Are you looking for a clear and concise way to specify your loan payoff amount? Crafting a well-structured letter can streamline the communication process with your lender and ensure that all necessary details are included. In this article, we'll provide an easy-to-follow template that will help you outline your loan payoff amount effectively. So, let's dive in and explore how you can make this important task as simple as possible!

Borrower's Full Name and Contact Information

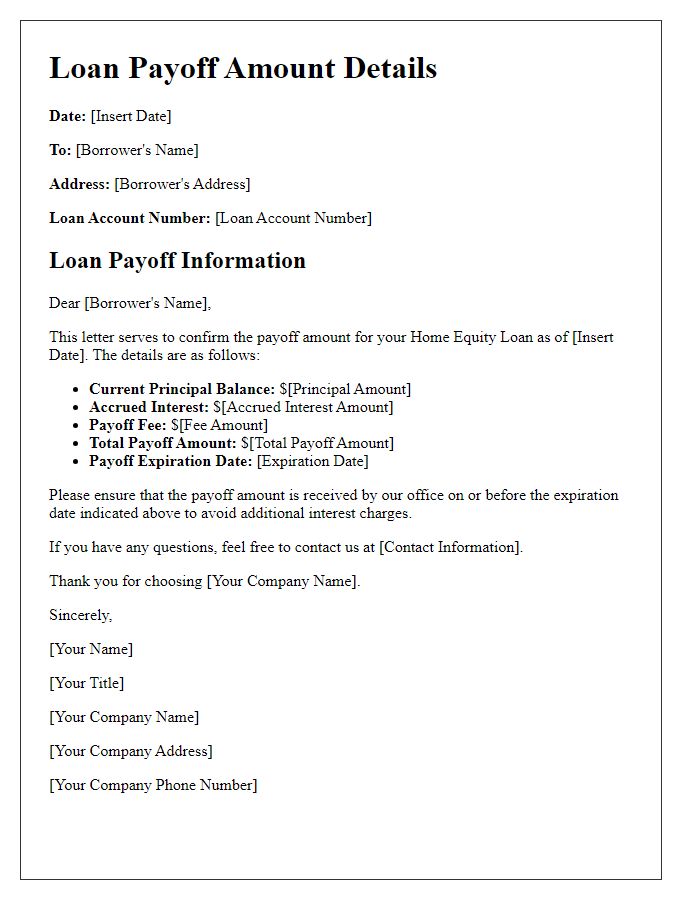

The loan payoff amount specifies the exact total due to settle outstanding debts for the borrower, including principal, accrued interest, and any applicable fees. Typically, an official payoff statement is issued by the lender, providing clear figures for the total payoff amount as of a specific date, which may include details like loan numbers, outstanding balances, and necessary instructions for payment methods. It is crucial for borrowers to confirm their full name and contact information for accurate processing, ensuring all communications are seamless and any discrepancies are promptly addressed to prevent complications in the loan payoff procedure.

