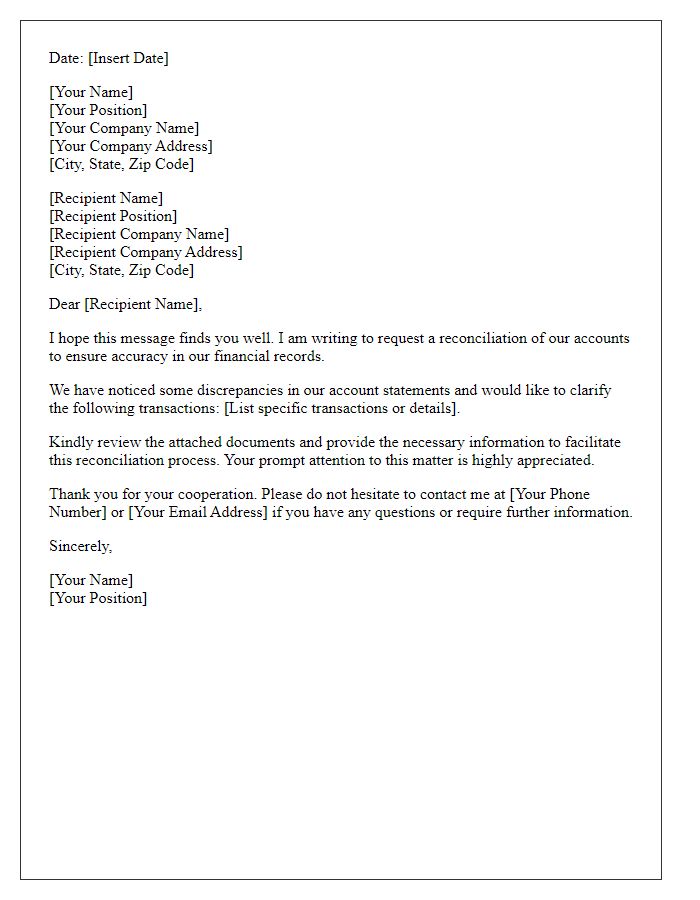

Are you looking to streamline your customer account reconciliation process? In this article, we'll explore practical tips and effective strategies that can help you maintain accurate and organized records. From setting clear communication channels with your clients to implementing helpful software tools, we've got you covered. So, let's dive in and discover how to refine your reconciliation practices for better financial clarity!

