Are you feeling overwhelmed by financial stress and considering loss mitigation options? You're not aloneâmany individuals face similar challenges and seek effective solutions to regain stability. In this article, we'll explore various loss mitigation strategies that can help you navigate these tough times and emerge stronger. So, grab a cup of coffee and let's dive in to discover the best paths forward together!

Borrower's Contact Information

Providing accurate Borrower's Contact Information is crucial for loss mitigation processes in financial institutions. This includes the full name of the borrower, mailing address for correspondence (which should include street number, street name, city, state, and ZIP code), and primary phone numbers (both home and mobile) where the borrower can be reached. Additionally, an email address can facilitate quick communication regarding the loss mitigation options available. Accurate and detailed contact information ensures timely updates on the borrower's status and aids in coordinating necessary negotiations or assistance.

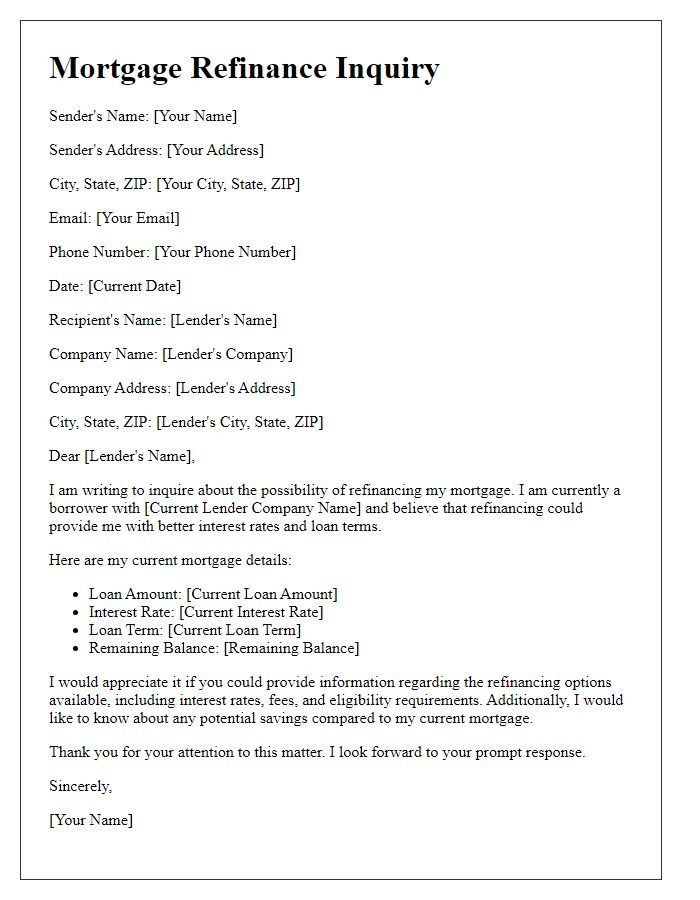

Loan Account Details

Loan account details are crucial for understanding financial obligations, particularly in mortgage or personal loans. The loan account number, typically a 10 to 20-digit code, identifies the specific account with the lending institution. Interest rates, which can vary from 3% to 10% depending on market conditions, directly influence monthly payments. The outstanding balance, which may range from thousands to hundreds of thousands of dollars, reflects the remaining amount owed on the loan. Repayment terms, generally spanning 15 to 30 years for mortgages, dictate how long the borrower has to settle the debt. Additionally, understanding any applicable late fees or additional charges is essential, as these can accumulate quickly and impact overall financial health (often around $25 to $50 per missed payment). Finally, attention to the loan type--secured or unsecured--provides insight into the risk involved; secured loans require collateral, while unsecured loans do not.

