We all make mistakes, and sometimes those missteps can linger longer than we'd like, especially when it comes to our credit reports. A goodwill deletion request can be a powerful tool in helping to rectify these issues and improve your credit standing. If you've learned from your past and are looking to make a positive change, expressing your situation clearly and sincerely can lead to favorable outcomes. Curious to learn more about how to craft your own effective goodwill deletion request?

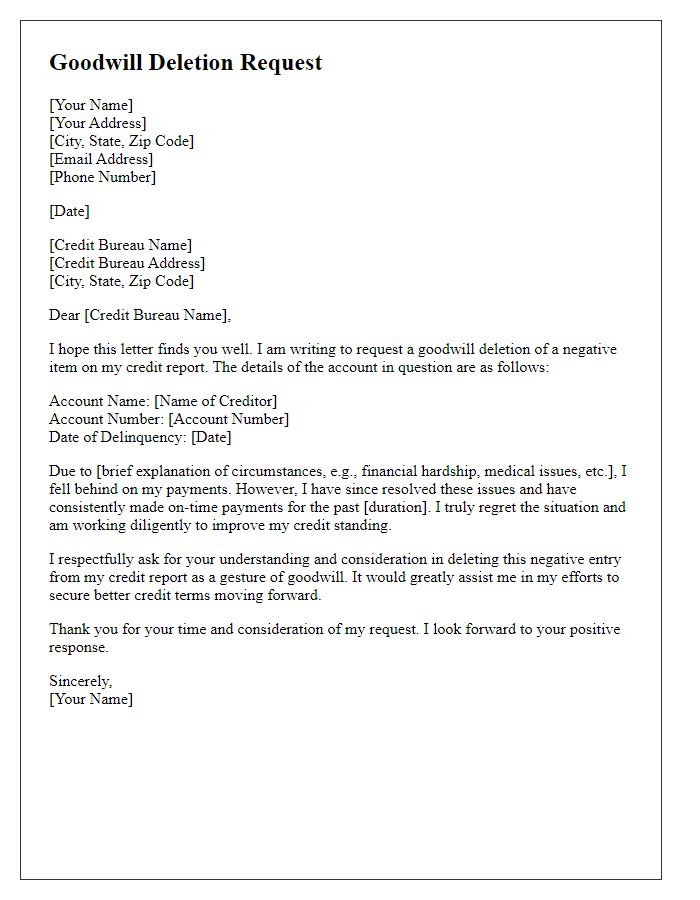

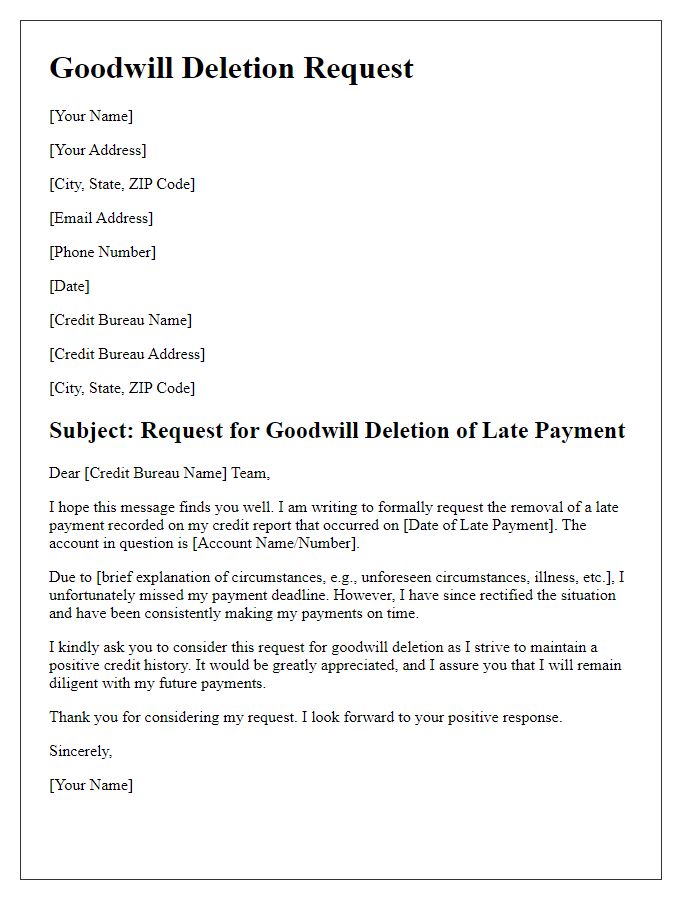

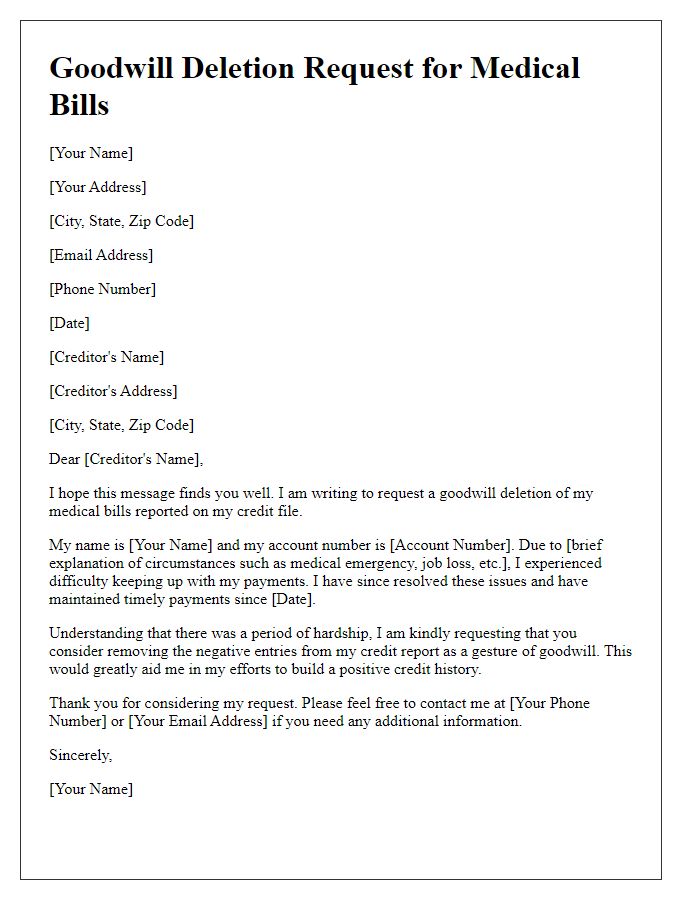

Personal Information

Individuals seeking a goodwill deletion of personal information from online platforms often contact companies directly, such as social media networks or data brokers. Sharing relevant details, such as full name, email address, and the specific data points in question (e.g., profile information, posted content, or account histories) is crucial. Citing relevant privacy laws, like the California Consumer Privacy Act (CCPA), which aims to protect personal data and consumer rights, can strengthen the request. Additional context, such as the potential impact of the retained information on personal privacy or reputation, enhances the request's significance. Clear examples of situations where the stored data may cause harm increase the urgency for the request's consideration.