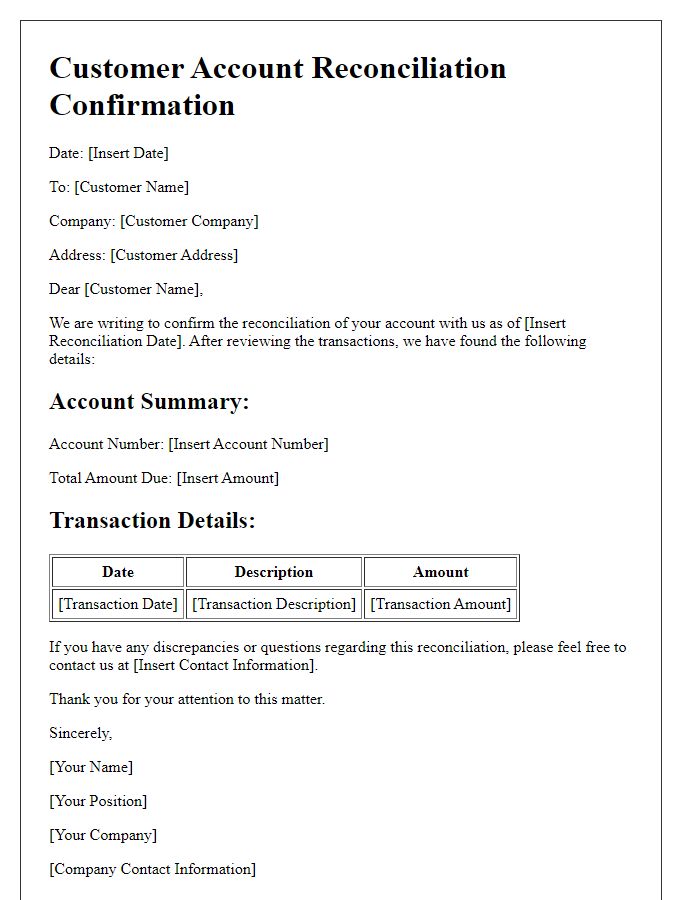

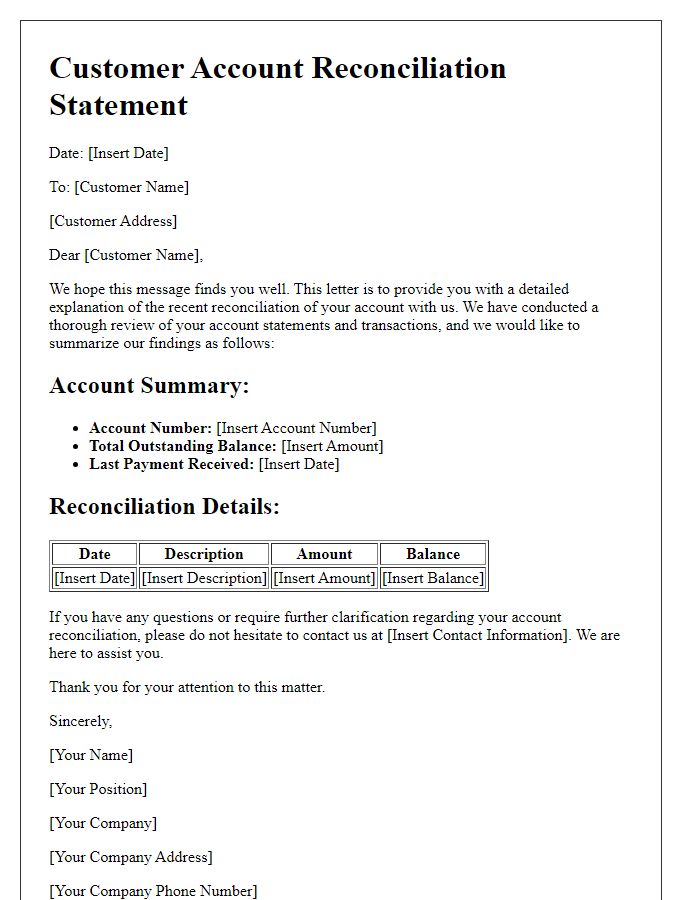

Customer's account details

Customer account reconciliation involves a detailed comparison of financial records to ensure accuracy. Each customer record typically includes essential details such as account number (a unique identifier assigned to every customer), transaction history (a chronological list of all transactions), outstanding balances (the total amount due), payment history (records of received payments), and contact information (such as phone numbers and email addresses for communication). This process helps identify discrepancies--gaps or inconsistencies--between the customer's records and the company's financial statements. Regular reconciliation can unveil issues such as unrecorded payments, duplicate transactions, or erroneous charges, leading to improved customer satisfaction and trust.

