Are you feeling overwhelmed by multiple loan payments and high interest rates? Loan consolidation might just be the solution you've been looking for to simplify your financial life. By combining your loans into a single payment, you not only streamline your expenses but also potentially lower your overall interest rate. Ready to dive into the details of how to apply for loan consolidation? Let's explore!

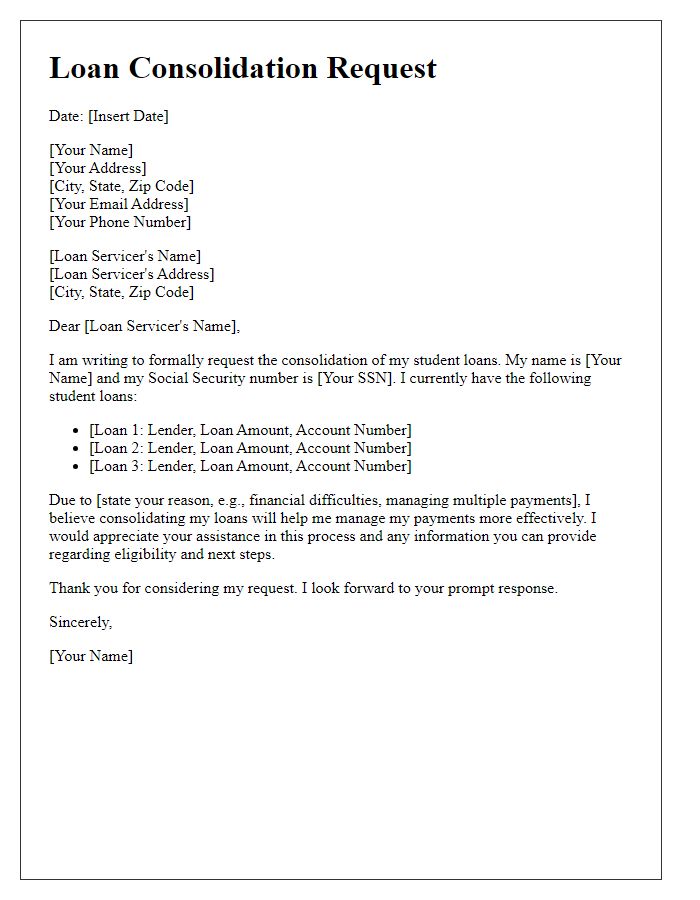

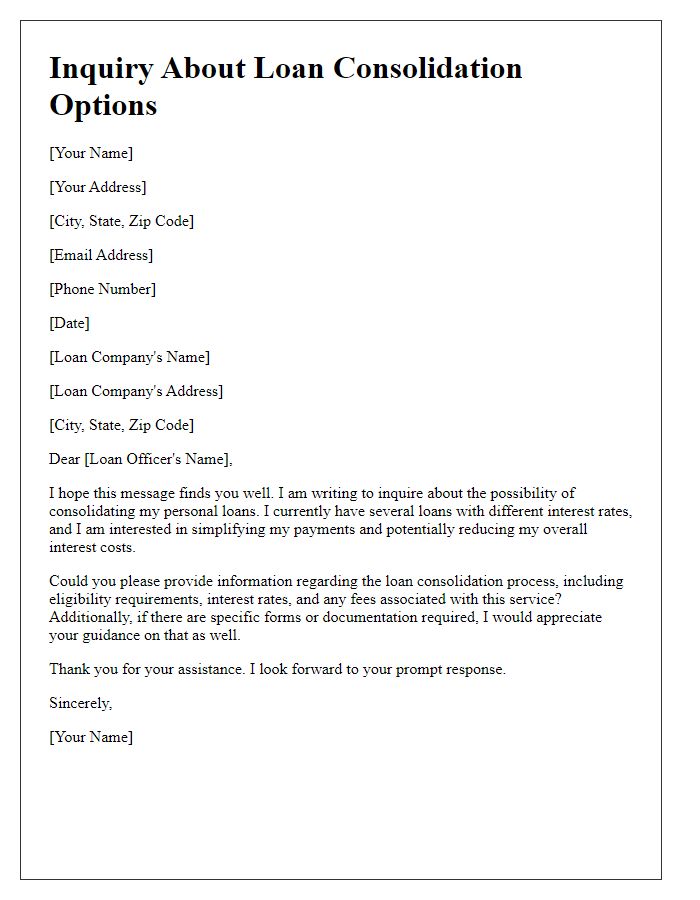

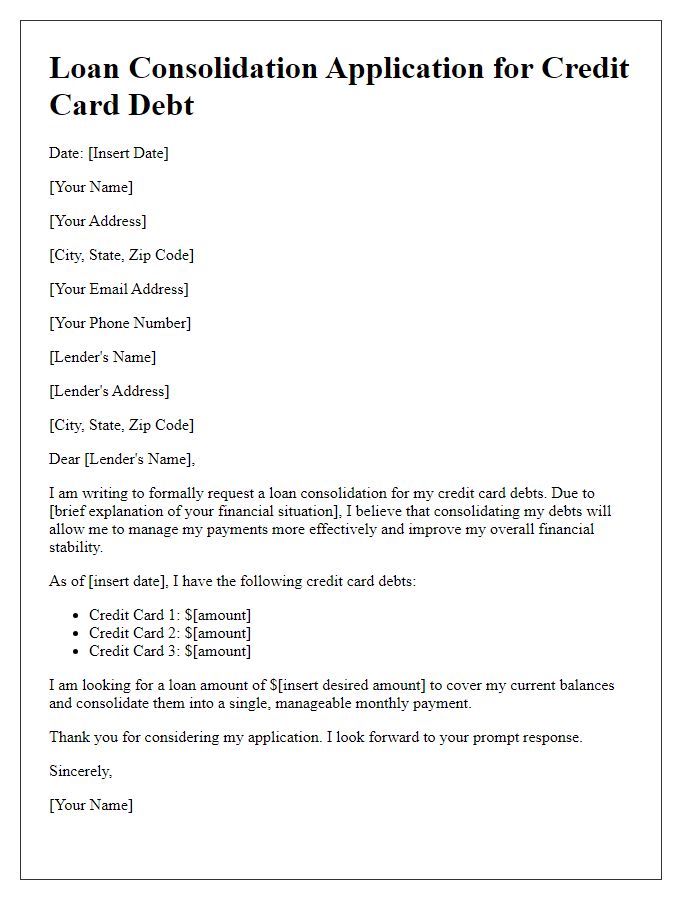

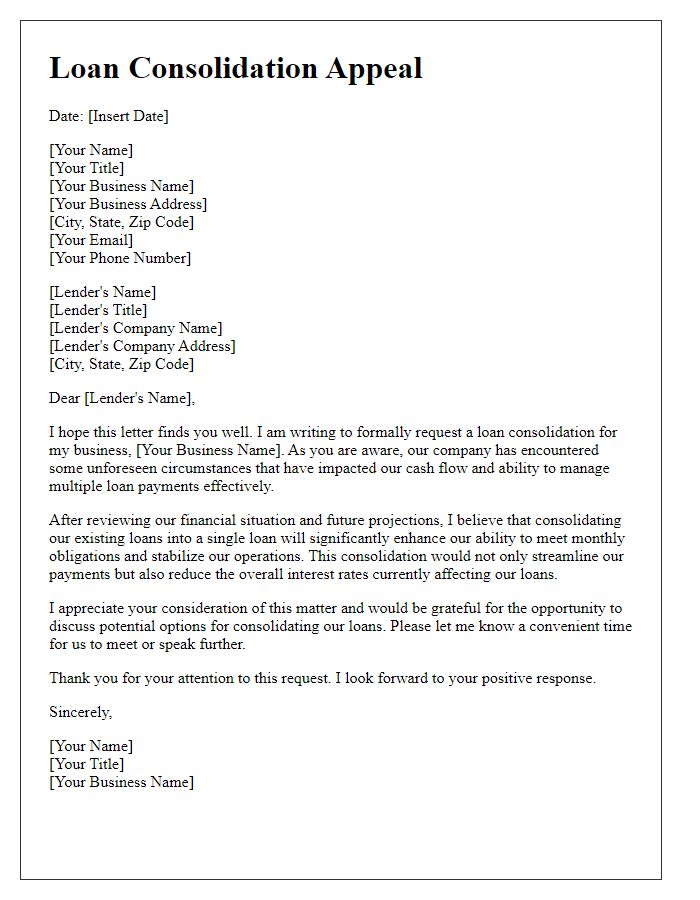

Personal information and contact details

In a loan consolidation application, applicants must provide essential personal information, ensuring lenders can accurately assess eligibility. This includes full name, which identifies the individual and verifies identity; current address, crucial for determining residency status and credit risk; date of birth, used to confirm age and assess financial independence; and social security number, vital for tracking credit history and preventing identity fraud. Contact details like phone number and email address serve as primary communication channels throughout the application process, facilitating a swift response from lenders. Accurate and complete personal information enhances the likelihood of approval and fosters trust between the applicant and the lending institution.

