In today's fast-paced business world, maintaining healthy cash flow is crucial for success. When it comes to managing outstanding invoices, clear and effective communication is key to fostering strong business relationships. A well-crafted letter template for business-to-business collections can not only streamline your collection process but also convey professionalism and understanding. Curious to learn more about how to create an impactful collections letter that gets results?

Professional tone and politeness

In professional environments, timely collections are crucial for maintaining cash flow and sustaining business operations. Clear communication can enhance relationships between companies. Crafting a formal letter requesting overdue payments requires politeness and professionalism while being assertive about the outstanding balance. Specific details include invoice numbers, due dates, and the exact amount owed to ensure clarity. Friendly reminders may include previously established payment terms, highlighting the value of their partnership. Such correspondence often emphasizes the mutual benefits of prompt payments, including continued service and support, which fosters a collaborative atmosphere for future transactions.

Clear invoice details and amount due

Invoicing is a fundamental aspect of business-to-business transactions, ensuring clarity regarding outstanding payments. Clear invoice details should include specific information such as invoice number (unique identifier), date of issue (typically within 30 days of service delivery), due date for payment (often set at 30 days post-invoice), and a complete breakdown of the amount due. The amount due may consist of individual line items, including services rendered or products provided, quantity, unit price, subtotal, taxes (such as sales tax based on jurisdiction), and the total amount owed. Providing this comprehensive data ensures that the recipient understands their financial obligation, facilitates timely payments, and promotes healthier cash flow for businesses. Accurate invoicing practices can significantly enhance the collection process, reduce misunderstandings, and maintain positive client relationships.

Defined payment terms and deadlines

In accounts receivable management, defined payment terms and deadlines are crucial for businesses to maintain cash flow and ensure timely payments. Standard terms often include Net 30 or Net 60, meaning payment must be made within 30 or 60 days from the invoice date. Late payment fees may apply after these deadlines, typically ranging from 1% to 1.5% per month, based on the outstanding balance. Clear communication of these terms in contracts and invoices helps prevent misunderstandings. Implementing automated reminders can enhance collection efforts, ensuring clients are aware of impending deadlines. Consistent follow-up, coupled with established protocols for disputes, fosters better business relationships and minimizes the risk of overdue accounts.

Contact information for queries

In business-to-business collections, communication plays a pivotal role. Providing accurate contact information accelerates resolution. Essential details include a direct line, such as a phone number (e.g., +1 (555) 123-4567), specific email address (e.g., collections@yourcompany.com), and a designated department within the organization (e.g., Accounts Receivable Department). This clarity aids in addressing payment queries promptly. Additionally, a mailing address for hard copy correspondence (e.g., 123 Business Lane, Suite 100, Cityville, ST 12345) ensures all communication channels remain open. Integrating this information fosters transparency and encourages timely payments, fostering stronger B2B relationships.

Consequences for non-payment

Consequences of non-payment for business-to-business transactions can significantly impact cash flow and operational stability. Outstanding invoices typically lead to increased operating costs, as businesses may need to allocate resources to follow up on late payments. Additionally, late payments can result in strained relationships with suppliers or vendors, which may hinder future negotiations or partnerships. Persistent non-payment might also lead to the engagement of collection agencies, incurring further fees and legal actions. Businesses may assess late payment penalties, such as interest charges of 1.5% per month, to recoup losses. Ultimately, a poor payment history can damage a company's credit rating, making it more challenging to secure loans or favorable terms with financial institutions.