Loan Account Details

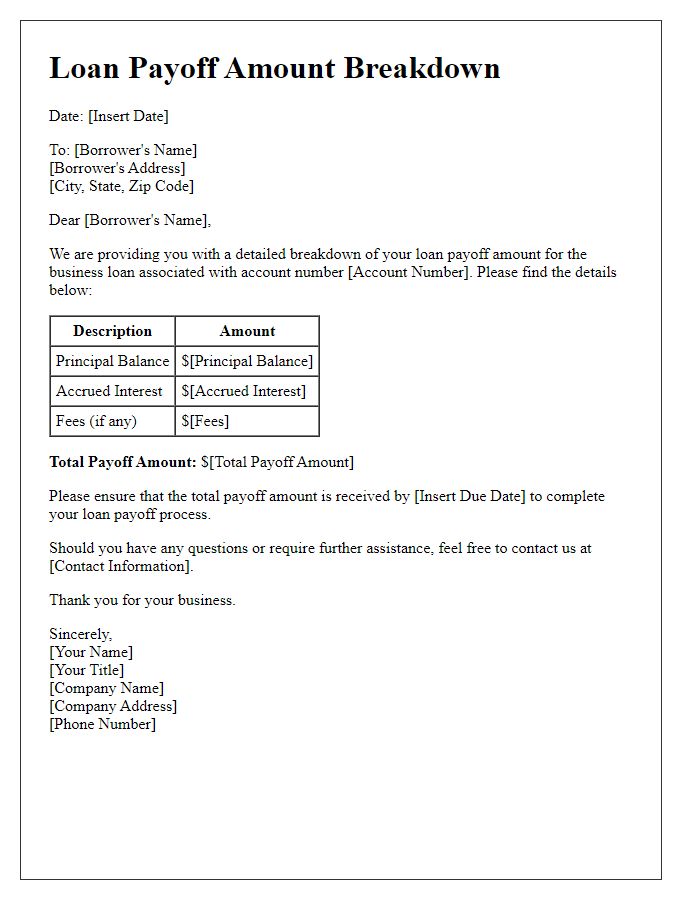

Loan payoff amounts are crucial for borrowers needing to settle debts. A typical loan account may include several key components: the outstanding principal amount (the original loan balance minus any payments made), accrued interest (calculated daily and often varies based on the interest rate), and fees (which may include late fees or prepayment penalties). For example, a personal loan of $10,000 with a 6% annual interest rate might accrue approximately $600 in interest over a year if paid monthly. Important factors affecting the payoff amount include the loan type (personal, mortgage, auto), the lender's policies, and the time of payment. Contacting the lender for an official payoff statement ensures accurate figures and helps avoid surprises when finalizing the loan closure.

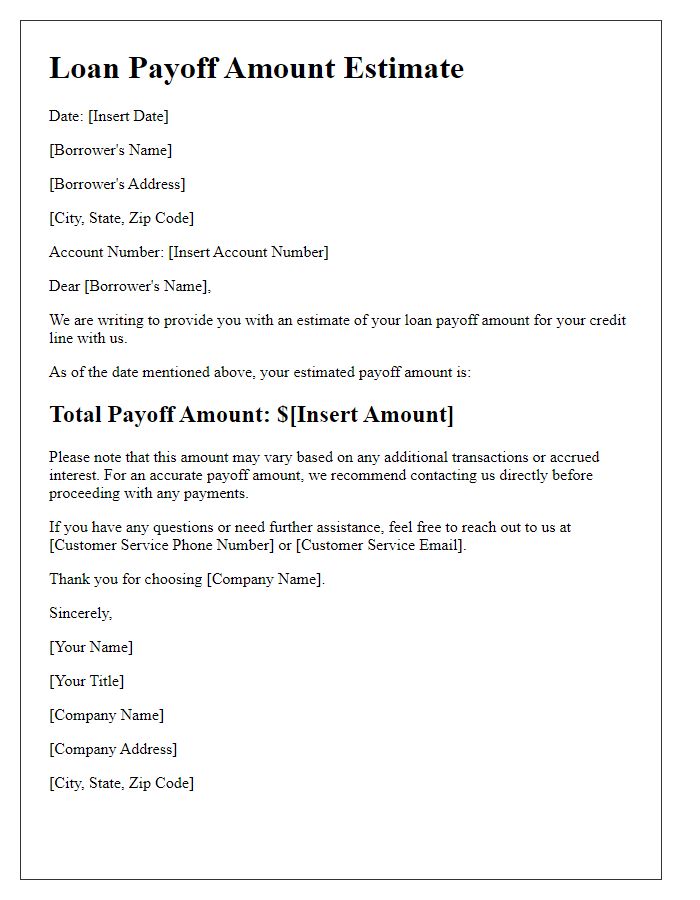

Request for Specific Payoff Amount

When individuals seek clarity on the total balance owed on loans, they often request a specific payoff amount from lenders or financial institutions. This payoff amount represents the total sum required to fully settle a loan, including principal, interest, and any applicable fees. Accurate calculations can prevent potential discrepancies, ensuring that borrowers make informed decisions regarding their financial obligations. For example, a mortgage payoff statement may detail the remaining principal balance of $250,000, accrued interest of $15,000, and a processing fee of $500, resulting in a total payoff amount of $265,500. Such transparency is essential for borrowers looking to clear debts efficiently.