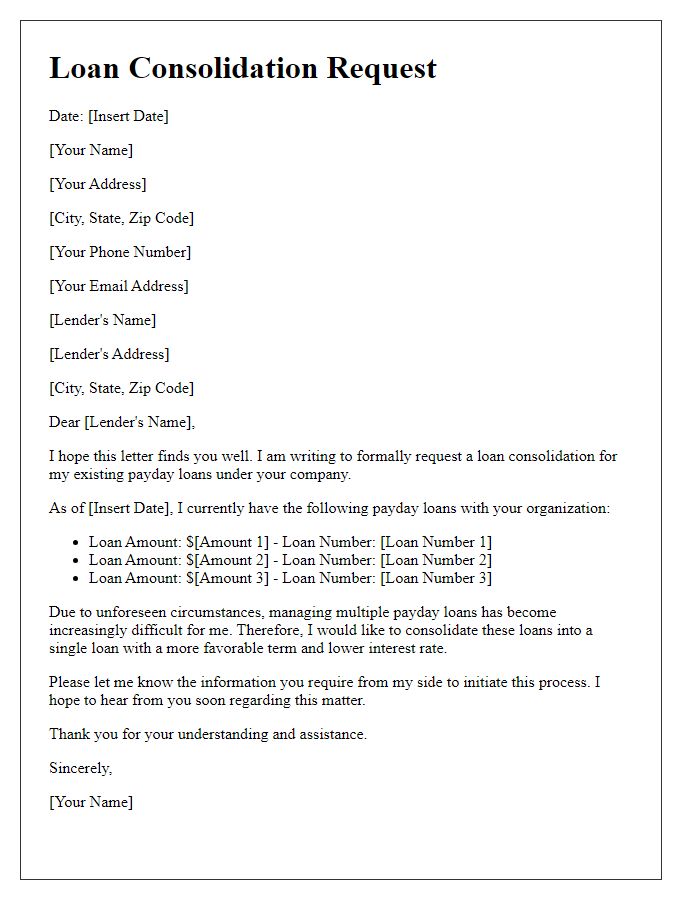

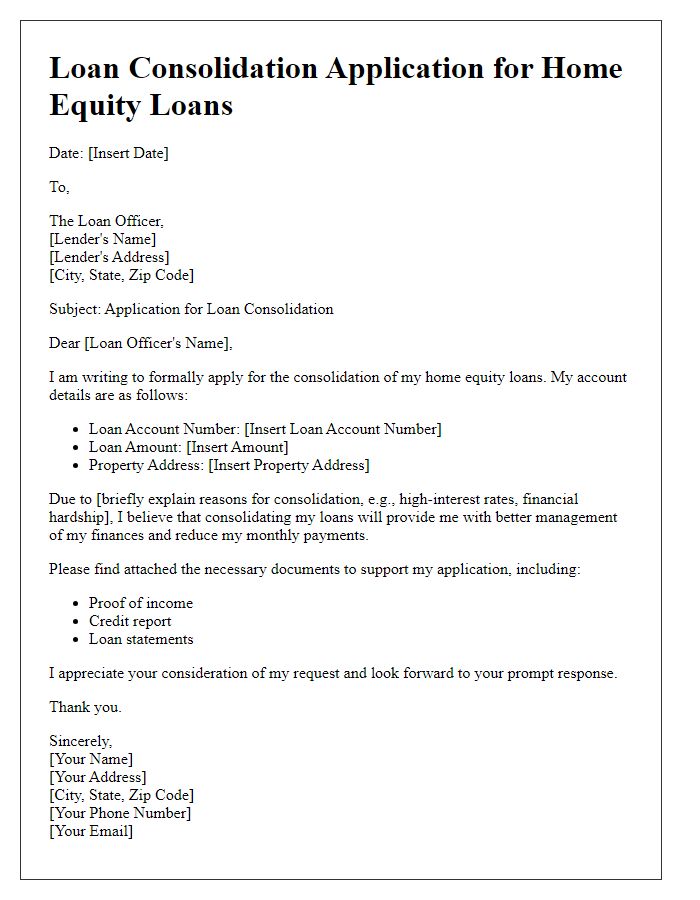

Loan account numbers and details of existing loans

Loan consolidation is a financial strategy employed to combine multiple existing debts into a single loan, simplifying repayment. For individuals seeking consolidation, it is essential to provide specific loan account numbers, which typically consist of 10-16 digits, alongside detailed descriptions of each existing loan. These loans may include personal loans from various banks, credit card debts accruing high-interest rates, and student loans issued by federal or private lenders, often totaling thousands of dollars. By consolidating these debts, borrowers can work towards achieving a lower overall interest rate, potentially reducing monthly payments, and improving financial management while avoiding default on their financial obligations.