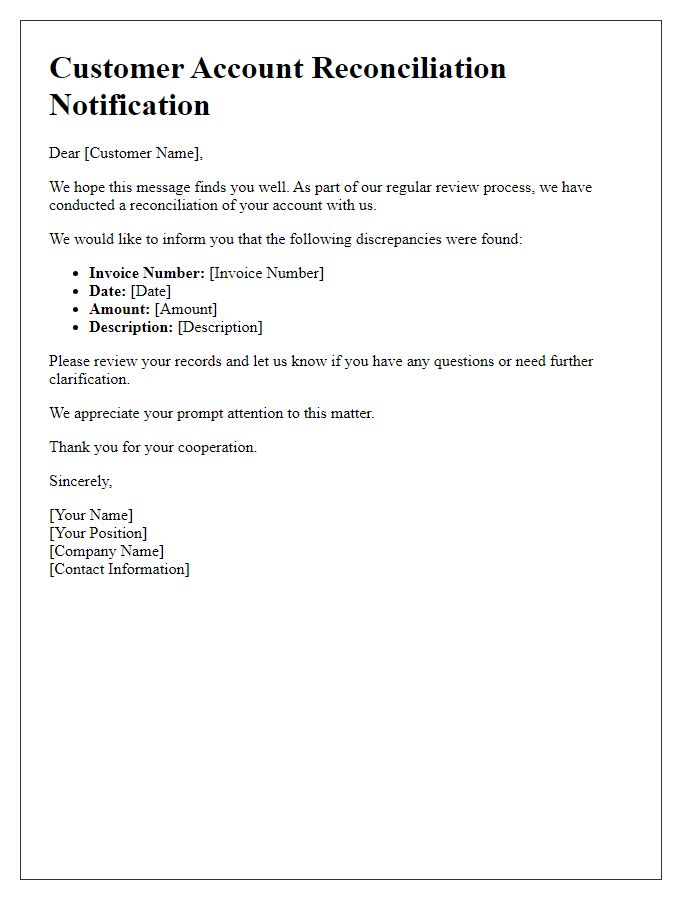

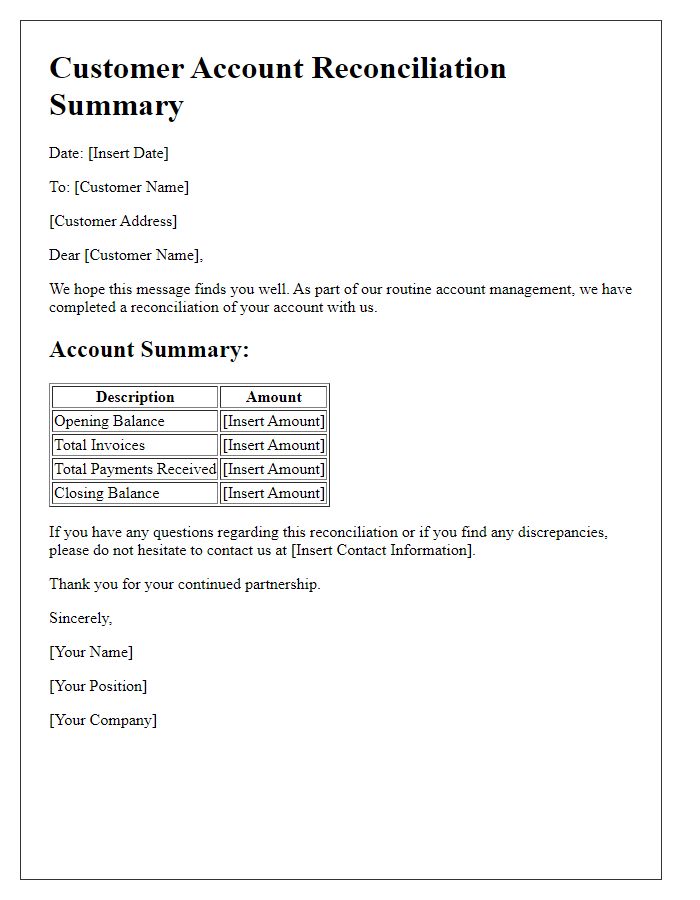

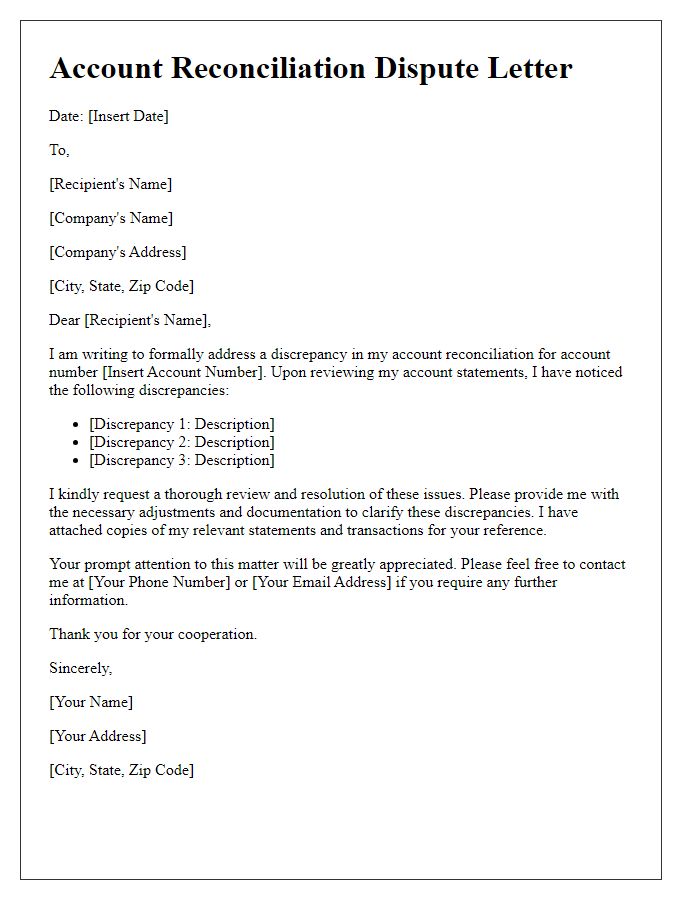

Summary of discrepancies

Customer account reconciliation often uncovers discrepancies that may arise from various factors. Common discrepancies include payment errors, such as overpayments or underpayments, which can be identified through careful comparison of transaction records specified by invoice dates (e.g., January 1-31, 2023). Additionally, accounting entries may reflect duplicate charges due to system errors or manual input mistakes, particularly in high-volume transactions. Furthermore, invoice adjustments stemming from returned goods or service credits may not be accurately recorded, causing differences between the customer's accounting records and the company's books. Addressing these discrepancies involves meticulous examination of account statements from both parties, including transaction details from both the customer's and the company's end, ensuring all adjustments are recorded, and confirming resolution timelines based on the financial reporting periods outlined in quarterly evaluations.

