If you've ever found yourself juggling bills and payments, you know just how crucial a clear payment schedule can be. Keeping track of when things are due and how much you owe can make all the difference in maintaining financial peace of mind. In this article, we'll explore an easy-to-use letter template for updating your payment schedule, ensuring you never miss a beat. So, let's dive in and simplify your financial planning together!

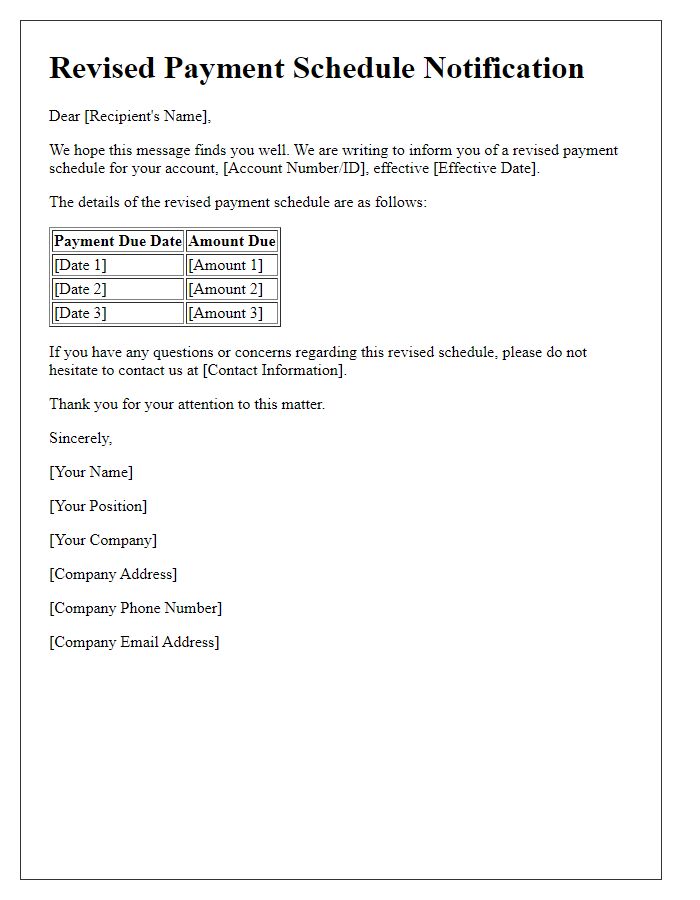

Client and Account Details

Due to recent enhancements in billing processes, a payment schedule update is essential for maintaining accurate account management. Client records, including identification numbers (e.g., Client ID: 123456) and specific account details (e.g., Account Number: 789012), require revision to reflect new payment timelines. The updated schedule may include key dates for upcoming installments and adjusted amounts, ensuring clients receive clear notifications about their due dates. Furthermore, accurate tracking of payment history assists in reducing discrepancies and enhancing overall financial transparency within accounts.