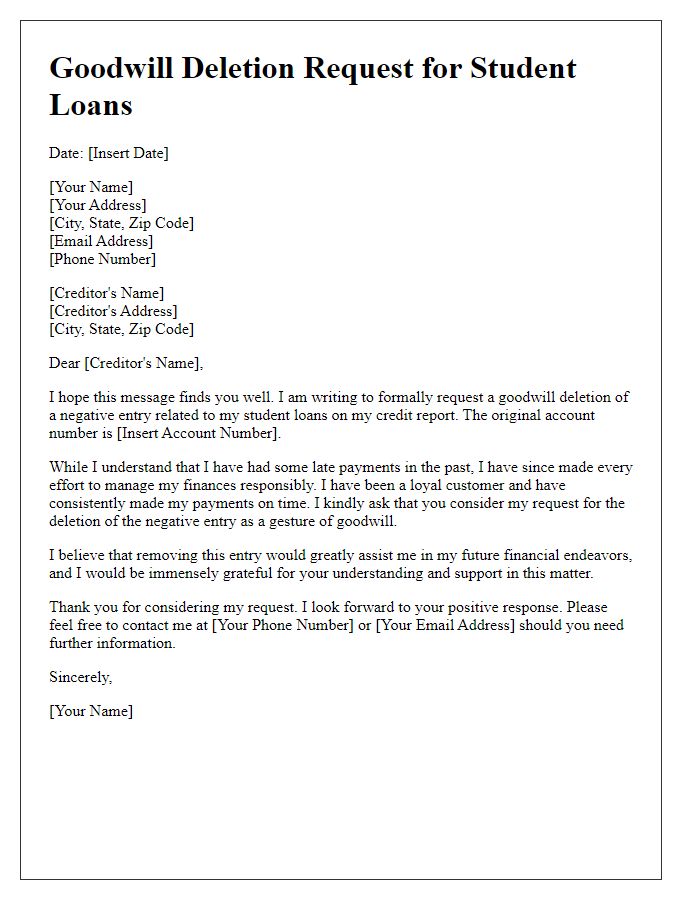

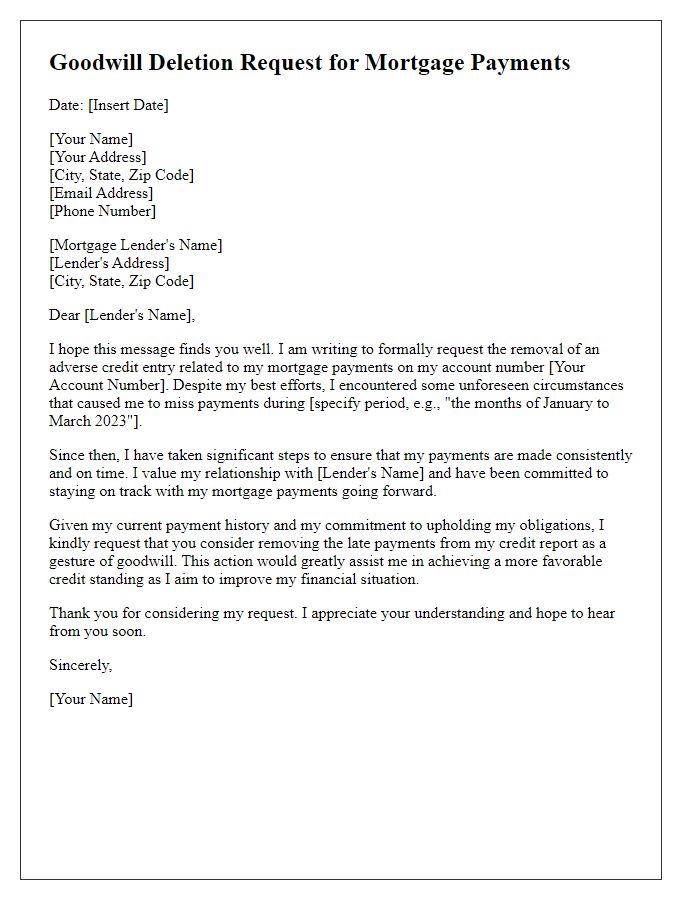

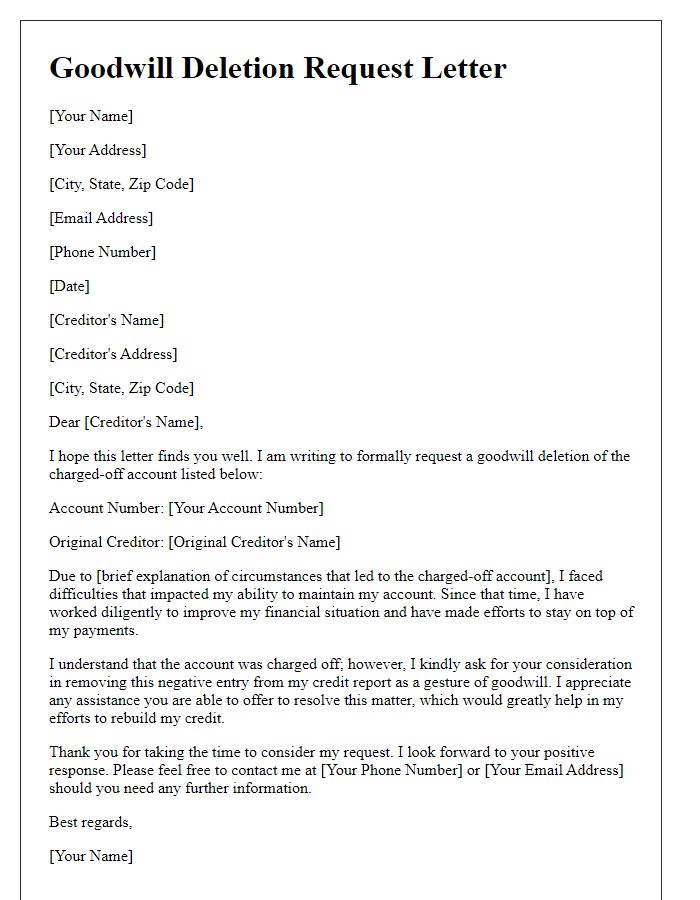

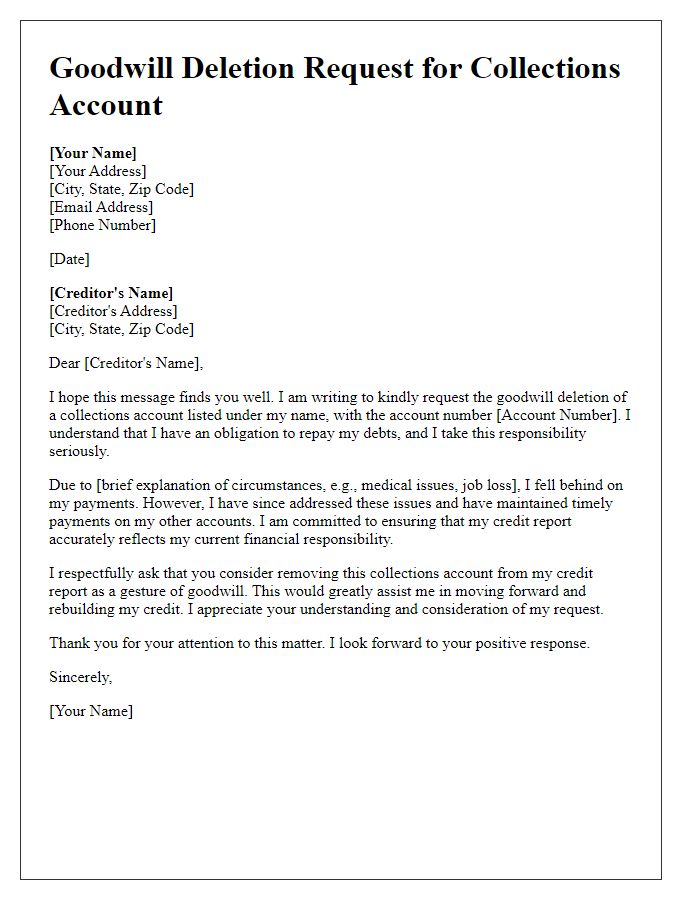

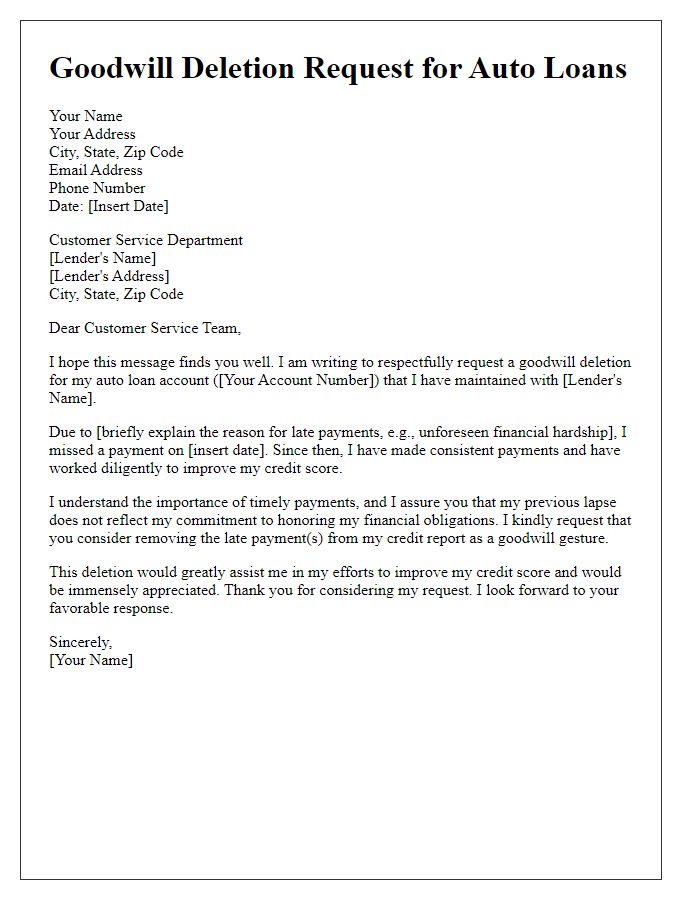

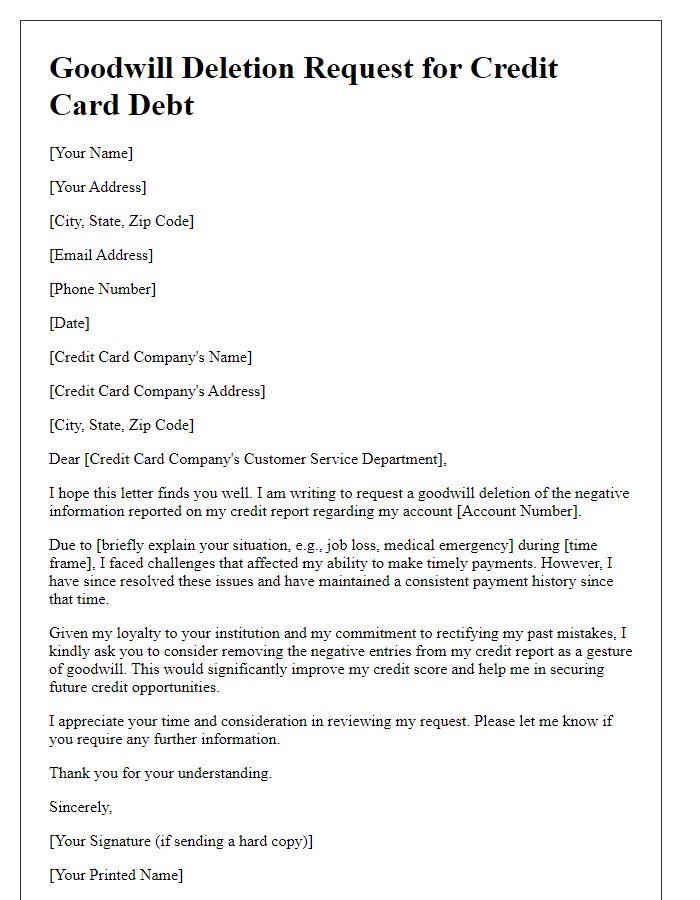

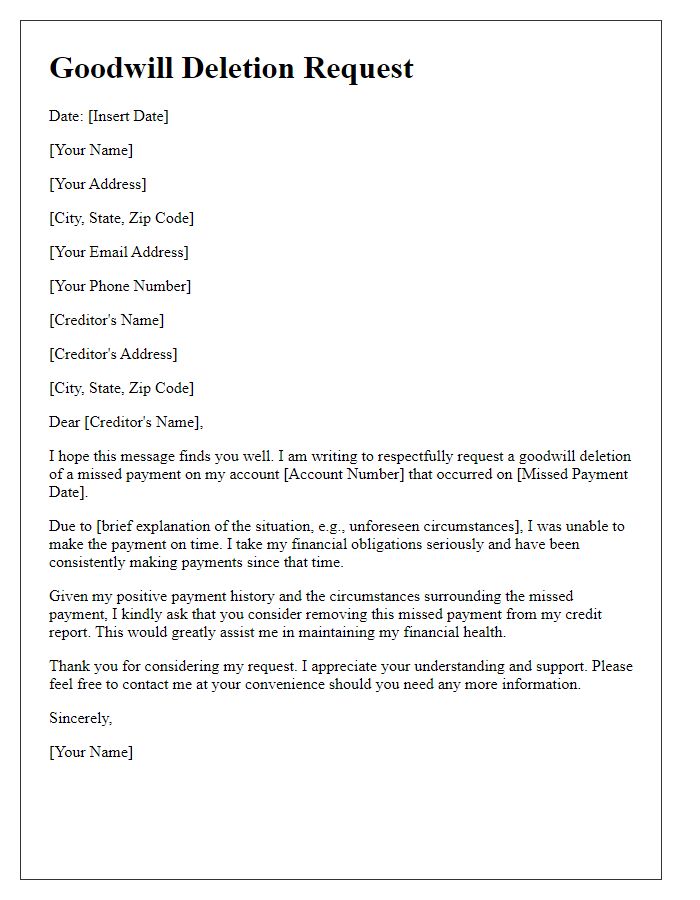

Account Details

Goodwill deletion requests involve asking a company or service to remove a negative mark or record from a user's account, often related to issues like late payments or errors. Users typically provide specific account details to establish their identity clearly. This request commonly includes their full name, account number, email address linked to the account, and any relevant dates or specifics regarding the incident. Support tickets or customer service emails are common methods for submitting these requests. Proper documentation, such