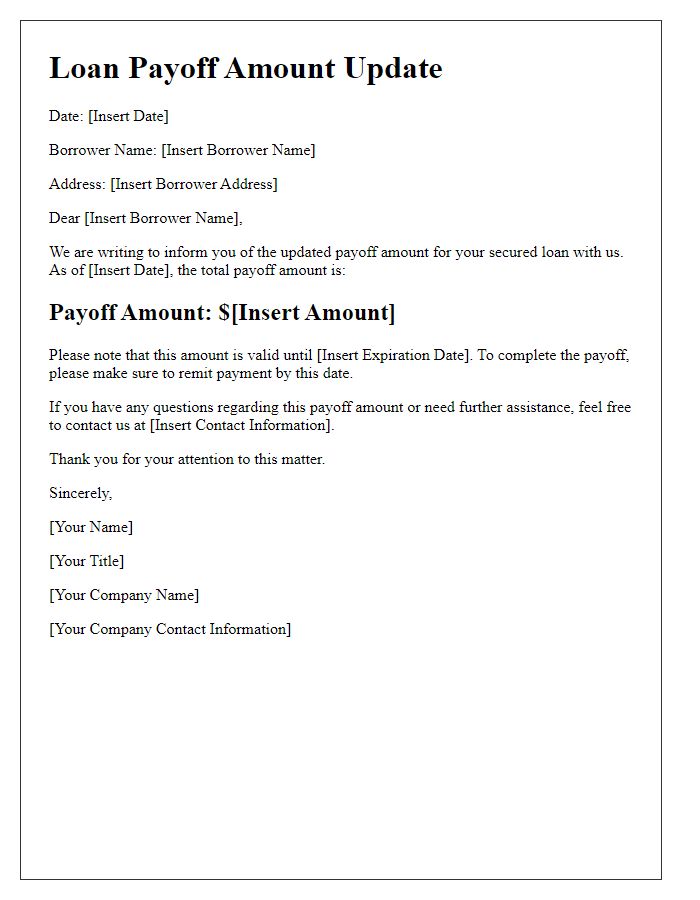

Preferred Date for Payoff Completion

Loan payoff amounts are crucial for borrowers during financial transactions. Determining the payoff amount, which includes the principal balance, accrued interest, and any potential fees, is vital for clarity and financial planning. The preferred completion date for loan payoff, often specified by borrowers, typically falls within 30 days of the request to ensure adequate time for processing and funds transfer. Various lenders like banks and credit unions may have different policies and timelines regarding payoff processing, impacting the final payment date. Factors like prepayment penalties and interest accrual adjustments should be considered, as they can influence the total amount owed. Understanding these elements is essential for borrowers aiming to close their accounts responsibly and efficiently.

Contact Information for Follow-up or Clarification

For clarity regarding the loan payoff amount, maintaining updated contact information is crucial. Borrowers should provide a reliable phone number, including area code, for immediate inquiries. An email address, preferably a personal account rather than a work-related one, ensures prompt communication regarding any concerns. Additionally, specifying the best times for contact enhances efficiency during follow-up calls. Ensure that the residential address is accurate for mailing official documentation related to the loan payoff. This organized approach streamlines the entire process for both the borrower and the lending institution.