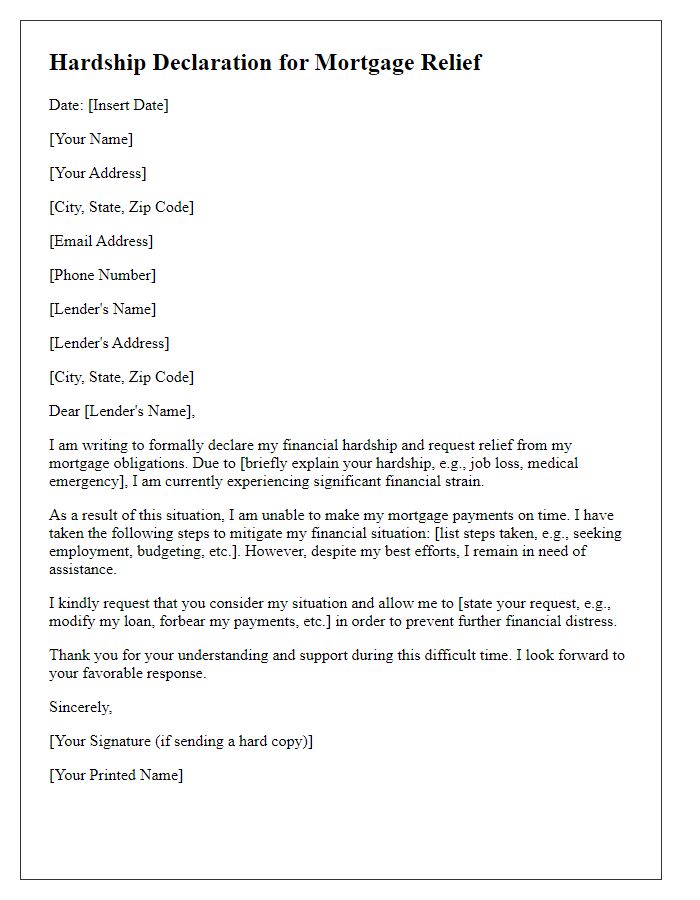

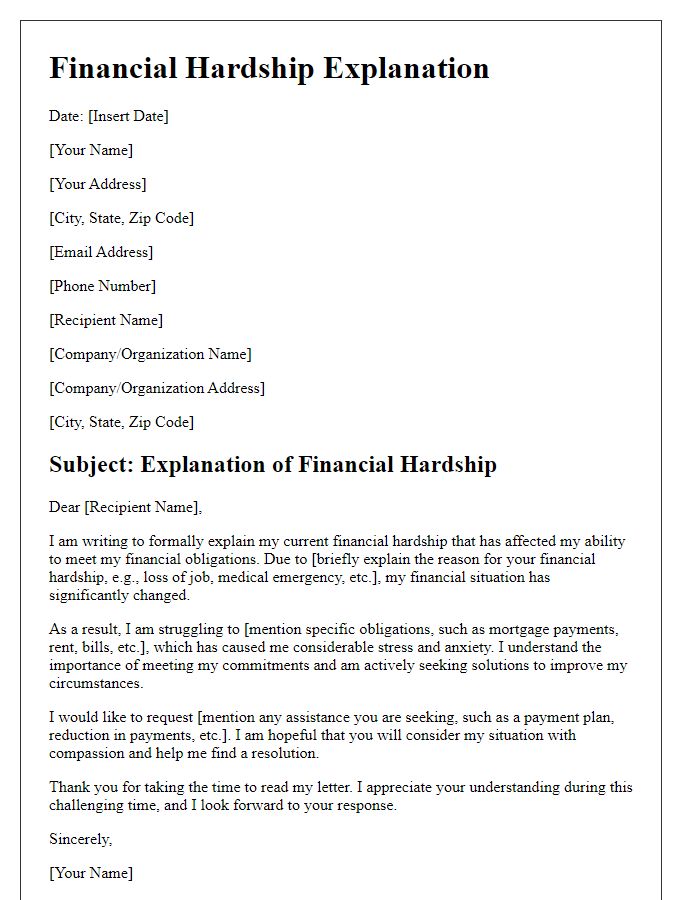

Explanation of Financial Hardship

Financial hardship occurs when individuals or families face unexpected economic challenges that hinder their ability to meet financial obligations. Situations such as job loss, medical emergencies, or unexpected expenses can lead to decreased income and increased financial strain. For instance, unemployment rates in 2023 rose to 6.7% in certain regions, affecting household budgets. A medical emergency can cost an average of $20,000, adding stress to already tight finances. Understanding these challenges is essential for banks and lenders when discussing loss mitigation options, which might include modifications, forbearance plans, or other support measures, aimed at alleviating financial pressure.

