Are you looking for a simple yet effective letter template to update your collections account? Whether you're a business owner needing to reach out to clients or someone managing personal finances, a clear and polite communication can make all the difference. In this article, we'll provide you with a customizable letter template that ensures your message is both professional and approachable. So, let's dive in and explore how to craft the perfect collections account update!

Clear Account Information

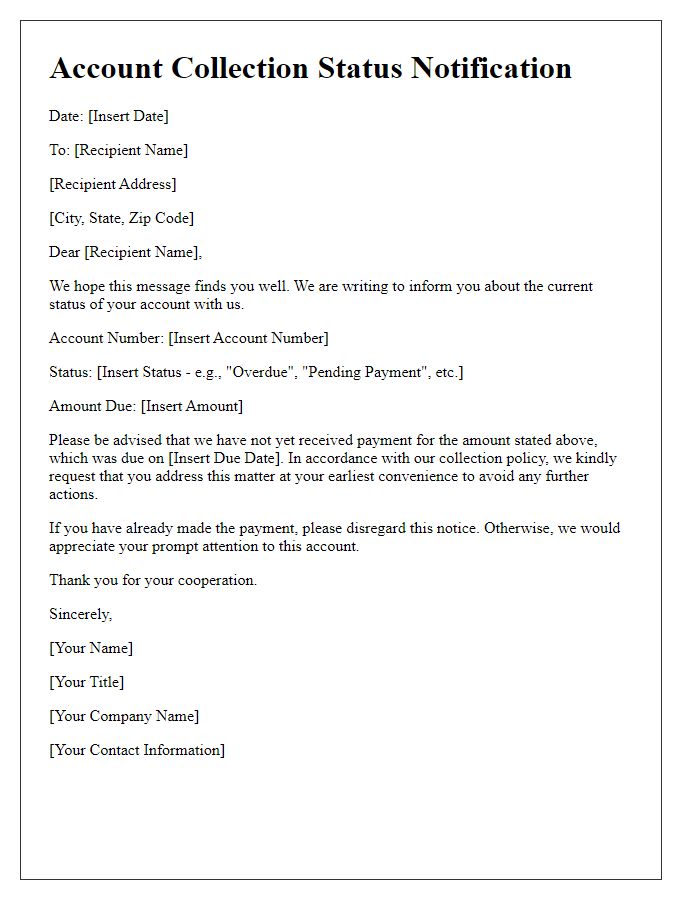

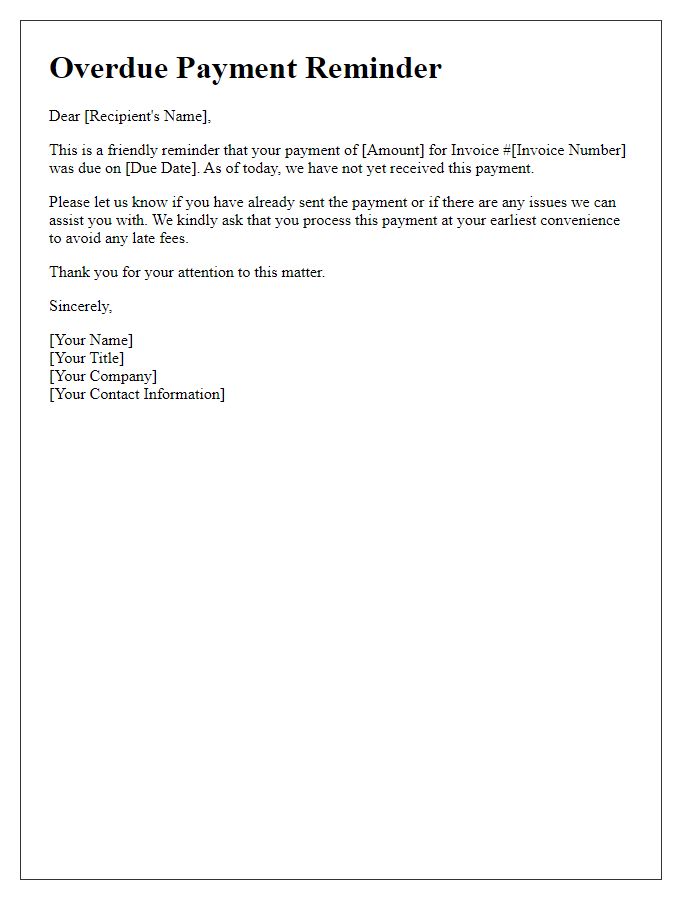

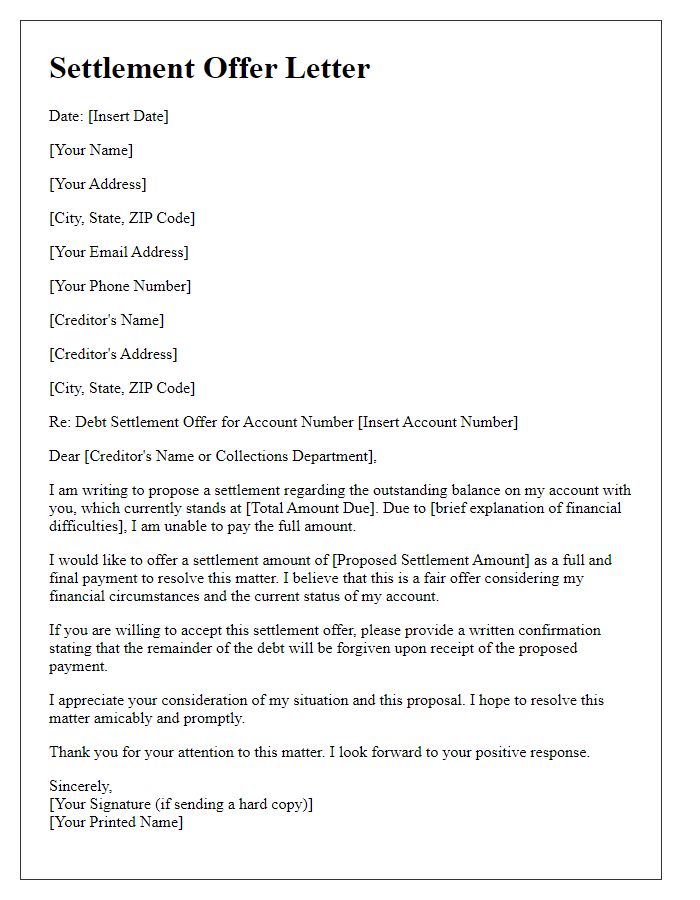

A collections account update requires precise communication regarding the financial status of an individual's account. Accurate account information, such as account number, outstanding balance, and due date, must be detailed to ensure clarity. Additionally, specifying the creditor's name, contact information, and payment methods available can help individuals understand their options. Including a timeline of events, such as when the account was opened, payment history, and attempts made for resolution, provides context. Clear instructions for disputing charges or establishing payment plans should also be listed to assist individuals in managing their financial responsibilities effectively.

