Are you a contractor looking to streamline your financial statement submission process? Crafting a professional and effective letter template can make all the difference in ensuring clarity and compliance with your accounting requirements. By outlining essential details, maintaining a clear structure, and using a conversational tone, you create a welcoming environment for financial discussions. Dive into this article to discover a customizable letter template that will make your submission process smoother and more efficient!

Accurate Financial Reporting

Accurate financial reporting is essential for contractors to maintain transparency and uphold trust with stakeholders. A well-prepared financial statement includes vital elements such as balance sheets, income statements, and cash flow statements. The balance sheet showcases assets, liabilities, and equity, providing a snapshot as of a specific date, often quarterly or annually. Income statements reflect revenue generated from projects, operational expenses, and net profits over a period, typically reviewed monthly or yearly. Cash flow statements detail cash inflows and outflows, essential for managing liquidity, particularly during peak construction seasons. Adherence to accounting principles such as GAAP (Generally Accepted Accounting Principles) ensures accuracy, while timely submission can impact project financing and bids for future contracts. Detailed documentation and supporting schedules bolster overall credibility during audits and reviews, facilitating smoother transactions and professionalism in the contracting industry.

Compliance with Regulations

Contractor financial statements must adhere to local regulations, specifically the Generally Accepted Accounting Principles (GAAP), which govern the accurate reporting of financial data. Comprehensive documentation, including balance sheets, income statements, and cash flow statements, should be meticulously prepared to reflect the fiscal health of the construction firm. The financial records must encompass all relevant periods, ensuring alignment with the annual reporting requirements set by the Financial Accounting Standards Board (FASB). Additionally, the submission must include notes to financial statements that provide clarifying information on accounting policies and any contingencies affecting the financial status. Non-compliance with these regulations may result in audit scrutiny or penalties imposed by regulatory bodies, including potential disenfranchisement from future contracts.

Detailed Cost Breakdown

Contractor financial statement submissions require a meticulous detailed cost breakdown to ensure transparency and accountability in project expenditures. This breakdown typically includes categories such as labor costs, material expenses, equipment rental fees, and overhead costs, with specific figures for each line item. For labor costs, hourly rates and total hours worked should be listed for each employee, reflecting any overtime charges from the project's duration, which may span several months. Material expenses should itemize all purchased goods, alongside vendor names and quantities, particularly highlighting significant items like concrete or steel, essential in large-scale construction projects. Equipment rental fees account for machinery like excavators and bulldozers, specifying rental periods to provide clarity on costs incurred. Overhead costs encompass administrative expenses, utilities, and insurance percentages related to the project. A thorough breakdown of these costs facilitates clear communication between the contractor and stakeholders, ensuring all parties are aligned on financial aspects throughout the project's lifecycle.

Clear Contractor Identification

Clear contractor identification is crucial for financial statement submissions in the construction industry. Each contractor, such as XYZ Construction Co., must be clearly distinguished by their legal name, business address, and unique identification numbers, like the Employer Identification Number (EIN) issued by the Internal Revenue Service. This ensures accurate record-keeping and compliance with regulations. Financial statements should include specifics about the reporting period, typically fiscal years ending December 31st or June 30th, along with detailed balance sheets outlining assets, liabilities, and equity. Furthermore, the inclusion of contact information for the responsible financial officer ensures prompt communication regarding any queries from regulatory bodies or clients. Proper identification minimizes confusion and aids in transparent financial dealings, exemplifying professionalism in the construction sector.

Timely Submission Process

Timely submission of contractor financial statements is crucial for maintaining compliance and ensuring proper evaluation of financial health. Contractors, typically engaged in various sectors such as construction, engineering, and services, must adhere to specific deadlines outlined by regulatory bodies or project stakeholders. For example, companies may face requirements to submit quarterly financial reports by the 15th day following the end of each quarter to meet local compliance standards. These statements often include balance sheets, income statements, and cash flow statements, reflecting the financial standing as of the reporting date. Failure to submit these documents within the designated time frame can lead to penalties, delays in project payments, and disruptions in business relationships, highlighting the importance of a systematic submission process.

Letter Template For Contractor Financial Statement Submission Samples

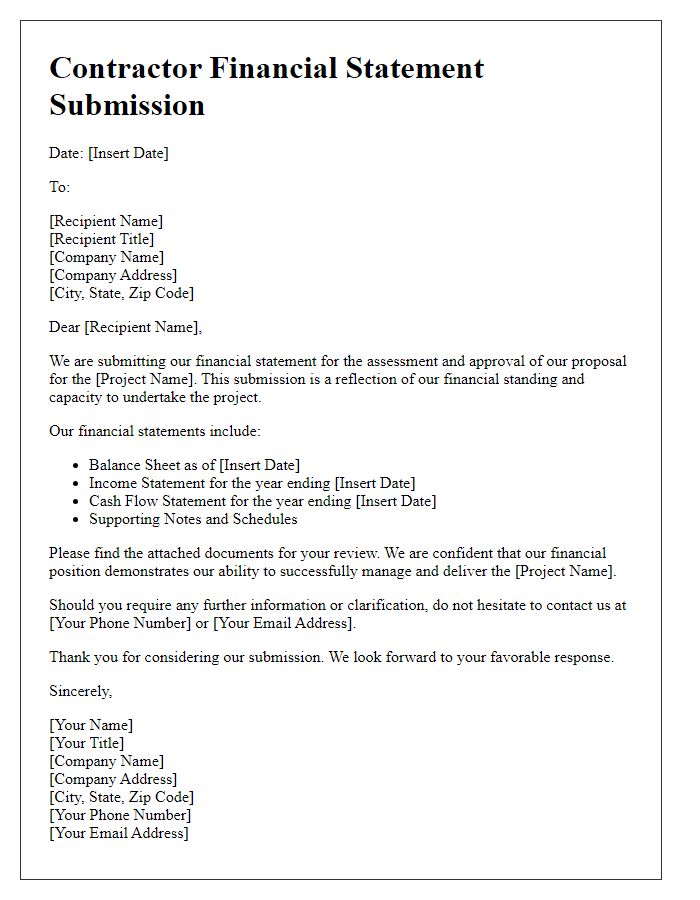

Letter template of Contractor Financial Statement Submission for Project Approval

