Are you facing the daunting possibility of foreclosure and feeling overwhelmed by the options available to you? Negotiating with your lender can seem intimidating, but it's an essential step in protecting your home and financial future. In this article, we'll explore effective strategies and practical tips that can help you navigate the negotiation process with confidence. So, let's dive in and discover how you can take charge of your situation and avoid foreclosure!

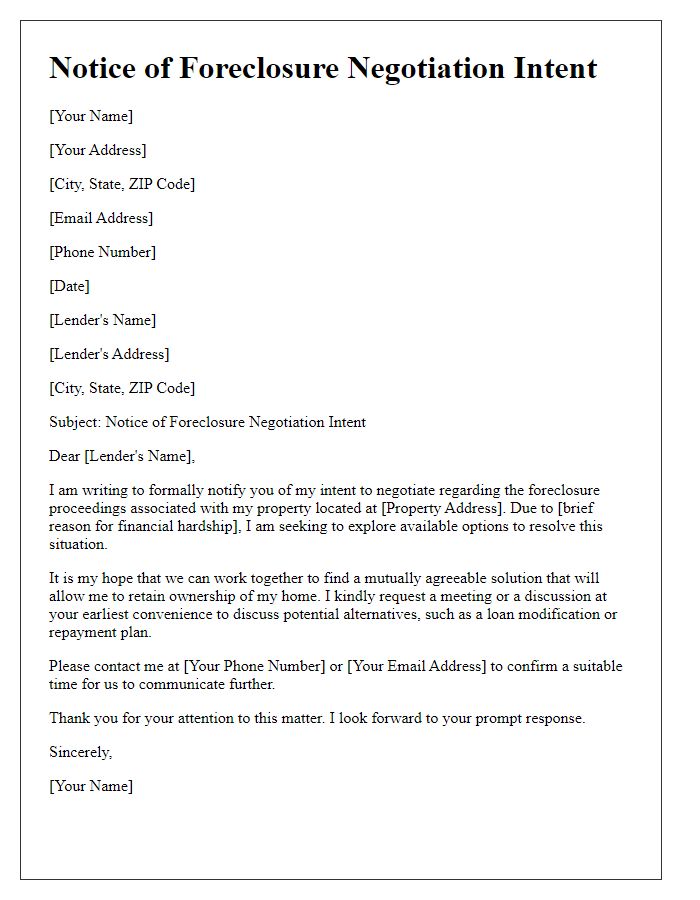

Financial Hardship Explanation

Homeowners facing foreclosure often encounter financial hardships, such as job loss, medical expenses, or unexpected repairs. These events might lead to missed mortgage payments, increasing debt, and mounting stress regarding financial stability. Negotiating with lenders can provide solutions like loan modification or a repayment plan, helping alleviate immediate concerns while allowing homeowners to regain control over their financial future. Engaging with legal or financial advisors can guide individuals through the negotiation process, emphasizing the importance of open communication with mortgage servicers about the reality of one's financial situation. This proactive approach can prevent further escalation toward foreclosure and create a pathway toward resolution.

