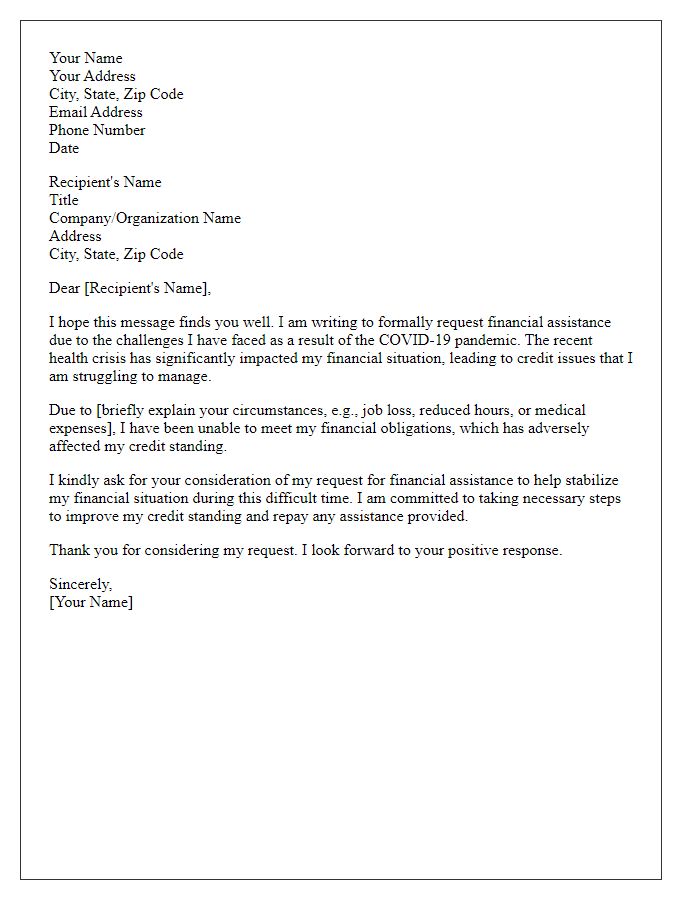

Letter template of request for COVID-19 financial assistance for credit issues

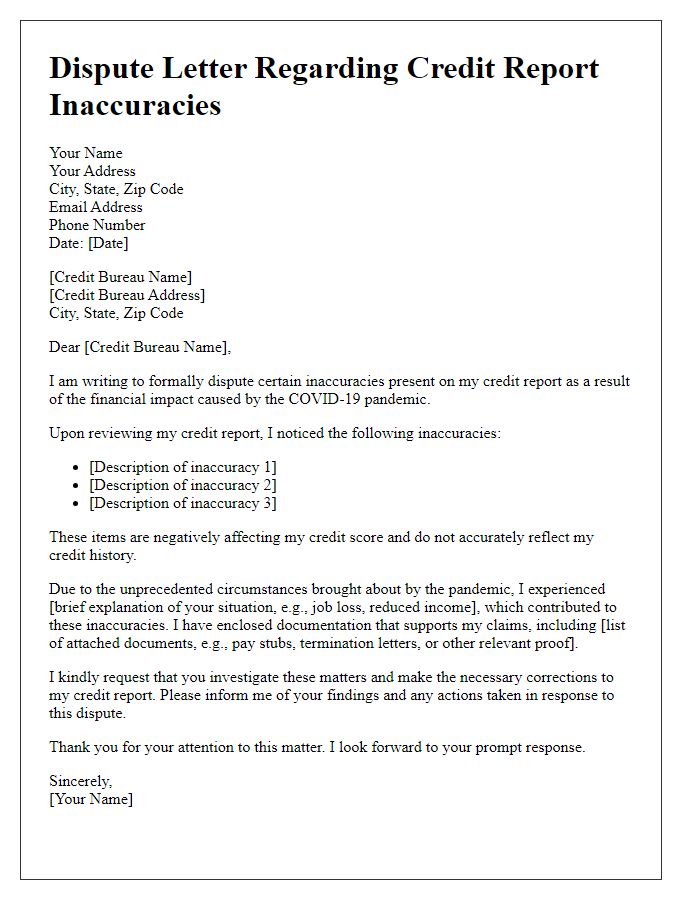

Letter template of dispute regarding credit report inaccuracies due to COVID-19 impact