Concise Payment Instructions

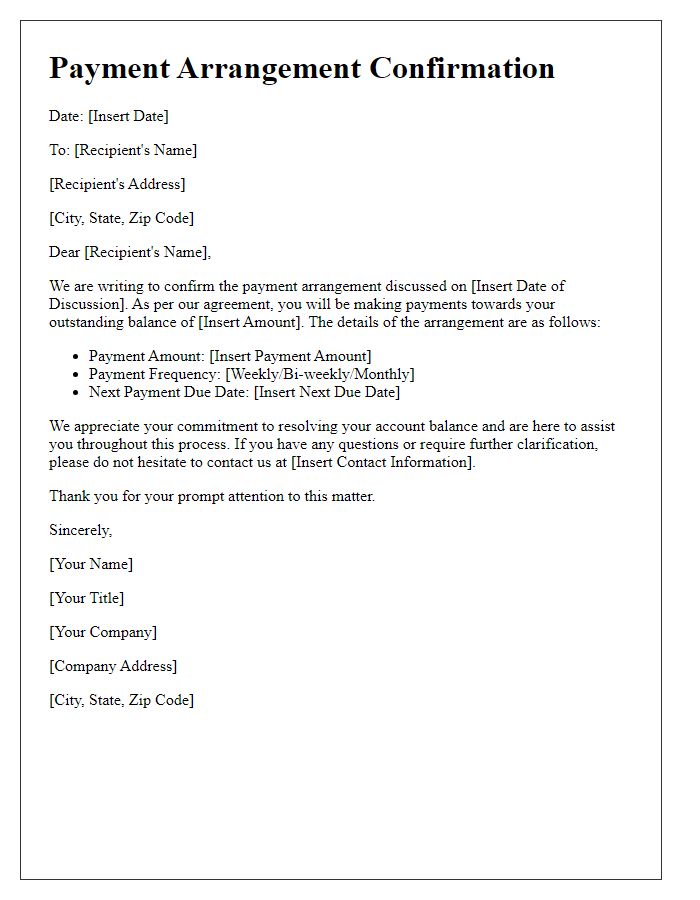

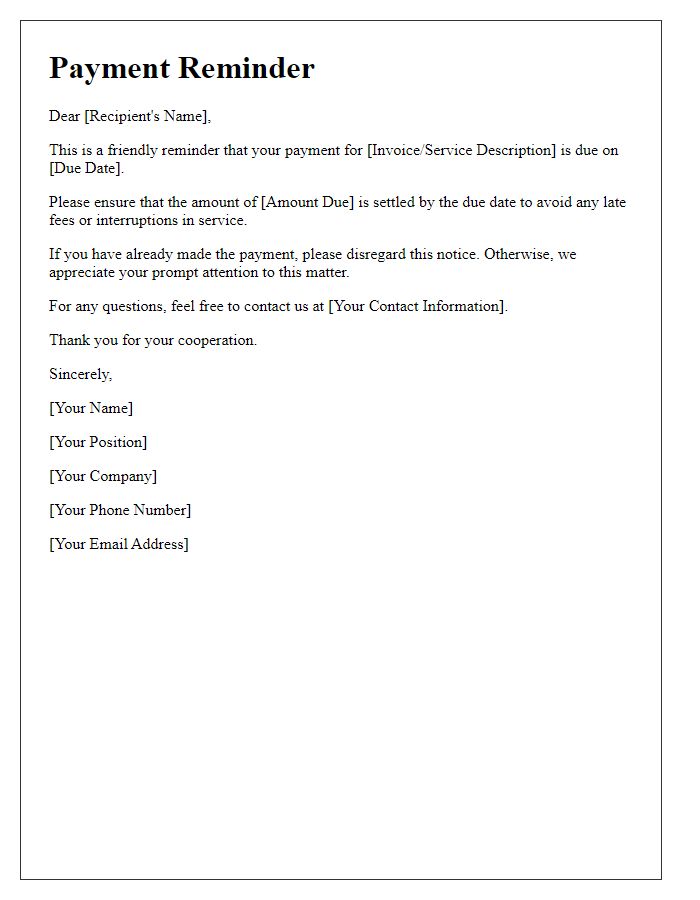

Collections accounts require precise payment instructions for effective resolution. Ensure payment methods include reliable options such as bank transfers or credit card transactions through secure payment platforms. Specifying account numbers, due dates, and amounts owed can help streamline the process. Emphasize the importance of keeping transaction receipts for verification during the account reconciliation phase. Regular follow-ups might be necessary to confirm that payments are accurately applied, mitigating risks of continued collection efforts. Organizations should also provide customer service contact information to assist with any inquiries throughout the payment process.