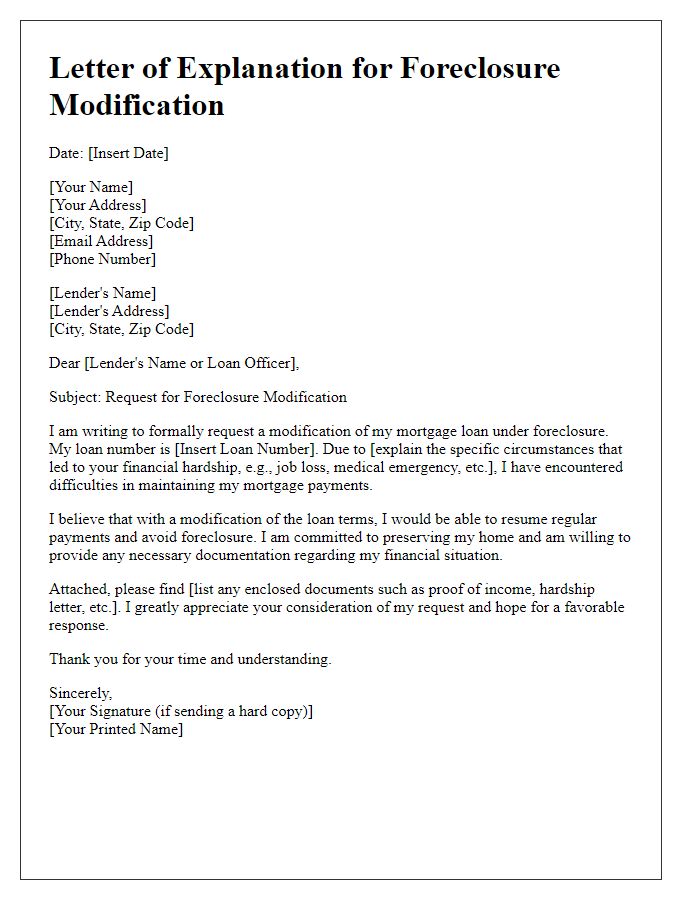

Income and Expense Documentation

Homeowners facing foreclosure often must provide detailed income and expense documentation to negotiate terms effectively with lenders. This documentation typically includes recent pay stubs from employment, bank statements covering the last two to three months, and tax returns from the past two years. Additionally, itemized expenses such as mortgage payments, utility bills, insurance premiums, and property taxes should be included to present a clear financial picture. Accurate documentation can demonstrate a homeowner's current inability to pay, opening the door for potential loan modifications, repayment plans, or other alternatives aimed at preventing foreclosure. Understanding local foreclosure laws (for example, laws in California often offer mediation options) can also enhance negotiation efforts, giving homeowners a stronger position while working with lenders such as Bank of America or Wells Fargo.