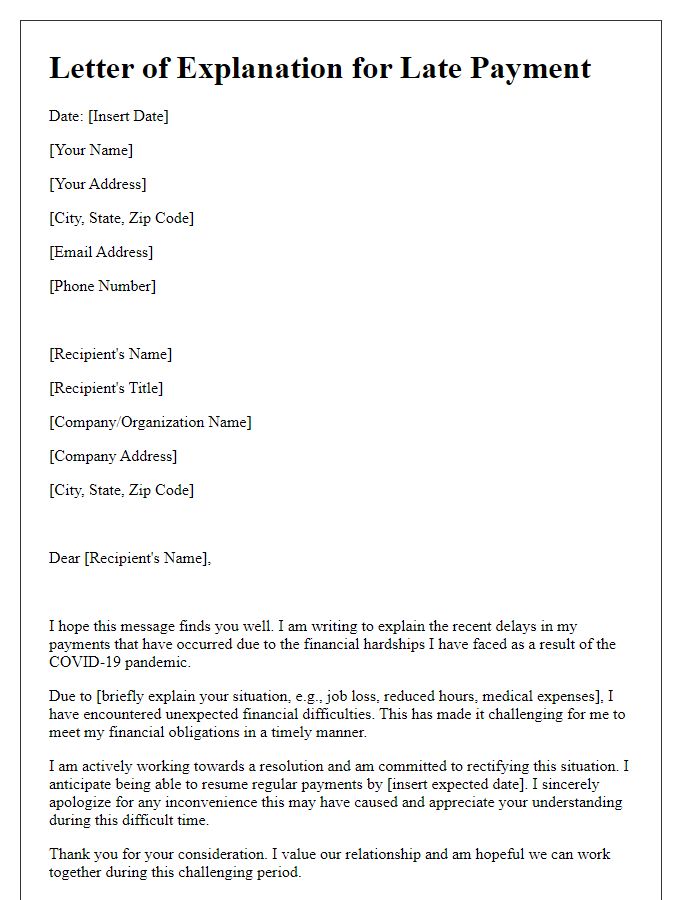

Letter template of explanation for late payments caused by COVID-19 hardships

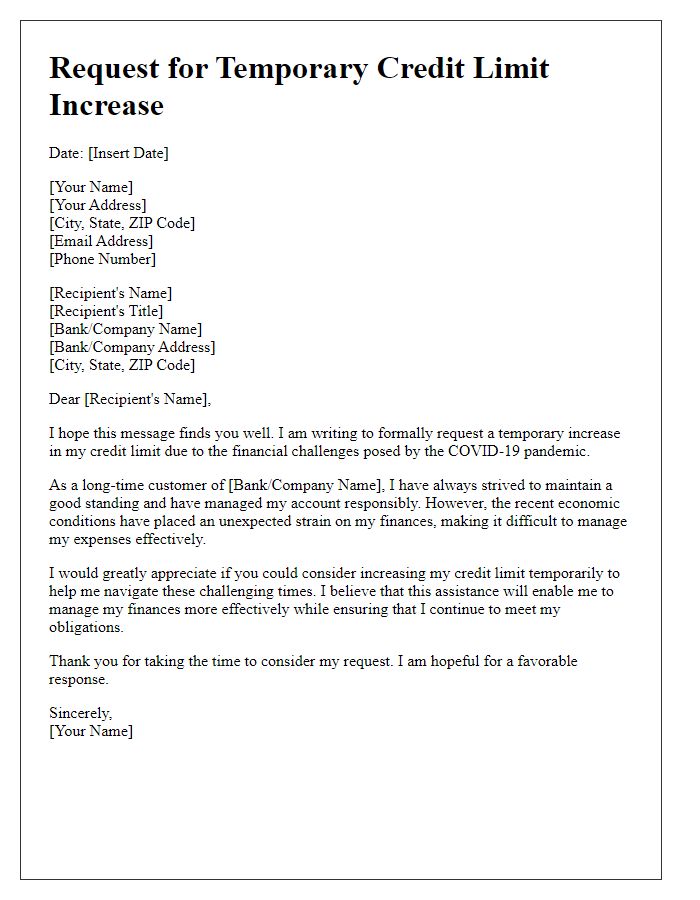

Letter template of request for temporary credit limit increase due to COVID-19

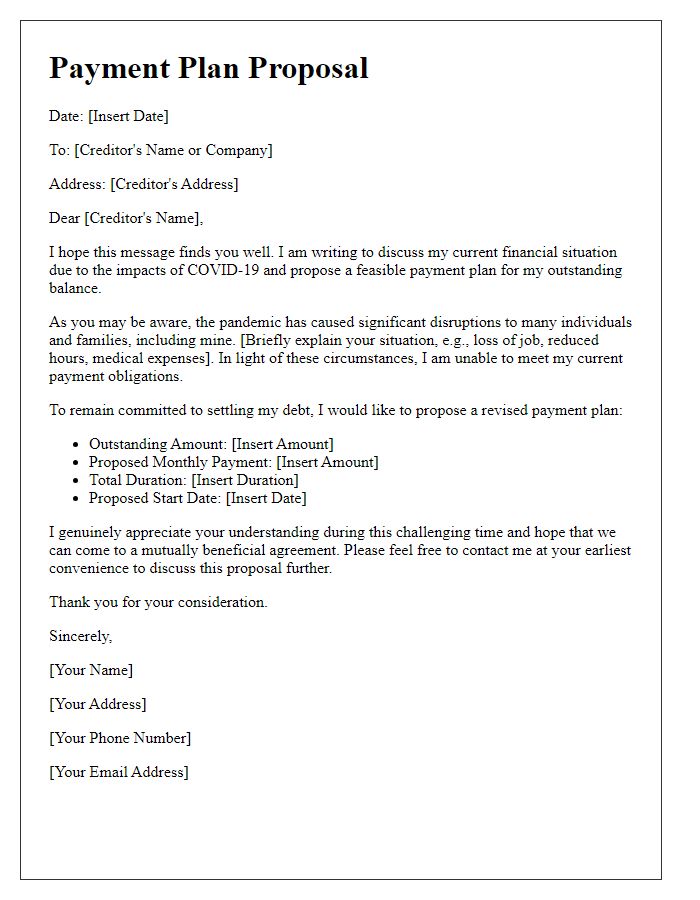

Letter template of payment plan proposal in light of COVID-19 financial difficulties