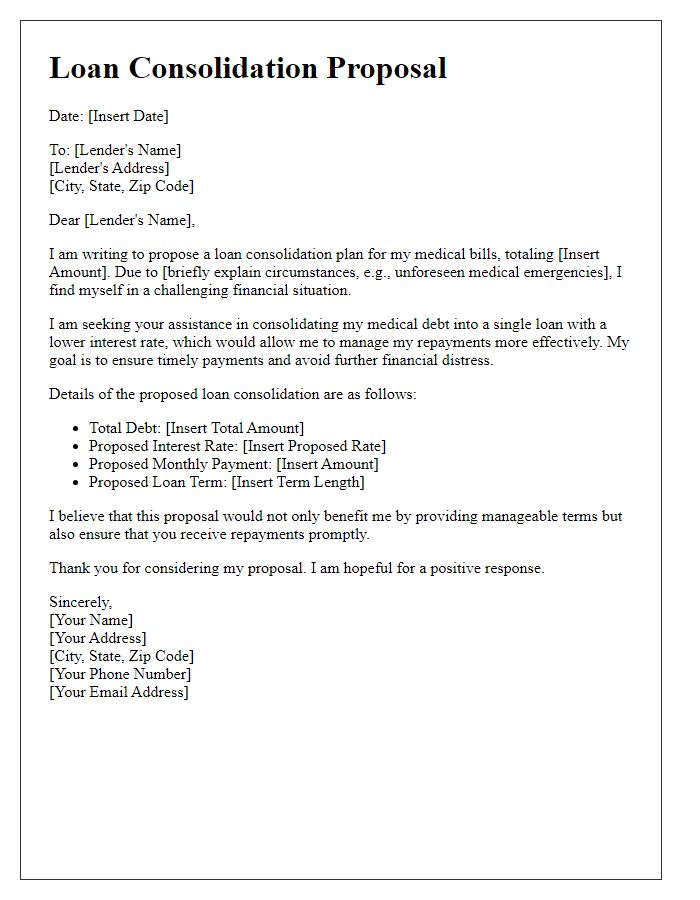

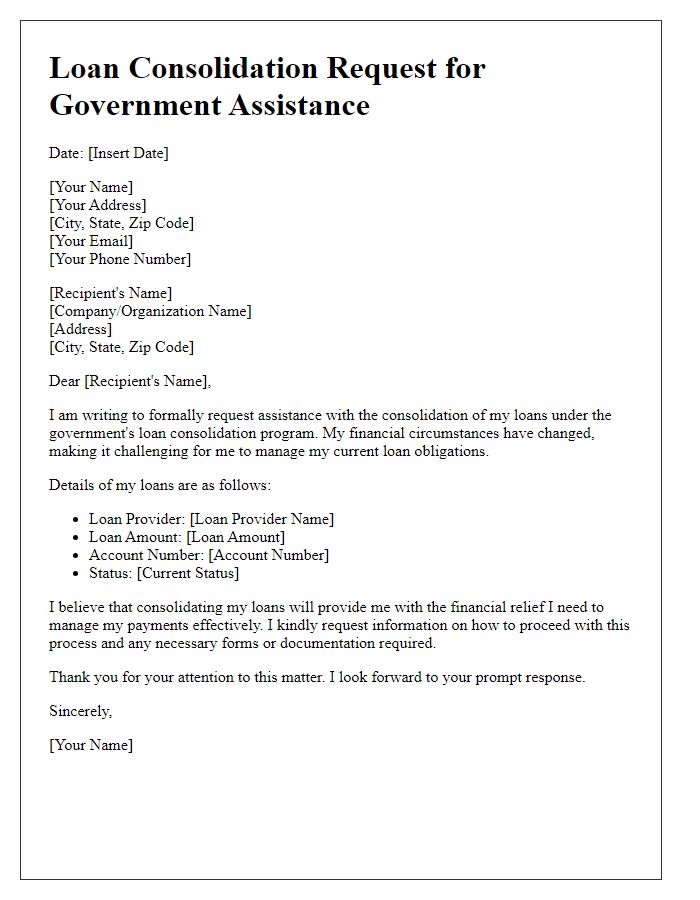

Reason for consolidation request

Loan consolidation is often requested to streamline financial obligations and simplify repayment processes. Borrowers may have numerous loans, such as student loans totaling over $30,000 or credit card debts exceeding $15,000, leading to confusion and increased stress. Combining these debts into a single loan with a lower interest rate, averaging around 4-6%, can significantly reduce monthly payments and contribute to better budgeting. Additionally, borrowers may face varying due dates, making it challenging to stay organized and on track, while consolidating loans allows for a single due date each month. This approach not only improves financial management but also strengthens credit scores over time by demonstrating responsible repayment habits.

Financial status and income documentation

Loan consolidation often requires a detailed understanding of financial status and income documentation. Applicants must submit recent income statements, such as pay stubs or tax returns, to verify earnings, often reflecting a minimum of the last two years' income history. Additionally, a comprehensive list of current debts, including credit cards, student loans, and mortgages, should be provided, showcasing total monthly payments and outstanding balances. This financial snapshot allows lenders to assess the applicant's ability to manage consolidated payments effectively while determining an appropriate interest rate. Ideally, documents should be validated with legal identification, such as a driver's license or social security card, to further authenticate the applicant's financial identity.

