Have you ever glanced at your credit report and noticed something that just didn't seem right? It's not uncommon for errors to creep in, and these inaccuracies can impact your financial health. In this article, we'll guide you through a simple letter template to effectively correct those pesky credit report mistakes. Ready to take control of your credit? Keep reading to discover how to draft the perfect correction letter!

Accurate Personal Information

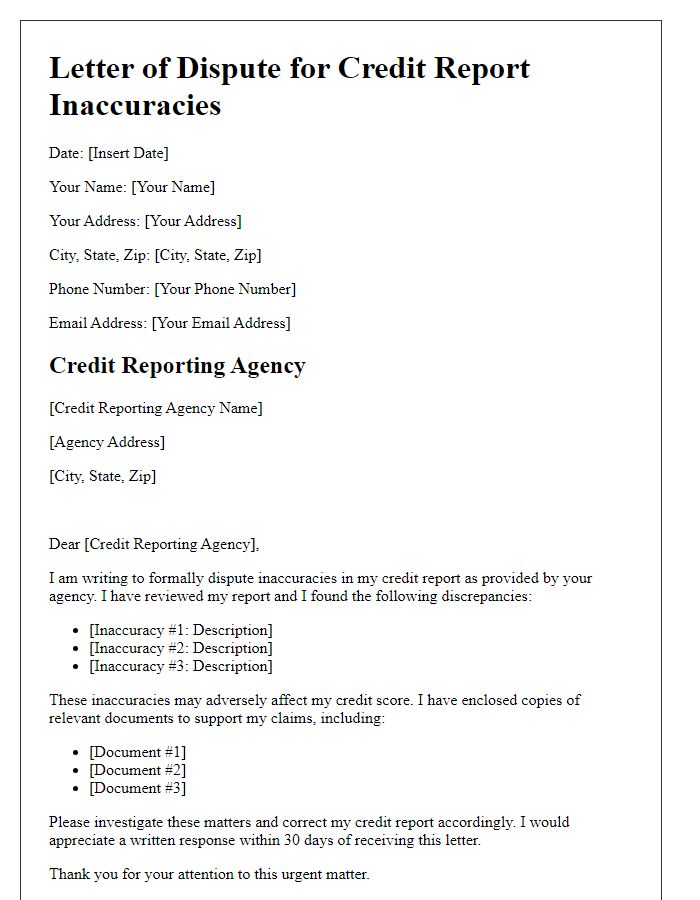

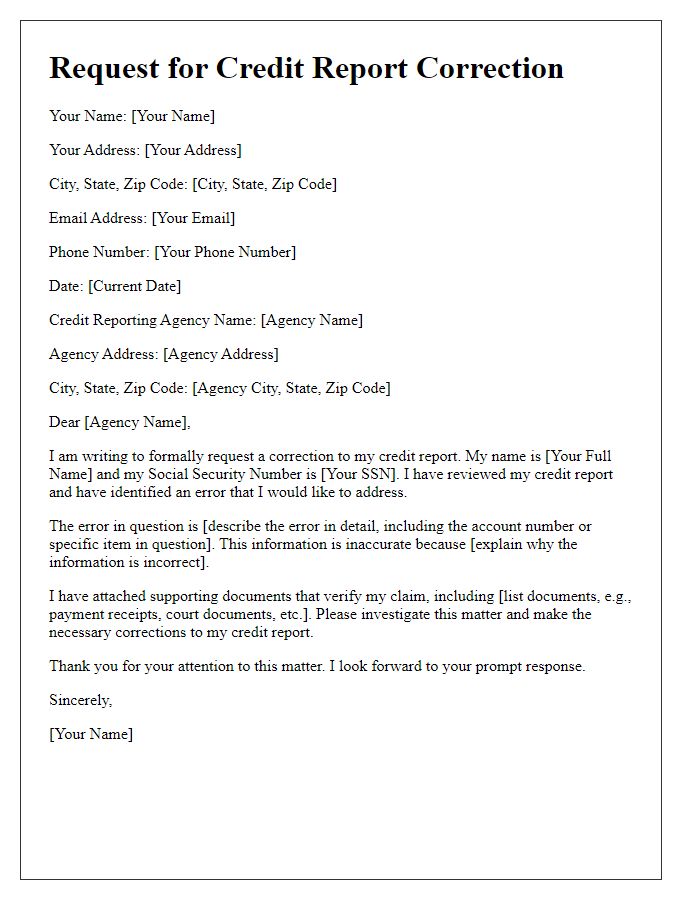

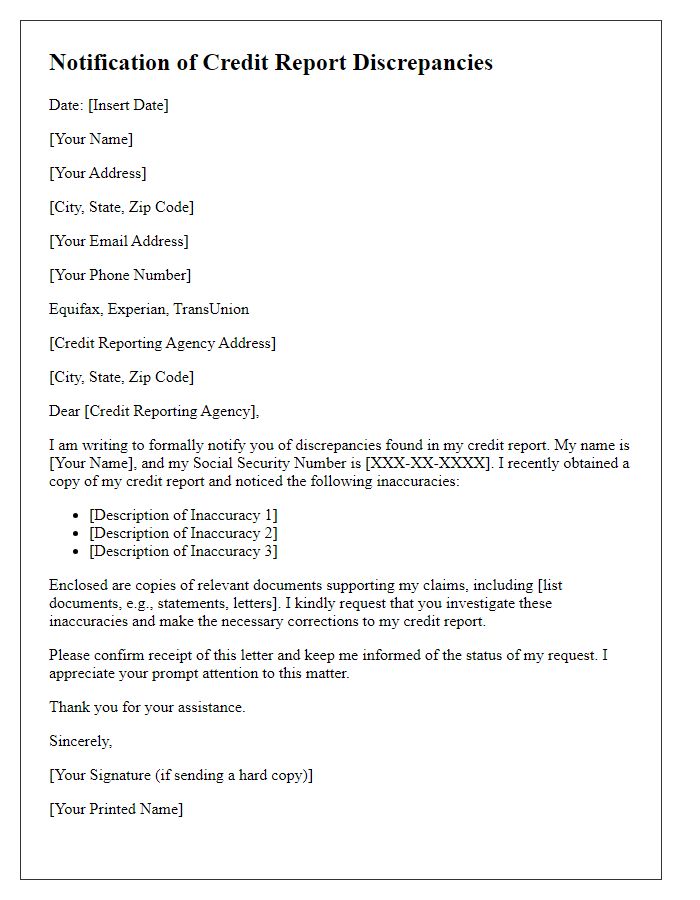

Accurate personal information on credit reports is essential for individuals seeking to maintain a healthy financial profile. Misreported data can lead to difficulties in securing loans or credit cards. For instance, incorrect names, addresses, or Social Security Numbers can confuse lenders and delay approval processes. Consumers must regularly review reports from major credit bureaus, such as Equifax, Experian, and TransUnion, which are mandated to provide free annual access to reports. When errors are identified, it benefits individuals to file a dispute, detailing specific inaccuracies and providing documentation as necessary. Timely corrections can improve credit scores, providing better financial opportunities.