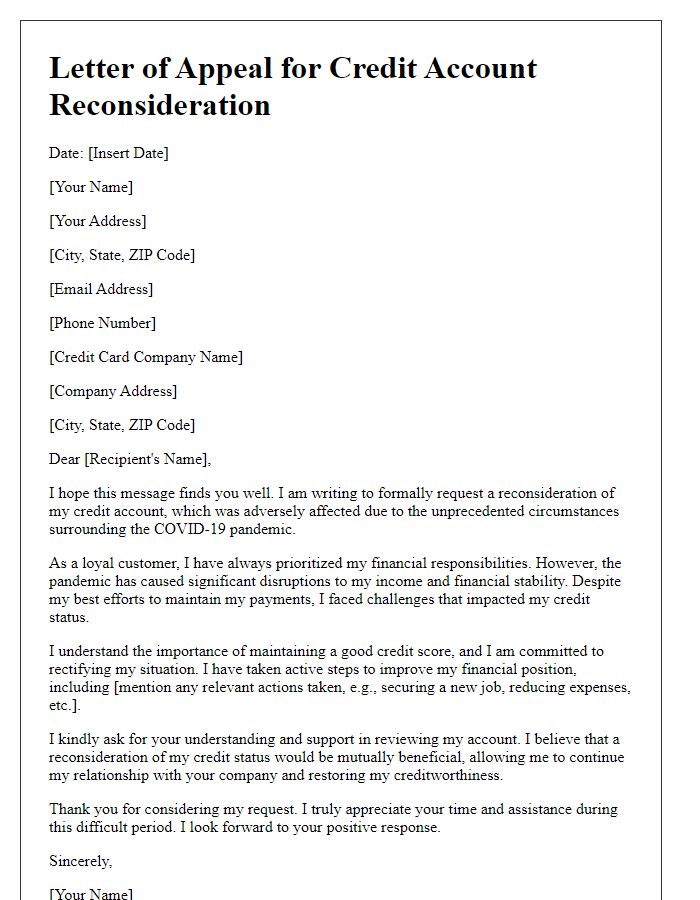

Letter template of appeal for credit account reconsideration due to COVID-19

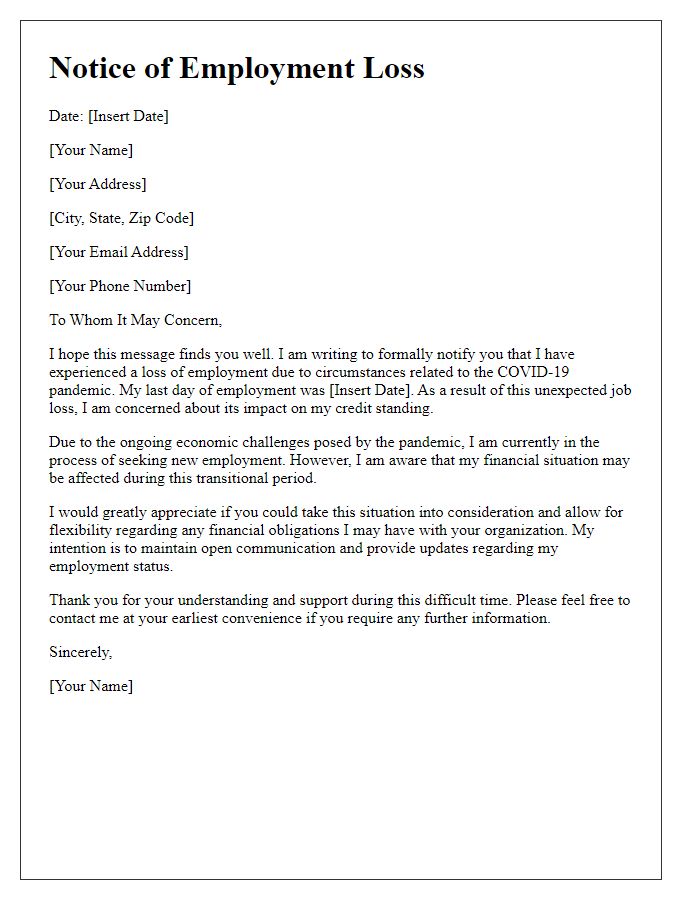

Letter template of notice of employment loss affecting credit standing due to COVID-19

Letter template of inquiry for forbearance options related to COVID-19 credit issues

Letter template of explanation for decreased credit scores linked to COVID-19

Comments