as payment history or correspondence, can bolster the request's effectiveness, demonstrating the user's responsible behavior and the desire for account correction.

Explanation of Circumstances

Goodwill deletion requests often involve explaining circumstances that led to a negative event impacting one's record. When addressing a financial institution or credit bureau, it is vital to detail specific instances such as unexpected medical expenses surpassing $5,000 leading to payment delays, or job loss during the COVID-19 pandemic resulting in a temporary inability to meet financial obligations. Highlighting previous positive payment history over a period of several years strengthens the case for goodwill deletion. Noteworthy events, like a natural disaster impacting local communities or significant personal hardships, can also be mentioned to provide context. Remember to express understanding of the policies in place and emphasize a commitment to maintaining positive credit behavior moving forward.

Request for Removal

A goodwill deletion request seeks the removal of a negative entry from a credit report. The Fair Credit Reporting Act (FCRA) allows consumers to dispute inaccurate information with credit bureaus such as Experian, Equifax, and TransUnion. A well-crafted request often includes personal details (full name, address, Social Security number), a specific account number associated with the negative entry, and a polite explanation of the request reason, emphasizing responsible credit behavior and any extenuating circumstances. Supporting documents (like payment records) can enhance the chances of successful removal. The method of communication can vary; many consumers choose certified mail for a traceable delivery to ensure the credit bureau acknowledges their request and its impending impact on their credit score.

Expression of Gratitude

Submitting a goodwill deletion request often requires a thoughtful approach to express appreciation while outlining the issue. This is important for organizations, such as credit bureaus or financial institutions, to consider the request favorably. Positive language and gratitude for past services can enhance the likelihood of a favorable outcome. Details like specific accounts, dates of missed payments, and the amount owed provide context to the situation. Also, community involvement or consistent payment history can demonstrate reliability. Acknowledging the impact of the negative mark on credit reports helps provide a clearer picture of the request's significance.

Comments