Contact Details for Inquiries

Contact details for inquiries regarding collections accounts are essential for effective communication and resolution. Typically, consumers can reach out to collection agencies through designated phone numbers, such as 1-800-555-0199 or customer service email addresses like support@collectionsagency.com. Furthermore, physical addresses for mailing correspondence are often included, like 1234 Finance Ave, Suite 400, Cityville, ST, 12345, to ensure written disputes or requests are appropriately directed. Detailed and accurate contact information allows for timely responses and fosters better understanding between consumers and agencies during the collections process.

Detailed Account Update

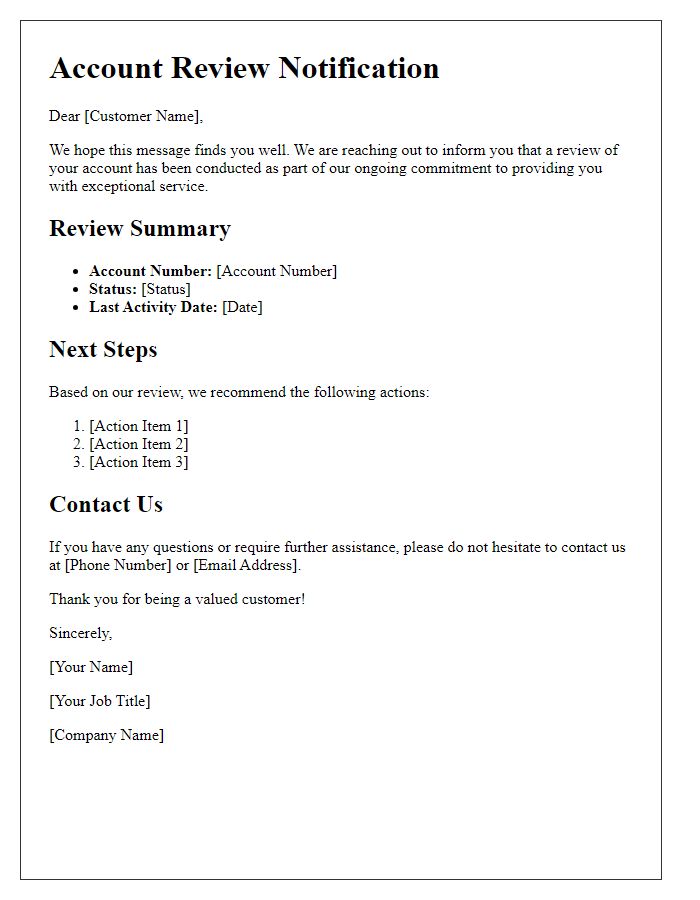

Account updates play a crucial role in managing collection processes effectively. On March 15, 2023, the total outstanding balance on the account numbered 123456789 reached $5,000, reflecting unpaid invoices dated back to November 2022. Recent payment activity includes a partial payment of $1,000 received on February 20, 2023, reducing the total owed. Communication efforts with the account holder at 456 Elm Street, Springfield, involved three follow-up calls between January and March 2023, aiming to resolve the overdue amount. Additionally, the account has been flagged for potential legal action if the remaining balance is not settled by April 30, 2023. Collection strategies will include sending a formal demand letter and exploring settlement options for the account holder.

Professional Tone and Language

A collections account update indicates the status of past-due balances for individuals or businesses in financial collections. Notifications must be clear and precise, detailing account numbers to avoid confusion. Collection agencies often review accounts aged over 90 days, emphasizing timely payment to avoid further actions. Maintaining a professional tone fosters communication and can encourage debt resolution, particularly in matters involving large sums exceeding $1,000 or recurring debts from services rendered in healthcare or finance sectors. Updates should include potential consequences of non-payment, such as credit score impact from 30-day late payments reported to credit bureaus like Experian or TransUnion.

Comments