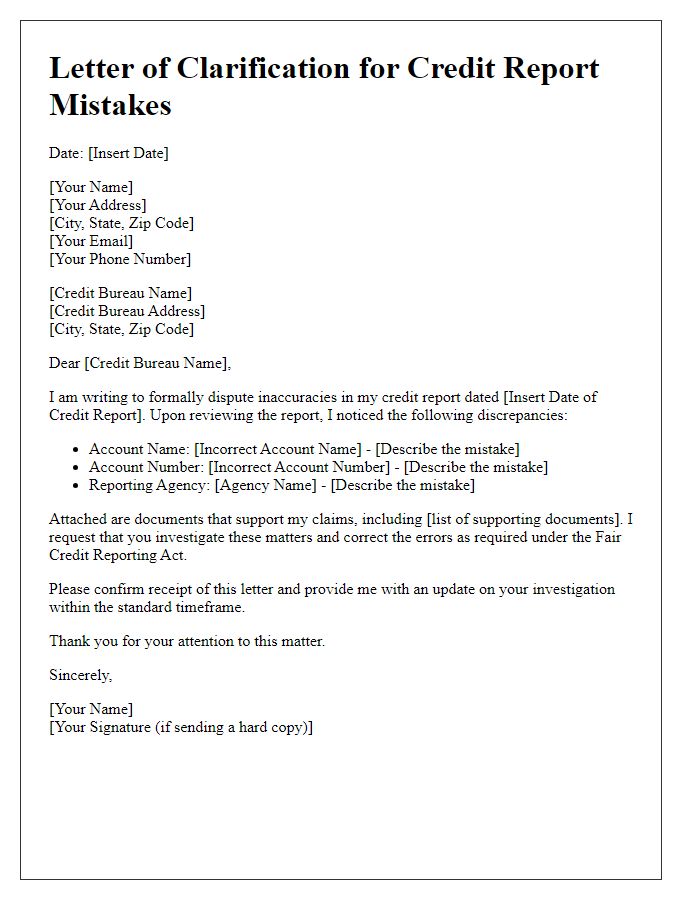

Specific Error Description

Errors on credit reports can significantly impact financial health. Common discrepancies include inaccurate account balances, wrong payment history, or accounts that do not belong to the individual. For instance, a late payment recorded in March 2023 on a credit account should reflect timely payments made on the 15th of each month. Additionally, accounts that have been settled or closed may still appear as open, misleading lenders. Mistakenly attributed debts can appear under an individual's name, such as a medical bill from a hospital in California (e.g., Stanford Medical Center) that was actually billed to another individual. These inaccuracies can lower credit scores (FICO or VantageScore) and need prompt rectification by contacting credit bureaus, including Experian, TransUnion, and Equifax, for corrections.

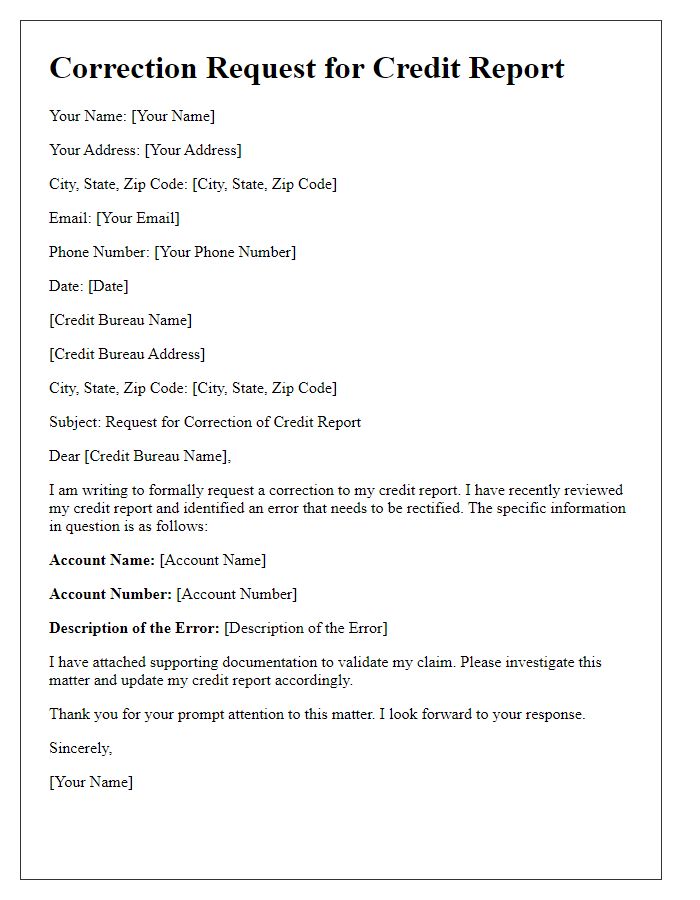

Supporting Documentation

When addressing errors on a credit report, such as incorrect account balances or misreported late payments, it is essential to gather supporting documentation. This may include recent billing statements (from lending institutions like banks or credit card companies) clearly showing accurate account details. Other essential documents can be payment receipts, dispute letters previously sent to creditors, and relevant identification documents (like a driver's license or Social Security card) for verification purposes. By compiling these pieces of evidence, individuals can effectively substantiate their claims, ensuring a higher likelihood of rectifying discrepancies in their credit reports through formal communication with credit bureaus.