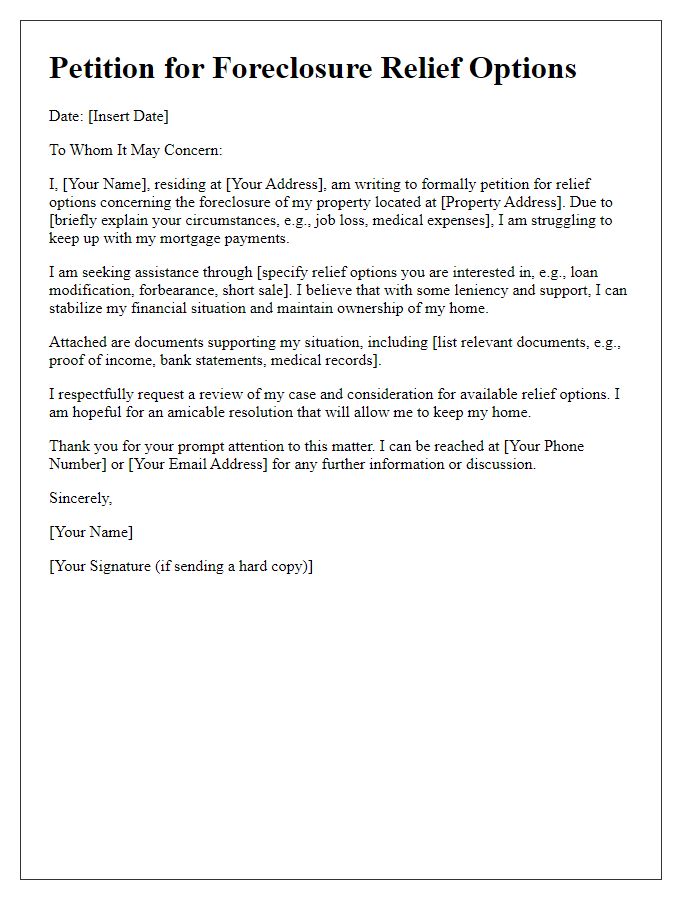

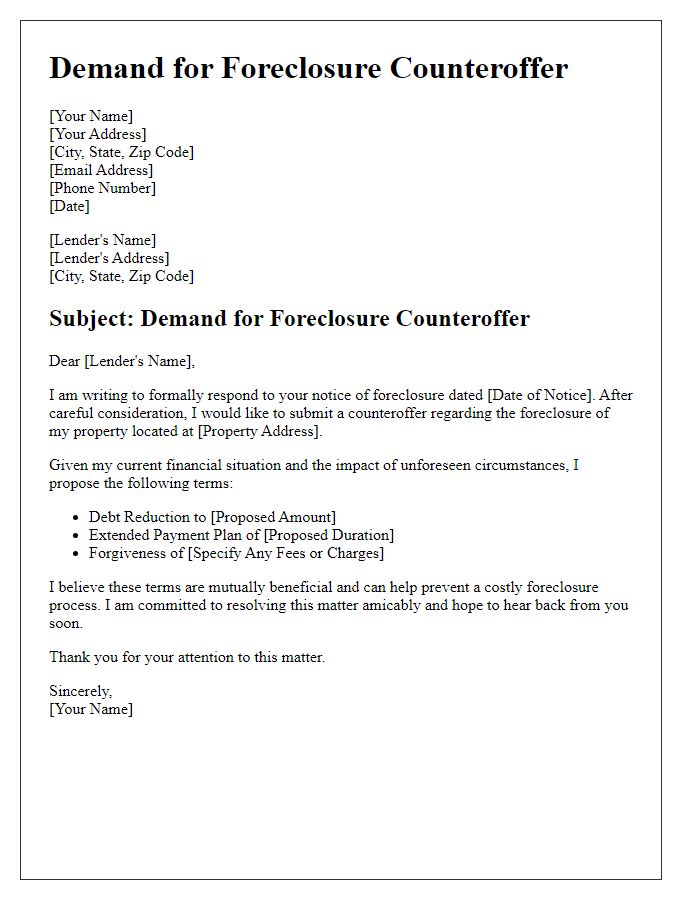

Proposed Repayment Plan

A proposed repayment plan for homeowners facing potential foreclosure is essential for establishing a path to financial stability. This plan typically outlines the total amount owed (including principal and interest) and suggests a structured timeline for repayment, such as a 12 to 24-month period. Key components include monthly payments that reflect the homeowner's current financial situation while aiming to catch up on missed payments. Communication with lenders, such as Bank of America or Wells Fargo, is crucial in negotiating favorable terms that can include lower interest rates or temporary forbearance options. Homeowners should emphasize their commitment to maintaining their property in areas like Los Angeles, California, where the real estate market remains competitive and essential for community stability. Detailed documentation of income sources and expenses must accompany the proposed plan to provide lenders with a clear understanding of the homeowner's financial capacity.

