Are you feeling overwhelmed by your current loan payments? A loan modification might be the solution you need to regain control of your finances. This article will guide you through the essential steps and considerations for requesting a loan modification effectively. Join us as we explore the ins and outs of this process and empower yourself to make informed financial decisions!

Borrower's Financial Situation

The financial situation of borrowers significantly impacts their ability to manage loan obligations sustainably. Economic downturns, such as the 2008 financial crisis, highlight how unemployment rates can spike, leading to higher delinquency rates on loans. For instance, in 2020, the COVID-19 pandemic caused unprecedented job losses, pushing unemployment to 14.7% in April, making it challenging for many individuals to maintain timely payments on mortgages. Essential considerations include debt-to-income ratios, where a ratio exceeding 43% often signifies financial strain, alongside monthly income fluctuations. Additionally, the increasing cost of living in metropolitan areas--such as San Francisco, where the median rent surpassed $3,500 in 2021--can exacerbate financial hardships among borrowers, leading to the necessity for loan modification. Understanding these factors is crucial for lenders when assessing the propriety of loan modification requests.

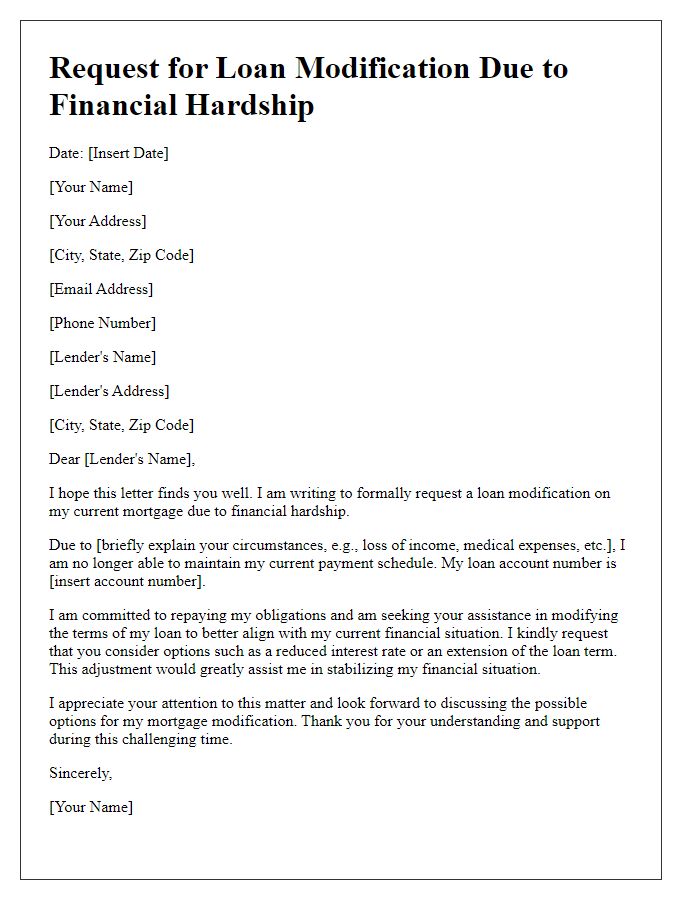

Reasons for Hardship

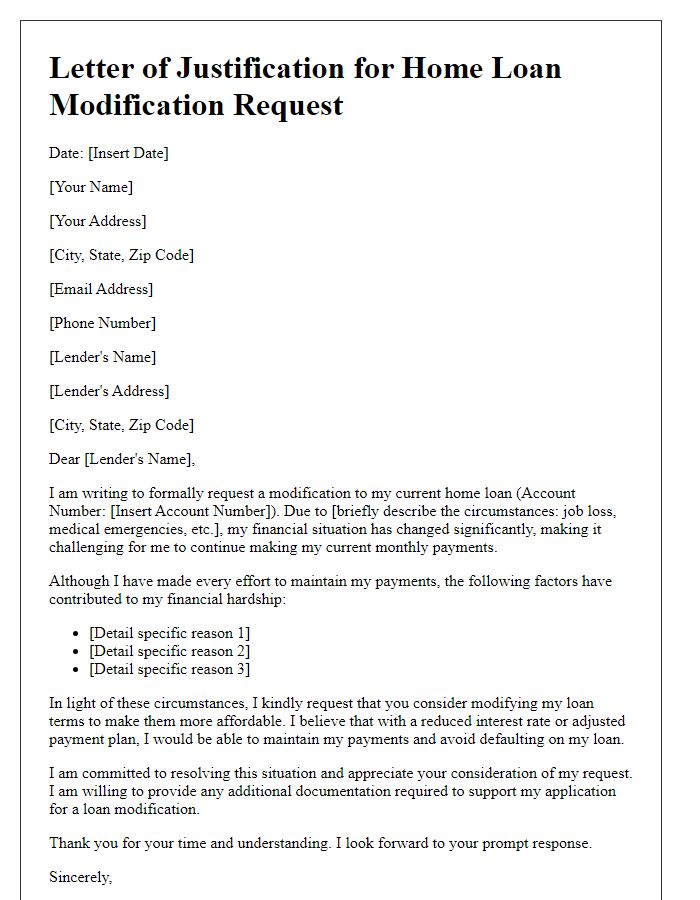

Financial hardships, such as job loss affecting income stability, significant medical expenses leading to debt accumulation, or unexpected home repairs requiring urgent financial attention, can drastically impair an individual's ability to maintain regular mortgage payments. Moreover, economic downturns, like the COVID-19 pandemic, have resulted in widespread unemployment rates soaring to nearly 14% in April 2020, exacerbating financial strain for many homeowners. A family's reliance on fixed income due to retirement or disability can also contribute to difficulty meeting mortgage obligations, especially when coupled with rising living costs, including utilities, groceries, and necessary medical care. These circumstances illustrate the unforeseen challenges many individuals face in preserving their homes, highlighting the need for loan modification consideration to provide necessary relief and sustain homeownership.