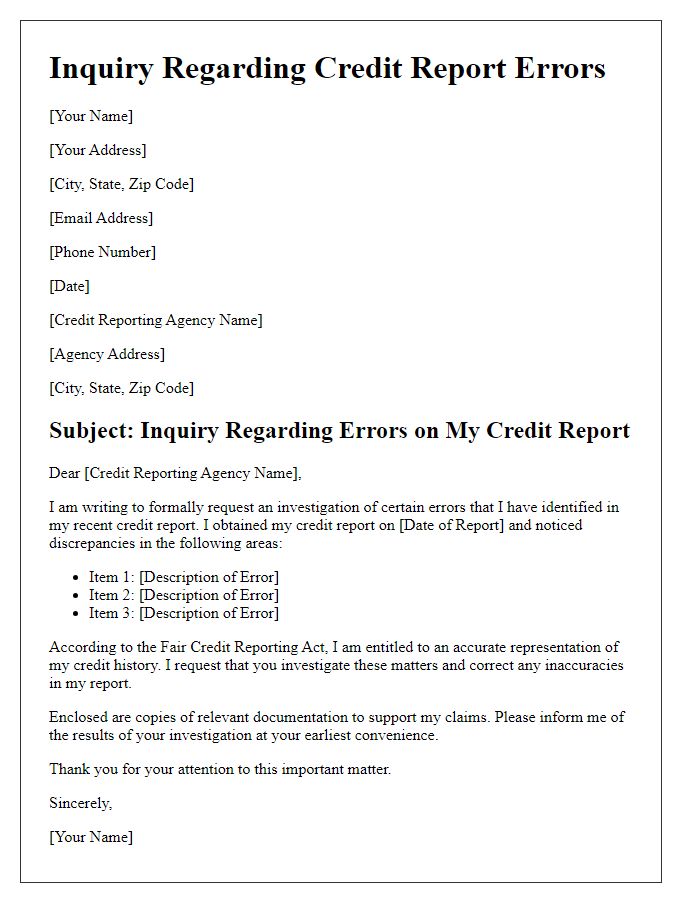

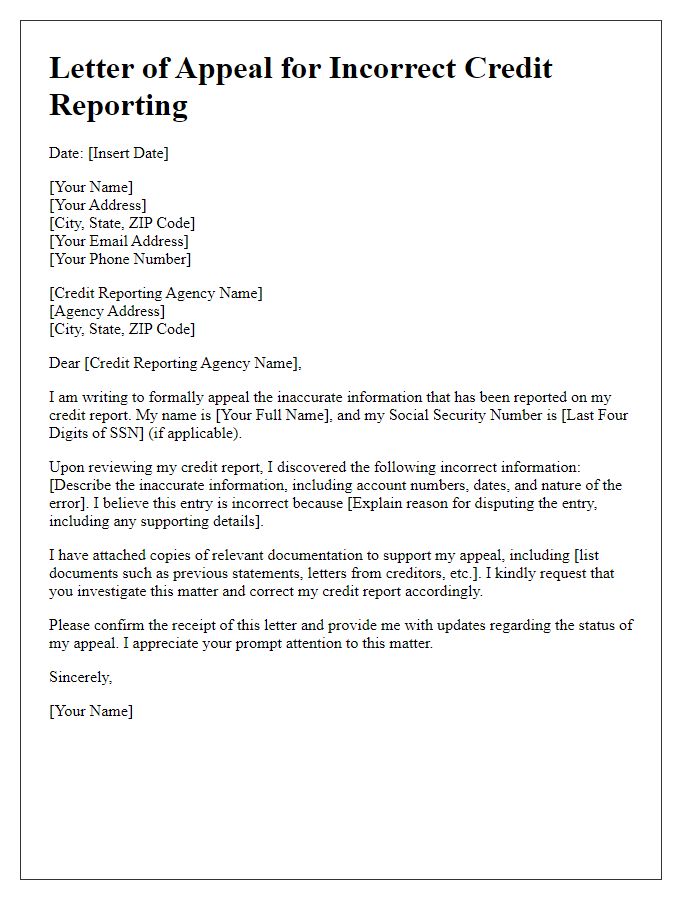

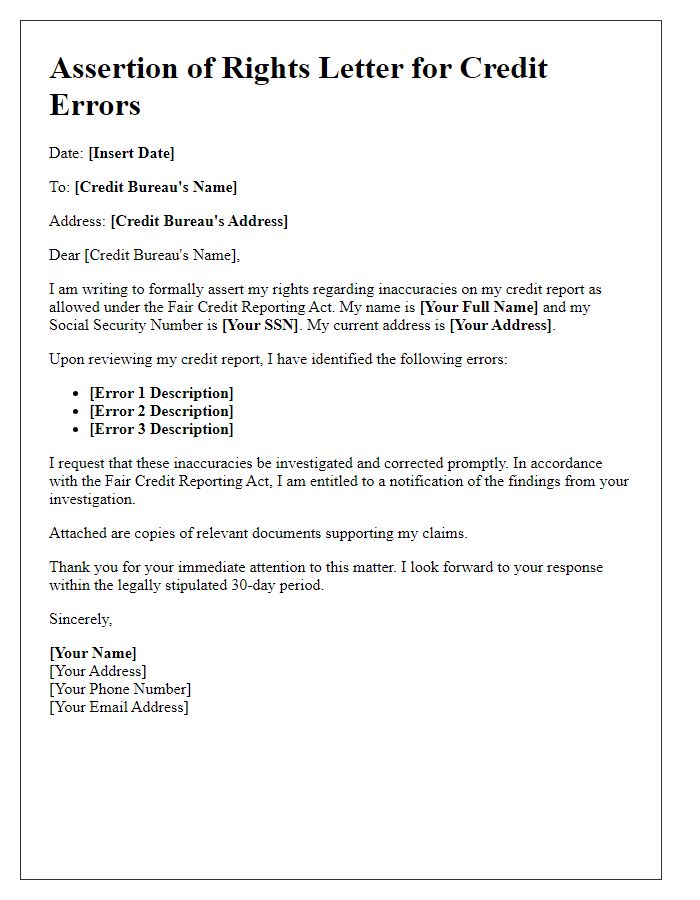

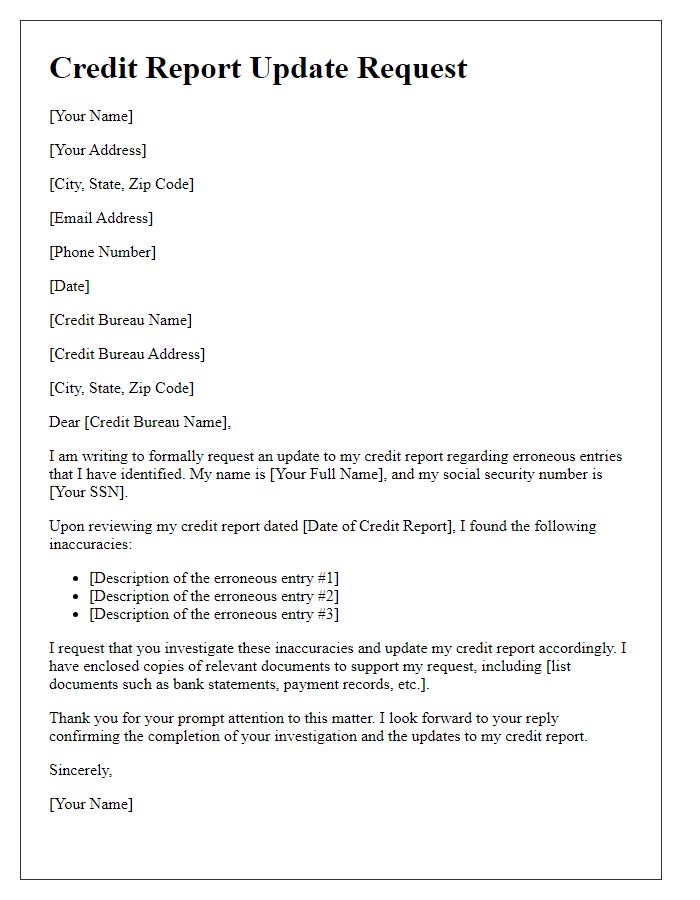

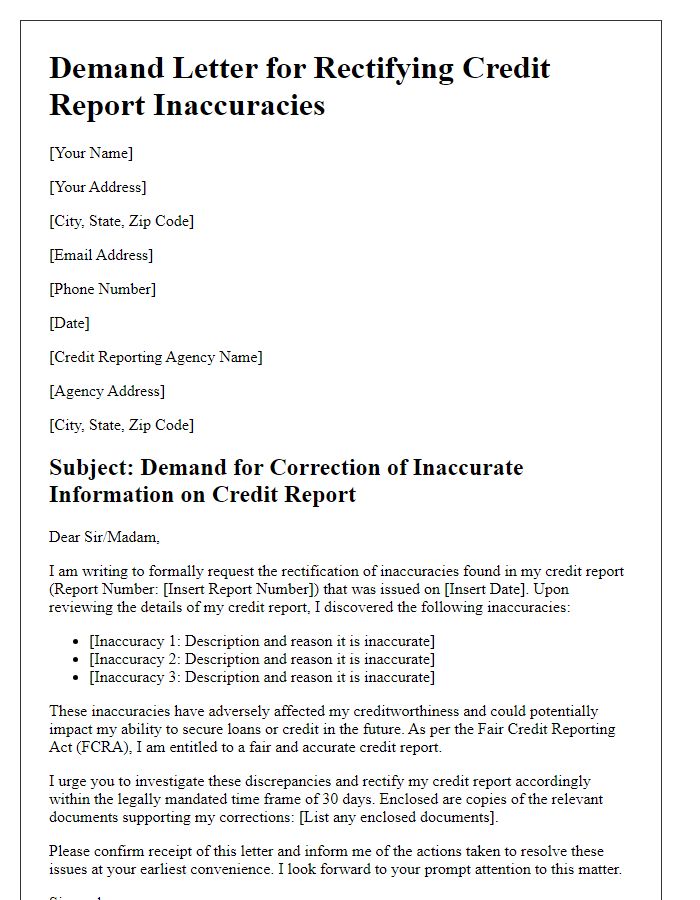

Request for Correction

Credit report inaccuracies can significantly impact financial standing, leading to potential denial of loans or unfavorable interest rates. In the United States, consumers are entitled to report discrepancies to credit bureaus, including Experian, TransUnion, and Equifax. A detailed dispute process requires identifying the specific errors, such as incorrect account balances or misreported payment histories, along with supporting documentation like bank statements or payment confirmations. Federal laws, particularly the Fair Credit Reporting Act (FCRA), mandate credit bureaus to investigate claims, usually within 30 days. The consumer must include personal identification information, a clear description of each error, and requests for corrective actions, promoting accurate credit reporting practices.

Clear Contact Information

A clear and detailed credit report correction request can greatly improve your chances of resolving issues. Include full name (first and last), current address (including city, state, and zip code), phone number (preferably a mobile number), and an email address. This information allows credit bureaus, such as Experian, Equifax, and TransUnion, to contact you efficiently. Additionally, ensure your Social Security number is mentioned (last four digits only) for identification purposes. Include any reference numbers related to the errors to expedite the process. Clear contact information enhances communication and expedites the resolution of discrepancies on your credit report.

Comments