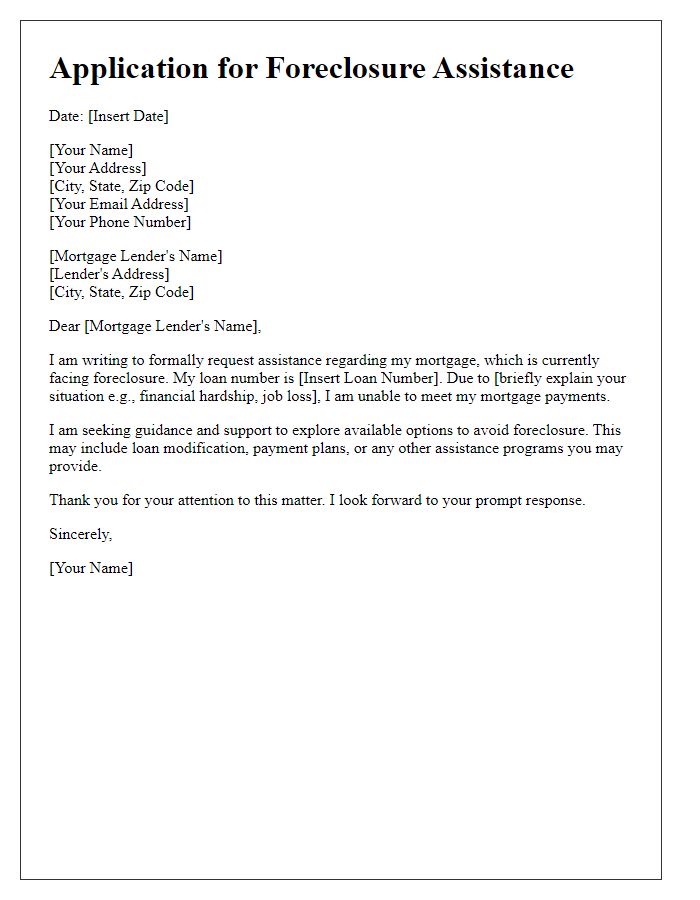

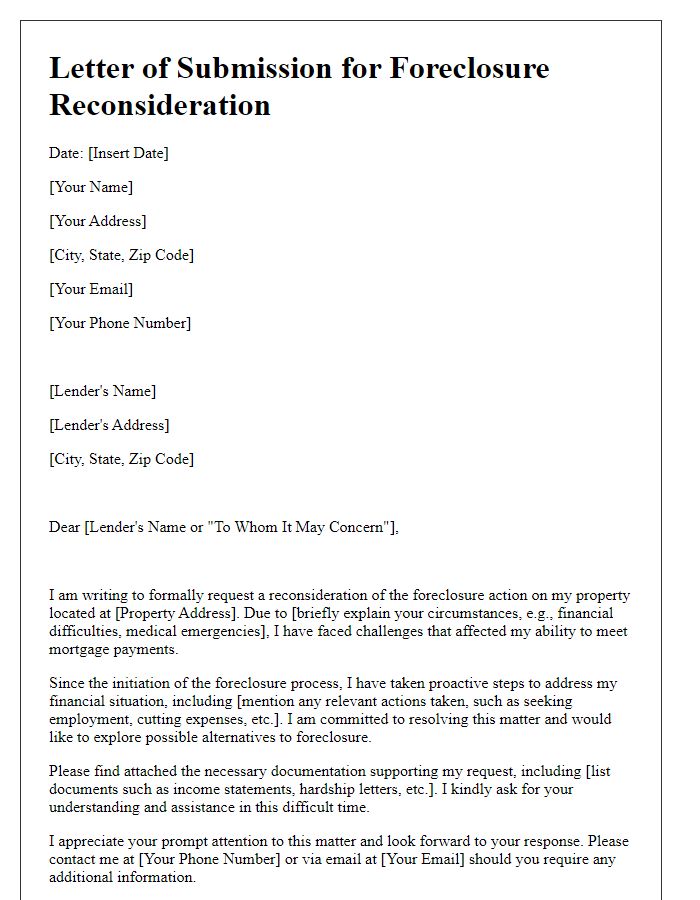

Request for Loan Modification

Homeowners facing foreclosure often seek financial relief through a loan modification, a process that alters the terms of their mortgage to make payments more manageable. In these negotiations, borrowers typically present a request outlining their current financial difficulties, such as job loss or medical expenses, while providing supporting documents like income statements and bank statements. Lenders, such as Wells Fargo or Bank of America, may assess the borrower's eligibility for reduced interest rates or extended loan terms, potentially lowering monthly payments significantly. Successful modifications may result in a forbearance agreement, where payments are temporarily paused until the homeowner stabilizes their financial situation, ultimately aiming to avoid the damaging impacts of foreclosure, including credit score decline and loss of home equity.

Contact Information and Signature

Foreclosure prevention strategies can offer homeowners a chance to negotiate alternatives before losing their property. Various options include loan modifications, repayment plans, or short sales, predominantly managed through discussions with lenders or mortgage servicers. Engaging with agencies such as HUD-approved housing counselors can provide crucial resources and assistance throughout the negotiation process. Statistically, over 10% of borrowers affected by foreclosure can benefit from these intervention tactics, which often lead to more favorable outcomes for both homeowners and lenders. Understanding state-specific regulations and timelines, such as the typical 120-day notice period for default, is essential for effective negotiation. Always ensure communication is documented, preserving a record of interactions with all parties involved in the foreclosure process.

Comments