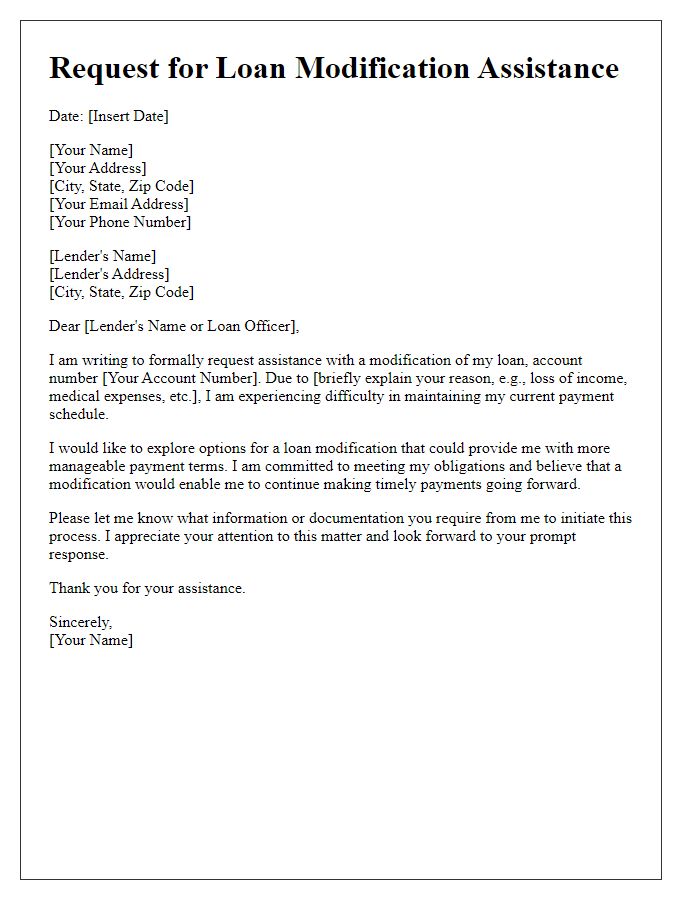

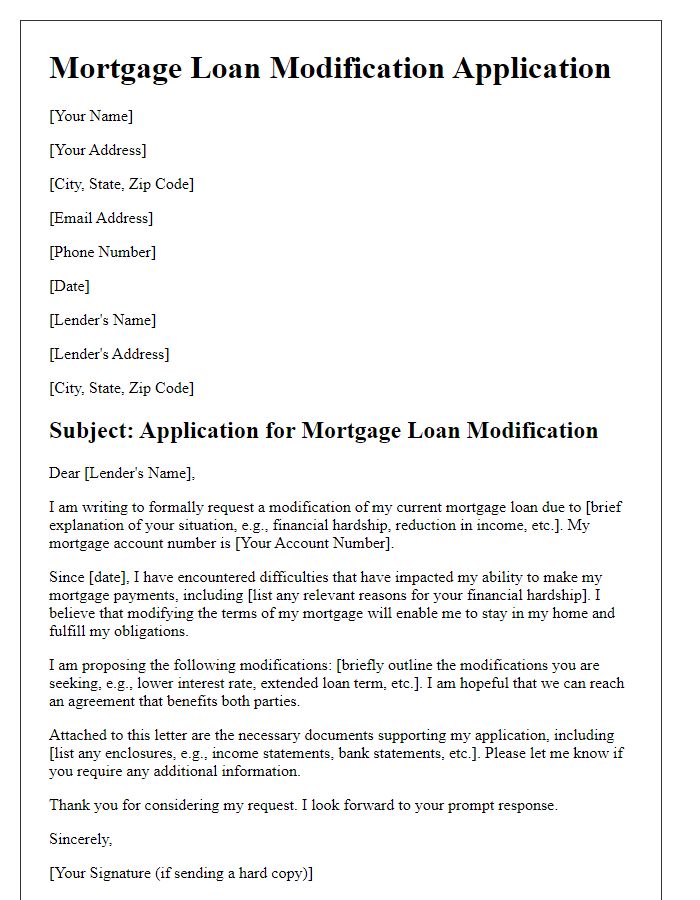

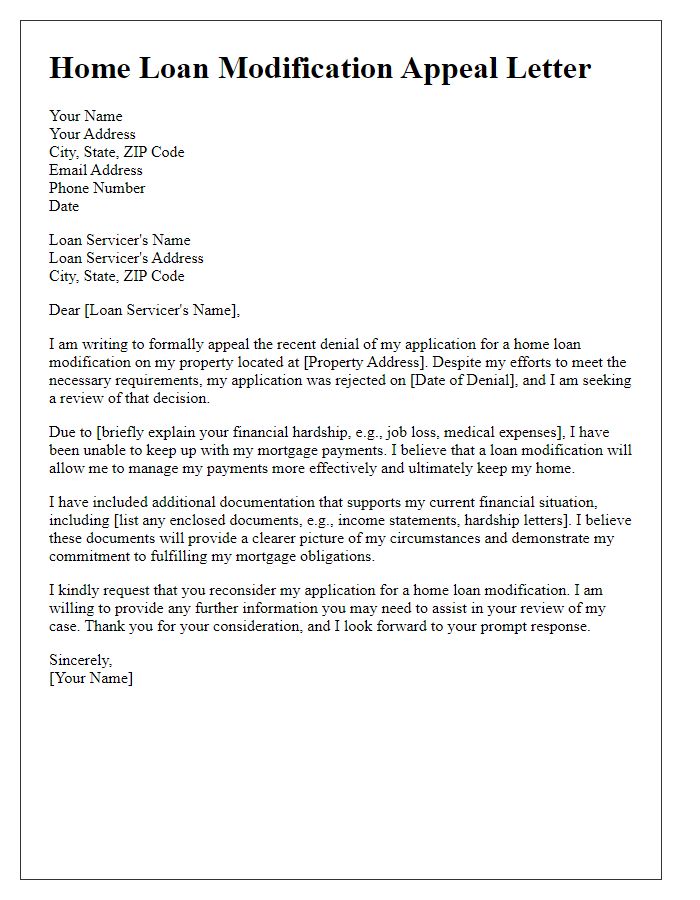

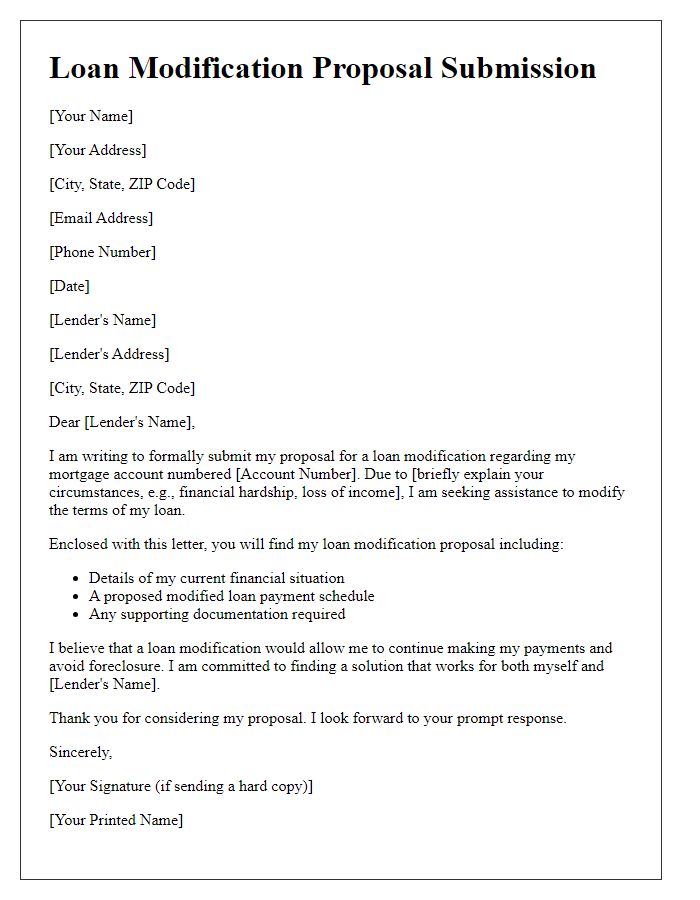

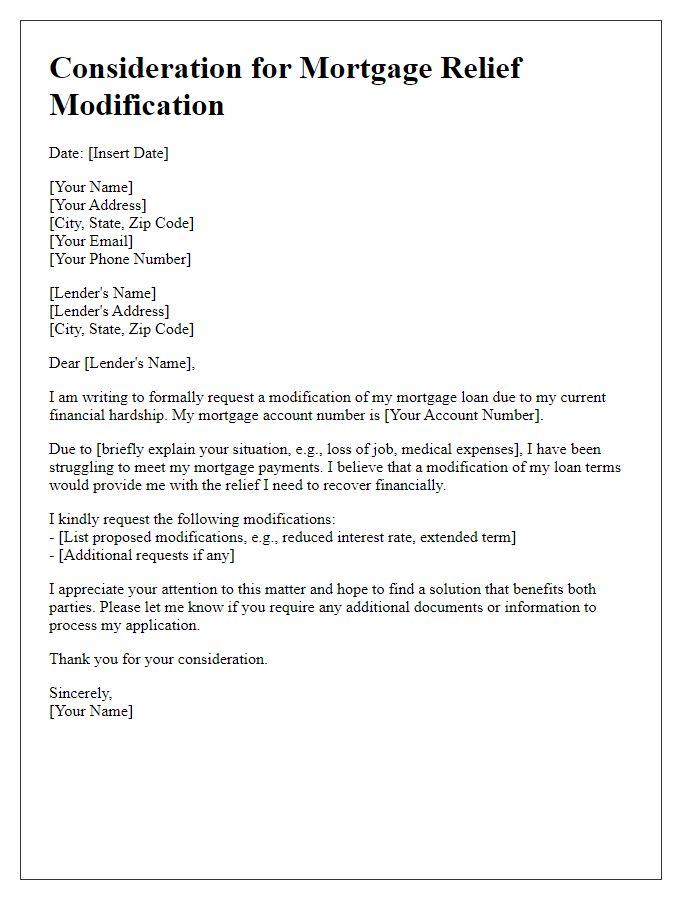

Request for Specific Modification Terms

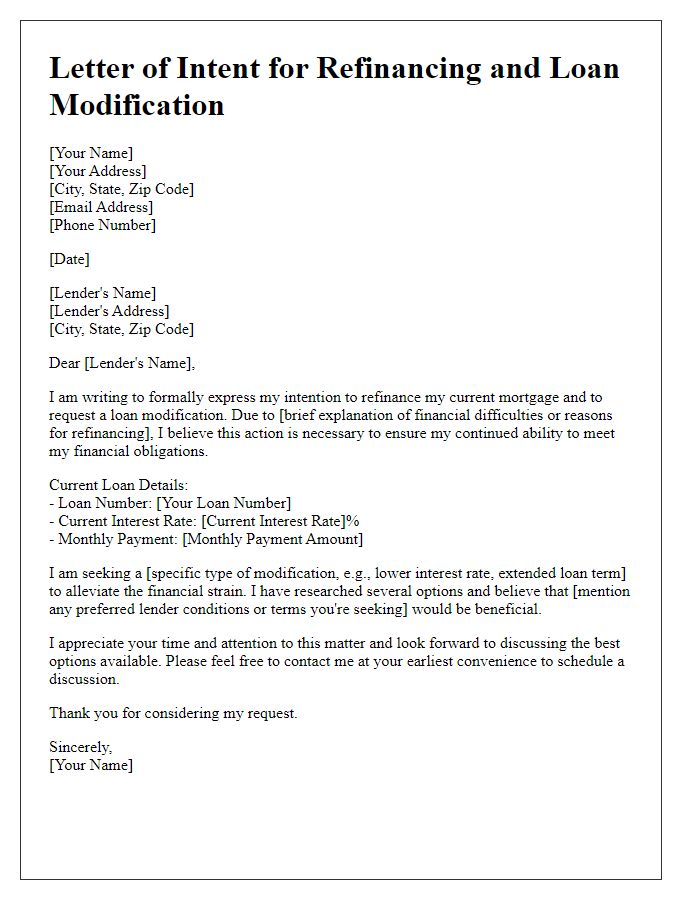

Requesting specific loan modification terms can be crucial for homeowners facing financial difficulties. Homeowners may seek to lower monthly payments from $1,500 to $1,200 by negotiating a reduction in interest rates from 5% to 3% with lenders such as Bank of America or Wells Fargo. A loan modification may also involve extending the loan term from 30 years to 40 years, which can further decrease monthly financial obligations. An important aspect to consider is the borrower's current financial situation, including recent job loss or medical expenses, which can serve as supporting evidence for the modification request. Documentation, such as income statements or hardship letters, can strengthen the case presented to the lender. Addressing applicable deadlines for modification requests is essential to ensure timely review and response from the lender.