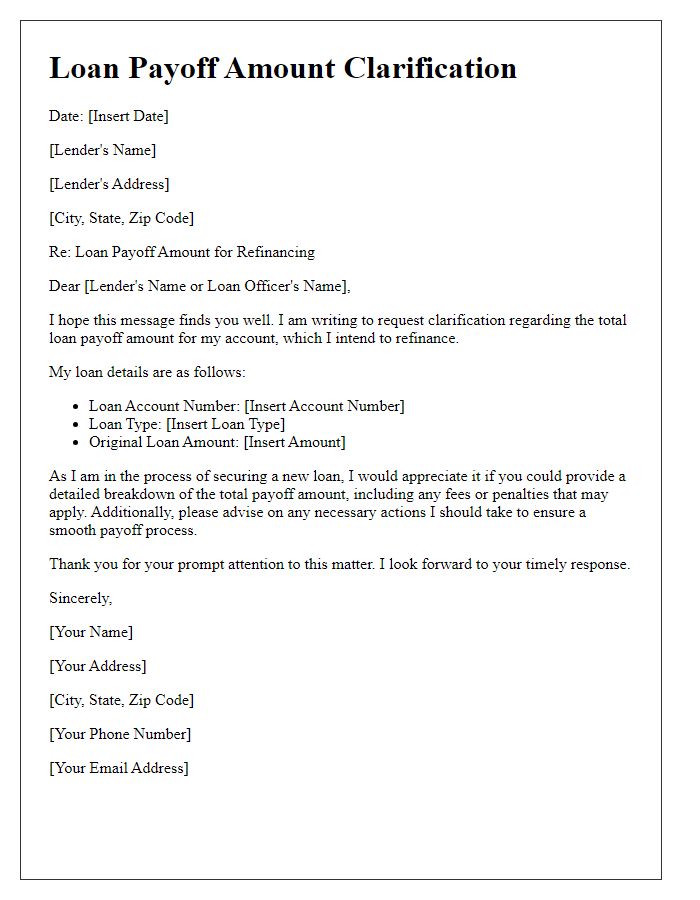

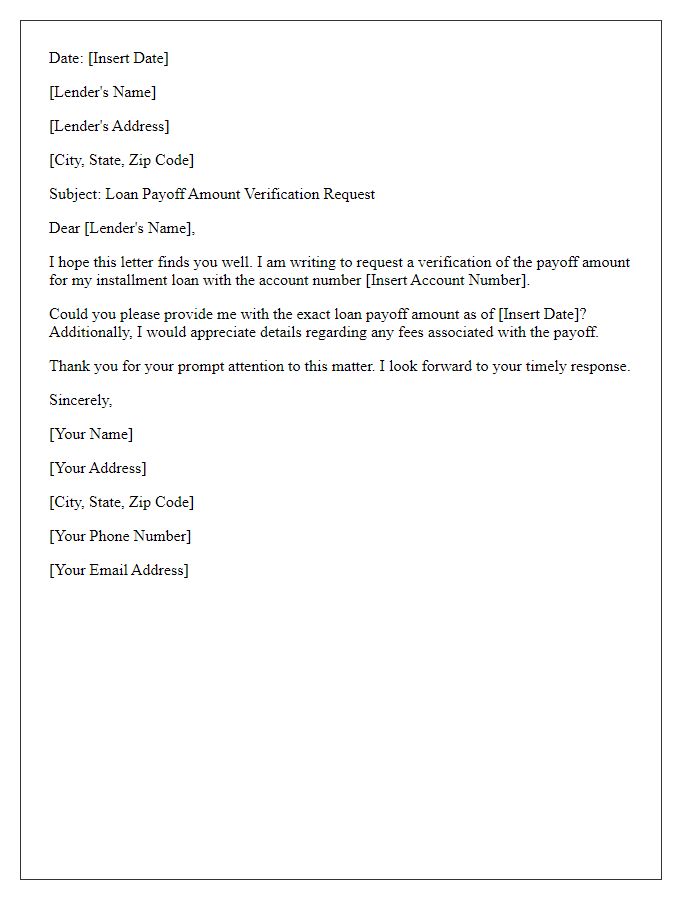

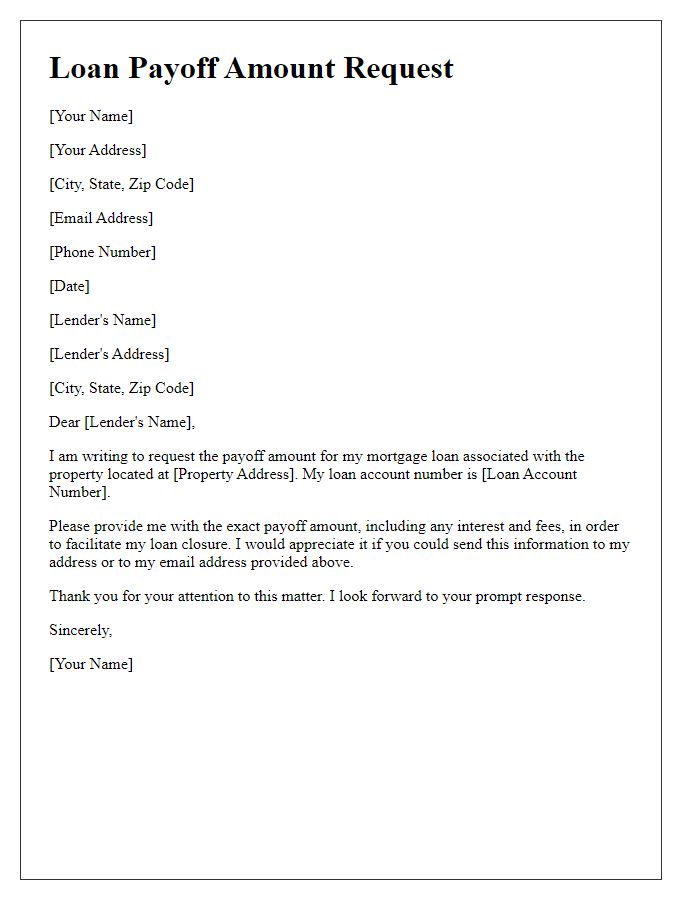

Letter Template For Loan Payoff Amount Specification Samples

Letter template of loan payoff amount clarification for refinancing loan.

Letter template of loan payoff amount verification for installment loan.

Comments