Are you feeling overwhelmed while drafting your business loan application appeal? Don't worry, you're definitely not alone in this! Writing an effective appeal letter can be crucial in securing the financing you need to grow your business. In this article, we'll explore essential tips and a handy template to help you craft a compelling letter that stands out to lendersâso let's dive in!

Clear Identification of Business Details

In a business loan application appeal, clear identification of business details is critical. Accurate business name, such as "GreenTech Innovations" indicates the focus on sustainable technology. Business registration number, like "123456789" provides a unique identifier essential for legal verification. Address specifics, for example, "123 Eco Way, Suite 100, San Francisco, CA" pinpoint location for accountability and service availability. Furthermore, establishing the type of business structure, whether Limited Liability Company (LLC) or Corporation, affects liability and tax implications. Providing a succinct business plan, including key figures from the fiscal year 2022 indicating revenue of $500,000 and a net profit margin of 20% establishes financial credibility. An effective appeal timeline, perhaps showing growth metrics since inception in 2020, demonstrates potential to repay the loan successfully.

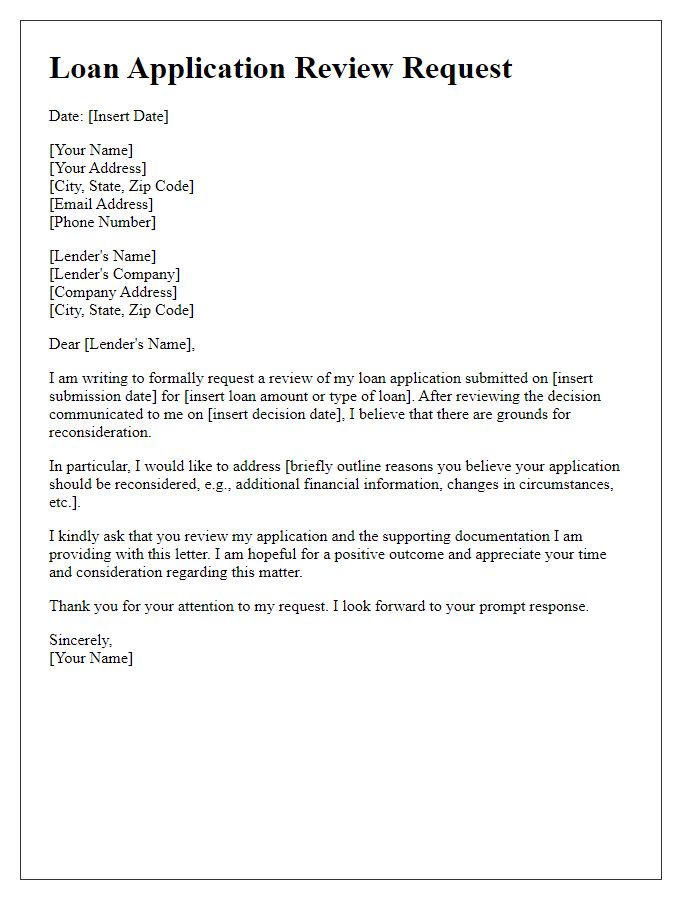

Detailed Explanation of Loan Appeal Reasons

A business loan application appeal can focus on specific reasons why additional funding is necessary for growth and sustainability. Current economic conditions reveal challenges for small businesses, particularly in sectors like retail and hospitality, where foot traffic has decreased significantly due to ongoing changes in consumer behavior. For instance, recent statistics indicate that foot traffic has dipped by over 30% in urban centers compared to pre-pandemic levels. The appeal can highlight how the initial loan amount was insufficient to cover operational expenses, such as rent in high-cost areas like Manhattan, which averages around $70 per square foot annually. Maintaining cash flow has become critical, especially as supply chain disruptions have increased costs and extended delivery times, impacting inventory management. Furthermore, an investment in marketing campaigns has proven necessary to engage customers through digital platforms, where online advertising expenditures have soared by 25%. Addressing these factors will strengthen the case for reconsideration, emphasizing the potential for revenue growth if the appeal is successful.