Documentation and Evidence

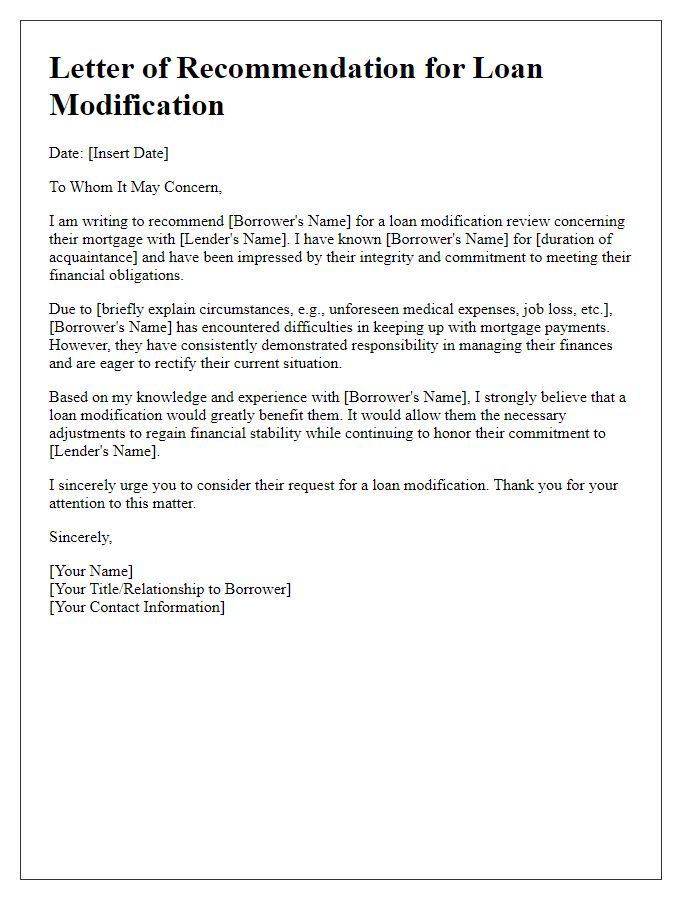

Loan modification requests require comprehensive documentation and evidence to support the application process effectively. Borrowers must gather essential financial documents, including recent pay stubs, tax returns from the previous two years, and a detailed account of monthly expenses (itemized bills such as utilities, food, and transportation). Additionally, a hardship letter (explaining the financial challenges faced, such as job loss or medical expenses) provides context for the request. It's crucial to include any relevant communication records with financial institutions, including past statements and foreclosure notices. A credit report detailing payment history can also strengthen the case, demonstrating the borrower's commitment to rectifying their financial situation. Properly organized documentation can expedite consideration and improve the chances of successful loan modification approval.

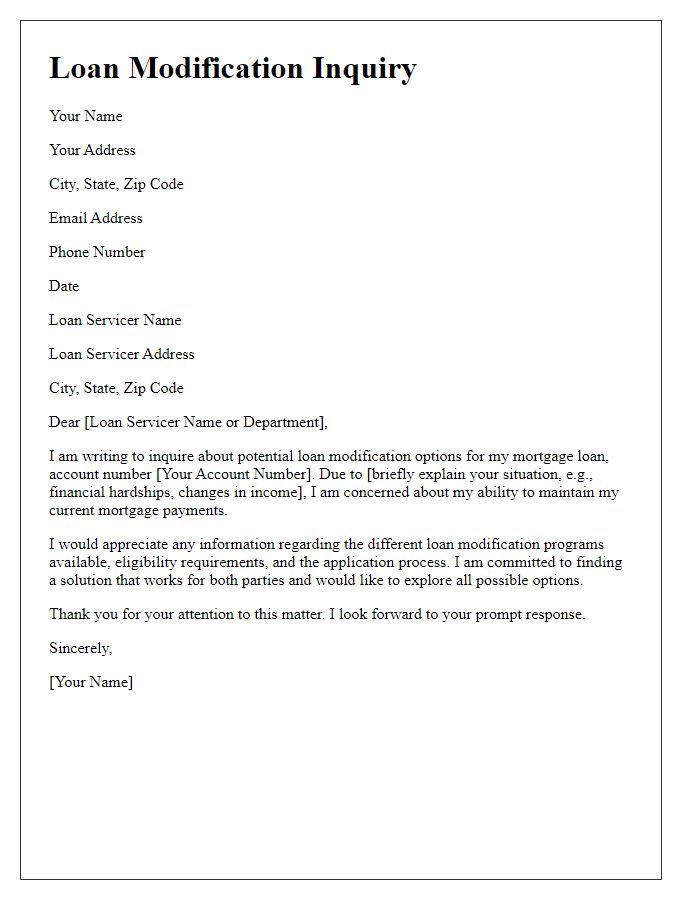

Contact Information and Signature

Contacting your loan servicer is crucial when seeking a loan modification. Providing accurate contact information includes your full name, address, phone number, and email address. This ensures that the servicer can effectively communicate the status of your request. A formal closing signature, handwritten preferably, adds professionalism to your correspondence. Including the date of your application can also help in tracking your request timeline. Ensure that you keep a copy of your letter for future reference.

Comments