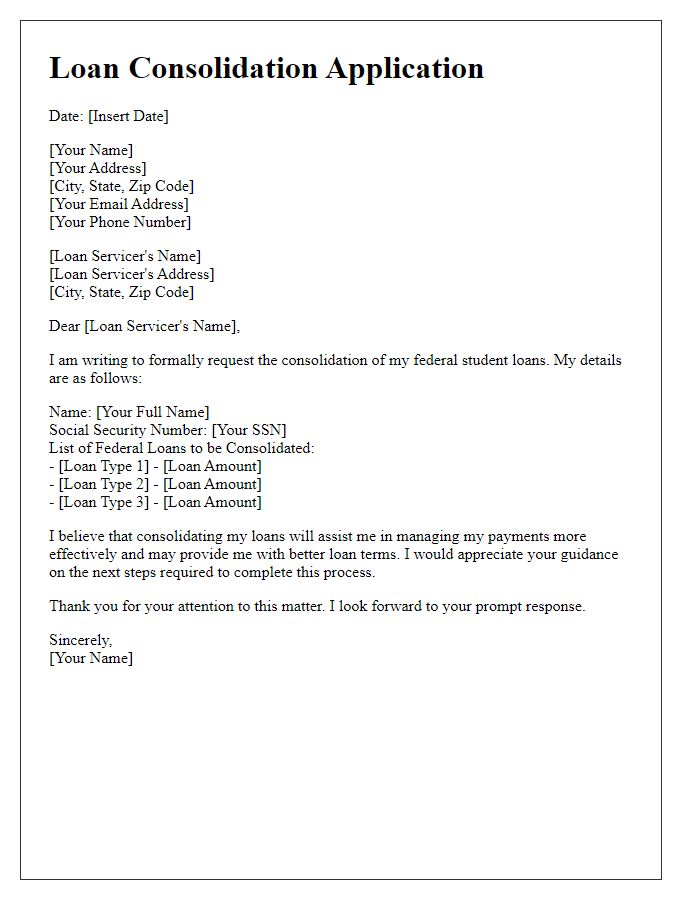

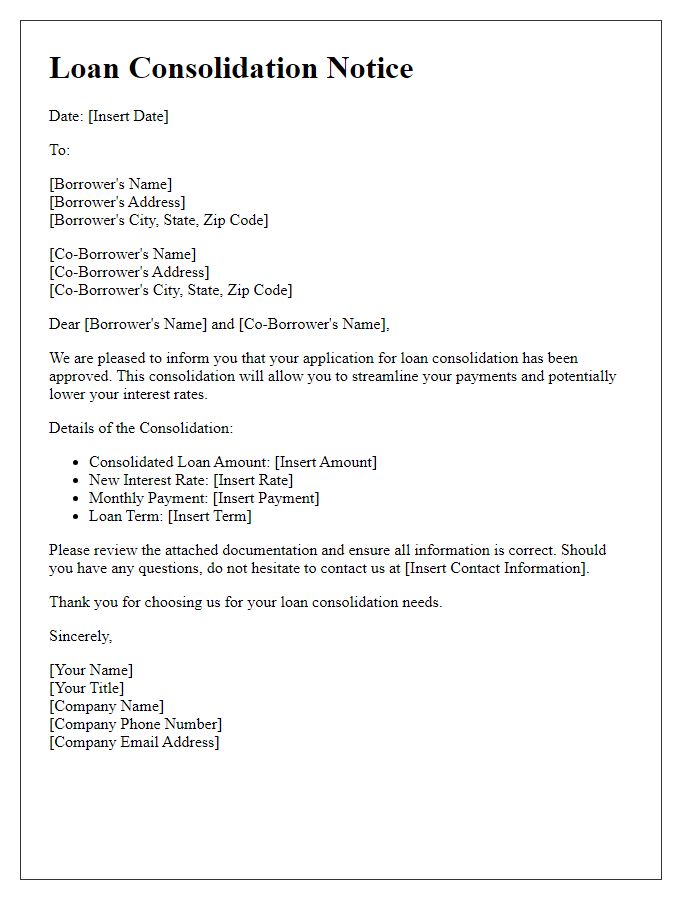

Proposed repayment plan and terms

Loan consolidation allows individuals to combine multiple debts into a single loan, simplifying repayment. A proposed repayment plan typically includes a fixed interest rate (often lower than previous balances) and a specific term length, such as 5 to 15 years. This new loan minimizes monthly payments by extending the repayment period, making it easier for borrowers to manage their finances. For example, a borrower with $30,000 in student loans at 7% interest may consolidate into a new loan at 4.5% over 10 years, resulting in a monthly payment reduction from $350 to approximately $300. Important considerations include potential fees for consolidation (often between 1% to 3% of the loan amount) and the impact on credit scores. It's vital to understand how consolidation affects long-term interest costs versus the benefits of reduced monthly payments.

Comments