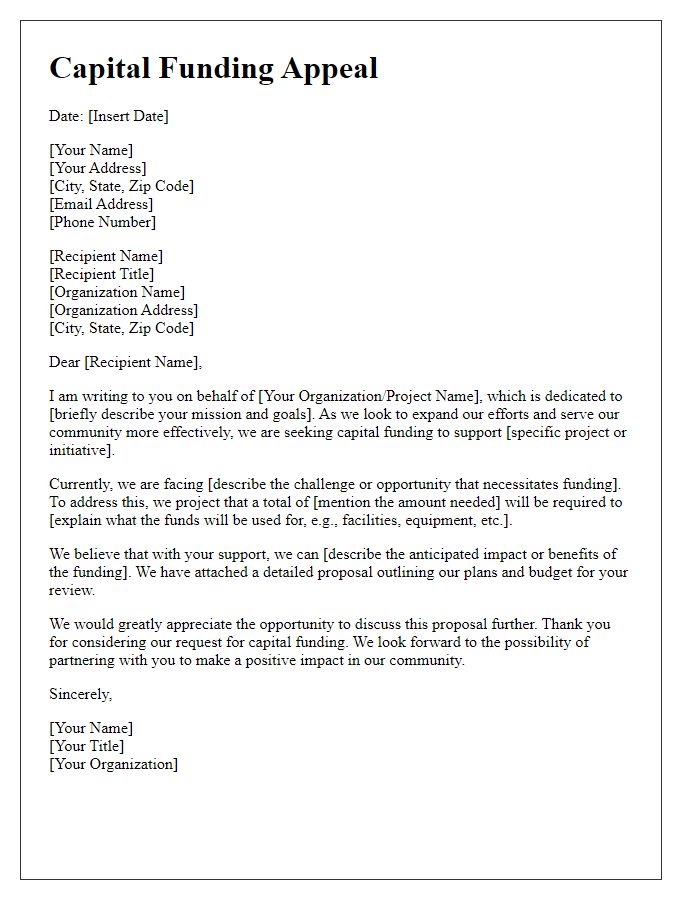

Financial Documentation and Justification

A comprehensive financial documentation package is essential for a business loan application appeal, particularly for small businesses seeking funding from banks like Wells Fargo or community lenders such as Kiva. Detailed statements including profit and loss reports, cash flow projections, and balance sheets can provide clarity on financial health. Important metrics such as current liabilities (totaling over $50,000), net income for the last fiscal year (showing a 20% increase), and operating expenses (averaging around $15,000 monthly) should be included. Justifications for the loan can highlight planned capital expenditures, such as purchasing new machinery (estimated cost $25,000) or expanding into new markets, which could potentially increase annual revenue by 30%. Accurate tax returns from the previous three years also bolster credibility. Demonstrating a solid payment history with creditors can show stability, reducing perceived risk for lenders and enhancing chances for loan approval.

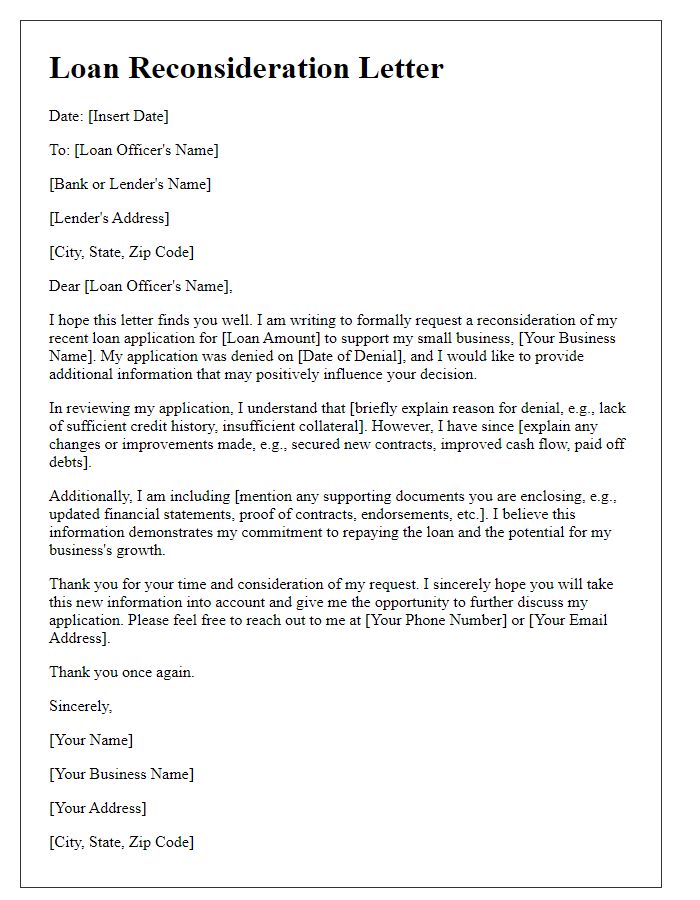

Revised Repayment Plan or Financial Projections

A revised repayment plan is crucial for ensuring sustainable financial health of small businesses facing cash flow challenges. For instance, a local bakery, Sweet Treats, located in Seattle, Washington, may need to adjust its loan repayments from quarterly to monthly payments to better align with its seasonal sales fluctuations. Financial projections should include detailed income forecasts based on historical revenue data, indicating expected growth of 15 percent over the next fiscal year due to increased foot traffic and strong community engagement. Including specific metrics like customer retention rates, average transaction values, and operational cost management strategies enhances the appeal by demonstrating commitment to responsible financial stewardship and long-term viability of the business.