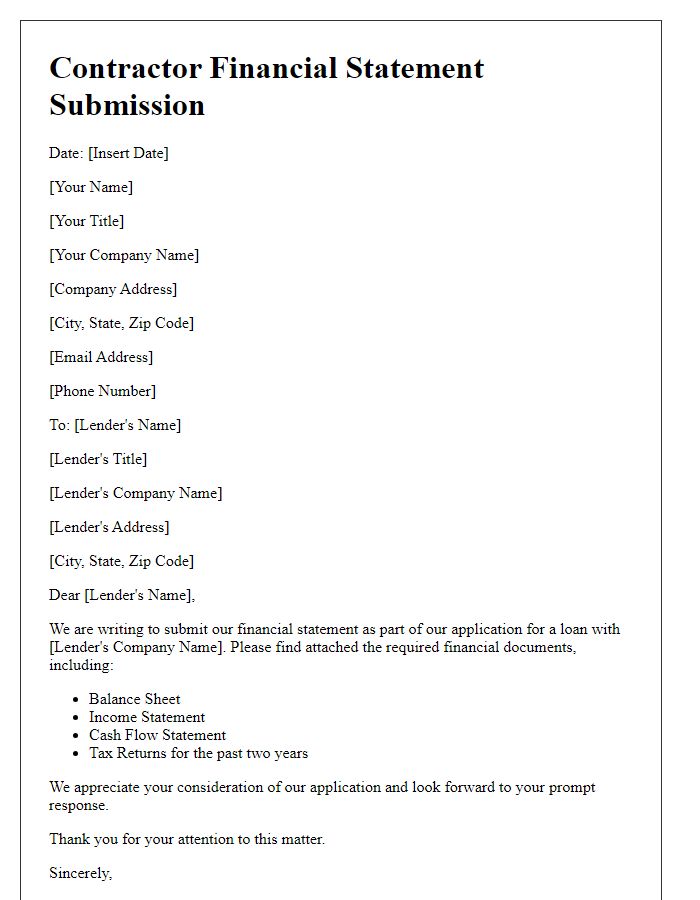

Letter template of Contractor Financial Statement Submission for Loan Application

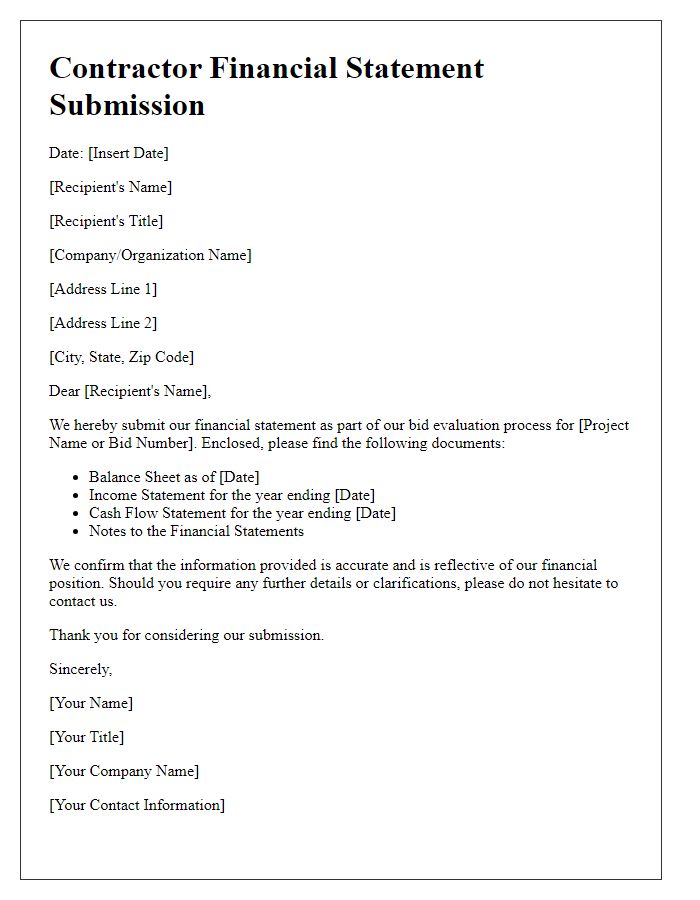

Letter template of Contractor Financial Statement Submission for Bid Evaluation

Letter template of Contractor Financial Statement Submission for Contract Renewal

Letter template of Contractor Financial Statement Submission for Performance Assessment

Letter template of Contractor Financial Statement Submission for Compliance Verification

Letter template of Contractor Financial Statement Submission for Auditing Purposes

Letter template of Contractor Financial Statement Submission for Partnership Proposal

Letter template of Contractor Financial Statement Submission for Grant Application

Comments