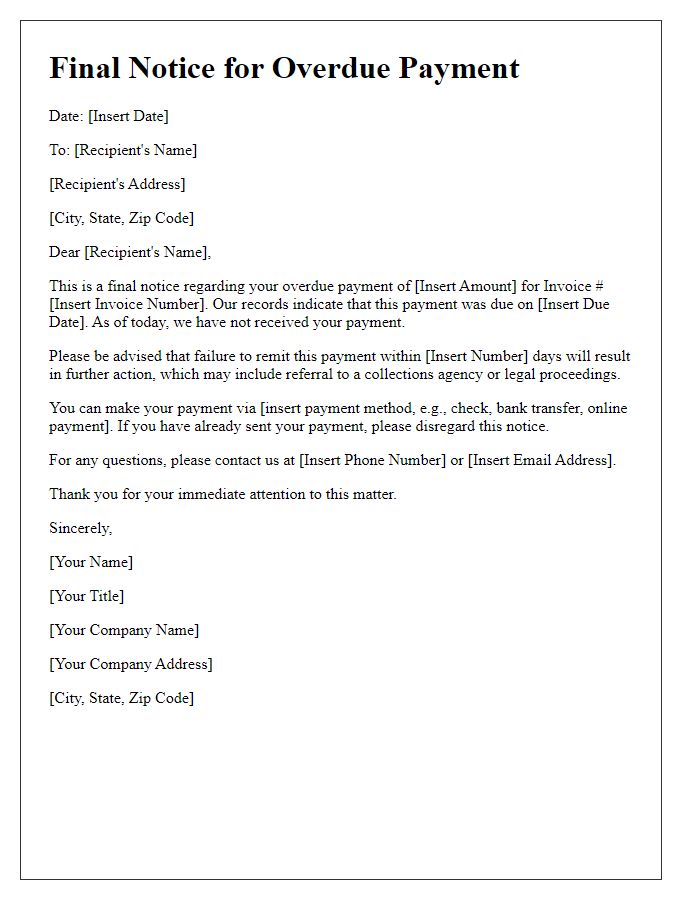

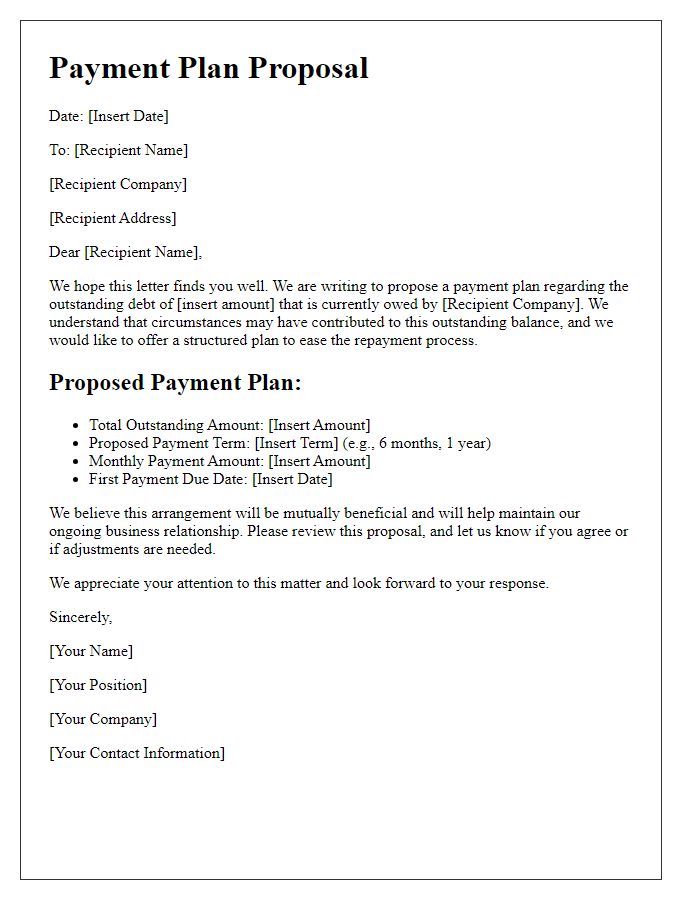

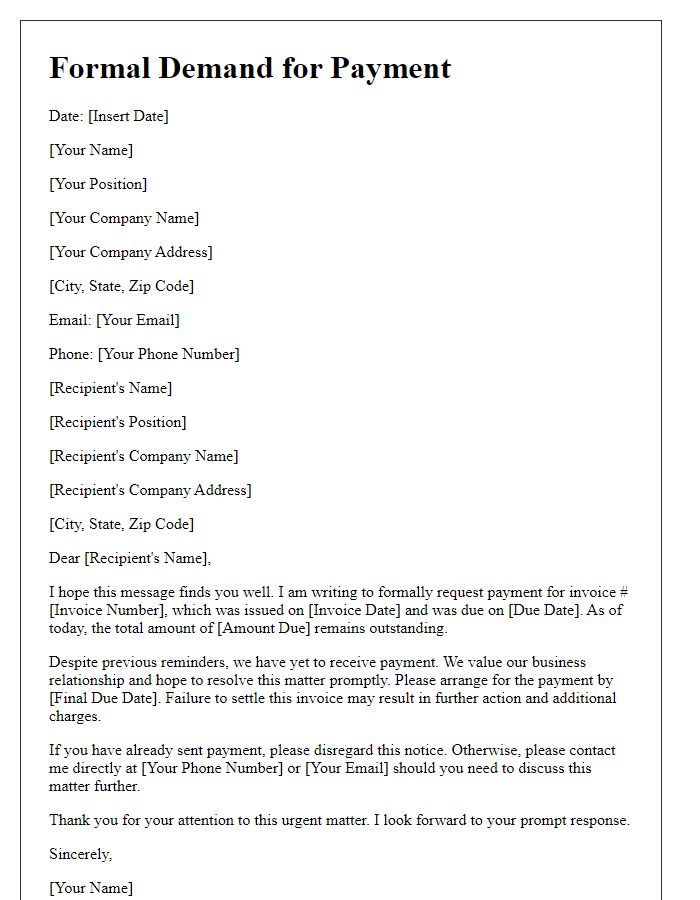

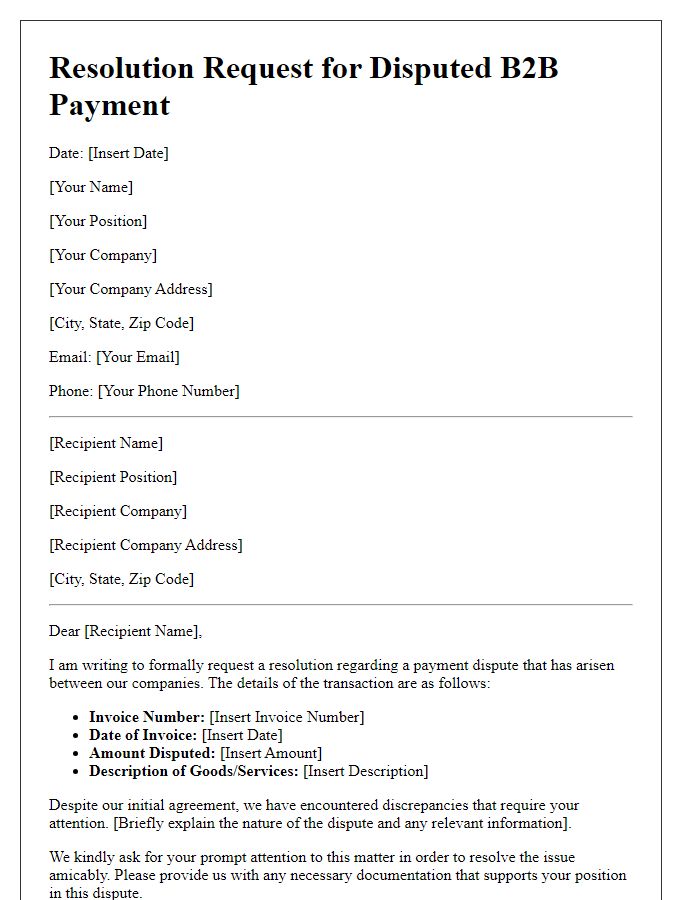

Letter Template For Business-To-Business Collections Samples

Letter template of friendly reminder for past due invoices in business dealings

Letter template of notification for upcoming payment deadlines in B2B contracts

Letter template of payment confirmation and gratitude for business relationships

Comments