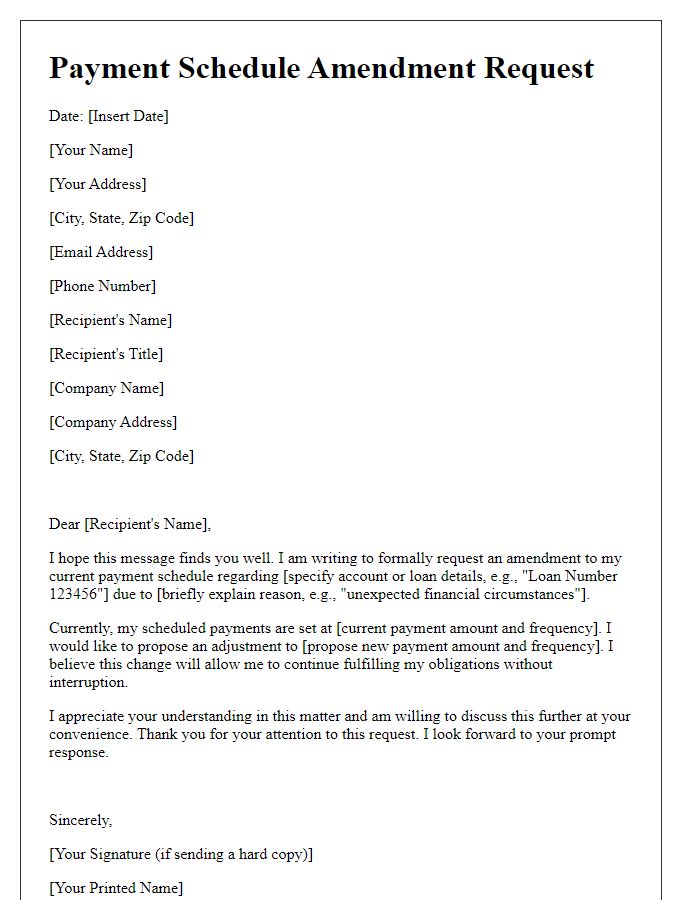

New Payment Schedule Overview

The new payment schedule overview outlines significant adjustments to the repayment timeline for loans, reflecting current financial guidelines and borrower capabilities. Payments will occur monthly, commencing on the 15th of each month, with a total of 12 installments. The first payment due date is set for January 15, 2024. The adjusted payment amount will total $500 per installment, covering principal and interest, with a total loan amount of $6,000 originally taken on November 1, 2023. The updated payment structure ensures compliance with revised interest rates, which are fixed at 5% per annum, remaining stable over the loan term, providing borrowers with predictable financial planning. Failure to adhere to the updated schedule after three consecutive missed payments may result in a late fee of $50 or potential legal action outlined in the loan agreement terms.

Impact on Current Agreement

A payment schedule update can significantly impact the current agreement between a financial institution and its clients. For instance, a revised timeline, such as extending the payment period from 12 months to 18 months, can alleviate immediate financial pressure on clients. Changes in interest rates, with a potential increase from 4% to 5%, might influence the overall cost of the agreement. Additionally, adjustments in payment methods, such as allowing digital platforms like PayPal or bank transfers, can enhance convenience for clients. Clear communication regarding these changes is essential to maintain trust and ensure all parties understand their obligations in the revised contract. Regular updates (monthly or quarterly) can further help clients anticipate financial commitments.

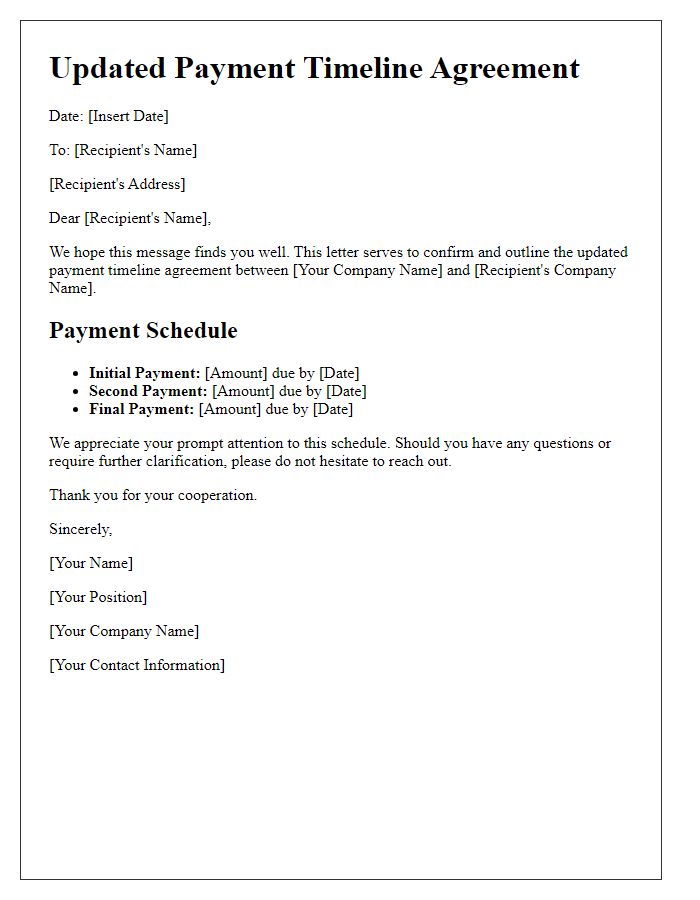

Benefits of Updated Schedule

An updated payment schedule offers numerous benefits for both creditors and debtors. Improved cash flow management allows businesses to allocate funds more effectively, avoiding financial strain during lean periods. Enhanced clarity helps individuals understand their payment obligations, reducing confusion and potential late fees. Structured timelines encourage timely payments, fostering trust and maintaining positive relationships between parties. Moreover, predictable payment intervals assist in budgeting, helping customers plan expenses and manage resources more efficiently. Overall, an updated payment schedule serves as a vital tool for financial stability and effective financial planning.

Contact Information for Queries

In case of any questions related to the payment schedule update, please feel free to reach out to our customer support team at our official email address: support@example.com. Our dedicated representatives are available from 9 AM to 5 PM (Eastern Standard Time) on business days to assist you. Alternatively, you can contact us at our toll-free number: 1-800-555-0199, ensuring that all your inquiries receive timely attention. We value your engagement and aim to provide the best support possible for a smooth experience.

Comments