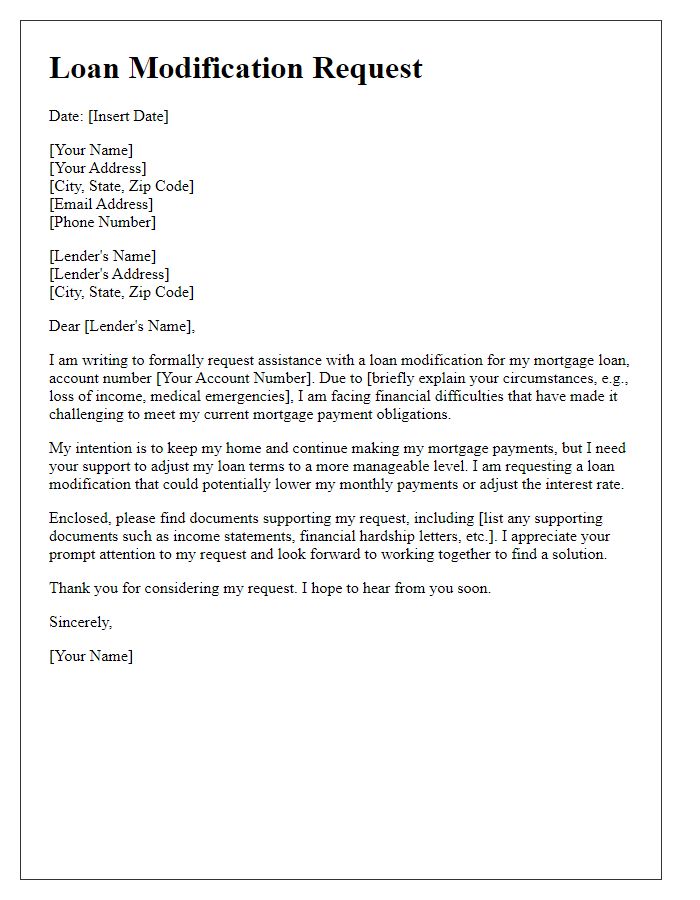

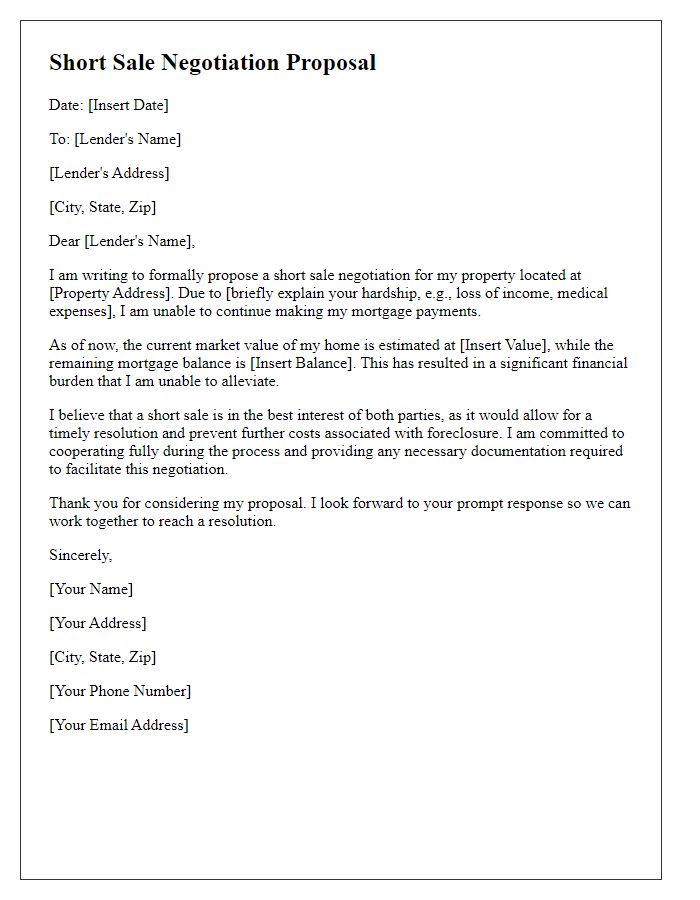

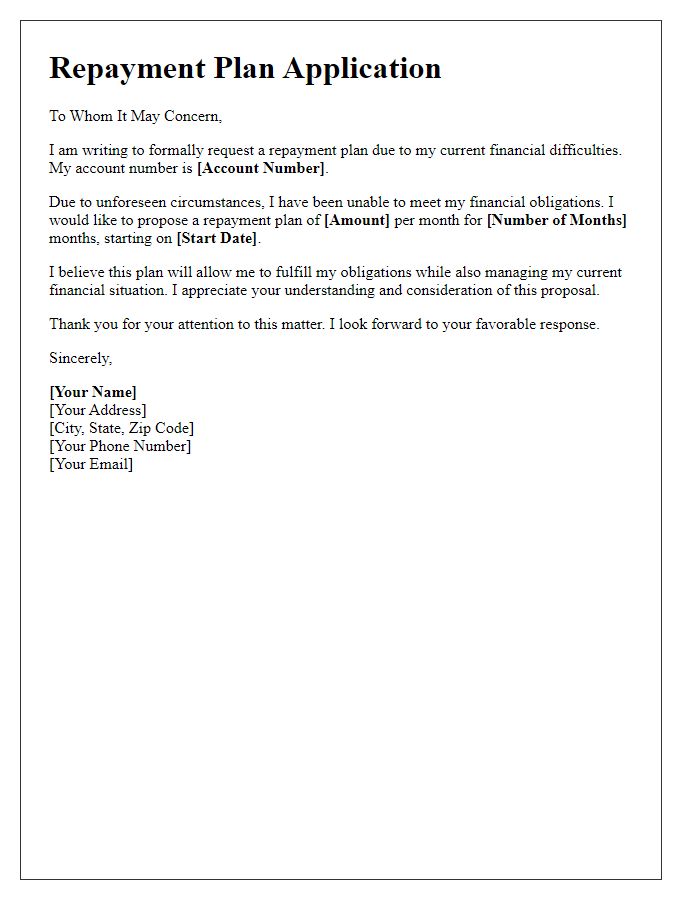

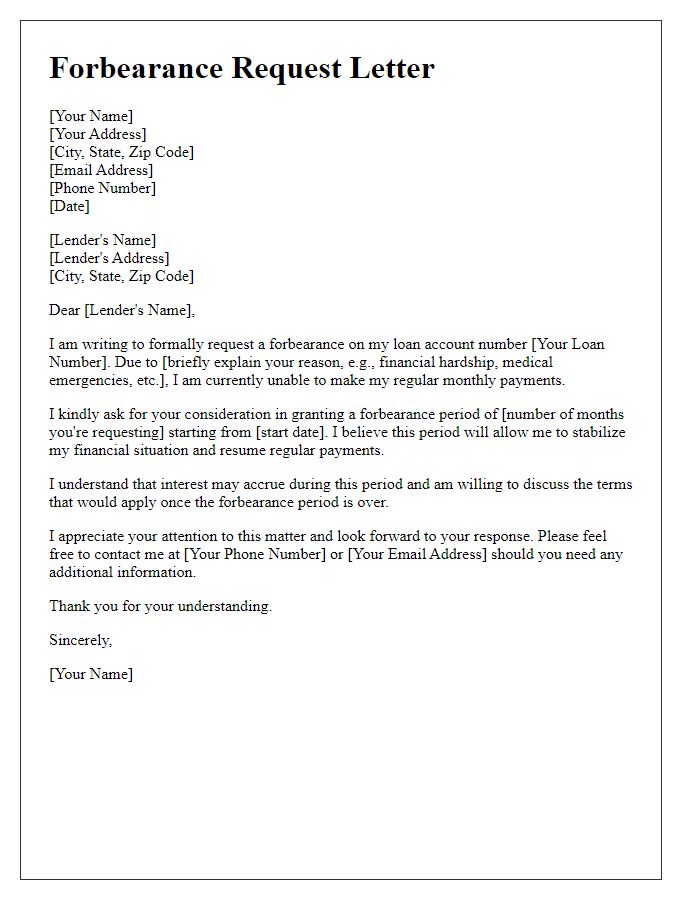

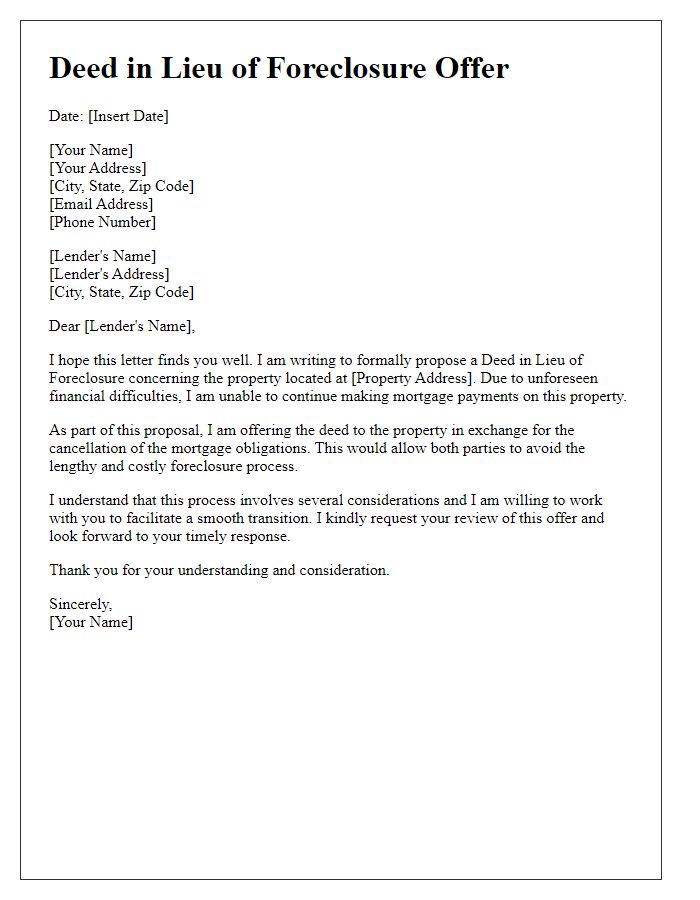

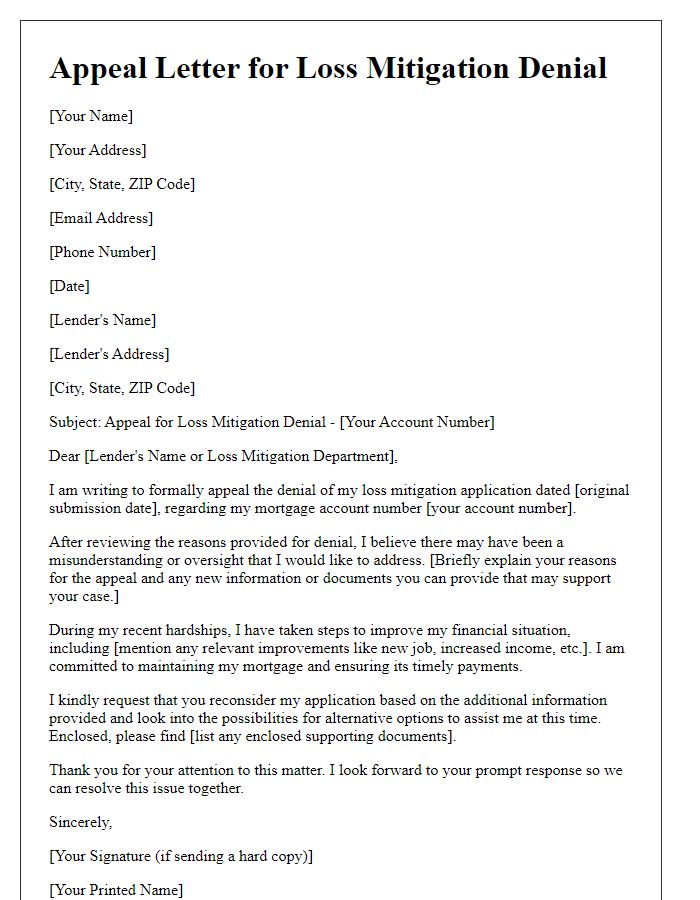

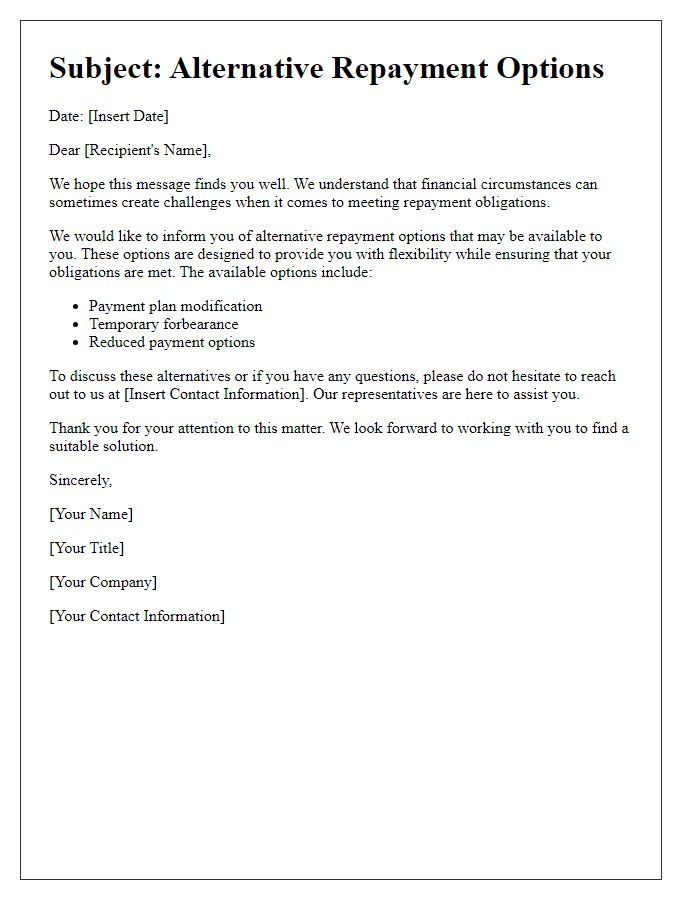

Request for Specific Mitigation Option

Individuals facing financial difficulties can explore various loss mitigation options offered by financial institutions. A specific mitigation option, such as a loan modification, may significantly reduce monthly mortgage payments, helping homeowners regain financial stability. This process often involves adjusting the loan terms, including interest rates, loan duration, or principal amount, tailored to a borrower's current financial situation. For example, a borrower struggling with a $250,000 mortgage may request a reduction in the interest rate from 5% to 3%, potentially lowering monthly payments from $1,500 to $1,050. Engaging with the lender's loss mitigation department, usually located at the company headquarters, is crucial for initiating this request. Documentation reflecting income changes, monthly expenses, and current financial hardship must be submitted to support the request, facilitating a comprehensive review of the borrower's situation.

Documentation and Evidence of Hardship

Loss mitigation options involve submitting documentation and evidence of financial hardship for review by lenders. Essential documents include a completed hardship affidavit detailing circumstances (e.g., job loss, medical expenses), income statements, and bank statements, typically covering the last two months. Additionally, tax returns from the previous year provide insight into overall financial status. Important evidence might include letters from employers or medical professionals verifying job loss or health issues. An accurate mortgage statement should accompany these documents to establish current payment status. The submission process typically requires adherence to specific lender guidelines to facilitate prompt assessment and aid in determining potential solutions, such as loan modification or forbearance.

Comments