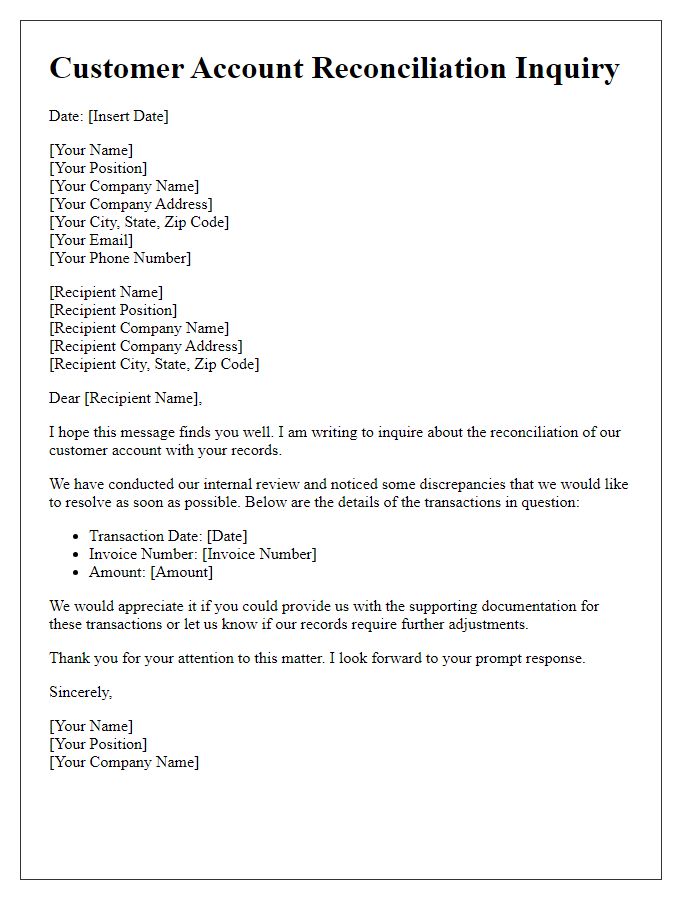

Supporting documentation

Customer account reconciliation involves the meticulous process of verifying financial records for accuracy and consistency. Essential documents include transactional statements, invoices, and payment records. These documents ensure a comprehensive cross-check of account balances and transactions. Accurate records provide clarity on discrepancies, facilitating error resolution. Specific data related to the customer account, such as the date (for example, all statements from Q3 2023) and unique transaction identifiers, are crucial. Supporting documentation helps maintain organizational integrity, establishing a clear audit trail and promoting transparent financial practices. Proper reconciliation reduces financial risks and fosters strong customer relationships through accountability.

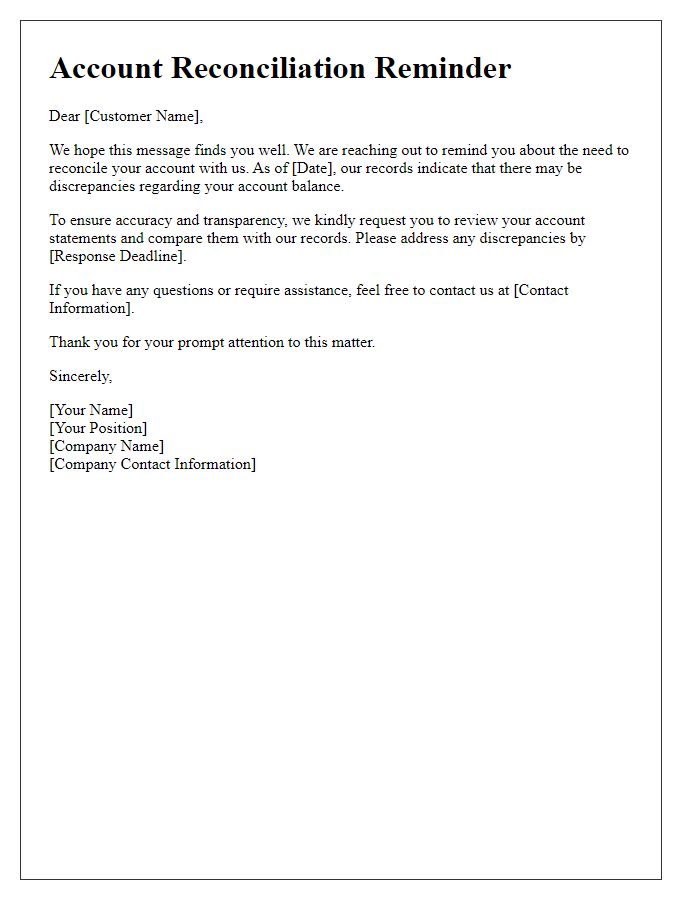

Deadlines for response

Customer account reconciliation is crucial in maintaining accurate financial records and ensuring transparency in transactions between businesses and clients. Specific deadlines for responses are essential, typically allowing 30 days from the date of notification to ensure timely adjustments. If discrepancies are identified, clients should respond before the 15th of the following month to avoid potential penalties. Additionally, periodic reconciliations are recommended quarterly, highlighting any outstanding balances or unusual transactions, which promotes trust and clarity in financial dealings. Proper documentation of all communications during this process fosters accountability and aids in resolving issues swiftly.

Contact information for queries

Customer account reconciliation is a critical process that ensures accuracy in financial records. For any queries regarding account discrepancies, customers can reach out via the dedicated customer support line, which operates from 9 AM to 6 PM, Monday through Friday, at (555) 123-4567. Alternatively, customers may send inquiries through email to support@companyname.com, where responses typically occur within 24 hours on business days. For urgent matters, a live chat feature is available on the official website, providing real-time assistance with account-related issues. Maintaining clear communication helps facilitate effective resolution of any concerns regarding the reconciliation process.

Comments