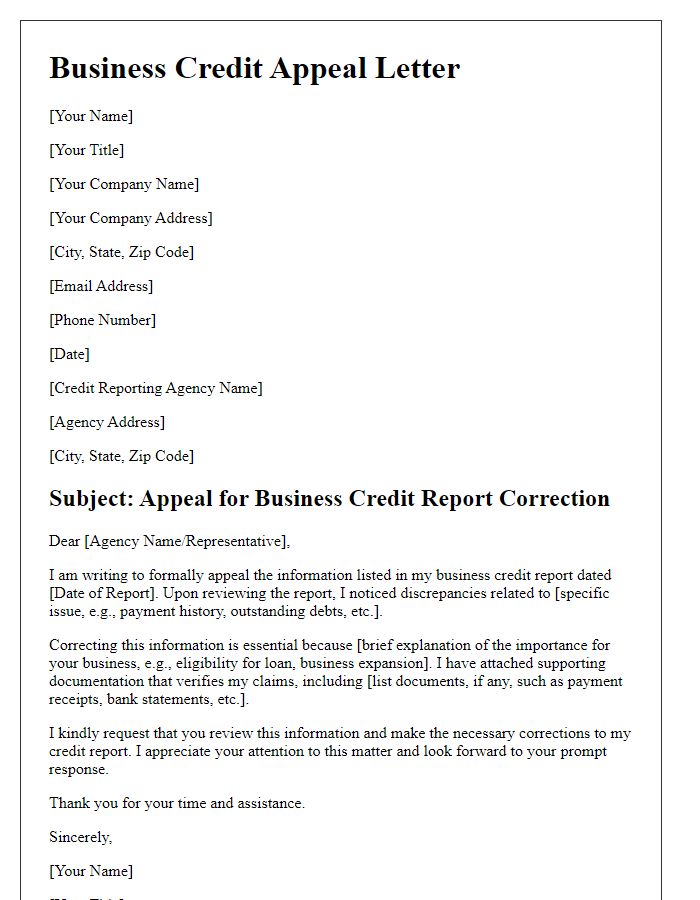

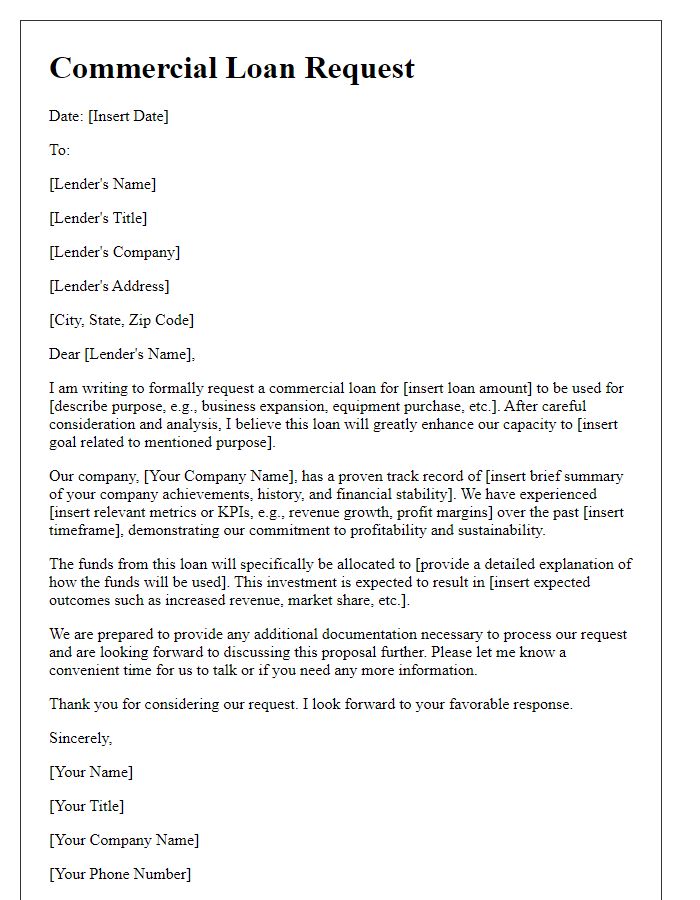

Strong Closing Statement and Contact Information

A robust closing statement in a business loan application appeal emphasizes commitment and readiness to provide additional information. It should restate the business's financial stability or growth potential while expressing appreciation for the lender's consideration. Include direct contact information, such as a cell phone number and email address, ensuring the lender can easily reach the applicant for further discussions. This approach demonstrates professionalism and reinforces the applicant's dedication to building a strong relationship with the financial institution. Clear and concise contact details express transparency and readiness to engage in dialogues, facilitating a positive response from the lender.

Comments